Electronic Grade Phosphoric Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440284 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Electronic Grade Phosphoric Acid Market Size

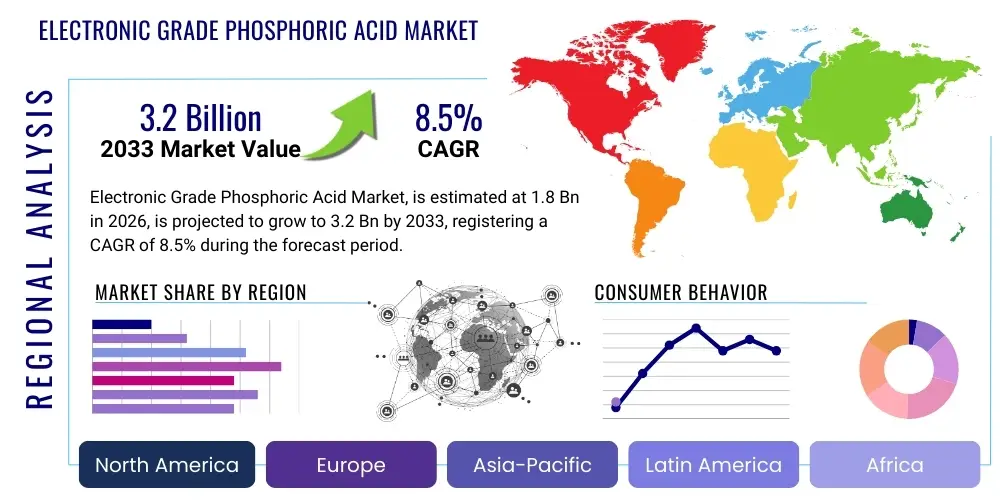

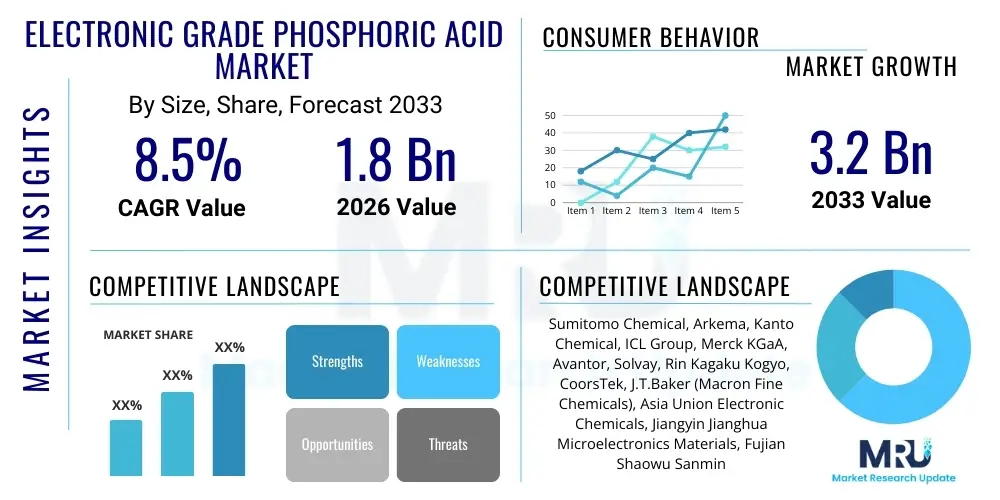

The Electronic Grade Phosphoric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Electronic Grade Phosphoric Acid Market introduction

The Electronic Grade Phosphoric Acid (EGPA) market is a highly specialized segment within the broader chemical industry, dedicated to supplying ultra-high purity phosphoric acid essential for advanced electronics manufacturing. This critical chemical, distinguished by its exceptionally low metallic and particulate impurities, serves as a cornerstone material in the production of semiconductors, flat panel displays (LCDs, OLEDs), and photovoltaic cells. Its unique properties, including its controlled etching capabilities and efficacy in cleaning sensitive surfaces, position it as an indispensable component in the fabrication of intricate electronic devices. The stringent purity specifications, often measured in parts per billion (ppb) or even parts per trillion (ppt) for critical impurities, underscore the technological sophistication required in its production and quality assurance, making it a high-value commodity in the global technology supply chain.

EGPA is primarily utilized in semiconductor manufacturing processes, where it acts as an etchant for silicon nitride and other thin films, and as a cleaning agent in various wafer fabrication steps. Its application ensures the removal of contaminants and precise patterning, which are vital for device performance and yield. Beyond semiconductors, EGPA finds extensive use in the production of display technologies, where it is employed in etching processes for glass substrates and thin-film transistors. The growing complexity and miniaturization of electronic components across industries, from consumer electronics to automotive and telecommunications, are continuously fueling demand for higher purity grades of phosphoric acid. This relentless drive for technological advancement and performance enhancement in end-use applications directly translates into an expanding and evolving market for EGPA, characterized by continuous innovation in purification techniques and quality control.

Key benefits of Electronic Grade Phosphoric Acid include its unmatched purity, consistent chemical properties, and superior performance in critical manufacturing environments, which collectively contribute to enhanced device reliability and reduced production defects. The primary driving factors for market growth stem from the burgeoning global demand for electronic devices, the rapid expansion of data centers and cloud infrastructure, the proliferation of 5G technology, the increasing adoption of electric vehicles (EVs), and advancements in artificial intelligence (AI) and machine learning (ML). These macroeconomic and technological trends necessitate the continuous production of more powerful, smaller, and energy-efficient electronic components, all of which rely heavily on high-purity materials like EGPA for their fabrication. The market is thus intrinsically linked to the broader health and innovation cycles of the global electronics industry, making it a pivotal enabler of technological progress.

Electronic Grade Phosphoric Acid Market Executive Summary

The Electronic Grade Phosphoric Acid (EGPA) market is experiencing robust expansion, fundamentally driven by the relentless growth and technological evolution within the global electronics sector. Key business trends indicate a strong emphasis on achieving higher purity levels, with manufacturers investing significantly in advanced purification technologies and rigorous quality control measures to meet the increasingly stringent demands of cutting-edge semiconductor fabrication processes. Consolidation among smaller players and strategic alliances aimed at securing raw material supply chains and expanding market reach are also notable trends. Furthermore, companies are focusing on optimizing production efficiencies and reducing environmental footprints, aligning with global sustainability initiatives, which presents both challenges and opportunities for innovation in manufacturing processes and waste management. The intense competition centers on product consistency, reliability, and the ability to innovate rapidly to serve new technological nodes.

Regionally, the Asia Pacific (APAC) continues to dominate the EGPA market, primarily due to the concentration of major semiconductor manufacturing hubs, advanced display panel factories, and photovoltaic cell production facilities in countries like Taiwan, South Korea, China, and Japan. This region is not only the largest consumer but also a significant producer, benefiting from extensive investments in electronics manufacturing infrastructure and a strong innovation ecosystem. North America and Europe, while smaller in terms of production volume, are witnessing renewed investment in domestic semiconductor manufacturing, partly driven by geopolitical considerations and supply chain resilience initiatives. These regions are also key centers for research and development, particularly in advanced materials and next-generation chip designs, which will further stimulate demand for high-purity chemicals in the long term, fostering strategic localized growth despite the existing APAC dominance.

From a segmentation perspective, the market is primarily categorized by purity level and application. The demand for ultra-high purity grades, specifically G4 and G5, is accelerating rapidly as semiconductor fabrication migrates to smaller process nodes (e.g., 5nm, 3nm). These advanced nodes necessitate exceptionally low levels of metallic and organic impurities to prevent defects and ensure device performance. In terms of applications, semiconductor etching and wafer cleaning represent the largest and fastest-growing segments, directly correlating with the increasing complexity and volume of integrated circuit production. The photovoltaic manufacturing and LCD panel production sectors also contribute significantly, driven by global renewable energy targets and the continuous evolution of display technologies. This evolving landscape of demand requires EGPA manufacturers to maintain a flexible and adaptable production portfolio, capable of catering to diverse and highly specialized requirements across the electronic manufacturing ecosystem.

AI Impact Analysis on Electronic Grade Phosphoric Acid Market

The advent and widespread integration of Artificial Intelligence (AI) are profoundly influencing the Electronic Grade Phosphoric Acid (EGPA) market, primarily by fueling an unprecedented demand for high-performance computing (HPC) chips, AI accelerators, and robust data center infrastructure. These advanced semiconductor devices, which are the backbone of AI and machine learning applications, necessitate extremely precise and defect-free manufacturing processes. Consequently, the escalating production volumes and technological complexity of AI-driven semiconductors directly translate into a surging requirement for ultra-high purity EGPA, which is indispensable for critical etching and cleaning steps. Users are keen to understand how this direct demand correlation will impact supply chain stability, potential price fluctuations, and the acceleration of R&D for even higher purity grades, as AI places increasingly stringent demands on material quality to achieve optimal computational performance and reliability.

- Increased demand for high-performance computing (HPC) chips and AI accelerators.

- Enhanced quality control and inspection systems in EGPA production leveraging AI algorithms.

- Optimization of chemical manufacturing processes and supply chain logistics through AI-driven analytics.

- Acceleration of R&D for novel purification techniques and advanced EGPA formulations.

- Predictive maintenance for production equipment, minimizing downtime and ensuring consistent output.

- Facilitation of digital twin technologies for virtual prototyping and process simulation in EGPA manufacturing.

DRO & Impact Forces Of Electronic Grade Phosphoric Acid Market

The Electronic Grade Phosphoric Acid (EGPA) market is shaped by a confluence of powerful drivers, significant restraints, and promising opportunities, all influenced by various impact forces. Key drivers include the exponential growth of the global semiconductor industry, propelled by advancements in AI, IoT, 5G, and automotive electronics, which consistently demand higher volumes and purer grades of EGPA. The increasing complexity and miniaturization of semiconductor devices also mandate more precise and contaminant-free processing, directly boosting EGPA consumption. Furthermore, the expansion of advanced display technologies like OLED and the burgeoning photovoltaic sector contribute substantially to market demand. These factors collectively create a strong and sustained pull for high-purity chemical inputs, reinforcing EGPA's critical role in modern electronics manufacturing, driving innovation in both production processes and product specifications to meet evolving industry standards.

Despite the robust growth drivers, the EGPA market faces several significant restraints. The exceptionally stringent purity requirements necessitate highly sophisticated and capital-intensive manufacturing processes, leading to high production costs and barriers to entry for new players. Volatility in raw material prices, particularly for phosphate rock, can impact profitability and supply stability. Additionally, strict environmental regulations governing the production, handling, and disposal of phosphoric acid pose ongoing compliance challenges and require substantial investments in sustainable practices and waste treatment. Geopolitical tensions and trade disputes also introduce uncertainties, potentially disrupting intricate global supply chains and affecting the availability and cost of critical inputs. These restraints often force manufacturers to innovate in process efficiency and material sourcing to maintain competitiveness and ensure business continuity in a highly regulated and technically demanding environment.

Opportunities within the EGPA market are abundant and include the emergence of new semiconductor technologies, such as advanced packaging and heterogeneous integration, which continue to push the boundaries of material purity and performance. The expansion into developing economies, where electronics manufacturing capabilities are rapidly growing, presents significant untapped market potential. Moreover, a heightened focus on green chemistry and sustainable production methods offers avenues for innovation in eco-friendly manufacturing processes, reducing waste, and improving energy efficiency, which can also enhance brand reputation and market differentiation. Strategic partnerships and collaborations between EGPA producers, equipment manufacturers, and end-users can foster co-development of solutions tailored to future technological requirements, enabling sustained growth. Impact forces such as rapid technological advancements in chip design, fluctuating global economic conditions, and evolving geopolitical landscapes continuously reshape the market dynamics, necessitating adaptive strategies from market participants to capitalize on emerging trends and mitigate potential risks effectively.

Segmentation Analysis

The Electronic Grade Phosphoric Acid (EGPA) market is comprehensively segmented to provide granular insights into its diverse applications and purity requirements, reflecting the intricate demands of the electronics manufacturing ecosystem. This segmentation typically categorizes the market based on purity level, which is a critical determinant of its suitability for various advanced processes, and by application, delineating its specific uses across different electronic components. Such detailed categorization enables market participants to understand the nuanced demands of distinct end-user industries, allowing for targeted product development, strategic marketing, and efficient resource allocation. The continuous evolution of semiconductor technology, coupled with advancements in display and photovoltaic manufacturing, consistently drives shifts within these segments, emphasizing the need for flexible and high-precision production capabilities.

The purity level segmentation is paramount, as even trace impurities can severely impact the performance and reliability of sensitive electronic components. As semiconductor nodes shrink and device complexity increases, the demand for higher purity grades intensifies, with manufacturers constantly striving to achieve "parts per billion" (ppb) or even "parts per trillion" (ppt) levels of purity for critical metallic and organic contaminants. This drive towards ultra-high purity influences both the technological investments required for purification processes and the pricing strategies within the market. Similarly, the application segmentation highlights the broad utility of EGPA, from etching delicate circuitry on silicon wafers to cleaning intricate display panels, each requiring specific chemical formulations and purity thresholds. Understanding these distinct requirements is crucial for manufacturers to tailor their product offerings and maintain a competitive edge in a market characterized by precision and performance.

- Purity Level

- G1

- G2

- G3

- G4

- G5

- Application

- Semiconductor Etching

- Wafer Cleaning

- Photovoltaic Manufacturing

- LCD Panel Production

- Others (e.g., LED, specialty components)

- Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Electronic Grade Phosphoric Acid Market

The value chain for Electronic Grade Phosphoric Acid (EGPA) is characterized by a series of highly specialized and interconnected stages, beginning with the sourcing of high-quality raw materials and culminating in its use by sophisticated electronics manufacturers. The upstream segment primarily involves the extraction and beneficiation of phosphate rock, which serves as the foundational raw material. Given the stringent purity requirements for EGPA, selecting phosphate rock with naturally low levels of undesirable impurities (such as heavy metals and radionuclides) is a critical first step. Suppliers of phosphate rock for EGPA production often undergo rigorous qualification processes to ensure consistency and suitability, distinguishing them from suppliers for commodity-grade phosphoric acid. This initial stage sets the fundamental purity baseline and significantly influences the subsequent refining efforts and costs within the value chain.

Midstream activities encompass the complex and multi-stage purification of technical or food-grade phosphoric acid into electronic grade. This transformation involves a combination of advanced chemical and physical separation techniques, including solvent extraction, ion exchange, crystallization, and membrane filtration, often in multiple iterations, to reduce impurities to ppb or ppt levels. Manufacturers invest heavily in state-of-the-art facilities, ultra-clean environments, and sophisticated analytical instrumentation (e.g., ICP-MS, ATOFMS) to monitor and control purity at every step. This intense purification process is a hallmark of EGPA production, demanding significant R&D, specialized engineering expertise, and substantial capital expenditure. Packaging in ultra-clean containers and specialized logistics for contamination prevention are also integral to the midstream, ensuring the product maintains its integrity until delivery.

The downstream segment involves the distribution and direct supply of EGPA to end-user electronics manufacturers. Distribution channels are often direct, with EGPA producers establishing strong, long-term relationships with semiconductor foundries, IDMs, display manufacturers, and photovoltaic cell producers. Given the critical nature of the material and the 'just-in-time' inventory strategies common in electronics manufacturing, reliability of supply, technical support, and logistical efficiency are paramount. Indirect channels might involve specialized chemical distributors for smaller or regional customers, but these distributors must adhere to strict handling and storage protocols to maintain product purity. The tight integration and high level of technical interaction between EGPA suppliers and their end-users underscore the strategic importance of this material within the electronics value chain, often involving collaborative efforts on quality specifications and performance optimization.

Electronic Grade Phosphoric Acid Market Potential Customers

The primary potential customers for Electronic Grade Phosphoric Acid (EGPA) are highly specialized and technologically advanced manufacturing entities within the electronics industry. At the forefront are semiconductor manufacturers, encompassing both integrated device manufacturers (IDMs) and pure-play foundries. These companies rely heavily on EGPA for various critical steps in the fabrication of microprocessors, memory chips (DRAM, NAND), sensors, and other integrated circuits. EGPA is indispensable for etching silicon nitride layers, passivating surfaces, and performing intricate wafer cleaning processes, all of which are crucial for achieving the minute geometries and high performance required in modern chips. The continuous drive towards smaller process nodes (e.g., 5nm, 3nm) and advanced packaging technologies further intensifies their demand for ultra-high purity grades of EGPA, making them the largest and most critical segment of the customer base.

Beyond the semiconductor industry, another significant customer segment includes manufacturers of flat panel displays. This group primarily comprises companies producing Liquid Crystal Displays (LCDs), Organic Light Emitting Diodes (OLEDs), and next-generation display technologies for televisions, smartphones, tablets, and automotive infotainment systems. In these applications, EGPA is utilized in etching various thin films on glass substrates, patterning electrodes, and cleaning processes to ensure defect-free and high-resolution displays. The increasing consumer demand for larger, higher-resolution, and more vibrant displays directly translates into a sustained requirement for EGPA. Similarly, manufacturers of photovoltaic (PV) cells, which convert sunlight into electricity, also represent a key customer segment. EGPA is employed in texturizing silicon wafers and in cleaning steps during solar cell fabrication to enhance efficiency and performance, driven by global renewable energy initiatives and government incentives.

Furthermore, specialized electronics component manufacturers, including those producing LEDs, advanced packaging substrates, and certain MEMS (Micro-Electro-Mechanical Systems) devices, also form a segment of potential customers. These industries, while potentially smaller in individual consumption compared to major semiconductor or display manufacturers, still require EGPA for their specific etching and cleaning applications where high precision and purity are paramount. The overarching characteristic of all these potential customers is their stringent quality control standards, their reliance on consistent chemical performance, and their continuous pursuit of technological innovation. Suppliers of EGPA must therefore offer not only ultra-pure products but also robust technical support, reliable logistics, and a deep understanding of their customers' evolving manufacturing processes to effectively serve this highly demanding and specialized market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, Arkema, Kanto Chemical, ICL Group, Merck KGaA, Avantor, Solvay, Rin Kagaku Kogyo, CoorsTek, J.T.Baker (Macron Fine Chemicals), Asia Union Electronic Chemicals, Jiangyin Jianghua Microelectronics Materials, Fujian Shaowu Sanming Chemical, Hubei Xingfa Chemicals Group, Yunnan Phosphor Chemical Group, LCY Chemical Corp., Taiwan Union Technology, Daejung Chemical, Cheil Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Phosphoric Acid Market Key Technology Landscape

The Electronic Grade Phosphoric Acid (EGPA) market is underpinned by an advanced and continuously evolving technology landscape, primarily focused on achieving and maintaining ultra-high purity levels required by the electronics industry. A cornerstone of this landscape is the development and implementation of sophisticated purification technologies. These include multi-stage solvent extraction, which selectively removes metallic and organic impurities based on their differential solubilities; ion exchange resins, which are highly effective in removing specific ionic contaminants; and advanced crystallization techniques, designed to separate impurities through controlled precipitation. Additionally, membrane separation processes, such as nanofiltration and reverse osmosis, are increasingly being employed to further polish the acid and remove particulate matter, ensuring the highest possible purity demanded by cutting-edge semiconductor fabrication processes. These purification innovations are critical for meeting the ever-tightening specifications for trace elements, measured in parts per billion (ppb) or even parts per trillion (ppt).

Alongside purification, advanced analytical methodologies form another crucial pillar of the EGPA technology landscape. To guarantee product quality and consistency, manufacturers utilize highly sensitive and precise analytical instruments capable of detecting and quantifying ultra-trace impurities. Inductively Coupled Plasma Mass Spectrometry (ICP-MS) is widely employed for its ability to detect a broad spectrum of metallic impurities at very low concentrations. Atomic Fluorescence Spectrometry (AFS) and Anodic Stripping Voltammetry (ASV) are also used for specific elemental analysis. Furthermore, techniques like Particle Counter analysis are essential for monitoring particulate contamination, while Total Organic Carbon (TOC) analyzers ensure organic impurity levels are within acceptable limits. The continuous innovation in these analytical tools, including the integration of automation and data analytics, is vital for real-time quality control, process optimization, and compliance with the dynamic purity standards of the electronics industry, thereby enhancing reliability and reducing manufacturing defects in end-user applications.

Process automation and digital transformation are increasingly impacting the EGPA technology landscape, driving efficiency, consistency, and safety. Advanced control systems, often integrated with AI and machine learning algorithms, are used to monitor and adjust purification parameters in real-time, optimizing yields and minimizing waste. Robotics are being employed in handling and packaging to reduce human intervention and potential contamination. Furthermore, the adoption of digital twin technologies allows for virtual prototyping and simulation of manufacturing processes, enabling predictive maintenance and process optimization without disrupting actual production. These technological advancements not only contribute to achieving superior product quality and cost-efficiency but also address environmental concerns by optimizing resource utilization and minimizing the generation of hazardous waste. The integration of these diverse technologies creates a robust and agile production environment, capable of responding to the stringent and evolving demands of the global electronic materials market.

Regional Highlights

- Asia Pacific (APAC): Dominates the Electronic Grade Phosphoric Acid market due to the concentration of major semiconductor manufacturing hubs, advanced display panel factories, and photovoltaic cell production facilities in countries like Taiwan, South Korea, China, and Japan. The region benefits from extensive investments in electronics manufacturing infrastructure, a skilled workforce, and a robust innovation ecosystem, making it both the largest consumer and a significant producer.

- North America: A key region for research and development in advanced semiconductor materials and next-generation chip designs. While not the largest production hub for EGPA, North America is witnessing renewed investment in domestic semiconductor manufacturing, driven by strategic initiatives and geopolitical considerations aimed at enhancing supply chain resilience. Demand is strong from high-tech industries and specialized electronics component manufacturers.

- Europe: Characterized by a strong focus on high-value, specialized electronic components, automotive electronics, and R&D in materials science. European governments and industries are increasingly investing in developing local semiconductor capabilities and fostering innovation in advanced manufacturing processes, which will stimulate demand for EGPA, particularly for higher purity grades used in niche applications.

- Latin America: An emerging market for electronics manufacturing, with increasing investments in consumer electronics assembly and localized component production. While currently a smaller consumer of EGPA compared to other regions, its growth trajectory in industrialization and technological adoption presents future opportunities for market expansion, particularly in lower to mid-range purity grades.

- Middle East and Africa (MEA): Represents a nascent but growing market for Electronic Grade Phosphoric Acid, driven by diversification efforts into technology-driven industries and increasing foreign direct investment in manufacturing. The region's potential lies in its burgeoning digital infrastructure projects and developing electronics assembly capabilities, which will gradually increase its demand for high-purity chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Phosphoric Acid Market.- Sumitomo Chemical

- Arkema

- Kanto Chemical

- ICL Group

- Merck KGaA

- Avantor

- Solvay

- Rin Kagaku Kogyo

- CoorsTek

- J.T.Baker (Macron Fine Chemicals)

- Asia Union Electronic Chemicals

- Jiangyin Jianghua Microelectronics Materials

- Fujian Shaowu Sanming Chemical

- Hubei Xingfa Chemicals Group

- Yunnan Phosphor Chemical Group

- LCY Chemical Corp.

- Taiwan Union Technology

- Daejung Chemical

- Cheil Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Phosphoric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Phosphoric Acid (EGPA) and its primary use?

Electronic Grade Phosphoric Acid (EGPA) is an ultra-high purity form of phosphoric acid, characterized by exceptionally low levels of metallic and particulate impurities. Its primary use is in the semiconductor industry for etching silicon nitride and other thin films, as well as for cleaning wafers during the fabrication of integrated circuits, critical for preventing defects and ensuring device performance.

Why is purity so critical for EGPA in electronics manufacturing?

Purity is paramount for EGPA because even trace amounts of impurities (parts per billion or trillion) can cause critical defects in semiconductor devices, leading to electrical shorts, poor performance, or complete device failure. As chip geometries shrink, the tolerance for impurities becomes even lower, necessitating increasingly stringent purity standards for EGPA.

Which regions are leading in demand and production for EGPA?

The Asia Pacific (APAC) region, particularly countries like Taiwan, South Korea, China, and Japan, dominates both the demand and production of EGPA. This is due to the high concentration of semiconductor foundries, display panel manufacturers, and photovoltaic cell production facilities in these nations, driving substantial consumption.

What are the key drivers for the Electronic Grade Phosphoric Acid market growth?

The key drivers include the robust expansion of the global semiconductor industry, propelled by advancements in AI, IoT, 5G, and electric vehicles (EVs). The increasing demand for advanced computing devices and higher-resolution displays also fuels the need for ultra-high purity EGPA.

What challenges do EGPA manufacturers face?

EGPA manufacturers face challenges such as high production costs associated with multi-stage purification processes, stringent environmental regulations, volatility in raw material prices (phosphate rock), and the continuous need for significant R&D investment to meet evolving purity standards for next-generation electronic devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Grade Phosphoric Acid Market Size Report By Type (Panel Level, IC Level, Others, By Grade, 80% Purity), By Application (Semiconductor, Liquid Crystal Display (LCD), VLSI & ULSI, Others, By End Use Industry, Semiconductor and Electronics, Materials & Chemicals, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- High Purity Electronic Grade Phosphoric Acid Market Statistics 2025 Analysis By Application (Cleaning, Etching), By Type (2 N, 3 N), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager