Electronic Gastroenteritis Endoscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431504 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Electronic Gastroenteritis Endoscope Market Size

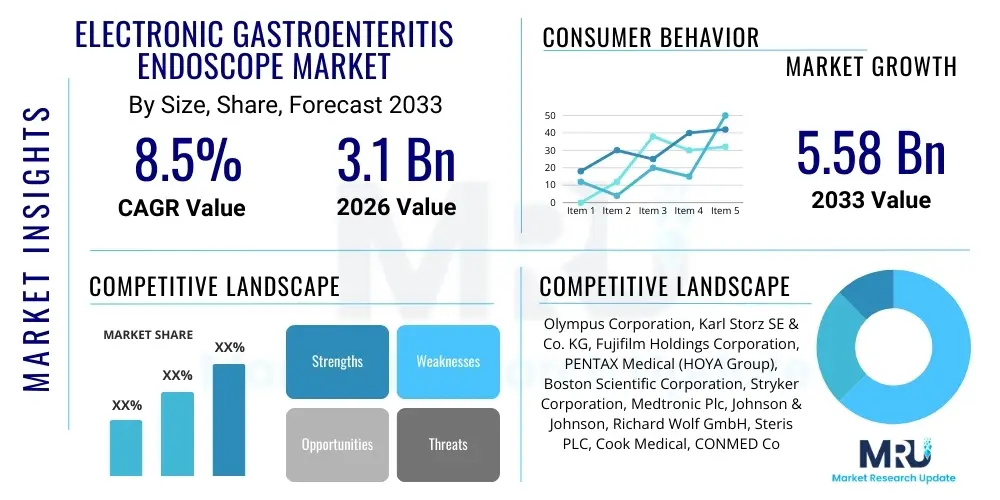

The Electronic Gastroenteritis Endoscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.58 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global prevalence of gastrointestinal disorders, coupled with technological advancements resulting in high-definition imaging, enhanced maneuverability, and integration of artificial intelligence (AI) for real-time diagnostics, making electronic endoscopes the standard of care for minimally invasive procedures.

Electronic Gastroenteritis Endoscope Market introduction

The Electronic Gastroenteritis Endoscope Market encompasses advanced medical devices used for the visual examination and therapeutic intervention of the upper and lower gastrointestinal (GI) tract, including the esophagus, stomach, duodenum, and colon. These devices, which have largely replaced traditional fiber optic systems, utilize high-resolution Charged Coupled Devices (CCDs) or Complementary Metal-Oxide-Semiconductor (CMOS) sensors to transmit real-time digital video feeds to external monitors, offering superior clarity and diagnostic accuracy. Major applications span diagnostic procedures such as early cancer screening and biopsies, and therapeutic interventions including polypectomy, hemostasis, and foreign body removal. The primary benefits include reduced procedural time, enhanced detection rates of subtle mucosal lesions, and improved patient outcomes due to less invasive techniques and faster recovery times, positioning them as indispensable tools in modern gastroenterology.

The market growth is fundamentally driven by the rising incidence of lifestyle-related GI diseases, such as Gastroesophageal Reflux Disease (GERD), inflammatory bowel disease (IBD), and colorectal cancer (CRC). Furthermore, global initiatives promoting preventive screening programs, particularly for CRC in developed economies, are escalating the demand for high-performance endoscopes. Technological driving factors include the development of slim-design scopes, which enhance patient comfort, and the integration of specialized imaging modalities like Narrow Band Imaging (NBI) and confocal endomicroscopy, which significantly improve the differentiation between benign and malignant tissues. Moreover, the increasing adoption of disposable endoscopes, aimed at mitigating cross-contamination risks and reducing reprocessing burdens in clinical settings, is further propelling market expansion globally.

Electronic Gastroenteritis Endoscope Market Executive Summary

The Electronic Gastroenteritis Endoscope Market is characterized by robust growth, driven by an aging global population susceptible to chronic GI illnesses and continuous innovation focused on optimizing image quality and procedural efficiency. Key business trends include intense competition among multinational corporations focusing on integrated endoscopy systems that combine advanced imaging, therapeutic tools, and digital data management platforms. Strategic mergers, acquisitions, and partnerships aimed at expanding geographic reach and enhancing product portfolios, particularly in the realm of single-use endoscopes and AI-powered diagnostic features, are defining the competitive landscape. Furthermore, stringent regulatory scrutiny, especially concerning reprocessing protocols and infection control, compels manufacturers to invest heavily in disposable or highly sterile system designs, which represents a significant investment area.

Regionally, North America and Europe currently dominate the market due to high healthcare expenditure, established screening protocols, and rapid adoption of cutting-edge technology. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rising awareness, improving healthcare infrastructure investments in emerging economies like China and India, and a growing medical tourism sector. Governments in these regions are increasingly funding specialized digestive disease centers, thereby increasing the installation base for high-end electronic endoscopy suites. The shifting focus towards early detection and personalized medicine treatments is further accelerating the demand across all major geographical areas.

Segment trends highlight the dominance of Video Endoscopes due to their superior image resolution and digital capabilities, increasingly preferred over older fiber optic models. Within the application segment, Hospitals maintain the largest market share, driven by complex therapeutic procedures and emergency requirements, but Ambulatory Surgical Centers (ASCs) are growing rapidly as they offer cost-effective and convenient settings for routine diagnostic screening. By disease type, the screening and management of Colorectal Cancer (CRC) represent the most lucrative segment, spurred by widespread public health campaigns and mandatory screening ages implemented in numerous high-income countries, ensuring sustained demand for high-definition colonoscopies and gastroscopies.

AI Impact Analysis on Electronic Gastroenteritis Endoscope Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Electronic Gastroenteritis Endoscope Market center around three key themes: clinical efficacy, workflow integration, and safety. Users frequently ask if AI can significantly increase the Adenoma Detection Rate (ADR) during colonoscopy, how AI algorithms are trained and validated to avoid false positives or negatives, and the practical challenges of integrating machine learning models into existing endoscopy hardware and electronic health records (EHRs). There is a high expectation that AI will standardize procedural quality, especially concerning lesion detection and classification, addressing the current variability among endoscopists. Concerns often revolve around regulatory approval pathways for AI as a medical device and the necessary infrastructure required for real-time processing of massive video data streams generated during examinations.

AI is fundamentally transforming diagnostic endoscopy by acting as a 'second observer,' assisting clinicians in real-time detection and characterization of polyps and mucosal abnormalities that might be missed due to fatigue or subtle visual cues. Deep learning algorithms are trained on vast datasets of endoscopic images and videos to identify patterns indicative of early-stage cancer or precancerous lesions with high sensitivity and specificity. This technological advancement is crucial because early detection is the single most critical factor in improving patient survival rates for conditions like CRC. Furthermore, AI systems are being developed to optimize withdrawal time during colonoscopy, ensuring thorough mucosal inspection according to established quality metrics.

The immediate practical impact of AI integration includes enhanced procedural efficiency, reduced inter-operator variability, and the potential to democratize high-quality endoscopic screening by providing decision support in resource-constrained settings. Future advancements are expected to involve predictive analytics, where AI models could analyze patient historical data in conjunction with real-time video to estimate malignancy risk, guiding endoscopists toward optimal treatment pathways. Despite the immense potential, successful market penetration relies heavily on generating robust clinical evidence demonstrating superior outcomes compared to human-only performance and achieving streamlined regulatory clearance across diverse international jurisdictions.

- AI enhances real-time polyp and lesion detection (increasing Adenoma Detection Rate - ADR).

- Automated lesion characterization aids in classifying polyps (e.g., neoplastic vs. hyperplastic) based on surface patterns.

- AI optimizes procedural workflow by monitoring scope withdrawal speed and ensuring complete mucosal coverage.

- Integration into endoscopy systems provides instantaneous visual alerts and decision support for endoscopists.

- Machine learning facilitates quality control and standardization across endoscopic procedures globally.

- Predictive analytics capabilities assist in calculating patient-specific risks of malignancy based on visual data.

- AI algorithms require stringent clinical validation and regulatory oversight to ensure diagnostic accuracy and patient safety.

DRO & Impact Forces Of Electronic Gastroenteritis Endoscope Market

The Electronic Gastroenteritis Endoscope Market dynamics are shaped by a complex interplay of strong clinical drivers, significant cost and regulatory restraints, and expansive opportunities created by technological innovation and global healthcare access improvements. The primary drivers include the escalating global burden of chronic GI diseases and associated cancer screening mandates, necessitating continuous upgrades in imaging capability. Restraints often revolve around the high initial capital investment required for purchasing and maintaining sophisticated endoscopy towers, compounded by the persistent risk and complexity associated with endoscope reprocessing and sterilization protocols, which drives demand for costly disposable solutions. Opportunities lie predominantly in integrating smart technologies like AI and robotics, and expanding market penetration in emerging economies where GI disease prevalence is high but access to advanced screening remains limited. These forces collectively dictate the adoption rate, pricing structure, and future technological trajectory of the market.

The key driving force is the imperative for early disease detection, particularly colorectal cancer. Electronic endoscopes, equipped with high-definition and enhanced visualization technologies (like magnification and chromatic endoscopy), offer unparalleled diagnostic capability, driving their mandatory adoption in major diagnostic centers. Furthermore, the trend toward minimally invasive therapeutic endoscopy procedures, replacing complex open surgeries, accelerates the demand for electronic endoscopes capable of accommodating multiple therapeutic accessories and tools. Reimbursement policies favoring preventative screening further solidify this growth trajectory, ensuring a stable financial incentive for healthcare providers to invest in high-quality systems.

Conversely, the substantial restraints include the skilled workforce requirement—gastroenterologists must undergo rigorous training to maximize the utility of advanced scopes—and the increasing public and regulatory concern over device-associated infections. This concern has led to higher operational costs related to stringent reprocessing guidelines or the costly transition towards single-use endoscopes. The impact forces are thus heavily weighted toward innovation that reduces the reprocessing burden while simultaneously improving detection rates. The confluence of these drivers and restraints creates opportunities for companies that can deliver disposable, high-resolution endoscopes integrated with AI diagnostic support, offering a balance of safety, performance, and operational efficiency.

Segmentation Analysis

The Electronic Gastroenteritis Endoscope Market is segmented based on the type of device, the application setting, and the specific disease being targeted. This segmentation helps in understanding specific user needs and identifying high-growth niches within the overall market. Video endoscopes dominate the market due to their technological superiority and digital output capabilities, facilitating easier integration with diagnostic software and teaching platforms. Hospitals represent the largest end-user segment due to the scope of procedures performed, but the fastest growth is observed in ambulatory settings, reflecting the shift toward outpatient care for routine screenings. Disease-wise, colorectal cancer screening remains the primary revenue driver, demanding regular high-volume procedures globally.

- By Type:

- Video Endoscopes

- Fiber Optic Endoscopes (Phasing Out)

- By Application:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Diagnostic Centers

- By Disease:

- Colorectal Cancer (CRC) Screening and Treatment

- Gastroesophageal Reflux Disease (GERD)

- Inflammatory Bowel Disease (IBD) (Crohn's Disease and Ulcerative Colitis)

- Ulcers and Bleeding Management

- Celiac Disease and Malabsorption Syndromes

- By End User:

- Gastroenterology Departments

- Oncology Departments

- Emergency Care Settings

Value Chain Analysis For Electronic Gastroenteritis Endoscope Market

The value chain for the Electronic Gastroenteritis Endoscope Market begins with the upstream activities of raw material procurement and component manufacturing, focusing heavily on high-precision optics, advanced sensor technology (CCDs/CMOS), flexible tubing materials, and specialized biocompatible polymers. Key suppliers in this phase include high-tech optical component providers and microelectronics firms, which require stringent quality control and supply chain reliability, given the critical nature of the final medical device. Research and Development (R&D) is a continuous and capital-intensive upstream process, centered on improving resolution, maneuverability, and durability, and integrating new technologies like therapeutic jet systems and AI software platforms. This early stage is highly concentrated, with a few specialized suppliers dictating component quality and cost.

The midstream phase involves the core manufacturing and assembly of the electronic endoscopes, dominated by established medical device manufacturers. This stage requires cleanroom environments, complex calibration, and assembly of hundreds of microscopic components, followed by rigorous quality assurance testing to meet international medical device standards (e.g., ISO 13485, FDA regulations). Manufacturing capabilities often involve regional hubs to serve local markets efficiently. After manufacturing, the distribution channel becomes critical. Direct distribution is common for high-end systems, where manufacturers utilize specialized sales forces and clinical application experts to engage directly with large hospital networks and teaching institutions, offering training, maintenance contracts, and systems integration support.

Indirect distribution plays a role, particularly in fragmented markets or regions where local distributors possess strong ties to smaller clinics and ambulatory surgical centers (ASCs). These indirect channels facilitate market penetration through established logistics and regulatory knowledge. The downstream phase involves the end-users—hospitals, ASCs, and diagnostic centers—where the equipment is utilized for patient care. Post-sale activities, including mandatory maintenance, repair, and crucially, reprocessing services, are highly value-added components of the downstream chain. Effective management of the reprocessing segment, either through in-house hospital facilities or third-party centralized services, significantly influences the total cost of ownership and patient safety, marking a major focal point for innovation and operational excellence.

Electronic Gastroenteritis Endoscope Market Potential Customers

Potential customers for electronic gastroenteritis endoscopes are defined primarily by institutions that provide complex diagnostic and therapeutic GI procedures. The largest and most influential customer base comprises large, multi-specialty hospitals and university medical centers. These institutions require the most advanced, high-resolution video endoscopes capable of complex therapeutic maneuvers, and they often purchase integrated endoscopy suites including ancillary equipment such as light sources, processors, and specialized software. Their purchasing decisions are driven by clinical performance metrics, integration capability with existing hospital IT systems, and the ability to handle high procedural volumes safely and efficiently. These customers prioritize long-term service contracts and access to the latest technological upgrades, sustaining consistent demand.

A rapidly growing customer segment consists of Ambulatory Surgical Centers (ASCs) and dedicated Gastroenterology Clinics. These customers focus heavily on efficiency and cost-effectiveness, primarily performing high-volume, routine diagnostic screenings like colonoscopies and routine gastroscopies. While they still require high-quality imaging, their preference often leans toward durable, easy-to-use systems with lower reprocessing burdens. The growing adoption of disposable electronic endoscopes is particularly attractive to this segment, as it eliminates the infection risk and overhead associated with complex sterilization processes, making their operational model simpler and more compliant.

Furthermore, government and private diagnostic centers, particularly those engaged in population-level cancer screening initiatives, represent critical customers. These entities are highly sensitive to price and total cost of ownership but benefit from volume-based purchasing power. Emerging markets present unique customer profiles, often involving government tenders for foundational endoscopy equipment in newly established public healthcare facilities. In these regions, balancing affordability with adequate technical specifications is paramount. Educational institutions and training hospitals also purchase systems frequently, often seeking robust simulation and training software integrated within the endoscopy platform to train the next generation of specialists.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.58 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, PENTAX Medical (HOYA Group), Boston Scientific Corporation, Stryker Corporation, Medtronic Plc, Johnson & Johnson, Richard Wolf GmbH, Steris PLC, Cook Medical, CONMED Corporation, Teleflex Incorporated, B. Braun Melsungen AG, Nipro Corporation, Creo Medical, CapsoVision, Jinshan Science & Technology, Micro-Tech (Nanjing) Co., Ltd., SonoScape Medical Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Gastroenteritis Endoscope Market Key Technology Landscape

The technological landscape of the Electronic Gastroenteritis Endoscope Market is rapidly evolving, moving beyond simple high-definition visualization to incorporate sophisticated digital and bio-integration features. The foundational technology remains the high-resolution imaging sensor, primarily utilizing 4K CMOS or advanced CCDs to provide exceptional mucosal detail, which is crucial for distinguishing early neoplastic changes. A significant trend is the increasing adoption of enhanced visualization techniques such as Narrow Band Imaging (NBI) by Olympus, Flexible Spectral Imaging Color Enhancement (FICE) by Fujifilm, and i-Scan by PENTAX. These techniques use specialized filters or digital processing to enhance the visibility of blood vessels and mucosal patterns without the need for traditional tissue staining, enabling faster and more accurate real-time optical biopsies. This capability reduces the reliance on full pathology reports for every identified lesion.

Beyond visualization, the market is defined by advancements in scope design and maneuverability. Ultra-slim scopes are gaining traction as they significantly reduce patient discomfort and the need for heavy sedation, improving procedural acceptance. The introduction of disposable endoscope systems, spearheaded by companies like Ambu and Boston Scientific, directly addresses the persistent challenge of device-related infections and complex, time-consuming reprocessing cycles. These single-use scopes, while currently trailing reusable systems in overall image quality, are quickly closing the gap and offer a compelling solution for infection control and logistical simplicity, particularly in emergency settings or smaller clinics. This shift impacts not only the device market but also the ancillary market for cleaning and sterilization equipment.

The most transformative current technology is the integration of Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are deployed for real-time video analysis during a procedure, serving as a computer-aided detection (CADe) tool to highlight suspicious polyps or lesions as they appear on the screen. Further AI advancements include Computer-Aided Diagnosis (CADx), which provides a provisional histological classification of the lesion (e.g., benign or malignant potential). Robotics and advanced motorization are also emerging, allowing for greater tip control and potentially leading to remotely operated or semi-autonomous endoscopy in the distant future. These digital integration efforts ensure that electronic endoscopes are not merely diagnostic tools but complex, connected data-generating devices critical for modern precision medicine.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics across the globe, heavily influenced by local healthcare policies, expenditure levels, and disease prevalence patterns. North America stands as the dominant market, driven by high per capita healthcare spending, advanced medical infrastructure, mandatory colorectal cancer screening programs starting at age 45, and the rapid adoption of new, expensive technologies like AI-enhanced and disposable endoscopes. The presence of major market players and robust reimbursement for both diagnostic and therapeutic endoscopic procedures ensure consistent and high-value equipment purchases.

Europe represents the second-largest market, characterized by stringent infection control regulations that accelerate the adoption of advanced reprocessing solutions and, increasingly, single-use scopes. Countries like Germany, the UK, and France maintain mature markets with well-established screening protocols. However, differences in public healthcare funding and regulatory pathways (e.g., MDR compliance) across member states lead to slower but steady technological uptake compared to the US. Growth in Eastern European countries is tied to infrastructure modernization initiatives funded partly by the European Union.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is attributed to massive population bases, rising incidence of GI cancers, expanding healthcare coverage, and government investments in healthcare infrastructure in emerging economies (China, India, South Korea). While price sensitivity is higher here, local manufacturers are rapidly scaling production of more cost-effective electronic endoscopes. Japan remains a technological leader in the region, focusing on advanced early gastric cancer detection techniques, thereby driving demand for ultra-high-definition and magnification endoscopy systems across the continent.

- North America: Market leader; driven by high spending, mandatory screening mandates (CRC), and rapid adoption of AI-enabled systems.

- Europe: Second largest market; strong focus on infection control, driving disposable scope demand, particularly mature markets like Germany and the UK.

- Asia Pacific (APAC): Fastest-growing region; fueled by increasing prevalence of GI diseases, government investments in infrastructure, and demand for early cancer detection (gastric and colorectal).

- Latin America (LATAM): Emerging market with increasing public and private investments in clinical modernization, but constrained by economic instability and variable public health funding.

- Middle East & Africa (MEA): Growth driven by healthcare expansion in Gulf Cooperation Council (GCC) countries and rising medical tourism, focusing on acquiring international standard electronic endoscopy suites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Gastroenteritis Endoscope Market.- Olympus Corporation

- Karl Storz SE & Co. KG

- Fujifilm Holdings Corporation

- PENTAX Medical (HOYA Group)

- Boston Scientific Corporation

- Stryker Corporation

- Medtronic Plc

- Johnson & Johnson (Ethicon)

- Richard Wolf GmbH

- Steris PLC

- Cook Medical

- CONMED Corporation

- Teleflex Incorporated

- B. Braun Melsungen AG

- Nipro Corporation

- Ambu A/S (Disposable Scope Focus)

- Creo Medical

- CapsoVision (Capsule Endoscopy)

- Jinshan Science & Technology

- Micro-Tech (Nanjing) Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Gastroenteritis Endoscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of electronic endoscopes over traditional fiber optic systems?

The primary driver is the significantly superior image quality provided by electronic video endoscopes, utilizing HD, 4K, and enhanced visualization technologies (like NBI). This improved clarity is essential for detecting subtle mucosal lesions and enhancing the Adenoma Detection Rate (ADR), which is a crucial quality metric in gastroenterology.

How is the risk of cross-contamination being addressed in the electronic endoscope market?

Cross-contamination risks are being addressed through two main avenues: the implementation of increasingly rigorous and standardized reprocessing protocols and, more significantly, the rapid commercialization and adoption of single-use or disposable electronic endoscopes, particularly in high-risk or emergency settings, eliminating the need for complex sterilization procedures.

Which geographical region is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This acceleration is due to expanding healthcare infrastructure, rising prevalence of GI cancers (especially gastric and colorectal), increasing access to advanced medical technology, and growing medical tourism within key countries like China, India, and South Korea.

What role does Artificial Intelligence (AI) currently play in electronic endoscopy?

AI currently functions primarily as a real-time Computer-Aided Detection (CADe) tool. It analyzes live video feed during the procedure to highlight potentially missed polyps or suspicious areas for the endoscopist, improving procedural accuracy, reducing variability among operators, and ultimately increasing the yield of cancer screening programs.

What are the main financial barriers to entry or adoption of advanced electronic endoscopy systems?

The main financial barriers include the high initial capital investment required for purchasing advanced endoscopy towers (processor, light source, monitor, and multiple scope types), high maintenance and service costs, and the ongoing expense associated with rigorous reprocessing protocols or the recurring cost of disposable endoscopes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager