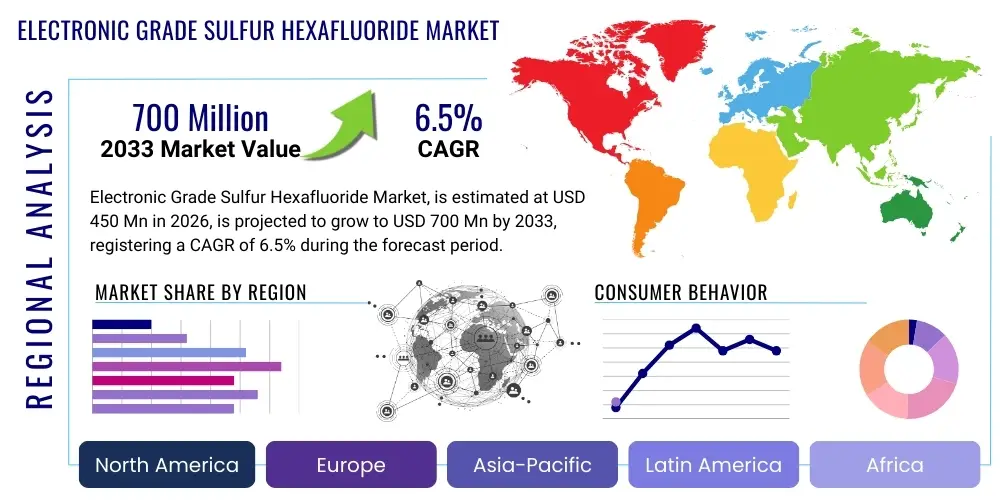

Electronic Grade Sulfur Hexafluoride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437424 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electronic Grade Sulfur Hexafluoride Market Size

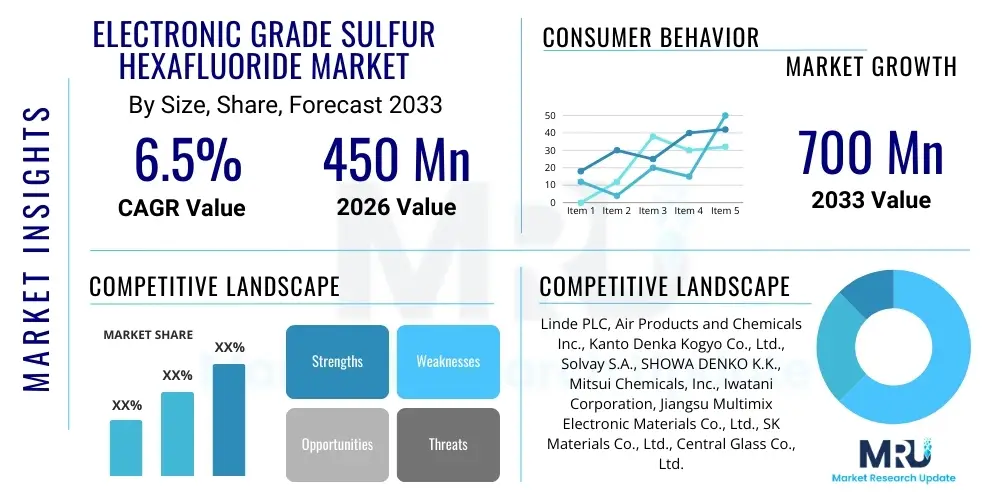

The Electronic Grade Sulfur Hexafluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Electronic Grade Sulfur Hexafluoride Market introduction

The Electronic Grade Sulfur Hexafluoride (SF6) market encompasses the supply and distribution of ultra-high purity SF6 gas specifically tailored for use in advanced electronics manufacturing processes, primarily within the semiconductor and flat panel display industries. This specialized grade demands purity levels exceeding 99.999%, with extremely low moisture and particulate contamination, critical for maintaining the integrity of delicate microelectronic circuits and minimizing yield loss during fabrication. SF6 functions primarily as an etchant, facilitating precise plasma etching of silicon wafers, particularly in deep reactive-ion etching (DRIE) and other critical pattern transfer steps essential for producing high-density integrated circuits (ICs), memory chips, and microelectromechanical systems (MEMS). The market dynamics are inextricably linked to global capital expenditure cycles in semiconductor fabrication plants (fabs) and technological advancements requiring increasingly intricate circuit designs.

Electronic Grade SF6 is an inert, non-toxic, and highly electronegative gas utilized for its superior dielectric strength and effective etching properties. Beyond etching, it is widely employed as a chamber cleaning gas in chemical vapor deposition (CVD) tools. After depositing materials like silicon dioxide or nitride onto wafers, SF6 is introduced into the chamber to clean residual layers quickly and efficiently, ensuring equipment uptime and process stability. The high cost associated with producing and handling ultra-pure SF6, coupled with stringent environmental regulations due to its high Global Warming Potential (GWP), necessitates specialized supply chains, robust recycling programs, and advanced abatement technologies, which fundamentally shape the competitive landscape of this niche market.

Major driving factors accelerating market expansion include the sustained proliferation of 5G technology, the rapid growth of data centers, the escalating demand for high-performance computing (HPC), and the development of smaller, more powerful electronic devices. These applications mandate smaller process nodes (e.g., 3nm, 2nm), increasing the complexity and the number of etching and cleaning cycles required per wafer, consequently boosting SF6 consumption. Furthermore, the global shift towards building regional semiconductor supply chain resilience (e.g., US CHIPS Act, European Chips Act) translates into massive investments in new fabrication facilities, which directly translates into a surging demand for specialized process gases like Electronic Grade SF6. However, regulatory pressures aiming to phase out high-GWP gases remain a significant long-term constraint.

Electronic Grade Sulfur Hexafluoride Market Executive Summary

The Electronic Grade Sulfur Hexafluoride (SF6) market is characterized by robust growth, primarily driven by unprecedented capital investments in the semiconductor sector globally, particularly in Asia Pacific. Business trends indicate a focus on supply chain purification and localization, as manufacturers seek to mitigate geopolitical risks and ensure stable access to ultra-high purity materials. Leading suppliers are aggressively investing in enhanced purification technologies, specialized transportation logistics for cylinders and bulk delivery, and sophisticated gas management systems at customer sites. A critical development is the increasing adoption of SF6 recycling and recovery systems, driven by both corporate sustainability goals and mounting environmental regulations regarding greenhouse gas emissions. Strategic partnerships between gas suppliers and major semiconductor foundries are becoming essential to guarantee high-volume, continuous supply that meets the evolving demands of advanced process nodes.

Regional trends clearly indicate the Asia Pacific (APAC) region, dominated by Taiwan, South Korea, China, and Japan, as the definitive epicenter of consumption, owing to the concentration of the world's most advanced semiconductor manufacturing capacity. China's ambitious national semiconductor self-sufficiency goals are fueling massive domestic fabrication capacity expansion, leading to the fastest regional growth rate, despite current geopolitical tensions affecting technology trade. North America and Europe, while smaller consumers, are experiencing renewed interest and investment following government incentives to onshore semiconductor production, suggesting sustained long-term growth in these established but regulatory-sensitive markets. Regulatory divergence, particularly regarding SF6 usage limitations across different jurisdictions (e.g., EU F-Gas regulations vs. less stringent Asian regulations), dictates regional operational strategies for suppliers.

Segmentation trends highlight that the consumption by Application segment is significantly dominated by etching processes, which require high volumes of SF6 for achieving anisotropic profiles in critical layers. However, the chamber cleaning segment is showing rapid growth due to the increased frequency of cleaning cycles mandated by highly sensitive extreme ultraviolet (EUV) lithography tools and complex multi-layer structures. In the Purity Grade segment, ultra-high purity (UHP) SF6 (typically 5N and 6N purity levels) is experiencing the highest demand growth, reflecting the industry's pervasive shift towards smaller feature sizes where even minute impurities can cause catastrophic device failure. The rise of advanced memory manufacturing (DRAM and NAND flash) and complex logic devices continues to reinforce the need for the highest available purity standards, driving premium pricing within the market.

AI Impact Analysis on Electronic Grade Sulfur Hexafluoride Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Electronic Grade Sulfur Hexafluoride market typically revolve around three core themes: process optimization, demand stimulation, and regulatory compliance assistance. Users are keen to understand how AI algorithms can optimize SF6 consumption within fabrication plants, thereby reducing costs and environmental footprint. Specific questions address the use of machine learning (ML) to predict optimal plasma etching parameters, minimizing SF6 wastage during chamber cleaning cycles, and improving the efficiency of abatement systems. Furthermore, there is significant interest in how the overwhelming demand for specialized AI hardware (AI accelerators, GPUs, specialized ASICs) will drive the underlying production of advanced semiconductors, leading directly to increased overall SF6 consumption. Finally, users question AI's role in helping companies navigate complex environmental reporting and compliance related to SF6's high Global Warming Potential.

AI's primary influence is indirect, stemming from the explosive increase in demand for high-end semiconductor chips necessary to power modern AI systems, large language models (LLMs), and data centers. These specialized computing chips are manufactured using the most advanced process nodes, often requiring 3D stacking and multiple deep etching steps (DRIE), which are highly dependent on Electronic Grade SF6. Consequently, AI acts as a fundamental demand driver, forcing semiconductor manufacturers to scale production and requiring more high-purity process gases. Simultaneously, direct application of AI within the fab environment, specifically in predictive maintenance and process control systems, offers the potential to slightly offset this increased demand by optimizing gas utilization rates and improving yield, leading to more efficient SF6 use per wafer produced.

The implementation of predictive analytics powered by AI allows fabrication facilities to maintain unprecedented levels of process consistency. By analyzing vast datasets generated during etching and deposition, ML models can identify optimal gas flow rates, pressure settings, and plasma power levels in real-time. This sophisticated control minimizes over-etching, reduces the need for re-runs, and ensures that the SF6 utilized achieves maximum material removal efficiency before being exhausted or abated. While AI dramatically increases the consumption baseline through higher production volumes, it simultaneously introduces incremental efficiency gains that enhance the value derived from every molecule of Electronic Grade SF6 consumed.

- AI-driven demand acceleration for advanced logic and memory chips, directly boosting SF6 consumption in front-end manufacturing.

- Implementation of Machine Learning (ML) for real-time optimization of plasma etching parameters, aiming for improved SF6 utilization efficiency.

- Enhanced predictive maintenance in CVD and etching tools, minimizing unplanned downtime and ensuring stable SF6 supply utilization.

- AI integration in smart environmental monitoring and reporting systems for precise tracking and management of SF6 emissions, aiding compliance.

- Potential for AI models to accelerate research into SF6 alternatives by rapidly screening and simulating new etching gas chemistries.

DRO & Impact Forces Of Electronic Grade Sulfur Hexafluoride Market

The market for Electronic Grade Sulfur Hexafluoride is propelled by the relentless expansion of the semiconductor industry and the ongoing reduction in feature size, necessitating highly precise etching agents. Conversely, the market faces significant headwinds due to the potent greenhouse gas nature of SF6, which invites intense regulatory scrutiny and pushes for the development and adoption of lower Global Warming Potential (GWP) alternatives. Opportunities arise from technological shifts, such as the increasing commercialization of MEMS devices and advanced 3D NAND structures, which utilize complex DRIE processes heavily dependent on SF6. These internal and external pressures create a high-impact force environment where innovation in recycling and purity standards dictates market resilience and competitive advantage.

Key drivers include the global push for digitalization and connectivity, exemplified by 5G rollout, IoT adoption, and hyperscale data center expansion, all reliant on advanced chips manufactured using SF6. The technical superiority of SF6 in deep silicon etching (high selectivity and anisotropy) remains unmatched by commercially viable alternatives in many critical applications. However, restraints are formidable; SF6 has a GWP of approximately 23,500 over a 100-year horizon, making it one of the most potent greenhouse gases targeted by international protocols and regional legislation, such as the EU F-Gas Regulation review. This environmental liability compels manufacturers to invest heavily in costly abatement and end-of-pipe mitigation technologies, increasing operational expenditure and encouraging substitution efforts.

Opportunities for growth are centered around innovation in SF6 handling and purity enhancement. The continued pursuit of sub-5nm process technology demands even higher purity levels (7N or greater) of SF6, opening premium market segments for suppliers capable of achieving these stringent specifications. Additionally, the need for robust SF6 reclamation and purification facilities offers significant business avenues, transforming used gas into high-quality electronic grade material, thereby mitigating environmental risk and improving resource efficiency. The balance between SF6's technological indispensability in current fabrication methods and the imperative to comply with decarbonization goals defines the core impact forces shaping investment decisions and technological roadmaps across the electronic materials supply chain.

Segmentation Analysis

The Electronic Grade Sulfur Hexafluoride market is primarily segmented based on Purity Grade, Application, and End-User. Analyzing these segments provides crucial insight into where the highest value and demand growth are situated. The market is increasingly polarizing toward ultra-high purity (UHP) standards, as sub-micron geometries require gas purity levels that minimize defect density and ensure high manufacturing yields. The semiconductor industry's continuous drive toward smaller nodes (e.g., 3nm, 2nm) ensures that the 5N (99.999%) and 6N (99.9999%) purity grades command the highest premium and exhibit the fastest growth trajectory, often requiring specialized, expensive purification techniques such as fractional distillation and advanced filtration.

From an application standpoint, plasma etching dominates consumption. SF6 is critical for processes like Deep Reactive Ion Etching (DRIE), especially in the fabrication of MEMS, sensors, and 3D NAND memory structures, where achieving high aspect ratios and vertical profiles is mandatory. However, the chamber cleaning application is rapidly expanding its share, driven by the intense cleaning cycles required for highly contaminant-sensitive tools, particularly those using advanced deposition techniques (e.g., Atomic Layer Deposition or ALD) essential for multi-patterning and high-k metal gate structures. The efficiency of SF6 in cleaning deposition residues quickly makes it indispensable, despite regulatory pressure, as downtime costs in modern fabs are extremely high.

Geographically, the Asia Pacific region dictates the global market, both in terms of consumption volume and technological adoption pace, reflecting its status as the world’s manufacturing hub for ICs and displays. The end-user segment is narrowly focused, with integrated device manufacturers (IDMs), pure-play foundries (e.g., TSMC, Samsung Foundry), and memory manufacturers (e.g., Micron, SK Hynix) constituting the vast majority of demand. Growth within these segments is entirely dependent on their individual capital expenditure cycles and global market share fluctuations in logic and memory chip production. The niche market for Flat Panel Display (FPD) manufacturing, while important, is secondary in volume compared to the core semiconductor sector, utilizing SF6 primarily for plasma processing of thin-film transistors (TFTs).

- Purity Grade:

- 5N (99.999%)

- 6N (99.9999%) and Above

- Application:

- Plasma Etching (DRIE, RIE)

- Chamber Cleaning (CVD Equipment)

- Others (e.g., Ion Implantation, Calibration)

- End-User:

- Integrated Device Manufacturers (IDMs)

- Foundries (Pure-Play)

- Memory Manufacturers

- Flat Panel Display Manufacturers

- MEMS/Sensor Manufacturers

- Packaging Type:

- Cylinders

- Bundles

- Bulk Tankers

Value Chain Analysis For Electronic Grade Sulfur Hexafluoride Market

The value chain for Electronic Grade Sulfur Hexafluoride is highly specialized, beginning with the complex and energy-intensive manufacturing of raw industrial-grade SF6, moving through extensive multi-stage purification, highly specialized logistics, and ultimately, delivery to sophisticated end-users. The upstream segment involves the synthesis of SF6, typically involving the reaction of sulfur with fluorine gas, a process dominated by a few large industrial chemical manufacturers globally. This raw material must then undergo rigorous purification to eliminate contaminants such as moisture, metallic particles, and other gaseous impurities (e.g., air, CF4, SO2), often requiring advanced cryogenic distillation and proprietary adsorbent techniques to achieve the electronic grades (5N to 6N) required by the semiconductor industry. Control over these purification assets represents a significant competitive barrier to entry.

Midstream activities are characterized by specialized packaging, certification, and distribution. Since SF6 is a critical process material, stringent quality control protocols, including detailed Certificate of Analysis (CoA) for every cylinder or delivery lot, are mandatory. Distribution channels are predominantly direct, involving close collaboration between the major specialty gas suppliers (e.g., Linde, Air Products, Kanto Denka) and the mega-fabs. The direct channel ensures security of supply, minimizes contamination risks associated with multiple transfers, and facilitates the integration of gas management systems (GMS) at the customer site. Indirect distribution is minimal, typically reserved for smaller volume or emerging market customers through specialized chemical distributors who still require robust handling and logistical capabilities due to the product's classification as a high-pressure, regulated gas.

The downstream segment centers on consumption, recovery, and abatement within the fabrication plants. End-users require reliable, continuous flow of SF6 delivered under high-pressure conditions directly to their etching or CVD tools. A crucial component of the downstream value chain, and an area of increasing investment, is the SF6 abatement and recovery infrastructure. Due to environmental regulations, exhaust gases containing SF6 must be treated—either by capturing and recycling the gas for subsequent purification (economic and environmental benefit) or by destroying it through thermal oxidation or plasma decomposition before release. The efficiency of these abatement technologies directly impacts the operating costs and regulatory compliance of the semiconductor manufacturer, effectively extending the value chain past simple consumption to responsible lifecycle management.

Electronic Grade Sulfur Hexafluoride Market Potential Customers

The primary consumers and buyers of Electronic Grade Sulfur Hexafluoride are global entities deeply vested in the manufacturing of high-technology microelectronic components, demanding extremely high purity levels and reliable supply logistics. These potential customers fall predominantly within the semiconductor ecosystem, specifically Integrated Device Manufacturers (IDMs) like Intel and Samsung, which control the entire process from design to fabrication, and Pure-Play Foundries such as Taiwan Semiconductor Manufacturing Company (TSMC) and GlobalFoundries. These companies require vast, uninterrupted quantities of SF6 to maintain continuous production cycles across multiple fabrication facilities (fabs), particularly as they transition to sub-5nm and sub-3nm nodes, where process gas reliability is paramount to achieving viable yields.

Secondary, yet significant, customer segments include specialized memory manufacturers focusing on complex 3D NAND Flash and DRAM technologies. Companies like SK Hynix and Micron Technology rely heavily on the anisotropic etching capabilities of SF6 to create the deep, vertical channels and stack structures necessary for high-density memory arrays. The transition from 2D planar structures to 3D vertical architecture has dramatically increased the demand for SF6 in these facilities, making memory producers a core growth vector for the market. Furthermore, manufacturers of Microelectromechanical Systems (MEMS) and sensors are crucial customers, as their components (e.g., accelerometers, gyroscopes, pressure sensors) often rely exclusively on the Bosch process, a specific method of Deep Reactive Ion Etching (DRIE) that uses SF6 and C4F8 cycling to create high aspect ratio features, differentiating their demand profile from standard IC production.

Lastly, the Flat Panel Display (FPD) sector, encompassing manufacturers of high-resolution LCD and OLED screens, utilizes Electronic Grade SF6 for thin-film transistor (TFT) etching and plasma cleaning processes. While the volume per facility is generally lower than that of a leading-edge semiconductor fab, the collective demand from major display producers in Asia (e.g., BOE Technology, LG Display) forms a stable base load for the market. These customers emphasize supply security and competitive pricing, typically consuming slightly lower purity grades than the most advanced semiconductor nodes. All these end-users prioritize suppliers who can offer integrated solutions that include sophisticated gas delivery systems, comprehensive environmental management services, and effective SF6 recycling programs, reflecting a holistic purchasing requirement beyond merely the gas itself.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Products and Chemicals Inc., Kanto Denka Kogyo Co., Ltd., Solvay S.A., SHOWA DENKO K.K., Mitsui Chemicals, Inc., Iwatani Corporation, Jiangsu Multimix Electronic Materials Co., Ltd., SK Materials Co., Ltd., Central Glass Co., Ltd., Chengda New Material, Praxair (now part of Linde), Sumitomo Seika Chemical Co., Ltd., Versum Materials (now part of Merck KGaA), Electronic Materials Corporation (EMC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Sulfur Hexafluoride Market Key Technology Landscape

The technology landscape surrounding Electronic Grade Sulfur Hexafluoride is primarily focused on achieving ultra-high purity, enhancing delivery mechanisms, and implementing advanced environmental mitigation systems. The purification technology segment utilizes highly sophisticated processes such as cryogenic distillation, which separates SF6 from contaminants based on boiling point differences at extremely low temperatures, and specialized adsorption techniques using molecular sieves to remove trace moisture and fluorinated byproducts down to parts per billion (ppb) levels. Suppliers must continuously refine these methods to meet the ever-increasing purity demands imposed by the latest node shrinks in semiconductor manufacturing, often requiring specialized, non-corrosive material handling systems throughout the purification train.

Delivery and infrastructure technology are critical elements of the landscape. Electronic Grade SF6 is typically delivered via specialized, highly polished, stainless steel cylinders or bulk tube trailers, requiring rigorous cleaning and passivation treatments to prevent internal contamination that could degrade the gas purity. Advanced gas management systems (GMS) are installed at customer sites to monitor real-time consumption, tank levels, pressure, and flow rates with exceptional accuracy. These GMS systems are increasingly integrated with predictive analytics platforms to ensure just-in-time delivery and prevent costly stock-outs in 24/7 fabrication environments. Furthermore, suppliers are investing in proprietary valve and regulator technology designed to minimize particle generation and maintain hermetic seals, safeguarding the UHP status of the gas right up to the point of process injection.

A significant technological focus is dedicated to abatement and resource recovery due to environmental pressures. Abatement technologies are broadly categorized into combustion-based (thermal oxidation) and non-combustion methods (plasma decomposition or catalytic conversion). Modern fabs prefer high-efficiency abatement units capable of destroying SF6 with greater than 99.99% efficiency before the exhaust is released. Simultaneously, gas recovery and recycling technology represents a key area of innovation. Sophisticated recovery units capture spent SF6, remove byproducts, and then send the gas back through the initial purification process. This closed-loop system not only reduces environmental emissions but also creates a sustainable, cost-effective feedstock source, driving technological advances in separation and re-purification processes to electronic grade standards.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum: APAC represents the largest and fastest-growing region in the Electronic Grade Sulfur Hexafluoride market, anchoring its position due to the concentration of global semiconductor manufacturing capabilities. Countries such as Taiwan (home to TSMC), South Korea (Samsung, SK Hynix), China, and Japan house the majority of advanced fabrication plants and memory production facilities globally. The Chinese market, in particular, is witnessing exponential growth fueled by national initiatives aimed at achieving self-sufficiency in semiconductor production, leading to massive investments in new fabs and, consequently, a soaring demand for UHP process gases. This region's dominance is projected to continue throughout the forecast period, but supply chain security remains a crucial strategic focus given geopolitical complexities.

- North America's Resurgence and Strategic Investment: The North American market is experiencing a revitalization, spurred by significant government policies like the CHIPS and Science Act, designed to incentivize the construction of advanced fabrication facilities within the United States. While currently consuming lower volumes than APAC, the establishment of new mega-fabs by Intel, TSMC, and Samsung represents a substantial future demand pipeline for Electronic Grade SF6. This market is highly regulated, necessitating robust SF6 management and abatement strategies, driving demand for technologically advanced recycling services alongside gas supply.

- Europe's Regulatory Challenges and Niche Demand: Europe maintains a significant but mature market, driven by established semiconductor players and specialized MEMS manufacturers (e.g., Bosch, STMicroelectronics). The region faces the most stringent regulatory environment globally concerning SF6 usage, primarily through the EU F-Gas Regulation, which mandates the reduction and eventual phase-out of high-GWP gases. Consequently, European consumers are at the forefront of implementing SF6 recycling and exploring alternative etching chemistries, although SF6 remains technologically irreplaceable for certain critical DRIE processes. Future growth is moderate and highly sensitive to regulatory enforcement and the success of local chip-making initiatives.

- Rest of the World (RoW) Emerging Consumption: Latin America, the Middle East, and Africa currently hold marginal shares, with demand primarily confined to electronics assembly operations or small-scale research facilities, not high-volume front-end semiconductor manufacturing. However, countries in the Middle East, leveraging high capital reserves, are beginning to explore opportunities to establish domestic semiconductor capabilities, which could translate into new, albeit localized, SF6 demand centers late in the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Sulfur Hexafluoride Market.- Linde PLC

- Air Products and Chemicals Inc.

- Kanto Denka Kogyo Co., Ltd.

- Solvay S.A.

- SHOWA DENKO K.K.

- Mitsui Chemicals, Inc.

- Iwatani Corporation

- Jiangsu Multimix Electronic Materials Co., Ltd.

- SK Materials Co., Ltd.

- Central Glass Co., Ltd.

- Chengda New Material

- Praxair (now part of Linde)

- Sumitomo Seika Chemical Co., Ltd.

- Versum Materials (now part of Merck KGaA)

- Electronic Materials Corporation (EMC)

- Taiyo Nippon Sanso Corporation

- Chemtrade Logistics Income Fund

- The Messer Group GmbH

- FUJI FILM Wako Pure Chemical Corporation

- Puyang Huicheng Electronic Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Sulfur Hexafluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Sulfur Hexafluoride and why is its purity level critical?

Electronic Grade Sulfur Hexafluoride (SF6) is a specialized, ultra-high purity gas (typically 5N to 6N grade) used exclusively in microelectronics manufacturing. Its high purity is critical because trace impurities, even at parts per billion levels, can interfere with delicate plasma processes, leading to defects, reduced yield, and failure in advanced semiconductor devices like those fabricated at sub-5nm nodes.

What are the main applications of Electronic Grade SF6 in semiconductor manufacturing?

The primary applications are plasma etching, particularly Deep Reactive Ion Etching (DRIE) for creating high aspect ratio structures in silicon wafers (essential for MEMS and 3D NAND memory), and chamber cleaning, where SF6 rapidly removes residual deposition materials from Chemical Vapor Deposition (CVD) tools to maintain operational efficiency and process stability.

How do environmental regulations impact the future growth of the SF6 market?

Environmental regulations significantly constrain the market due to SF6's extremely high Global Warming Potential (GWP 23,500). Regulations like the EU F-Gas mandate strict emission reductions and encourage substitution with lower-GWP alternatives. This pressure drives investment in high-efficiency abatement technologies and sophisticated SF6 recycling/recovery systems, adding complexity and cost to the supply chain but ensuring sustainable usage.

Which region dominates the consumption of Electronic Grade SF6 and why?

The Asia Pacific (APAC) region dominates consumption, specifically Taiwan, South Korea, and China. This dominance is attributed to the fact that APAC hosts the largest global concentration of advanced semiconductor fabrication plants (fabs) and memory manufacturing facilities, making it the epicenter of capital expenditure and output for high-tech microchips.

Is SF6 replaceable by alternative gases for critical etching processes?

While research into alternatives (like NF3, C4F8, or mixtures) is ongoing and partially successful in some cleaning applications, SF6 remains technologically difficult to replace entirely for specific, critical etching steps, such as achieving high-aspect-ratio vertical profiles in Deep Reactive Ion Etching (DRIE) used in MEMS and advanced 3D NAND manufacturing, due to its unique plasma characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager