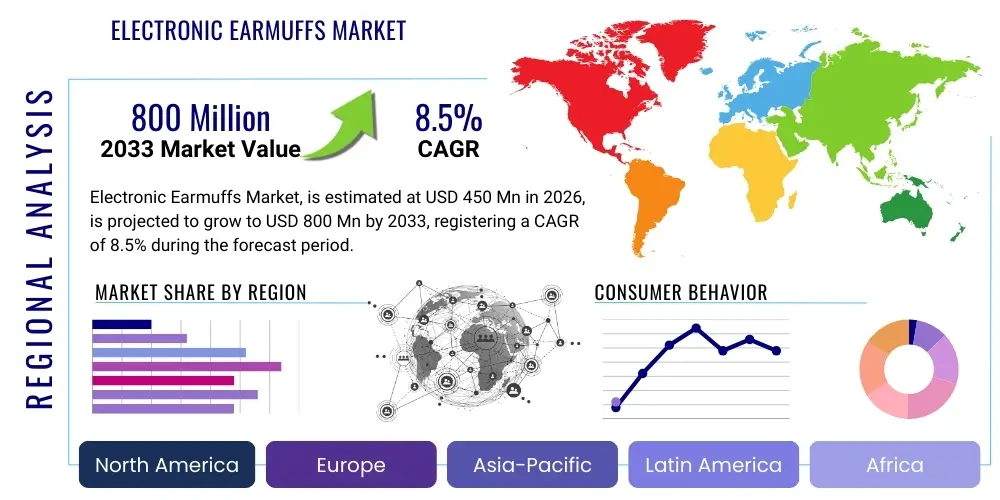

Electronic Earmuffs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434548 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electronic Earmuffs Market Size

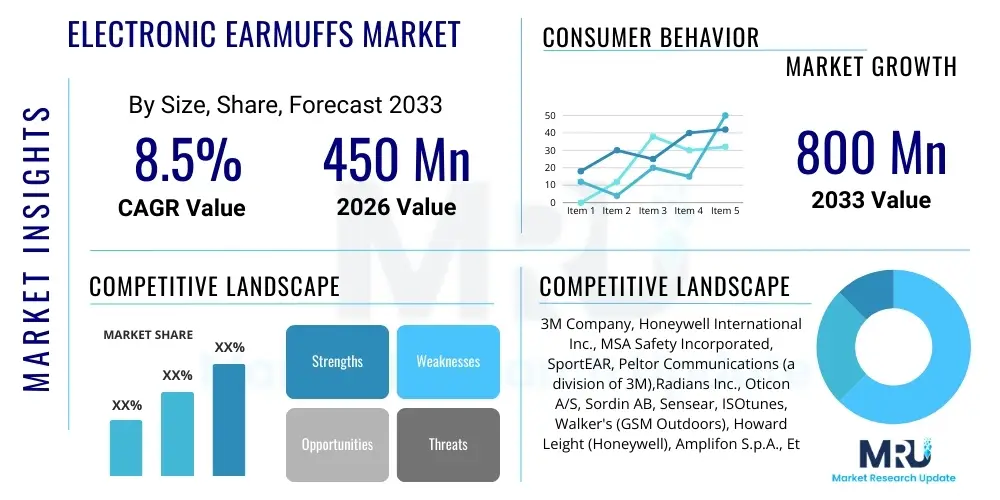

The Electronic Earmuffs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Electronic Earmuffs Market introduction

The Electronic Earmuffs Market encompasses a range of advanced hearing protection devices designed to mitigate hazardous noise levels while simultaneously allowing users to hear ambient sounds and communications clearly. Unlike passive earmuffs, electronic versions incorporate sophisticated circuitry, microphones, and speakers to either amplify low-level sounds (situational awareness) or instantly suppress dangerously loud noises (active hearing protection). These devices are becoming essential safety equipment across various sectors, driven by increasingly stringent occupational health and safety regulations globally. The product portfolio includes sophisticated features such as digital signal processing (DSP), Bluetooth connectivity for communication, and various noise reduction ratings (NRR) tailored for specific acoustic environments, making them crucial tools for modern workforce safety and recreational activities.

Major applications of electronic earmuffs span industrial manufacturing, construction, aviation ground support, military and defense, and increasingly, recreational shooting sports and motorsports. The primary benefit these devices offer is the critical balance between protection and communication; users can maintain vital situational awareness—such as hearing warning alarms, machinery movements, or peer conversations—without removing the hearing protection. This capability significantly reduces the risk of accidents caused by sensory deprivation inherent in traditional passive hearing protectors, thereby improving overall operational efficiency and compliance. Furthermore, the integration of communication technologies transforms these safety devices into functional two-way communication tools, which is paramount in complex or noisy operational settings.

The market is experiencing robust growth fueled by several macroeconomic and regulatory factors. Driving factors include the continuous rise in occupational noise-induced hearing loss (NIHL) cases, prompting global health organizations like OSHA (Occupational Safety and Health Administration) and the European Agency for Safety and Health at Work (EU-OSHA) to enforce stricter personal protective equipment (PPE) mandates. Technological advancements, particularly in miniaturization, battery life, and digital audio processing capabilities, are making electronic earmuffs more comfortable, effective, and user-friendly, expanding their adoption among consumers and professionals alike. The growing popularity of recreational activities, such as hunting and target shooting, where precise hearing is essential yet noise exposure is severe, further contributes significantly to market expansion.

Electronic Earmuffs Market Executive Summary

The Electronic Earmuffs Market is positioned for substantial expansion, characterized by a fundamental shift toward digitally enabled and connected protective equipment. Business trends indicate a strong focus on merging hearing protection with communication capabilities, exemplified by the increasing proliferation of Bluetooth-integrated models designed for industrial IoT environments. Major manufacturers are prioritizing ergonomic design, extended battery life, and superior noise cancellation technologies, aiming to appeal to both the professional industrial sector and high-end recreational users. Strategic mergers and acquisitions are common, as established PPE providers seek to integrate specialized audio technology expertise, optimizing product development cycles and expanding market reach into niche applications like specialized military operations and sophisticated medical settings requiring sterile communication.

Regional trends highlight North America and Europe as the dominant revenue generators, primarily due to rigorous regulatory frameworks governing workplace noise exposure and the mature nature of their industrial and safety markets. The enforcement intensity of standards set by organizations like the American National Standards Institute (ANSI) and the European Union’s Noise at Work Directive mandates the use of certified electronic protection, driving high replacement and adoption rates. Asia Pacific (APAC) represents the fastest-growing region, propelled by rapid industrialization, large-scale infrastructure projects (e.g., in China and India), and the subsequent need for modern safety standards implementation, albeit often starting from a lower baseline of enforcement compared to Western markets. Latin America and MEA are showing promising growth, particularly in mining, oil and gas, and major construction sectors, spurred by multinational company operations bringing international safety standards.

Segmentation trends indicate a strong preference for the Active Noise Reduction (ANR) segment over passive technology, driven by its superior ability to provide immediate protection without compromising situational awareness. Within applications, the Industrial segment remains the largest volume consumer, while the Shooting/Recreational segment drives innovation, demanding features such as customizable audio profiles and advanced sound amplification capabilities crucial for environmental awareness during hunting or tactical scenarios. The market is also seeing polarization based on technology; while basic electronic models satisfy general construction needs, high-fidelity digital earmuffs featuring sophisticated Digital Signal Processing (DSP) algorithms are capturing premium pricing in the aerospace and professional safety markets, reflecting the increasing importance of audio clarity and reliability in critical operations.

AI Impact Analysis on Electronic Earmuffs Market

Common user inquiries concerning AI's integration into Electronic Earmuffs center on how AI can move hearing protection beyond simple noise suppression to truly adaptive, intelligent auditory management. Users frequently ask if AI can differentiate between harmful impulse noise (like a gunshot) and essential communication (like speech or alarms) instantaneously, or how machine learning algorithms could create personalized acoustic profiles based on the user's unique auditory sensitivity and typical work environment over time. Concerns also revolve around the data privacy implications of devices constantly monitoring the acoustic environment and the potential for AI-driven systems to become overly complex or suffer from latency, which is unacceptable in high-risk environments. The overarching expectation is that AI will enhance situational awareness by selectively filtering noise in real-time with unparalleled accuracy, essentially creating a 'smart ear' that dynamically adjusts protection levels without manual intervention, thus maximizing safety and minimizing listening fatigue.

- AI algorithms enable highly precise, real-time noise classification and selective attenuation, distinguishing speech from machinery noise.

- Machine learning facilitates the creation of personalized hearing protection profiles that adapt to changes in the user's acoustic history and work setting.

- Predictive maintenance capabilities are enhanced through AI analysis of internal circuitry performance, forecasting potential component failures.

- AI-driven beamforming microphone arrays improve speech clarity and sound source localization, boosting situational awareness dramatically.

- Integration with Augmented Reality (AR) systems allows AI to layer digital audio alerts or critical information over the filtered environment soundscape.

- Advanced deep learning models are used to optimize battery consumption for complex digital signal processing (DSP) tasks in compact form factors.

- AI aids in compliance monitoring by automatically logging exposure levels and demonstrating adherence to occupational noise safety limits.

DRO & Impact Forces Of Electronic Earmuffs Market

The Electronic Earmuffs Market is primarily influenced by a dynamic interplay of regulatory mandates, technological leaps, and growing safety consciousness across industrial and consumer sectors. The overarching driver is the strict enforcement of occupational health standards globally, forcing industries to adopt certified PPE to avoid heavy penalties and litigation related to NIHL. Complementing this is the rapid evolution of digital audio processing (DSP) and wireless communication (Bluetooth Low Energy, IoT integration), which transforms earmuffs from mere protectors into essential communication hubs. These technological forces are creating significant opportunities for innovation in features such as sound amplification clarity and adaptive noise cancellation. However, the market faces restraints, primarily concerning the high initial cost of premium, feature-rich electronic models compared to inexpensive passive alternatives, creating resistance in price-sensitive markets. Furthermore, the reliance on battery power introduces logistical challenges regarding charging infrastructure, lifespan, and reliability, particularly in remote or continuously operational environments, influencing purchasing decisions and overall adoption rates, especially when non-compliance risk calculation favors cost savings over advanced protection in some developing regions.

Segmentation Analysis

The Electronic Earmuffs Market is highly segmented based on the core technology, intended application, and distribution channel, providing manufacturers with clear pathways for product specialization. Segmentation by product type distinguishes between passive earmuffs (often included for comparison or integration), basic electronic models, and sophisticated digital earmuffs featuring advanced DSP and communication capabilities. The application segment is critical, as the requirements for a shooting earmuff (high NRR, rapid impulse suppression, ambient amplification) differ significantly from those for an industrial earmuff (robustness, integration with hard hats, continuous noise reduction). This detailed categorization allows for precise marketing, regulatory compliance targeting, and optimized product design tailored to the unique acoustic profiles and hazards of specific end-user environments.

- By Product Type:

- Basic Electronic Earmuffs

- Digital Electronic Earmuffs (DSP-enabled)

- Bluetooth/Communication Earmuffs

- By Application/End-Use:

- Industrial & Manufacturing (Heavy machinery, production lines)

- Construction & Mining

- Military & Defense

- Aviation & Ground Support

- Recreational Shooting Sports (Hunting, Target Practice)

- Others (Motorsports, Musicians, General Consumer Use)

- By Noise Reduction Rating (NRR):

- Low NRR (Below 25 dB)

- High NRR (25 dB and Above)

- By Distribution Channel:

- Online Retail

- Offline Retail (Specialty Stores, Safety Distributors)

Value Chain Analysis For Electronic Earmuffs Market

The value chain for the Electronic Earmuffs Market is complex, beginning with highly specialized upstream suppliers and culminating in direct sales to industrial safety managers or consumers through diverse downstream channels. Upstream analysis focuses on the sourcing of critical components: microprocessors and digital signal processing (DSP) chips, high-fidelity microphones, specialized speakers, and advanced battery packs (often Li-ion or rechargeable polymer). Key raw material suppliers also provide specialized acoustic dampening foams and durable, ergonomic polymer casings. The quality and availability of these proprietary electronic components, particularly the DSP chips responsible for noise filtering accuracy and latency, heavily influence the final product performance and cost structure, creating strategic dependencies on semiconductor manufacturers and specialized audio component providers.

The midstream phase involves manufacturing, assembly, and integration. This stage requires significant investment in precision assembly lines and quality control to ensure NRR certification compliance (e.g., ANSI S3.19 or EN 352 standards). Manufacturers integrate the electronic modules into the protective cups, focusing heavily on achieving optimal acoustic sealing and ergonomic fit. This process also includes rigorous testing for durability, ingress protection (IP ratings), and electronic functionality, often involving compliance with various regional regulatory bodies. Operational efficiency and supply chain resilience, particularly given global component shortages, are key competitive advantages at this stage, dictating production capacity and time-to-market for new models incorporating the latest technological advancements.

Downstream analysis highlights the critical role of distribution channels. Direct distribution is common for large industrial contracts, where manufacturers negotiate directly with major corporations or government entities (military, aviation) for bulk safety equipment orders, often involving specialized training and support. Indirect distribution utilizes established safety equipment distributors (e.g., Grainger, Fastenal), which serve a broad base of smaller industrial and construction clients. For the recreational and consumer segments, e-commerce platforms (Amazon, specialized sporting goods websites) and large-format sporting goods retailers are paramount. The choice of channel influences pricing, marketing strategies, and customer service requirements, with specialized industrial distributors often requiring comprehensive safety certification documentation and technical support, whereas consumer channels rely heavily on online reviews and digital marketing efforts.

Electronic Earmuffs Market Potential Customers

Potential customers for electronic earmuffs represent a wide array of sectors characterized by persistent high noise exposure and a need for effective communication. The largest segment remains the industrial end-users, including employees in heavy manufacturing, automotive assembly, foundries, textile production, and food and beverage processing plants, where machinery generates continuous noise exceeding safe limits (typically 85 dB). Safety managers in these organizations are the primary buyers, motivated by regulatory compliance, reduction of workers' compensation claims related to NIHL, and improving overall operational efficiency by enabling clear communication among personnel.

A rapidly expanding customer base resides within the construction and infrastructure development sectors, particularly heavy construction sites, roadwork, and tunneling projects, where impact noise and machinery operation are unavoidable. Similarly, military and law enforcement agencies are high-value customers, demanding tactical earmuffs that offer superior impulse noise suppression (for firearms) while amplifying environmental sounds for enhanced troop safety and situational awareness during complex operations. This segment often requires highly customized, robust, and often encrypted communication capabilities integrated directly into the protection device.

Furthermore, the consumer and recreational market constitutes a significant and growing segment. This includes avid shooters, hunters, motorsports enthusiasts (pit crews, racers), and even professional musicians or concertgoers who require hearing protection that preserves sound quality while attenuating damaging peaks. These buyers prioritize comfort, aesthetic design, connectivity features (Bluetooth for music/calls), and rechargeable battery systems. As awareness of long-term hearing health grows among the general public, the market for high-quality consumer electronic protection is expanding beyond traditional high-risk activities into everyday environments like commuting or yard work.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., MSA Safety Incorporated, SportEAR, Peltor Communications (a division of 3M),Radians Inc., Oticon A/S, Sordin AB, Sensear, ISOtunes, Walker's (GSM Outdoors), Howard Leight (Honeywell), Amplifon S.p.A., Etymotic Research, Hellberg Safety, Pro Ears, Cabela's, AXIL, Elvex Corporation, Bilsom Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Earmuffs Market Key Technology Landscape

The technological core of the electronic earmuffs market is centered on advanced digital signal processing (DSP) capabilities, which differentiate modern protectors from older analog systems. DSP chips are essential for executing complex algorithms that analyze incoming sound in milliseconds. This real-time analysis allows the device to instantaneously compress or clip harmful impulse noise (like impacts or explosions) while amplifying softer ambient sounds, thereby maintaining the user's auditory connection to their environment. Key technological advancements include the development of proprietary algorithms for environmental noise modeling, allowing earmuffs to predict and suppress specific frequencies associated with common industrial machinery, vastly improving the clarity of human speech over background noise. Furthermore, the integration of multiple high-sensitivity microphones facilitates advanced sound localization, giving users a more accurate sense of directionality, crucial for safety in dynamic work sites.

Connectivity features constitute the second major technological thrust in this market. The transition from wired to wireless communication, predominantly via Bluetooth 5.0 and newer standards, has been transformative. This allows users to seamlessly connect to smartphones, two-way radios, and industrial IoT devices without compromising protection or mobility. Modern electronic earmuffs often incorporate robust antennae and protocols designed for stable connection in harsh radio frequency (RF) environments typical of industrial plants. Beyond simple communication, manufacturers are integrating 'talk-through' technology that filters ambient sound solely for local conversation, minimizing the disruption of communication protocols. Power management is also a critical technological area, with increasing focus on high-density, fast-charging lithium polymer batteries and energy-efficient electronic components to ensure extended operational life—often exceeding 40 hours—on a single charge, which is a major requirement for full work shift coverage.

The future technology landscape is moving towards full connectivity and adaptive intelligence. There is significant research into micro-acoustic transducer technology, aimed at improving fidelity and reducing the physical size of the components, enabling lighter, lower-profile earmuffs that are more compatible with other PPE (e.g., helmets, glasses). Furthermore, the convergence of electronic earmuffs with head-up display (HUD) systems and industrial augmented reality (AR) platforms is gaining traction. This integration allows the device to act as an auditory layer of a larger digital safety system, providing geo-localized warnings or maintenance instructions directly into the user’s ear based on their location and environmental noise analysis. This fusion of sophisticated noise cancellation with advanced communication and information delivery systems represents the next frontier in personal protective equipment, driving high-value segment growth.

Regional Highlights

-

North America: Market Dominance Driven by Strict Safety Mandates and High Recreational Spending

North America, particularly the United States and Canada, holds the largest market share in the electronic earmuffs sector. This dominance is attributable to the rigorous enforcement of occupational safety standards by agencies such as OSHA, which imposes substantial fines for non-compliance with noise exposure limits. The region’s advanced industrial base—including aviation, automotive manufacturing, and aerospace—requires reliable, high-performance protective communication gear. Furthermore, the high prevalence and cultural importance of shooting sports and hunting in the US generate a massive demand for technologically advanced consumer electronic earmuffs featuring high impulse noise suppression and sophisticated sound amplification capabilities. Consumers in this region also demonstrate a greater willingness to invest in premium safety brands, supporting the growth of the high-end digital earmuffs segment.

The market environment is highly competitive, characterized by quick adoption of new wireless and DSP technologies. The primary focus for manufacturers operating here is on meeting ANSI/CSA standards and integrating seamlessly with common radio systems used across industries. State-level initiatives promoting hearing conservation further solidify the market's trajectory. Investment in digital platforms and e-commerce for both industrial safety distributors and specialized recreational retailers ensures wide market reach and swift customer access to the latest product iterations, reflecting the region's maturity in adopting online purchasing for specialized PPE.

-

Europe: Strong Growth Fuelled by EU Directives and Environmental Noise Legislation

Europe represents a highly mature and critical market, driven primarily by the European Union’s Noise at Work Directive (2003/10/EC), which establishes clear action levels and exposure limit values for workers. This regulatory landscape compels companies across all member states to implement electronic protection, prioritizing those that offer measurable and verifiable noise reduction. Key markets include Germany, the UK, and Scandinavia, known for their large and sophisticated manufacturing, construction, and specialized naval defense industries. The emphasis in Europe is often placed on holistic worker health and safety, leading to high demand for ergonomic designs and devices that mitigate listening fatigue over long shifts.

The European market also exhibits a strong preference for multi-functional earmuffs that adhere to the EN 352 series of standards, often integrating communication functions compatible with EU standards for radio and telecommunications equipment. Furthermore, strict environmental noise pollution regulations in urban centers indirectly boost the adoption of advanced electronic PPE for municipal services and construction crews working during restricted hours, enabling essential communication with minimal noise leakage. Competitive strategies often revolve around compliance certifications, demonstrating superior comfort characteristics, and providing long-term service contracts for industrial clients.

-

Asia Pacific (APAC): Emerging Hub with Rapid Industrialization and Safety Awareness

The Asia Pacific region is projected to register the fastest growth rate during the forecast period, transitioning from a heavy reliance on passive protection to adopting electronic safety gear. This shift is primarily driven by massive infrastructure investments, the proliferation of large-scale manufacturing hubs (particularly in China, India, and Southeast Asia), and increasing influence from multinational corporations that impose global safety standards on their local operations. While regulatory enforcement varies significantly across countries, large domestic enterprises are increasingly recognizing the economic benefits of reducing hearing impairment claims and improving worker productivity through clear communication.

Market growth in APAC is characterized by price sensitivity but also significant volume potential. Key market strategies involve offering a diverse product mix, from cost-effective basic electronic models suitable for general factory floor use to premium digital products required for specialized electronics manufacturing or precision engineering. The rapid expansion of e-commerce platforms is crucial for penetrating the vast, geographically dispersed consumer markets for recreational use. As disposable incomes rise and safety awareness campaigns gain traction, countries like South Korea and Japan are driving innovation adoption, demanding connectivity features and high-fidelity audio protection tailored to demanding, high-tech environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Earmuffs Market.- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- SportEAR

- Peltor Communications (a division of 3M)

- Radians Inc.

- Oticon A/S

- Sordin AB

- Sensear

- ISOtunes

- Walker's (GSM Outdoors)

- Howard Leight (Honeywell Safety Products)

- Amplifon S.p.A.

- Etymotic Research

- Hellberg Safety

- Pro Ears

- Cabela's

- AXIL

- Elvex Corporation

- Bilsom Group

Frequently Asked Questions

Analyze common user questions about the Electronic Earmuffs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of electronic earmuffs over traditional passive earmuffs?

The primary advantage is situational awareness. Electronic earmuffs use microphones and digital circuitry to actively suppress harmful impulse noise while amplifying safe ambient sounds and speech, enabling clear communication and awareness without removing protection, which is essential for safety and productivity.

How is the Noise Reduction Rating (NRR) calculated for electronic earmuffs?

The NRR indicates the potential noise exposure reduction in decibels (dB) when the earmuff is worn correctly. For electronic models, the NRR is calculated based on the passive protection component of the device, although active noise cancellation technologies can further enhance effective protection in certain frequency ranges.

What role does Digital Signal Processing (DSP) play in modern electronic hearing protection?

DSP is critical for rapid, intelligent noise management. It allows the earmuff to analyze acoustic input in milliseconds, differentiate between speech, alarms, and damaging noise, and apply precise, instantaneous electronic attenuation or amplification based on pre-set or adaptive algorithms.

Which industry segment is the largest consumer of electronic earmuffs globally?

The Industrial and Manufacturing segment is the largest consumer. This demand is driven by stringent occupational safety regulations (like OSHA in North America and EU Directives in Europe) requiring robust hearing protection combined with communication capabilities for complex, continuously noisy environments.

Are Bluetooth features permissible for use in highly regulated industrial safety environments?

Yes, Bluetooth integration is increasingly standard and permissible, provided the device maintains its required Noise Reduction Rating (NRR) certification. Manufacturers ensure Bluetooth use does not compromise acoustic sealing or electrical safety, transforming the earmuffs into essential wireless communication hubs for industrial IoT and operational coordination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager