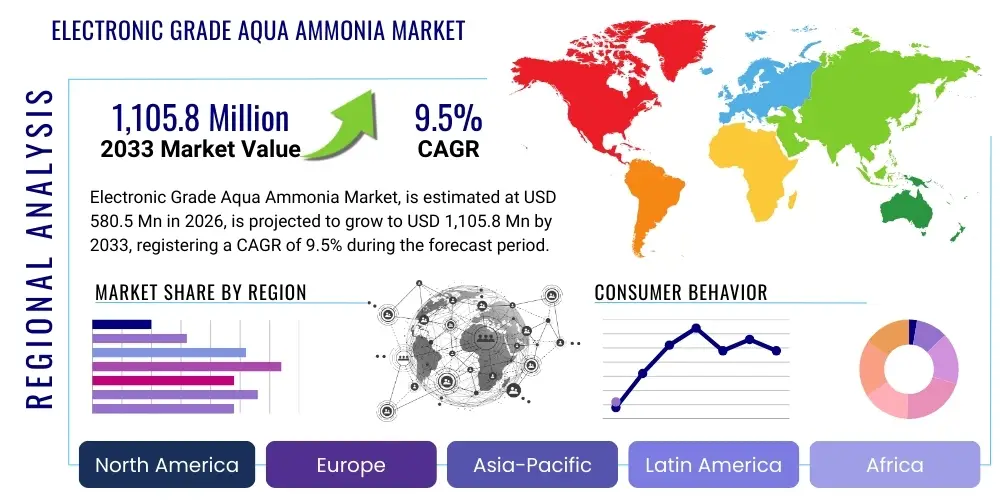

Electronic Grade Aqua Ammonia Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438069 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electronic Grade Aqua Ammonia Market Size

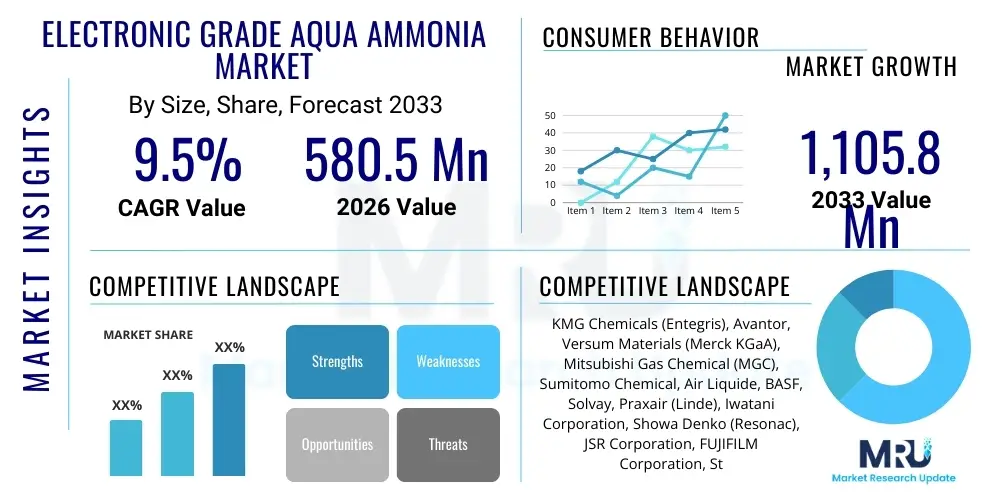

The Electronic Grade Aqua Ammonia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $580.5 Million in 2026 and is projected to reach $1,105.8 Million by the end of the forecast period in 2033. This robust expansion is directly attributed to the relentless growth of the semiconductor industry, particularly the demand for higher purity wet chemicals essential for manufacturing advanced memory chips (DRAM and NAND) and complex logic components (CPUs and GPUs) at smaller nodes, necessitating stringent quality control of cleaning and etching agents.

Electronic Grade Aqua Ammonia Market introduction

Electronic Grade Aqua Ammonia (EGA), also known as high-purity aqueous ammonia or ammonium hydroxide, is a specialty chemical crucial for the fabrication of integrated circuits (ICs) and other sophisticated electronic components. This chemical is distinguished by its extremely low metallic and particulate contamination levels, typically measured in parts per trillion (ppt) or parts per billion (ppb), adhering to rigorous standards set by industry bodies and major semiconductor manufacturers. EGA plays a vital role in several wet processing steps during chip manufacturing, ensuring optimal yield and reliability of devices built on increasingly sensitive silicon wafers.

Major applications of Electronic Grade Aqua Ammonia center around its use as a powerful and selective cleaning agent in SC-1 (Standard Clean 1) solutions, often combined with hydrogen peroxide and deionized water, used to remove organic residues and particulate matter from silicon wafer surfaces without damaging the underlying substrate. Furthermore, it serves as a mild etchant and pH regulator in specific chemical mechanical polishing (CMP) slurries and as a precursor chemical in certain deposition processes, such as chemical vapor deposition (CVD) for forming thin film layers. The benefits of using EGA include superior cleaning performance necessary for sub-10nm fabrication nodes, reduced defect rates, and enhanced component reliability.

The market is primarily driven by the escalating global demand for advanced consumer electronics, data center infrastructure, and automotive electronics, particularly electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These sectors require continuous innovation in semiconductor technology, compelling wafer fabrication plants (fabs) to increase capacity and adopt smaller feature sizes, which inherently demand higher volumes of ultra-high purity chemicals like EGA. Additionally, geographical shifts in semiconductor manufacturing, particularly the aggressive expansion of fabrication capabilities in Asia Pacific and the renewed focus on localized supply chains in North America and Europe, further propel market growth, driving capacity expansion among key chemical suppliers.

Electronic Grade Aqua Ammonia Market Executive Summary

The Electronic Grade Aqua Ammonia Market demonstrates strong growth momentum, underpinned by favorable macro-economic business trends, especially the accelerating pace of digitalization and the worldwide push for 5G, IoT, and AI integration, all requiring massive increases in high-performance computing capabilities. Key business trends include significant investments in purification technologies by chemical suppliers to achieve increasingly demanding purity specifications (E11 and beyond), coupled with strategic partnerships between specialty chemical producers and Tier 1 semiconductor manufacturers to ensure stable, localized, and resilient supply chains. This shift towards regional sourcing, spurred by recent geopolitical and logistical volatility, is redefining long-term procurement strategies and favoring suppliers who can guarantee ultra-low contamination levels consistently across large batch sizes.

Regionally, the Asia Pacific (APAC) market remains the dominant force, driven by the concentration of major foundry operations and memory manufacturers in regions such as Taiwan, South Korea, China, and Japan. China, specifically, exhibits the fastest growth due to substantial governmental investment aimed at achieving self-sufficiency in semiconductor production, necessitating vast quantities of high-purity wet chemicals. However, significant expansion is also observed in North America and Europe, fueled by policy initiatives like the CHIPS Act (US) and the European Chips Act, which incentivize the construction of new mega-fabs, thereby creating fresh demand pockets for sophisticated manufacturing materials, including EGA, within these Western geographies.

Segmentation trends indicate a notable shift towards ultra-high purity grades (E11 or customized grades) due to the migration to sub-7nm and sub-5nm manufacturing nodes, where even trace contaminants can severely compromise device yield. While low concentration types (< 15%) currently hold the largest volume share for general wafer cleaning tasks, the higher concentration grades are critical for specialized applications, and demand for these is increasing alongside the complexity of deposition and etching processes. Applications such as advanced multi-step wafer cleaning and highly selective etching are witnessing the most accelerated demand, highlighting the integral role EGA plays in maintaining the integrity of delicate features during advanced photolithography cycles and material deposition sequences.

AI Impact Analysis on Electronic Grade Aqua Ammonia Market

User queries regarding the impact of AI on the Electronic Grade Aqua Ammonia market primarily revolve around how AI-driven demand forecasting, quality control, and process optimization will influence the market's stability and growth. Users are keen to understand if AI tools will accelerate the development of next-generation semiconductors, thereby escalating the need for EGA, or if AI in manufacturing process control will lead to reduced chemical consumption through hyper-efficient usage protocols. The consensus theme is that AI will primarily act as a powerful catalyst for increased demand, driven by the massive computing power required for training large AI models and deploying AI applications, which mandates higher production of leading-edge semiconductor chips, directly increasing the requirement for high-purity wet process chemicals like EGA. Simultaneously, AI is expected to optimize chemical supply chains and purity assurance protocols, making the production and delivery of EGA more precise and resilient.

- AI drives exponential growth in high-performance computing (HPC) and data center infrastructure, necessitating increased semiconductor fabrication and, consequently, higher demand for EGA.

- Implementation of AI in semiconductor manufacturing processes enhances yield optimization, which indirectly increases the overall consumption rate of high-purity chemicals per production volume target.

- AI algorithms are utilized for real-time monitoring and predictive maintenance of purification systems, ensuring the consistently high purity levels (E11+) required for advanced node manufacturing.

- Supply chain logistics for EGA benefit from AI-powered demand forecasting, minimizing inventory risks and optimizing transport routes for these sensitive, high-value chemicals.

- AI-enabled metrology and quality inspection tools improve the detection of trace contaminants, raising the purity standards suppliers must meet, forcing technological investment in advanced purification columns and filters.

DRO & Impact Forces Of Electronic Grade Aqua Ammonia Market

The Electronic Grade Aqua Ammonia market is subjected to significant dynamic forces encompassing compelling market drivers, persistent restraints, and transformative opportunities. The primary driver remains the continuous technological miniaturization in the semiconductor industry, specifically the push toward 3nm and 2nm process nodes, where chemical purity is non-negotiable for defect reduction. This miniaturization effect ensures consistent demand growth. Restraints, however, are dominated by the exceptionally high capital expenditure required for establishing and maintaining ultra-high purity production facilities, alongside the inherent volatility associated with global semiconductor fabrication capacity utilization cycles. Opportunities are abundant in the development of specialized, environmentally friendlier grades and in capturing market share within newly established fabrication clusters globally, particularly those supported by governmental subsidies promoting local supply resilience.

The critical impact forces shaping this market include the regulatory landscape, which is steadily becoming stricter regarding effluent control and hazardous material handling, particularly in developed regions. Furthermore, the intense competition among global semiconductor giants (foundries, memory makers) to ramp up production volumes exerts downward pricing pressure on commodity-grade chemicals but simultaneously elevates the demand and premium for proprietary, ultra-pure specialty chemicals like EGA. Technological substitution risk remains relatively low, as EGA remains fundamental to standard wafer cleaning procedures (SC-1), but ongoing research into supercritical CO2 cleaning methods poses a long-term, albeit slow-moving, threat that necessitates continuous innovation in the chemical formulation.

A crucial factor is the geopolitical impact on supply chain stability. As EGA is predominantly manufactured and supplied by a limited number of specialized global chemical companies, any disruption in raw material sourcing (ammonia) or regional trade restrictions directly impacts the highly sensitive semiconductor manufacturing ecosystem. The need for dual sourcing and the localization of chemical production near mega-fabs globally are powerful driving forces resulting from these geopolitical risks, offering unique opportunities for regional suppliers to expand their footprint and for global players to diversify their manufacturing base across North America, Europe, and key Asian hubs outside of the major established centers.

Segmentation Analysis

The Electronic Grade Aqua Ammonia market is segmented based on critical parameters including Purity Grade, Concentration Level, and Application, reflecting the diverse and highly technical requirements of modern semiconductor fabrication. Purity Grade segmentation is the most impactful factor, differentiating standard electronic grades (E3, E7) suitable for older nodes or less sensitive processes from ultra-high purity grades (E11, E12) mandatory for advanced logic and memory manufacturing (sub-10nm). Concentration level dictates usage efficiency and specific process requirements, while application segments detail the final purpose of the chemical, spanning critical wafer cleaning to specialized etching and deposition processes.

- By Purity Grade:

- E3 Grade (Low Purity, high contamination risk, generally ppb levels)

- E7 Grade (Standard Purity for mature nodes, lower ppb levels)

- E11 Grade (Ultra-High Purity, critical for advanced nodes, ppt levels)

- Custom/Next-Generation Grades (Tailored for sub-5nm and beyond)

- By Concentration Level:

- Low Concentration (<= 15% NH3, commonly used in SC-1 solutions)

- High Concentration (> 15% NH3, used for specific etching and precursor formulation)

- By Application:

- Wafer Cleaning and Surface Preparation (SC-1 process)

- Etching and Stripping

- Chemical Vapor Deposition (CVD) Precursors

- Chemical Mechanical Planarization (CMP) Slurry Additives

- Others (e.g., pH adjustment in wastewater treatment of fab effluents)

- By End-User:

- Integrated Device Manufacturers (IDMs)

- Foundries (Pure-play fabs)

- Memory Manufacturers (DRAM, NAND)

Value Chain Analysis For Electronic Grade Aqua Ammonia Market

The value chain for Electronic Grade Aqua Ammonia is highly specialized and complex, starting from the upstream procurement of high-purity anhydrous ammonia (the base raw material) through to the downstream delivery to semiconductor fabrication facilities (fabs). Upstream analysis focuses on securing stable, cost-effective supplies of anhydrous ammonia, which must meet initial stringent quality controls before purification. Key challenges at this stage include managing the volatile pricing of energy and natural gas, which are integral to basic ammonia production. Suppliers must heavily invest in specialized infrastructure for transportation and storage, mitigating risks associated with handling pressurized and volatile industrial gases, requiring specialized containment and safety protocols well before the electronic purification stage.

Midstream activities involve the critical and proprietary process of converting anhydrous ammonia into ultra-high purity aqueous ammonia. This stage demands sophisticated purification technologies, including advanced filtration, ion exchange, distillation, and proprietary chemical treatments, often conducted in Class 100 or Class 10 cleanroom environments to prevent external contamination. The distribution channel involves highly specialized logistics networks, utilizing dedicated, high-purity packaging (e.g., fluoropolymer-lined containers) and temperature-controlled transport systems. Direct distribution from the producer to the mega-fab is often preferred for large-volume contracts, guaranteeing purity control and timely delivery, minimizing third-party risks inherent in complex supply chains.

Downstream analysis centers on the consumption patterns within semiconductor fabs, where EGA is categorized as a mission-critical process chemical. The relationship between chemical suppliers and end-users is often direct (direct distribution), characterized by long-term supply agreements and joint quality assurance protocols. Indirect distribution plays a smaller role, typically involving specialized chemical distributors that manage smaller, non-Tier 1 accounts or provide localized inventory management services. The efficacy of the entire value chain hinges on zero-defect tolerance at every stage, given that contamination during delivery or storage can immediately impact multi-million dollar wafer batches and severely reduce manufacturing yields.

Electronic Grade Aqua Ammonia Market Potential Customers

The primary customers for Electronic Grade Aqua Ammonia are concentrated within the high-tech electronics manufacturing ecosystem, dominated by companies involved in silicon wafer processing and advanced component fabrication. These end-users are hyper-focused on material quality, supply resilience, and technical support, viewing EGA not merely as a commodity but as a critical process enabler. The largest volume buyers include Integrated Device Manufacturers (IDMs) like Intel and Samsung, which manage their entire semiconductor production flow from design to fabrication, requiring vast quantities of consistently pure chemicals for their expansive global operations. These customers often dictate proprietary purity standards that exceed general industry benchmarks.

Pure-play foundries, such as TSMC and GlobalFoundries, represent the fastest-growing customer segment. As outsourcing of semiconductor manufacturing increases, the demand from these specialized fabrication houses for EGA escalates proportionally with their capacity expansion and technological advancement (e.g., transitioning to Gate-All-Around (GAA) architectures). These foundries are volume-driven, necessitating robust, scalable supply mechanisms for EGA, primarily used in the foundational cleaning steps of logic circuit manufacturing, ensuring defect-free interfaces crucial for subsequent deposition layers.

Furthermore, memory manufacturers, including key players in the DRAM (Dynamic Random-Access Memory) and NAND flash sectors, constitute a significant customer base. Memory fabrication involves complex, stacked structures requiring exceptionally stringent cleaning cycles to prevent layer adhesion issues and charge leakage. The adoption of advanced 3D NAND technology, involving dozens of layers, has amplified the consumption of high-purity EGA in intricate wet chemical processes. Other smaller, but important, customers include manufacturers of compound semiconductors (e.g., GaAs, SiC) and specialty microelectronics components, who also rely on EGA for specific cleaning and etching protocols in their specialized device fabrication lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million |

| Market Forecast in 2033 | $1,105.8 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KMG Chemicals (Entegris), Avantor, Versum Materials (Merck KGaA), Mitsubishi Gas Chemical (MGC), Sumitomo Chemical, Air Liquide, BASF, Solvay, Praxair (Linde), Iwatani Corporation, Showa Denko (Resonac), JSR Corporation, FUJIFILM Corporation, Stella Chemifa, Ashland, DuPont, SK Materials, Central Glass, T.N.C. Industrial Chemical, Zhejiang Huasheng Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Aqua Ammonia Market Key Technology Landscape

The technology landscape for Electronic Grade Aqua Ammonia is defined by proprietary purification methods aimed at achieving increasingly stringent levels of purity, specifically targeting metallic ions and non-volatile residues (NVRs) down to parts per trillion (ppt) levels. The core technology involves continuous distillation and multi-stage filtration processes. High-performance purification columns utilizing advanced polymeric resins and specialized membranes are employed to selectively remove trace impurities. Furthermore, suppliers are integrating advanced analytical techniques, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS), capable of detecting ultra-low levels of contamination, ensuring that the final product adheres to the demanding specifications required for 7nm and 5nm node fabrication, making process control software and real-time monitoring systems vital components of the production technology.

Significant technological advancements are focused on improving handling and packaging methods to maintain purity during transportation and storage. This includes the widespread adoption of specialized PFA (perfluoroalkoxy alkanes) and PTFE (polytetrafluoroethylene) lined containers, along with closed-loop dispensing systems at the fab site. These advanced material science applications prevent leaching and external particle ingress, which could otherwise compromise the chemical's integrity. Suppliers are also developing specialized manufacturing facilities located in close proximity to major semiconductor clusters (fab-side chemical facilities) to minimize transport time and risk, often employing just-in-time delivery systems managed through highly automated chemical distribution equipment.

Future technological trends involve the development of "green" purification technologies that reduce energy consumption and minimize chemical waste generated during the purification cycles. There is an increasing focus on achieving higher chemical yield from the raw ammonia input while meeting the ultra-high purity demands. Additionally, the industry is exploring advanced process modeling and simulation tools to predict and mitigate contamination risks in complex purification sequences. The integration of sensors and digital twin technology allows for precise control over distillation and concentration parameters, pushing the technological boundary toward the E12 grade specification, which will be essential for future 2nm and sub-2nm nodes, necessitating continuous investment in research and development to maintain competitive superiority in this critical specialty chemical sector.

Regional Highlights

The global consumption and production of Electronic Grade Aqua Ammonia are heavily concentrated within specific geographical regions, directly correlating with the distribution of semiconductor manufacturing capacity. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the vast majority of global demand, fueled by the presence of integrated manufacturing powerhouses in South Korea (Samsung, SK Hynix), Taiwan (TSMC, UMC), Japan (Kioxia, Renesas), and the rapidly expanding fabrication sector in Mainland China. The market growth in China is particularly explosive due to national strategic investments aimed at increasing domestic chip production, driving colossal demand for high-purity chemicals.

North America and Europe, while traditionally representing smaller consumption bases, are experiencing a renaissance driven by significant government incentives (CHIPS Acts). These regions are undergoing substantial increases in fab construction (e.g., Intel in Ohio and Germany; TSMC in Arizona), guaranteeing strong double-digit growth rates for EGA consumption throughout the forecast period. The focus in these Western regions is heavily tilted toward establishing secure, high-quality, localized supply chains, favoring suppliers who can rapidly build purification and delivery infrastructure near these new mega-sites, ensuring regional supply resilience against geopolitical supply shocks and minimizing logistical complexities.

- Asia Pacific (APAC): Dominant market share due to existing massive fabrication clusters; highest demand from South Korea, Taiwan, and China. Focused on mass production of advanced memory (DRAM/NAND) and cutting-edge logic chips.

- North America: Experiencing rapid market acceleration fueled by the US CHIPS and Science Act; major investments by Intel, TSMC, and Samsung are driving the need for localized EGA production and distribution hubs.

- Europe: Moderate growth trajectory bolstered by the European Chips Act, focusing on establishing supply chain security and increasing local semiconductor manufacturing capability, especially in Germany and France.

- Latin America & MEA: Minimal current market share, primarily dependent on imported finished electronic goods; growth is slow, limited to smaller assembly and testing operations rather than primary wafer fabrication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Aqua Ammonia Market.- KMG Chemicals (Entegris)

- Avantor

- Versum Materials (Merck KGaA)

- Mitsubishi Gas Chemical (MGC)

- Sumitomo Chemical

- Air Liquide

- BASF

- Solvay

- Praxair (Linde)

- Iwatani Corporation

- Showa Denko (Resonac)

- JSR Corporation

- FUJIFILM Corporation

- Stella Chemifa

- Ashland

- DuPont

- SK Materials

- Central Glass

- T.N.C. Industrial Chemical

- Zhejiang Huasheng Chemical

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Aqua Ammonia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Aqua Ammonia and why is its purity level critical in semiconductor manufacturing?

Electronic Grade Aqua Ammonia (EGA) is ultra-high purity ammonium hydroxide used in semiconductor wet chemical processing. Its extreme purity (often ppt levels) is critical because trace metallic ions or particulate contamination can cause crystalline defects, leakage currents, and severely reduce the functional yield of complex integrated circuits, especially those built on advanced, smaller manufacturing nodes (sub-10nm).

Which applications drive the highest demand for Electronic Grade Aqua Ammonia?

The highest demand is driven by wafer cleaning and surface preparation, specifically the SC-1 (Standard Clean 1) process, which uses EGA combined with hydrogen peroxide to remove organic contaminants and particles. Secondary applications include specialized etching steps and use as an additive in certain chemical mechanical planarization (CMP) slurries required for advanced chip architecture manufacturing.

How is the adoption of sub-5nm technology nodes affecting the Electronic Grade Aqua Ammonia market?

The migration to sub-5nm nodes drastically increases demand for EGA with Purity Grade E11 and higher. These smaller geometries are profoundly sensitive to defects, meaning manufacturers must procure specialty ammonia with guaranteed contamination levels in the parts per trillion (ppt) range, forcing suppliers to invest heavily in next-generation purification and analysis technology.

What role do geopolitical factors play in the supply chain of Electronic Grade Aqua Ammonia?

Geopolitical factors, including trade disputes and regional policies (e.g., US CHIPS Act, EU Chips Act), significantly influence the EGA supply chain by emphasizing the need for regional localization of production. This mitigates risks associated with long-distance international transport of sensitive chemicals and ensures a resilient supply for critical domestic semiconductor industries in North America and Europe.

What is the projected Compound Annual Growth Rate (CAGR) for the Electronic Grade Aqua Ammonia Market from 2026 to 2033?

The Electronic Grade Aqua Ammonia Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This growth is primarily fueled by accelerated global investment in new mega-fabs and the unrelenting technical requirements imposed by advanced logic and memory chip manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager