Electromagnetic Stabilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432149 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electromagnetic Stabilizer Market Size

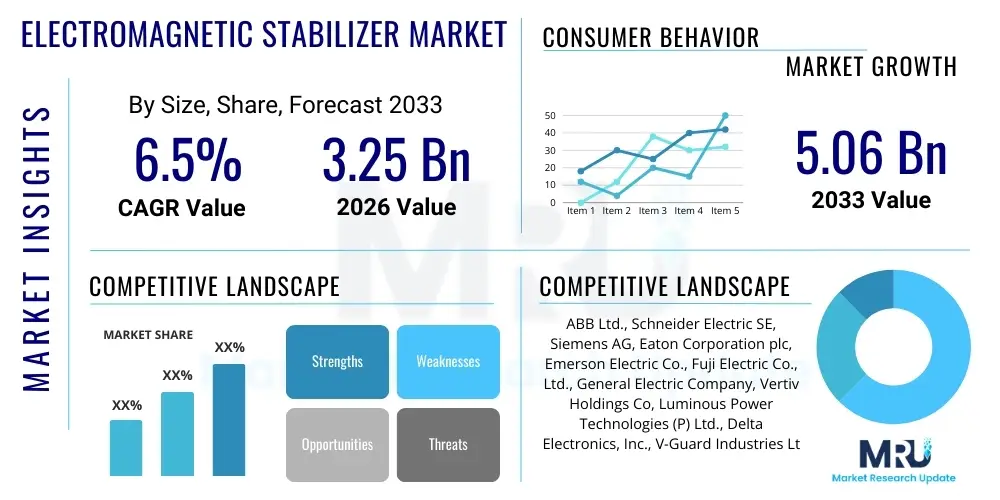

The Electromagnetic Stabilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.25 Billion in 2026 and is projected to reach USD 5.06 Billion by the end of the forecast period in 2033.

Electromagnetic Stabilizer Market introduction

The Electromagnetic Stabilizer Market encompasses devices engineered to maintain a constant output voltage regardless of input voltage fluctuations, primarily utilizing electromagnetic components such as inductors and transformers in combination with sophisticated control circuitry. These devices are critical for protecting sensitive electronic equipment from voltage spikes, sags, and surges, thereby ensuring operational stability and prolonging the lifespan of connected machinery. The core product description involves advanced voltage regulation technologies ranging from ferroresonant designs to solid-state solutions that rapidly compensate for power variations by managing the magnetic flux within the stabilizer architecture. Major applications span a diverse range of industries including consumer electronics, telecommunications, medical imaging systems, industrial automation, and data centers where reliable power quality is non-negotiable. The primary benefit derived from deploying electromagnetic stabilizers is the enhanced reliability of electrical infrastructure and the mitigation of costly downtime associated with power quality issues. Key driving factors propelling market expansion include the rapid proliferation of high-precision electronic equipment, escalating demand for robust power solutions in emerging economies, and the increasingly unstable nature of aging electrical grids globally, necessitating superior protective measures.

Electromagnetic Stabilizer Market Executive Summary

The Electromagnetic Stabilizer Market demonstrates robust expansion driven by critical technological adoption across high-growth sectors, particularly industrial IoT and advanced medical diagnostics. Current business trends indicate a strong pivot towards solid-state electromagnetic stabilizers due to their higher efficiency, faster response times, and compact form factor compared to traditional servo stabilizers. Key players are focusing heavily on integrating smart monitoring and predictive maintenance capabilities, leveraging cloud connectivity to offer advanced power management solutions that cater to the exacting requirements of modern data infrastructure. Regional trends show that Asia Pacific (APAC) remains the dominant market, propelled by massive investments in manufacturing infrastructure and increasing urbanization, leading to higher consumption of stabilizers in residential and commercial sectors. North America and Europe are characterized by demand for high-end, high-precision stabilizers required for mission-critical applications such as healthcare and defense. Segmentation trends highlight that the application segment comprising industrial machinery holds the largest market share, though the fastest growth is anticipated in the IT and telecommunications sectors due to continuous expansion of 5G networks and data center capacity worldwide. Moreover, there is a distinct shift in segment preference towards three-phase stabilizers as large industrial and commercial operations increasingly seek comprehensive power protection solutions.

AI Impact Analysis on Electromagnetic Stabilizer Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in electromagnetic stabilizers frequently revolve around predictive failure analysis, optimized power distribution, and enhanced efficiency management. Users are concerned about how AI can move stabilizers beyond mere reactive voltage correction towards proactive power quality management. Key themes include the ability of AI algorithms to learn complex load patterns and grid instability signatures, allowing the stabilizer to anticipate voltage fluctuations before they become critical. There is a strong expectation that AI will significantly reduce energy waste by dynamically adjusting magnetic components based on real-time load requirements, leading to enhanced overall system efficiency (AEO focus: Predictive Maintenance, Energy Efficiency, Dynamic Load Management). Furthermore, users inquire about AI’s role in diagnostic reporting and identifying external grid faults, thereby transforming the stabilizer into an intelligent power quality gatekeeper that provides actionable insights rather than just mitigation. This shift towards smart stabilization is viewed as a critical step for modernizing infrastructure in data centers and precision manufacturing facilities.

- AI enables predictive maintenance by analyzing historical voltage fluctuation data and component wear patterns, forecasting potential failures before they occur.

- Machine Learning algorithms optimize stabilizer response time and regulation accuracy by learning specific load characteristics and reacting dynamically to transient conditions.

- AI facilitates smart energy management by minimizing operational losses through optimal setting adjustments of magnetic elements based on real-time power demand.

- Integration of deep learning allows stabilizers to differentiate between benign and harmful voltage events, improving operational resilience and reducing unnecessary interventions.

- AI-driven diagnostics provide comprehensive power quality reports, identifying upstream grid issues and offering prescriptive solutions for overall electrical system health.

DRO & Impact Forces Of Electromagnetic Stabilizer Market

The Electromagnetic Stabilizer Market is influenced by a powerful combination of market drivers, operational restraints, and substantial opportunities, all shaped by underlying impact forces. Key drivers include the exponential growth in demand for uninterrupted and clean power, particularly from sectors relying on sensitive microelectronics, such as IT, telecom, and healthcare. The increasing penetration of renewable energy sources, while beneficial, introduces inherent grid intermittency and voltage instability, necessitating robust stabilization solutions. Conversely, the market faces restraints such related to the bulkiness and relatively high initial capital cost of high-capacity electromagnetic stabilizers, particularly the traditional servo and ferroresonant types, which can deter adoption in price-sensitive markets. Furthermore, the rising competition from advanced alternative technologies like Active Power Filters (APFs) presents a challenge, pushing manufacturers to innovate rapidly to maintain market relevance.

Opportunities for growth are significant, primarily driven by large-scale infrastructure projects in developing economies, focusing on building smart cities and modernizing antiquated power grids. There is a burgeoning opportunity in integrating electromagnetic stabilizers with IoT platforms for remote monitoring and centralized control, appealing directly to large industrial campuses and critical infrastructure operators. The stringent regulatory requirements concerning power quality and energy efficiency, particularly in developed regions, also create a sustained need for high-performance stabilization products. These market dynamics collectively amplify the impact forces, which include intensity of competitive rivalry among international and regional players, the threat of substitution from alternative power conditioning solutions, and the high bargaining power of large enterprise buyers seeking customized, integrated power solutions.

The convergence of rapid industrial digitalization and the vulnerability of complex electronic systems to power disturbances solidifies the market's trajectory. The impact of economic cycles, while present, is often mitigated by the non-discretionary nature of power protection in critical applications. The most substantial impact force remains technological change; manufacturers must continually invest in R&D to develop lighter, more efficient, and smarter stabilizers (e.g., solid-state designs) to overcome the traditional drawbacks of electromagnetic technology and leverage the immense opportunities presented by emerging high-precision manufacturing and data storage needs globally.

Segmentation Analysis

The Electromagnetic Stabilizer Market is extensively segmented based on Type, Phase, Application, and geographic regions, allowing for targeted analysis of market dynamics and growth pockets. The segmentation by Type delineates between ferroresonant, servo-controlled, and solid-state varieties, reflecting differences in technology, efficiency, and response speed. Phase segmentation distinguishes between single-phase and three-phase stabilizers, crucial for catering to residential/small commercial loads versus large industrial and data center applications, respectively. Application segmentation is perhaps the most critical, highlighting end-user industries such as Consumer Electronics, Industrial Automation, Healthcare, and Telecommunications, each presenting unique demands concerning precision and capacity. This granular segmentation provides stakeholders with detailed insights into the specific technological requirements and procurement patterns across diverse vertical markets.

- By Type:

- Servo Stabilizers

- Solid-State Stabilizers (Static Voltage Regulators)

- Ferroresonant Stabilizers

- Magnetic Induction Stabilizers

- By Phase:

- Single-Phase Stabilizers

- Three-Phase Stabilizers

- By Application:

- Consumer Electronics (e.g., HVAC, Refrigeration)

- Industrial Machinery and Automation

- Healthcare and Medical Devices (e.g., MRI, CT Scanners)

- IT and Data Centers

- Telecommunications and Broadcasting

- Defense and Aerospace

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Electromagnetic Stabilizer Market

The value chain for the Electromagnetic Stabilizer Market begins with upstream activities focused on the procurement of core raw materials, predominantly high-grade electrical steel, copper wire for winding transformers and inductors, and specialized electronic components like microcontrollers and power semiconductors. Efficient sourcing and quality control of these primary materials are paramount, as they directly impact the stabilizer’s efficiency, response speed, and overall reliability. Manufacturers must maintain robust relationships with metal suppliers and semiconductor vendors to ensure supply chain resilience and cost optimization. The core manufacturing phase involves specialized processes such as transformer winding, insulation, assembly of control boards, and rigorous testing for regulation accuracy and load handling capabilities, often requiring high levels of vertical integration or close partnership with specialized component suppliers.

Midstream activities revolve around product distribution and market reach. The distribution channel is often bifurcated into direct sales channels for large industrial clients and indirect channels utilizing a network of authorized distributors, system integrators, and electrical contractors for smaller commercial and residential markets. Direct sales are crucial for customized, high-capacity three-phase units often required in data centers or large manufacturing plants, ensuring specialized technical support and installation guidance are provided. Indirect channels leverage extensive logistical networks to achieve broad market penetration and timely delivery to dispersed end-users, requiring effective inventory management and channel partner training on product specifications and service protocols.

Downstream activities focus on post-sale services, including installation, commissioning, maintenance contracts, and eventual repair or replacement. Given that stabilizers are protective devices for critical infrastructure, post-sales support quality is a major differentiator. The engagement of skilled technicians is essential for proper system integration and calibration to the specific electrical environment. Ultimately, the efficiency of the entire value chain hinges on manufacturers’ ability to manage raw material price volatility, maintain quality control during assembly, and establish reliable distribution pathways that minimize time-to-market and maximize customer service responsiveness, thereby solidifying brand trust and driving repeat business among industrial end-users.

Electromagnetic Stabilizer Market Potential Customers

Potential customers for electromagnetic stabilizers are diverse, spanning virtually every sector that relies on sensitive electronic equipment or requires uninterrupted operations. The largest segments of end-users are concentrated within the industrial automation sector, including heavy manufacturing, petrochemicals, and processing plants, where large three-phase stabilizers protect expensive CNC machines, motors, and robotic systems from severe voltage fluctuations. Another significant buyer demographic is the IT and telecommunications sector, which utilizes high-precision solid-state stabilizers to ensure the integrity and uptime of servers, network equipment, and crucial data center infrastructure, where even momentary power dips can cause catastrophic data loss or system failure.

The healthcare industry represents a high-value customer base, deploying stabilizers to safeguard critical and costly medical devices such as MRI machines, CT scanners, and life support systems, where power stability is directly linked to patient safety and diagnostic accuracy. Furthermore, small to medium enterprises (SMEs) and residential consumers constitute a large volume market for single-phase stabilizers, protecting everyday consumer electronics, office equipment, and refrigeration units against common grid inconsistencies prevalent in urban and semi-urban areas. As grid instability increases globally due to infrastructural limitations and the integration of decentralized renewable energy, the demand for stabilization solutions across all these end-user segments is projected to rise steadily.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.25 Billion |

| Market Forecast in 2033 | USD 5.06 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Schneider Electric SE, Siemens AG, Eaton Corporation plc, Emerson Electric Co., Fuji Electric Co., Ltd., General Electric Company, Vertiv Holdings Co, Luminous Power Technologies (P) Ltd., Delta Electronics, Inc., V-Guard Industries Ltd., Servomax Limited, MICROTEK International Pvt. Ltd., Su-Kam Power Systems Ltd., Kirloskar Electric Company Limited, Statron AG, TSi Power Corporation, Kinetic Control Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electromagnetic Stabilizer Market Key Technology Landscape

The Electromagnetic Stabilizer Market is characterized by a mature base technology undergoing rapid modernization through integration with digital control systems and power electronics. Historically, the market was dominated by Servo-Controlled Voltage Stabilizers (SCVS), which utilize a motorized auto-transformer to mechanically adjust the voltage. While robust and reliable, their slow response time (measured in seconds) makes them inadequate for highly transient environments. The key technological shift involves the transition toward Solid-State Stabilizers (SSS), also known as Static Voltage Regulators (SVRs). SSS units employ advanced power semiconductors, such as insulated-gate bipolar transistors (IGBTs) or thyristors, coupled with high-speed microcontrollers to achieve near-instantaneous voltage correction (response times often in milliseconds), offering superior precision and zero moving parts, drastically improving reliability and reducing maintenance requirements.

A significant area of technological focus is the development of magnetic induction technology, specifically for high-capacity industrial applications where high efficiency and ruggedness are necessary. These advanced induction stabilizers leverage specialized transformer designs and sophisticated magnetic flux control mechanisms, offering high regulation accuracy over a wider input voltage range without the wear and tear associated with brushes found in traditional servo models. Furthermore, the convergence of electromagnetic stabilization principles with Active Power Filtering (APF) technologies is creating hybrid solutions. These hybrids not only correct voltage fluctuations but also mitigate harmonic distortions and improve overall power factor, addressing multiple facets of poor power quality simultaneously. This integration is vital for industries running non-linear loads, such as large variable frequency drives (VFDs) and specialized IT equipment.

The future technology landscape is heavily influenced by the Internet of Things (IoT) and AI integration. Modern stabilizers are increasingly equipped with embedded network interface cards (NICs) and cloud connectivity, enabling remote monitoring, logging of power events, and predictive analytics. Manufacturers are embedding sophisticated digital signal processors (DSPs) to execute complex control algorithms, enhancing the overall precision and adaptability of the stabilization process. This technological evolution ensures that electromagnetic stabilizers remain competitive against newer power quality solutions, transitioning them from simple protection devices to intelligent components of a holistic smart grid management system, capable of communication and self-optimization within complex electrical networks.

Regional Highlights

The regional analysis of the Electromagnetic Stabilizer Market reveals distinct growth patterns and technological adoption rates influenced by local economic development, infrastructure quality, and industrial concentration. Asia Pacific (APAC) holds the leading position in terms of market share and is expected to exhibit the fastest growth over the forecast period. This dominance is primarily attributed to rapid industrialization, extensive government investment in infrastructural development, and the massive consumer electronics manufacturing base across countries like China, India, and South Korea. Furthermore, the often-unstable power grids in developing APAC nations necessitate widespread adoption of stabilizers in residential, commercial, and industrial settings to protect valuable equipment. The market in APAC is characterized by high volume demand for both single-phase and three-phase units, often prioritizing cost-effectiveness alongside reliability.

North America and Europe represent mature markets characterized by stringent power quality standards and a high concentration of critical infrastructure, including large data centers, high-tech manufacturing, and advanced medical facilities. In these regions, the demand is heavily skewed towards high-precision, high-efficiency, solid-state stabilizers that offer instantaneous response and seamless integration with smart grid technologies. The focus is less on basic protection against routine fluctuations and more on mitigating complex power quality issues, such as sags and swells, which are detrimental to highly sensitive computing and diagnostic equipment. Regulatory mandates for energy efficiency in these regions further drive the adoption of technologically advanced magnetic and solid-state designs over less efficient, older servo models.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets showing significant potential. Growth in LATAM is driven by urbanization and modernization of industrial sectors, especially in Brazil and Mexico, where power supply reliability can be variable, fueling demand for reliable stabilizers in commercial and light industrial applications. In MEA, major infrastructure and construction projects, coupled with significant investments in oil, gas, and telecommunications sectors, are fueling the need for high-capacity three-phase stabilizers to protect expansive industrial plants and rapidly growing metropolitan areas. While these regions face challenges related to initial investment constraints, the increasing penetration of international manufacturing standards and the necessity of safeguarding expensive imports are creating sustainable long-term market opportunities for stabilizer vendors.

- Asia Pacific (APAC): Market leader and fastest-growing region; driven by rapid industrialization, massive electronics manufacturing, high population density, and existing grid instability. China and India are the primary growth engines, fueling high volume sales in consumer and industrial segments.

- North America: Mature market focused on high-specification, solid-state stabilizers for data centers, healthcare, and high-tech defense applications. Strict power quality regulations drive premium product adoption.

- Europe: Characterized by strong demand for energy-efficient stabilizers due to stringent environmental policies. Key sectors include industrial automation (Germany) and renewable energy integration. Emphasis on integrated smart monitoring solutions.

- Latin America (LATAM): Emerging market driven by infrastructural development and modernization. Demand concentrated in metropolitan centers and industrial zones (e.g., Brazil, Mexico) where power supply reliability is inconsistent.

- Middle East & Africa (MEA): Growth fueled by large-scale infrastructure projects (e.g., smart city development, oil and gas expansion). Demand is high for robust, high-temperature tolerant stabilizers for demanding environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electromagnetic Stabilizer Market.- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Eaton Corporation plc

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Vertiv Holdings Co

- Luminous Power Technologies (P) Ltd.

- Delta Electronics, Inc.

- V-Guard Industries Ltd.

- Servomax Limited

- MICROTEK International Pvt. Ltd.

- Su-Kam Power Systems Ltd.

- Kirloskar Electric Company Limited

- Statron AG

- TSi Power Corporation

- Kinetic Control Systems

- Godrej & Boyce Mfg. Co. Ltd. (Stabilizer Division)

- Socomec Group SA

Frequently Asked Questions

Analyze common user questions about the Electromagnetic Stabilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a servo stabilizer and a solid-state stabilizer?

The primary difference lies in the mechanism and speed of voltage correction. Servo stabilizers utilize a motorized system and moving parts, offering high capacity but slower response times (seconds). Solid-state stabilizers use power electronics (IGBTs/Thyristors) with no moving parts, providing near-instantaneous response (milliseconds), making them superior for protecting highly sensitive, transient-sensitive equipment like data center servers and medical devices.

Which application segment drives the highest demand for three-phase electromagnetic stabilizers?

The Industrial Machinery and Automation segment consistently drives the highest demand for three-phase electromagnetic stabilizers. These high-capacity units are essential for protecting large industrial loads such as CNC machines, heavy motors, Variable Frequency Drives (VFDs), and complex robotic assembly lines where phase balance and voltage stability are critical for continuous operation and asset protection.

How is the integration of IoT impacting the functionality of modern electromagnetic stabilizers?

IoT integration transforms stabilizers into smart devices capable of remote monitoring, logging real-time power quality data, and centralized management. This connectivity enables predictive maintenance, alerts operators to potential power grid issues immediately, and allows for remote parameter adjustments, significantly enhancing operational efficiency and reducing on-site maintenance requirements.

What are the key restraint factors challenging the growth of the Electromagnetic Stabilizer Market?

Key restraints include the relatively high initial capital expenditure required for high-capacity units, especially solid-state and magnetic induction types, which can be prohibitive for small businesses. Additionally, the market faces intense competition from advanced alternative power quality solutions, such as Uninterruptible Power Supplies (UPS) and Active Power Filters (APFs), which offer broader protection capabilities.

Why is the Asia Pacific region projected to exhibit the highest growth rate in this market?

The Asia Pacific region’s accelerated growth is fueled by unprecedented infrastructural development, rapid urbanization, massive expansion in the manufacturing sector (particularly electronics and automotive), and persistent challenges related to inconsistent power quality and frequent voltage fluctuations across large parts of the electrical grids in emerging economies like India and China, necessitating widespread protective measures.

Market Dynamics and Competitive Landscape

The competitive landscape of the Electromagnetic Stabilizer Market is highly fragmented, featuring a mix of large multinational conglomerates that offer integrated power solutions and specialized regional players focused predominantly on servo or static stabilizers. The market exhibits intense rivalry driven primarily by technological innovation, pricing strategy, and the quality of post-sales service and technical support. Large global players such as ABB, Schneider Electric, and Eaton leverage their extensive global distribution networks, diversified product portfolios, and strong brand recognition to maintain market dominance, particularly in high-specification industrial and data center segments. Their competitive advantage stems from the ability to offer comprehensive power management ecosystems, often bundling stabilizers with UPS systems, switchgear, and energy monitoring software.

Mid-sized and regional players, especially prevalent in APAC (e.g., Luminous, V-Guard), compete effectively by focusing on high-volume, cost-competitive products tailored specifically for residential and light commercial applications, where price sensitivity is high. These regional champions often excel in customizing products to handle local voltage standards and environmental conditions (such as high temperatures). The primary competitive factor among all tiers of players is the response time and efficiency of the stabilizer; solid-state technology has become a crucial battleground, pushing R&D investment towards faster switching speeds, higher power density, and reduced footprint, allowing them to better service the rapidly expanding high-tech industries. Acquisitions and strategic partnerships are common, aimed at consolidating technological capabilities, expanding geographic reach, and securing access to crucial supply chain components like semiconductors.

Further intensifying competition is the evolving trend toward digital servicing. Companies are increasingly differentiating themselves through software-as-a-service (SaaS) models built around their stabilizer products, offering subscription-based access to advanced analytics, predictive maintenance insights, and energy optimization reports. This shift requires competitors to not only master electrical engineering but also develop strong software and data science capabilities. Compliance with international standards, such as IEEE and IEC, is non-negotiable for accessing major industrial procurement contracts, forcing smaller players to continually upgrade their certification status. The long operational life of stabilizers means securing initial installation contracts, especially in critical infrastructure, translates into long-term revenue streams from maintenance and service contracts, making the initial project wins highly competitive.

Growth Opportunities Analysis

Several significant growth opportunities are poised to shape the future trajectory of the Electromagnetic Stabilizer Market. The most compelling opportunity lies in the global push towards smart grid infrastructure and the subsequent need for stabilizing technologies capable of interacting seamlessly with decentralized power sources, especially solar and wind energy. As renewable energy integration increases grid volatility, stabilizers that can effectively manage bi-directional power flow and high transient spikes become essential. Manufacturers who develop highly resilient, modular stabilizers specifically designed for hybrid power systems stand to capture substantial market share from utility and large commercial clients focused on sustainable energy solutions.

Another high-potential avenue is the rapid expansion of the edge computing and 5G network infrastructure. Edge data centers and remote cellular base stations require compact, highly reliable, and virtually maintenance-free stabilization solutions due to their dispersed locations and often limited physical access. Solid-state stabilizers, owing to their smaller footprint, higher efficiency, and ability to handle high-frequency fluctuations characteristic of modern telecom equipment, are ideally positioned to capitalize on this boom. Developing specialized ruggedized stabilizers that can withstand extreme environmental conditions (e.g., deserts or high altitudes) for telecom deployment represents a niche, yet highly profitable, opportunity.

Furthermore, the increased reliance on automation and precision equipment in high-growth manufacturing sectors, such as semiconductors, electric vehicle (EV) battery production, and specialized pharmaceuticals, presents a critical need for ultra-high-precision voltage regulation. These processes are intolerant to even minor voltage deviations. Stabilizer manufacturers offering products with tighter regulation tolerances (e.g., ±0.5% or better) and certified clean power delivery features can command premium pricing and secure contracts in these highly sensitive industrial environments. Leveraging advanced materials to improve magnetic components, thereby reducing losses and improving overall efficiency, further unlocks opportunities in meeting stringent environmental and operational performance metrics demanded by these sophisticated industrial clients.

Challenges and Risk Factors

The Electromagnetic Stabilizer Market faces several inherent challenges and external risk factors that could impede growth. A primary internal challenge is the perennial trade-off between the physical size, weight, and capacity of electromagnetic stabilizers. Traditional models, particularly large three-phase units, require significant installation space and complex logistics, presenting an obstacle in space-constrained urban areas and existing industrial retrofits. This size limitation often pushes end-users toward smaller, though potentially less robust, alternatives like electronic voltage regulators or passive solutions, particularly in residential or small commercial settings. Overcoming this requires continuous innovation in materials science and power electronics to achieve higher power density and reduced footprint without compromising performance.

An external risk factor stems from the volatile pricing of key raw materials, namely copper and electrical steel. Since these materials constitute a significant portion of the stabilizer’s manufacturing cost, fluctuations in global commodity markets directly impact profitability and pricing strategy. Manufacturers face the constant pressure of absorbing these costs or passing them on to consumers, which could affect competitiveness against alternative solutions. Furthermore, the market faces the risk of technological obsolescence, specifically from non-stabilizer technologies like advanced UPS systems equipped with superior power conditioning capabilities, which offer not only stabilization but also blackout protection, potentially substituting the need for a dedicated stabilizer in certain applications.

Operational risks include maintaining quality control across complex global supply chains, especially when sourcing specialized electronic control boards and semiconductors. A lapse in component quality can severely undermine the reliability of the stabilizer, leading to premature failure and costly warranty claims, particularly damaging in mission-critical applications where failure is unacceptable. Additionally, the proliferation of low-quality, uncertified stabilizers from smaller, regional manufacturers in price-sensitive markets poses a safety and reliability risk to the end-users and creates downward pressure on the average selling prices for certified, high-quality products. Navigating complex and varying regional certification and regulatory standards also adds significant compliance overhead for international vendors seeking global market access.

Industry Outlook and Future Trends

The industry outlook for the Electromagnetic Stabilizer Market is largely positive, transitioning from a focus purely on protection to integrated power management and optimization. The future is defined by smart stabilizers that are integral components of intelligent electrical systems. A major trend is the accelerated adoption of Magnetic Flux Modulation (MFM) and other high-frequency magnetic technologies to achieve faster correction speeds and higher efficiency ratings (approaching 99%) than possible with legacy servo designs. This focus on efficiency aligns perfectly with global energy conservation mandates and operational cost reduction goals in industrial sectors. Stabilizers are becoming 'green' appliances, emphasizing minimal operational heat loss and reduced energy consumption under variable load conditions.

Another defining trend is the increasing demand for customization and modularity. Industrial customers require stabilizers built specifically for unique voltage profiles, ambient operating temperatures, and harmonic mitigation requirements. Manufacturers are responding by offering modular stabilization systems that can be easily scaled up or down and configured to meet highly specific power conditioning needs, moving away from standardized, one-size-fits-all products. This modular approach is particularly important for large construction projects and evolving data center expansion where flexibility and future-proofing are paramount considerations for initial investment decisions and long-term TCO (Total Cost of Ownership).

Furthermore, the service model around stabilizers is rapidly evolving. The focus is shifting from purely selling hardware to providing comprehensive power quality monitoring solutions. Future stabilizers will not just regulate voltage; they will act as diagnostic nodes within the electrical infrastructure, providing detailed historical data on grid performance and load interactions. This shift towards data-driven value-added services, including remote diagnostics and prescriptive maintenance recommendations powered by AI, is expected to create new recurring revenue streams for market players and deepen their relationship with critical infrastructure end-users, solidifying the stabilizer's role as a mission-critical asset management tool rather than just a protective accessory.

Regulatory Landscape and Standards

The Electromagnetic Stabilizer Market is governed by a diverse and complex set of international, regional, and national regulatory standards focusing primarily on electrical safety, performance efficiency, and electromagnetic compatibility (EMC). Compliance with these standards is mandatory for market entry, particularly in developed economies. Key international standards include those set by the International Electrotechnical Commission (IEC), specifically IEC 60076 series for transformers, which influences the design of magnetic components within stabilizers, and IEC 62040 concerning Uninterruptible Power Systems, which often overlap in requirements related to power conditioning devices.

In North America, stabilizers must often comply with safety standards established by organizations such as Underwriters Laboratories (UL), specifically UL 1012 (Power Units Other Than Class 2), which addresses construction, fire, and electric shock hazards. Furthermore, the European Union mandates compliance with the CE marking directives, including the Low Voltage Directive (LVD) and the EMC Directive, ensuring that stabilizers are electrically safe and do not generate excessive electromagnetic interference while also being immune to external electromagnetic noise. These requirements often necessitate rigorous testing for electromagnetic compatibility and adherence to specific design parameters to ensure minimal harmonic distortion is introduced back into the grid.

Regional variations, such as Bureau of Indian Standards (BIS) certification in India or CCC (China Compulsory Certification) in China, further complicate the regulatory landscape for manufacturers seeking widespread international distribution. These localized standards often dictate specific minimum efficiency levels and performance parameters tailored to the unique voltage environments and grid characteristics of those regions. The trend towards energy efficiency legislation, such as various energy star ratings or regional Minimum Energy Performance Standards (MEPS), is increasingly pushing manufacturers to develop advanced magnetic and solid-state designs that meet higher efficiency thresholds, transforming regulatory compliance into a key driver for technological innovation and market differentiation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager