Electrolytic Copper Foil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432048 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electrolytic Copper Foil Market Size

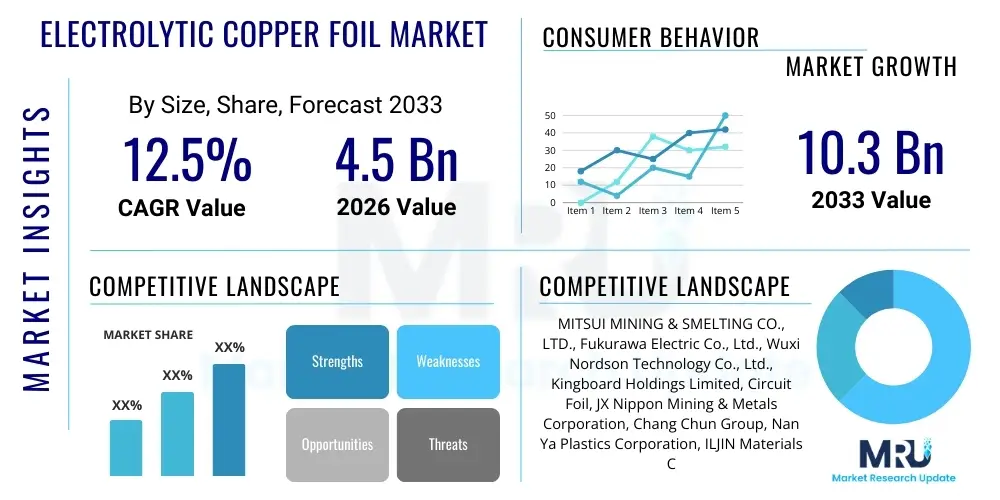

The Electrolytic Copper Foil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Electrolytic Copper Foil Market introduction

Electrolytic copper foil (ECF) is a critical enabling material, manufactured through the electrodeposition process, resulting in ultra-thin sheets of high-purity copper with specific rough and smooth sides, optimized for subsequent lamination onto substrates. This highly specialized material serves primarily as the current collector in lithium-ion batteries, foundational to the global shift toward electric vehicles (EVs) and high-capacity energy storage systems (ESS). Its unique properties, including high conductivity, excellent ductility, and customizable surface roughness, are indispensable for maximizing battery energy density and enhancing overall cycle life. The demand landscape is intrinsically tied to global climate policies and investments in electrification infrastructure.

The primary applications of ECF are concentrated in the electronics and energy sectors. In electronics, it forms the basis of printed circuit boards (PCBs), where its high dimensional stability and fine pattern etching capabilities enable the miniaturization and high functionality of advanced computing and telecommunication devices, including smartphones, servers, and networking equipment. However, the most explosive growth segment remains the automotive industry, where ECF is integral to power cells used in hybrid and battery electric vehicles. The increasing range and performance requirements for EVs necessitate thicker, higher-density copper foils, driving innovation in manufacturing techniques to ensure mechanical integrity and consistent quality.

Key benefits derived from using ECF include superior thermal management within battery packs and electronic components due to high thermal conductivity, coupled with reduced resistance, which minimizes energy loss during charge and discharge cycles. Driving factors for market expansion are multi-faceted, encompassing stringent environmental regulations promoting EV adoption, massive public and private sector investment in 5G and 6G network infrastructure requiring high-frequency circuit materials, and the accelerating development of grid-scale renewable energy storage solutions. These macroeconomic trends ensure sustained, high-volume demand for specialized, high-performance electrolytic copper foil variants.

Electrolytic Copper Foil Market Executive Summary

The global Electrolytic Copper Foil market demonstrates robust expansion, characterized by significant shifts in manufacturing capabilities and geographical concentration. Business trends indicate a strong move toward high-end, specialized foils, particularly those tailored for high-power lithium batteries (thick foils, 8-12 µm) and high-frequency PCBs (ultra-thin foils, < 6 µm). Manufacturers are heavily investing in R&D to improve adhesion strength, uniformity, and resistance to oxidation, crucial parameters for next-generation battery performance and longevity. Regional trends show Asia Pacific, specifically China, South Korea, and Japan, maintaining dominance due to massive domestic EV battery production capacities and established electronics manufacturing ecosystems. North America and Europe are rapidly increasing their market share through substantial government incentives aimed at localizing the battery supply chain (gigafactories), creating immediate localized demand for ECF. Segmentation trends highlight the Li-ion battery application segment as the primary revenue driver, far outpacing traditional PCB usage, although demand for high-frequency/high-speed digital PCBs leveraging specialized RTF (Reverse Treated Foil) also contributes significantly to market value growth.

AI Impact Analysis on Electrolytic Copper Foil Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the manufacturing and quality control processes within the Electrolytic Copper Foil market. Common user inquiries often revolve around how AI can mitigate the complexity of maintaining consistent ultra-thin foil production tolerances, especially as thickness decreases below 6 micrometers. Users are keen to understand AI's role in predictive maintenance (reducing costly downtime in electrodeposition tanks), optimizing current density profiles for desired mechanical properties, and improving defect detection rates far beyond human capability. The core expectation is that AI will enhance material consistency, minimize production waste associated with off-spec batches, and accelerate the development cycle for novel foil chemistries or surface treatments required for solid-state batteries. These themes reflect a proactive industry seeking operational excellence and material innovation through digital transformation.

AI's primary influence is realized through sophisticated process control systems. ML algorithms analyze vast datasets generated by sensors monitoring electrolyte composition, temperature gradients, plating speed, and current uniformity in real-time. By identifying non-linear correlations between input variables and the final foil characteristics (e.g., tensile strength, peel strength, purity), AI systems can dynamically adjust operational parameters, ensuring production stability. This capability is vital for meeting the demanding specifications of high-energy-density batteries, where even minor variations in copper morphology can impact performance metrics and safety.

Furthermore, AI is crucial in streamlining the supply chain and demand forecasting. Given the tight integration between ECF producers and large-scale battery manufacturers, accurate demand prediction, informed by global EV sales projections and regulatory changes, allows ECF suppliers to optimize raw material procurement (high-ppurity copper sulfate) and capacity scheduling. This enhanced visibility reduces inventory holding costs and minimizes lead times, bolstering the overall resilience of the battery supply chain. The long-term impact involves using generative AI models to simulate and design new composite materials or surface treatments necessary for emerging battery architectures.

- AI optimizes electrodeposition current profiling for uniform foil thickness and improved mechanical properties.

- Predictive Maintenance (PdM) powered by ML reduces unplanned downtime of high-cost plating drums and ancillary equipment.

- Automated Visual Inspection (AVI) systems utilizing deep learning enhance defect detection accuracy for microscopic flaws and inclusions.

- AI-driven optimization of electrolyte composition maintains peak performance and reduces chemical consumption.

- Enhanced supply chain logistics and material sourcing decisions based on advanced demand forecasting models.

DRO & Impact Forces Of Electrolytic Copper Foil Market

The Electrolytic Copper Foil market is heavily influenced by dynamic forces centered around rapid technological adoption, geopolitical supply chain stability, and raw material price volatility. The primary drivers are the massive, sustained investments in global EV production capacity and the proliferation of stationary energy storage solutions critical for grid balancing. Restraints often manifest as high initial capital expenditure required for setting up ultra-clean manufacturing facilities and the technical challenge of consistently producing extremely thin foils (e.g., 4.5 µm) at industrial scale without sacrificing quality. Opportunities lie significantly in developing advanced functionalized foils, such as those with dendrite-suppressing coatings or specialized surface treatments, catering to solid-state or high-silicon-anode battery designs. These forces combine to dictate market direction, demanding continuous technological innovation and robust supply chain management from key participants.

Specific market drivers include government mandates phasing out internal combustion engines (ICE), which directly escalate EV sales and, consequently, ECF demand. Furthermore, the expansion of 5G and impending 6G telecommunications infrastructure requires high-performance, low-loss PCBs utilizing specialized ECF variants designed for high-frequency signal integrity. However, the market faces significant restraints related to the energy-intensive nature of the electrodeposition process, contributing to high operational costs. Additionally, the dominant reliance on China for raw material refinement and copper foil production exposes the global supply chain to geopolitical risks and trade disputes, necessitating diversification efforts in other regions like North America and Europe.

The impact forces influencing competitive behavior include the need for vertical integration, driven by the desire to secure critical raw material supply (high-purity copper) and maintain quality control throughout the production cycle. The competitive landscape is characterized by intense R&D focusing on ultra-thin and functionalized foils, defining the technological edge of market leaders. Furthermore, the requirement for localized production near burgeoning battery gigafactories (e.g., in Germany, Hungary, and the US) exerts significant pressure on companies to rapidly scale up capacity in new geographic regions, balancing efficiency gains against logistical complexities and varying regulatory environments.

- Drivers:

- Accelerated adoption and scaling of Electric Vehicle (EV) manufacturing globally.

- Rapid expansion of grid-scale energy storage systems (ESS) for renewable energy integration.

- High demand from advanced electronics, 5G/6G infrastructure, and high-density Printed Circuit Boards (PCBs).

- Technological advancements allowing for thinner and higher-purity foil production.

- Restraints:

- Volatility and high cost of raw copper material, impacting operational expenditure.

- Requirement for extremely high capital investment and precision engineering in manufacturing facilities.

- Technical limitations and yield challenges associated with producing ultra-thin foils (e.g., < 6 µm).

- Intense energy consumption and associated environmental pressures during the electrodeposition process.

- Opportunities:

- Development and commercialization of functionalized copper foils for next-generation batteries (e.g., solid-state, Li-metal).

- Expansion into emerging markets for flexible electronics and sophisticated wearables.

- Strategic localization of manufacturing capacity in North America and Europe to serve regional gigafactories.

- Focus on sustainable and green manufacturing processes (e.g., optimized energy recovery).

- Impact Forces:

- Supplier consolidation and vertical integration to stabilize raw material input.

- Regulatory pressures promoting local production and clean manufacturing standards.

- Intensified competition leading to rapid price erosion in commodity foil grades.

- Need for continuous material innovation driven by evolving battery chemistry requirements.

Segmentation Analysis

The Electrolytic Copper Foil market is fundamentally segmented by application, thickness, and end-use industry, reflecting the diverse and highly technical requirements of various consumer and industrial sectors. The application segment, particularly Li-ion batteries, dominates both volume and value, driven by the global transition to electric mobility. Segmentation by thickness is crucial, as ultra-thin foils (6 µm and below) command a significant premium due to the complexity of manufacturing and their necessity in high-frequency, high-speed PCBs and high-performance battery designs seeking maximum energy density. Geographic segmentation remains highly relevant, with capacity concentrated in Asia Pacific, while demand centers are rapidly decentralizing towards North America and Europe, influencing localized investment strategies and supply chain dynamics.

- By Application:

- Lithium-ion Batteries (LiBs)

- Printed Circuit Boards (PCBs)

- Electromagnetic Shielding

- Others (e.g., Connectors, Flexible Heaters)

- By Thickness:

- Ultra-thin Foil (< 6 µm)

- Thin Foil (6 µm – 12 µm)

- Standard/Thick Foil (> 12 µm)

- By Product Type:

- Standard Electrodeposited Copper Foil (ED)

- High-Strength Copper Foil (HS)

- Reverse Treated Foil (RTF)

- Double-Sided Treated Foil (DSTF)

- By End-Use Industry:

- Automotive (EVs, HEVs)

- Consumer Electronics

- Telecommunications & IT

- Aerospace & Defense

- Industrial & Energy Storage

Value Chain Analysis For Electrolytic Copper Foil Market

The value chain for the Electrolytic Copper Foil market is intensive, beginning with the highly specialized extraction and refining of high-purity copper, progressing through the complex electrodeposition process, and culminating in delivery to major electronics and battery manufacturers. Upstream analysis focuses on securing consistent access to high-grade copper sulfate electrolyte, derived from high-purity copper cathode. Price fluctuations and supply concentration in mining and refining regions pose significant risks upstream. Major ECF manufacturers often seek long-term contracts or engage in partial vertical integration to mitigate these supply risks and ensure material quality prerequisites are met, as impurities can severely compromise the performance of the final foil product.

The midstream segment involves the core manufacturing process—electrodeposition using large, rotating titanium drums in acidic copper sulfate solutions. This stage requires immense precision engineering, high energy inputs, and stringent quality control, defining the technical barriers to entry. After the foil is deposited, it undergoes crucial surface treatments (e.g., anti-tarnish coatings, roughening treatments) to enhance adhesion to substrates (like polymer films for flexible circuits or anode materials for batteries). Distribution channels are highly direct for large volume applications; for instance, ECF manufacturers often deliver directly to battery gigafactories or major Tier 1 PCB fabricators globally, requiring sophisticated global logistics.

Downstream analysis centers on the end-use applications, primarily Li-ion battery cell production and PCB lamination. Direct distribution dominates, characterized by tight specification controls and supplier qualification processes that can last several years, especially in the automotive sector. Indirect distribution, involving small distributors or material agents, caters primarily to smaller, niche PCB fabricators or specialized shielding applications. The power balance within the value chain is shifting, with major battery manufacturers (the buyers) gaining leverage due to the consolidation of EV platforms and the establishment of dedicated local supply chain mandates (e.g., critical mineral acts), pushing ECF suppliers to rapidly standardize and localize production.

Electrolytic Copper Foil Market Potential Customers

The primary consumers of Electrolytic Copper Foil are large-scale manufacturers operating within the advanced electronics and electric mobility ecosystems, demanding materials that adhere to strict performance, purity, and dimensional standards. The most significant customer base is the consortium of global Li-ion battery cell manufacturers (gigafactories), which require vast quantities of high-purity copper foil to serve as the anode current collector for batteries powering EVs and grid storage systems. These customers prioritize long-term supply reliability, customized surface treatment for optimal slurry adhesion, and guaranteed consistency of foil thickness (e.g., 6 µm, 8 µm) to achieve required energy density targets and safety standards, making them high-volume, repeat purchasers.

Another major segment comprises manufacturers of high-performance Printed Circuit Boards (PCBs) and Flexible Printed Circuits (FPCs). Within this category, customers specializing in high-frequency applications, such as 5G/6G communication infrastructure, advanced driver-assistance systems (ADAS), and high-performance computing (HPC), are premium buyers. They specifically demand specialized foils, such as Reverse Treated Foil (RTF), characterized by low profile, excellent signal integrity, and superior peel strength to withstand high temperatures during the lamination and etching processes. The procurement cycle here involves rigorous qualification based on thermal and electrical performance metrics.

Finally, emerging customers include developers and producers of sophisticated energy storage solutions beyond standard Li-ion chemistries (e.g., solid-state batteries, lithium metal batteries), who require custom-developed foils often featuring specialized coatings or extremely thin profiles (down to 4 µm or less). Additionally, companies involved in electromagnetic interference (EMI) shielding for sensitive medical or defense electronics represent a steady, albeit smaller, segment requiring high-purity, uniform foil sheets. The purchasing decisions across all segments are driven by a combination of price, quality consistency, and the strategic location of the ECF supplier relative to the end-manufacturing facility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MITSUI MINING & SMELTING CO., LTD., Fukurawa Electric Co., Ltd., Wuxi Nordson Technology Co., Ltd., Kingboard Holdings Limited, Circuit Foil, JX Nippon Mining & Metals Corporation, Chang Chun Group, Nan Ya Plastics Corporation, ILJIN Materials Co., Ltd., SKC Co., Ltd., Micro Power, Ltd., Shenzhen Jinzhou Precision Technology Co., Ltd., Lingbao Wason Copper Foil Co., Ltd., UACJ Foil Corporation, Shandong Jinbao Electronics Co., Ltd., Suzhou Cu-Tech Co., Ltd., Guangdong Chaohua Technology Co., Ltd., Targray Technology International, Inner Mongolia Dinglong Copper Foil Co., Ltd., Guangdong Hongyuan Copper Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrolytic Copper Foil Market Key Technology Landscape

The technology landscape of the Electrolytic Copper Foil market is characterized by continuous refinement of the electrodeposition process to achieve higher material purity, superior mechanical properties, and unprecedented thinness. A core technological focus is the optimization of the plating process within the electroforming cells, specifically controlling the current density and electrolyte additives to manipulate the crystal structure (grain size and orientation) of the deposited copper. Advanced machinery now incorporates sophisticated titanium cathode drums with micron-level surface finishes and high-precision temperature control systems to ensure uniformity, crucial for producing ultra-thin foils (e.g., 4.5 µm and 3.0 µm) demanded by next-generation high-energy-density Li-ion batteries and foldable electronics.

Furthermore, significant technological efforts are directed toward surface treatment technologies, which are essential for enhancing the bonding strength between the copper foil and subsequent materials. This involves complex chemical and electrochemical roughening, often employing specialized proprietary processes to create a dense, tree-like microstructure on one side of the foil (the "matte" side) to maximize physical interlocking with electrode slurry or substrate resin. Innovations in Reverse Treated Foil (RTF) are crucial for high-speed digital circuits, where minimizing the profile of the copper surface texture is essential to reduce signal loss and insertion attenuation at frequencies above 20 GHz. The development of specialized adhesion layers, sometimes involving inorganic coatings or modified organic silanes, is critical for achieving robust peel strength without compromising electrical performance.

A burgeoning technological segment involves the creation of functionalized or composite copper foils. This includes applying protective thin films or coatings directly onto the copper surface to prevent side reactions with advanced battery chemistries, such as high-voltage cathodes or silicon-rich anodes, which are prone to excessive volume expansion and electrolyte degradation. For example, some manufacturers are investigating nanoscale lithium or carbon coatings to stabilize the anode interface and suppress dendrite formation in lithium-metal batteries. This innovation requires integrating chemical vapor deposition (CVD) or atomic layer deposition (ALD) processes directly into the ECF manufacturing line, representing a significant capital and technological leap aimed at addressing future battery challenges and securing competitive advantage in the high-performance segment.

Regional Highlights

The geographical distribution of the Electrolytic Copper Foil market demonstrates pronounced asymmetry between production and consumption, driven heavily by the concentration of electric vehicle and battery manufacturing hubs.

- Asia Pacific (APAC): APAC is the unequivocal global leader in both production capacity and consumption. Countries like China, South Korea, and Japan host the majority of the world's large-scale copper foil manufacturers and are home to leading battery producers (CATL, LG Energy Solution, Samsung SDI, Panasonic). China, in particular, dominates due to its immense domestic demand from the EV market and its established supply chain infrastructure, maintaining strong vertical integration from copper refining to foil production. The region is the primary source for standard and high-end foils globally, dictating market pricing and supply trends.

- North America: This region is experiencing the fastest growth rate, fueled by the establishment of numerous battery gigafactories (driven by US government incentives like the Inflation Reduction Act). While production capacity is currently lagging behind demand, aggressive localization strategies by both domestic and foreign ECF manufacturers are underway. Demand is concentrated among major automotive OEMs and their battery joint ventures, focusing heavily on securing long-term supply agreements for high-quality, automotive-grade foil.

- Europe: Europe is a critical growth region, driven by the EU’s green transition mandates and the rapid construction of localized battery manufacturing hubs (e.g., in Germany, Hungary, Poland, and Scandinavia). European demand emphasizes compliance with strict sustainability standards and traceable raw material sourcing. Key drivers include premium automotive manufacturers and established industrial electronics sectors. European ECF suppliers are focusing on specialized, environmentally compliant foils.

- Latin America (LATAM): The market in LATAM is comparatively nascent, focused primarily on supporting local PCB manufacturing for consumer electronics and industrial applications. Growth potential exists due to the region's vast copper resources (Chile, Peru), offering opportunities for upstream integration, though downstream ECF production remains limited.

- Middle East and Africa (MEA): ECF consumption in MEA is minor, mainly dependent on imports to support basic electronics assembly and infrastructure projects. The long-term outlook is linked to potential investments in renewable energy and subsequent grid storage requirements, creating future demand for battery-grade foils, particularly in high-growth economies planning diversification away from oil dependency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrolytic Copper Foil Market.- MITSUI MINING & SMELTING CO., LTD.

- Fukurawa Electric Co., Ltd.

- Wuxi Nordson Technology Co., Ltd.

- Kingboard Holdings Limited

- Circuit Foil

- JX Nippon Mining & Metals Corporation

- Chang Chun Group

- Nan Ya Plastics Corporation

- ILJIN Materials Co., Ltd.

- SKC Co., Ltd.

- Micro Power, Ltd.

- Shenzhen Jinzhou Precision Technology Co., Ltd.

- Lingbao Wason Copper Foil Co., Ltd.

- UACJ Foil Corporation

- Shandong Jinbao Electronics Co., Ltd.

- Suzhou Cu-Tech Co., Ltd.

- Guangdong Chaohua Technology Co., Ltd.

- Targray Technology International

- Inner Mongolia Dinglong Copper Foil Co., Ltd.

- Guangdong Hongyuan Copper Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electrolytic Copper Foil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Electrolytic Copper Foil?

The primary driver is the accelerating global transition toward electric vehicles (EVs) and the subsequent requirement for high-performance lithium-ion batteries, which utilize ECF as the essential anode current collector, demanding massive annual volumes.

How is the Electrolytic Copper Foil market segmented by application?

The market is predominantly segmented into Lithium-ion Batteries (LiBs), which dominate revenue share, and Printed Circuit Boards (PCBs), serving the high-frequency and advanced electronics sectors globally.

What technological advancements are critical for next-generation ECF?

Critical technological advancements include achieving ultra-thin thicknesses (4.5 µm and below) for maximum battery energy density, developing specialized Reverse Treated Foils (RTF) for high-speed signal integrity in 5G/6G PCBs, and functionalized coatings for compatibility with silicon-anode and solid-state battery chemistries.

Which region currently holds the largest market share in ECF production?

The Asia Pacific region, primarily driven by manufacturing capacities in China, South Korea, and Japan, holds the largest market share in ECF production, due to the concentration of battery gigafactories and extensive electronics manufacturing ecosystems.

What are the key risks associated with the ECF value chain?

Key risks include the high volatility of raw copper prices, the massive capital expenditure required for high-purity manufacturing facilities, and supply chain concentration issues, particularly relating to geopolitical stability in dominant production regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High-frequency High-speed Copper Clad Laminate Market Statistics 2025 Analysis By Application (Power Amplifiers, Antenna Systems, Telematics, Communications Systems, Active Safety), By Type (Resin Copper Clad Laminate, Fiberglass Cloth Copper Clad Laminate, Electrolytic Copper Foil Copper Clad Laminate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electrolytic Copper Foil Market Statistics 2025 Analysis By Application (Printed Circuit Board, Lithium-Ion Batteries), By Type (Below 10 um, 10-20 um, 20-50 um, Above 50 um), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electrolytic Copper Foil Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Below 10 mm, 10- 20 mm, 20-50 mm, Above 50 mm), By Application (Printed Circuit Board, Lithium-Ion Batteries, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager