Electronic Data Interchange (EDI) Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434279 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electronic Data Interchange (EDI) Software Market Size

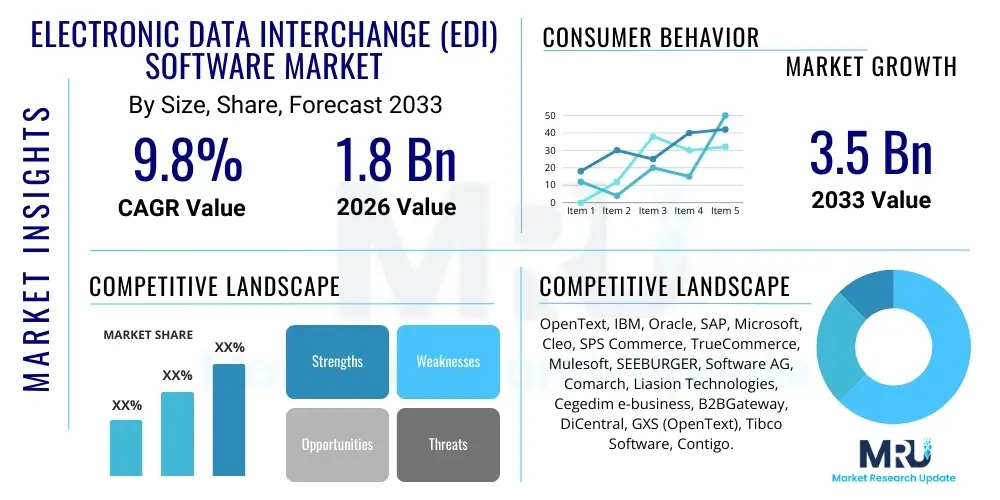

The Electronic Data Interchange (EDI) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating necessity for seamless, automated business-to-business (B2B) communication and transaction processing across global supply chains. Regulatory pressures, especially in sectors like healthcare and finance, mandate standardized data exchange, further cementing EDI's critical role in modern commerce infrastructure. The shift towards cloud-based and managed EDI services is a primary catalyst facilitating adoption among Small and Medium Enterprises (SMEs), which historically found on-premise solutions cost-prohibitive, thus expanding the total addressable market significantly over the forecast horizon.

Electronic Data Interchange (EDI) Software Market introduction

The Electronic Data Interchange (EDI) Software Market encompasses solutions designed to facilitate the automated, structured exchange of business documents, such as purchase orders, invoices, and shipping notices, between different computer systems, minimizing human intervention and manual data entry errors. These systems adhere to globally recognized standards (e.g., ANSI X12, UN/EDIFACT) ensuring interoperability across disparate business partners, regardless of their internal IT infrastructure. EDI software can be deployed as on-premise installations, cloud-based Software as a Service (SaaS) models, or managed services, catering to the varying technical requirements and scale of enterprises, from large multinational corporations to agile mid-sized businesses seeking supply chain efficiency.

Major applications of EDI software span core business functions, including procurement, logistics, finance, and inventory management. In logistics and transportation, EDI accelerates the flow of goods by automating bills of lading and advanced shipping notices, drastically reducing lead times and optimizing warehouse operations. For the retail sector, efficient EDI ensures timely processing of high volumes of purchase orders, stock level updates, and sales reports, which are crucial for just-in-time inventory strategies and minimizing stockouts. Furthermore, its benefits are manifold; it ensures significant operational cost savings by eliminating paper processing, enhances data accuracy by reducing manual data transcription errors, and improves compliance with stringent industry regulations, ultimately fostering stronger, more reliable trading partner relationships.

The primary driving factors sustaining the market's robust growth include the pervasive trend of globalization, demanding real-time synchronization across international borders and diverse regulatory environments. Additionally, the proliferation of digital supply chain initiatives, where end-to-end visibility and automated workflows are paramount, places EDI technology at the foundational layer of digital transformation strategies. The increasing complexity of regulatory frameworks, particularly in highly regulated industries like healthcare (HIPAA mandates) and finance, necessitate the structured and secure exchange of information that only standardized EDI protocols can reliably provide, pushing non-compliant organizations toward mandatory adoption of advanced EDI solutions.

Electronic Data Interchange (EDI) Software Market Executive Summary

The Electronic Data Interchange (EDI) Software Market is currently characterized by significant business trends focused on migration toward cloud-native and API-enabled EDI solutions, allowing for faster integration and greater scalability compared to traditional on-premise VANs (Value Added Networks). Companies are increasingly prioritizing hybrid deployment models that combine the security of on-premise systems for sensitive data with the flexibility and cost-efficiency of cloud services for external communication. Furthermore, the market is experiencing consolidation, with major players acquiring specialized integration providers to offer comprehensive, end-to-end B2B integration platforms that incorporate not only traditional EDI but also modern data formats like JSON and XML, addressing the diverse needs of contemporary digital ecosystems and providing advanced analytics on transaction flow and compliance.

From a regional perspective, North America maintains the largest market share, driven by stringent regulatory requirements, particularly in the US healthcare and retail industries, and the early, widespread adoption of standardized B2B processes by large enterprises. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid industrialization, burgeoning e-commerce sectors, and government initiatives aimed at modernizing supply chain infrastructure in emerging economies like India and Southeast Asia. Europe remains a mature yet expanding market, where cross-border trade standardization efforts and the adoption of protocols like PEPPOL for public procurement are accelerating the demand for compliant EDI services.

Segment trends highlight the overwhelming preference for the managed services component, especially among Small and Medium Enterprises (SMEs), as it offloads the complexity of protocol management, compliance updates, and maintenance to third-party experts, providing guaranteed uptime and cost predictability. Vertically, the retail and consumer goods sectors are the primary users, necessitated by high transaction volumes and demanding supply chain dynamics; however, the automotive and logistics sectors are showing accelerated investment in advanced, real-time EDI capabilities to support complex just-in-sequence (JIS) and traceability requirements inherent in modern manufacturing operations, ensuring that the software adapts effectively to industry-specific data standards and operational requirements.

AI Impact Analysis on Electronic Data Interchange (EDI) Software Market

Common user questions regarding AI's influence on the EDI market center on whether AI will entirely replace traditional EDI infrastructure, how AI can handle unstructured data inputs preceding standardization, and what role machine learning plays in predictive failure analysis within B2B integration processes. Users are concerned about migrating legacy systems and ensuring compliance while leveraging AI benefits. The consensus highlights that AI will not eliminate EDI but rather augment it by automating manual mapping processes, enhancing data quality validation, and providing predictive insights into supply chain disruptions. Specifically, AI’s primary contribution will be automating the transformation and normalization of non-standardized external documents into compliant EDI formats and ensuring robust anomaly detection in high-volume transaction sets, thereby reducing the operational burden on IT teams and significantly improving the reliability of data exchange processes.

- AI-powered mapping tools reduce the time and effort required for configuring new trading partners.

- Machine learning algorithms enhance data validation, proactively identifying and correcting errors before transactions fail.

- Predictive analytics monitors transaction volumes and patterns to anticipate bottlenecks or compliance risks.

- Natural Language Processing (NLP) enables the processing of unstructured data (e.g., email attachments) into structured EDI documents.

- AI optimizes routing and latency in Value Added Networks (VANs) by learning peak transaction times.

DRO & Impact Forces Of Electronic Data Interchange (EDI) Software Market

The EDI Software Market is fundamentally shaped by powerful drivers, necessitating immediate adoption, while simultaneously navigating significant restraints related to integration complexity and cost. Opportunities for market expansion are abundant, particularly in emerging markets and through the integration of cutting-edge technologies. The most significant drivers include the mandatory requirement for digitization of B2B transactions, global supply chain pressure demanding real-time visibility and efficiency, and strict regulatory standards (such as HIPAA in healthcare and governmental e-invoicing mandates) that enforce standardized data exchange, compelling organizations to invest in robust, compliant EDI solutions. These forces collectively create a high-impact environment where reliable EDI infrastructure is non-negotiable for competitive operational performance.

However, the market faces considerable restraints, notably the high initial setup costs associated with complex on-premise installations and the long, often cumbersome integration periods required to onboard numerous trading partners, especially when dealing with legacy proprietary systems. Furthermore, the ongoing challenge of integrating traditional EDI systems with modern enterprise applications (ERPs, WMS) and new data formats (APIs) often necessitates specialized IT expertise, which can be scarce and expensive. This complexity disproportionately affects SMEs who lack dedicated internal resources for managing sophisticated integration platforms, slowing down broad market adoption despite the availability of more accessible cloud solutions.

Opportunities for growth are concentrated in the rapid uptake of cloud-based and hybrid EDI solutions, which lower the barriers to entry for SMEs and offer superior scalability and disaster recovery capabilities. The increasing relevance of blockchain technology in supply chain verification presents a unique opportunity for EDI providers to integrate secure, decentralized transaction ledgers, enhancing trust and traceability. Furthermore, focusing on vertical-specific solutions, such as hyper-specialized EDI tools for the pharmaceutical supply chain or complex automotive manufacturing (JIS), allows vendors to capture niche, high-value segments demanding deep process integration and tailored compliance features, thereby maximizing market penetration.

Segmentation Analysis

The EDI Software Market segmentation provides a granular view of deployment preferences, functional components, scale of utilization, and predominant industry applications. The market is primarily bifurcated by the method of deployment (Cloud vs. On-Premise), reflecting the ongoing digital transformation shift toward flexible, subscription-based models. Component analysis reveals a strong emphasis on service delivery, as complexity drives demand for expert management. Enterprise size delineates distinct needs between large, historically integrated organizations and agile, growing SMEs. Finally, industry vertical segmentation showcases the highest adoption rates in high-transaction sectors like Retail and Logistics, alongside critical compliance-driven segments such as Healthcare and Banking, influencing vendor strategy and product development focus.

- By Deployment Type:

- Cloud-based EDI

- On-Premise EDI

- By Component:

- EDI Software

- Services (Managed Services, Professional Services, Consulting)

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- Retail and Consumer Goods

- Logistics and Transportation

- Healthcare and Pharmaceuticals

- Automotive

- Manufacturing

- Banking, Financial Services, and Insurance (BFSI)

Value Chain Analysis For Electronic Data Interchange (EDI) Software Market

The value chain of the EDI Software Market begins with upstream activities centered on core software development, involving research, infrastructure planning, and the creation of standardized translation software compliant with protocols like X12 and EDIFACT. Key upstream suppliers include technology providers delivering secure communication protocols (e.g., AS2), cloud infrastructure services (AWS, Azure), and specialized integration engine developers. The focus at this stage is on developing scalable, secure, and highly reliable software components that can handle vast transaction volumes and ensure data integrity across various connectivity methods, requiring significant investment in R&D to maintain pace with evolving security standards and integration requirements.

The core EDI service provision stage, which sits in the middle of the value chain, involves deploying and managing the EDI environment. This includes data mapping and translation, ensuring connectivity across diverse trading partners, managing Value Added Networks (VANs), and providing managed services for system maintenance, compliance checks, and error resolution. Direct distribution channels involve vendors selling their proprietary software or SaaS platforms directly to large enterprise clients who maintain in-house EDI teams. This approach allows for highly customized integration but demands high operational investment from the end-user. Conversely, indirect channels are dominated by system integrators, consulting firms, and specialized managed service providers who deploy and often operate the EDI solutions on behalf of smaller clients or those preferring an outsourced model, acting as critical intermediaries.

Downstream activities focus heavily on implementation, integration with the customer's Enterprise Resource Planning (ERP) systems, and continuous post-sales support crucial for maintaining trading partner connectivity. The distribution channel dynamics are shifting, with a pronounced trend away from traditional, proprietary VAN models towards internet-based secure protocols (AS2) and cloud-based EDI-as-a-Service, which streamline the distribution and maintenance process. End-users benefit from simplified deployment and reduced total cost of ownership, while vendors benefit from recurring revenue streams. The success downstream is determined by the provider’s ability to quickly onboard new partners and ensure 24/7 technical support, guaranteeing transactional flow and compliance.

Electronic Data Interchange (EDI) Software Market Potential Customers

The primary consumers of Electronic Data Interchange (EDI) software are organizations across all industry verticals that engage in high-volume, repetitive, structured transactions with a large network of external trading partners, including suppliers, distributors, retailers, and financial institutions. These customers are typically motivated by the need for operational efficiency, cost reduction associated with manual data handling, and mandatory compliance with industry-specific regulations that dictate standardized data exchange formats. Large enterprises, especially those operating complex global supply chains (e.g., multinational automotive manufacturers or Tier 1 retailers), are traditionally the largest segment due to their dependency on real-time data flow and their influence in mandating EDI adoption across their entire partner ecosystems.

The potential customer base is expanding significantly into the Small and Medium Enterprise (SME) segment, largely due to the increased affordability and reduced complexity offered by cloud-based and managed EDI services. While SMEs may not possess the internal IT infrastructure or expertise of large corporations, they are often required by their larger trading partners (anchor tenants) to adopt EDI to maintain business relationships. This pressure creates a substantial market opportunity for vendors offering scalable, easy-to-deploy, and low-maintenance solutions, allowing SMEs to compete effectively by automating their B2B transactions without massive capital expenditure or burdensome IT overhead.

Key sectors driving demand include Healthcare, where compliance with HIPAA requires strict EDI standards for claims processing and patient data exchange, and the Retail sector, where managing complex inventory and fulfillment logistics for e-commerce requires highly reliable, standardized document exchange (850 Purchase Order, 810 Invoice). Other critical end-users are within the BFSI sector, utilizing EDI for secure interbank communications and payment processing, and government entities, which are increasingly adopting e-invoicing and e-procurement mandates requiring standardized data exchange protocols to ensure transparency and efficiency in public spending processes, fundamentally widening the applicability of EDI technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OpenText, IBM, Oracle, SAP, Microsoft, Cleo, SPS Commerce, TrueCommerce, Mulesoft, SEEBURGER, Software AG, Comarch, Liasion Technologies, Cegedim e-business, B2BGateway, DiCentral, GXS (OpenText), Tibco Software, Contigo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Data Interchange (EDI) Software Market Key Technology Landscape

The technological evolution within the EDI market is focused on transitioning from rigid, proprietary communication methods to flexible, web-enabled B2B integration platforms. Core technologies include standardized translation software that converts internal data formats into external EDI standards (ANSI X12, EDIFACT, ODETTE). Connectivity protocols have diversified significantly; while traditional proprietary Value Added Networks (VANs) are still used, modern deployments heavily utilize secure internet protocols like AS2 (Applicability Statement 2) for direct, reliable, and secure point-to-point communication, dramatically reducing reliance on traditional network operators and lowering long-term connectivity costs.

A critical shift involves the convergence of traditional EDI capabilities with modern Application Programming Interfaces (APIs). Hybrid integration platforms are emerging as standard, allowing enterprises to manage both legacy EDI transactions and real-time API-based interactions through a single unified gateway. This convergence addresses the need for instantaneous data exchange required by modern e-commerce and logistics applications, while maintaining the standardized, high-volume batch processing capabilities inherent to EDI. Furthermore, cloud computing infrastructure (IaaS/PaaS) underpins the growing popularity of EDI-as-a-Service (EDIaaS) models, offering scalability, enhanced security features, and automated disaster recovery, mitigating the technological burden for end-users.

Emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) are increasingly integrated to automate complex and error-prone EDI processes, particularly data mapping and transformation rules creation. AI algorithms learn historical transaction patterns to suggest optimal data mappings and proactively identify anomalies, significantly improving data quality and reducing manual intervention. Additionally, blockchain technology is being explored to create immutable transaction records and enhance trust and transparency in supply chain auditing, especially in complex, multi-party EDI environments, offering a future-proof layer of security and verification for mission-critical B2B exchanges.

Regional Highlights

North America currently dominates the global EDI Software Market, primarily driven by the United States. This dominance stems from the region's highly mature commercial infrastructure, coupled with mandatory standardization in key verticals. The U.S. healthcare sector, in particular, relies heavily on EDI standards for claims and remittance processing (mandated by HIPAA). The sophisticated retail and automotive supply chains in North America also drive high transaction volumes and necessitate robust, reliable EDI systems. Ongoing digital transformation efforts and substantial investments in cloud technology further solidify the region's market leadership, with large enterprises continually upgrading their integration capabilities to handle multi-channel commerce and complex global fulfillment demands.

Europe represents the second-largest market, characterized by strong cross-border trade and regulatory standardization efforts across the European Union. Initiatives such as the use of PEPPOL (Pan-European Public Procurement Online) for electronic invoicing in public sector procurement are compelling widespread EDI adoption across member states. Countries like Germany, France, and the UK demonstrate high maturity, driven by sophisticated manufacturing and logistics sectors demanding optimized B2B communication. The European market exhibits a strong trend towards compliant, government-mandated e-invoicing standards, making adherence to localized EDI protocols a major driver for software procurement and managed services, facilitating seamless commercial operations across diverse jurisdictions.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the forecast period. This rapid growth is attributable to accelerated economic development, substantial government investment in digital infrastructure, and the explosive growth of e-commerce and manufacturing bases in countries like China, India, and Southeast Asia. As local enterprises integrate into global supply chains, the necessity to communicate using recognized international standards (EDIFACT, X12) becomes critical. While initially slow due to infrastructural deficits, the increasing adoption of cost-effective, scalable cloud EDI solutions is enabling widespread market penetration, particularly among mid-sized manufacturers and logistics providers seeking international competitiveness and streamlined trade processes.

- North America: Market leader due to strict healthcare regulations (HIPAA), large enterprise retail dominance, and early cloud adoption maturity.

- Europe: Driven by multi-national logistics requirements, cross-border trade integration, and mandatory e-invoicing initiatives (PEPPOL).

- Asia Pacific (APAC): Fastest-growing region, fueled by manufacturing expansion, e-commerce proliferation, and increasing integration into global supply chains.

- Latin America (LATAM): Growth propelled by government mandates for fiscal documentation and digital tax compliance, especially in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market focusing on modernizing ports and logistics infrastructure, creating demand for secure EDI for trade facilitation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Data Interchange (EDI) Software Market.- OpenText

- IBM

- Oracle

- SAP

- Microsoft

- Cleo

- SPS Commerce

- TrueCommerce

- Mulesoft (Salesforce)

- SEEBURGER

- Software AG

- Comarch

- Liasion Technologies (OpenText)

- Cegedim e-business

- B2BGateway

- DiCentral

- GXS (OpenText)

- TIBCO Software

- Contigo

- HighJump (Körber)

Frequently Asked Questions

Analyze common user questions about the Electronic Data Interchange (EDI) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Cloud-based EDI and traditional On-Premise EDI?

Cloud-based EDI offers a subscription model (SaaS), requiring minimal upfront capital investment and leveraging vendor-managed infrastructure for scalability and maintenance, making it ideal for SMEs. On-Premise EDI requires significant internal IT resources for installation, maintenance, and updates, providing maximum control over data but incurring higher complexity and initial cost.

How is the growth of API integration affecting the standard Electronic Data Interchange (EDI) market?

APIs are not replacing EDI but are complementing it within hybrid integration platforms. While APIs enable real-time, synchronous communication crucial for modern applications, EDI remains the mandatory standard for structured, high-volume batch transactions in established supply chains and regulated industries. Hybrid systems manage both protocols seamlessly.

Which industry vertical demonstrates the highest investment in advanced EDI solutions?

The Retail and Consumer Goods vertical shows the highest overall transaction volume and continuous investment, driven by the need for tight inventory control, e-commerce fulfillment efficiency, and managing vast, diverse global supplier networks. Healthcare also invests heavily due to strict compliance mandates (HIPAA) governing standardized claims processing.

What role does Artificial Intelligence play in modern EDI software?

AI improves EDI processes by automating data mapping and translation, reducing manual configuration time for new trading partners. Machine learning enhances data quality by predicting and flagging transaction errors proactively, and NLP tools can convert unstructured external data into compliant EDI formats, thereby boosting operational efficiency and accuracy.

What are the key drivers for EDI adoption among Small and Medium Enterprises (SMEs)?

The main driver for SMEs is the mandate from larger trading partners (anchor tenants) to adopt standardized B2B processes. However, increasing affordability, reduced complexity, and lower maintenance burden provided by Managed EDI Services and Cloud-based SaaS solutions are critical enablers for broader SME adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Data Interchange (EDI) Software Market Size Report By Type (Cloud Based, On-Premise), By Application (Large Enterprises, SMEs), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Electronic Data Interchange (EDI) Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud Based, On-Premise), By Application (Large Enterprises, SMEs), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager