Electrolyte Drinks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436631 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electrolyte Drinks Market Size

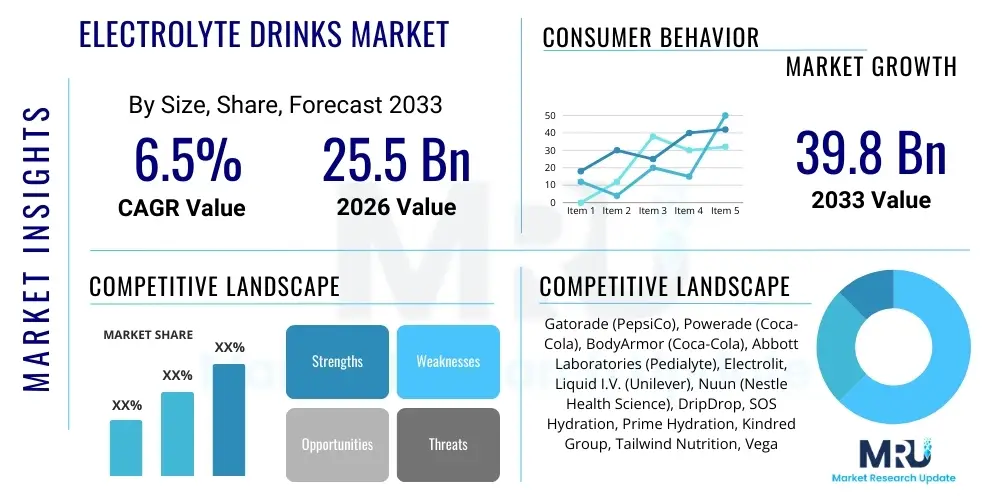

The Electrolyte Drinks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 39.8 Billion by the end of the forecast period in 2033.

Electrolyte Drinks Market introduction

The Electrolyte Drinks Market comprises specialized beverages formulated to restore critical mineral balance, essential for bodily functions such as nerve signaling and muscle contraction, particularly post-exertion or during illness. These products are moving beyond traditional high-sugar sports drinks to embrace clean-label ingredients, natural sweeteners, and specialized functional additions. Product applications are expanding rapidly from professional sports recovery and clinical rehydration to daily wellness support, reflecting a profound global consumer emphasis on proactive health and preventative nutritional strategies. The increasing visibility of dehydration symptoms in both athletic and general populations underpins the market's fundamental demand structure.

Major applications include optimizing athletic performance, aiding faster post-exercise recovery, and acting as medical rehydration therapy for gastroenteritis. The inherent benefits, such as rapid fluid absorption and reduced muscle fatigue, are key consumer drivers. Furthermore, the market benefits significantly from the rise in non-professional fitness activities and the pervasive influence of digital media promoting constant, optimal hydration. Manufacturers are focusing heavily on delivering enhanced nutritional profiles that integrate vitamins, zinc, and other micronutrients alongside core electrolytes (sodium, potassium, magnesium, calcium).

Key driving factors involve growing consumer education on the necessity of electrolyte balance for cognitive function and general well-being, coupled with climate-related issues causing increased average temperatures globally. This creates a sustained need for efficient rehydration solutions. Innovation is centered on diversifying product formats, with effervescent tablets and concentrated powders gaining popularity due to their superior convenience, reduced environmental footprint, and cost-effectiveness compared to bulky ready-to-drink (RTD) liquid bottles, thereby broadening market accessibility.

Electrolyte Drinks Market Executive Summary

Current business trends within the Electrolyte Drinks Market highlight a strong commitment to premiumization through sustainable sourcing and clean-label ingredient profiles, specifically minimizing artificial additives and synthetic sugars. There is a palpable shift towards customized functional beverages, addressing niche consumer needs such as keto-friendliness, vegan compliance, and specific caloric intake requirements. Market competition is intensifying, driven by rapid acquisitions of small, innovative niche brands by large multinational beverage corporations seeking immediate access to the premium and specialized hydration segments. Strategic marketing increasingly relies on digital platforms and influencer endorsements to build brand trust and educate consumers on specific product benefits, moving away from generic sports advertising.

Geographically, North America and Europe retain the largest market share due to mature health infrastructure and high per capita spending on wellness products. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by increasing urbanization, tropical climates necessitating constant rehydration, and rising middle-class disposable incomes adopting global fitness and nutritional trends. Regional strategies emphasize localization, with manufacturers in APAC tailoring flavor profiles and packaging sizes to align with local consumption habits and competitive pricing structures prevalent in emerging economies.

Segment analysis indicates that while liquid RTD formats still command the highest volume sales due to convenience, the powder and concentrate segment is experiencing exponential value growth, particularly through e-commerce distribution channels which offer superior logistical advantages. Segmentation by application shows that the market for general wellness and daily hydration is expanding faster than the traditional high-performance sports segment, signifying the product category's mainstream acceptance. Furthermore, the institutional segment, including hospitals and corporate wellness programs, is becoming a strategically important revenue stream, demanding specialized, clinically validated electrolyte formulations for specific patient or employee needs.

AI Impact Analysis on Electrolyte Drinks Market

Analysis of user inquiries regarding AI in this domain reveals significant interest in hyper-personalized nutrition and robust supply chain resilience. Users are keen to understand how AI can move beyond general advice to offer bespoke electrolyte formulas calculated from their real-time biometric data, genetic markers, and daily activity logs. Key concerns revolve around data privacy when integrating health tracking devices with purchase recommendations, and the scalability of AI-driven, small-batch manufacturing. Stakeholders also expect AI to resolve complex logistical challenges related to temperature-sensitive ingredients and volatile consumer demand patterns, ensuring product quality and minimizing costly inventory spoilage across diverse global markets.

- AI-driven personalized formulation: Creating tailored electrolyte blends based on individual physiological markers, activity intensity, and ambient humidity detected via connected health wearables.

- Optimized demand forecasting: Machine learning models predicting precise regional or seasonal spikes in demand for specific flavors and formats, reducing guesswork in inventory management.

- Supply chain efficiency: Using AI to optimize cold chain routes, monitor transport conditions in real-time, and automate quality checks during ingredient sourcing and bottling processes.

- Enhanced consumer support: Deploying AI-powered virtual assistants to analyze user symptoms or exercise data and recommend the most suitable product and optimal consumption schedule.

- R&D acceleration: Utilizing AI to rapidly screen and test new, naturally sourced electrolyte compounds or flavor combinations, shortening the product development cycle significantly.

- Automated quality control: Implementing computer vision and sensor technology on production lines for non-destructive testing of product consistency and ensuring compliance with stringent regulatory standards.

DRO & Impact Forces Of Electrolyte Drinks Market

The market's growth is fundamentally driven by a widespread global realization of the importance of hydration for physical and cognitive performance, coinciding with increased participation in both amateur and competitive sports. Major restraints include the persistent market perception that electrolyte drinks are synonymous with high-sugar content, necessitating continuous marketing efforts to differentiate modern, low-calorie offerings. Furthermore, the volatility in raw material costs, particularly for premium natural sweeteners and sustainable packaging, introduces complexity in maintaining competitive and accessible price points across all consumer segments. These drivers and restraints combine to create a dynamic environment defined by relentless functional and ethical innovation.

Significant opportunities abound in the domain of functional beverage hybrid products, such as incorporating immune-boosting ingredients (e.g., zinc, Vitamin C) or nootropics alongside core electrolytes, broadening appeal to wellness consumers seeking stacked benefits. Geographic expansion into under-penetrated emerging markets, coupled with establishing strong partnerships with institutional buyers like large hospital groups, presents avenues for substantial long-term volume growth. The ongoing shift toward powder and tablet formats, supported by the booming e-commerce infrastructure, also offers an opportunity to reduce supply chain costs and enhance global market reach efficiently.

The principal impact forces are consumer demand for absolute ingredient purity and environmental sustainability. This pressure compels manufacturers to invest heavily in vertically integrated sourcing models to ensure traceability and ethical practices for key minerals and natural flavors. Technological forces are driving the adoption of advanced aseptic filling and packaging technologies to ensure product safety and extend shelf life without relying on chemical preservatives. Only those firms that successfully align product efficacy, ethical sourcing, and environmental responsibility are positioned to weather competitive pressures and achieve durable brand loyalty in this rapidly evolving health-centric marketplace.

Segmentation Analysis

Market segmentation is strategically critical for targeted growth, dividing the Electrolyte Drinks market based on physiological function (Product Type), consumer delivery preference (Packaging Format), desired outcome (Application), and purchase mechanism (Distribution Channel). This granular perspective allows companies to specifically address the needs of disparate user groups—from high-end athletes demanding isotonic recovery solutions to the general public seeking easy, unflavored hydration concentrates sold via subscription e-commerce models. Understanding the dominance of the general wellness segment over traditional sports nutrition dictates where R&D and marketing investments are prioritized globally.

- By Product Type: Isotonic (balanced water, salt, and sugar for sustained effort), Hypotonic (low sugar, fast rehydration focus), Hypertonic (high sugar, slow absorption, used for energy loading).

- By Packaging Format: Ready-to-Drink (RTD) Bottles & Cans (convenience focus), Powder & Concentrates (cost-effective, long shelf life), Effervescent Tablets & Sachets (portability and customization).

- By Flavor Type: Natural Fruit Flavors (Citrus, Berry, Tropical), Unflavored/Savory, Artificial Flavors.

- By Application: Sports & Fitness Nutrition (performance and recovery), Daily Wellness & Hydration (general population), Medical & Clinical Rehydration (ORS solutions for illness).

- By Distribution Channel: Supermarkets & Hypermarkets (Volume sales), Convenience Stores (Impulse buys), Pharmacy & Drug Stores (Clinical focus), Online Retail & E-commerce (High growth for powders/subscriptions).

- By End-User: Athletes, General Adults, Pediatric Population, Geriatric Population.

Value Chain Analysis For Electrolyte Drinks Market

The upstream segment of the value chain is focused on the procurement of high-quality ingredients, primarily specialized mineral salts (sodium, potassium), purified water, and natural flavorings/sweeteners. Manufacturers face challenges in maintaining stability and consistent supply of natural ingredients, which are subject to agricultural commodity fluctuations. Significant investment is required in raw material validation to ensure purity and compliance with strict regulatory standards (e.g., heavy metal testing). Establishing long-term, ethical sourcing contracts is paramount to mitigate risks and satisfy the increasing consumer demand for supply chain transparency and sustainable ingredient origin.

The core manufacturing process involves blending, sterilization, and high-speed aseptic packaging. Technology is critical here, with automated systems ensuring precise osmolarity control—a core quality metric distinguishing product efficacy. Efficiency in bottling and canning operations directly affects cost competitiveness. Downstream logistics involve both direct sales (B2B to gyms/hospitals) and indirect distribution through wholesalers and retailers. The need for cold chain management for many RTD products adds substantial complexity and cost to the downstream flow, particularly in regions with underdeveloped infrastructure, often favoring the distribution of shelf-stable powdered formats.

Distribution channel performance is segmented: traditional retail (supermarkets and convenience stores) provides massive volume reach and immediate accessibility, dominating the RTD segment. Conversely, online retail and Direct-to-Consumer (D2C) platforms are revolutionizing the powder and concentrate segment, offering higher margins, subscription revenue, and invaluable consumer data capture. Optimizing this distribution network requires balancing speed-to-shelf for RTD products with the cost-efficiency of shipping bulk powders. Brands that successfully integrate online and offline strategies, leveraging predictive analytics for inventory deployment, achieve superior market positioning and logistical resilience.

Electrolyte Drinks Market Potential Customers

The potential customer base for electrolyte drinks has diversified significantly from the historically narrow focus on endurance athletes. Today, the largest and fastest-growing segment consists of general wellness consumers who incorporate these drinks into their daily routines for fatigue management, cognitive enhancement, and preventative hydration. This group seeks low-sugar, naturally flavored products that align with broader lifestyle trends, often purchased through convenient online subscription services. This mass-market adoption reflects a societal shift toward recognizing hydration as foundational to overall health, not just athletic recovery.

A second major customer category includes athletes, ranging from amateur fitness enthusiasts to elite professionals. These buyers require scientifically optimized formulations—precise isotonic or hypotonic solutions—tailored for pre-workout preparation, peak performance maintenance, and rapid post-session nutrient recovery. Purchases in this segment are highly influenced by performance data, product certifications (e.g., banned substance free), and endorsements from sports dietitians or governing bodies. The purchase trigger is highly functional, prioritizing efficacy and absorption rate over general taste appeal.

A third, high-value segment comprises institutional and clinical customers, including hospitals, elderly care facilities, and pediatric clinics. These buyers require specialized Oral Rehydration Solutions (ORS) that meet strict medical efficacy standards (e.g., WHO guidelines) for managing severe dehydration related to illness or surgery. Furthermore, companies are increasingly incorporating electrolyte drinks into corporate wellness programs to boost employee focus and well-being, viewing them as essential workplace provisioning, thereby creating a stable, high-volume B2B demand stream focused primarily on efficacy and bulk pricing agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gatorade (PepsiCo), Powerade (Coca-Cola), BodyArmor (Coca-Cola), Abbott Laboratories (Pedialyte), Electrolit, Liquid I.V. (Unilever), Nuun (Nestle Health Science), DripDrop, SOS Hydration, Prime Hydration, Kindred Group, Tailwind Nutrition, Vega (Danone), Isostar, Science in Sport (SiS), Pocari Sweat (Otsuka Pharmaceutical), Lucozade Sport (Suntory), Ultima Replenisher, LMNT (Redmond Re-Lyte). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrolyte Drinks Market Key Technology Landscape

Technological advancements in the Electrolyte Drinks Market are primarily focused on enhancing product stability, safety, and nutritional efficacy while minimizing the reliance on artificial preservatives. A critical area is aseptic processing and Ultra-High Temperature (UHT) treatment combined with high-barrier packaging materials (e.g., multi-layer PET and Tetra Pak) to extend the shelf life of liquid products that contain sensitive natural ingredients. Furthermore, sophisticated water purification systems, utilizing reverse osmosis and advanced filtration, are essential for creating the pristine base required for high-quality functional beverages, contributing significantly to both flavor consistency and product safety standards.

In formulation technology, the emphasis is on microencapsulation techniques, which protect sensitive micronutrients and flavor compounds from degradation during manufacturing and storage, ensuring their bioavailability upon consumption. For powders and concentrates, advanced granulation and compression technologies are employed to guarantee rapid, lump-free dissolution in water, which is a key consumer quality metric for portability formats. These techniques ensure that the precise balance of electrolytes (osmolarity) remains stable, delivering the intended physiological effect—be it isotonic or hypotonic rapid rehydration.

Beyond the product itself, digital technology is a key enabler. E-commerce platforms leverage AI for personalized marketing and dynamic pricing strategies, particularly for subscription services specializing in powders. Manufacturing facilities are increasingly adopting IoT sensors for real-time quality control and predictive maintenance, enhancing operational efficiency and reducing resource consumption. This confluence of food science, packaging innovation, and digital analytics is vital for maintaining a competitive edge in a market where both functional claims and delivery convenience are paramount to consumer purchasing decisions.

Regional Highlights

North America currently serves as the global leader in market value, driven by a highly mature sports nutrition segment and a robust culture of preventative wellness. The region is characterized by high consumer spending on premium, innovative formulations, particularly those featuring natural ingredients, minimal sugar, and specialized functional additions like adaptogens. The U.S. market benefits from extensive retail distribution networks and aggressive digital marketing strategies employed by both legacy brands (PepsiCo, Coca-Cola) and disruptive clean-label newcomers, ensuring rapid product cycles and high consumer visibility.

The European market, led by Western economies, displays a strong consumer preference for ecological and ethical sourcing, influencing a decisive shift towards concentrated powders, tablets, and sustainable packaging solutions to minimize waste. Strict European Union (EU) regulations regarding nutritional claims and ingredient purity drive local innovation towards transparency and natural derivation. While sports nutrition is strong, the European market is also distinguished by a powerful emphasis on general daily wellness and hydration solutions tailored for busy professional lifestyles, often favoring less aggressively flavored, simpler formulations.

Asia Pacific (APAC) is positioned as the primary growth engine, projected to achieve the highest CAGR due to rapid economic expansion and increasing awareness of heat-related dehydration in populous, often tropical, climates. Key drivers include government initiatives promoting active lifestyles and the increasing penetration of global sports brands. Success in APAC is highly dependent on localizing flavor profiles (using regional fruits) and optimizing distribution to vast, fragmented retail environments and the burgeoning mobile commerce user base. The Middle East, influenced by high ambient temperatures and large-scale sports investment, also presents strong demand, particularly for high-performance rehydration products aimed at outdoor labor and athletic populations.

- North America: Market value leader; characterized by strong demand for premium, clean-label, functional hydration; robust e-commerce and retail presence drives high competition and rapid innovation cycles.

- Europe: Driven by sustainability and strict regulatory focus; high preference for low-sugar, natural ingredients, and concentrated formats (powders/tablets) to reduce plastic waste; strong growth in Germany and the UK.

- Asia Pacific (APAC): Highest expected CAGR; fueled by urbanization, rising incomes, and tropical climate necessitating constant fluid replacement; market growth relies on localization and competitive pricing strategies.

- Latin America (LATAM): Moderate growth supported by intense regional sports culture (football); market viability is often linked to economic stability, favoring cost-effective, high-volume RTD products distributed through traditional channels.

- Middle East and Africa (MEA): Growth stimulated by extreme heat and significant investment in regional sporting events and infrastructure; demand focuses on high-efficacy formulations suitable for harsh environmental conditions and active outdoor workforces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrolyte Drinks Market.- Gatorade (PepsiCo)

- Powerade (Coca-Cola Company)

- BodyArmor (Coca-Cola Company)

- Abbott Laboratories (Pedialyte)

- Electrolit (Pisa Farmaceutica)

- Liquid I.V. (Unilever)

- Nuun (Nestle Health Science)

- DripDrop (Cofidep S.A.S.)

- SOS Hydration

- Prime Hydration (New entrant/influencer-backed)

- Kindred Group

- Tailwind Nutrition

- Vega (Danone North America)

- Isostar

- Science in Sport (SiS)

- Pocari Sweat (Otsuka Pharmaceutical)

- Lucozade Sport (Suntory)

- The Coca-Cola Company (Zico Coconut Water)

- Ultima Replenisher

- LMNT (Redmond Re-Lyte)

Frequently Asked Questions

Analyze common user questions about the Electrolyte Drinks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between isotonic, hypotonic, and hypertonic electrolyte drinks?

The difference lies in osmolarity (solute concentration) relative to body fluids. Isotonic solutions offer balanced energy and rehydration. Hypotonic solutions (low concentration) are absorbed fastest for pure fluid replacement. Hypertonic solutions (high concentration) are slow-absorbing, primarily utilized for carbohydrate loading rather than rapid water uptake.

Are low-sugar or natural electrolyte drinks as effective as traditional high-sugar sports beverages?

Yes, for general hydration and light-to-moderate exercise, low-sugar drinks with optimized sodium and potassium ratios are highly effective. High-sugar isotonic drinks are usually only necessary for high-intensity, long-duration endurance sports where immediate carbohydrate energy replenishment is required alongside electrolyte replacement.

What factors are driving the shift toward powder and concentrate formats over ready-to-drink bottles?

The shift is driven by sustainability and cost efficiency. Concentrates significantly reduce packaging waste and transportation costs (lower weight/volume), offering consumers a better cost-per-serving and enhanced convenience for travel and customized dosage flexibility.

How is consumer demand for 'clean labels' impacting product formulation in this market?

Clean label demand mandates the elimination of artificial colors, synthetic sweeteners (like sucralose), and chemical preservatives. This necessitates reliance on natural sources like stevia, monk fruit, fruit purees, and sea salt, driving up specialized ingredient costs but fundamentally increasing consumer trust and product integrity.

Which geographical region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing disposable incomes, and the necessity for effective rehydration solutions in its predominant tropical climates.

What role do electrolytes play in general health beyond athletic performance?

Electrolytes are vital for regulating nerve impulses, ensuring proper muscle function (including the heart), maintaining cellular fluid balance (osmotic pressure), and preventing symptoms of chronic dehydration, such as headaches, even in non-strenuous daily activities.

How are environmental sustainability concerns affecting packaging innovation in the electrolyte drinks market?

Concerns are driving innovation towards post-consumer recycled (PCR) plastics, aluminum cans, glass bottles, and a greater emphasis on highly concentrated powders and tablets to drastically reduce the material volume and weight associated with shipping and consumption.

How does the medical application of electrolyte solutions differ from sports nutrition products?

Medical electrolyte solutions (ORS) adhere to strict clinical guidelines, using specific sodium-to-glucose ratios for curative treatment of severe dehydration. Sports products focus on maximizing performance and energy delivery, often containing higher carbohydrates and additional functional ingredients for recovery and preventative use.

What is the forecast growth rate for the online retail distribution channel?

The online retail channel is projected for significantly higher growth than offline retail, propelled by the convenience of subscription models, the logistical advantages of selling powders, and the ability for niche brands to reach targeted consumers directly via D2C platforms.

How is the geriatric population influencing product development in electrolyte beverages?

The aging population requires specialized hydration due to physiological changes and medication side effects. This drives development toward low-sodium, high-potassium formulations that are easy to consume, free from stimulants, and strictly focused on essential mineral balance.

What key strategic approaches are new market entrants employing to challenge established giants like Gatorade?

New entrants specialize by focusing on hyper-clean ingredient decks (zero artificial additives), targeting specialized diets (e.g., keto), leveraging rapid digital marketing, and utilizing D2C models to foster direct consumer relationships, bypassing traditional retail dominance.

What role does flavor development play in the market's current competitive landscape?

Flavor is a crucial differentiator, particularly as nutritional differences among clean-label products narrow. R&D invests heavily in highly palatable, natural fruit profiles and exotic flavors to appeal to consumers transitioning away from sugary drinks, necessitating sophisticated sensory testing.

What technological advancements are optimizing the bottling process to reduce waste and energy use?

Optimizations include the adoption of lightweighting technology for containers, utilizing high-efficiency aseptic filling machines, and integrating robotic systems for precision material handling, collectively reducing production waste and the manufacturing process's overall carbon footprint.

How is the growing prevalence of chronic diseases (like diabetes) impacting the market?

Chronic disease prevalence necessitates the availability of sugar-free or very low-glycemic index electrolyte solutions. This creates strong market demand for natural, zero-sugar alternatives that can support mineral balance without causing adverse blood sugar spikes, requiring specialized formulation certifications.

How are wearable technology and fitness tracking devices influencing consumption patterns?

Wearables enable data-driven consumption by quantifying individual sweat rate and activity levels. Integration with specialized apps allows for personalized reminders and product recommendations, promoting timely and optimal usage of electrolyte products based on measured physiological need.

What is the significance of the carbohydrate-to-electrolyte ratio in sports formulations?

The ratio is critical for maximizing both fluid delivery and energy provision. A moderate carbohydrate load (6-8%) in isotonic drinks optimizes absorption efficiency. Imbalances can lead to digestive distress or insufficient fuel for prolonged, strenuous physical activity.

Are there regulatory barriers specific to the classification of electrolyte drinks?

Yes, complexity arises from classification as a conventional food, a dietary supplement, or a medical food (ORS). Classification dictates labeling requirements, allowed health claims, and ingredient restrictions, posing significant compliance hurdles for global brands operating across multiple jurisdictions.

How is ingredient transparency influencing consumer trust and loyalty?

Complete transparency, often facilitated by technology like blockchain tracking or detailed online sourcing information, is critical for building trust. Consumers are loyal to brands that provide verifiable proof of ingredient origin and ethical production, often willing to pay a premium for guaranteed integrity.

What are the emerging trends in electrolyte sourcing, particularly natural alternatives?

Trends emphasize sourcing electrolytes naturally from ingredients like coconut water, maple water, various sea salts (e.g., Celtic or Himalayan), and fruit extracts. These sources offer a 'health halo' and provide trace minerals that appeal strongly to the holistic wellness segment.

What impact has the global COVID-19 pandemic had on the electrolyte drinks market?

The pandemic significantly accelerated market growth by heightening consumer focus on immunity, preventative health, and hydration as a core wellness strategy, driving massive demand for ORS solutions and rapidly increasing the penetration of e-commerce delivery channels.

What is the typical shelf life for powdered electrolyte mixes compared to RTD liquid bottles?

Powdered mixes typically have a much longer shelf life, often 18 to 36 months, due to the absence of water which prevents microbial activity. Liquid RTD bottles, especially clean-label versions with minimal preservatives, usually range from 9 to 18 months, requiring more stringent cold chain management.

What differentiates the marketing approach for the general wellness segment versus the professional athlete segment?

Wellness marketing uses aspirational lifestyle messaging, focusing on daily self-care and clean ingredients. Athlete marketing emphasizes measurable performance metrics, scientific validation, and endorsements from sports bodies to prove recovery efficiency and efficacy.

How is the industrial hemp and CBD trend influencing electrolyte drink formulations?

A growing niche involves infusing electrolytes with CBD to target consumers seeking reduced inflammation, enhanced post-exercise recovery, or general stress management. This segment focuses on therapeutic benefits but faces high regulatory variability across different jurisdictions.

How does the presence of high-profile "influencer brands" (e.g., Prime) affect market competition?

Influencer brands drive massive, immediate surges in visibility and initial sales volume, disrupting established market order by leveraging social media virality and forcing traditional competitors to increase digital engagement and accelerate flavor/product innovation cycles to retain younger consumers.

How does the sourcing of water (e.g., purified vs. spring water) impact product marketing and pricing?

Sourcing specialty or spring water acts as a strong marketing differentiator, justifying premium pricing based on perceived purity and natural mineral content. Purified water, while standardized, offers fewer marketing advantages but lower input costs.

How are specialized diets (e.g., Keto, Vegan) addressed in the electrolyte drinks market?

The market actively caters to these diets by producing certified products: keto-friendly options are zero-sugar with specific sodium levels, and vegan products ensure all ingredients, including stabilizers and colorings, are strictly plant-derived, often leading to premium positioning.

How are manufacturers addressing potential plastic pollution concerns related to RTD products?

Manufacturers are committed to utilizing 100% rPET (recycled plastic), transitioning to aluminum cans, and promoting reusable bottle systems supported by concentrated powder refills, focusing on material circularity to minimize environmental impact.

What is the long-term outlook for the integration of customized electrolyte manufacturing processes?

The outlook is highly positive. Driven by AI and consumer demand, manufacturing will shift towards flexible, modular systems capable of producing small, highly customized batches based on individual biometric data or unique subscription requests, defining the next era of personalized nutrition.

What technological innovations are being used to enhance the solubility and mixability of electrolyte powders?

Innovations include micronization (reducing particle size), using advanced granulation techniques, and incorporating specific excipients to ensure rapid, uniform, and residue-free dissolution in water, meeting the consumer expectation for instant convenience.

What key drivers for the institutional purchasing of electrolyte drinks by military and emergency services?

These services prioritize high-efficacy, durable, and easily transportable solutions for extreme conditions. Purchasing decisions rely on clinical performance data, compliance with strict operational nutrition standards, and proven effectiveness in preventing heat exhaustion among personnel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager