Electronic Grade Vinylene Carbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431866 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electronic Grade Vinylene Carbonate Market Size

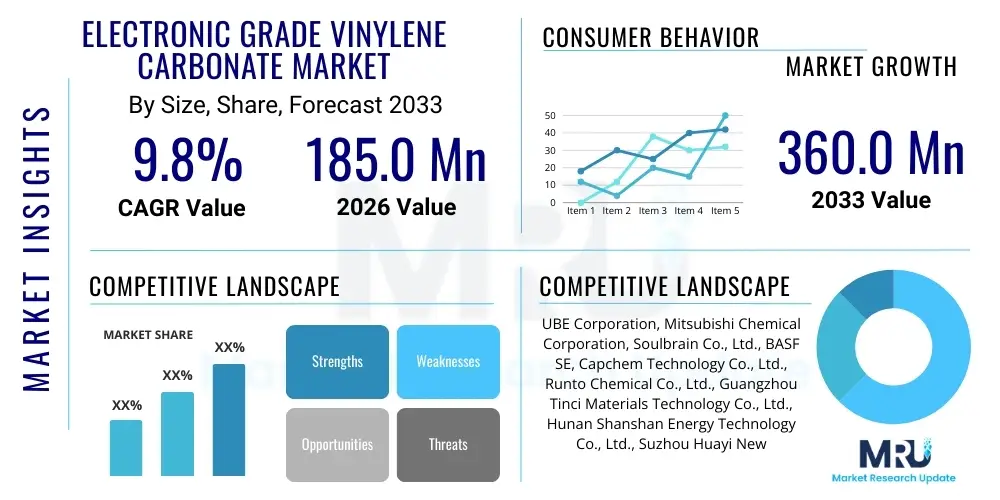

The Electronic Grade Vinylene Carbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 185.0 Million in 2026 and is projected to reach USD 360.0 Million by the end of the forecast period in 2033.

Electronic Grade Vinylene Carbonate Market introduction

The Electronic Grade Vinylene Carbonate (E-VC) market encompasses the specialized segment of VC utilized exclusively as an essential additive in electrolyte solutions for high-performance lithium-ion batteries (LiBs). E-VC, typically required at purity levels exceeding 99.99%, plays a pivotal role in forming a stable Solid Electrolyte Interphase (SEI) layer on the graphite anode surface during the initial charging cycles of the battery. This stable SEI layer is critical for preventing continuous decomposition of the electrolyte, thereby significantly extending the battery’s cycle life, enhancing safety characteristics, and improving overall performance, particularly under high-voltage conditions.

E-VC is integral to modern battery chemistries, especially those employed in high-energy density applications such as electric vehicles (EVs) and grid-scale energy storage systems (ESS). The primary function of E-VC is to act as a sacrificial film-forming agent, ensuring that lithium-ion movement remains efficient while mitigating parasitic reactions. Major applications include power batteries for transportation, energy storage batteries, and rechargeable batteries used in sophisticated consumer electronics, where longevity and performance consistency are paramount. The market expansion is intrinsically linked to the global pivot towards electrification and renewable energy integration, necessitating increasingly sophisticated and reliable battery components.

The core benefits derived from E-VC usage include enhanced thermal stability, reduced capacity fade over time, and improved low-temperature performance. Driving factors for the market's robust growth include stringent government mandates promoting electric vehicle adoption globally, massive investments in giga-factories for lithium-ion battery production, and ongoing research efforts by battery manufacturers to increase energy density without compromising safety. The relentless demand for longer-lasting and faster-charging batteries in the automotive sector particularly fuels the requirement for extremely high-purity E-VC.

Electronic Grade Vinylene Carbonate Market Executive Summary

The Electronic Grade Vinylene Carbonate market exhibits strong growth momentum, primarily dictated by the exponential expansion of the electric vehicle industry and large-scale renewable energy integration projects. Key business trends indicate a vertical integration strategy among leading chemical suppliers and battery manufacturers aimed at securing the supply of ultra-high purity materials and controlling production costs. Technological advancements are centering on continuous synthesis processes and enhanced purification techniques to meet the demanding specifications of next-generation batteries, particularly those operating at higher cut-off voltages. Regional trends firmly establish the Asia Pacific, led by China, South Korea, and Japan, as the undisputed hub for both E-VC production and consumption, driven by the world’s largest installed capacity for LiB manufacturing. These nations dominate the supply chain dynamics, controlling the majority of global electrolyte production.

In terms of segmentation trends, the application segment targeting electric vehicles (EVs) commands the largest market share and is projected to demonstrate the fastest growth rate, significantly outpacing demand from consumer electronics. This dominance is due to the larger battery packs and the higher performance requirements inherent in automotive applications, which necessitate greater volumes and stringent quality control of E-VC. Furthermore, the segmentation by purity level shows an increasing shift towards ultra-high purity grades (99.99% and above), reflecting the industry's need for maximum SEI stability and minimal side reactions, crucial for extending the life of premium EV battery cells.

The market faces operational challenges related to maintaining purity during large-scale manufacturing and managing the supply chain volatility of precursor chemicals. Strategic focus areas for market players include expanding production capacities in regions closer to major giga-factories and investing heavily in R&D to develop novel electrolyte additives that can synergize with E-VC or offer superior performance for solid-state or semi-solid battery architectures. The overarching market landscape is competitive, characterized by a few dominant Asian players who leverage superior purification technologies and established relationships with Tier 1 battery manufacturers.

AI Impact Analysis on Electronic Grade Vinylene Carbonate Market

User queries regarding AI's influence in the Electronic Grade Vinylene Carbonate market frequently revolve around process optimization, quality control standardization, and enhanced battery modeling. Users are keen to understand how AI can solve the inherent challenges of achieving ultra-high purity consistently and cost-effectively in E-VC manufacturing. Key themes include the use of machine learning (ML) for predictive maintenance in complex distillation systems, AI-driven spectroscopy analysis for real-time quality assurance, and the role of intelligent algorithms in designing electrolyte formulations that maximize the synergistic effect of E-VC with other additives. Concerns often center on the initial investment costs for implementing AI infrastructure and the need for specialized data scientists in traditional chemical manufacturing environments. Expectations are high that AI will lead to faster material discovery cycles, significantly higher production yields, and ultimately, a reduction in the overall cost of high-performance Li-ion batteries.

- AI-enhanced Quality Control: Machine vision and ML algorithms analyze spectral data to ensure real-time purity levels (e.g., monitoring trace moisture and metallic impurities) exceeding 99.99%.

- Predictive Maintenance: AI models forecast equipment failure in high-purity synthesis and distillation units, minimizing downtime and preventing batch contamination.

- Process Optimization: Utilizing reinforcement learning to fine-tune reaction parameters (temperature, pressure, catalyst concentration) to maximize E-VC yield and minimize energy consumption.

- Supply Chain Resilience: AI-driven logistics planning optimizes the sourcing of precursors, reducing vulnerability to geopolitical and volatile raw material price fluctuations.

- Electrolyte Formula Design: Generative AI assists in rapidly screening thousands of additive combinations to identify optimal electrolyte formulations featuring E-VC for specific high-voltage applications.

DRO & Impact Forces Of Electronic Grade Vinylene Carbonate Market

The Electronic Grade Vinylene Carbonate market's trajectory is primarily shaped by the unstoppable global shift toward electric mobility and sustainable energy solutions. The principal driver is the massive deployment of high-performance lithium-ion batteries across the automotive and grid storage sectors, where E-VC is non-negotiable for achieving longevity and safety. However, the market faces significant restraints, chiefly the extremely rigorous purity requirements. Trace impurities can severely compromise battery performance, making manufacturing processes complex and capital-intensive. Furthermore, the reliance on specific precursor chemicals and the limited number of qualified global suppliers create potential supply chain bottlenecks and price volatility risks. Opportunities arise from the evolution of next-generation batteries, particularly high-nickel cathodes and silicon-anode batteries, which require even more advanced and specialized SEI-forming agents, offering avenues for product innovation and premium pricing.

Impact forces currently dominating the market landscape include stringent environmental regulations demanding improved battery recyclability and extended product life, which directly necessitate the stable performance provided by E-VC. Additionally, the aggressive pricing strategies adopted by major Chinese battery manufacturers exert constant downward pressure on the cost of battery components, forcing E-VC producers to optimize their operational efficiencies. Technological impact is profound, as continuous advancements in battery energy density push the material specifications to unprecedented levels, requiring manufacturers to maintain continuous R&D investment. Geopolitical tensions regarding control over critical battery material supply chains also serve as a significant impact force, encouraging diversification of manufacturing bases outside of primary Asian locations.

The market is characterized by high entry barriers due to the need for specialized production facilities capable of delivering the required purity levels, limiting competition primarily to established chemical giants with deep technical expertise. The cumulative effect of these drivers, restraints, and opportunities ensures that while growth remains strong, it is highly concentrated geographically and technically challenging, emphasizing reliability and consistency over mass-market commoditization.

Segmentation Analysis

The Electronic Grade Vinylene Carbonate market is comprehensively segmented based on its purity level, the type of battery application it serves, and its geographical consumption patterns. Segmentation by purity is crucial, reflecting the technical demands of different battery chemistries, with ultra-high purity grades commanding a premium due to their necessity in high-end electric vehicle and energy storage systems where performance degradation must be minimized over thousands of cycles. Segmentation by application highlights the shift in market gravity from traditional consumer electronics (laptops, phones) to the power segment, dominated by the explosive demand from the global Electric Vehicle industry, which requires vastly larger volumes of electrolyte additives per unit.

- By Purity Level:

- 99.9% Purity (Standard Grade)

- 99.99% Purity (High Grade)

- 99.999% Purity (Ultra-High Grade)

- By Application:

- Electric Vehicles (EVs) & Hybrid Electric Vehicles (HEVs)

- Energy Storage Systems (ESS) / Grid Storage

- Consumer Electronics (CE)

- Industrial Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Electronic Grade Vinylene Carbonate Market

The value chain for Electronic Grade Vinylene Carbonate is highly technical and begins with the upstream sourcing of raw materials, predominantly Ethylene Carbonate (EC) and various catalysts required for the synthesis process. Securing a reliable and high-quality source of EC is paramount, as impurities present at this stage are exponentially difficult and costly to remove later. The upstream segment is characterized by large chemical commodity producers, but the electronic-grade requirement filters the suppliers significantly, focusing on specialized chemical synthesis firms. Midstream processing involves the complex, multi-stage synthesis of VC from EC, followed by intensive, advanced purification techniques—such as multi-stage distillation and crystallization—to achieve the electronic-grade purity necessary for battery applications. This stage represents the highest value addition due to the proprietary technology and extreme quality control required.

The downstream segment primarily consists of electrolyte manufacturers who purchase the E-VC additive and blend it with solvents (like EC, DMC, DEC, etc.) and lithium salts (LiPF6) to formulate the final electrolyte solution. These electrolyte houses, such as UBE and Soulbrain, act as critical intermediaries before the material reaches the ultimate consumers: the battery cell manufacturers (e.g., CATL, LGES, Panasonic). Distribution channels are predominantly direct, characterized by long-term supply agreements between E-VC producers and electrolyte manufacturers due to the mission-critical nature of the material and the strict qualification processes involved. Indirect channels, involving regional chemical distributors, exist but are less common for the highest purity grades required by Tier 1 automotive battery producers.

The concentration of battery manufacturing facilities in Asia Pacific dictates the entire value chain flow, leading to intense competition and consolidation among Asian E-VC producers. Effective management of the distribution channel requires specialized logistics for transporting high-purity, often moisture-sensitive, chemical compounds. Successful market penetration relies heavily on establishing robust technical partnerships and proving consistent quality compliance with the stringent specifications set by major global battery OEMs, ensuring traceability from raw material to finished cell.

Electronic Grade Vinylene Carbonate Market Potential Customers

The primary potential customers and end-users of Electronic Grade Vinylene Carbonate are sophisticated manufacturers positioned deep within the lithium-ion battery supply chain. These customers are categorized into two main groups: the specialized electrolyte formulators and the integrated battery cell manufacturers that produce their electrolytes in-house. Electrolyte formulators represent the largest immediate buyers, as they require E-VC as a critical ingredient to formulate the proprietary solutions tailored to different cell chemistries (e.g., LFP, NMC, NCA). Their purchasing decisions are driven entirely by the purity level, batch consistency, and security of supply, as any impurity can lead to catastrophic cell failure or reduced lifespan.

The second major customer group includes the globally recognized Tier 1 battery giga-factories. While some outsource electrolyte production, others are increasingly integrating this step to control quality and cost, making them direct buyers of high-ppurity additives like E-VC. These companies are focused on sourcing materials that enable them to achieve high energy density, fast charging capabilities, and the required warranty periods (typically 8–10 years for EV batteries). Their demand is voluminous and highly sensitive to technological specifications, particularly for use in advanced anode materials like silicon-graphite composites, which demand even more robust SEI formation agents.

The key attributes of these potential customers are their high volume requirement, their global geographical spread (now expanding rapidly into North America and Europe), and their insistence on achieving IATF 16949 certification standards for automotive applications. Winning a long-term contract with these players requires not just competitive pricing, but demonstrated excellence in quality control, technical support, and the ability to scale production reliably and swiftly in line with the explosive growth in EV production forecasts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.0 Million |

| Market Forecast in 2033 | USD 360.0 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UBE Corporation, Mitsubishi Chemical Corporation, Soulbrain Co., Ltd., BASF SE, Capchem Technology Co., Ltd., Runto Chemical Co., Ltd., Guangzhou Tinci Materials Technology Co., Ltd., Hunan Shanshan Energy Technology Co., Ltd., Suzhou Huayi New Energy Technology Co., Ltd., L&F Co., Ltd., Kanto Chemical Co., Inc., Dongwha Electrolyte, Central Glass Co., Ltd., Tomiyama Pure Chemical Industries, Ltd., and Jiangsu Guotai Super Power New Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Vinylene Carbonate Market Key Technology Landscape

The technology landscape governing the production of Electronic Grade Vinylene Carbonate is dominated by processes centered on achieving and sustaining exceptionally high purity levels, which is the singular most critical factor for market acceptance. Traditional synthesis methods often involve reacting Ethylene Carbonate with oxidizing agents, but the subsequent purification stage dictates the commercial viability and electronic grade status of the product. Key technologies employed include continuous fractional distillation under vacuum and controlled temperature crystallization. These sophisticated separation techniques are necessary to remove trace impurities such as moisture, metal ions, and other organic residues, which can fatally compromise the stability of the final electrolyte solution and the performance of the battery cell.

Recently, there has been increasing investment in flow chemistry and continuous manufacturing processes over traditional batch synthesis. Continuous flow synthesis offers enhanced safety, better heat and mass transfer control, and, crucially, improved consistency in product quality, which is vital for the automotive industry's high-volume demand. Furthermore, advancements in analytical chemistry, particularly high-resolution chromatographic techniques and advanced spectroscopic methods, are integral to the key technology landscape. These analytical tools provide real-time or near real-time feedback on impurity levels, allowing manufacturers to maintain stringent quality gates and certify the product for use in high-voltage LiBs (4.3V and above), where material degradation is accelerated.

Future technological trends focus on developing greener synthesis routes that minimize solvent usage and waste generation, aligning with sustainability goals. Furthermore, research is ongoing into developing novel, structurally modified vinylene carbonate derivatives or alternative functional additives that can outperform E-VC in stabilizing advanced silicon anodes, potentially leading to a technology shift. However, for the immediate forecast period, optimization of existing advanced purification technologies remains the primary focus for market players aiming to achieve the 'five-nines' purity standard (99.999%) increasingly demanded by EV manufacturers.

Regional Highlights

The regional dynamics of the Electronic Grade Vinylene Carbonate market are heavily skewed toward Asia Pacific (APAC), which acts as both the largest producer and consumer globally. This dominance is directly attributable to APAC hosting the vast majority of the world's lithium-ion battery giga-factories, concentrated primarily in China, South Korea, and Japan. China is particularly pivotal, leading global EV and battery production, resulting in immense domestic demand for high-purity electrolyte additives like E-VC. The regional presence of key chemical giants and vertically integrated battery suppliers solidifies APAC's control over the supply chain and pricing dynamics.

Europe and North America represent the fastest-growing regional markets, driven by significant government initiatives (such as the European Green Deal and U.S. Inflation Reduction Act) aimed at localizing EV and battery manufacturing. While production of E-VC additive in these regions is currently low compared to APAC, massive foreign direct investment in gigafactories by Asian and domestic players is rapidly accelerating the demand for local E-VC supply chains. This regional growth signifies a strategic shift toward establishing secure, localized, and resilient supply lines, reducing reliance on long trans-oceanic logistics and mitigating geopolitical risks.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as small but significant markets, primarily due to rising domestic EV adoption and, more importantly, increasing investment in large-scale utility and grid energy storage projects. While these regions do not yet have substantial E-VC manufacturing capacity, their role as end-users for imported batteries and energy storage solutions is increasing, creating a specialized demand for robust, reliable LiBs that inherently require E-VC for long-term operational stability under diverse climatic conditions.

- Asia Pacific (APAC): Dominates the global market share; driven by massive LiB production capacity in China, South Korea, and Japan; focus on ultra-high purity grades for EV batteries.

- Europe: High growth rate fueled by the rapid establishment of European giga-factories (e.g., Germany, Hungary, Sweden); strong regulatory push for sustainability and localization of battery supply chains.

- North America: Experiencing rapid demand growth due to the expansion of U.S. and Canadian battery manufacturing facilities (IRA-driven incentives); emphasis on creating a domestic, resilient supply chain for critical materials.

- Latin America (LATAM) & Middle East & Africa (MEA): Nascent markets primarily driven by grid modernization, utility-scale ESS deployments, and increasing governmental support for limited EV adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Vinylene Carbonate Market.- UBE Corporation

- Mitsubishi Chemical Corporation

- Soulbrain Co., Ltd.

- BASF SE

- Capchem Technology Co., Ltd.

- Runto Chemical Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

- Hunan Shanshan Energy Technology Co., Ltd.

- Suzhou Huayi New Energy Technology Co., Ltd.

- L&F Co., Ltd.

- Kanto Chemical Co., Inc.

- Dongwha Electrolyte

- Central Glass Co., Ltd.

- Tomiyama Pure Chemical Industries, Ltd.

- Jiangsu Guotai Super Power New Materials Co., Ltd.

- Daicel Corporation

- Nantong Guanghe Chemical Co., Ltd.

- Zhuzhou Kejin Industrial Co., Ltd.

- Wujiang Wanmu Chemical Co., Ltd.

- Shandong Dongying Chemical Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Vinylene Carbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Vinylene Carbonate (E-VC) and why is it essential for Li-ion batteries?

E-VC is an ultra-high purity chemical additive used in lithium-ion battery electrolytes. It is essential because it forms a stable Solid Electrolyte Interphase (SEI) layer on the graphite anode during the initial charging cycle, preventing continuous electrolyte decomposition. This process significantly extends the battery's cycle life, enhances thermal stability, and is critical for high-voltage applications in electric vehicles (EVs).

Which purity level of Vinylene Carbonate is most demanded by the EV industry?

The EV industry primarily demands ultra-high purity grades, typically 99.99% or higher (often referred to as four or five nines purity). Achieving this purity level is crucial because even trace impurities, especially moisture or metal ions, can severely degrade the battery’s long-term performance and safety, directly impacting vehicle warranty obligations.

How do global EV adoption trends influence the E-VC market growth?

Global EV adoption is the single most significant driver. As EV manufacturers scale up production and require increasingly larger battery packs with extended driving ranges, the demand for sophisticated electrolyte additives like E-VC rises exponentially. This massive shift directly dictates market size, necessitating continuous capacity expansion and technological improvement from E-VC suppliers worldwide.

What are the primary technical challenges faced in E-VC manufacturing?

The primary technical challenges involve maintaining ultra-high purity and consistency during large-scale manufacturing. The synthesis and, critically, the multi-stage purification processes require complex, high-capital equipment and specialized handling to prevent contamination, especially from moisture, which is extremely detrimental to electronic-grade battery chemicals.

Where is the geographical center of production and consumption for Electronic Grade Vinylene Carbonate?

The geographical center for both production and consumption is overwhelmingly the Asia Pacific region, primarily China, South Korea, and Japan. This concentration is due to these countries housing the world's largest lithium-ion battery manufacturing base (giga-factories) and possessing established expertise in specialized electrolyte chemical production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager