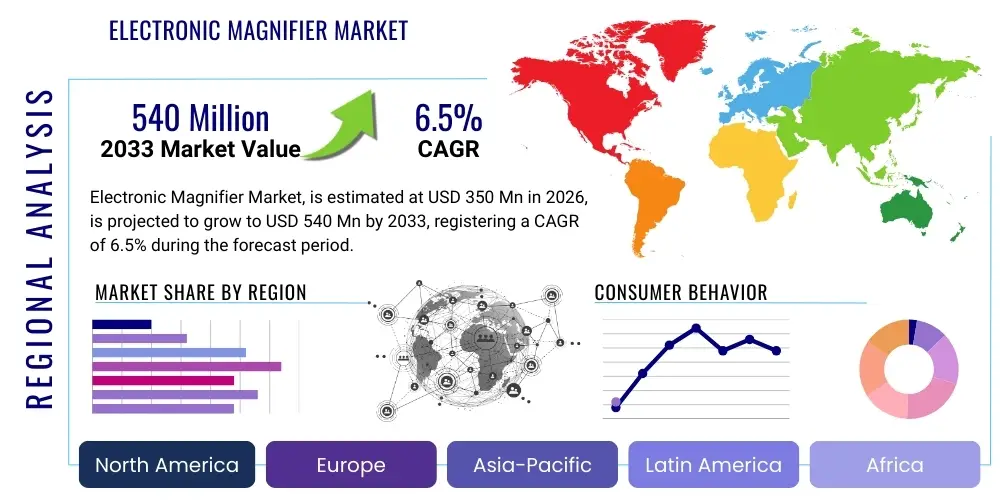

Electronic Magnifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436792 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electronic Magnifier Market Size

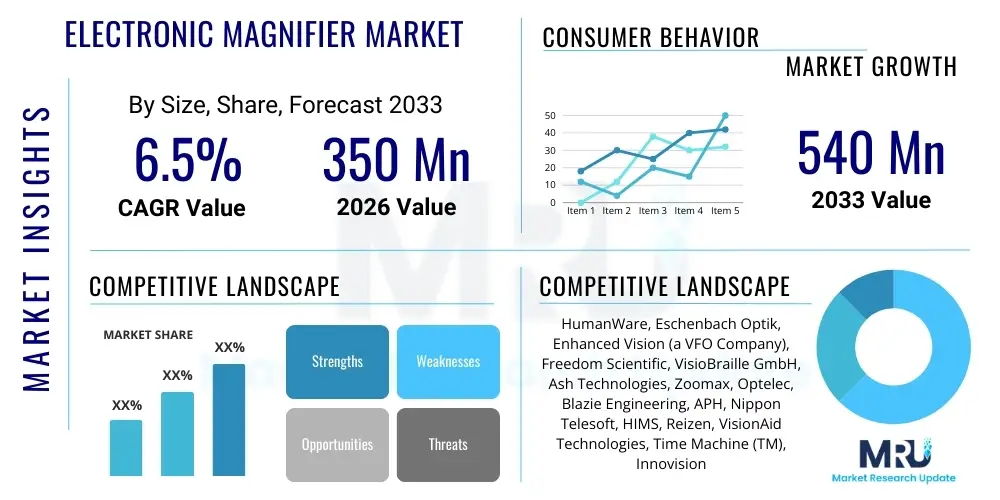

The Electronic Magnifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing global geriatric population, which experiences higher incidences of age-related macular degeneration and other low vision conditions, alongside significant technological advancements in digital imaging and display technologies enhancing the utility and portability of these devices. The rising awareness about accessibility aids in educational and professional settings further contributes substantially to market expansion across developed and emerging economies.

Electronic Magnifier Market introduction

The Electronic Magnifier Market encompasses devices designed to assist individuals with low vision, visual impairments, or those requiring enhanced viewing capabilities for detailed work, by utilizing digital cameras and high-resolution screens to enlarge text and images. These devices, often categorized into portable handheld units and fixed desktop models, capture visual input, process it digitally, and display the magnified output with adjustable features such as color contrast, brightness, and magnification level. Key applications span personal reading, professional inspection tasks, classroom accessibility, and industrial quality assurance, providing a superior and more flexible alternative to traditional optical magnifiers. The integration of advanced features such as Optical Character Recognition (OCR) and text-to-speech functionality is transforming these tools from simple magnification aids into comprehensive assistive technology solutions.

Product descriptions typically involve high-definition cameras capable of capturing minute details, sophisticated digital signal processing chips for real-time image rendering, and ergonomic designs that prioritize user comfort and ease of operation. Major applications include enabling students with visual disabilities to access standard textbooks, assisting elderly individuals in reading medicine labels and bills, and supporting manufacturing professionals in inspecting circuit boards or micro-components. The core benefits derived from electronic magnifiers include improved reading speed, enhanced visual clarity, reduced eye strain, and significantly increased independence and quality of life for users facing visual challenges.

Driving factors for this market include rapid technological evolution leading to more compact, feature-rich, and affordable devices, supportive governmental initiatives promoting accessibility standards, and the compelling demographic trend characterized by a rapidly expanding global population aged 60 and over. Furthermore, the increasing penetration of digital literacy and the demand for versatile assistive devices in workplaces and educational institutions are acting as strong market accelerators, ensuring sustained demand for advanced electronic magnification solutions throughout the forecast period.

Electronic Magnifier Market Executive Summary

The Electronic Magnifier Market is characterized by robust business trends focusing on miniaturization, enhanced battery performance, and the seamless integration of connectivity features like Wi-Fi and Bluetooth for transferring data and integrating with other smart devices. Key strategic developments observed across the competitive landscape include mergers and acquisitions aimed at consolidating specialized technology and expanding geographical reach, alongside significant investments in research and development to introduce Artificial Intelligence (AI) for better image stabilization and predictive text reading. The primary shift is moving away from purely hardware-focused products toward software-driven, comprehensive assistive platforms, enhancing user experience through highly customizable interfaces and cloud-based services.

Regionally, North America and Europe currently dominate the market due to well-established healthcare infrastructure, high prevalence of age-related vision conditions, and strong governmental support for disability aids and accessibility standards. However, the Asia Pacific region is poised to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive population growth, improving access to advanced medical technology, and increasing disposable income, particularly in countries like China and India, where awareness campaigns are gaining traction. Latin America and the Middle East and Africa (MEA) represent emerging opportunities, contingent upon overcoming challenges related to pricing sensitivity and limited distribution channels.

Segment trends highlight the growing preference for portable electronic magnifiers over desktop models, owing to their flexibility, discretion, and ability to be used in diverse environments. Within applications, the Low Vision Aids segment remains the largest revenue contributor, while the Industrial Quality Assurance segment is witnessing rapid adoption due to the requirement for high-precision, magnified inspection tools in complex manufacturing processes such as electronics assembly and medical device production. Technology wise, digital magnifiers with advanced optical zoom capabilities and multi-mode viewing options are becoming standard, positioning the market for continuous feature expansion and user-centric design innovation.

AI Impact Analysis on Electronic Magnifier Market

User inquiries regarding AI's influence on the Electronic Magnifier Market frequently center on how machine learning can improve the core functions of these devices, specifically addressing questions like: "Can AI stabilize shaky handheld images better?", "How will AI-driven OCR handle complex or handwritten texts?", and "Will personalized magnification settings become standard through AI learning?". Users are keen on understanding the shift from simple digital processing to intelligent assistive technology. The analysis reveals a clear expectation for AI to enhance device autonomy, increase accuracy in complex visual tasks, and offer personalized user experiences that dynamically adjust to specific vision needs and environmental conditions. Concerns often revolve around data privacy related to image processing and the cost implications of integrating sophisticated AI hardware.

The key themes emerging from user expectations suggest that AI integration is crucial for addressing the current limitations of electronic magnifiers, such as dealing with motion blur in portable units and accurately interpreting diverse font styles or highly patterned backgrounds. Users anticipate that AI algorithms, particularly deep learning models, will significantly improve image quality by applying advanced noise reduction and contrast enhancement techniques tailored specifically for low vision needs. Furthermore, there is a strong interest in AI-powered contextual awareness, allowing the device to intelligently prioritize and highlight relevant information on a page, moving beyond simple uniform magnification.

Overall, AI is expected to revolutionize the usability and efficacy of electronic magnifiers. It is shifting the market focus from merely enlarging images to providing smart visual interpretation and assistance. This integration is projected to drive premium pricing in high-end models, offering competitive advantages to manufacturers who successfully deploy robust, user-friendly AI features. The market anticipates a future where magnifiers not only assist vision but actively interpret the visual world for the user, thereby expanding the potential application base beyond traditional low vision support into specialized professional fields requiring cognitive visual assistance.

- AI-driven Image Stabilization: Minimizing blur and optimizing clarity, especially in portable, high-magnification scenarios.

- Enhanced Optical Character Recognition (OCR): Improving accuracy for varied fonts, complex layouts, and low-quality print materials.

- Personalized User Profiles: Machine learning algorithms automatically adjusting color, contrast, and magnification based on individual vision prescriptions and ambient light conditions.

- Real-time Text-to-Speech Improvement: Utilizing advanced neural networks for more natural-sounding, context-aware reading assistance.

- Smart Edge Detection and Highlighting: AI identifying important textual or graphical boundaries and prioritizing them for better user focus.

- Predictive Visual Assistance: Integrating object recognition to identify and describe items not easily visible to the user.

DRO & Impact Forces Of Electronic Magnifier Market

The dynamics of the Electronic Magnifier Market are profoundly shaped by a confluence of accelerating drivers, persistent restraints, compelling opportunities, and powerful market impact forces. The dominant driver remains the demographic shift characterized by an aging global population, as age-related macular degeneration and cataracts significantly increase the addressable market size. Simultaneously, regulatory environments in developed nations, mandating accessibility compliance in public and private sectors, necessitate the provision of such aids. However, significant restraints include the high initial cost of advanced digital magnification systems, which often limits adoption in lower-income demographics and developing regions, alongside limited reimbursement policies in certain healthcare systems. These forces collectively dictate the pace and direction of technological innovation and market penetration.

Opportunities for growth are primarily centered around technological convergence, specifically the integration of electronic magnifiers into multifunctional smart devices, such as specialized tablets or smartphones equipped with high-powered cameras and proprietary low-vision software, making the technology more discreet and accessible. Furthermore, market penetration into industrial sectors, particularly high-precision manufacturing and quality control (QC), represents a substantial untapped revenue stream, demanding ultra-high-resolution inspection devices. Manufacturers are also seizing the chance to develop subscription-based software services related to cloud storage of scanned materials and advanced AI features, moving toward a recurring revenue model.

The critical impact forces influencing the market include rapid component price decreases (e.g., CMOS sensors and display panels), which put downward pressure on average selling prices but simultaneously increase accessibility for consumers. Competitive intensity is high, with established optical companies and tech startups vying for market share through product differentiation based on software features and portability. The COVID-19 pandemic also served as a transient impact force, initially disrupting supply chains but subsequently accelerating the demand for home-based assistive reading technology, emphasizing digital solutions over physical aids. Ultimately, consumer acceptance of digital aids versus traditional optical aids is the long-term defining impact force determining market saturation levels.

Segmentation Analysis

The Electronic Magnifier Market segmentation provides a crucial framework for understanding the diverse needs of end-users and the varying technological configurations of available products. The market is primarily dissected based on Product Type, Application, End-User, and Technology, reflecting distinct characteristics in device functionality, portability, and intended use environment. Analyzing these segments helps stakeholders tailor product development, pricing strategies, and marketing campaigns to specific, high-growth niches. For instance, the high demand for portable units dictates focus on lightweight design and extended battery life, whereas the industrial segment demands rugged construction and exceptional resolution capabilities.

- By Product Type:

- Portable/Handheld Electronic Magnifiers

- Desktop/Fixed Electronic Magnifiers (CCTVs)

- By Application:

- Low Vision Aids (Reading, Writing, General Tasks)

- Inspection and Quality Control (Industrial)

- Educational Assistance

- Medical and Clinical Use

- By End-User:

- Personal Consumers

- Hospitals and Clinics

- Educational Institutions (Schools, Universities)

- Manufacturing and Industrial Facilities

- Rehabilitation Centers

- By Technology:

- Digital Magnifiers (Software-based enhancement)

- Hybrid Opto-Digital Magnifiers (Combining traditional optics with digital processing)

Value Chain Analysis For Electronic Magnifier Market

The value chain for the Electronic Magnifier Market begins with upstream activities focused on sourcing and manufacturing critical components. These components include high-resolution image sensors (CMOS/CCD), advanced optical lenses, digital processing units (DSPs), and high-contrast OLED or LCD screens. Key upstream suppliers are often specialized semiconductor and display panel manufacturers, whose technological advancements directly influence the performance and cost structure of the final product. Strong relationships with reliable component providers are essential to mitigate supply chain disruptions and ensure the incorporation of cutting-edge technology, such as AI-enabled processors necessary for real-time image correction and cognitive assistance features. Component quality heavily impacts the device's efficacy, particularly regarding latency and image fidelity.

Midstream activities encompass the core manufacturing, assembly, and integration processes. Original Equipment Manufacturers (OEMs) focus on hardware design, ergonomic development, and the proprietary software integration, which often includes specialized low-vision algorithms for magnification and color filtering. This stage is where intellectual property and technological differentiation are established. Manufacturing typically involves cleanroom assembly, rigorous calibration of optics and cameras, and extensive quality checks to ensure compliance with medical device regulations or accessibility standards. Effective inventory management and lean manufacturing principles are crucial here to manage costs while maintaining high quality standards required for assistive technologies.

Downstream analysis highlights the complexity of distribution and sales, which involve both direct and indirect channels. Direct sales often target large institutions, educational bodies, and government procurement offices, requiring specialized sales teams familiar with accessibility funding and procurement cycles. Indirect distribution relies heavily on specialized distributors focusing on assistive technology, ophthalmology clinics, rehabilitation centers, and authorized retailers. These channels provide vital support, training, and after-sales service to end-users. The distribution strategy must also address the need for personalized product trials and demonstrations, given the highly specific nature of low vision needs. Marketing efforts often prioritize endorsements from low vision specialists and patient advocacy groups, emphasizing the life-changing benefits and technological sophistication of the products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HumanWare, Eschenbach Optik, Enhanced Vision (a VFO Company), Freedom Scientific, VisioBraille GmbH, Ash Technologies, Zoomax, Optelec, Blazie Engineering, APH, Nippon Telesoft, HIMS, Reizen, VisionAid Technologies, Time Machine (TM), Innovision, Sight-Pro, Magnified Solutions, Vision Dynamics, ClearView |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Magnifier Market Potential Customers

The Electronic Magnifier Market targets a broad yet highly specific cohort of potential customers, primarily defined by visual impairment or the need for precision visual inspection. The largest and most consistently growing customer base consists of elderly individuals suffering from age-related vision loss, such as macular degeneration, diabetic retinopathy, and glaucoma, who seek tools to maintain their independence in daily activities like reading, writing, and engaging with digital screens. These personal consumers prioritize ease of use, portability, long battery life, and high contrast viewing options. Marketing efforts directed at this segment often utilize medical referrals, senior living communities, and specialized low vision clinics to drive adoption. Ensuring intuitive design and robust customer support are paramount for retaining this segment.

A second major customer category includes educational institutions, particularly K-12 schools and universities, which procure desktop and portable magnifiers to ensure compliance with disability laws and provide equitable access to curriculum materials for visually impaired students. Procurement decisions here are often driven by institutional budgets, durability requirements, and compatibility with existing assistive technology ecosystems. The demand from this sector focuses on features such as connectivity for screen sharing, robust network integration, and compatibility with standard educational software platforms. Suppliers often engage in bidding processes and long-term contracts with educational departments or state-level accessibility resource centers.

The third significant segment comprises industrial and manufacturing entities, predominantly within the electronics, aerospace, medical device, and precision engineering fields. These end-users utilize electronic magnifiers, often high-magnification desktop models, for quality assurance, inspection of intricate components, fault diagnosis, and detailed assembly work where human error must be minimized. Customers in this industrial segment prioritize objective metrics such as extremely high resolution, precise measurement capabilities, connectivity for documentation and archival, and ergonomic interfaces optimized for continuous use in a production environment. The sales cycle here is often technical, involving specialized application engineers and demonstrating clear return on investment through improved quality and reduced rework rates.

Electronic Magnifier Market Key Technology Landscape

The technological landscape of the Electronic Magnifier Market is rapidly evolving, driven by advancements in digital imaging, display technology, and sophisticated software algorithms. Core technology revolves around high-definition digital cameras (typically CMOS sensors) paired with powerful Digital Signal Processors (DSPs) optimized for low latency and real-time image manipulation. Modern magnifiers leverage advanced computational photography techniques, including multi-frame averaging and high dynamic range (HDR) processing, to deliver clearer images under varying lighting conditions, a crucial feature for portable devices used outdoors or in poorly lit environments. Furthermore, the shift from traditional LCDs to high-contrast OLED displays enhances text readability by offering deeper blacks and wider viewing angles, directly addressing a primary need of low-vision users.

Software and processing capabilities constitute the primary area of differentiation and innovation. Key technological features now standard in premium electronic magnifiers include advanced Optical Character Recognition (OCR) coupled with text-to-speech engines, allowing users to convert magnified visual text into synthesized audio output. This integration provides multimodal access to information. Manufacturers are also heavily investing in proprietary algorithms for color modulation, known as false-color modes, which enhance contrast (e.g., yellow text on a black background) to suit specific retinal conditions. Moreover, connectivity features, such as wireless casting to larger screens (televisions or monitors) and Bluetooth integration for external peripherals like keyboards or refreshable braille displays, expand the utility of these devices far beyond basic magnification.

Emerging technologies, specifically Artificial Intelligence (AI) and Machine Learning (ML), are beginning to redefine the market. AI is being deployed for smart image stabilization to counteract hand tremors, especially in high-magnification handheld units, ensuring a steady, clear display. Furthermore, ML models are utilized for adaptive contrast adjustment, learning the user's preferred settings based on context and time of day, thereby automating the optimization process. The future technological trajectory is focused on augmented reality (AR) integration, potentially allowing users to overlay magnified text onto their real-world view via smart glasses, offering a more seamless and less obtrusive assistive experience. These technological leaps are fundamental to achieving higher performance, greater user satisfaction, and ultimately, deeper market penetration.

Regional Highlights

- North America: This region holds a leading market share due to high consumer awareness, advanced healthcare infrastructure, and the presence of major market players and robust distribution networks. Significant government and private funding for assistive technology, coupled with strict adherence to Section 508 and ADA accessibility standards, drives consistent institutional procurement. The large geriatric population and high prevalence of degenerative eye diseases also fuel demand for high-end digital magnifiers with integrated smart features.

- Europe: Europe represents a mature market, strongly supported by favorable reimbursement policies in countries like Germany, the UK, and Scandinavia, which classify electronic magnifiers as essential medical aids. The focus here is often on quality, ergonomic design, and compliance with stringent EU medical device regulations. Western European countries exhibit high per capita spending on assistive devices, while Eastern Europe shows promising growth due to increasing healthcare modernization efforts.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive population density, rapid economic development in countries like China and India, and improving standards of living that increase accessibility to advanced medical devices. While price sensitivity remains a factor, the sheer volume of the aging population and increasing focus on educational inclusion are accelerating market adoption, leading to strong demand for cost-effective, highly portable solutions.

- Latin America: Market penetration is lower in Latin America, facing challenges related to economic volatility and limited public spending on assistive technologies. However, urbanization and expanding middle classes in Brazil and Mexico are generating new pockets of demand. The market tends to favor mid-range, versatile electronic magnifiers that offer significant functional improvements over traditional optical aids at competitive prices.

- Middle East and Africa (MEA): The MEA region is characterized by fragmented market development. Demand is concentrated in technologically advanced Gulf Cooperation Council (GCC) countries, driven by high disposable incomes and investments in specialized healthcare facilities. In Africa, adoption remains nascent, primarily limited to major urban centers and supported by non-governmental organization (NGO) initiatives focusing on visual rehabilitation and accessibility programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Magnifier Market.- HumanWare

- Eschenbach Optik

- Enhanced Vision (a VFO Company)

- Freedom Scientific

- VisioBraille GmbH

- Ash Technologies

- Zoomax

- Optelec

- Blazie Engineering

- APH (American Printing House for the Blind)

- Nippon Telesoft

- HIMS

- Reizen

- VisionAid Technologies

- Time Machine (TM)

- Innovision

- Sight-Pro

- Magnified Solutions

- Vision Dynamics

- ClearView

Frequently Asked Questions

Analyze common user questions about the Electronic Magnifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a desktop (CCTV) and a portable electronic magnifier?

Desktop Electronic Magnifiers (often called CCTVs) offer higher magnification levels, superior stability, and larger screens for prolonged use at a fixed location, making them ideal for home or office. Portable magnifiers prioritize compactness, lightweight design, and battery operation for mobility and use outside the home.

How do Electronic Magnifiers improve over traditional optical magnifiers for low vision users?

Electronic magnifiers provide variable magnification, adjustable contrast and color filters, digital image enhancement for clearer text, and often include advanced features like OCR and text-to-speech, significantly reducing eye strain and increasing functional reading capabilities that optical aids cannot match.

What key technological trends are currently driving innovation in this market?

The primary technological trends include the integration of AI for smart image stabilization and adaptive contrast, enhanced battery longevity, the adoption of high-contrast OLED display panels, and the shift towards highly portable, integrated devices offering multi-modal access (visual and audio).

Which end-user segment contributes the most significantly to the Electronic Magnifier Market revenue?

The Personal Consumers segment, driven predominantly by the global aging population and the associated increase in age-related low vision conditions such as Macular Degeneration, consistently contributes the largest share of overall market revenue, followed closely by educational and institutional purchases.

Are electronic magnifiers covered by health insurance or government assistance programs?

Coverage varies significantly by region. In North America and parts of Europe, some high-end electronic magnifiers may be partially covered by Medicare, Medicaid, or specialized private insurance policies if classified as durable medical equipment (DME) or essential assistive technology, often requiring a doctor's prescription and specific functional necessity justification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager