Electronic Grade Fiber Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433669 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electronic Grade Fiber Glass Market Size

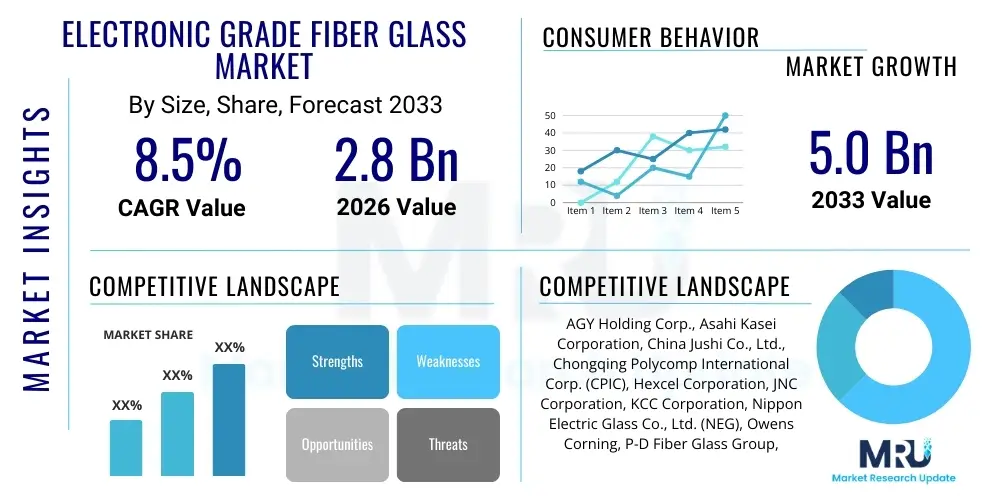

The Electronic Grade Fiber Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Electronic Grade Fiber Glass Market introduction

The Electronic Grade Fiber Glass Market encompasses the production and utilization of specialized glass fibers, primarily E-glass and related high-performance variants such as D-glass or S-glass derivatives, tailored specifically for applications requiring stringent dielectric properties, thermal stability, and mechanical strength. These materials are fundamental components in the manufacturing of Printed Circuit Boards (PCBs), especially in the form of woven roving and chopped strand mats, serving as reinforcement for laminate substrates. The demand for these materials is intrinsically linked to the global expansion of advanced electronics, including consumer electronics, automotive components, telecommunications infrastructure (5G/6G), and high-performance computing (HPC) centers.

Electronic Grade Fiber Glass is characterized by low dielectric constant (Dk) and dissipation factor (Df), making it crucial for high-speed data transmission required in modern electronic devices. The primary application involves creating prepregs and copper-clad laminates (CCLs) which are the building blocks of PCBs. As electronic devices become smaller, more complex, and require higher operating frequencies, the quality and technical specifications of the reinforcing fiber glass directly influence the overall performance and reliability of the final electronic product. Key benefits include excellent dimensional stability under thermal stress, chemical resistance, and superior mechanical durability compared to organic reinforcements.

Driving factors for this market include the rapid global rollout of 5G and future 6G networks, necessitating high-frequency, low-loss materials for base stations and mobile devices. Furthermore, the proliferation of Internet of Things (IoT) devices, the electrification of vehicles (EVs), and massive investments in cloud infrastructure and Artificial Intelligence (AI) necessitate continuous innovation in PCB technology, thereby increasing the demand for high-performance electronic grade fiber glass. The push towards miniaturization and higher power density further compels manufacturers to adopt these specialized materials over conventional glass fiber variants.

Electronic Grade Fiber Glass Market Executive Summary

The Electronic Grade Fiber Glass market is characterized by intense technological evolution driven by the accelerating demand for high-speed, high-density electronic interconnection solutions. Current business trends indicate a significant shift towards ultra-low Dk/Df glass materials, moving beyond standard E-glass toward variants like spread glass and thin glass fabrics to support High-Density Interconnect (HDI) PCBs and sophisticated multilayer board architectures required for advanced server technologies and aerospace applications. Strategic alliances between glass fiber manufacturers and PCB laminate producers are crucial for co-developing materials that meet future specifications. Sustainability concerns are also beginning to influence procurement, with manufacturers exploring eco-friendly sizing materials and reduced energy consumption processes, though technical performance remains the paramount factor.

Regionally, Asia Pacific (APAC), led by China, South Korea, Taiwan, and Japan, dominates both the production and consumption landscape due to the concentration of global electronics manufacturing hubs, including major foundries and EMS (Electronic Manufacturing Services) providers. North America and Europe, while smaller in volume, represent key centers for high-value applications such as military/aerospace electronics and advanced data center infrastructure, driving demand for the highest-specification, often proprietary, fiber glass types. The market in these developed regions prioritizes reliability and certification over sheer cost, fostering innovation in specialized coatings and treatments.

Segment trends highlight the critical growth of the thin yarn segment, essential for producing finer weave patterns and enabling the manufacture of ultra-thin core layers necessary for complex multilayer PCBs used in flagship consumer devices and advanced computing. The application segmentation shows robust growth in the data center and server segment, fueled by global digitalization and the AI boom. Furthermore, the automotive segment, particularly related to Advanced Driver-Assistance Systems (ADAS) and battery management systems (BMS) in EVs, is emerging as a powerful, high-requirement application area, demanding materials capable of handling extreme operating conditions and high-frequency communication protocols.

AI Impact Analysis on Electronic Grade Fiber Glass Market

Common user questions regarding AI’s impact on the Electronic Grade Fiber Glass market revolve primarily around two themes: the exponential demand for high-speed PCB materials needed to power AI infrastructure, and the potential for AI to optimize the manufacturing and quality control processes of the glass fiber itself. Users are concerned about whether current fiber glass technology can keep pace with the data processing speeds required by next-generation AI accelerators and generative models. Key themes emerging from this analysis include the expectation that AI deployment will drive massive investment in hyperscale data centers, thereby increasing the volume and technical demands (ultra-low Dk/Df, thermal dissipation capability) placed on electronic grade substrates. Additionally, there is significant interest in how AI tools can be integrated into glass fiber production lines to predict defects, optimize furnace energy use, and accelerate material R&D, potentially leading to novel fiber chemistries.

- AI infrastructure dramatically increases demand for high-performance, low-loss electronic grade fiber glass (e.g., woven fabrics for server boards, GPU boards).

- Accelerated adoption of ultra-thin glass fabric technology (e.g., 1080 and thinner) to facilitate higher density and reduced signal loss in AI processing units (APUs) and interconnects.

- AI-driven optimization in glass melting and drawing processes, leading to reduced energy costs and improved consistency in fiber diameter and tensile strength.

- Increased R&D speed through machine learning simulations to rapidly test and validate new fiber glass formulations with superior dielectric properties.

- Enhanced supply chain management and predictive maintenance for fiber glass manufacturing equipment, ensuring stable production capacity to meet sudden spikes in AI hardware demand.

DRO & Impact Forces Of Electronic Grade Fiber Glass Market

The Electronic Grade Fiber Glass market is heavily influenced by the dual forces of technological progression in electronics and macroeconomic factors affecting global manufacturing. Key drivers include the pervasive digitalization across industries, coupled with the mandatory rollout of 5G/6G communication infrastructure, which necessitates advanced PCB materials. However, the market faces significant restraints, notably the cyclical nature of the semiconductor and consumer electronics industries, along with the high capital intensity and strict regulatory compliance required for establishing new high-purity glass melting capacity. Opportunities arise from disruptive technologies such as advanced packaging (e.g., chiplets) and additive manufacturing techniques that require highly specialized or non-traditional substrate materials, offering avenues for premium product development and market differentiation. These factors create complex impact forces, where material innovation must be balanced against volatile market demand and intense cost pressure from high-volume applications.

The primary driver remains the continuous pursuit of faster data rates and smaller form factors in electronic devices. Every new generation of microprocessor or communications standard requires materials with lower Dk and Df values to minimize energy loss and signal latency. This pushes manufacturers toward proprietary glass formulations and specialized treatments. Counteracting this momentum are restraints such as fluctuating raw material costs (e.g., boron, silica), which directly impact profitability, and the long qualification cycles required by major electronics original equipment manufacturers (OEMs). A new fiber type must undergo rigorous testing before being approved for mass production of critical components, creating high barriers to entry for novel products.

Opportunities are vast in emerging high-reliability sectors. The growth of autonomous vehicles and aerospace electronics demands fiber glass that can withstand extreme temperature variations and vibration while maintaining signal integrity. The shift toward greener electronics also presents an opportunity for manufacturers to develop halogen-free or sustainably sourced glass fibers that meet increasingly strict environmental standards without compromising performance. Impact forces—the synthesis of these DRO elements—suggest a bifurcated market: one segment dominated by high-volume, cost-optimized standard E-glass, and a rapidly expanding, high-margin segment focused on niche, technologically superior, ultra-low-loss materials critical for future computing and connectivity.

Segmentation Analysis

The Electronic Grade Fiber Glass market is meticulously segmented based on yarn type, fabric weave, application, and end-use industry, reflecting the diverse and precise requirements of the electronics manufacturing sector. Segmentation by yarn type, such as 7628, 1080, and 106, is crucial as it dictates the density and thickness of the resulting PCB laminate, directly influencing signal propagation characteristics. The application segmentation is pivotal, with core markets like PCs/laptops giving way to higher-growth areas such as data centers and automotive electronics, each demanding specific technical performance attributes from the glass reinforcement. Understanding these segments is key for market participants to tailor production capacity and R&D efforts toward the highest-growth, highest-margin opportunities.

- By Yarn Type:

- Standard Yarns (e.g., 7628)

- Thin Yarns (e.g., 1080, 106)

- Ultra-Thin Yarns (e.g., 1027, 1035)

- By Glass Type:

- E-Glass (Standard Electronic Grade)

- D-Glass (Low Dielectric Constant)

- NE-Glass/High-Performance Variants

- By Application:

- Copper Clad Laminates (CCLs)

- Prepregs

- Others (e.g., Special Composites)

- By End-Use Industry:

- Consumer Electronics (Smartphones, Tablets)

- Telecommunications (5G Infrastructure, Base Stations)

- Automotive Electronics (ADAS, BMS, Infotainment)

- Aerospace and Defense

- IT and Data Centers (Servers, Storage)

- Industrial Electronics

Value Chain Analysis For Electronic Grade Fiber Glass Market

The value chain for Electronic Grade Fiber Glass is highly integrated and technically demanding, starting with raw material extraction and culminating in the final electronic assembly. Upstream activities involve the sourcing and purification of high-pgrade raw materials, primarily silica sand, kaolin, and boron compounds. The most critical upstream process is the glass melting stage, requiring highly controlled environments to achieve the specific chemical composition and homogeneity necessary for electronic grade materials, which directly influence the dielectric performance. Success at this stage relies heavily on energy efficiency and maintaining proprietary formulations to achieve desirable low Dk/Df properties.

Midstream processes encompass the drawing of the fiber into fine filaments, the application of specialized sizing (chemical coatings that improve adhesion to resin systems like epoxy or polyimide), and the weaving of these filaments into precise fabrics (e.g., 7628, 1080). These woven fabrics, known as glass cloth, are then sold to laminate manufacturers. The quality of the sizing treatment is a major point of differentiation, as it determines the physical and electrical compatibility between the glass and the resin. Distribution channels are typically direct from the glass weaver to the copper-clad laminate (CCL) manufacturer, minimizing intermediaries to ensure quality control and traceability.

Downstream activities involve the CCL manufacturer, who impregnates the glass fabric with resin to create prepregs and then laminates these materials with copper foil to produce CCLs. These CCLs are then purchased by PCB fabricators. The entire chain is characterized by a strong direct link between the glass fiber producer and the final electronics OEM/ODM, often necessitating high levels of collaborative R&D to optimize the substrate stack-up for new processor generations. Indirect distribution plays a minimal role, usually confined to standard-grade materials or smaller regional suppliers, as high-performance electronic grade fiber glass requires stringent technical specification management.

Electronic Grade Fiber Glass Market Potential Customers

The primary customers for Electronic Grade Fiber Glass are the manufacturers of copper-clad laminates (CCLs) and prepregs, which form the base material for PCBs. These customers act as critical intermediaries between the fiber glass producers and the ultimate end-users. Major global CCL manufacturers, often concentrated in Asia Pacific, procure large volumes of electronic grade fiber glass fabrics based on detailed specifications relating to thickness, weave pattern, and dielectric properties. These manufacturers require stable, high-volume supply and consistent quality to maintain their production cycles and meet the stringent requirements of their OEM clients.

Secondary, yet highly influential, customers are the large Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) in the electronics sector, particularly those dominating telecommunications, automotive, and IT infrastructure. While they do not purchase the fiber glass directly, their design specifications for their PCBs mandate the use of specific high-performance glass materials. Therefore, the fiber glass producers must market their technical capabilities and products to these major OEMs to ensure their material is included in the approved vendor list (AVL) of the CCL manufacturers. This strategic influence makes the technical design teams of companies like Apple, Samsung, Huawei, Cisco, and NVIDIA critical stakeholders.

Finally, specialized buyers include fabricators focused on niche, high-reliability applications, such as defense contractors and aerospace component manufacturers. These buyers often require small volumes of highly specialized fiber glass (e.g., D-glass or proprietary low-loss materials) that offer extreme thermal or radiation resistance. For these customers, cost sensitivity is lower, and the priority is placed entirely on material performance, certification, and traceability, representing a premium segment of the potential customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGY Holding Corp., Asahi Kasei Corporation, China Jushi Co., Ltd., Chongqing Polycomp International Corp. (CPIC), Hexcel Corporation, JNC Corporation, KCC Corporation, Nippon Electric Glass Co., Ltd. (NEG), Owens Corning, P-D Fiber Glass Group, Saint-Gobain Vetrotex, Taishan Fiber Glass Inc., Taiwan Glass Industry Corporation, Teijin Limited, Xingda Cable Group, Johns Manville, PPG Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Fiber Glass Market Key Technology Landscape

The technological landscape of the Electronic Grade Fiber Glass market is defined by continuous innovation aimed at reducing dielectric constant (Dk) and dissipation factor (Df) while maintaining mechanical robustness. Traditional E-glass, with its Dk around 6.0, is increasingly being challenged by proprietary low-Dk glass formulations, such as D-glass (Dk ~4.0) and high-performance variants (often boron-free or modified silica compositions), designed specifically for high-frequency and millimeter-wave applications. A key technological focus is on optimizing the glass composition by precisely controlling alkali content and introducing specialized oxides to minimize signal loss, critical for 5G and future high-speed computing platforms. This requires advanced melting furnace technologies capable of handling these complex chemistries consistently.

Beyond the core glass chemistry, significant technological progress is concentrated in the textile and sizing stages. The development of ultra-thin glass yarns (below 3.0 microns in filament diameter) and specialized weaving techniques, such as spread glass fabrics, is essential for minimizing the "glass weave effect"—a phenomenon causing signal integrity issues due to resin-rich or fiber-rich areas. Spread glass technology flattens the yarn bundle, providing a more uniform dielectric environment across the PCB surface, which is crucial for high-speed digital and RF circuits. Furthermore, manufacturers are heavily investing in high-precision looms and inspection systems to ensure fabric uniformity, zero defects, and tightly controlled thickness tolerances.

The chemical sizing applied to the fiber surface represents another critical technology area. Sizing formulations must provide excellent coupling with sophisticated resin systems, including high-Tg epoxies, polyimides, and specialized low-loss hydrocarbon resins (e.g., PTFE-based). The shift toward environmentally friendly, often halogen-free, sizing agents is a major trend, requiring chemical R&D to achieve superior resin adhesion and thermal performance without using regulated substances. Advanced sizing technology ensures maximum thermal and mechanical performance of the final laminate, which is essential for high layer count, complex PCBs used in data center switches and routers.

Regional Highlights

The Electronic Grade Fiber Glass market exhibits pronounced regional disparities, driven by the global distribution of electronics manufacturing capabilities and end-market demand. Asia Pacific (APAC) stands as the undisputed epicenter, dominating both consumption and production. This region hosts the world's largest PCB fabrication centers and most of the major copper-clad laminate manufacturers, particularly concentrated in China, Taiwan, South Korea, and Japan. The immense volume demand for consumer electronics, coupled with rapid infrastructure build-out (5G/data centers), cements APAC's market leadership. Furthermore, significant regional players have invested heavily in high-performance glass manufacturing facilities to capture domestic and export demand.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on specialized, high-reliability applications, including military, aerospace, and advanced medical devices. While the volume of standard E-glass consumption is lower than in APAC, these regions drive innovation in ultra-low Dk/Df materials and specialized proprietary chemistries. The demand here is less price-sensitive and more focused on performance, adherence to strict regulatory standards (such as ITAR or REACH), and supply chain security. This focus fosters a segment of the market where regional producers maintain a competitive edge through technical expertise and strong governmental or industrial partnerships.

Emerging markets in Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares, but demand is growing, albeit from a low base. Growth is primarily fueled by increasing digitalization, urbanization, and initial investments in domestic electronics assembly and telecommunications infrastructure upgrades. These regions typically rely on imported raw materials and finished components from APAC or established global suppliers. However, as local manufacturing capacity for basic electronic goods expands, the demand for standard electronic grade fiber glass is expected to accelerate, creating opportunities for global suppliers focusing on cost-effective, readily available material grades.

- Asia Pacific (APAC): Market leader due to concentration of PCB manufacturing and consumer electronics production; key growth driven by 5G rollout in China and South Korea, and high-volume demand from Taiwan-based foundries.

- North America: High-value market focused on defense, aerospace, and specialized server/data center PCBs; driving demand for premium, ultra-low-loss fiber glass materials and specialized sizing chemistries.

- Europe: Focus on high-reliability automotive electronics (EVs, ADAS) and industrial automation; market growth tied to stringent quality standards and regional push for advanced manufacturing technologies (Industry 4.0).

- Latin America & MEA: Developing markets showing steady growth in telecommunications and basic consumer electronics assembly; primarily reliant on imported intermediate products but potential for localized growth in standard E-glass segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Fiber Glass Market.- Nippon Electric Glass Co., Ltd. (NEG)

- Owens Corning

- China Jushi Co., Ltd.

- Chongqing Polycomp International Corp. (CPIC)

- Taishan Fiber Glass Inc.

- AGY Holding Corp.

- Saint-Gobain Vetrotex

- P-D Fiber Glass Group

- Taiwan Glass Industry Corporation

- KCC Corporation

- JNC Corporation

- Asahi Kasei Corporation

- Hexcel Corporation

- Johns Manville

- Teijin Limited

- PPG Industries

- Xingda Cable Group

- Nitto Boseki Co., Ltd.

- Superior Fibre Glass Products

- Schott AG (Specialty Glass)

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Fiber Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Fiber Glass and how does it differ from standard glass fiber?

Electronic Grade Fiber Glass (E-glass) is a specialized reinforcement material used in PCBs, characterized by its low alkali content, high insulation properties, and consistent dielectric constant (Dk) and dissipation factor (Df). It differs from standard industrial glass fiber by possessing much higher purity and tighter control over chemical composition and filament diameter, which is essential for maintaining signal integrity at high electronic frequencies.

Which fiber glass type is critical for high-frequency 5G applications?

For demanding high-frequency applications like 5G infrastructure and advanced computing, low-Dk/Df variants, such as D-Glass or proprietary high-performance NE-Glass types, are critical. These materials minimize signal loss and latency compared to standard E-glass, ensuring optimal performance for millimeter-wave communication protocols and high-speed data transmission required by these networks.

How does the shift to electric vehicles (EVs) impact the demand for this market?

The electrification of vehicles significantly increases demand for high-reliability electronic grade fiber glass. EVs require robust PCBs for battery management systems (BMS), power electronics (inverters/converters), and ADAS sensors, all of which necessitate materials capable of high thermal stability, complex layering, and superior mechanical durability under harsh automotive operating conditions.

What is the significance of "spread glass" technology in modern electronics?

Spread glass technology involves mechanically flattening the woven glass yarn bundles, leading to a flatter, more uniform fabric surface. This innovation reduces the "glass weave effect" in PCBs, which can cause differential signal delay and impedance variation, making it vital for ultra-high-speed digital and RF circuits to maintain signal integrity.

Which geographic region dominates the global Electronic Grade Fiber Glass market?

The Asia Pacific (APAC) region, driven by countries like China, Taiwan, and South Korea, dominates the global market. This dominance stems from the region's concentration of leading copper-clad laminate manufacturers, extensive PCB fabrication infrastructure, and the massive, ongoing demand from the consumer electronics and telecommunications sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager