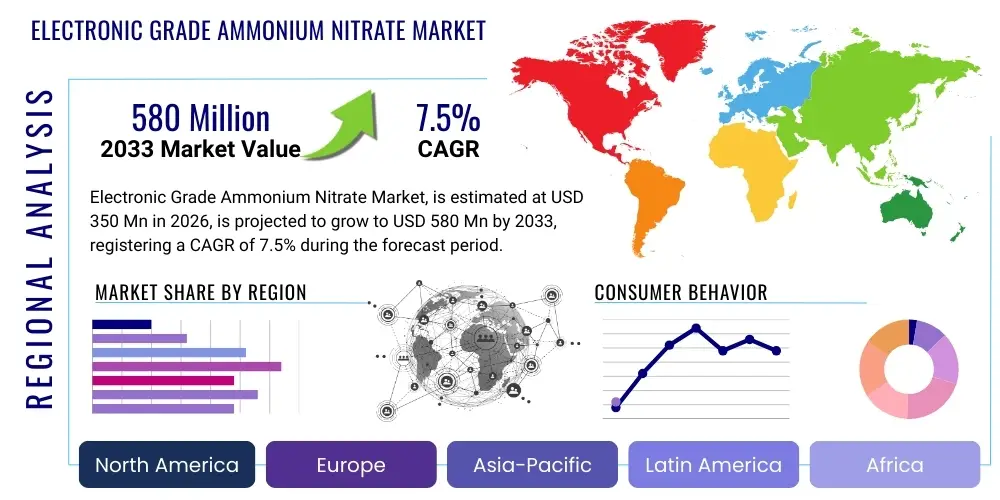

Electronic Grade Ammonium Nitrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438467 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electronic Grade Ammonium Nitrate Market Size

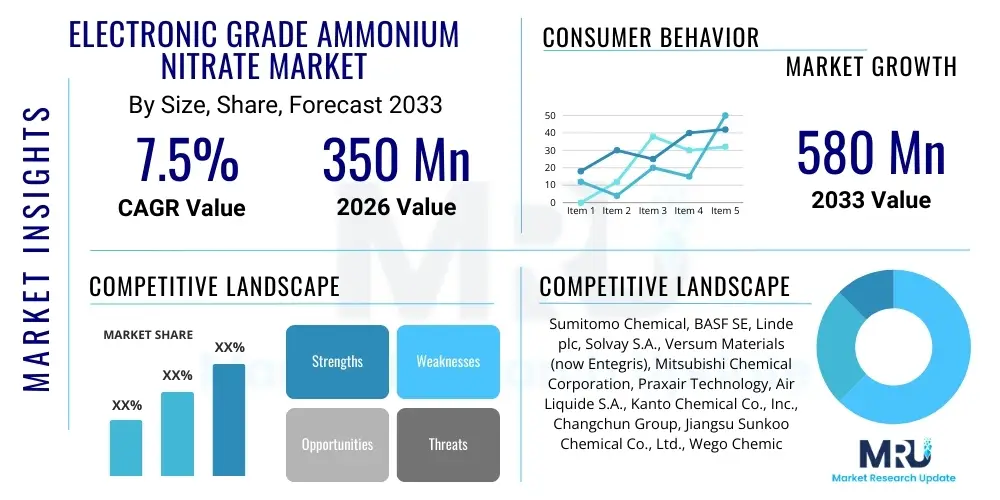

The Electronic Grade Ammonium Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 580 Million by the end of the forecast period in 2033.

Electronic Grade Ammonium Nitrate Market introduction

Electronic Grade Ammonium Nitrate (EGAN) is a highly purified chemical compound essential for manufacturing advanced electronic components. Unlike standard ammonium nitrate used primarily in fertilizers or industrial explosives, EGAN is characterized by extremely low levels of metal ions, chlorides, and other contaminants, typically measured in parts per billion (ppb) or parts per trillion (ppt). This stringent purity requirement is critical because impurities can severely compromise the performance, lifespan, and reliability of sensitive electronic devices, especially semiconductors and flat-panel displays. EGAN serves primarily as a raw material in specialized etching, cleaning, and chemical synthesis processes within controlled manufacturing environments, particularly within cleanroom facilities where material contamination control is paramount.

The product’s primary function lies in its use as a precursor for generating specific chemical solutions required for photolithography, wet etching, and chemical mechanical planarization (CMP) processes. Its applications are inextricably linked to the global expansion of the consumer electronics, data center, and automotive sectors, all of which rely heavily on high-performance logic and memory chips. The benefits of using Electronic Grade Ammonium Nitrate stem from its chemical stability and its ability to dissociate cleanly into desired components without leaving detrimental residues, thereby ensuring high yield rates in fabrication plants (fabs).

Driving factors propelling the EGAN market include the continuous miniaturization of semiconductor nodes, which demands ever-higher purity chemicals; the robust growth of the global memory chip (DRAM and NAND) market; and the escalating investment in new fabrication facilities, particularly across Asia Pacific. Furthermore, the increasing complexity of 3D-stacked architectures and the transition to advanced materials in semiconductor manufacturing necessitate the use of ultra-high purity reagents like EGAN to maintain structural integrity and electrical characteristics of microelectronic circuits. Regulatory pressures regarding material traceability and sustainability are also influencing manufacturing standards, subtly boosting demand for suppliers capable of delivering certified high-grade products consistently.

Electronic Grade Ammonium Nitrate Market Executive Summary

The Electronic Grade Ammonium Nitrate market exhibits robust expansion, driven predominantly by structural shifts in the semiconductor industry, specifically the rapid scaling of advanced manufacturing nodes (7nm, 5nm, and below) and monumental investment in foundry capacity expansion globally. Business trends highlight a pronounced vertical integration strategy among key chemical suppliers aiming to control the entire purification and delivery pipeline, ensuring compliance with increasingly stringent impurity specifications set by major semiconductor foundries. Furthermore, strategic alliances between EGAN producers and regional distributors are becoming common to optimize supply chain resilience and address just-in-time delivery requirements specific to the high-tech manufacturing sector, mitigating geopolitical risks associated with raw material sourcing.

Regional trends unequivocally point toward Asia Pacific (APAC) as the epicenter of demand and manufacturing prowess. Countries like South Korea, Taiwan, China, and Japan house the vast majority of global semiconductor fabrication plants, leading to unparalleled consumption of electronic-grade chemicals. While North America and Europe remain crucial for advanced research and localized specialty manufacturing, the bulk of commercial market growth is centralized in APAC, where governmental subsidies and strategic national initiatives are fueling massive investments in indigenous chip production capabilities. This regional dominance is intensifying the need for localized high-purity chemical production infrastructure to reduce logistical vulnerabilities.

Segmentation trends indicate a clear preference for the highest purity grades (99.99% and above), reflecting the industry's shift towards more complex and smaller-featured devices where even trace amounts of contaminants are intolerable. The application segment remains dominated by semiconductor manufacturing, particularly the etching and cleaning phases, but emerging applications in advanced flat panel displays (OLED/QLED) and high-efficiency solar photovoltaics are contributing peripheral growth. Key chemical suppliers are dedicating significant R&D resources to developing specialized handling and storage solutions, ensuring the purity established during manufacturing is preserved throughout transportation and delivery to the end-user fabrication facility.

AI Impact Analysis on Electronic Grade Ammonium Nitrate Market

User queries regarding AI's impact on the EGAN market typically focus on operational efficiency, predictive quality control, and the acceleration of R&D for next-generation materials. Users are highly interested in how AI, particularly machine learning (ML) algorithms, can optimize the complex, multi-stage purification processes required to achieve parts-per-trillion purity standards for EGAN, minimizing batch variations and waste. A common concern revolves around whether AI-driven manufacturing planning, which enhances semiconductor production throughput, will lead to proportional, linear growth in EGAN consumption, or whether AI-optimized chemical utilization processes might temper demand growth by improving efficiency within the fabrication plant itself. Furthermore, users expect AI to play a critical role in predicting equipment failure within chemical delivery systems and in rapid analysis of material traceability logs, thereby solidifying supply chain integrity and ensuring product quality consistency across global operations.

- AI optimizes the synthesis and purification processes of EGAN, reducing energy consumption and improving batch consistency, thereby lowering operational costs for manufacturers.

- Machine learning algorithms enhance predictive maintenance of chemical delivery and storage infrastructure in fabs, minimizing the risk of contamination during the supply phase.

- AI-driven yield management in semiconductor fabrication plants increases overall chip output, leading to higher, sustained consumption rates of high-purity input chemicals like EGAN.

- Predictive quality analytics utilizing AI ensure real-time impurity detection during EGAN production, guaranteeing compliance with ultra-strict semiconductor industry specifications (ppb/ppt levels).

- Intelligent supply chain management systems leverage AI to forecast EGAN demand based on global semiconductor order books, improving inventory optimization and reducing supply volatility.

DRO & Impact Forces Of Electronic Grade Ammonium Nitrate Market

The dynamics of the Electronic Grade Ammonium Nitrate market are defined by a powerful interplay between escalating purity demands and significant supply chain fragility. Drivers (D) are rooted in the technological advancement of microelectronics, particularly the relentless shrinking of semiconductor feature sizes which necessitates the use of chemicals with zero defects. Restraints (R) are primarily associated with the high barriers to entry, including the immense capital expenditure required for ultra-clean production facilities and the inherent volatility and strict regulatory oversight governing the handling, storage, and transport of ammonium nitrate products globally. Opportunities (O) emerge from the expansion into new, high-growth electronic applications, such as advanced packaging and microLED displays, alongside strategic regional diversification of the supply base to enhance resilience against geopolitical and logistical disruptions. These factors collectively create intense impact forces, driving manufacturers toward advanced filtration and quality control technologies.

Impact forces are heavily skewed toward the "Demand Pull" effect originating from key semiconductor foundry operators. The global chip shortage and ongoing geopolitical competition to secure reliable domestic chip supply mandate continuous, high-volume procurement of EGAN, regardless of minor price fluctuations. Simultaneously, the force of "Technological Substitution Risk" is relatively low, as EGAN is fundamentally necessary for specific chemical reactions (e.g., as a nitrogen source or an etchant precursor) where few chemically equivalent alternatives meet the requisite purity standards economically. Therefore, competition primarily exists on the axes of purity, consistency, and supply chain reliability, rather than on fundamental material substitution.

A significant long-term impact force is the necessity for sustainable manufacturing. Increasing scrutiny on the environmental footprint of chemical production is pressuring EGAN manufacturers to adopt closed-loop systems, minimize waste, and improve energy efficiency in their highly purified production processes. This requirement for "Green Chemical Manufacturing" influences investment decisions and favors suppliers who can demonstrate both ultra-high purity and environmental stewardship. The regulatory environment acts as a strong impact force, particularly concerning the hazardous nature of ammonium nitrate, necessitating specialized, compliant transportation and storage infrastructures which significantly increase operational complexity and cost throughout the value chain.

Segmentation Analysis

The Electronic Grade Ammonium Nitrate market is primarily segmented based on the level of chemical purity required by the end-user application, and secondarily by the specific electronic component type being manufactured. Purity segmentation is the most critical differentiator, as the tolerances for metallic and non-metallic impurities directly correlate with the performance and yield of advanced microelectronic devices. The highest purity grades, often designated as G5 or P5 (parts per trillion level), command premium pricing and are exclusively consumed by leading-edge semiconductor fabrication facilities. Application segmentation demonstrates the market's dependence on the cyclical yet structurally growing semiconductor industry, which dwarfs other uses like flat panel display manufacturing and specialized laboratory research.

- By Purity Grade:

- Standard Purity (99.9% - Used for less critical processes or bulk material cleaning)

- High Purity (99.99% - Suitable for Solar Cells and some FPD manufacturing)

- Ultra-High Purity (G4/G5 Grade, PPT Level - Essential for 7nm and 5nm semiconductor manufacturing)

- By Application:

- Semiconductor Manufacturing (Etching, Cleaning, Chemical Synthesis)

- Flat Panel Displays (FPDs - LCD, OLED)

- Solar Photovoltaics (PV)

- Research and Laboratory Use

- By Form:

- Liquid Solution (Aqueous forms are common for easy handling and dosing)

- Solid/Crystalline Form (Less common in electronics unless converted on-site)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Electronic Grade Ammonium Nitrate Market

The value chain for Electronic Grade Ammonium Nitrate is complex and characterized by stringent quality checkpoints, moving from basic raw material synthesis to highly specialized purification and final delivery. Upstream analysis begins with the sourcing and initial synthesis of basic industrial-grade ammonium nitrate, typically derived from ammonia and nitric acid. This initial production stage requires large-scale chemical manufacturing capability. The critical step, and the primary value addition point, involves the subsequent multi-stage purification processes (including specialized filtration, ion exchange, and distillation) necessary to eliminate trace metallic impurities and achieve the required parts-per-billion or parts-per-trillion specifications demanded by semiconductor customers. This purification infrastructure is highly proprietary and capital-intensive.

Downstream analysis focuses on the integration of EGAN into end-user manufacturing processes. The purified chemical is usually delivered in specialized, high-integrity containers (often stainless steel or high-density polyethylene drums designed to prevent leaching) directly to semiconductor fabrication plants (fabs) or large FPD manufacturing sites. The distribution channel is predominantly direct or via highly specialized, certified chemical logistics providers. Direct distribution is preferred for major customers to maintain control over the supply chain and purity integrity right up to the point of use. This model minimizes the risk of contamination associated with third-party warehousing or excessive transshipment, which is crucial for maintaining the electronic grade designation.

Indirect distribution may involve regional distributors authorized to handle hazardous, high-purity chemicals, particularly for smaller fab operations or R&D laboratories that require smaller, more manageable volumes. However, due to the high sensitivity and stringent requirements of the electronics industry, the distinction between "direct" and "indirect" often blurs into a system of highly controlled "direct-to-fab" deliveries managed by a limited number of specialized logistic partners. The entire value chain is therefore characterized by extreme quality focus, specialized packaging, and complex risk management protocols relating to safety and product integrity, distinguishing it sharply from the standard industrial chemical supply chain.

Electronic Grade Ammonium Nitrate Market Potential Customers

The core customer base for Electronic Grade Ammonium Nitrate consists of major global semiconductor manufacturers, also known as Integrated Device Manufacturers (IDMs) and pure-play foundries. These entities consume EGAN as a critical process chemical during the fabrication of microprocessors, memory chips (DRAM, NAND flash), and various logic circuits. Their requirements are characterized by extremely large, consistent volumes and the necessity for the highest possible purity grades (PPT levels). The yield rate of their multi-billion dollar fabrication plants directly depends on the consistency and purity of input materials like EGAN, making them highly demanding but stable customers.

Secondary potential customers include manufacturers of advanced display technologies, specifically those producing high-resolution LCDs and advanced OLED panels for consumer electronics like smartphones, televisions, and tablets. While their volume requirements are typically lower than those of leading-edge semiconductor fabs, they still necessitate high-purity material to prevent defects and ensure uniform color and electrical performance across large display substrates. Additionally, manufacturers focusing on high-efficiency solar cells (Photovoltaic) utilize EGAN in certain doping or surface passivation stages, representing a growing, although less purity-sensitive, customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 580 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, BASF SE, Linde plc, Solvay S.A., Versum Materials (now Entegris), Mitsubishi Chemical Corporation, Praxair Technology, Air Liquide S.A., Kanto Chemical Co., Inc., Changchun Group, Jiangsu Sunkoo Chemical Co., Ltd., Wego Chemical Group, Zhejiang Kaili Chemical Co., Ltd., Hongji Chemical Group, Hefei Lirong Chemical Co., Ltd., Shandong Jingshang Chemical Co., Ltd., Central Glass Co., Ltd., Merck KGaA, Avantor, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Ammonium Nitrate Market Key Technology Landscape

The technological landscape for the Electronic Grade Ammonium Nitrate market is dominated by advancements in ultra-purification methodologies designed to strip trace impurities down to single-digit parts per trillion levels. Achieving this level of purity necessitates integrating cutting-edge filtration techniques, including advanced membrane separation and proprietary ion-exchange resin systems, which must operate within meticulously controlled cleanroom environments. These sophisticated purification trains are often customized to target specific metallic ions (like Fe, Cu, Na) known to be detrimental to silicon wafer processing. The innovation is not just in the purification chemistry itself but also in the materials science used for the equipment, ensuring that the purification machinery itself does not introduce contaminants.

A secondary, but critical, technological focus is on analytical testing and quality assurance. Ultra-trace impurity analysis relies heavily on advanced spectroscopic methods such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS), often requiring specialized clean-bench sampling to prevent environmental contamination during testing. Continuous process monitoring (CPM) technologies, leveraging sensor integration and real-time data analytics, are increasingly being adopted to ensure batch-to-batch consistency and provide immediate alerts upon deviation. This high level of analytical sophistication is a fundamental requirement for EGAN suppliers to meet the strict certification protocols established by major foundry clients.

Furthermore, the packaging and delivery technology forms a crucial component of the landscape. Suppliers must utilize specialized, inert packaging materials and develop rigorous cleaning and passivation procedures for delivery containers (drums, tankers, or barrels) to maintain the product’s purity throughout the supply chain. These technologies include specialized internal coatings and nitrogen blanketing systems to prevent oxidation or particulate intrusion during transport. The implementation of smart containers equipped with temperature and pressure sensors is an emerging technological trend aimed at providing end-to-end traceability and purity assurance, integrating seamlessly with the end-user’s factory input systems.

Regional Highlights

The Asia Pacific (APAC) region is indisputably the largest and fastest-growing market for Electronic Grade Ammonium Nitrate. This dominant position is directly attributable to the high concentration of advanced semiconductor fabrication facilities (fabs) located in countries such as Taiwan (TSMC, UMC), South Korea (Samsung, SK Hynix), mainland China (SMIC, Hua Hong), and Japan (Renesas, Kioxia). These nations serve as the primary global manufacturing hub for logic, memory, and specialized analog chips, generating massive, consistent demand for high-purity process chemicals. Government support through strategic industrial policies and substantial subsidies aimed at achieving self-sufficiency in chip production further fuels the expansion of the EGAN market within this region, leading to significant investments in localized high-purity chemical production capacity.

North America and Europe represent mature, high-value markets, primarily driven by R&D, specialized manufacturing, and the production of high-performance components for aerospace, defense, and high-end computing. While the volume consumption in these regions is lower compared to APAC, the demand is often for the most technologically demanding, ultra-high-purity grades (G5/PPT level), reflecting the emphasis on next-generation process development and advanced materials research. Recent legislative efforts, such as the CHIPS Act in the US and the European Chips Act, are stimulating new investments in domestic fab capacity, which is expected to modestly increase local EGAN consumption, diversifying the supply chain away from exclusive reliance on Asian suppliers.

The market in Latin America and the Middle East & Africa (MEA) remains nascent, primarily limited to small-scale electronics assembly, localized R&D, and some photovoltaic manufacturing. Demand in these regions is typically met through imports from established APAC, North American, or European suppliers. However, as certain MEA countries invest in industrial diversification, particularly in solar energy projects, the underlying demand for high-purity chemicals necessary for PV production is expected to see gradual, targeted growth. Overall, regional market dynamics are profoundly influenced by global capital expenditure cycles within the semiconductor industry, which heavily favors the establishment of new fabs in established APAC territories.

- Asia Pacific (APAC): Dominates global consumption due to the concentration of leading semiconductor foundries (Taiwan, South Korea, China, Japan). Highest growth rate projected, driven by capacity expansion and governmental support for indigenous chip manufacturing.

- North America: High-value market focused on advanced R&D and specialized, leading-edge fabrication processes. Growth expected from new US fab investments stemming from governmental incentives.

- Europe: Stable demand primarily linked to mature semiconductor manufacturing bases, automotive electronics, and strategic chemical supply companies. Focus is shifting toward securing resilient local chemical supply chains.

- Latin America (LATAM): Minor market share, largely reliant on imported EGAN for localized assembly and smaller PV projects.

- Middle East & Africa (MEA): Minimal current market presence; potential future growth tied to expanding renewable energy (solar) infrastructure projects requiring high-purity chemical inputs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Ammonium Nitrate Market.- Sumitomo Chemical

- BASF SE

- Linde plc

- Solvay S.A.

- Versum Materials (now Entegris)

- Mitsubishi Chemical Corporation

- Praxair Technology

- Air Liquide S.A.

- Kanto Chemical Co., Inc.

- Changchun Group

- Jiangsu Sunkoo Chemical Co., Ltd.

- Wego Chemical Group

- Zhejiang Kaili Chemical Co., Ltd.

- Hongji Chemical Group

- Hefei Lirong Chemical Co., Ltd.

- Shandong Jingshang Chemical Co., Ltd.

- Central Glass Co., Ltd.

- Merck KGaA

- Avantor, Inc.

- Taiyo Nippon Sanso Corporation

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Ammonium Nitrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard and electronic grade ammonium nitrate?

The primary difference is purity level; Electronic Grade Ammonium Nitrate (EGAN) contains extremely low concentrations of metal ions and particulates, typically measured in parts per billion (ppb) or parts per trillion (ppt), which is crucial for preventing defects in semiconductor manufacturing processes.

Which application segment drives the highest demand for Electronic Grade Ammonium Nitrate?

Semiconductor manufacturing is the dominant application segment, specifically processes requiring ultra-high purity chemicals for cleaning, etching, and chemical synthesis in advanced logic and memory chip fabrication (e.g., 7nm, 5nm nodes).

Why is the Asia Pacific region the largest consumer of EGAN?

APAC dominates consumption because it hosts the highest global concentration of large-scale semiconductor fabrication plants (fabs) and major flat panel display manufacturing facilities, particularly in Taiwan, South Korea, and China.

What technological factors are restraining market entry for new EGAN suppliers?

Market entry is restrained by the immense capital expenditure required for building specialized ultra-clean production facilities, the necessity for proprietary purification technologies, and the high cost of sophisticated analytical testing (ICP-MS) required for quality certification.

How do geopolitical factors affect the Electronic Grade Ammonium Nitrate supply chain?

Geopolitical tensions affect the supply chain by increasing the focus on regional diversification and resilience. Major semiconductor consumers are increasingly seeking localized sourcing or dual-sourcing strategies to mitigate risks associated with long-distance transportation and potential trade restrictions on critical high-purity chemicals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager