Electronic Cigarette Lithium Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435379 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electronic Cigarette Lithium Battery Market Size

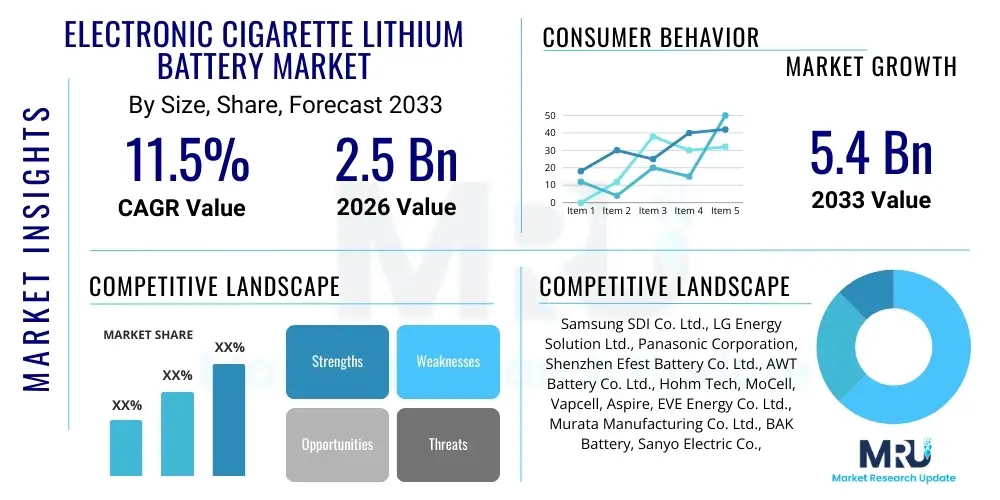

The Electronic Cigarette Lithium Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $5.4 Billion by the end of the forecast period in 2033.

Electronic Cigarette Lithium Battery Market introduction

The Electronic Cigarette Lithium Battery Market encompasses the production, distribution, and integration of lithium-ion (Li-ion) and lithium-polymer (Li-Po) cells specifically designed for powering various electronic nicotine delivery systems (ENDS), commonly known as e-cigarettes or vaping devices. These batteries are foundational components, responsible for heating the e-liquid to produce vapor. The necessity for high energy density, compact size, and robust safety mechanisms drives innovation within this specialized battery segment. Modern electronic cigarette designs, ranging from small disposable systems to advanced, high-wattage regulated devices, require customized battery solutions that can deliver instantaneous high current while maintaining acceptable thermal performance and longevity. The primary product is typically a cylindrical 18650, 20700, or 21700 cell for advanced mods, or custom-sized pouch cells for sleek, closed pod systems.

Major applications of these batteries span the entire spectrum of the vaping industry, including rechargeable open-tank systems, pre-filled closed pod systems, and the increasingly popular disposable e-cigarettes. The evolution of vaping hardware mandates continuous improvements in battery capacity and cycle life to enhance user satisfaction. Key benefits derived from advancements in this market include extended vaping sessions, faster recharge times facilitated by USB-C integration, and improved overall device safety due to sophisticated Battery Management Systems (BMS). The integration of batteries that offer superior volumetric efficiency allows manufacturers to create smaller, more discreet devices without compromising performance, catering to consumer demands for portability and aesthetics.

Driving factors propelling market growth include the global acceptance and expansion of vaping products as alternatives to traditional cigarettes, particularly in developed economies. Furthermore, technological advancements leading to safer and higher-performing batteries, alongside the massive uptake of disposable e-cigarettes requiring high-volume, cost-effective embedded power solutions, significantly contribute to market dynamics. Regulatory frameworks, although sometimes restrictive, often push manufacturers toward higher quality, certified battery production, thereby stabilizing the specialized market for high-reliability cells.

Electronic Cigarette Lithium Battery Market Executive Summary

The Electronic Cigarette Lithium Battery Market is poised for substantial growth, primarily driven by the mass proliferation of disposable and pod-based vaping systems and the ongoing global shift away from combustible tobacco. Business trends highlight a crucial focus on miniaturization and high C-rate (discharge rate) capabilities, necessitating strong partnerships between specialized battery cell manufacturers and leading ENDS OEMs. Furthermore, sustainability is becoming a major commercial consideration, pushing research into improved recycling processes for the embedded lithium components in disposable devices, an area facing intense scrutiny from environmental bodies. Supply chain resilience, particularly concerning key raw materials like cobalt and lithium, remains a strategic priority for maintaining stable pricing and production volumes across the forecast period.

Regional trends indicate that the Asia Pacific (APAC) region continues its dominance, not just as the primary manufacturing hub for electronic cigarette batteries and devices, but also as a rapidly growing consumption market, particularly in Southeast Asia. North America and Europe, characterized by stricter regulatory oversight (such as the EU's Tobacco Products Directive and evolving FDA rules), drive the demand for certified, high-quality, and traceable battery units, often commanding a premium price. The Latin American and Middle East & Africa (MEA) markets are emerging rapidly, benefiting from less established regulatory environments and increasing disposable incomes, which fuels demand for imported or locally assembled vaping products powered by imported batteries.

Segmentation trends reveal that the rechargeable segment, particularly focusing on high-capacity Li-ion cells (e.g., 21700) for advanced mod systems, maintains steady value growth due to professional user demand for long duration and performance. However, the non-rechargeable segment, dominated by proprietary Li-Po cells embedded in disposable units, is witnessing explosive volume growth, dramatically expanding the overall market size. Within application segmentation, closed pod systems, which prioritize portability and ease of use, are demanding highly specialized, custom-dimensioned batteries that offer a balance between energy density and ultra-compact form factors. The competitive landscape is intensely focused on intellectual property related to thermal management and rapid charging protocols.

AI Impact Analysis on Electronic Cigarette Lithium Battery Market

Common user questions regarding AI's impact on the Electronic Cigarette Lithium Battery Market frequently center on safety enhancements, battery longevity, and supply chain efficiency. Users are keenly interested in how Artificial Intelligence can prevent thermal runaways and predict battery failure, thus improving device safety and reducing recalls. There is also significant curiosity regarding AI’s role in optimizing charging cycles to maximize battery life (State of Health monitoring). Furthermore, users and industry professionals inquire about how AI-driven predictive maintenance and manufacturing quality control can lower costs and accelerate the development of next-generation high-performance cells specifically tailored for diverse vaping profiles. The overarching expectation is that AI will transform batteries from static power sources into intelligent components capable of self-diagnosis and optimized energy management.

Based on this analysis, the key themes summarize that AI is crucial for elevating the safety and performance standards of electronic cigarette batteries. AI algorithms are being deployed in Battery Management Systems (BMS) to analyze usage patterns (e.g., puff duration, wattage settings) in real-time, allowing the battery to dynamically adjust charging and discharging curves to prevent stress and overheating. This intelligent energy management ensures that lithium cells operate within optimal parameters, drastically extending the effective cycle life of rechargeable devices. In the manufacturing sector, AI and machine learning are pivotal for enhancing quality control by analyzing massive datasets from production lines, identifying micro-defects during cell assembly, and ensuring greater consistency in high-volume production necessary for disposable units.

Beyond device-level application, AI significantly impacts the supply chain. Predictive analytics, driven by AI, helps manufacturers forecast demand for specific battery types (e.g., high-capacity 21700 vs. high-volume pouch cells) with greater accuracy. This optimization reduces inventory costs, mitigates risks associated with raw material price volatility, and streamlines logistics from lithium processing to final device assembly. The adoption of AI-driven design tools also accelerates R&D for novel battery chemistries better suited for the high-power, intermittent demands of vaping, offering a distinct competitive edge to manufacturers prioritizing technological integration.

- AI enhances Battery Management Systems (BMS) for real-time thermal and stress regulation.

- Predictive maintenance algorithms improve battery State of Health (SOH) and longevity.

- Machine learning optimizes manufacturing processes, leading to higher quality and fewer defects in cell production.

- AI-driven supply chain analytics improve demand forecasting and raw material procurement efficiency.

- Intelligent charging profiles minimize degradation and maximize charge speed safely.

DRO & Impact Forces Of Electronic Cigarette Lithium Battery Market

The Electronic Cigarette Lithium Battery Market is subject to complex dynamics driven by both technological progress and stringent external regulatory environments. Key drivers include the overwhelming global consumer preference for portable and discreet vaping devices, which necessitates continuous innovation in miniaturized, high-density cells capable of delivering high peak power for vaporization. Furthermore, the rapid adoption of rechargeable pod systems and the explosive growth in disposable models, particularly in emerging markets, create sustained, high-volume demand for specialized lithium battery formats. Technological improvements in materials science, such as the gradual commercialization of silicon-anode or solid-state electrolyte technologies, promise to boost energy capacity and safety profiles, further accelerating market expansion. These performance gains are directly correlated with improved user experience, maintaining market momentum.

Conversely, significant restraints hinder growth. Foremost among these are the global safety concerns surrounding lithium-ion batteries, particularly instances of overheating, venting, or thermal runaway in unregulated or faulty devices. These safety risks lead to consumer apprehension and invite stricter government oversight. Furthermore, the intense regulatory pressure on electronic cigarette products worldwide, including outright bans or severe marketing restrictions in major territories, limits market access and creates uncertainty for manufacturers. Economic volatility in the supply chain, specifically concerning the soaring prices and geopolitical risks associated with sourcing raw materials like lithium, nickel, and cobalt, puts significant pressure on manufacturing costs and profitability, especially for high-volume, low-margin disposable segments. The challenge of ethically sourcing and recycling these materials also imposes cost burdens and operational complexities.

Opportunities within the market center on developing sustainable battery solutions. The massive volume of batteries in disposable devices presents a substantial environmental concern, opening doors for companies specializing in advanced battery recycling technologies or biodegradable/less resource-intensive components. Moreover, the shift towards higher-voltage systems and standardized replaceable battery formats (like 21700) for advanced devices creates opportunities for specialized, certified battery suppliers focused purely on safety and performance guarantees. Impact forces primarily stem from consumer safety expectations, which amplify the pressure for robust third-party testing and certification (a major factor influencing purchasing decisions), and escalating regulatory interventions, which dictate product design, labeling, and permissible battery specifications, shaping market viability more than almost any other factor.

Segmentation Analysis

The Electronic Cigarette Lithium Battery market is comprehensively segmented based on three primary categories: Type, Capacity, and Application. Analyzing these segments provides crucial insights into manufacturing priorities and consumer consumption patterns. By Type, the market is divided into Lithium-ion (Li-ion) and Lithium-polymer (Li-Po) batteries, reflecting the fundamental cell chemistry and form factor differences. Li-ion typically dominates the higher-capacity, cylindrical rechargeable market, while flexible Li-Po cells are essential for sleek, custom-shaped devices like pod systems and disposables where space utilization is paramount. This segmentation highlights the trade-off between energy density, safety mechanism integration, and geometric constraints imposed by device design.

Segmentation by Capacity focuses on the milliampere-hour (mAh) rating, which directly correlates with vaping duration. This includes categories such as Low Capacity (below 500 mAh, typical for disposables), Medium Capacity (500 mAh to 1500 mAh, common in standard rechargeable pod systems), and High Capacity (above 1500 mAh, crucial for advanced, high-wattage mods). The growth rate within these segments is highly varied, with the low-capacity segment currently experiencing exponential volume growth due to the disposable trend, while the high-capacity segment maintains steady value growth driven by experienced users demanding extended battery life and higher power delivery for sophisticated coils.

Application-based segmentation divides the market based on the end-device type: Rechargeable E-cigarettes (Open Systems/Mods), Closed Pod Systems, and Disposable E-cigarettes. Each application dictates specific battery design requirements. Disposable units require low-cost, high-volume embedded batteries, driving intense pricing pressure. Closed pod systems demand high-reliability, custom Li-Po batteries integrated into compact assemblies. Open systems utilize standardized, high C-rate replaceable Li-ion cells, prioritizing maximum safety features and robustness, thus offering the highest margin potential for specialty battery manufacturers focusing on performance.

- Segmentation by Type

- Lithium-ion (Li-ion)

- Lithium-polymer (Li-Po)

- Segmentation by Capacity (mAh)

- Low Capacity (Under 500 mAh)

- Medium Capacity (500 mAh – 1500 mAh)

- High Capacity (Above 1500 mAh)

- Segmentation by Application

- Rechargeable E-cigarettes (Open Systems/Mods)

- Closed Pod Systems

- Disposable E-cigarettes

Value Chain Analysis For Electronic Cigarette Lithium Battery Market

The value chain for electronic cigarette lithium batteries begins with intensive upstream analysis, focusing on the procurement and processing of critical raw materials. This includes mining and refining lithium, cobalt, nickel, manganese, and graphite. Geopolitical factors and fluctuating commodity prices heavily influence this stage, creating significant cost instability further down the chain. Major battery cell producers, primarily concentrated in Asia Pacific (APAC), secure long-term contracts with specialized chemical processors and material suppliers to ensure steady input. The stringent requirements for high-purity materials suitable for high-C rate discharge applications mean that only select suppliers meet the necessary quality thresholds. Cell manufacturing involves complex, capital-intensive processes like electrode coating, cell assembly, formation, and aging—stages where precision and quality control determine the final battery performance and safety rating.

The midstream segment involves the integration and packaging of the cells. Depending on the electronic cigarette type, cells are either packaged into standardized cylindrical formats (18650, 21700) or integrated directly as custom Li-Po packs with embedded protection circuitry (BMS). OEMs and Original Design Manufacturers (ODMs) of electronic cigarettes either purchase finished, certified cells directly or outsource the entire battery pack assembly process. The distinction between direct and indirect distribution channels becomes apparent here. Direct channels often involve large-scale vape device manufacturers sourcing directly from Tier 1 battery suppliers (e.g., Samsung, LG Chem, specialized Chinese manufacturers) for guaranteed volume and quality for their proprietary products.

Downstream analysis focuses on the distribution and end-user markets. Finished vaping devices, which contain the batteries, are channeled through various routes: specialized vape retailers, convenience stores, online e-commerce platforms, and wholesale distributors. Indirect distribution utilizes large global electronics distributors or specialized tobacco/nicotine product wholesalers who manage complex international logistics, including navigating regulations around shipping lithium batteries. For the large volume of disposable e-cigarettes, high-efficiency, localized distribution networks are critical for rapidly scaling market penetration. Success in the value chain is highly dependent on managing regulatory compliance at every stage, from material safety data sheets (MSDS) to final product certification (e.g., CE, FCC, RoHS).

Electronic Cigarette Lithium Battery Market Potential Customers

The primary customers for electronic cigarette lithium batteries are the manufacturers and integrators of the final vaping hardware. This includes Original Equipment Manufacturers (OEMs) who design, brand, and market their own complete vaping systems, encompassing multinational tobacco companies diversifying into the ENDS market and large, established independent vape brands. These customers demand high volumes of customized batteries that meet rigorous safety certifications and performance specifications tailored to their proprietary hardware designs. They often seek long-term supply agreements to guarantee quality consistency and supply stability, particularly for mass-market closed pod systems and high-volume disposable products.

Another significant customer segment comprises Original Design Manufacturers (ODMs) and smaller contract assemblers. These entities specialize in designing and manufacturing devices on behalf of brand owners. They require a flexible supply chain capable of delivering diverse battery specifications—ranging from small, ultra-thin pouch cells to standard cylindrical cells—to support multiple clients simultaneously. These customers prioritize competitive pricing and rapid prototyping capabilities from their battery suppliers to meet fast-moving market trends and minimize time-to-market for new device launches.

Finally, the aftermarket segment, comprising specialized distributors, vape shop owners, and knowledgeable end-users, represents the demand for standardized, replaceable high-performance Li-ion cells (such as 18650s or 21700s). These batteries are typically purchased separately and used in advanced, regulated mod systems. This segment prioritizes brand reputation, verifiable authenticity, and the highest possible C-rate and capacity specifications, driving demand for premium, certified cells from established global battery brands. Safety certifications and independent testing reports are critical purchasing criteria for this discerning customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $5.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung SDI Co. Ltd., LG Energy Solution Ltd., Panasonic Corporation, Shenzhen Efest Battery Co. Ltd., AWT Battery Co. Ltd., Hohm Tech, MoCell, Vapcell, Aspire, EVE Energy Co. Ltd., Murata Manufacturing Co. Ltd., BAK Battery, Sanyo Electric Co., Molicel (EMPOW/LTS), Lishen Battery, Ganfeng Lithium Co. Ltd., Amperex Technology Limited (ATL), BYD Company Ltd., Huayou Cobalt, and Contemporary Amperex Technology Co. Ltd. (CATL) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Cigarette Lithium Battery Market Key Technology Landscape

The technological landscape of the electronic cigarette lithium battery market is characterized by a relentless pursuit of higher energy density, improved safety features, and faster charging capabilities, tailored specifically for the intermittent high-power discharge requirements of vaporization devices. A core focus is the evolution of cathode materials. While traditional Lithium Cobalt Oxide (LCO) remains prevalent, particularly in smaller, capacity-focused cells, there is increasing experimentation with Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) chemistries. These advanced formulations offer higher volumetric energy density, enabling manufacturers to pack more power into smaller form factors, which is critical for meeting the aesthetic demands of modern vaping devices. Furthermore, research into utilizing silicon-based anodes is gaining traction, as silicon has the theoretical potential to store significantly more lithium ions than traditional graphite, promising substantial increases in overall battery capacity without proportional size increases, despite challenges related to volumetric expansion and cycle life degradation.

Safety technology is another paramount area of innovation, particularly in light of regulatory scrutiny. The integration of highly sophisticated Battery Management Systems (BMS) featuring advanced microcontrollers and proprietary algorithms is becoming standard across all market tiers, moving beyond simple overcharge and short-circuit protection. Modern BMS actively monitor thermal conditions, cell voltage imbalances, and C-rate demands in real-time, sometimes leveraging AI for predictive fault detection, as analyzed previously. Thermal management solutions, including phase change materials and optimized cell spacing, are essential for high-wattage devices, ensuring that heat generated during rapid discharge is safely dissipated, thereby preventing thermal runaway incidents that have historically plagued the vaping industry.

Finally, the development of ultra-fast charging technology is a key competitive differentiator. Consumers demand rapid turnaround times for their rechargeable devices, pushing battery manufacturers to engineer cells that can tolerate high current input without sacrificing longevity or safety. This requires optimizing electrolyte composition and electrode structure to allow for faster lithium ion intercalation kinetics. Looking toward the future, the prospect of Solid-State Batteries (SSBs) represents a transformative technology, offering non-flammable solid electrolytes that could inherently resolve many of the safety concerns associated with liquid electrolytes, while simultaneously increasing energy density. While full commercialization of SSBs for high C-rate applications in vaping is still nascent, incremental advancements in semi-solid state solutions are starting to penetrate the premium device segment, marking the next frontier in battery power for electronic cigarettes.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, led by China and South Korea, is the undisputed manufacturing hub for the Electronic Cigarette Lithium Battery Market. China hosts the vast majority of ENDS device assemblers and specialized battery pack integrators, benefiting from established supply chains and expertise in Li-ion cell production (e.g., from major players like CATL and EVE Energy). Furthermore, APAC is a rapidly expanding consumer market, particularly countries like Indonesia, South Korea, and Japan, which contributes significantly to both the supply side and demand side, especially for cost-effective disposable products. This region dictates global pricing and volume trends due to its massive production scale and efficiency.

- North America (NA) High-Value Market: North America, primarily the United States, represents a mature, high-value consumer market characterized by strong consumer spending and a preference for premium, high-performance rechargeable systems and certified, traceable products. Regulatory requirements, particularly from the FDA, mandate stringent safety and quality standards for batteries used in authorized vaping products, driving demand for specialized, high-margin, Tier 1 cells. Innovation often focuses on integrating sophisticated smart technology and superior safety features to comply with evolving state and federal regulations, making it a critical market for technological validation.

- Europe (EU) Regulatory Influence: Europe is characterized by the implementation of the Tobacco Products Directive (TPD), which imposes specific constraints on tank size and nicotine strength, indirectly influencing battery design (favoring medium-capacity cells for compliant devices). Countries like the UK, Germany, and France are major consumption centers. The region demands environmental compliance, particularly regarding Waste Electrical and Electronic Equipment (WEEE) directives, pushing manufacturers to focus on battery recyclability and ethical sourcing, influencing material selection and product end-of- life management strategies.

- Latin America (LATAM) Emerging Growth: LATAM is exhibiting rapid growth, driven by increasing consumer awareness and the gradual liberalization of import policies in countries such as Mexico and Brazil. This region primarily relies on imported, finished devices, translating to demand for high-volume, mid-to-low cost batteries suitable for entry-level and mass-market rechargeable and disposable systems. Market expansion here is highly sensitive to economic stability and currency fluctuations affecting import costs.

- Middle East and Africa (MEA) Potential: The MEA market is fragmented, with consumption increasing significantly in the GCC nations and South Africa. Regulatory environments are diverse, ranging from outright bans to open commercialization. The demand is often for high-end, premium devices in wealthy Middle Eastern states and for high-volume, affordable disposable units elsewhere. MEA serves as an important growth frontier, potentially driven by demographic shifts and urbanization accelerating acceptance of ENDS products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Cigarette Lithium Battery Market.- Samsung SDI Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Corporation

- Shenzhen Efest Battery Co. Ltd.

- AWT Battery Co. Ltd.

- Hohm Tech

- MoCell

- Vapcell

- Aspire

- EVE Energy Co. Ltd.

- Murata Manufacturing Co. Ltd.

- BAK Battery

- Sanyo Electric Co.

- Molicel (EMPOW/LTS)

- Lishen Battery

- Ganfeng Lithium Co. Ltd.

- Amperex Technology Limited (ATL)

- BYD Company Ltd.

- Huayou Cobalt

- Contemporary Amperex Technology Co. Ltd. (CATL)

Frequently Asked Questions

Analyze common user questions about the Electronic Cigarette Lithium Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive growth in the Electronic Cigarette Lithium Battery Market?

The primary driver is the exponential global demand for disposable electronic cigarettes, which utilize high-volume, low-capacity integrated lithium batteries. Additionally, consumer demand for higher performance and faster charging in rechargeable vaping mods contributes significantly to market value growth.

How does regulatory compliance impact battery manufacturing and market access?

Stringent regulations, particularly in North America and Europe, mandate high safety standards, traceability, and certification (e.g., UN 38.3 testing). This increases manufacturing complexity and costs, favoring Tier 1 suppliers who can reliably meet global safety protocols and ensure verifiable product quality.

What are the key technological advancements expected to influence the market?

Key technological advancements include the widespread integration of advanced Battery Management Systems (BMS) utilizing AI for predictive safety, the incorporation of higher energy density cathode materials (NCA/NMC), and the future adoption of safer, higher-capacity solid-state electrolyte technologies.

Which segment of electronic cigarette batteries is currently seeing the highest volume growth?

The non-rechargeable (disposable) application segment, specifically utilizing low-capacity Lithium-polymer (Li-Po) pouch cells, is experiencing the highest volume growth due to their low cost, ease of use, and convenience, dominating recent market entries.

What are the main safety challenges associated with electronic cigarette lithium batteries?

The main challenges are thermal runaway, short-circuiting, and cell venting, often linked to user misuse, external damage, or manufacturing defects. Industry focus is on enhanced cell protection circuitry and robust thermal management to mitigate these critical risks effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager