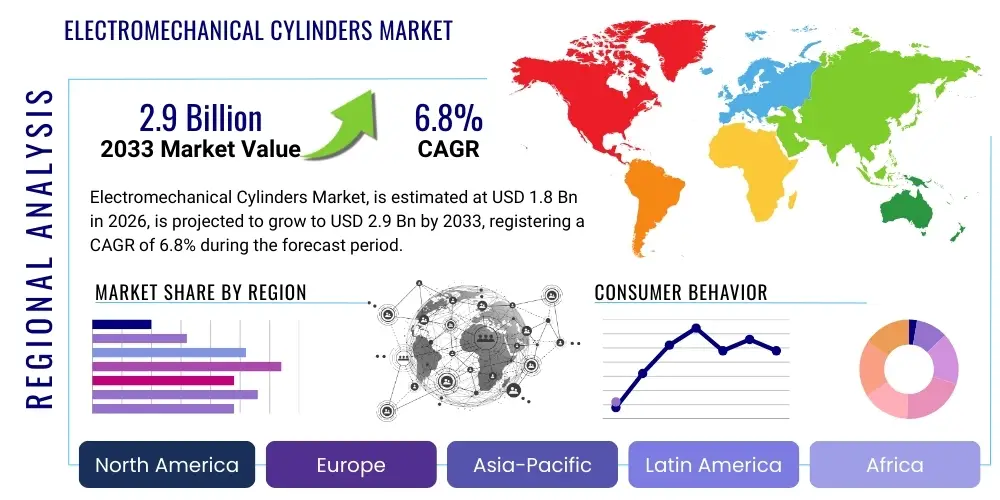

Electromechanical Cylinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438503 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Electromechanical Cylinders Market Size

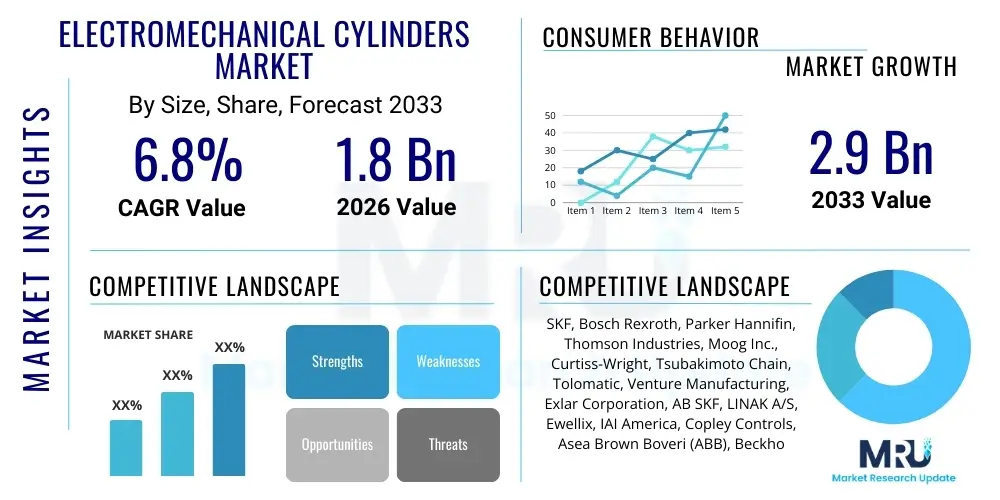

The Electromechanical Cylinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Electromechanical Cylinders Market introduction

The Electromechanical Cylinders (EMCs) Market encompasses devices that convert electrical energy into linear mechanical motion using a motor, screw mechanism (such as ball screws or roller screws), and a piston rod. These sophisticated actuators are replacing traditional hydraulic and pneumatic cylinders, particularly in applications demanding high precision, repeatability, and superior energy efficiency. Unlike fluid power systems, EMCs offer closed-loop control, making them ideal for complex automation tasks where accurate positioning and speed control are critical. This shift is fundamentally driven by the global move towards smarter manufacturing processes and the tenets of Industry 4.0, which prioritize connectivity and data management.

The primary applications of electromechanical cylinders span across various heavy-duty and precision-intensive sectors. In the automotive industry, they are essential for resistance welding, pressing, and assembly line automation. Within the food and beverage sector, EMCs ensure hygienic and precise filling and packaging operations. Furthermore, the aerospace and defense sectors utilize these cylinders for flight simulation, material testing, and precise control surface actuation due to their reliability and robust performance characteristics. The demand is also significantly bolstered by the growing utilization of robotics and specialized testing equipment, which require the high force density and dynamic performance capabilities intrinsic to EMC technology.

Key driving factors propelling the market include stringent environmental regulations pushing industries away from oil-based hydraulic systems, and the imperative for manufacturers to reduce operational costs through improved energy efficiency. EMCs consume power only when actively moving, offering significant energy savings compared to constantly pressurized pneumatic or hydraulic setups. The inherent benefits, such as reduced noise levels, easier maintenance (due to the absence of fluid leaks), and simplified integration into digital control networks, cement their position as the preferred actuation solution in advanced industrial environments globally. The continuous innovation in motor and screw technologies further enhances the performance envelope of these devices.

Electromechanical Cylinders Market Executive Summary

The Electromechanical Cylinders Market is experiencing robust growth driven by the acceleration of industrial automation and the necessity for highly precise motion control across manufacturing domains. Business trends indicate a strong preference for roller screw mechanisms due to their superior load capacity and extended service life, particularly in high-cycle, demanding applications. Furthermore, the market sees increasing integration of advanced sensor technology and sophisticated servo drives, enabling predictive maintenance capabilities and enhanced system connectivity, aligning closely with smart factory initiatives. Strategic collaborations between cylinder manufacturers and specialized software providers are becoming critical for offering complete, integrated motion solutions, moving beyond component sales to comprehensive system engineering services.

Regionally, the Asia Pacific (APAC) continues to lead the market expansion, fueled by massive capital investment in the automotive manufacturing sector, particularly electric vehicle production, and the rapid establishment of automated factories in countries like China, Japan, and South Korea. North America and Europe, while mature, exhibit high growth rates in specialized segments such as aerospace testing and high-speed packaging, where the demand for absolute precision justifies the higher initial cost of EMCs. European growth is additionally supported by strong mandates for energy efficiency and sustainability in industrial operations, promoting the immediate replacement of less efficient pneumatic systems.

Segment-wise, the high-force segment, often utilizing roller screws, is witnessing the fastest adoption rate, particularly in heavy industrial applications such as metal forming and large-scale material handling. In terms of end-use, the automotive and general industrial manufacturing sectors remain the largest consumers, but the food and beverage industry is rapidly emerging as a significant growth vector due to stringent sanitary requirements and the need for repeatable, consistent processes. The trend is moving towards modularity and customization, where manufacturers are offering cylinders specifically optimized for harsh environments, including cleanroom and washdown specifications, thereby broadening the addressable market considerably.

AI Impact Analysis on Electromechanical Cylinders Market

Common user questions regarding AI's impact on Electromechanical Cylinders center around predictive maintenance capabilities, optimization of duty cycles, and integration with autonomous manufacturing systems. Users frequently ask if AI can significantly extend the lifespan of costly roller screws, how machine learning algorithms analyze vibration and temperature data from integrated sensors, and what the return on investment (ROI) is for implementing AI-driven control systems over traditional PLC programming. There is a clear expectation that AI should move EMC systems from reactive maintenance models to highly proactive, self-optimizing operational states, specifically aiming to reduce unexpected downtime and precisely tune performance based on real-time load conditions and environmental variables.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the lifecycle and operational efficiency of electromechanical cylinders. AI algorithms are now routinely employed to process the vast amounts of telemetry data generated by integrated sensors—including force, temperature, vibration, and current draw—to develop highly accurate degradation models. These predictive models allow maintenance schedules to be optimized based on actual component wear rather than fixed intervals, potentially extending the mean time between failures (MTBF) and minimizing catastrophic equipment failure. This shift provides tangible improvements in overall equipment effectiveness (OEE) for automated production lines utilizing EMCs.

Furthermore, AI plays a crucial role in enhancing the real-time performance of EMCs through adaptive control. ML techniques can analyze historical operational data to identify optimal parameter settings for varying loads and speeds, allowing the cylinder’s servo drive to dynamically adjust acceleration profiles and positioning feedback loops. This capability ensures maximum throughput while minimizing energy consumption and mechanical stress. The future trajectory involves integrating EMCs directly into larger AI-driven Industrial Internet of Things (IIoT) frameworks, allowing centralized control systems to orchestrate dozens or hundreds of actuators simultaneously for complex tasks like autonomous material handling or adaptive assembly operations.

- AI-driven Predictive Maintenance: Enhances system reliability by analyzing sensor data (vibration, temperature) to forecast component failure, optimizing service intervals for screw mechanisms and motors.

- Adaptive Motion Control: Utilizes Machine Learning to dynamically optimize cylinder speed, force, and acceleration profiles in real-time, improving energy efficiency and throughput.

- Enhanced Anomaly Detection: AI models rapidly identify minor deviations in performance signatures, preventing minor faults from escalating into major operational failures.

- Optimized Energy Consumption: ML algorithms fine-tune duty cycles based on production schedules, minimizing electricity usage during non-critical phases of operation.

- Seamless Integration with Robotics: Facilitates high-level coordination and trajectory planning for EMCs operating within collaborative robot (cobot) environments.

DRO & Impact Forces Of Electromechanical Cylinders Market

The Electromechanical Cylinders market is primarily driven by the imperative for industrial manufacturers to achieve greater precision, energy conservation, and system flexibility, underpinned by the global transition to smart manufacturing environments (Industry 4.0). However, this growth is significantly restrained by the substantially higher initial capital expenditure required for purchasing and installing EMC systems compared to conventional hydraulic or pneumatic alternatives, alongside the technical complexity involved in integrating advanced servo drives and control software into legacy operational technology (OT) infrastructure. Opportunities are abundant in the development of specialized, compact cylinders for mobile robotics and portable automation equipment, alongside leveraging advancements in materials science to create lighter and more robust screw mechanisms, further expanding their applicability beyond traditional factory floors. The impact forces acting upon the market are characterized by the rapid technological obsolescence risk inherent in highly digitized systems and the competitive pressure to reduce the total cost of ownership (TCO) through standardized, scalable modular designs.

Segmentation Analysis

The Electromechanical Cylinders Market is segmented based on the critical parameters of mechanism type, force capacity, and end-use application, providing a granular view of demand distribution and technological preference across industries. Type segmentation—primarily differentiating between ball screw, roller screw, and lead screw technologies—reflects a trade-off between speed/precision (ball screws) and high load/durability (roller screws), with customization being a key market differentiator. The force capacity dictates the market adoption across light-duty automation versus heavy-duty industrial pressing and molding. End-use segmentation highlights that while traditional factory automation remains the core demand driver, emerging high-growth segments include specialized testing, medical equipment manufacturing, and the rapidly growing semiconductor fabrication sector, which demands ultra-high precision motion control systems.

- By Type:

- Roller Screw Electromechanical Cylinders

- Ball Screw Electromechanical Cylinders

- Lead Screw Electromechanical Cylinders

- By Force Capacity:

- Low Force (Up to 5 kN)

- Medium Force (5 kN to 50 kN)

- High Force (Above 50 kN)

- By Application:

- Automotive Manufacturing

- Food and Beverage Processing

- Industrial Automation and Robotics

- Aerospace and Defense

- Material Handling and Logistics

- Medical and Pharmaceutical

- Testing and Simulation Equipment

- By End-Use Industry:

- General Industrial Manufacturing

- Process Industries

- Semiconductor & Electronics

- Oil & Gas

Value Chain Analysis For Electromechanical Cylinders Market

The value chain of the Electromechanical Cylinders market is inherently complex, starting with the upstream sourcing of specialized raw materials and highly sophisticated components. Upstream activities involve the procurement of high-grade steel alloys for screw mechanisms and aluminum for cylinder bodies, alongside specialized electronics such as rare-earth magnets for servo motors and precision bearings. Key challenges at this stage include ensuring quality control for highly sensitive components like precision-ground screws and maintaining a stable supply chain for microprocessors essential for integrated drives. The manufacturing phase involves precision machining, complex assembly of the mechanical components (screw and nut), and meticulous integration of the electronic control systems, where intellectual property related to control algorithms provides a significant competitive advantage.

Downstream analysis focuses on system integration, distribution, and end-user deployment. Distribution channels include direct sales for highly customized or large-scale projects, and indirect sales through specialized industrial distributors and system integrators who add value by configuring, installing, and commissioning the EMC systems into existing factory infrastructure. The system integrators play a crucial role in bridging the gap between component manufacturers and the end-user's specific automation requirements, often bundling the cylinder with controllers, software, and necessary mechanical interfaces. Technical support and post-sales servicing are critical downstream activities, particularly given the reliance of modern EMCs on complex servo technology and software interfaces.

Direct sales channels are preferred by major manufacturers when dealing with global corporations or high-volume OEM contracts, allowing for tight control over pricing and customized product specifications. Indirect channels, particularly through regional industrial automation distributors, are vital for penetrating the SME segment and providing immediate localized inventory and technical assistance. The effectiveness of the value chain is increasingly measured by the ability to provide modular, easily configurable products and comprehensive digital support documentation, optimizing the total delivery and implementation cycle time for the end customer.

Electromechanical Cylinders Market Potential Customers

Potential customers for Electromechanical Cylinders are primarily found in sectors requiring high-force density, repeatable movement, and superior energy efficiency, effectively segmenting the buyer landscape into heavy-duty industrial users and precision automation specialists. Large-scale automotive OEMs constitute a significant customer base, utilizing EMCs extensively in automated welding lines, assembly presses, and testing rigs, driven by the need for faster cycle times and consistent quality output in modern vehicle manufacturing, especially for electric vehicle battery assembly where extreme precision is mandatory. Similarly, general industrial manufacturing facilities, particularly those involved in metal forming, injection molding, and large-scale material handling, represent core buyers seeking to replace inefficient fluid power systems with robust, digital-ready alternatives.

Beyond traditional factory floors, high-value end-users include specialized laboratories and defense contractors. Aerospace and defense organizations employ EMCs in sophisticated flight simulators and structural testing equipment where precise force application and displacement measurement are non-negotiable. Furthermore, the semiconductor and electronics manufacturing industry is a rapidly growing customer segment, relying on the ultra-precise positioning capability of certain EMC types (often integrated with linear motors) to handle delicate components and perform wafer processing stages with micron-level accuracy. These customers prioritize technical specifications like repeatability, duty cycle, and the reliability of integrated control feedback systems over initial cost.

The customer base also extends significantly into the packaging and food processing industries. Food and beverage manufacturers leverage EMCs for their hygienic design options (stainless steel, washdown resistant) and their ability to execute precise dosing, filling, and sealing operations, ensuring compliance with strict sanitary standards. These users value the clean operation—absence of oil or fluid contamination—and the ease of integrating EMCs into automated cleaning cycles (CIP/SIP). Ultimately, any industrial operation undergoing modernization toward Industry 4.0 principles, prioritizing data connectivity, energy reduction, and flexible manufacturing, stands as a prime potential customer for electromechanical cylinder technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Bosch Rexroth, Parker Hannifin, Thomson Industries, Moog Inc., Curtiss-Wright, Tsubakimoto Chain, Tolomatic, Venture Manufacturing, Exlar Corporation, AB SKF, LINAK A/S, Ewellix, IAI America, Copley Controls, Asea Brown Boveri (ABB), Beckhoff Automation, Siemens AG, Mitsubishi Electric, Rockwell Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electromechanical Cylinders Market Key Technology Landscape

The technological landscape of the Electromechanical Cylinders market is dominated by advancements in three core areas: motor and drive integration, screw mechanism design, and embedded sensor technology. The shift toward integrated servo motor and drive systems is paramount, as this integration allows for extremely compact footprints and reduces the complexity of wiring and external cabinet space required. Modern EMCs utilize high-performance brushless DC (BLDC) motors and synchronous servo motors paired with sophisticated digital servo drives capable of executing high-frequency closed-loop position and force control. These systems often incorporate EtherCAT or PROFINET communication protocols, ensuring high-speed data exchange necessary for real-time automation environments, making them plug-and-play components within digital factories.

Continuous innovation in the screw mechanism is crucial for enhancing performance characteristics. Roller screw technology, particularly planetary and satellite roller screws, represents the leading edge for high-force, high-duty cycle applications due to their large contact area which significantly increases load capacity and longevity compared to standard ball screws. Manufacturers are also focusing on improving surface treatments, such as specialized coatings, to reduce friction, minimize wear, and allow for operation in environments with minimal lubrication. These improvements directly contribute to lower total cost of ownership and reduced maintenance requirements, enhancing their competitive standing against hydraulic systems.

Furthermore, the incorporation of advanced sensing and diagnostic capabilities is becoming standard practice. EMCs are increasingly equipped with high-resolution absolute encoders for precise positioning feedback, alongside vibration, temperature, and current sensors embedded directly into the cylinder body or motor housing. This integrated sensing capability is essential for enabling the AI-driven predictive maintenance and condition monitoring features that the market now demands. The ability to generate real-time operational data allows end-users to optimize processes, troubleshoot remotely, and ensure compliance with quality control specifications in precision applications.

Regional Highlights

The regional dynamics of the Electromechanical Cylinders Market exhibit distinct patterns influenced by industrial maturity, technological adoption rates, and regulatory environments concerning energy efficiency. The Asia Pacific (APAC) region currently holds the largest market share and is projected to experience the fastest growth throughout the forecast period. This dominance is attributed to aggressive governmental policies supporting industrial modernization in China and India, coupled with massive private investment in high-tech manufacturing, particularly robotics, consumer electronics, and electric vehicle production across Japan and South Korea. The large volume of factory construction and automation retrofits in APAC creates an unparalleled demand for efficient motion control systems.

Europe represents a highly mature yet innovative market, characterized by stringent regulations focused on environmental protection and energy conservation, driving the accelerated replacement of fluid power systems with energy-saving EMCs. Germany, as a global hub for advanced engineering and automotive production, leads the demand within the region, emphasizing high-precision applications and integrated Industry 4.0 solutions. The European market focuses heavily on technological sophistication, favoring highly customized, closed-loop servo systems capable of complex motion profiling, particularly in machine tools and specialized processing industries.

North America maintains a strong position, driven by significant capital investment in aerospace and defense, food and beverage processing, and the revitalization of domestic manufacturing capacity. The demand here is often characterized by a need for rugged, high-force cylinders for heavy machinery and testing applications, particularly in the oil and gas equipment sector and large-scale material handling logistics. The widespread adoption of collaborative robotics and advanced automation technologies across the U.S. and Canada further solidifies the need for reliable, high-performance EMCs capable of integrating seamlessly into sophisticated digital control networks.

- Asia Pacific (APAC): Dominant market size; fastest growth rate fueled by EV manufacturing, electronics production, and government-backed industrial automation initiatives (e.g., Made in China 2025).

- Europe: High adoption rates driven by energy efficiency mandates and strong emphasis on Industry 4.0 compliance; key demand sectors include high-precision machine tools and pharmaceutical processing.

- North America: Focus on high-force and heavy-duty applications in aerospace, defense, and material handling logistics; robust market for testing and simulation equipment requiring utmost accuracy.

- Latin America: Emerging market with slower adoption, concentrating primarily on basic industrial automation and modernization of mining and primary processing facilities.

- Middle East and Africa (MEA): Limited adoption focused on oil and gas infrastructure and large-scale construction projects; increasing opportunities in nascent manufacturing hubs, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electromechanical Cylinders Market.- SKF

- Bosch Rexroth

- Parker Hannifin

- Thomson Industries

- Moog Inc.

- Curtiss-Wright

- Tsubakimoto Chain

- Tolomatic

- Venture Manufacturing

- Exlar Corporation

- AB SKF

- LINAK A/S

- Ewellix

- IAI America

- Copley Controls

- Asea Brown Boveri (ABB)

- Beckhoff Automation

- Siemens AG

- Mitsubishi Electric

- Rockwell Automation

Frequently Asked Questions

Analyze common user questions about the Electromechanical Cylinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Electromechanical Cylinders over hydraulic or pneumatic systems?

The primary advantage is superior energy efficiency, as EMCs only consume power on demand, combined with precise, digital control capabilities offering micron-level repeatability and easier integration into modern networked automation systems (Industry 4.0).

Which screw technology offers the highest force capacity and durability in EMCs?

Roller screw technology, specifically planetary roller screws, provides the highest load capacity, rigidity, and extended service life, making them the preferred choice for heavy-duty, high-cycle industrial pressing and forming applications.

How is the high initial cost of EMCs justified for industrial manufacturers?

The high initial investment is justified by the significantly lower operating expenses (reduced energy consumption), minimized maintenance costs (no fluid leaks or filtering), and increased productivity derived from higher precision and reduced system downtime, leading to a lower Total Cost of Ownership (TCO) over the cylinder's lifespan.

What role does Artificial Intelligence (AI) play in the future development of the EMC Market?

AI is crucial for enabling predictive maintenance by analyzing integrated sensor data (vibration, temperature) to forecast failures, optimizing operational parameters in real-time for maximum energy efficiency, and facilitating advanced adaptive motion control strategies.

Which geographic region currently dominates the Electromechanical Cylinders market?

The Asia Pacific (APAC) region currently dominates the market, driven by rapid industrial expansion, massive investments in automotive and electronics manufacturing, and widespread adoption of factory automation technologies across major economies like China and Japan.

The following detailed exposition provides a technical deep dive into the Electromechanical Cylinders Market, focusing on advanced technological aspects, segmentation dynamics, competitive strategies, and future projections that define this critical segment of the industrial automation ecosystem. Understanding these nuances is essential for stakeholders seeking to maximize market penetration and strategic investment decisions in motion control technology.

A crucial factor driving the market’s technological trajectory is the increasing convergence of mechanical engineering excellence with advanced software control. Electromechanical cylinders are no longer viewed simply as mechanical replacements for fluid power systems; they are sophisticated, networked nodes within the Industrial Internet of Things (IIoT). This paradigm shift necessitates expertise not just in manufacturing precision components but also in developing proprietary control algorithms that manage inertia, resonance, and thermal dynamics. Manufacturers investing heavily in developing integrated servo drives that are optimized specifically for the unique load characteristics of ball screws and roller screws are gaining a significant competitive edge, allowing for faster commissioning and superior performance out-of-the-box compared to third-party drive solutions.

The competitive landscape is defined by large, diversified automation conglomerates alongside specialized, high-performance cylinder manufacturers. Large players like Bosch Rexroth and Parker Hannifin leverage their extensive global distribution networks and broad product portfolios (including hydraulics and pneumatics) to offer complete solutions, positioning EMCs as the high-end, high-performance option. Conversely, specialist companies such as Exlar Corporation and Tolomatic focus on niche expertise, often providing highly customized solutions for extreme environments or specialized applications, such as high vacuum or radiation resistance, where standard products fail to meet stringent requirements. This dual competitive structure ensures continuous innovation across standard product offerings and specialized engineering services.

From a market penetration standpoint, the segment of medium-to-high force cylinders (5 kN to 50 kN) is expected to exhibit the most pronounced growth over the forecast period. This range covers the vast majority of applications in general assembly, moderate-force pressing, and automated handling systems across multiple industries. While the ultra-high force (>50 kN) segment remains critical for heavy industries like metal forming, its lower volume growth rate contrasts with the rapid volume increase anticipated in the medium-force segments where the replacement of pneumatic systems is most feasible economically. The modularity of these systems, allowing users to select appropriate motor, screw, and gearbox combinations, is pivotal for tailoring solutions without excessive customization costs, democratizing high-precision automation.

Furthermore, sustainability concerns are reshaping procurement decisions globally. Electromechanical cylinders align perfectly with corporate sustainability goals due to their inherent energy efficiency—often consuming up to 80% less energy than equivalent hydraulic systems under partial load conditions. The elimination of oil disposal, a significant environmental and operational cost associated with hydraulics, further strengthens the business case for EMC adoption. In regions like Europe and North America, where carbon neutrality and stringent waste management are legal and ethical priorities, this environmental advantage translates directly into accelerated market uptake. Manufacturers who can transparently demonstrate the lifecycle environmental benefits of their products are seeing increased preference among environmentally conscious industrial buyers.

The penetration of EMCs into the mobile machinery market also presents a substantial, untapped opportunity. Historically dominated by hydraulics due to their high force density and robust nature, mobile applications (e.g., specialized agricultural equipment, construction vehicles) are beginning to integrate electric actuation for auxiliary functions. This is driven by the overall trend toward vehicle electrification and the desire for more precise control over implements. Developing ruggedized, weather-resistant EMCs with integrated battery management capabilities is a key technological challenge and a potential high-growth area for specialized manufacturers in the coming decade, further diversifying the application spectrum beyond stationary factory automation.

In conclusion, the Electromechanical Cylinders market is experiencing a dynamic transformation fueled by digital connectivity, sustainability demands, and technological refinement in precision engineering. The market is moving towards highly integrated, smart actuators that leverage AI for operational optimization, positioning EMCs not just as components, but as foundational elements of the next generation of industrial automation infrastructure. Continued investment in roller screw longevity, servo drive optimization, and system modularity will be critical for sustaining the projected high growth trajectory.

Technical specifications for high-performance EMCs are becoming increasingly focused on lifetime metrics and maintenance ease. For instance, the demand for standardized lubrication protocols, often utilizing grease cartridges integrated directly into the cylinder body, simplifies preventative maintenance. Furthermore, the use of corrosion-resistant materials and hygienic designs (e.g., IP69K rated) is mandatory for proliferation into sensitive sectors like pharmaceutical and cleanroom manufacturing, ensuring that the physical design matches the sophistication of the internal electronics and control systems. The ability to guarantee a specific number of cycles under defined load conditions is a standard requirement, pushing manufacturers to continuously improve material science and tolerance levels in their production processes.

The increasing complexity of automation tasks also necessitates seamless integration with higher-level control systems, such as Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP). EMC manufacturers are responding by ensuring their products support multiple industrial Ethernet standards and provide standardized data formats for easy interoperability. This level of digital readiness is fundamental to attracting customers focused on implementing fully digital twins of their manufacturing operations, where accurate simulation and optimization of actuator performance are paramount before physical deployment. The development of standardized function blocks for common PLC platforms (e.g., Siemens, Rockwell) simplifies programming and further reduces integration barriers for end-users.

Key to sustaining growth is addressing the skills gap prevalent in the industrial automation sector. While EMCs offer simpler maintenance than hydraulics, they require expertise in servo control and motion programming. Manufacturers are actively investing in training programs and developing user-friendly configuration software that abstracts much of the underlying complexity, making the technology accessible to a broader range of automation engineers and technicians. This effort in education and simplification is crucial for facilitating mass market adoption beyond highly specialized engineering firms and into the general industrial landscape.

The material handling and logistics sector remains a powerful catalyst for market growth, driven by the massive expansion of e-commerce and automated warehousing. High-speed sorting, palletizing, and robotic pick-and-place systems rely on the dynamic, repeatable performance of EMCs. In this context, the focus is on speed and acceleration rather than maximum force, favoring high-pitch ball screws and lightweight designs. The continuous operation required in logistics centers also puts extreme pressure on duty cycle ratings, making robustness and thermal management critical design considerations for cylinders deployed in this fast-paced environment.

Finally, market competition is increasingly shifting from purely component price to ecosystem completeness. Companies that can provide not only the cylinder but also the motor, drive, integrated safety features (like safe torque off - STO), and comprehensive diagnostic software bundled as a unified, certified solution are establishing significant dominance. This holistic approach simplifies procurement and deployment for the end-user and reinforces the manufacturer's value proposition as a comprehensive motion control partner, rather than just a hardware supplier.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager