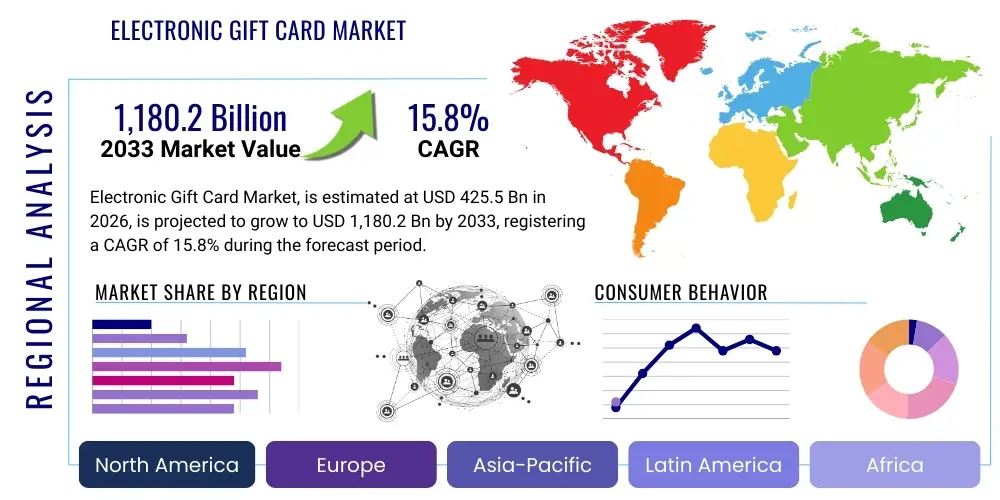

Electronic Gift Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438680 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electronic Gift Card Market Size

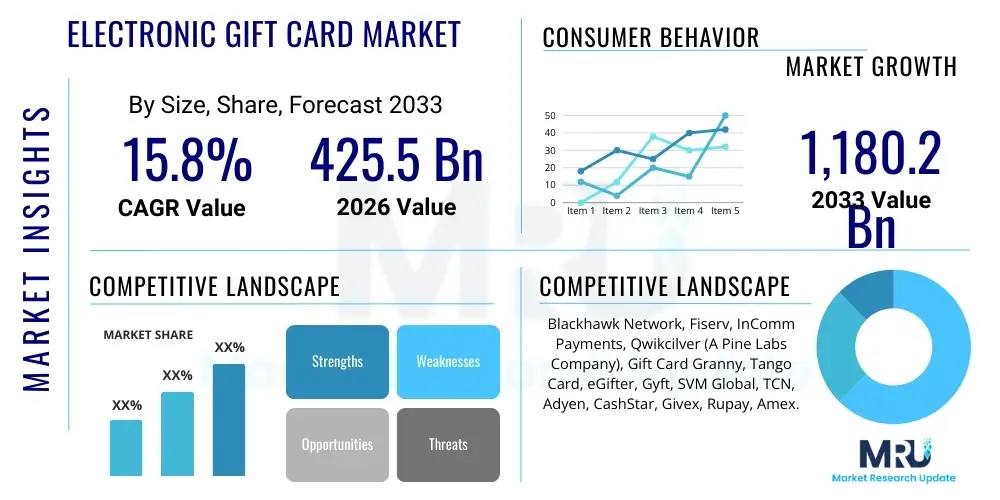

The Electronic Gift Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $425.5 Billion in 2026 and is projected to reach $1,180.2 Billion by the end of the forecast period in 2033. This substantial growth trajectory is attributed to the accelerating shift toward digital payment methods, the pervasive adoption of mobile wallets, and the increasing versatility of e-gift cards across various retail and service sectors. The convenience, security, and immediate delivery inherent in electronic gift cards make them an increasingly favored alternative to traditional physical formats, positioning them as a core component of the modern retail ecosystem.

Electronic Gift Card Market introduction

The Electronic Gift Card Market encompasses the issuance, distribution, and redemption of digital vouchers or prepaid monetary values used as alternatives to cash for purchases of goods and services. These cards, often delivered via email, SMS, or integrated into mobile applications, serve as effective tools for customer acquisition, loyalty programs, corporate incentives, and personal gifting. The product description involves secure digital codes linked to a specific monetary value, facilitating seamless transactions both online and in physical stores via technologies like QR codes or mobile payment platforms. Major applications span across retail (e-commerce), entertainment, food and beverage (F&B), travel, and telecommunications, driven by their flexibility and instant usability.

The principal benefits driving market expansion include enhanced convenience, reduced operational costs for retailers compared to physical card production, and superior tracking and analytics capabilities for marketing departments. For consumers, e-gift cards offer instantaneous delivery, eliminating logistical delays, and are less susceptible to loss or damage than their plastic counterparts. They also provide flexibility in denomination and personalized messaging options, enhancing the gifting experience. Furthermore, the increasing integration of Application Programming Interfaces (APIs) and cloud-based solutions has simplified the backend processes for gift card management, making them an attractive proposition for small and medium-sized enterprises (SMEs) seeking to expand their customer reach.

Key driving factors accelerating the adoption of electronic gift cards include the rapid proliferation of smartphones and internet penetration globally, especially in emerging economies, which establishes the foundational infrastructure for digital transactions. The pandemic-induced acceleration of e-commerce and contactless payment preferences has cemented the necessity of digital gifting options. Moreover, corporations increasingly utilize e-gift cards for employee rewards, customer promotions, and sales channel incentives, recognizing their effectiveness in stimulating immediate engagement and measurable returns. Regulatory frameworks that standardize digital financial security and consumer protection also bolster confidence in these digital instruments.

Electronic Gift Card Market Executive Summary

The Electronic Gift Card Market is characterized by robust growth, fueled by convergent business trends emphasizing digital transformation, personalization, and seamless omni-channel experiences. Current business trends show a pronounced shift towards integrating e-gift card solutions directly into loyalty program frameworks and mobile banking applications, maximizing user engagement and reducing friction during redemption. Retailers are leveraging sophisticated data analytics capabilities inherent in digital cards to gain deeper insights into consumer purchasing behaviors, enabling highly targeted marketing campaigns. Furthermore, there is a rising trend of cross-border e-gifting facilitated by global payment processors, addressing the demand for sending value internationally with ease and security.

Regionally, North America continues to dominate the market due to high consumer spending power, advanced digital infrastructure, and the early adoption of mobile wallet technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive population density, surging mobile commerce, and rapid urbanization, particularly in China and India. European markets are characterized by a focus on stringent data privacy regulations (like GDPR), which, while challenging, necessitate secure and compliant digital card platforms, fostering innovation in encryption and consumer trust. Latin America and the Middle East & Africa (MEA) are emerging as high-potential areas, propelled by increasing financial inclusion initiatives and a growing preference for cashless transactions.

Segment trends highlight the dominance of the Retail segment by application, reflecting the sheer volume of transactions across general merchandise and specialized stores. By card type, the Closed Loop segment remains prevalent as it guarantees spend within the issuing retailer's ecosystem, enhancing revenue capture and brand loyalty. However, the Open Loop segment is gaining momentum, offering greater utility and flexibility, making it a powerful tool for corporate incentives and promotional campaigns where broad acceptance is required. Technology trends underscore the shift towards tokenization, blockchain for enhanced security, and the use of artificial intelligence to prevent fraud during the issuance and redemption processes, ensuring market integrity and sustained growth across all segments.

AI Impact Analysis on Electronic Gift Card Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electronic Gift Card Market predominantly revolve around security, personalization, and fraud prevention capabilities. Consumers and businesses are keenly interested in how AI can detect and mitigate sophisticated fraudulent activities, which pose a significant threat to digital monetary instruments. A key theme is personalization—users question AI's role in tailoring e-gift card recommendations and promotions based on recipient data, moving beyond generic offers to hyper-relevant gifting suggestions. Furthermore, there is significant interest in how AI can streamline customer support and instantly resolve issues related to card activation or balance inquiries, enhancing the overall user experience and operational efficiency for gift card providers. The overall expectation is that AI will be the foundational technology for the next generation of smart, secure, and highly personalized e-gifting solutions, moving away from simple digital codes toward intelligent stored value products.

AI's integration fundamentally transforms the lifecycle of electronic gift cards, beginning with issuance and extending through redemption and post-sales analysis. Machine learning algorithms are crucial for optimizing inventory management of digital codes and predicting peak demand periods, thereby preventing system bottlenecks and ensuring immediate delivery capabilities. On the consumer side, AI-powered recommendation engines utilize historical purchase data, demographic information, and social media sentiment to suggest the most appropriate e-gift card values and brands, significantly improving gifting success rates and driving higher conversion for retailers. This level of personalized marketing is difficult to achieve with traditional methods and represents a major competitive advantage for AI-enabled platforms.

The most profound impact of AI is observed in fraud detection and risk management. AI models are trained on vast datasets of transaction patterns to identify anomalies indicative of illicit activities, such as bulk purchases using stolen credentials or rapid attempted redemptions across multiple geographies. Real-time monitoring and predictive analytics enable platforms to flag suspicious transactions instantly, drastically reducing chargebacks and financial losses associated with e-gift card fraud, which has historically been a major concern in the digital payments space. Moreover, AI-driven chatbots and virtual assistants handle the majority of routine customer service inquiries, providing 24/7 support for balance checks, transaction history, and troubleshooting, freeing human agents to focus on complex fraud cases and high-value customer interactions.

- AI-driven fraud detection using behavioral biometrics and anomaly recognition.

- Hyper-personalization of e-gift card offers and recommendations based on deep learning analysis of customer profiles.

- Optimization of dynamic pricing and promotional strategies through predictive modeling.

- Automated customer service (chatbots) for instant inquiry resolution regarding balances and activation.

- Enhanced security through AI-managed tokenization and secure code generation.

- Improved retailer analytics on redemption patterns and customer segmentation for inventory planning.

- Streamlined compliance monitoring by analyzing transactional data against regulatory standards.

DRO & Impact Forces Of Electronic Gift Card Market

The Electronic Gift Card Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive landscape. Key drivers include the overwhelming shift toward digital commerce and mobile payments, which positions e-gift cards as a natural extension of cashless transaction ecosystems. The convenience of instant delivery and ease of integration into mobile wallets significantly enhances the consumer experience, reinforcing adoption. However, market growth faces restraints, primarily related to ongoing concerns about cyber security, sophisticated fraud techniques targeting digital codes, and fragmentation in regulatory standards across different geographical regions, which complicates cross-border operations. Opportunities abound in leveraging emerging technologies like blockchain for enhanced security and the expansion of use cases into non-traditional sectors such as healthcare and peer-to-peer digital payments.

The primary impact forces propelling the market relate to Technological Advancements and Consumer Behavior Shifts. Rapid technological evolution in payment infrastructure, including NFC and QR code payment standards, constantly lowers the barrier to entry for both issuing and redeeming e-gift cards. Simultaneously, evolving consumer preferences, particularly among millennials and Gen Z, prioritize digital, customizable, and instant solutions over physical alternatives. This generation views e-gift cards not merely as monetary value but as a flexible and immediate means of recognition and reward, driving demand for innovative digital features, such as video personalization and integrated social media sharing capabilities.

Conversely, regulatory pressures and the threat of substitution act as significant constraining forces. Governments globally are increasingly scrutinizing digital payment products for anti-money laundering (AML) and know-your-customer (KYC) compliance, requiring substantial investment in compliance technology from market participants. Moreover, the threat of substitution comes from other emerging payment technologies, such as direct peer-to-peer (P2P) transfers via apps or the adoption of retail-specific loyalty cryptocurrency, which could potentially diminish the unique appeal of the traditional e-gift card format if not continuously innovated upon. Successfully navigating these impact forces requires providers to invest heavily in both superior security measures and seamless integration across multiple digital channels.

Segmentation Analysis

The Electronic Gift Card Market segmentation provides a detailed structural breakdown based on criteria such as card type, application, sales channel, and end-user, illustrating diverse consumer and corporate demands. This granular analysis is crucial for stakeholders to tailor product offerings and marketing strategies effectively. The market is primarily bifurcated into Open Loop and Closed Loop systems based on acceptance. Open Loop cards, generally associated with major payment networks (Visa, Mastercard), offer universal acceptance, driving their utility for corporate incentives. Conversely, Closed Loop cards restrict redemption to the issuing retailer, making them essential tools for maintaining brand loyalty and capturing in-house revenue. The Application segment reveals the dominance of retail and e-commerce, though significant growth is observed in specialized sectors like health and wellness and digital media subscriptions, indicating diversification in use cases.

- By Card Type:

- Closed Loop

- Open Loop

- By Application:

- Retail and E-commerce

- Corporate (Incentives and Rewards)

- Entertainment and Media (Gaming, Streaming Subscriptions)

- Food and Beverage (QSR and Casual Dining)

- Health and Wellness

- Travel and Hospitality

- Telecommunications

- By Sales Channel:

- Online Sales (Direct Website, Third-Party Aggregators)

- Offline Sales (Physical Retail Points, Kiosks)

- By End User:

- Individual Consumer

- Corporate Client

- By Regional Outlook:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Electronic Gift Card Market

The value chain for the Electronic Gift Card Market is intricate, involving several specialized entities from issuance to final redemption, ensuring secure and efficient value transfer. Upstream analysis focuses on technology providers, including secure code generation platforms, fraud prevention software vendors, and payment processing gateways that form the foundational infrastructure. These entities supply the necessary tools for retailers and aggregators to mint and manage digital card inventory securely. Key activities include software development, data encryption, and robust API integration services that allow smooth interaction between point-of-sale (POS) systems and the core gift card platform. Maintaining high uptime and scalability is critical at this stage.

Midstream activities involve the issuers and distributors. Issuers are typically the retailers or corporate clients (for closed loop cards) or financial institutions (for open loop cards). Distribution channels are highly diversified, encompassing direct channels (retailer’s own e-commerce site or mobile app) and indirect channels, primarily through third-party gift card aggregators, B2B incentive platforms, and loyalty program administrators. The choice of distribution channel significantly impacts market reach and associated commission structures. The efficiency of this stage relies on seamless integration of ordering, secure delivery via email/SMS, and robust customer support infrastructure capable of handling large volumes of transactions and inquiries.

Downstream analysis focuses on the redemption process and end-users. Redemption occurs at physical POS systems integrated with mobile wallets or through online checkout processes, requiring high interoperability between the gift card platform and the retailer’s enterprise resource planning (ERP) system. Direct distribution channels offer the issuer complete control over branding and data, while indirect channels provide wider market exposure but often involve higher distribution costs and data sharing constraints. The ultimate success of the value chain is measured by the ease of use for the consumer and the ability of the retailer to swiftly process the transaction and recognize the associated revenue, minimizing system failures and ensuring consumer trust.

Electronic Gift Card Market Potential Customers

The primary end-users and potential customers of the Electronic Gift Card Market are broadly categorized into Individual Consumers and Corporate Clients, each seeking different utilities from the product. Individual consumers utilize e-gift cards primarily for personal gifting purposes, valuing the instant delivery, convenience, and personalization options available, especially when buying for someone at a distance or needing a last-minute present. This segment drives demand for highly branded, specific closed-loop cards (e.g., streaming services, major e-commerce platforms) that align with specific interests or lifestyle choices. Their purchasing decisions are heavily influenced by the ease of purchase, security assurances, and the variety of denominations offered.

Corporate clients represent a rapidly growing segment, utilizing e-gift cards for sophisticated business purposes beyond mere gifting. This includes employee recognition and incentive programs, customer loyalty rewards, sales channel motivation, and consumer promotions (e.g., rebates and sign-up bonuses). Corporations prefer open-loop cards for their versatility in broad incentive programs but also use closed-loop cards strategically when aiming to drive traffic and sales specifically to their own products or services. These buyers prioritize bulk purchasing capabilities, comprehensive reporting tools, tax compliance features, and robust API integration into their existing human resources or marketing platforms.

Furthermore, specialized sectors also emerge as significant potential customers. The gaming industry utilizes e-gift cards for in-game purchases and subscriptions, leveraging their digital nature for immediate in-app use. Similarly, the travel and hospitality sectors are increasingly using them for flexible bookings and compensation programs. The healthcare sector is beginning to adopt prepaid digital cards for wellness incentives and benefit disbursements. These specialized customers require customized integration and security features tailored to their industry-specific compliance standards, such as HIPAA compliance in the health sector, demonstrating the evolving breadth of the electronic gift card application base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $425.5 Billion |

| Market Forecast in 2033 | $1,180.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blackhawk Network, Fiserv, InComm Payments, Qwikcilver (A Pine Labs Company), Gift Card Granny, Tango Card, eGifter, Gyft, SVM Global, TCN, Adyen, CashStar, Givex, Rupay, Amex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Gift Card Market Key Technology Landscape

The Electronic Gift Card Market relies heavily on sophisticated digital technologies to ensure security, instant delivery, and seamless integration across multiple retail platforms. Core technologies include cloud-based gift card management platforms (GCMPs) that handle the lifecycle of digital codes, from generation and activation to tracking and reconciliation. Secure communication protocols, such as tokenization, are essential to replace sensitive card numbers with non-sensitive identifiers, drastically minimizing the risk of data compromise during transmission and storage. Furthermore, robust API ecosystems are critical, enabling quick integration with merchant POS systems, e-commerce checkout pages, and third-party distribution partners, ensuring an omni-channel experience where the digital card is usable everywhere.

Emerging technologies are increasingly defining the competitive edge in this market. Blockchain technology is being explored by leading providers to create decentralized, tamper-proof ledgers for tracking the ownership and transaction history of open-loop gift cards, offering superior transparency and mitigating the potential for fraud associated with traditional databases. The application of sophisticated data analytics and machine learning (ML) algorithms is paramount for proactive fraud detection, analyzing thousands of transactional data points in real-time to identify anomalies and block fraudulent activity before value is transferred. These ML models are constantly refined to stay ahead of evolving cyber threats, making security an intelligence-driven function.

Mobile integration technologies, particularly Near Field Communication (NFC) and QR code standardization, are vital for enabling physical in-store redemption through mobile wallets like Apple Pay and Google Wallet. This convergence ensures that e-gift cards are not confined to the online environment but can seamlessly facilitate contactless payments at the point of sale. Moreover, the focus on user experience drives the adoption of intuitive digital interface designs and rapid delivery mechanisms (SMS, direct app push notifications), underpinned by high-speed server architecture to guarantee instant activation and use. These technological advancements collectively drive efficiency, increase consumer trust, and expand the utility of electronic gift cards beyond traditional gifting.

Regional Highlights

North America maintains its stronghold in the Electronic Gift Card Market, characterized by high disposable income, mature e-commerce infrastructure, and widespread adoption of advanced mobile payment solutions. The United States, in particular, showcases high penetration rates for both closed-loop retail cards and open-loop incentive cards, driven by a strong corporate sector reliance on digital rewards and high consumer comfort levels with digital financial products. Regulatory clarity, although complex in certain state jurisdictions, generally supports the robust growth of the market, making it a crucial region for launching innovative gift card technologies and business models.

The Asia Pacific (APAC) region is expected to demonstrate the highest growth potential throughout the forecast period. This rapid expansion is primarily attributed to explosive growth in mobile internet usage, the rise of domestic digital payment giants (e.g., Alipay, WeChat Pay), and a massive, digitally native consumer base, especially in China, India, and Southeast Asia. The market here is highly fragmented but dynamic, with regional players dominating local closed-loop ecosystems. Increasing cross-border e-gifting facilitated by simplified regulatory protocols and improved payment gateways is further fueling the demand for instantly deliverable digital vouchers across the expansive regional landscape.

Europe presents a strong, though more complex, market due to varying national regulations and consumer preferences. Western Europe (UK, Germany, France) shows high acceptance rates, particularly for corporate incentive programs and specific retail closed-loop cards. The implementation of stricter data protection laws, such as GDPR, necessitates that e-gift card providers prioritize privacy-compliant data handling and robust security measures. This regulatory environment encourages technological innovation focused on secure infrastructure. The Middle East and Africa (MEA), while smaller, are growing rapidly, driven by governmental push for financial inclusion and cashless societies, providing significant untapped opportunities for international gift card platforms.

- North America: Dominant market share; driven by high e-commerce volume and established corporate incentive programs; characterized by mature mobile wallet ecosystems.

- Asia Pacific (APAC): Fastest growing region; propelled by high mobile penetration, increasing financial inclusion, and major growth in regional e-commerce hubs (China, India).

- Europe: Stable growth; strong focus on regulatory compliance (GDPR) and secure platform development; high adoption in corporate reward schemes across Western European countries.

- Latin America (LATAM): Emerging market; growth tied to rising smartphone adoption and efforts to curb cash dependency; strong potential in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Significant potential due to government initiatives promoting cashless transactions and increasing penetration of digital services; demand concentrated in UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Gift Card Market.- Blackhawk Network

- Fiserv, Inc.

- InComm Payments

- Qwikcilver (A Pine Labs Company)

- Tango Card

- eGifter

- Gift Card Granny

- Gyft (Acquired by First Data/Fiserv)

- SVM Global

- TCN

- Adyen

- CashStar (A Blackhawk Network Company)

- Givex

- Kroger Company (Own Gift Card Program)

- Target Corporation (Own Gift Card Program)

- Amazon.com, Inc.

- Paytronix Systems, Inc.

- Rupay

- American Express (Amex)

- Mastercard Incorporated

Frequently Asked Questions

Analyze common user questions about the Electronic Gift Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Closed Loop and Open Loop Electronic Gift Cards?

Closed Loop e-gift cards are redeemable only at the specific retailer or chain that issued them, fostering brand loyalty and internal revenue capture. Open Loop cards, backed by major payment networks like Visa or Mastercard, can be used wherever the network is accepted, offering greater flexibility and serving primarily as corporate incentives or rewards.

How is Artificial Intelligence (AI) enhancing the security of E-Gift Card transactions?

AI utilizes sophisticated machine learning algorithms to monitor transaction patterns in real-time, instantly identifying and flagging anomalies indicative of fraud, such as rapid attempts at redemption or bulk purchasing with compromised credentials, significantly reducing financial loss and boosting consumer trust.

Which geographical region is expected to exhibit the highest growth rate (CAGR) in the Electronic Gift Card Market?

The Asia Pacific (APAC) region is projected to experience the highest Compound Annual Growth Rate (CAGR). This growth is driven by the rapid expansion of mobile commerce, massive populations, increasing internet penetration, and a significant shift away from traditional cash transactions toward digital financial instruments in countries like India and China.

What is the primary driver for corporate adoption of Electronic Gift Cards?

The primary driver is the efficiency and measurability of digital rewards for employee incentive programs, customer loyalty schemes, and promotional campaigns. E-gift cards offer immediate delivery, diverse customization, and precise tracking capabilities, allowing corporations to effectively manage budgets and analyze the return on investment (ROI) of their reward systems.

Are Electronic Gift Cards subject to the same regulatory requirements as traditional payment cards?

Yes, but compliance varies. While closed-loop cards often have fewer regulations regarding money transmission, open-loop cards are generally subject to stringent financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) rules, especially concerning large denominations or cross-border transfers to ensure financial integrity and consumer protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager