Electronic Grade Ammonia Water Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436434 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electronic Grade Ammonia Water Market Size

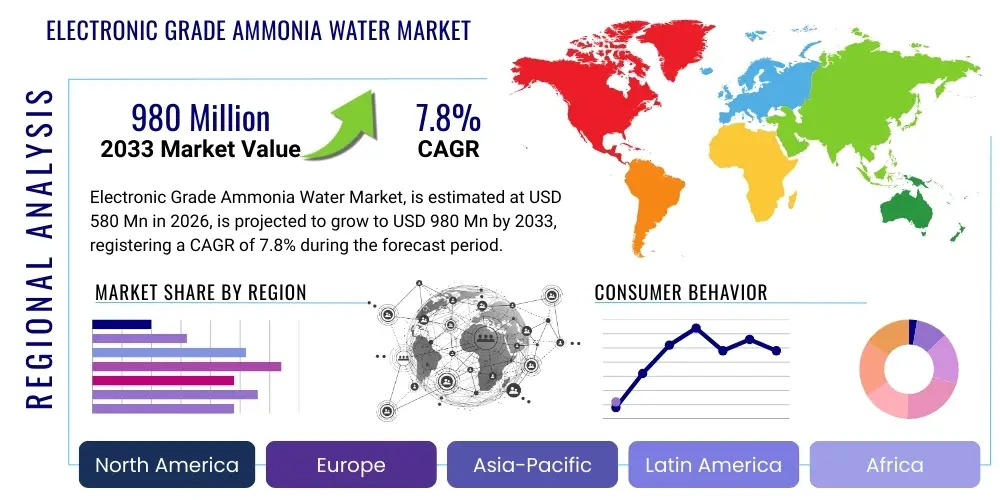

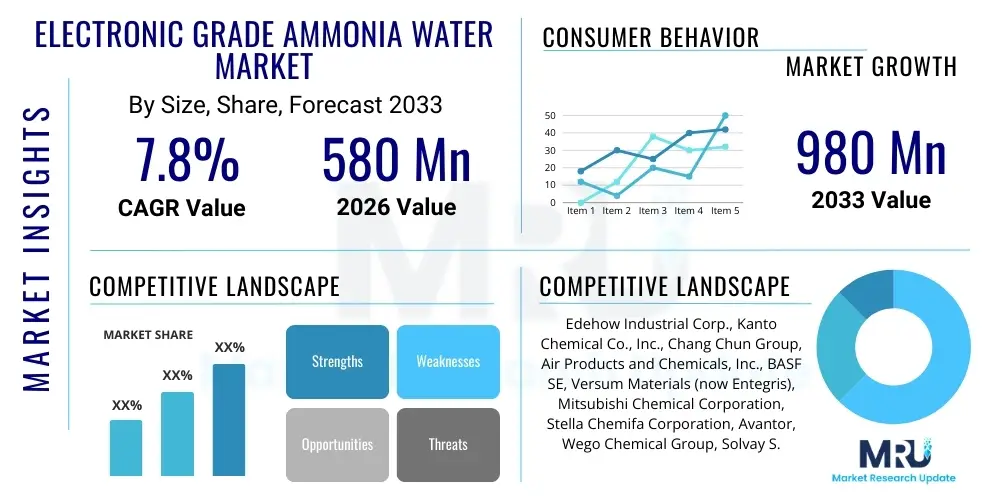

The Electronic Grade Ammonia Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033.

Electronic Grade Ammonia Water Market introduction

The Electronic Grade Ammonia Water (EGAW), often referred to as high-purity aqueous ammonia, is a critical chemical reagent essential for the production processes within the semiconductor and microelectronics industries. Characterized by extremely low levels of metallic impurities and particulates, EGAW is fundamentally necessary for processes such as surface cleaning, etching, and chemical vapor deposition (CVD) in the fabrication of integrated circuits (ICs), memory chips, and advanced display panels. The market dynamics are intrinsically linked to the global demand for electronics, which dictates the scale and complexity of semiconductor manufacturing operations worldwide. As device miniaturization continues following Moore's Law, the stringent quality requirements for EGAW escalate, driving continuous innovation in purification and handling technologies. The specification of EGAW is meticulously defined by organizations like SEMI (Semiconductor Equipment and Materials International), which standardize purity thresholds to ensure inter-operability and reliability across global fabrication facilities. The shift from Parts Per Billion (PPB) to Parts Per Trillion (PPT) specifications over the last decade highlights the intensity of this purity race, directly influencing chemical manufacturing processes and increasing R&D investment within the supplier base.

The primary application areas for Electronic Grade Ammonia Water include the manufacturing of advanced silicon wafers, cleaning processes in the fabrication of Thin-Film Transistor (TFT) LCDs and OLED displays, and specialized chemical mechanical planarization (CMP) slurries. Its high purity ensures minimal contamination risk, which is paramount in environments where even trace impurities can render an entire batch of microchips defective. Specifically in semiconductor cleaning, EGAW is a key component of the SC-1 (Standard Clean 1) solution, a crucial wet chemistry mixture used to remove organic contamination and micro-particles from wafer surfaces. The benefits of using high-purity ammonia water stem from its efficiency as a cleaning agent, particularly its role in removing organic residues and neutralizing acidic components during multi-step semiconductor processing. The chemical stability, excellent solvency, and compatibility with existing manufacturing infrastructures further solidify its position as an indispensable material, underpinning modern chip complexity and performance requirements.

Market growth is predominantly driven by the robust expansion of data centers, the rapid proliferation of 5G and nascent 6G technology, and the escalating consumer demand for sophisticated electronic devices, including smartphones, Internet of Things (IoT) devices, and high-specification electric vehicles (EVs). Each of these sectors relies heavily on high-performance semiconductors fabricated using these ultra-pure chemicals, directly translating into increased consumption of ultra-pure chemical precursors like EGAW. Furthermore, significant governmental and private investments exceeding billions of dollars in establishing new semiconductor fabrication facilities (Fabs), particularly in regions like North America and Europe aiming for supply chain resilience and geographical diversification, are providing substantial tailwinds for the electronic chemical market. This localization trend mandates parallel investment in the high-purity chemical supply ecosystem, positioning EGAW for sustained, high-value growth throughout the forecast period, especially in segments focused on advanced logic and memory manufacturing.

Electronic Grade Ammonia Water Market Executive Summary

The Electronic Grade Ammonia Water market is poised for significant expansion, driven primarily by unprecedented demand from the global semiconductor industry, which is undergoing a massive capacity build-out phase across all major geographies. Key business trends indicate a strategic move towards localized production and enhanced proprietary purification technologies (such as continuous cryogenic distillation and advanced membrane separation) required to meet the increasingly stringent purity specifications mandated by sub-10nm logic nodes. Competition is intensifying not only on price but crucially on validated purity certifications and secure, long-term supply agreements. Strategic partnerships between highly specialized chemical suppliers and major semiconductor foundries are becoming non-negotiable for ensuring long-term supply stability and quality control, while investment in highly sustainable and energy-efficient manufacturing practices is emerging as a critical competitive differentiator, influencing major procurement decisions.

Regionally, the Asia Pacific (APAC) continues its dominance, leveraging its established ecosystem and massive existing manufacturing capacity concentrated in powerhouse economies like Taiwan, South Korea, and China. However, governmental incentives and substantial subsidies aimed at bolstering domestic semiconductor production in North America (e.g., the U.S. CHIPS Act) and Western Europe (e.g., the EU Chips Act) are fostering accelerated growth in these regions. North America, in particular, is witnessing a massive influx of investment into new fabrication facilities, which necessitates a parallel, high-speed build-up of the ultra-pure chemical supply ecosystem. This creates lucrative, high-security supply chain opportunities for EGAW suppliers focused on meeting domestic sourcing requirements and mitigating geopolitical supply risks, fundamentally altering global distribution patterns over the next seven years.

Segment trends conclusively demonstrate that the highest growth rate is anticipated in the most sophisticated purity segments, specifically the Sub-PPT (Parts Per Trillion) grade, reflecting the industry's relentless pursuit of transistor miniaturization and higher integration density in state-of-the-art integrated circuits. By application, while the semiconductor wafer cleaning segment remains the largest and most foundational consumer, the demand for EGAW in specialized advanced display manufacturing, particularly high-resolution OLED panels and flexible display technologies, is growing at an above-average pace. Regarding supply logistics, the high-volume bulk supply method, offering significant economies of scale, continues to hold the largest market share, though specialized customized packaging solutions catering to smaller, flexible manufacturing lines and dedicated R&D facilities are expanding their niche market presence due to enhanced safety and ease of use in sensitive environments.

AI Impact Analysis on Electronic Grade Ammonia Water Market

User queries regarding AI's influence on the Electronic Grade Ammonia Water market consistently focus on three overarching dimensions: optimization of manufacturing processes, predictive intelligence for supply chain management, and the potential for AI-driven materials innovation. The common theme among these user concerns points toward AI’s critical, near-term impact being centered on dramatically enhancing operational efficiency, providing highly accurate predictive maintenance for complex chemical infrastructure, and rigorously improving real-time quality control within both the chemical production facilities and the subsequent semiconductor fabrication environments. Users are intensely interested in AI's capability to maintain the extremely elusive and sensitive ultra-high purity levels of EGAW, predicting and preempting potential contamination events originating from raw materials or infrastructure degradation, and optimizing complex logistics chains to prevent any supply disruptions, which are particularly critical given the material’s sensitivity and high consumption rates in leading fabs.

The strategic implementation of AI and Machine Learning (ML) models is transforming the production of ultra-pure chemicals. For EGAW manufacturers, AI is used to correlate thousands of sensor inputs—including temperature, pressure, flow rates, and spectral data—to establish highly precise purification parameters that guarantee consistency across vast production volumes. This precision minimizes batch-to-batch variation, a persistent challenge in high-purity chemical production. Moreover, in the downstream semiconductor fabrication process, AI tools are employed to optimize the usage of EGAW in the wet bench cleaning steps. By analyzing real-time particle counts and yield data, AI systems can dynamically adjust the concentration and temperature of the SC-1 mixture, thereby minimizing chemical waste while maximizing wafer yield, which is a key cost driver for major foundries.

Looking forward, the long-term impact of AI extends into materials science. While AI is unlikely to rapidly replace EGAW, it is highly likely to accelerate the discovery and testing of next-generation photoresists, etchants, and specialized cleaning additives that must be perfectly compatible with high-purity aqueous ammonia. AI-driven simulation and materials informatics are speeding up the formulation development process, ensuring that new electronic materials integrate seamlessly with existing chemical cleaning platforms like EGAW. Thus, AI acts as an enabler, ensuring that the necessary ultra-pure chemicals can be produced more reliably, used more efficiently, and integrated more quickly into the rapidly evolving microchip manufacturing roadmap, which is constantly pushing the boundaries of nanoscale physics and engineering.

- AI-driven Predictive Maintenance: Minimizing equipment failure in complex, multi-stage purification systems, significantly reducing unplanned downtime, and ensuring the continuous production of consistent, ultra-pure EGAW grades.

- Enhanced Quality Control (QC) and Verification: Using sophisticated machine learning algorithms to analyze continuous spectral data (e.g., ICP-MS outputs) in real-time, instantly detecting trace metallic impurities (at PPT levels) and automatically adjusting purification parameters with precision beyond manual capabilities.

- Optimized Supply Chain Logistics and Demand Forecasting: AI models predict subtle shifts in demand patterns from major foundries based on their CapEx cycles and production forecasts, allowing suppliers to optimize inventory levels, manage specialized container rotation, and ensure timely, secure delivery of highly volatile, high-value chemicals.

- Process Optimization in Fabrication Facilities: AI algorithms dynamically fine-tune the consumption rates, concentration, and thermal profiles of EGAW within etching and cleaning baths inside semiconductor fabrication plants, leading to a substantial reduction in material waste and quantifiable improvement in overall wafer yield.

- Data Analytics for Yield Improvement Correlation: AI systems correlate specific EGAW batch purity reports and delivery conditions directly with the final semiconductor chip yield data, identifying hitherto hidden chemical parameter thresholds that maximize manufacturing success and consistency, providing crucial feedback to the chemical supplier.

DRO & Impact Forces Of Electronic Grade Ammonia Water Market

The Electronic Grade Ammonia Water market operates under the influence of a potent mix of market Drivers, structural Restraints, and emerging Opportunities (DRO), which collectively dictate the competitive dynamics and future trajectory of this highly specialized sector. The paramount driver remains the relentless, compounding global demand for advanced semiconductors, fueled by transformative technologies such as Artificial Intelligence infrastructure, high-performance computing (HPC), and the mass deployment of 5G/6G communication networks. This explosive demand necessitates not only a vast increase in silicon wafer production volume but also a continuous and non-negotiable requirement for increasingly higher purity levels of process chemicals like EGAW to facilitate the precision required for fabricating smaller, more complex transistor structures at the atomic level. The intense global geopolitical competition to achieve technological superiority in microelectronics guarantees sustained, high-level capital investment across the entire semiconductor value chain, thereby creating a reliable growth engine for ultra-pure chemical suppliers.

Conversely, significant structural restraints pose continuous challenges to market expansion. The production of EGAW, especially at the Sub-PPT grade, demands extremely specialized infrastructure, cleanroom environments, and highly capital-intensive purification and analytical testing processes, which naturally creates extremely high barriers to entry for potential new market participants. Furthermore, maintaining stringent and consistent ultra-high purity across large-scale commercial batches is a formidable technical hurdle, requiring continuous, sophisticated quality monitoring and state-of-the-art analytical chemistry protocols. A critical logistical restraint involves the inherent volatility and complexity of the raw industrial-grade ammonia supply chain, coupled with rapidly escalating global environmental, health, and safety (EHS) regulations pertaining to hazardous chemical manufacturing, handling, and rigorous waste disposal, particularly stringent in established markets like Japan and the EU. These factors substantially increase both the operational complexity and the unit cost of production.

Opportunities for market players are substantial and strategically focused. These include strategic geographical expansion aimed at localizing production near massive new semiconductor fabrication clusters in burgeoning regions (e.g., Southeast Asia, India, and the newly developing Fabs in the US and EU) to capitalize on supply chain resilience mandates. Product differentiation through the innovation of advanced, purity-preserving packaging technologies and the development of customized EGAW formulations optimized for new and specific advanced lithography, cleaning chemistries, and specialized material removal techniques present key high-value growth avenues. The overriding impact force on the market remains the global semiconductor capital expenditure cycle. The synchronized announcements and execution of significant CapEx investments by major global foundries for establishing or expanding new Giga-Fabs directly results in a massive and immediate spike in demand for bulk, high-purity EGAW, acting as the primary, market-defining leverage point that dictates short-to-medium term market expansion, price stability, and overall supplier profitability.

Segmentation Analysis

The Electronic Grade Ammonia Water market is rigorously segmented based on three primary metrics: purity level, application, and supply method. This comprehensive segmentation framework is crucial for conducting a granular market analysis, providing vital insights into specific consumer requirements and regional demand drivers, which ultimately informs strategic business planning and capacity allocation. The classification by purity level (e.g., UP, UPSS, UPSSS, or the most advanced Sub-PPT grade) is recognized as the most commercially critical differentiator, as the purity directly determines compatibility with advanced manufacturing nodes; as complexity increases, purity specifications become exponentially more demanding, driving higher prices and necessitating specialized production facilities.

Segmentation by application clearly delineates the consumption hierarchy across the microelectronics supply chain. Semiconductor wafer cleaning remains the bedrock and volume driver of the market, essential across all fabrication stages. However, the market also serves specialized demands such as intricate etching processes and the formulation of Chemical Mechanical Planarization (CMP) slurries where EGAW acts as a precise pH regulator and activator. Furthermore, the burgeoning demand from the advanced display manufacturing sector, particularly for high-resolution OLED and flexible display technologies, represents a high-growth application segment requiring high purity, albeit generally in lower volumes compared to silicon wafer processing.

The segmentation based on supply method addresses the critical logistical and volume requirements of end-users. Large, integrated device manufacturers (IDMs) and major foundries prefer the bulk delivery method, utilizing dedicated tankers and large drums to maximize cost efficiencies and ensure a continuous, high-volume supply stream directly into their centralized chemical distribution systems. Conversely, academic research laboratories, smaller specialized foundries, and R&D facilities often require smaller volume packaging (cylinders or small bottles). Suppliers must maintain flexibility in their packaging and distribution infrastructure to serve this diverse customer base effectively, often implementing complex safety and purity maintenance protocols for smaller, custom-packaged orders.

- By Purity Level:

- UP (Ultra-Pure)

- UPSS (Ultra-Pure Select Service)

- UPSSS (Ultra-Pure Select Service Standard)

- Sub-PPT (Parts Per Trillion) Grade (Highest Growth Segment)

- By Application:

- Semiconductor Wafer Cleaning (Largest Volume Segment)

- Etching Process (Targeted Applications)

- Chemical Mechanical Planarization (CMP) Slurries (pH Regulator Role)

- Display Manufacturing (TFT-LCD, OLED)

- Others (e.g., Advanced Solar Cells, R&D)

- By Supply Method:

- Bulk Delivery (Tankers and Large ISO Containers)

- Cylinders and Drums (Intermediate Volume)

- Small Volume Bottles/Containers (Specialty and R&D Use)

Value Chain Analysis For Electronic Grade Ammonia Water Market

The complex value chain for Electronic Grade Ammonia Water is characterized by intense specialization and a sharp transition from commodity chemical production to ultra-high-purity electronic chemical manufacturing. The upstream segment involves the procurement of raw, industrial-grade anhydrous ammonia, typically sourced from large global petrochemical and industrial gas producers. This raw material must meet initial quality checks but requires substantial refinement. The core value-add is concentrated in the midstream purification stage, where specialized electronic chemical suppliers utilize proprietary, highly controlled manufacturing environments to convert commodity ammonia into the requisite electronic grade. This involves rigorous multi-stage processes including fractional vacuum distillation, advanced metal removal using specific ion exchange resins, and precision filtration to remove particulates down to the required sub-nanometer scale, which demands significant capital and intellectual property investment.

The critical midstream phase also encompasses stringent Quality Assurance (QA) and sophisticated packaging protocols. Given the highly corrosive nature and extreme sensitivity of EGAW to atmospheric and material contamination, specialized containerization is non-negotiable. This includes the use of inert, high-purity materials like PFA-lined tanks, Teflon components, or certified high-density polyethylene (HDPE) containers specifically engineered to prevent leaching of impurities over time. Logistics and distribution channels are highly regulated. For the largest consumers (Tier 1 Foundries), the distribution is predominantly a direct sales model, often involving dedicated fleets and real-time monitoring to ensure just-in-time delivery and immediate purity verification at the fab gate. This direct relationship facilitates rapid technical support and streamlined quality feedback loops, essential for advanced manufacturing.

The downstream analysis centers on consumption by the highly concentrated end-user base. The main buyers—global semiconductor foundries (e.g., TSMC, Intel, Samsung), major memory producers, and leading display manufacturers—integrate EGAW directly into their automated wet benches and chemical mixing stations. The success of the chemical supplier is directly measured by the consistency of their product and their ability to integrate technically with the end-user’s complex manufacturing control systems. Indirect distribution channels, utilizing highly specialized regional chemical distributors, exist to serve smaller-volume customers, including contract manufacturers, smaller R&D houses, and academic institutions, requiring flexible inventory and customized packaging. The consistent demand from advanced node production continues to push the entire value chain toward tighter tolerances and enhanced security measures.

Electronic Grade Ammonia Water Market Potential Customers

The core customer base for the Electronic Grade Ammonia Water market is dominated by global technology manufacturing conglomerates that rely on complex, multi-step chemical processes to create microelectronic components. These end-users are defined by their massive cleanroom infrastructure, substantial capital investment in lithography and etching equipment, and an absolute reliance on chemical consistency for maintaining high production yields. The primary segment comprises the world’s leading Semiconductor Manufacturers, including integrated device manufacturers (IDMs) like Intel and Samsung, pure-play foundries like TSMC and GlobalFoundries, and specialized memory manufacturers such as SK Hynix and Micron. These entities utilize EGAW extensively in the SC-1 cleaning steps to remove contaminants and prepare silicon wafers for subsequent deposition layers, making them the largest volume consumers by a significant margin.

A secondary, high-value customer segment includes manufacturers of advanced Flat Panel Displays (FPDs). This group, featuring major players like LG Display, Samsung Display, and BOE, requires high-purity ammonia water for critical etching and cleaning steps during the fabrication of Thin-Film Transistor (TFT) arrays, particularly for high-end OLED and flexible display technologies where defect density must be minimized across large substrates. As display resolution and complexity increase, their purity demands are converging with those of the semiconductor industry. Furthermore, specialized Chemical Formulation Companies represent an important, often indirect, customer group. These companies purchase high-purity EGAW as a critical base component for mixing proprietary Chemical Mechanical Planarization (CMP) slurries used to achieve wafer surface planarity during the fabrication of advanced integrated circuits, requiring specific purity profiles to avoid interference with catalytic components.

Lastly, emerging end-user segments include specialized manufacturers in high-efficiency photovoltaics (solar cells) and advanced materials research laboratories. Although lower in volume compared to the semiconductor sector, these consumers are critical for driving specialized purity requirements and validating novel applications. The overarching characteristic linking all these potential customers is their stringent quality assurance requirements and their preference for suppliers who can demonstrate impeccable quality control, global logistical capability, and robust intellectual property in ultra-purification technology, often leading to multi-year supply contracts crucial for market stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Edehow Industrial Corp., Kanto Chemical Co., Inc., Chang Chun Group, Air Products and Chemicals, Inc., BASF SE, Versum Materials (now Entegris), Mitsubishi Chemical Corporation, Stella Chemifa Corporation, Avantor, Wego Chemical Group, Solvay S.A., Merck KGaA, JSR Corporation, Sumitomo Chemical, Suzhou Jingrui Chemical Co., Ltd., Anqing Hongsheng Chemical Co., Ltd., Shouguang Hongyuan Chemical Co., Ltd., Zhejiang Sanli Chemical Co., Ltd., Dongyue Group, Hubei Jingdian Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Ammonia Water Market Key Technology Landscape

The technological landscape of the Electronic Grade Ammonia Water market is fundamentally driven by the relentless pursuit of zero-defect manufacturing in microelectronics, necessitating continuous advancements in purification science and materials handling. Key technologies center around highly optimized, multi-stage purification trains. These typically integrate advanced techniques such as high-efficiency fractional distillation conducted under ultra-pure conditions, specialized membrane separation methodologies (including reverse osmosis optimized for ion rejection), and continuous flow ion-exchange systems utilizing proprietary high-capacity resins specifically engineered to scavenge metallic cations down to parts-per-trillion levels. Furthermore, manufacturers are investing heavily in proprietary filtering media designed with tailored pore structures to capture particulates at the sub-nanometer scale, which is essential for achieving the required purity for leading-edge 5nm and 3nm node fabrication.

Complementary technological advancements are crucial in the areas of analytical chemistry and real-time process monitoring. Achieving and maintaining Sub-PPT purity requires incredibly sensitive and often expensive analytical instruments, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and specialized particle counters capable of measuring contamination at the limit of detection. Integrating these tools with automated Process Analytical Technology (PAT) systems allows for instantaneous purity verification and closed-loop feedback control, ensuring deviations are corrected immediately. Furthermore, technology related to packaging and handling is equally vital to preserve product integrity. Advanced container technologies employ inert, ultra-high-purity materials, such as chemically resistant PFA linings and specialized Teflon or high-density polyethylene (HDPE) containers manufactured in ISO-certified cleanrooms, preventing leaching of impurities from the container walls into the ultra-pure chemical during storage and prolonged transport.

The latest technological trends point towards sustainable manufacturing and enhanced supply chain resilience. This includes the deployment of modular, high-efficiency purification plants located strategically near major consumption hubs (following the trend of semiconductor localization). These facilities leverage advanced process control systems, often incorporating AI/ML, to optimize energy usage and minimize the volume of hazardous waste streams generated during the purification steps, aligning with strict global environmental regulations and corporate sustainability targets. Innovation in packaging also focuses on optimizing volume-to-weight ratios and ensuring safer, more efficient delivery to the cleanroom point-of-use. This comprehensive technological focus, balancing extreme purity requirements with environmental responsibility and logistical efficiency, defines the competitive edge in the modern Electronic Grade Ammonia Water market.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of volume consumption and capacity. This is due to the unparalleled concentration of semiconductor manufacturing foundries (Taiwan, South Korea, China) and advanced display panel producers, which necessitates the highest absolute demand for EGAW. APAC sets the global pace for technological demands, specifically for the highest purity grades.

- North America: Exhibits the fastest projected growth rate, driven by massive federal investment (CHIPS Act) aimed at re-establishing robust domestic semiconductor fabrication capabilities. Demand is highly focused on securing a resilient, localized supply of ultra-high purity EGAW to support cutting-edge technology nodes built by companies like Intel and TSMC on U.S. soil.

- Europe: Characterized by steady, moderate, but high-value growth. This region primarily serves established automotive electronics manufacturers and specialized industrial control systems producers. The recent implementation of the EU Chips Act is designed to stimulate investment in new local Fabs, signaling a medium-to-long term boost in regional EGAW consumption, focusing on self-sufficiency.

- China: A critical strategic market undergoing aggressive expansion in its domestic chip manufacturing sector (driven by players like SMIC and YMTC). This push for semiconductor self-sufficiency mandates huge, ongoing increases in the procurement of high-purity electronic chemicals, positioning China as a primary engine for absolute volume growth in the near term.

- Taiwan and South Korea: These are foundational markets defined by the presence of global semiconductor leaders (TSMC, Samsung, SK Hynix). Demand here is intensely focused on the premium Sub-PPT grade segment, supporting the most advanced logic and memory production globally (e.g., 3nm and 2nm nodes), driving technological innovation among suppliers.

- Latin America, Middle East, and Africa (MEA): These regions currently hold a marginal share, primarily catering to localized consumer electronics assembly and R&D activities. Future growth prospects are linked to potential diversification of global manufacturing bases, though significant semiconductor fabrication investment remains nascent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Ammonia Water Market.- Edehow Industrial Corp.

- Kanto Chemical Co., Inc.

- Chang Chun Group

- Air Products and Chemicals, Inc.

- BASF SE

- Versum Materials (now Entegris)

- Mitsubishi Chemical Corporation

- Stella Chemifa Corporation

- Avantor

- Wego Chemical Group

- Solvay S.A.

- Merck KGaA

- JSR Corporation

- Sumitomo Chemical

- Suzhou Jingrui Chemical Co., Ltd.

- Anqing Hongsheng Chemical Co., Ltd.

- Shouguang Hongyuan Chemical Co., Ltd.

- Zhejiang Sanli Chemical Co., Ltd.

- Dongyue Group

- Hubei Jingdian Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Ammonia Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Ammonia Water and why is its purity level critical for semiconductors?

Electronic Grade Ammonia Water (EGAW) is an ultra-high purity aqueous solution of ammonia used predominantly in semiconductor and advanced display manufacturing. Its extreme purity, rigorously controlled to Parts Per Trillion (PPT) levels for metallic elements, is absolutely critical because even minuscule trace contaminants can cause electrical shorts or defects in nanoscale microchip circuits, severely compromising production yield and device reliability.

How does the global shift to smaller semiconductor nodes below 5nm specifically impact EGAW consumption?

The transition to advanced manufacturing nodes (5nm and below) exponentially increases the required purity standards, focusing demand heavily on the Sub-PPT grade, which commands a premium. Furthermore, the complexity of cleaning processes for these nodes often requires more frequent and sophisticated wet chemistry steps, leading to a substantial increase in the volume consumption of ultra-pure EGAW per wafer fabricated.

Which geographical region currently dominates the EGAW market and what drives its leadership?

The Asia Pacific (APAC) region fundamentally dominates the global EGAW market in terms of volume and market share. Its leadership is driven by the massive concentration of the world’s leading semiconductor fabrication plants (fabs) and advanced display production facilities located in Taiwan, South Korea, and China, making it the primary epicenter of electronics manufacturing and consumption.

What are the primary logistical and supply chain challenges faced by EGAW suppliers?

The key challenges include maintaining consistent, certified ultra-high purity during prolonged transport, which necessitates specialized, chemically inert packaging (e.g., PFA-lined containers) and meticulous handling protocols. Additionally, the need for real-time quality verification upon delivery and navigating complex, hazardous chemical transportation regulations add significant logistical complexity and cost.

What role does AI play in the future manufacturing and application of Electronic Grade Ammonia Water?

AI is strategically employed to enhance operational efficiency. This includes using machine learning for predictive maintenance of purification equipment, enabling real-time detection and elimination of trace contamination, and optimizing demand forecasting and logistics to ensure a stable supply of this critical, high-purity chemical to semiconductor foundries worldwide, ultimately improving yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager