Electronic Measuring System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433364 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electronic Measuring System Market Size

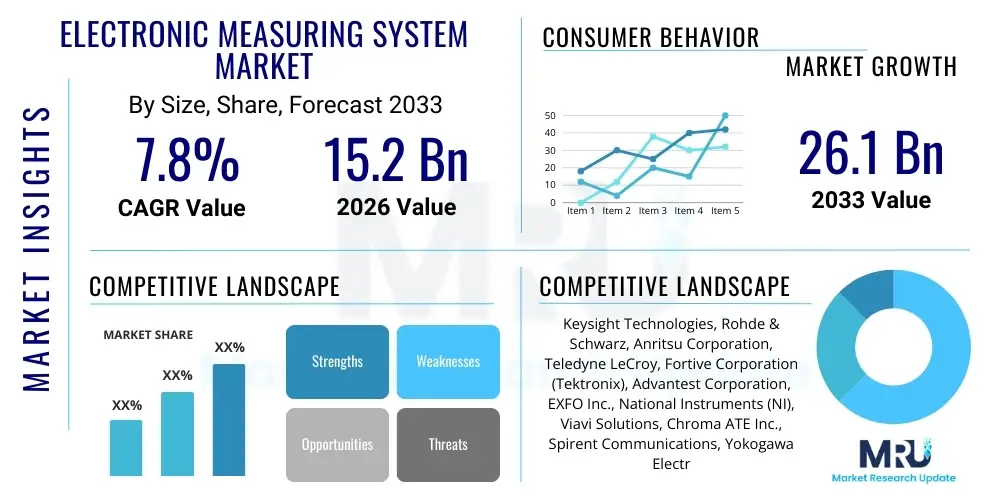

The Electronic Measuring System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 26.1 Billion by the end of the forecast period in 2033.

Electronic Measuring System Market introduction

The Electronic Measuring System (EMS) Market encompasses a diverse range of instrumentation used globally across various industries to precisely measure, analyze, and control electrical signals, physical parameters, and device performance. These systems are foundational to modern technology development, ensuring quality control, adherence to standards, and facilitating cutting-edge research. Products within this market include essential tools such as oscilloscopes, spectrum analyzers, network analyzers, signal generators, multimeters, and modular instruments. The increasing complexity of electronic devices, particularly in communications, automotive electronics, and consumer gadgets, necessitates highly accurate and high-speed measurement capabilities provided by these sophisticated systems.

Major applications of EMS span critical sectors including telecommunications infrastructure development, where they are vital for testing 5G components and ensuring signal integrity; aerospace and defense, utilized for rigorous testing of mission-critical systems and components under extreme conditions; and the semiconductor industry, crucial for characterizing new chip designs and managing manufacturing yield. The fundamental benefit provided by EMS is the reliability of electronic products, reducing failure rates, speeding up design cycles, and enabling compliance with stringent regulatory frameworks worldwide. Furthermore, the shift towards software-defined instrumentation allows for greater flexibility and automation in testing environments, significantly enhancing operational efficiency.

Key driving factors propelling the growth of this market include the global deployment of 5G and 6G networks, which demands advanced testing solutions capable of handling ultra-high frequencies and massive MIMO complexity. The rapid proliferation of Internet of Things (IoT) devices, requiring low-power consumption verification and robust connectivity testing, also fuels demand. Additionally, the automotive sector’s transition towards Electric Vehicles (EVs) and autonomous driving systems necessitates precise battery management system testing, electromagnetic compatibility (EMC) analysis, and sensor calibration, all reliant on advanced electronic measuring systems.

Electronic Measuring System Market Executive Summary

The Electronic Measuring System (EMS) market is undergoing significant transformation, driven by macro business trends emphasizing digitalization and integrated testing solutions. The shift from traditional benchtop instruments to modular, software-defined architectures (such as PXI and AXIe) is a defining trend, enabling engineers to create highly customized, scalable, and automated test environments. This integration streamlines workflow and drastically reduces the time-to-market for complex electronic products. Furthermore, the focus on sustainable design and energy efficiency is boosting demand for precision instruments capable of measuring minute power consumption levels and validating energy-harvesting technologies.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, fueled primarily by massive investments in semiconductor fabrication plants (Fabs), particularly in China, Taiwan, and South Korea, coupled with robust consumer electronics manufacturing capabilities. North America and Europe maintain strong positions due to high levels of R&D expenditure in aerospace, defense, and advanced communication technologies (6G research). Segments trends highlight rapid growth in the communication test equipment category, driven by 5G rollout and associated infrastructure buildout. Additionally, the proliferation of specialized measurement equipment for power electronics, crucial for the expanding EV industry, is experiencing an accelerated CAGR compared to general-purpose testing equipment.

The market’s competitive landscape is characterized by established global leaders focusing intensely on integrating artificial intelligence and machine learning algorithms into their software platforms to offer predictive analytics and optimized testing procedures. Consolidation efforts and strategic partnerships between hardware manufacturers and software providers are becoming common to deliver complete, integrated solutions. Overall, the market trajectory is highly positive, supported by the foundational role EMS plays in the development of next-generation technologies across all major industrial verticals.

AI Impact Analysis on Electronic Measuring System Market

Common user inquiries regarding the influence of AI on the Electronic Measuring System Market frequently center on themes of automation, predictive maintenance, and complex data handling. Users are keen to understand how AI can move beyond simple test sequencing to implement autonomous decision-making within test systems, allowing for faster fault isolation and optimized calibration routines. Significant interest lies in utilizing machine learning for analyzing massive datasets generated by high-speed measurements, especially in fields like 5G beamforming and quantum computing experimentation, where traditional statistical analysis falls short. Concerns often revolve around the security implications of cloud-based AI processing and the required standardization of data formats to ensure compatibility across diverse instrumentation from multiple vendors.

The integration of artificial intelligence is fundamentally changing how electronic measurement systems are deployed and operated. AI algorithms are enabling a new generation of smart test equipment capable of interpreting complex signal anomalies that human operators or fixed thresholds might miss, leading to more comprehensive and efficient testing cycles. For instance, in manufacturing environments, AI assists in predictive quality control by correlating measurement data with historical manufacturing parameters, anticipating yield issues before they become critical. This shift enhances the utility of high-end equipment by transforming them from mere data acquisition tools into intelligent diagnostic platforms, thereby maximizing asset utilization and minimizing downtime associated with instrument calibration drift or unexpected failures.

Furthermore, AI facilitates the development of self-calibrating instruments and aids in streamlining the massive data flows typical of modern systems, such as advanced radar or satellite communication testing. By automating complex pattern recognition and filtering noise, AI ensures that valuable insights are rapidly extracted from petabytes of test results. This evolution is crucial for sectors pushing the boundaries of physics and engineering, ensuring that measurement constraints do not bottleneck innovation. The market expectation is clear: future EMS will be defined not just by hardware specifications but by the intelligence embedded within the measurement software layer.

- AI-driven automation reduces human intervention in complex test sequences, speeding up verification time.

- Machine Learning enhances predictive maintenance for instrumentation, increasing uptime and calibration efficiency.

- AI algorithms facilitate advanced anomaly detection in high-speed and complex signals (e.g., radar, optical communication).

- Improved data analytics capabilities allow for rapid identification of root causes in manufacturing defects.

- Enables the development of cognitive measurement systems that adapt test parameters dynamically based on observed results.

- Optimizes resource allocation in large-scale test beds by learning usage patterns and prioritizing tasks.

DRO & Impact Forces Of Electronic Measuring System Market

The Electronic Measuring System market is shaped by a powerful interplay of drivers, restraints, and opportunities. The core drivers revolve around technological proliferation, specifically the mass rollout of 5G infrastructure, the explosive growth of IoT ecosystems requiring pervasive sensor testing, and the automotive sector’s pivot toward electric and autonomous vehicles, demanding rigorous component validation. Restraints primarily involve the substantial capital expenditure required to acquire high-end, high-frequency measurement equipment and the persistent challenge of establishing universal standards for complex, multi-vendor testing environments. Opportunities are significant, notably in the nascent fields of quantum computing measurement, high-speed optical testing, and the expanding market for modular and virtual instrumentation which offers cost-effective scalability, driving substantial innovation and market penetration.

Segmentation Analysis

The Electronic Measuring System market is comprehensively segmented based on product type, component, application, and end-user industry, reflecting the diverse requirements of the global technological landscape. Segmentation by product type highlights the distinction between general-purpose equipment (like digital multimeters and basic oscilloscopes) and specialized high-performance equipment (like vector network analyzers and signal sources used in R&D). Component segmentation often breaks down the market into hardware (probes, mainframes, modules) and software (analysis, control, and automation suites), reflecting the growing importance of the software layer in system performance and flexibility. This detailed categorization is crucial for manufacturers to align their product offerings with specific market demands, particularly where high precision or high data throughput is critical.

Application segmentation reveals key growth drivers, differentiating between traditional laboratory testing, manufacturing quality assurance, and field troubleshooting requirements. The end-user analysis is perhaps the most critical for forecasting, as the distinct needs of the aerospace and defense sector (extreme reliability and ruggedized equipment) contrast sharply with the volume and cost sensitivities of the consumer electronics industry. The demand for increasingly accurate measurements, coupled with the need for instruments that can function across extremely broad bandwidths, dictates the competitive strategy within each segment. Modular instrumentation, for instance, thrives in research and manufacturing where scalability and future-proofing are paramount, whereas traditional integrated instruments remain dominant in field service applications where portability is key.

The ongoing trend towards system integration and the adoption of hybrid testing methodologies blur the lines between traditional segmentation categories. Modern EMS solutions frequently combine elements of hardware, specialized software, and AI processing to offer turnkey solutions for complex industry problems, such as electromagnetic interference (EMI) mitigation or advanced power integrity testing. This convergence necessitates that market analysts track both the discrete hardware segments and the integrated solution segment to capture the full scope of market dynamics and technology adoption rates across diverse industrial ecosystems.

- By Product Type:

- General Purpose Test Equipment (GPTE)

- Specialized Test Equipment (STE)

- Modular Instruments (PXI, AXIe)

- By Component:

- Hardware (Mainframes, Modules, Probes, Sensors)

- Software (Test Automation, Analysis & Visualization)

- By Application:

- Research & Development

- Manufacturing & Production Testing

- Field Testing & Maintenance

- Calibration & Services

- By Industry Vertical:

- Aerospace & Defense

- Telecommunications

- Semiconductor & Electronics

- Automotive

- Industrial & Manufacturing

- Healthcare & Medical Devices

Value Chain Analysis For Electronic Measuring System Market

The value chain for the Electronic Measuring System market begins with the upstream segment, involving the sourcing and refinement of highly specialized raw materials, including advanced semiconductor materials, specialized optics, and high-purity metals essential for high-frequency components like RF front-ends and high-resolution ADCs (Analog-to-Digital Converters). This stage is followed by component manufacturing, where specialized firms produce the core technological building blocks—such as custom ASIC chips, high-precision sensors, and complex printed circuit boards—which are critical for the accuracy and speed of the final instruments. Strategic partnerships in the upstream segment ensure a steady supply of cutting-edge technology vital for maintaining competitive advantage in instrument performance.

Mid-stream activities encompass the assembly, integration, and software development by the primary EMS manufacturers. This stage involves the complex integration of proprietary hardware with sophisticated operating and measurement software, along with extensive quality assurance and calibration procedures to meet industry standards. Distribution channels form a critical nexus connecting manufacturers to end-users; these typically involve a blend of direct sales forces catering to large governmental and industrial clients, and indirect channels relying on specialized distributors and value-added resellers (VARs) who provide localized technical support and integration services, particularly in fragmented regional markets.

The downstream segment involves installation, training, and extensive after-sales support, including periodic calibration and maintenance services, which often represent a significant and recurring revenue stream for EMS providers. Direct sales facilitate deep customer relationships necessary for complex, custom solutions in aerospace or advanced research, while indirect channels provide wider geographical reach and cater efficiently to the demands of small and medium-sized enterprises (SMEs) and educational institutions. The efficiency of the distribution network directly impacts market penetration and customer satisfaction, emphasizing the strategic importance of well-managed logistics and responsive technical service capabilities throughout the entire value lifecycle.

Electronic Measuring System Market Potential Customers

The potential customer base for the Electronic Measuring System market is highly diverse, spanning all sectors involved in the design, manufacture, and maintenance of electronic and electrical systems. Core end-users include major telecommunications operators and equipment manufacturers (TEMs) who require advanced network analyzers and signal generators for developing and deploying 5G, fiber optics, and future 6G networks. Secondly, the aerospace and defense sector represents a vital customer segment, utilizing high-reliability, ruggedized measurement systems for avionics, radar development, electronic warfare testing, and stringent component qualification processes required for mission-critical applications.

A substantial customer segment is the semiconductor and electronics manufacturing industry, ranging from foundries and integrated device manufacturers (IDMs) to consumer electronics assembly plants. These buyers rely heavily on high-speed digital oscilloscopes, arbitrary waveform generators, and specialized parametric testers for wafer probing, chip characterization, and ensuring the integrity of complex interfaces like DDR and PCIe. The automotive industry has rapidly emerged as a key buyer, driven by the massive need for testing power electronics (inverters, motors), high-voltage batteries, and the array of sensors and communication modules necessary for Advanced Driver Assistance Systems (ADAS) and autonomous vehicles.

Finally, governmental and private research and development (R&D) institutions, along with academic laboratories, constitute a foundational demand source. These groups require cutting-edge, flexible instrumentation for fundamental research in areas such as particle physics, quantum mechanics, and advanced materials science. These buyers often prioritize modularity and customizability, favoring platforms like PXI that can be reconfigured rapidly for novel experimental setups, ensuring that the market for highly advanced, single-unit systems and specialized accessories remains robust.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 26.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Teledyne LeCroy, Fortive Corporation (Tektronix), Advantest Corporation, EXFO Inc., National Instruments (NI), Viavi Solutions, Chroma ATE Inc., Spirent Communications, Yokogawa Electric, Cobham Advanced Electronic Solutions, B&K Precision, Good Will Instrument Co., Ltd. (GW Instek), Rigol Technologies, Saluki Technology, MKS Instruments, Teradyne, Astronics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Measuring System Market Key Technology Landscape

The technological landscape of the Electronic Measuring System market is rapidly evolving, primarily characterized by the accelerated adoption of Software-Defined Instrumentation (SDI). SDI leverages powerful computational resources and flexible software architectures to perform measurement functions that were traditionally locked into dedicated hardware. This paradigm shift offers immense advantages in terms of future-proofing, allowing instruments to be updated or repurposed via software upgrades, dramatically extending the useful life of the hardware platform. Technologies like Virtual Instruments (VIs) and centralized control platforms are integral to SDI, enabling remote access, collaborative testing, and seamless integration into automated test environments (ATEs).

Another crucial technological trend is the modularization of instruments, epitomized by the PXI (PCI eXtensions for Instrumentation) and AXIe standards. Modular systems allow users to build highly specialized, compact, and scalable test setups by selecting specific function modules (digitizers, signal generators, switches) and inserting them into a standardized chassis. This approach is paramount in high-throughput manufacturing and complex R&D where synchronization across hundreds of channels is required, such as in massive MIMO antenna testing or high-volume semiconductor verification. The high-speed data transfer backplane within these modular systems ensures minimal latency and maximum data throughput, essential for modern high-frequency measurements.

Furthermore, the drive towards higher frequencies and wider bandwidths, necessitated by 5G/6G communications and advanced radar systems, pushes the boundaries of hardware design, focusing on minimizing noise and maximizing signal integrity up to the millimeter-wave band (mmWave). This includes advancements in RF and microwave components, such as high-linearity mixers and wideband ADCs. The incorporation of advanced connectivity standards like Ethernet and cloud integration allows for distributed testing, enabling global teams to access and manage instrumentation remotely, furthering efficiency and collaboration in complex multinational projects.

Regional Highlights

The global electronic measuring system market exhibits distinct regional dynamics driven by unique industrial structures, investment levels in R&D, and governmental policies related to technological infrastructure development. North America remains a leader in high-end, specialized measurement equipment, particularly in the aerospace and defense sectors, due to substantial military expenditure and advanced technological mandates. The region also hosts key players in the semiconductor design and software instrumentation domains, fostering innovation in AI-driven measurement solutions and advanced modular testing platforms like PXI. Strong academic and corporate R&D activity ensures continuous demand for state-of-the-art testing tools to push the frontiers of communication (6G research) and quantum computing.

Europe demonstrates robust demand, largely fueled by its thriving automotive industry—a major consumer of power electronics and safety-critical testing equipment required for EV and autonomous vehicle validation. Additionally, European defense modernization efforts and strict regulatory frameworks concerning electromagnetic compatibility (EMC) drive continuous investment in high-quality spectrum and network analyzers. The emphasis on high-precision industrial measurement and calibration services in countries like Germany and France ensures a steady market for reliable, highly accurate instrumentation, often supported by public-private partnerships focused on industrial digitalization (Industry 4.0 initiatives).

Asia Pacific (APAC) is unequivocally the fastest-growing and largest market for electronic measuring systems, primarily due to its unparalleled dominance in manufacturing, encompassing consumer electronics, telecommunications equipment, and massive semiconductor production capabilities. Countries such as China, South Korea, and Taiwan are investing trillions in expanding their foundry capacities, driving an insatiable demand for high-volume automated test equipment (ATE) and specialized semiconductor parametric analyzers. Furthermore, the region’s aggressive 5G infrastructure deployment and subsequent technological leaps into 6G research and development solidify APAC's central role in shaping future EMS demand. This rapid scaling requires localized support, encouraging international vendors to establish large calibration and service centers within the region.

Latin America and the Middle East & Africa (MEA) represent emerging markets, where growth is currently concentrated in modernizing telecommunication networks and investing in basic industrial maintenance and calibration capabilities. In the MEA region, large-scale government-backed projects, particularly in defense technology and large oil and gas sector maintenance, are key drivers. As infrastructure development accelerates, particularly the expansion of regional data centers and smart city initiatives, the demand for general-purpose test equipment and essential network diagnostic tools is expected to rise significantly, creating substantial future market opportunities for cost-effective and ruggedized solutions.

- North America: Dominant in R&D, Aerospace & Defense, and high-frequency communication testing (6G). Home to major instrument manufacturers and key software innovation hubs.

- Asia Pacific (APAC): Fastest growth due to semiconductor manufacturing expansion, mass production of consumer electronics, and rapid 5G infrastructure deployment in China, South Korea, and Taiwan.

- Europe: Strong demand from the Automotive sector (EV testing), industrial automation (Industry 4.0), and adherence to strict EMC/EMI regulatory standards.

- Latin America & MEA: Emerging markets driven by telecom infrastructure modernization, initial industrial maintenance needs, and defense procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Measuring System Market.- Keysight Technologies

- Rohde & Schwarz

- Anritsu Corporation

- Fortive Corporation (Tektronix)

- Teledyne LeCroy

- National Instruments (NI)

- Advantest Corporation

- Viavi Solutions

- EXFO Inc.

- Yokogawa Electric Corporation

- Chroma ATE Inc.

- Spirent Communications

- B&K Precision

- Cobham Advanced Electronic Solutions

- Teradyne Inc.

- Astronics Corporation

- Good Will Instrument Co., Ltd. (GW Instek)

- Rigol Technologies

- Fluke Corporation (A Fortive Company)

- MKS Instruments

Frequently Asked Questions

Analyze common user questions about the Electronic Measuring System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Electronic Measuring System Market?

Market growth is primarily driven by the global deployment of 5G and future 6G communication networks, the accelerating transition toward electric and autonomous vehicles requiring high-voltage testing, and the pervasive expansion of IoT devices demanding extensive low-power and connectivity validation. Furthermore, the ongoing technological race in semiconductor manufacturing fuels demand for high-precision Automated Test Equipment (ATE).

How is Software-Defined Instrumentation (SDI) affecting the industry?

SDI is revolutionizing the industry by separating measurement functions from dedicated hardware, allowing instruments to be controlled, reconfigured, and updated entirely through software. This modular approach enhances test flexibility, reduces equipment redundancy, lowers capital expenditure over time, and facilitates seamless integration with complex automation systems (ATE).

Which industry vertical is the largest consumer of high-end measuring systems?

The Telecommunications and Semiconductor industries are the largest consumers of high-end measuring systems, especially specialized equipment like Vector Network Analyzers (VNAs) and high-bandwidth oscilloscopes. This demand stems from the critical need to test complex RF components, integrated circuits, and high-speed data interfaces required for modern communication infrastructure and advanced chip design.

What role does Artificial Intelligence (AI) play in modern electronic testing?

AI is increasingly used to enhance test efficiency by automating complex procedures, performing predictive maintenance on test equipment, and rapidly analyzing vast datasets generated by high-speed measurements. AI algorithms improve diagnostic accuracy and enable cognitive test systems that dynamically adapt parameters based on real-time test outcomes.

What are the key technological challenges currently faced by EMS manufacturers?

Key challenges include developing instruments capable of measuring accurate signals at increasingly higher frequencies (mmWave and sub-THz for 6G), managing the complexity of integrated multi-standard communication testing, and reducing the total cost of ownership (TCO) for highly specialized test setups, particularly for advanced quantum and optical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager