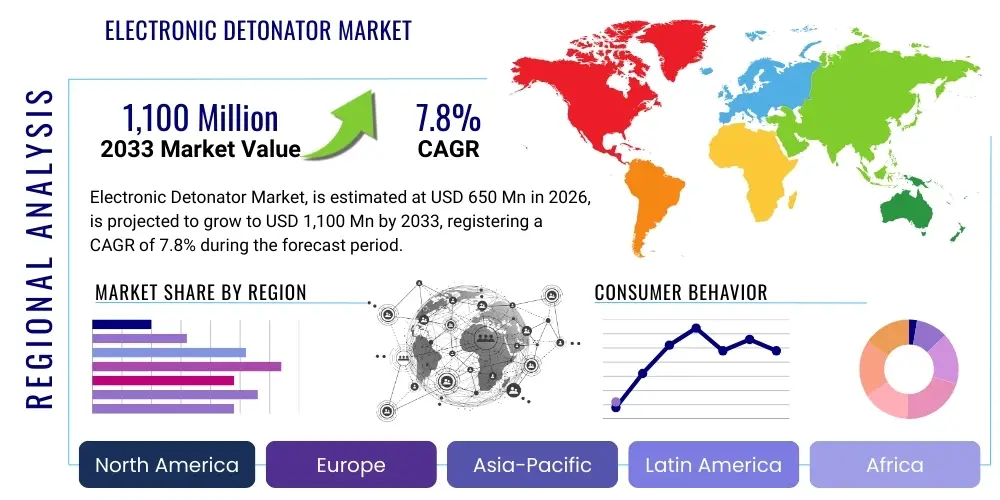

Electronic Detonator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436864 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electronic Detonator Market Size

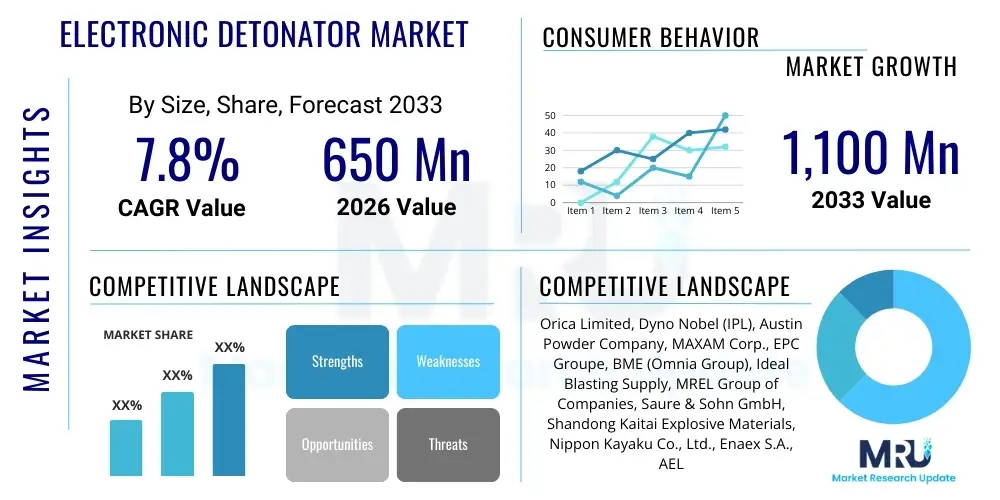

The Electronic Detonator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033.

Electronic Detonator Market introduction

The Electronic Detonator Market encompasses the manufacturing, distribution, and utilization of advanced initiation systems used primarily in blasting operations across mining, construction, and defense sectors. These systems represent a significant technological evolution over traditional non-electric and safety fuse detonators, offering unparalleled precision, timing accuracy, and safety features. Electronic detonators utilize microprocessors and sophisticated programming capabilities to precisely control the time delay of explosive charges, which is crucial for achieving optimal fragmentation, reducing ground vibration, and ensuring better overall blast results, thereby increasing operational efficiency and minimizing environmental impact. The adoption of these high-technology devices is accelerating globally, driven by stringent safety regulations and the pressing industry need for improved productivity in large-scale resource extraction and infrastructure development projects. These devices offer superior flexibility in blast design compared to their conventional counterparts, allowing blasters to manage complex firing sequences with millisecond accuracy, which is virtually impossible with non-electric systems.

Electronic detonators consist of three main components: a chip-based timing circuit, an initiating element (such as a bridge wire or energetic material), and wiring or a wireless transmission system. The product range includes programmable systems where delays can be set to the nearest millisecond, and non-programmable systems that still utilize electronic firing mechanisms but with fixed timing. Major applications span surface and underground mining, large civil engineering projects like tunneling and road construction, and specialized demolition work where precision is paramount. The primary benefits include enhanced safety through two-way communication and logging, significant improvement in blasting quality, optimized ore recovery in mining, and reduced collateral damage in construction environments. The market is fundamentally driven by the global demand for minerals and infrastructure development, compelling companies to adopt more efficient and safer blasting methodologies.

Key driving factors fueling market expansion include the increasing focus on worker safety standards, particularly in deep underground mining where misfires pose extreme risks, and the requirement for optimized fragmentation to reduce subsequent crushing and grinding costs. Furthermore, the integration of electronic detonators with advanced blast design software and remote firing systems allows for fully automated and monitored operations, appealing strongly to large international mining corporations focused on digitalization. The continuous innovation in wireless electronic blasting systems (WES) further promises increased deployment flexibility, especially in complex, multi-level blasting operations, reducing the reliance on extensive cable networks and significantly lowering the time required for tie-up and inspection, thus improving cycle times.

Electronic Detonator Market Executive Summary

The Electronic Detonator Market is experiencing robust growth fueled by technological advancements and the increasing global emphasis on operational safety and efficiency in extractive and construction industries. Key business trends include the shift towards sophisticated programmable systems that offer wireless communication capabilities, allowing operators to execute complex blasts remotely and with greater reliability. Regional trends show strong adoption in mature mining markets like North America and Australia, which lead in safety standardization, while rapid industrialization and large-scale infrastructure investment in Asia Pacific, particularly China and India, drive exponential demand. Segment trends indicate that the mining and quarrying sector remains the largest end-user due to the massive scale of operations requiring precise sequential blasting, and within the product types, programmable electronic detonators are gaining market share rapidly over non-programmable variants, reflecting the industry's investment in higher accuracy and specialized blast designs. Moreover, sustainability is becoming a major trend, as precise blasting minimizes excessive use of explosives and reduces energy consumption in post-blast processing stages, aligning with corporate environmental, social, and governance (ESG) objectives.

AI Impact Analysis on Electronic Detonator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electronic Detonator Market frequently revolve around predictive maintenance, autonomous blasting control, and the integration of blast data with real-time geological modeling. Users are concerned with how AI can optimize blast design parameters—such as charge weight, burden, and spacing—based on immediate rock mass characteristics and desired fragmentation outcomes, ensuring consistent and optimal results. Key expectations focus on the ability of AI algorithms to analyze vast datasets collected from sensors, drones, and post-blast monitoring to automatically suggest or implement precise delay timing adjustments for electronic detonators, minimizing human error and maximizing efficiency. Furthermore, there is significant interest in using machine learning to predict potential misfires or equipment failures in the electronic initiation system itself, thereby enhancing safety protocols and reducing operational downtime.

- AI optimizes blast design parameters by processing seismic, geological, and drilling data for real-time adjustments.

- Machine learning algorithms enhance fragmentation analysis post-blast, providing feedback loops for future detonator timing optimization.

- AI-driven predictive maintenance forecasts component failure within detonator systems, increasing reliability and reducing operational risk.

- Integration of AI with autonomous drilling rigs allows for precise hole positioning and automated assignment of electronic detonator firing sequences.

- Advanced image recognition (AI vision) systems verify correct tie-in and placement of electronic detonators before initiation, drastically improving safety compliance.

- AI supports sophisticated vibration monitoring and control, allowing electronic detonators to adjust delays dynamically to mitigate ground vibration effects near sensitive structures.

DRO & Impact Forces Of Electronic Detonator Market

The Electronic Detonator Market is primarily propelled by stringent safety mandates and the critical need for operational efficiency (Drivers), yet its expansion is constrained by high initial investment costs and regulatory hurdles (Restraints). Opportunities lie in the continued development of wireless blasting technologies and market expansion into emerging economies with high infrastructure demand (Opportunities). These factors collectively create a dynamic competitive environment where the technological sophistication of the product and the ability to integrate systems seamlessly into complex mining workflows act as significant Impact Forces. The market experiences a continuous push-pull effect, where the proven economic benefits of optimized blasting frequently overcome the barriers of high capital expenditure, especially for large, global mining corporations seeking marginal efficiency gains that translate into millions of dollars saved annually. Furthermore, geopolitical stability in resource-rich regions heavily influences the demand cycle, as mining activities directly correlate with the global economic outlook.

Specifically, the primary driver is the demonstrable improvement in accuracy (measured in micro-seconds versus milliseconds for traditional systems) which directly translates into better rock fragmentation, reducing subsequent energy consumption in crushing and grinding—often the most energy-intensive part of the mining process. Conversely, a major restraint is the regulatory complexity surrounding the transportation, storage, and handling of explosives and electronic components, which varies widely by jurisdiction and can slow down product introduction. Another significant restraint is the necessity for highly trained personnel to operate and program these sophisticated electronic systems, representing a major hurdle for smaller operators or those in remote locations lacking specialized technical expertise.

The largest opportunities stem from the potential for fully autonomous and remote blasting operations, driven by wireless technology and IoT integration, which reduces the need for human presence in hazardous areas. Emerging markets present substantial growth potential as these regions leapfrog older blasting technologies directly to electronic systems during rapid infrastructure expansion. Impact forces include intense competition among established global players vying for exclusive supply contracts with major mining companies and the continuous pressure for innovation to reduce system costs and improve ease of use, ensuring that electronic detonators become the standard, not the premium, option across all scales of operation. The ongoing development of robust cybersecurity measures for wireless systems also represents a critical impact force influencing trust and adoption rates.

Segmentation Analysis

The Electronic Detonator Market is primarily segmented based on the type of product, the technology utilized for communication, and the specific end-user industry employing these systems. Understanding these segments is crucial for strategic planning, as different applications require varied levels of precision and communication complexity. The dominance of the mining sector is evident, though the defense and construction industries utilize specialized electronic detonators designed for unique logistical and security requirements. Segmentation by type highlights the market's trajectory towards high-precision programmable units, which maximize operational benefits, while technology segmentation shows a steady move away from wireline towards more flexible and efficient wireless detonation systems, particularly in large open-pit mines where laying extensive wiring networks is cumbersome and costly.

- By Type:

- Programmable Electronic Detonators

- Non-Programmable Electronic Detonators

- By Technology:

- Wireline Systems

- Wireless Systems (WES)

- By End-User:

- Mining & Quarrying (Surface Mining, Underground Mining)

- Construction (Tunnels, Roads, Dams, Urban Demolition)

- Oil & Gas (Seismic Exploration, Well Perforation)

- Defense/Military (Specialized Demolition, Training)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Electronic Detonator Market

The value chain for the Electronic Detonator Market starts with the Upstream Analysis, focusing on the procurement of critical raw materials and components, which include specialized microprocessors, complex integrated circuits, bridge wires, casing materials (often high-strength plastics or metals), and energetic chemical compounds used for the initiation charge. Manufacturers rely heavily on a highly specialized network of suppliers for these electronic and chemical components. Given the need for high reliability and precise specifications, quality control at the component level is paramount. Key upstream activities involve R&D into miniaturization and robust design to ensure detonators withstand harsh environmental conditions typical of mining and construction sites, requiring specialized chemical engineering and electronics manufacturing expertise to maintain production quality and consistency.

Midstream activities involve the core manufacturing and assembly of the detonator systems, including circuit board fabrication, housing assembly, programming of microchips, and final system integration (e.g., combining detonators with firing boxes, remote controls, and communication cables/antennae). Distribution channels are highly structured and involve both Direct and Indirect methods. Due to the hazardous nature of the product, direct distribution is often preferred for large, strategic customers (Tier 1 mining companies), enabling manufacturers to provide specialized technical support, training, and maintenance services directly. Indirect channels involve authorized, licensed distributors and specialized logistics providers that manage the complex regulatory requirements for transporting explosive materials, often catering to smaller quarrying operations and regional construction firms that require local, timely supply and immediate technical assistance.

Downstream analysis focuses on the end-users—primarily mining, construction, and defense sectors—and the after-sales support provided by manufacturers. The performance of electronic detonators heavily depends on proper blast design and integration with drilling and loading operations. Therefore, the value delivered downstream includes sophisticated software tools for blast modeling, on-site technical consultation, and comprehensive training programs to maximize the return on investment for the customer. The shift towards wireless systems is streamlining the downstream process by reducing the complexity of the tie-in phase, thereby accelerating blast cycles and contributing significantly to the overall value proposition realized by the end-user.

Electronic Detonator Market Potential Customers

The primary customers for electronic detonators are entities involved in large-scale resource extraction, civil infrastructure development, and defense operations where controlled, precise blasting is essential. The largest customer segment remains the Mining and Quarrying industry, including major international mining houses (e.g., Rio Tinto, BHP, Glencore) that operate massive open-pit and deep underground mines and require millisecond accuracy to optimize fragmentation and reduce seismicity. These customers are driven by maximizing ore recovery and minimizing post-blast processing costs, making the precision offered by electronic detonators indispensable. Mid-sized quarrying operations also represent a significant customer base, adopting these systems to comply with increasingly strict local regulations regarding noise and vibration control near populated areas, often requiring specific, customizable blast patterns.

The Construction sector, including large civil engineering firms undertaking major tunneling projects (e.g., metro systems, highways, hydro-power dams) and specialized urban demolition companies, forms the second major customer cohort. For tunneling, precision in blast profiles is crucial for structural integrity and minimizing overbreak, while in urban settings, the ability of electronic systems to tightly control vibration and flyrock is mandatory. Furthermore, the Oil & Gas industry utilizes specialized electronic detonators and shaped charges for seismic exploration (to map subterranean structures) and well perforation (to enhance flow rates), focusing heavily on reliability and deep-hole performance under high pressure and temperature conditions. The Defense sector, while smaller in volume, represents a high-value customer base for specialized, secure initiation systems used in training, ordnance disposal, and strategic demolition applications, prioritizing fail-safe mechanisms and encrypted firing protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orica Limited, Dyno Nobel (IPL), Austin Powder Company, MAXAM Corp., EPC Groupe, BME (Omnia Group), Ideal Blasting Supply, MREL Group of Companies, Saure & Sohn GmbH, Shandong Kaitai Explosive Materials, Nippon Kayaku Co., Ltd., Enaex S.A., AEL Mining Services (AECI Group), Chemring Group PLC, Ensign-Bickford Aerospace & Defense. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Detonator Market Key Technology Landscape

The Electronic Detonator Market is defined by a technological landscape centered on microprocessors, secure communication protocols, and advanced energy storage mechanisms designed for rugged environments. Key technologies include highly precise quartz crystal oscillators embedded in the microchips, ensuring timing accuracy within microseconds, which is critical for complex sequencing. The evolution from simple analog circuitry to complex digital processing allows detonators to perform internal diagnostics, communicate bi-directionally with the firing box, and receive unique firing codes, significantly improving security and accountability. Furthermore, the miniaturization of components enables the integration of more sophisticated features while maintaining the detonator's physical robustness required to survive high shock loads during handling and placement. Manufacturers are continuously improving the chemical initiation chain to ensure absolute reliability, often using highly stable primary and secondary explosives that require minimal energy input to trigger the main charge, enhancing safety during transport and storage.

The most transformative technology in recent years is the development and commercialization of Wireless Electronic Blasting Systems (WES). WES utilizes robust, encrypted radio frequency (RF) communication protocols to eliminate the need for physical wiring between the firing unit and the detonators. This drastically reduces setup time, simplifies complex blast patterns, and enhances safety by keeping personnel farther away from the blast face during hook-up and firing. The technological challenge here involves ensuring RF reliability in highly conductive, often wet, or confined underground environments, requiring specialized antenna design and signal processing. Another critical technology is the development of robust, high-capacity, and long-life capacitors or battery systems within the detonator itself, ensuring sufficient energy is stored to reliably fire the primary charge even after extended periods in the blast hole.

Integration technology also plays a crucial role, linking electronic detonators with other mining technologies. This includes specialized blast planning software that calculates optimal delay times based on rock mechanics and geology, and remote firing systems that interface with centralized mine control rooms. Data logging capabilities—the ability of the electronic detonator to record its status, location, and delay time—allow for sophisticated post-blast analysis and process improvement. Manufacturers are increasingly adopting IoT (Internet of Things) principles, enabling real-time monitoring and management of detonator inventory and deployment status across multiple blast sites, creating an integrated digital ecosystem for explosives management that enhances operational control and minimizes potential misuse or theft.

Regional Highlights

- North America: This region is characterized by large-scale, highly mechanized mining operations, particularly in Canada (gold, iron ore) and the US (coal, copper). North America is a mature market and an early adopter of advanced electronic detonators due to rigorous safety legislation and a strong focus on maximizing efficiency in labor-intensive operations. The market is driven by technological refresh cycles and the high adoption rate of wireless systems in open-pit mines.

- Europe: The European market, encompassing Western and Eastern Europe, shows stable growth driven by specialized construction projects (tunnels, urban development) and quarrying. Strict environmental regulations concerning vibration limits (VOD) and noise control make the precision offered by electronic detonators essential for compliance, sustaining demand despite slower growth in large-scale mining compared to other regions.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive government investment in infrastructure (roads, railways, dams) and the escalating demand for mineral resources in China, India, and Southeast Asia. While cost sensitivity remains a factor, increasing safety enforcement and the sheer volume of construction and mining activities are rapidly accelerating the transition from traditional non-electric systems to electronic detonators.

- Latin America: Dominated by major mining countries like Chile, Peru, and Brazil (copper, iron ore), Latin America represents a high-volume market. Large multinational corporations operating here are driving the adoption of high-precision electronic systems to optimize ore recovery in complex geological formations, focusing on reducing dilution and increasing overall blast efficiency.

- Middle East & Africa (MEA): Growth in MEA is driven by increased oil and gas exploration activities, which utilize specialized perforating charges and seismic blasting, alongside emerging mining projects in Africa. Market adoption is accelerating as regulatory frameworks mature and large international contractors prioritize global safety standards, pushing local operators towards electronic initiation systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Detonator Market.- Orica Limited

- Dyno Nobel (IPL)

- Austin Powder Company

- MAXAM Corp.

- EPC Groupe

- BME (Omnia Group)

- Ideal Blasting Supply

- MREL Group of Companies

- Saure & Sohn GmbH

- Shandong Kaitai Explosive Materials Co., Ltd.

- Nippon Kayaku Co., Ltd.

- Enaex S.A.

- AEL Mining Services (AECI Group)

- Chemring Group PLC

- Ensign-Bickford Aerospace & Defense

- Grasberg Mining Company (Internal Use Systems)

- Polyex International

- Jiangsu Leiming Explosives Co., Ltd.

- Kelun Electronics Co., Ltd.

- Nobel Enerji A.S.

Frequently Asked Questions

Analyze common user questions about the Electronic Detonator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of electronic detonators over traditional non-electric systems?

The primary advantage is precision timing. Electronic detonators offer millisecond or microsecond accuracy in delay sequencing, which is crucial for optimizing rock fragmentation, reducing ground vibration, and maximizing overall blast effectiveness, resulting in lower processing costs downstream.

Which end-user segment drives the highest demand in the Electronic Detonator Market?

The Mining and Quarrying segment generates the highest demand, particularly large-scale surface and underground operations. These sectors rely on electronic systems to handle massive volumes of material efficiently, ensuring high ore recovery rates and adherence to strict safety protocols.

What are Wireless Electronic Blasting Systems (WES) and how do they benefit operations?

WES are advanced systems that use secure radio frequency communication to initiate detonators remotely without physical wiring. They benefit operations by drastically reducing setup time, increasing operator safety by moving personnel away from the blast zone, and simplifying complex, multi-level blast designs.

What are the main restraints hindering the global adoption of electronic detonators?

The main restraints are the high initial capital investment required for the systems (detonators and firing equipment) compared to conventional methods, along with the necessity for specialized training and certification of personnel to program and operate the sophisticated electronic hardware and software.

How does AI contribute to improving electronic detonator performance?

AI contributes by analyzing vast operational and geological datasets to optimize blast parameters in real-time. This includes predictive delay adjustment, fragmentation analysis feedback, and predictive maintenance diagnostics for the electronic initiation equipment, enhancing safety and overall efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager