Electronic Grade Gallium Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437876 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electronic Grade Gallium Oxide Market Size

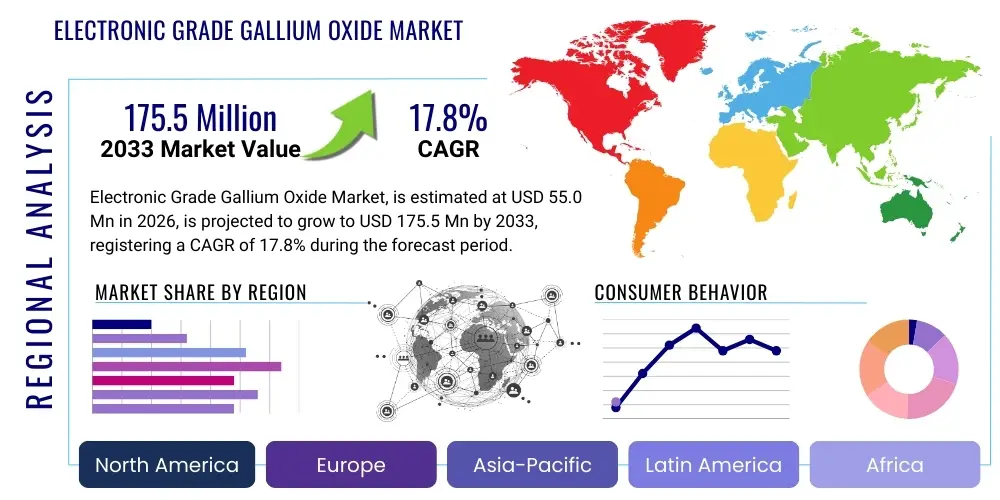

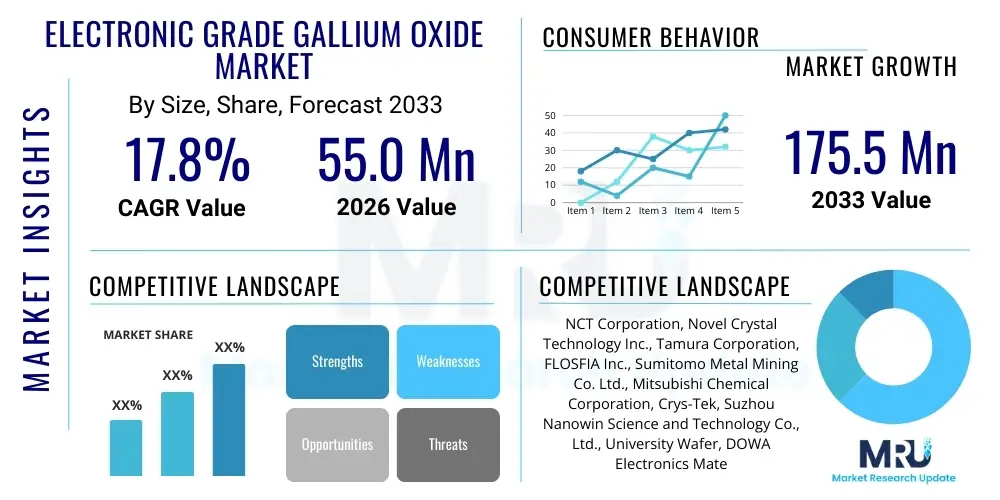

The Electronic Grade Gallium Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.8% between 2026 and 2033. The market is estimated at USD 55.0 Million in 2026 and is projected to reach USD 175.5 Million by the end of the forecast period in 2033.

Electronic Grade Gallium Oxide Market introduction

Electronic Grade Gallium Oxide (Ga2O3) stands as a critical material in the next generation of semiconductor technology, primarily due to its ultra-wide bandgap (UWBG) properties, typically around 4.8 eV to 5.3 eV, significantly exceeding that of Silicon Carbide (SiC) and Gallium Nitride (GaN). This expansive bandgap imparts exceptional characteristics, including high breakdown electric field strength, superior radiation hardness, and the potential for greater power density and efficiency in electronic devices. The material's introduction into commercial research and development is driven by the urgent industry demand for devices that can operate reliably under extreme conditions—high temperature, high voltage, and high frequency—which traditional silicon-based components fail to sustain efficiently. The inherent advantages of Ga2O3 enable the fabrication of thinner, lighter, and more energy-efficient power conversion and management systems, making it a cornerstone for future electrical infrastructure.

The primary applications of electronic grade gallium oxide are concentrated in high-power electronics, radio frequency (RF) devices, and advanced UV photodetectors. Within power electronics, Ga2O3 is ideally suited for Schottky barrier diodes (SBDs) and Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs), targeting industrial motor drives, electric vehicle (EV) charging infrastructure, and large-scale renewable energy systems. Its theoretical Baliga’s Figure of Merit (BFOM) is dramatically higher than competing wide-bandgap semiconductors, signaling its potential for transformative efficiency gains in power switching applications. Furthermore, the material’s transparency in the deep ultraviolet (DUV) range makes it invaluable for solar-blind photodetectors used in flame detection, space communication, and specialized defense applications, cementing its position as a versatile and high-performance material.

Major driving factors fueling the market expansion include global initiatives toward electrification and energy efficiency, particularly the push for high-voltage DC (HVDC) transmission and the proliferation of advanced EV platforms requiring sophisticated power management modules. The growing deployment of 5G and nascent 6G telecommunications infrastructure necessitates high-frequency, high-power RF components, a niche where Ga2O3 excels due to its thermal stability and electronic properties. Additionally, continuous technological advancements in crystal growth methods, such as the Edge-defined Film-fed Growth (EFG) technique, are progressively reducing manufacturing costs and increasing the availability of high-quality, large-diameter substrates, overcoming previous restraints related to material scalability and purity, thus accelerating its commercial viability.

Electronic Grade Gallium Oxide Market Executive Summary

The Electronic Grade Gallium Oxide Market is characterized by intense technological competition and substantial investment, positioning it as one of the fastest-growing segments within the advanced semiconductor materials industry. Business trends indicate a shift towards strategic partnerships and vertical integration, where substrate manufacturers are collaborating closely with device fabricators to standardize material quality and accelerate device prototyping. Key focus areas for businesses include perfecting mass-production techniques for large-diameter wafers (e.g., 4-inch and 6-inch) and developing effective thermal management solutions, which is a major engineering challenge for Ga2O3 devices due to its relatively low thermal conductivity compared to GaN or SiC. The market is also seeing rising venture capital interest focused on epitaxy equipment and defect reduction technologies, reinforcing the expectation of commercial breakthrough within the next three to five years.

Regionally, the Asia Pacific (APAC) currently dominates the market, largely driven by significant government funding and robust semiconductor manufacturing ecosystems in countries like Japan, China, and South Korea, which are leading research and production efforts in UWBG materials. Japan, in particular, holds a pioneering position in Ga2O3 crystal growth technologies. North America and Europe, while lagging slightly in production capacity, are strong centers for application development and end-use demand, particularly within the aerospace, defense, and electric vehicle sectors. Regional trends also show a distinct correlation between increased 5G infrastructure rollout and the accelerated adoption research of Ga2O3 components suitable for high-frequency switch applications, establishing these regions as critical future growth areas.

Segment trends highlight the critical importance of the Substrate and Epitaxial Wafer segment, which currently commands the largest market share and dictates the pace of technological readiness. The focus within this segment is strictly on achieving ultra-high purity levels (99.999% and above) and controlling crystallographic defects to enable reliable high-voltage operation. By application, the Power Devices segment, encompassing high-voltage switches and diodes, is anticipated to exhibit the highest CAGR due to the unprecedented efficiency potential of Ga2O3 in power conversion systems. Furthermore, the development of solar-blind UV detectors represents a burgeoning niche segment, capitalizing on Ga2O3's inherent material characteristics for specialized sensor technologies required in defense and industrial monitoring.

AI Impact Analysis on Electronic Grade Gallium Oxide Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electronic Grade Gallium Oxide market frequently center on two main themes: how AI technologies can accelerate the material science R&D, and conversely, how the computational demands of AI itself drive the need for Ga2O3 devices. Key concerns often revolve around the use of machine learning (ML) to optimize complex crystal growth processes, which are notoriously sensitive to minor environmental variations and impurities. Users are keen to know if AI can predict optimal growth parameters, minimize defects, and ultimately reduce the high costs associated with obtaining high-quality, large-diameter Ga2O3 substrates. Furthermore, there is significant interest in how AI, requiring massive data centers and high-speed processing hardware, necessitates extreme energy efficiency; Ga2O3 components are viewed as a potential solution to mitigate the substantial power consumption of future AI computational infrastructure, particularly in power delivery systems for advanced processors and accelerators.

The integration of AI into the Ga2O3 lifecycle facilitates transformative changes from material synthesis to device implementation. AI algorithms are increasingly employed in computational material science to simulate electronic structures, thermal behavior, and defect formation mechanisms in Ga2O3, drastically reducing the traditional trial-and-error approach inherent in developing new semiconductor materials. This application accelerates the discovery of optimal doping strategies and surface passivation techniques necessary for reliable device performance. Crucially, the deployment of energy-intensive AI processing units across cloud computing and edge devices mandates revolutionary improvements in power efficiency. Gallium Oxide's high critical electric field allows for the creation of exceptionally efficient power switches, serving as the enabling hardware layer that manages the vast energy requirements of AI data centers, ensuring operational sustainability and minimizing heat generation associated with exascale computing efforts.

- AI-driven optimization of crystal growth parameters (e.g., EFG method) to minimize defect density and increase yield.

- Machine Learning application in simulating and predicting thermal management issues inherent to Ga2O3 devices.

- Increased demand for Ga2O3-based high-efficiency power management units (PMUs) to support power-hungry AI servers and GPUs.

- AI enhancement of epitaxial layer quality control and non-destructive material testing procedures.

- Simulation of advanced device architectures (MOSFETs, HFETs) under extreme operating conditions using predictive AI modeling.

- Automation of complex fabrication steps, enhancing repeatability and precision in wafer processing.

DRO & Impact Forces Of Electronic Grade Gallium Oxide Market

The Electronic Grade Gallium Oxide Market is shaped by a potent combination of enabling drivers, significant technological restraints, and compelling opportunities that define its long-term trajectory. Drivers are fundamentally linked to the material’s intrinsic physical superiority, specifically its ultra-wide bandgap, which promises efficiencies far exceeding silicon or established wide-bandgap materials like SiC and GaN. The overarching global transition toward electric vehicles, advanced smart grids, and high-frequency communication systems (5G/6G) constitutes a massive end-user demand pull, requiring power components capable of handling higher voltages and operating at greater switching speeds with minimal loss. This material benefit, combined with increasing investment in research infrastructure by governments in major economies, provides a strong momentum pushing Ga2O3 toward commercial readiness across critical power and RF sectors.

However, significant restraints temper this growth enthusiasm, predominantly related to manufacturing maturity and inherent material challenges. The primary restraint is the low thermal conductivity of Ga2O3, which poses critical thermal management difficulties when designing high-power devices, often necessitating complex and costly heat dissipation solutions. Furthermore, the market struggles with material availability and cost; while substrate growth techniques like EFG are scalable, the process of consistently producing large-area, high-purity, and low-defect single crystals remains expensive and complex, limiting large-scale commercial viability compared to SiC. Additionally, challenges persist in developing robust p-type doping—a critical requirement for building fundamental electronic components like bipolar junction transistors—which currently restricts the material primarily to unipolar device designs (e.g., MOSFETs and SBDs), thereby limiting its full application potential.

Opportunities for market acceleration are vast and center around leveraging unique material advantages for niche high-growth applications and technological breakthroughs. The development of hybrid Ga2O3/GaN or Ga2O3/SiC structures offers a compelling opportunity to mitigate thermal restraints while utilizing Ga2O3’s superior bandgap for specific high-voltage layers, combining the best features of different materials. The growing market for specialized deep UV photodetectors, where Ga2O3 provides unmatched solar blindness and responsivity, represents a crucial early market entry point not contingent on resolving all power device thermal challenges. Moreover, sustained private and public sector investment aimed at refining epitaxy processes (HVPE, MBE) and achieving reliable p-type conductivity through advanced doping methods or band engineering techniques promises to dismantle current restraints, unlocking the full potential of Ga2O3 in the dominant power electronics sector, cementing its role as a disruptive semiconductor material.

Segmentation Analysis

The Electronic Grade Gallium Oxide Market segmentation is highly specialized, reflecting the material’s nascent stage of commercialization and its deep reliance on material quality and purity. The market is primarily divided based on the type of material produced (Substrate and Epitaxial Wafer), the purity level required for various applications, and the target end-use industry. Given that Ga2O3 is still establishing a commercial foothold, the material segment holds paramount importance, as the viability of end-use devices directly depends on the defect density and size of the single-crystal substrate. High purity levels, typically defined as 5N (99.999%) or higher, are non-negotiable for electronic applications, especially those requiring high breakdown voltage capability, making purity a key factor distinguishing electronic grade material from lower-grade chemical compounds.

Segmentation by application clearly delineates between high-power handling devices and specialized sensing components. The Power Devices segment currently dominates research funding and long-term potential due to the material's superior Baliga’s Figure of Merit, targeting transformative solutions for renewable energy and electric mobility. Conversely, the smaller, yet highly specialized, Photodetectors segment capitalizes on the intrinsic UV-sensing properties of the material, providing a valuable revenue stream and demonstrating early commercial success. The diversity in end-use sectors, spanning defense, aerospace, automotive, and IT infrastructure, underscores the material's broad applicability once manufacturing scalability and cost efficiency are fully achieved, driving different purity and geometry requirements across these distinct segments.

- By Type:

- Substrate

- Epitaxial Wafer (Homoepitaxy and Heteroepitaxy)

- By Purity:

- 5N Grade (99.999%)

- 6N Grade (99.9999%) and above

- By Application:

- Power Devices (MOSFETs, SBDs, JFETs)

- RF Devices (HEMTs)

- Photodetectors (UV Sensors)

- Other Components (e.g., Radiation Detectors)

- By End-User Industry:

- Automotive (Electric Vehicles and Charging Infrastructure)

- Aerospace & Defense

- Energy & Utilities (Smart Grid, Renewable Energy Conversion)

- Telecommunications (5G/6G Base Stations)

- Industrial Power Supplies

Value Chain Analysis For Electronic Grade Gallium Oxide Market

The value chain for electronic grade gallium oxide is complex and highly specialized, beginning with the sourcing and ultra-purification of the elemental raw material, Gallium (Ga). Upstream analysis reveals that primary Gallium is usually a byproduct of aluminum or zinc processing, requiring subsequent rigorous chemical processing to achieve the 6N or 7N purity necessary for semiconductor applications, a stage that is critical and cost-intensive. This purified Gallium is then oxidized to produce Gallium Oxide powder, which serves as the feed material for the critical substrate growth phase. Control over impurity introduction during this initial stage is paramount, as residual contaminants can drastically impact the electronic properties of the final wafer, dictating the ultimate performance limits of the device.

The midstream segment of the value chain involves two major, highly technical processes: bulk crystal growth (substrate manufacturing) and epitaxial layer deposition. Substrate production, often utilizing sophisticated methods like Edge-defined Film-fed Growth (EFG) or Czochralski techniques, transforms the purified Ga2O3 into single-crystal wafers. These substrates are then polished to achieve atomic-level smoothness. Following this, epitaxial layer growth (Homoepitaxy, typically using methods like HVPE or MOCVD) is performed to deposit the active device layers. This manufacturing phase, characterized by extremely high capital expenditure and intellectual property surrounding defect control and film thickness uniformity, dictates the material cost and accessibility in the downstream market. Manufacturers often maintain strict control over both substrate growth and epitaxy to ensure compatibility and quality assurance.

The downstream segments encompass device fabrication, distribution, and end-user integration. Device fabrication involves photolithography, etching, and metallization processes to construct discrete components such as MOSFETs or SBDs, often carried out by specialized semiconductor foundries or Integrated Device Manufacturers (IDMs). Distribution channels are typically direct for specialized electronic grade material, involving close consultation between the Ga2O3 supplier and the IDM or Original Equipment Manufacturer (OEM). Indirect distribution, utilizing specialized distributors focused on advanced materials, caters to research institutions and smaller developers. The final stage involves integration into high-power modules, charging systems, or defense sensors, where the material’s unique properties translate into superior system performance and energy efficiency for the ultimate buyers.

Electronic Grade Gallium Oxide Market Potential Customers

The core potential customers for electronic grade gallium oxide are high-tech manufacturers and system integrators focused on high-voltage and high-frequency applications where energy efficiency and reliability under extreme conditions are non-negotiable criteria. Electric Vehicle (EV) manufacturers and their tier-one power module suppliers represent a major segment. These companies require highly efficient power switches (inverters, DC-DC converters) to reduce system size, weight, and crucially, energy loss, thereby extending battery range and reducing charging times. Ga2O3's potential for high breakdown voltage allows for simpler, lighter power conversion circuits compared to silicon or even SiC solutions, directly appealing to the automotive industry's continuous drive for improved performance metrics and reduced manufacturing complexity in high-power domains.

Another significant customer base includes utility companies and manufacturers of renewable energy infrastructure, such as solar inverters and wind turbine power conditioners. The push towards smart grids and high-voltage DC (HVDC) power transmission demands components that can handle thousands of volts efficiently. Ga2O3 devices offer superior switching performance at these extreme voltages compared to existing technology, leading to reduced cooling requirements and increased lifespan for large-scale power electronics. Furthermore, the defense and aerospace sectors are critical customers, specifically requiring Ga2O3 for high-reliability, radiation-hardened power devices used in satellite communication, radar systems, and specialized military electronics where component failure is unacceptable and environmental stability is crucial.

Lastly, telecommunications infrastructure developers, particularly those building out 5G and future 6G networks, constitute a high-potential customer group. These networks rely on high-frequency, high-power RF front-end modules and base station power amplifiers. While GaN currently dominates this space, ongoing research into Ga2O3-based High Electron Mobility Transistors (HEMTs) suggests its potential for even higher frequency operation or integration into hybrid RF and power solutions. Additionally, research institutions and governmental laboratories involved in fundamental physics, material science, and military technology procurement remain essential early adopters, driving initial material specifications and developing foundational patents that will shape the long-term commercial purchasing patterns in the global semiconductor market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Million |

| Market Forecast in 2033 | USD 175.5 Million |

| Growth Rate | 17.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCT Corporation, Novel Crystal Technology Inc., Tamura Corporation, FLOSFIA Inc., Sumitomo Metal Mining Co. Ltd., Mitsubishi Chemical Corporation, Crys-Tek, Suzhou Nanowin Science and Technology Co., Ltd., University Wafer, DOWA Electronics Materials Co., Ltd., IQE Plc, Shin-Etsu Handotai Co., Ltd. (SEH), Kyma Technologies, Inc., Saint-Gobain, TAIYO NIPPON SANSO Corporation, EV Group (EVG), Aixtron SE, Applied Materials Inc., EpiGaN NV, Infineon Technologies AG (R&D focus). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Gallium Oxide Market Key Technology Landscape

The technological landscape of the Electronic Grade Gallium Oxide market is dominated by advancements in crystal growth methods, epitaxy, and device fabrication techniques specifically adapted for the material's unique characteristics. The development of scalable and cost-effective bulk crystal growth is the foremost technological challenge. Currently, the Edge-defined Film-fed Growth (EFG) method is the most commercially viable technique for producing large-diameter (up to 4-inch) substrates, favored for its potential for mass production and relatively high growth rate. However, EFG-grown crystals often contain twins and defects, necessitating strict quality control. Alternative methods, such as the Czochralski (Cz) method and Floating Zone (FZ) growth, are also explored, primarily in research settings, focusing on achieving superior crystalline quality and lower defect densities, even if currently at a higher cost and smaller scale. Achieving consistent, high-purity 6N-grade material across large wafers remains the technological benchmark that dictates market readiness.

Following substrate preparation, the success of Ga2O3 devices hinges on advanced epitaxy techniques used to deposit the active semiconductor layers. Hydride Vapor Phase Epitaxy (HVPE) is widely regarded as the most promising technique for achieving high growth rates and thick, high-quality homoepitaxial layers necessary for high-voltage power devices. HVPE offers excellent purity control and high throughput compared to other methods. Molecular Beam Epitaxy (MBE) and Metal-Organic Chemical Vapor Deposition (MOCVD) are also employed, primarily for thinner, more precisely controlled layers required for specialized RF devices or research prototypes, offering superior interface control. The core technological objective in epitaxy is the precise control over doping, especially n-type doping (often achieved using Silicon or Tin), and minimizing unintentional impurities which could degrade the material's high breakdown voltage capabilities in the final device structure.

In terms of device architecture, the technological focus centers on overcoming the p-type doping challenge and developing robust dielectric interfaces. Since reliable p-type Ga2O3 remains elusive, most commercial efforts concentrate on unipolar devices like enhancement-mode or depletion-mode MOSFETs and high-performance Schottky Barrier Diodes (SBDs). Key technological innovations include employing advanced gate dielectrics (e.g., Al2O3, HfO2) deposited via Atomic Layer Deposition (ALD) to minimize interface traps and achieve higher carrier mobility. Furthermore, mitigating the low thermal conductivity of the material drives innovation in advanced packaging and device geometry, such as the use of vertical device structures or integration with high-thermal conductivity substrates like SiC or diamond films via advanced wafer bonding techniques, ultimately ensuring stable and reliable operation at high current densities demanded by the target power electronics market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Electronic Grade Gallium Oxide, primarily driven by Japan, which is recognized as the global leader in Ga2O3 research, bulk crystal growth technology (especially EFG), and intellectual property. Countries like China and South Korea are rapidly expanding their semiconductor manufacturing capabilities and investing heavily in UWBG materials to secure a strategic advantage in the power electronics supply chain, fueled by robust government support for next-generation technology development and high regional demand from the automotive and consumer electronics sectors.

- North America: North America represents a critical hub for application development, especially within the aerospace, defense, and high-performance computing sectors. The region benefits from strong foundational research at key universities and governmental labs (e.g., Department of Defense funding). While raw material production is currently lower than in APAC, North American companies focus heavily on high-end epitaxy, device design, and integrating Ga2O3 components into mission-critical systems requiring extreme reliability and radiation hardness.

- Europe: Europe exhibits strong potential, driven primarily by its established automotive industry, massive commitments to renewable energy, and the Green Deal initiatives that mandate high energy efficiency standards. European research focuses heavily on thermal management solutions, advanced packaging for power modules, and developing innovative device structures to commercialize Ga2O3 for industrial motor drives and power grid applications. Government initiatives aim to reduce reliance on Asian material suppliers through local manufacturing support.

- Latin America (LATAM): LATAM currently holds a minor share in the market, primarily serving as an emerging end-user region. Demand is concentrated in large-scale infrastructure projects, such as power transmission networks and industrial operations, often relying on imported components. Growth is expected to be gradual, contingent upon regional investment in smart grid modernization and localized EV infrastructure development.

- Middle East and Africa (MEA): The MEA market is small but growing, driven by significant investments in diversified economies, particularly in renewable energy (solar farms) and specialized defense technologies. High ambient temperatures in certain MEA regions make the inherent high-temperature operational capability of Ga2O3 devices highly attractive for power conversion systems where traditional silicon-based components struggle to maintain efficiency and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Gallium Oxide Market.- NCT Corporation (Novel Crystal Technology Inc.)

- Tamura Corporation

- FLOSFIA Inc.

- Sumitomo Metal Mining Co. Ltd.

- Mitsubishi Chemical Corporation

- Crys-Tek

- Suzhou Nanowin Science and Technology Co., Ltd.

- University Wafer

- DOWA Electronics Materials Co., Ltd.

- IQE Plc

- Shin-Etsu Handotai Co., Ltd. (SEH)

- Kyma Technologies, Inc.

- Saint-Gobain

- TAIYO NIPPON SANSO Corporation

- EV Group (EVG)

- Aixtron SE

- Applied Materials Inc.

- Infineon Technologies AG (R&D focus)

- ROHM Co., Ltd. (R&D interest)

- Nichia Corporation

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Gallium Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Gallium Oxide and how does it compare to Silicon Carbide (SiC) and Gallium Nitride (GaN)?

Electronic Grade Gallium Oxide (Ga2O3) is an Ultra-Wide Bandgap (UWBG) semiconductor material with a bandgap (4.8-5.3 eV) significantly wider than SiC (3.3 eV) and GaN (3.4 eV). This allows Ga2O3 devices to achieve a much higher breakdown electric field, leading to components with superior power handling, greater energy efficiency, and smaller physical footprints, particularly suited for high-voltage power electronics applications.

What are the primary applications driving the demand for Ga2O3 substrates?

The primary demand drivers are the transition to high-voltage power devices (MOSFETs and SBDs) for Electric Vehicle (EV) charging infrastructure and industrial power supplies, where unprecedented energy efficiency is required. Additionally, specialized solar-blind UV photodetectors for aerospace and defense purposes capitalize on the material’s unique light-sensing characteristics.

What are the biggest technological challenges facing the commercialization of Ga2O3 devices?

The most significant challenges are the material’s low thermal conductivity, which necessitates complex thermal management solutions, and the persistent difficulty in achieving stable, high-quality p-type doping, which currently limits the design of more versatile bipolar electronic devices necessary for full commercial market penetration.

Which manufacturing technique is most critical for the cost-effective production of high-quality Ga2O3 wafers?

The Edge-defined Film-fed Growth (EFG) method is currently considered the most critical technological path for cost-effective, large-scale production of Ga2O3 substrates up to 4 inches in diameter. Advances in EFG yield and defect reduction are essential for lowering material costs and accelerating widespread commercial adoption in the semiconductor industry.

Which regions are leading the research and production in the Electronic Grade Gallium Oxide market?

The Asia Pacific region, particularly Japan, leads the world in both research and commercial production of high-quality Ga2O3 substrates, backed by pioneering work in crystal growth techniques. North America and Europe are strong contributors in advanced device application development, particularly in defense and automotive power electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager