Electronic Cigarette and Tobacco Vapor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433570 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electronic Cigarette and Tobacco Vapor Market Size

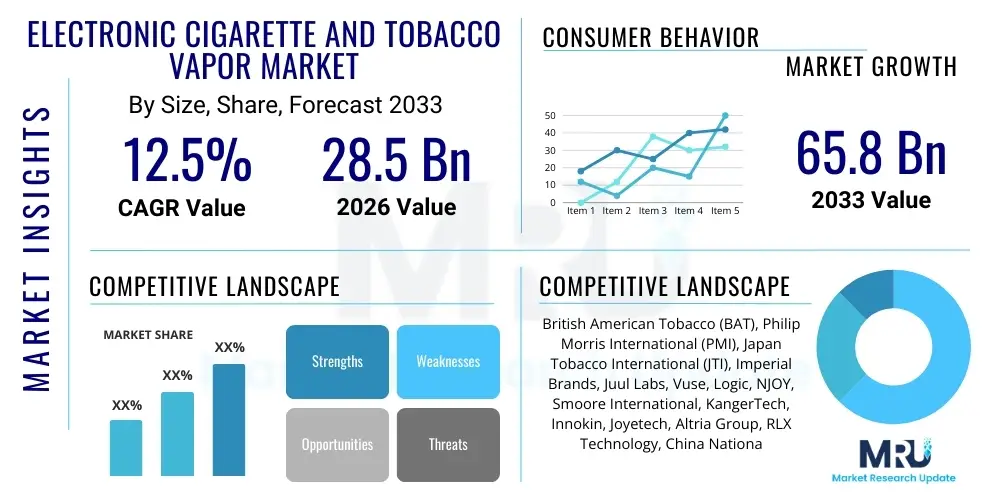

The Electronic Cigarette and Tobacco Vapor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 65.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global demand for perceived less-harmful alternatives to conventional combustible tobacco products. Regulatory frameworks are dynamically shaping market access and product innovation, particularly concerning flavor restrictions and device safety standards. The market trajectory indicates a strong shift toward advanced pod systems and disposable devices, reflecting consumer preference for convenience and discreet usage.

Electronic Cigarette and Tobacco Vapor Market introduction

The Electronic Cigarette and Tobacco Vapor Market encompasses a diverse range of nicotine delivery systems designed to heat e-liquids or process tobacco without combustion, generating an inhalable aerosol. These products, often categorized into vape mods, pod systems, disposable vapes, and Heat-Not-Burn (HNB) devices, serve as alternatives to traditional cigarettes. The primary application of these systems is smoking cessation or reduction, offering users a transition mechanism away from the perceived higher risks associated with tar and carbon monoxide generated by burning tobacco. Benefits prominently include the elimination of smoke, reduction of odor, and the potential for reduced exposure to many harmful chemicals found in cigarette smoke, though long-term health effects remain a significant area of ongoing research and regulatory focus.

Major driving factors fueling market expansion include evolving public health initiatives that encourage harm reduction, aggressive product innovation leading to improved user experience and safety features, and robust marketing campaigns targeting adult smokers seeking alternatives. Furthermore, the increasing accessibility of these products through specialized vape shops, convenience stores, and rapidly expanding online retail channels enhances market penetration globally. Regulatory acceptance, particularly in developed economies that view vaping as a legitimate harm reduction tool, provides a crucial structural foundation for continued growth and capital investment in manufacturing and distribution infrastructure.

The product landscape is characterized by rapid technological cycles. Recent innovations focus on enhanced battery life, temperature control accuracy for consistent vapor delivery, and the integration of smart technologies for personalized usage tracking. While e-cigarettes utilize a liquid containing nicotine, propylene glycol, vegetable glycerin, and flavorings, HNB products, such as those utilizing tobacco sticks, focus on delivering a tobacco experience without burning, representing a distinct sub-segment addressing consumers who prefer the taste of real tobacco. This differentiation allows the overall vapor market to cater to a broader spectrum of adult smokers, solidifying its position as a major disruptive force in the nicotine industry.

Electronic Cigarette and Tobacco Vapor Market Executive Summary

The Electronic Cigarette and Tobacco Vapor Market is undergoing a rapid metamorphosis, characterized by intense regulatory scrutiny and significant fragmentation across product categories. Business trends reveal a dominant shift towards closed-pod systems and disposables, favored by consumers for ease of use and reduced maintenance, simultaneously benefiting key industry players through proprietary cartridge sales and high-volume manufacturing. Major tobacco companies continue to heavily invest in this space, acquiring smaller innovative firms and utilizing their established distribution networks to achieve market dominance, particularly in the premium HNB segment. Strategic maneuvers focus on achieving Premarket Tobacco Product Application (PMTA) authorization in critical markets like the U.S., defining barriers to entry for competitors lacking the necessary scientific and regulatory resources.

Regionally, the market exhibits highly asymmetrical growth patterns. North America and Western Europe remain primary revenue generators, though facing increasing challenges from flavor bans and taxation policies designed to curb youth access. Conversely, the Asia Pacific (APAC) region, particularly countries like China, Indonesia, and South Korea, is emerging as the future growth engine, driven by a large existing smoking population, rising disposable incomes, and relatively nascent regulatory frameworks that are quickly being established. Latin America and the Middle East and Africa (MEA) present significant, yet underdeveloped, opportunities, requiring tailored marketing strategies to overcome socio-cultural barriers and infrastructure deficiencies.

Segmentation trends illustrate that while HNB remains a critical high-value segment championed by multinational corporations (MNCs), the disposable vape category has exploded, offering unparalleled convenience and accessibility, appealing particularly to younger demographics and former smokers. Component innovation is focusing on optimizing e-liquid formulas and developing safer, more efficient battery technologies (like ceramic heating elements) to enhance user safety and vapor quality. The rapid proliferation of online distribution channels, despite increasing regulatory restrictions on e-commerce sales of vaping products in some jurisdictions, continues to reshape consumer purchasing habits, emphasizing the need for robust Age Verification (AV) systems.

AI Impact Analysis on Electronic Cigarette and Tobacco Vapor Market

Common user questions regarding AI's impact on the Electronic Cigarette and Tobacco Vapor Market frequently revolve around personalization, regulatory compliance, and product safety enhancements. Users are concerned about how AI will influence personalized nicotine delivery, asking if AI-driven analysis of user habits could optimize dosage and flavor profiles for smoking cessation effectiveness. Significant queries also focus on the role of AI in supply chain integrity, specifically in detecting and combating the proliferation of counterfeit products, which pose substantial health risks. Furthermore, users inquire about AI's capacity to streamline the complex and costly regulatory submission processes (like PMTA or TPD), and how predictive analytics might be used by regulators to monitor marketing practices and prevent unauthorized youth access, reflecting a dual-sided expectation of AI both benefiting industry efficiency and enhancing regulatory oversight.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize several core aspects of the vapor market, moving beyond basic automation into predictive and personalized capabilities. In manufacturing, AI optimizes production lines by predicting equipment failures, managing inventory fluctuations, and ensuring batch consistency, crucial for maintaining the stringent quality controls required in medical-grade nicotine delivery. For marketing, ML models analyze vast datasets of consumer behavior, geographic purchasing patterns, and social media sentiment to create hyper-targeted advertising campaigns while ensuring compliance with evolving advertising restrictions, avoiding targeting prohibited demographics, thereby mitigating regulatory risk. This detailed behavioral analysis enables companies to launch products that precisely match prevailing consumer preferences, minimizing R&D waste.

Crucially, AI applications are advancing product safety and development. ML algorithms are used to screen new e-liquid formulations for potential harmful interactions or thermal degradation products before clinical trials, dramatically accelerating the time-to-market for safer products. Furthermore, in clinical settings and epidemiological studies, AI helps process complex user data from connected devices to better understand long-term effects and the efficacy of vaping as a cessation tool. AI-powered Age Verification (AV) systems deployed at online points of sale enhance compliance and prevent unauthorized purchases, addressing one of the industry's most critical regulatory concerns and demonstrating a commitment to responsible retailing, thereby bolstering the industry's standing with legislative bodies.

- AI-driven personalized dosing and flavor recommendations improve smoking cessation success rates.

- Machine learning optimizes supply chain logistics, minimizing waste and predicting demand spikes across regions.

- AI enhances quality control and consistency in e-liquid manufacturing and device assembly, flagging deviations immediately.

- Predictive analytics supports complex regulatory submissions (e.g., PMTA) by organizing and analyzing toxicological data efficiently.

- Advanced image recognition and ML combat counterfeit products in distribution channels, ensuring product integrity.

- AI-powered chatbots and customer service platforms provide instant, accurate information regarding product usage and safety.

- Regulatory monitoring tools use natural language processing (NLP) to track compliance across digital marketing materials globally.

DRO & Impact Forces Of Electronic Cigarette and Tobacco Vapor Market

The Electronic Cigarette and Tobacco Vapor Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate market velocity and strategic focus. Primary drivers include the global prioritization of harm reduction strategies among public health authorities and the continuous influx of innovation that makes vapor products more appealing and effective as alternatives to traditional cigarettes. However, these positive drivers are constantly counterbalanced by substantial restraints, predominantly centered on increasingly restrictive regulatory environments—such as flavor bans, high excise taxes, and stringent marketing restrictions aimed at preventing youth usage—creating significant market volatility and operational hurdles. The opportunity landscape is vast, capitalizing on unexplored geographic markets, the integration of cannabis/CBD vaping products, and the development of truly "smart" therapeutic devices that integrate medical feedback loops, presenting pathways for significant long-term capital expansion and market diversification.

Key drivers center on consumer health consciousness and technological advancement. A growing body of scientific evidence suggests that vaping products, while not risk-free, expose users to significantly lower levels of harmful toxicants compared to combustion cigarettes, driving adoption among adult smokers seeking a perceived safer alternative. Device technology has progressed remarkably, offering improved reliability, aesthetic appeal, and sophisticated safety features (e.g., overheating protection, child-resistant mechanisms). Furthermore, aggressive market entry and strategic acquisitions by multinational tobacco companies (MTCs) provide massive capital investment, professionalized marketing, and established global distribution channels, accelerating the transition of smokers to vapor products and bolstering overall market size.

Major restraints pose fundamental challenges to market growth. The most significant constraint is regulatory uncertainty, particularly the implementation of bans on characterizing flavors (outside of tobacco), which are often cited as crucial for adult smokers switching away from traditional products but are simultaneously blamed for attracting underage users. High taxes imposed on vapor products in various jurisdictions, often mirroring those on traditional tobacco, erode the cost advantage that e-cigarettes typically offer, potentially disincentivizing switching. Public perception campaigns, frequently fueled by misinformation or preliminary research findings, generate negative sentiment regarding the long-term safety of vaping, which can deter potential adult users and strengthen calls for stricter legislative controls, creating a pervasive environment of operational risk.

The primary opportunities lie in market expansion and product specialization. Emerging economies, especially across the Asia Pacific and parts of Latin America, represent massive untapped consumer bases where smoking rates are high and regulatory regimes are still forming, offering first-mover advantages. Product specialization, particularly the maturation of the HNB segment and the integration of pharmaceutical standards into nicotine delivery devices, allows companies to target high-value, quality-focused consumers. Furthermore, companies are leveraging digital platforms and robust data analytics to manage compliance and tailor product offerings, circumventing some traditional marketing restrictions while fostering direct consumer relationships, ensuring loyalty and informed product use, which are critical for long-term sustainability and market leadership amidst escalating competitive intensity.

Segmentation Analysis

Segmentation analysis provides a crucial understanding of the diverse product categories and user profiles that constitute the Electronic Cigarette and Tobacco Vapor Market, enabling targeted strategic planning and resource allocation. The market is broadly segmented by Product Type (modular, closed system, disposable, HNB), Component (e-liquid, battery, atomizer), Distribution Channel, and End-User demographics. The most dynamic segmentation remains by product type, where disposables have recently cannibalized market share from traditional open-tank systems due to their simplicity and cost-effectiveness for entry-level users. Conversely, the HNB segment demands significant capital investment and regulatory clearance, positioning it as a high-margin, less competitive segment dominated by large MTCs targeting established adult smokers seeking an alternative nicotine delivery system that closely mimics the ritual of smoking tobacco.

E-liquid formulation constitutes another vital segmentation area, characterized by the shift from traditional freebase nicotine to nicotine salts, which offer a smoother, higher-nicotine delivery experience, enabling the popularization of small pod systems. This segment is constantly innovating in terms of flavor science, requiring compliance with stringent ingredient lists and safety testing to maintain market access, especially in regulated markets like the EU (via TPD) and the US (via PMTA standards). Distribution channels reflect a blend of modern and traditional retail, where dedicated vape shops offer expert advice and customization, while online retail provides unparalleled reach and competitive pricing, though facing increased regulatory scrutiny over effective age verification mechanisms to combat youth access.

Demographically, the market segments target two primary consumer groups: long-term adult smokers seeking cessation or reduction tools, and younger adult consumers attracted to the novelty, customization, and flavor variety offered by vaping. Strategic success hinges on clearly differentiating products tailored for cessation (often higher nicotine, tobacco/menthol flavors) from those for recreational use (low nicotine, complex flavors), aligning product positioning with regulatory expectations, and avoiding crossover appeal to underage users. Understanding these consumer profiles allows manufacturers to optimize product features—such as battery capacity, design aesthetics, and connectivity features—to maximize adoption rates within the targeted cohort, ensuring sustainable growth that aligns with public health objectives.

- By Product Type:

- Disposable Vapes

- Modular Systems (Mods)

- Pod Systems (Open & Closed)

- Heat-Not-Burn (HNB) Devices

- E-Hookah

- By Component:

- E-Liquid (Nicotine & Non-Nicotine)

- Vaporizers/Atomizers

- Batteries & Charging Devices

- Cartridges & Pods

- By Distribution Channel:

- Online Retail (E-commerce)

- Vape Shops & Specialty Stores

- Hypermarkets/Supermarkets

- Convenience Stores & Gas Stations

- By End-User (Age Group):

- 18-25 Years

- 26-40 Years

- 41 Years and Above

Value Chain Analysis For Electronic Cigarette and Tobacco Vapor Market

The value chain for the Electronic Cigarette and Tobacco Vapor Market is complex and highly concentrated, dominated by vertically integrated MTCs in the upstream raw material procurement and manufacturing stages, while the downstream retail and distribution channels are intensely fragmented. Upstream analysis begins with the sourcing of essential raw materials, including pharmaceutical-grade nicotine (often synthetic or highly purified tobacco-derived), propylene glycol (PG), vegetable glycerin (VG), and flavor concentrates. Manufacturing involves sophisticated processes for producing high-tech microprocessors, lithium-ion batteries, and specialized ceramic or metal heating elements (atomizers). Given the stringent quality and safety requirements, particularly for e-liquids and battery safety, the upstream suppliers must adhere to rigorous certification standards (e.g., ISO, GMP), creating significant barriers to entry for new entrants and favoring established chemical and electronics suppliers, particularly those operating out of East Asia.

Midstream activities primarily focus on the assembly and blending stages. Device assembly, predominantly located in China (Shenzhen area), involves integrating components into final products—mods, pods, or HNB devices. E-liquid blending and packaging, though sometimes done locally in destination markets for flavor customization or regulatory compliance (e.g., bottle size limits in the EU), require aseptic conditions and highly precise dosing, particularly for nicotine concentration. A crucial aspect of midstream management is intellectual property protection; companies aggressively patent coil designs, heating methods, and device mechanisms to maintain competitive differentiation. Efficiency in this stage directly impacts product margins, making automation and quality control paramount.

Downstream analysis highlights the complexity of distribution. Direct channels include manufacturer-owned online portals and brand flagship stores, offering greater control over pricing and customer data, crucial for targeted marketing and compliance verification. Indirect channels are more prevalent and include specialized vape shops (offering expertise and customization), convenience stores (volume sales, high accessibility), and mass retailers. The rapid rise of online retail necessitates advanced logistical solutions and strict enforcement of age verification protocols. The fragmentation in the indirect channel means manufacturers must manage relationships with thousands of small retailers globally, leading to significant costs associated with sales force management, compliance training, and maintaining brand visibility across diverse point-of-sale environments.

Electronic Cigarette and Tobacco Vapor Market Potential Customers

Potential customers for the Electronic Cigarette and Tobacco Vapor Market are primarily categorized into three groups: adult smokers seeking a complete transition (cessation focus), dual users aiming to reduce conventional cigarette consumption (harm reduction focus), and established adult vapers who continue to purchase advanced devices and specialized e-liquids (maintenance and customization focus). The most economically valuable customer segment remains the adult smoker cohort (typically aged 30+), particularly those who are highly motivated to quit or reduce risk but have historically struggled with traditional Nicotine Replacement Therapies (NRTs). This segment demands reliable, easy-to-use products, such as closed pod systems and HNB devices, which provide high nicotine satisfaction and minimal learning curve, focusing on flavors acceptable to traditional smokers (tobacco, menthol).

The secondary, yet rapidly expanding, customer base includes millennials and younger Gen Z adults (aged 18-25, in jurisdictions where legally permissible) who are often attracted to vapor products due to social trends, technological novelty, and the extensive flavor profiles offered. This group shows a preference for disposable devices and customized modular systems, valuing aesthetics, portability, and social engagement features. While often non-smokers before entering the vapor market, their consumption patterns are monitored closely by regulators due to concerns over initiating nicotine dependence. Targeting this demographic requires sophisticated digital marketing that complies strictly with age restrictions and avoids claims related to health or cessation, focusing instead on lifestyle and technology.

E-commerce platforms and specialty vape shops are crucial for reaching potential customers. Specialty shops serve the "enthusiast" market, offering high-end mods and complex custom builds, while online platforms cater to price-sensitive and convenience-focused buyers, including those in geographically remote areas. The successful identification of potential customers hinges on utilizing big data analytics to distinguish between these different user groups based on purchasing frequency, preferred nicotine strength, and device sophistication. Regulatory efforts increasingly mandate that marketing efforts must demonstrably target adult smokers, compelling companies to refine their customer segmentation to prove they are contributing to public health goals by successfully converting conventional cigarette users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 65.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | British American Tobacco (BAT), Philip Morris International (PMI), Japan Tobacco International (JTI), Imperial Brands, Juul Labs, Vuse, Logic, NJOY, Smoore International, KangerTech, Innokin, Joyetech, Altria Group, RLX Technology, China National Tobacco Corporation (CNTC related entities), Bidi Vapor, E-Cigarette Direct, VaporFi, Aspire, Shenzhen IVPS (Smok) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Cigarette and Tobacco Vapor Market Key Technology Landscape

The Electronic Cigarette and Tobacco Vapor Market is a hotbed of technology innovation, centered on enhancing safety, efficiency, and user experience. The core technological advancements revolve around heating element design, battery management systems, and e-liquid formulation stability. A critical shift has occurred from traditional silica wicks and coiled wire to ceramic heating elements and advanced mesh coils. Ceramic heaters offer better temperature stability, preventing the overheating of e-liquids that can generate harmful byproducts (like formaldehyde), thus addressing key consumer and regulatory health concerns. Mesh coils significantly increase the surface area contact with the e-liquid, leading to superior flavor delivery and denser vapor production, catering to the performance-focused user base. Continuous improvements in these atomizer technologies directly influence the perceived quality and safety profile of the final vapor product.

Battery technology and associated management systems represent another essential technological focus. Since vaporization devices rely on lithium-ion batteries, safety—specifically preventing thermal runaway and explosion—is paramount. Manufacturers are integrating sophisticated microprocessors and proprietary chipsets that offer precise temperature control, intelligent puff monitoring, and rapid charging capabilities, optimizing power delivery for specific coil resistance and nicotine salt formulas. These smart features not only ensure safety but also allow for connectivity, enabling users to track usage data, manage nicotine consumption, and receive firmware updates via smartphone applications. This convergence of hardware and software transforms basic vaping devices into connected personal health tools, further blurring the lines between consumer electronics and medical devices, particularly in highly regulated therapeutic markets.

Furthermore, innovations in nicotine delivery and e-liquid chemistry are critical. The transition to nicotine salt technology allows for higher nicotine concentrations to be delivered smoothly without the harshness associated with freebase nicotine, making products like closed pod systems highly effective for heavy smokers transitioning away from conventional cigarettes. On the HNB front, technology focuses on precise thermal management to ensure tobacco sticks are heated just enough to release nicotine and flavor without reaching combustion temperatures, minimizing toxicant generation. Patents are highly contested in this domain, covering specialized air-flow designs, thermal insulation materials, and induction heating techniques, demonstrating the industry's commitment to delivering a consistent, low-emission tobacco experience while maximizing consumer safety and device longevity through robust technological architecture.

Regional Highlights

The global electronic cigarette and tobacco vapor market demonstrates pronounced regional variations dictated by regulatory severity, consumer acceptance, and prevailing smoking rates. North America, specifically the United States, represents the largest single market in terms of value, driven by high consumer spending power and a massive existing infrastructure for vapor product distribution. However, this market faces immense regulatory headwinds, including state and city-level flavor bans, high excise taxes, and the rigorous, multi-year process of securing PMTA authorization from the FDA, leading to significant market consolidation and favoring well-capitalized players. The Canadian market, governed by federal and provincial regulations, focuses heavily on limiting youth access while still promoting vaping as a potential cessation tool for adults, maintaining a delicate regulatory balance.

Europe stands as the second-largest regional market, primarily regulated by the Tobacco Products Directive (TPD) which standardizes nicotine limits, tank sizes, and labeling requirements across the EU member states, ensuring a high level of product consistency and safety. Key markets like the UK have integrated vaping into public health strategies, actively promoting it as an effective tool for quitting smoking, contributing to high adoption rates. Conversely, some Eastern European nations and Scandinavian countries maintain stricter controls or outright bans. The fragmentation of the European market requires manufacturers to maintain highly sophisticated supply chains capable of adapting packaging and formulation to meet the nuanced requirements of over 27 separate jurisdictions, creating logistical complexity but ensuring relative regulatory stability compared to the unpredictable changes seen elsewhere.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is fueled by countries with large, established smoking populations, such as Indonesia, the Philippines, and South Korea. While China remains the global manufacturing hub (supplying over 90% of the world's devices), its domestic regulatory environment is tightening, particularly concerning HNB and e-liquid standardization. Japan is a unique HNB powerhouse, where HNB devices have achieved remarkable market penetration due to a legal framework that restricts high-nicotine e-liquids but allows the sale of heated tobacco sticks. The region represents the most significant opportunity for volume growth, necessitating careful navigation of diverse cultural preferences and rapidly evolving governmental policies regarding nicotine sale and consumption.

Latin America and the Middle East and Africa (MEA) currently contribute smaller but rapidly growing shares to the global market. In Latin America, regulatory approaches range from outright prohibition (e.g., Mexico, Brazil initially) to regulated allowance, requiring localized market entry strategies that prioritize compliance with often ambiguous or delayed legislation. The MEA region is characterized by high smoking rates and increasing disposable incomes in key markets like the UAE and Saudi Arabia, which are beginning to officially regulate and tax vapor products, transitioning sales from the gray market to formalized retail channels. Strategic challenges in these regions include mitigating the presence of counterfeit goods and establishing robust distribution networks capable of handling the logistics and compliance burdens associated with specialized product importation.

- North America (U.S., Canada): Highest revenue market; driven by PMTA process, heavy taxation, and focus on closed-system products.

- Europe (UK, Germany, France): Strong adoption rates supported by TPD regulation; UK champions vaping as a public health tool; high product standardization.

- Asia Pacific (China, Japan, South Korea): Fastest growth region; China dominates manufacturing; Japan is the global leader in HNB consumption; regulatory frameworks are rapidly developing.

- Latin America (Brazil, Mexico): Characterized by regulatory uncertainty and potential for massive future market expansion if prohibition laws are relaxed.

- Middle East & Africa (UAE, Saudi Arabia): Emerging formalized markets with high consumption potential, moving away from gray market operations toward regulated sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Cigarette and Tobacco Vapor Market.- British American Tobacco (BAT)

- Philip Morris International (PMI)

- Japan Tobacco International (JTI)

- Imperial Brands

- Juul Labs

- Vuse (BAT subsidiary)

- Logic (JTI subsidiary)

- NJOY

- Smoore International (Vaporesso)

- KangerTech

- Innokin

- Joyetech

- Altria Group (Minority stake in Juul)

- RLX Technology

- China National Tobacco Corporation (CNTC related entities)

- Bidi Vapor

- E-Cigarette Direct

- VaporFi

- Aspire

- Shenzhen IVPS (Smok)

Frequently Asked Questions

Analyze common user questions about the Electronic Cigarette and Tobacco Vapor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Electronic Cigarette and Tobacco Vapor Market?

The Electronic Cigarette and Tobacco Vapor Market is projected to grow at a robust CAGR of 12.5% between 2026 and 2033, driven by increasing adult smoker conversion rates and continuous product innovation in harm reduction technologies.

Which product segment is currently exhibiting the highest growth trajectory?

The Disposable Vapes segment is currently experiencing the highest unit volume growth globally due to consumer demand for convenience, ease of use, and low maintenance, though Heat-Not-Burn (HNB) remains the high-value segment championed by major tobacco corporations.

How do stringent regulations, such as flavor bans, impact market dynamics?

Stringent regulations, particularly flavor bans and high taxation, restrain market growth by reducing consumer appeal and eroding the cost advantages of vaping products, simultaneously leading to market consolidation that favors established firms capable of navigating complex regulatory compliance.

What role does Artificial Intelligence (AI) play in the vapor market value chain?

AI plays a crucial role in enhancing product safety through advanced e-liquid formulation testing, optimizing manufacturing consistency, personalizing nicotine delivery for efficacy, and ensuring regulatory compliance in marketing and age verification processes.

Which geographic region is expected to drive future market expansion?

The Asia Pacific (APAC) region is expected to be the key driver of future market expansion, fueled by high population density, large existing smoking populations, and emerging regulated markets in countries such as Indonesia, South Korea, and the Philippines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager