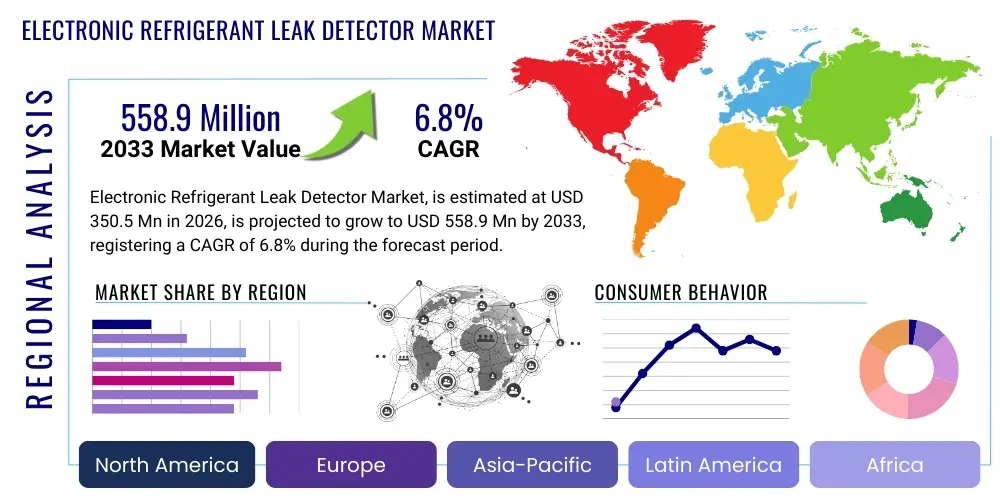

Electronic Refrigerant Leak Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436788 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electronic Refrigerant Leak Detector Market Size

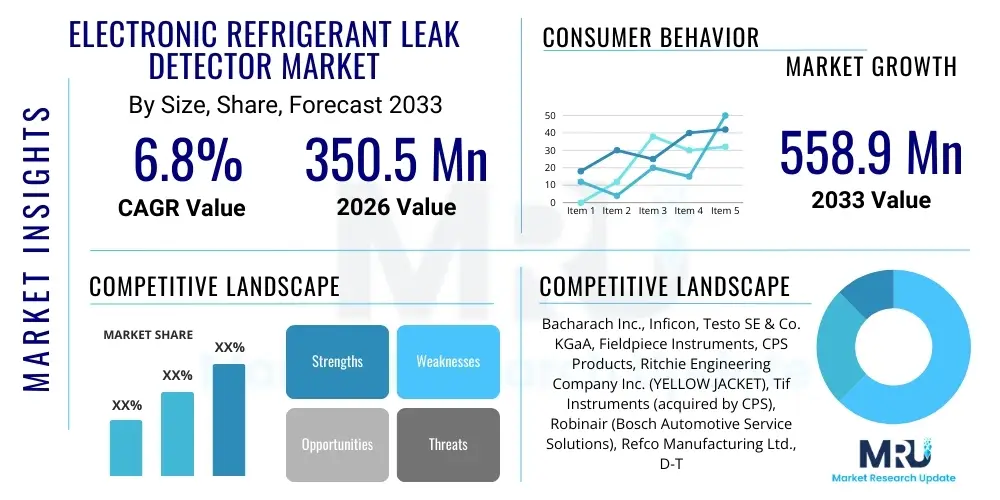

The Electronic Refrigerant Leak Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 558.9 Million by the end of the forecast period in 2033.

Electronic Refrigerant Leak Detector Market introduction

The Electronic Refrigerant Leak Detector Market encompasses devices designed to identify and pinpoint leaks in systems containing refrigerants, such as HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) units and automotive air conditioning systems. These detectors utilize advanced electronic sensor technologies, including heated diode, infrared (IR), and electrochemical sensors, to accurately detect trace amounts of refrigerant gases that escape pressurized systems. Unlike older soap bubble or dye methods, electronic detectors offer high sensitivity, fast response times, and quantitative measurements, crucial for compliance with environmental regulations mandating the control of potent greenhouse gases like HFCs, HFOs, and traditional CFCs/HCFCs.

The major applications of these sophisticated devices span across residential, commercial, and industrial sectors, primarily driven by the necessity for system efficiency maintenance and regulatory adherence. In the commercial refrigeration sector, detectors are vital for monitoring large-scale cold storage facilities and supermarket refrigeration racks, minimizing product loss and energy inefficiency. The automotive sector relies heavily on these tools for servicing car AC systems, particularly as new, mildly flammable refrigerants like R-1234yf become standard. The core benefit of electronic leak detection is minimizing environmental harm caused by refrigerant release, alongside significant cost savings achieved by reducing energy consumption and prolonging the lifespan of HVACR equipment.

Driving factors propelling market expansion include increasingly stringent environmental regulations, particularly those established by the Kigali Amendment to the Montreal Protocol, phasing down high Global Warming Potential (GWP) refrigerants. Furthermore, the burgeoning demand for energy-efficient cooling solutions in rapidly urbanizing regions, coupled with continuous technological advancements leading to more sensitive and selective detectors (such as those utilizing infrared technology), fuels market growth. The routine maintenance requirements of a vast installed base of HVACR systems globally ensure consistent demand for reliable, high-performance leak detection equipment.

Electronic Refrigerant Leak Detector Market Executive Summary

The Electronic Refrigerant Leak Detector Market Executive Summary highlights robust growth driven by environmental mandates and technological maturity. Key business trends indicate a shift towards advanced infrared (IR) and heated diode sensor technologies, favored for their improved accuracy, reduced false alarms, and superior sensitivity to new generation refrigerants. Manufacturers are focusing on developing smart, connected detectors featuring Bluetooth capabilities for data logging and report generation, streamlining compliance procedures for technicians. Regional trends reveal North America and Europe leading in adoption due to mature regulatory frameworks, while the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid expansion in cold chain logistics, commercial construction, and increasing disposable incomes leading to higher residential AC penetration.

Segment trends emphasize the dominance of the handheld segment, primarily used by service and maintenance professionals for field operations, though fixed or stationary detectors are gaining traction in industrial settings where continuous monitoring is mandatory. Infrared detectors are steadily overtaking heated diode detectors in terms of revenue share, reflecting end-user preference for long sensor life and high selectivity. The HVACR service and maintenance segment remains the largest application area, intrinsically linked to the repair and installation cycles of cooling infrastructure globally. Strategic partnerships between detector manufacturers and large HVACR servicing companies are becoming essential for securing market share and ensuring product training.

Overall, the market dynamic is characterized by the necessity of compliance. The increasing complexity of refrigerant blends and the push toward natural refrigerants (hydrocarbons, CO2) require detectors capable of handling a wider chemical spectrum, ensuring market resilience even amidst global economic fluctuations. Investment in R&D focusing on micro-electromechanical systems (MEMS) sensors promises smaller, more cost-effective, and highly sensitive devices in the near future, sustaining the projected CAGR through the forecast period.

AI Impact Analysis on Electronic Refrigerant Leak Detector Market

User queries regarding the impact of AI on Electronic Refrigerant Leak Detector Market frequently revolve around predictive maintenance capabilities, enhanced diagnostic accuracy, and the integration of machine learning with sensor data. Users are keen to know if AI can transform reactive repair schedules into proactive maintenance regimes by analyzing continuous monitoring data from fixed detectors, identifying subtle changes in leakage patterns before they escalate into significant environmental releases. Key themes also include the expectation that AI models will filter out environmental noise and false positives, significantly improving the reliability of detection in complex industrial environments. There is a strong user expectation for AI algorithms to correlate leak events with operational parameters (temperature, pressure, vibration) to pinpoint root causes faster and more efficiently than manual analysis, thereby reducing downtime and operational costs.

- AI-driven Predictive Maintenance: Utilizing historical and real-time sensor data from stationary detectors to forecast potential leak occurrences, enabling scheduled, non-emergency repairs.

- Enhanced Data Interpretation: Machine learning algorithms analyze complex sensor readings to differentiate between background noise, non-refrigerant gases, and actual refrigerant traces, reducing false alarm rates (FAR).

- Automated Compliance Reporting: AI systems integrate leak data with regulatory requirements, automatically generating detailed reports needed for environmental compliance bodies, reducing administrative overhead.

- Optimized Detector Placement: AI analyzes facility layouts, air flow dynamics, and system pressure points to recommend optimal locations for fixed detector installation, maximizing detection efficacy.

- Remote Diagnostic and Calibration: AI allows for remote monitoring of detector health and drift, automating calibration schedules and ensuring sustained operational accuracy without constant manual intervention.

DRO & Impact Forces Of Electronic Refrigerant Leak Detector Market

The Electronic Refrigerant Leak Detector Market is fundamentally driven by tightening global environmental protocols, particularly the F-gas regulations in Europe and the phasedown schedules under the Kigali Amendment, which necessitate precise tracking and mitigation of refrigerant emissions. Restraints primarily involve the high initial cost of advanced infrared detection units compared to cheaper heated diode models, and the complexity associated with calibrating detectors for the rapidly proliferating range of mixed and new refrigerants, leading to potential inaccuracies. Opportunities lie predominantly in integrating smart features like IoT connectivity and AI-enhanced diagnostics into handheld devices, opening new revenue streams in the industrial and large commercial sectors requiring constant monitoring. The impact forces are characterized by high regulatory pressure (driving adoption), coupled with moderate technological innovation (improving performance), and low to moderate pricing pressure from Asian manufacturers, influencing overall market profitability and market structure.

Segmentation Analysis

The Electronic Refrigerant Leak Detector Market Segmentation Analysis is critical for understanding specific consumer behaviors and technological preferences across various end-user environments. The market is primarily segmented based on the technology utilized (e.g., heated diode, infrared, corona discharge), the type of product (handheld vs. stationary), the application area (HVACR, automotive, industrial), and the target refrigerant type (CFC, HCFC, HFC, HFO, natural refrigerants). The continuous diversification of refrigerant types globally necessitates the development of highly selective, multi-gas detectors, driving segmentation strategy. Handheld devices dominate the volume segment due to their flexibility in field service, while infrared technology captures the highest value share due to superior performance and longer operational lifespan. Analyzing these segments helps stakeholders tailor product development and marketing efforts to specific regulatory and application requirements.

- By Technology

- Heated Diode

- Infrared (IR) Sensor

- Corona Discharge (Negative Corona)

- Electrochemical Sensor (Less common for standard refrigerants, often used for specific natural refrigerants)

- Ultrasonic (Sometimes used in conjunction with electronic detectors)

- By Type

- Handheld Detectors (Portable)

- Stationary Detectors (Fixed/Continuous Monitoring Systems)

- By Refrigerant Type

- CFCs/HCFCs (Legacy refrigerants)

- HFCs (Current dominant refrigerants like R-134a, R-410A)

- HFOs (New generation low GWP refrigerants like R-1234yf)

- Natural Refrigerants (Ammonia, CO2, Hydrocarbons like Propane)

- By Application

- HVACR Service and Maintenance

- Automotive Air Conditioning Service

- Industrial Refrigeration and Manufacturing

Value Chain Analysis For Electronic Refrigerant Leak Detector Market

The Value Chain Analysis for the Electronic Refrigerant Leak Detector Market begins with upstream activities, which include the procurement and processing of highly specialized components, most notably the sensor elements (IR optical benches, heated semiconductor tips) and microprocessors. Sensor manufacturing is highly technical and often proprietary, involving specialized materials science and advanced fabrication techniques. Midstream activities center on product design, assembly, calibration, and rigorous quality assurance testing, ensuring the devices meet required sensitivity and regulatory standards (e.g., SAE J2791 or EN 14624). The efficiency and precision of calibration directly impact the device's market viability, making it a critical value-add step in this stage.

Downstream analysis focuses heavily on distribution and post-sale service. Given that these are specialized tools, distribution channels are diverse, involving both direct sales to large industrial end-users and sales through specialized HVACR and automotive tool distributors, wholesalers, and professional equipment retailers. The emphasis on regulatory compliance means that training and certification programs, often provided by manufacturers or key distributors, are essential services that contribute significant value. Direct channels are crucial for high-volume sales to institutional buyers, while indirect channels provide wider geographical reach to individual technicians and small businesses.

The distribution logistics are structured to provide readily available product access and calibration support. Original Equipment Manufacturers (OEMs) often rely on exclusive agreements with major regional distributors who possess the technical knowledge required to support the product line. Aftermarket support, including recalibration services and replacement sensor heads, forms a recurring revenue stream and is a key competitive differentiator, promoting long-term customer loyalty and ensuring the continued operational accuracy mandated by environmental protection agencies. Effective management of this complex service ecosystem is crucial for maximizing total value captured across the chain.

Electronic Refrigerant Leak Detector Market Potential Customers

Potential customers for Electronic Refrigerant Leak Detectors are diverse but highly specialized, primarily comprising professional technicians and large institutional entities responsible for operating or maintaining refrigeration and air conditioning systems. The largest customer segment includes HVACR service companies and independent technicians who require portable, high-sensitivity detectors for routine maintenance, diagnostics, and certification work in residential and commercial buildings. Automotive service centers and garages constitute another major purchasing group, driven by the need to efficiently service modern vehicle AC systems using new refrigerants like R-1234yf. Industrial users, such as food and beverage processors, petrochemical plants, and large cold storage facilities, typically purchase stationary, continuously monitoring systems to detect early signs of leakage from extensive, mission-critical refrigeration infrastructure.

Furthermore, government agencies and municipal maintenance departments tasked with managing public infrastructure (schools, hospitals, transit systems) often procure these detectors to ensure environmental compliance and optimize energy expenditure within their facilities. Original Equipment Manufacturers (OEMs) of refrigeration equipment also utilize these detectors extensively during the manufacturing and quality assurance phases to verify the integrity of newly assembled units before shipment. The purchase decision for these customers is heavily influenced by detector sensitivity, durability, compliance certification (e.g., CE, UL), and the availability of localized calibration services, demonstrating a strong preference for high-quality, professional-grade instrumentation that minimizes the risk of compliance penalties and system downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 558.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bacharach Inc., Inficon, Testo SE & Co. KGaA, Fieldpiece Instruments, CPS Products, Ritchie Engineering Company Inc. (YELLOW JACKET), Tif Instruments (acquired by CPS), Robinair (Bosch Automotive Service Solutions), Refco Manufacturing Ltd., D-TEK, Inc., Elitech Technology, Ltd., General Tools & Instruments, Mastercool Inc., Sensit Technologies, Amprobe Test Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Refrigerant Leak Detector Market Key Technology Landscape

The Electronic Refrigerant Leak Detector Market Key Technology Landscape is dominated by three primary sensor technologies: heated diode, infrared (IR), and corona discharge. Heated diode sensors, traditionally the most common and cost-effective, operate by heating a semiconductor tip that reacts with halogenated refrigerants, producing an ion current spike. While sensitive, they are prone to sensor burnout and can be less selective, reacting to moisture or other airborne contaminants, thus often requiring frequent replacement and calibration. Their low initial cost, however, maintains their strong presence, particularly in the aftermarket for basic HVACR tools, catering to cost-sensitive professionals who prioritize simplicity and immediate availability.

Infrared (IR) sensor technology represents the current state-of-the-art, rapidly gaining market share due to its superior performance attributes. IR detectors operate by measuring the absorption of infrared energy at specific wavelengths characteristic of refrigerant molecules. This method offers high selectivity, allowing the detector to target specific refrigerants while ignoring others, drastically reducing false positives. Crucially, IR sensors boast significantly longer lifespans, often lasting for years without replacement, justifying their higher initial investment. The shift towards HFO refrigerants, which exhibit distinct absorption spectra, further accelerates the adoption of IR technology as it provides reliable detection capabilities necessary for these newer chemical compounds.

The emerging technological trend involves the integration of advanced connectivity and sensing architectures. Modern detectors are incorporating micro-electromechanical systems (MEMS) sensors to achieve smaller form factors and lower power consumption. Furthermore, Bluetooth and Wi-Fi connectivity are standard features in high-end models, enabling data logging, integration with mobile applications for trend analysis, and seamless generation of compliance documentation. The ultimate goal of these technological advancements is to provide technicians with highly robust, precise, and user-friendly tools that not only detect leaks but also contribute holistically to efficient system management and regulatory compliance, transitioning the detector from a simple tool to a smart diagnostic instrument.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Electronic Refrigerant Leak Detector Market, largely driven by varying levels of regulatory enforcement and infrastructure maturity.

- North America: This region is a leading market, characterized by stringent EPA regulations (particularly Section 608 for refrigerants) and a large, established HVACR service industry. High awareness regarding environmental compliance and a robust industrial sector utilizing complex refrigeration systems ensure strong demand for high-end, highly accurate detectors, particularly those leveraging infrared technology. Adoption of fixed monitoring systems in large commercial buildings is particularly strong here.

- Europe: Driven by the EU F-Gas Regulation, Europe exhibits some of the highest standards for leak detection and repair frequency. This strict regulatory environment forces professionals to invest in the most reliable and certified equipment, stimulating the demand for advanced portable and stationary units. Germany, France, and the UK are key markets, focusing heavily on reducing greenhouse gas emissions from refrigeration units and transitioning rapidly to low-GWP alternatives.

- Asia Pacific (APAC): Expected to register the fastest growth during the forecast period. This surge is attributed to rapid urbanization, massive infrastructure development (commercial real estate, data centers), and the corresponding expansion of the cold chain and air conditioning sectors (especially in China, India, and Southeast Asian nations). While price sensitivity is higher, growing regulatory pressure and increasing environmental awareness are gradually shifting preferences toward reliable electronic detectors over traditional methods.

- Latin America (LATAM): Growth is steady, primarily centered around economic hubs like Brazil and Mexico. The market is moderately mature, with demand stemming from automotive AC repair and basic commercial refrigeration maintenance. Market adoption often follows global trends but at a slower pace due to varied regulatory enforcement and reliance on imported technology.

- Middle East and Africa (MEA): Characterized by extreme climatic conditions, leading to heavy reliance on powerful air conditioning systems, particularly in the GCC countries. Investment in large-scale infrastructure projects and emerging regulatory frameworks related to environmental protection drive the necessity for effective leak detection. Demand is concentrated in large urban areas and industrial zones, often favoring durable, high-temperature resistant devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Refrigerant Leak Detector Market.- Bacharach Inc.

- Inficon

- Testo SE & Co. KGaA

- Fieldpiece Instruments

- CPS Products

- Ritchie Engineering Company Inc. (YELLOW JACKET)

- Tif Instruments (acquired by CPS)

- Robinair (Bosch Automotive Service Solutions)

- Refco Manufacturing Ltd.

- D-TEK, Inc.

- Elitech Technology, Ltd.

- General Tools & Instruments

- Mastercool Inc.

- Sensit Technologies

- Amprobe Test Tools

- Advanced Test Products (ATP)

- Fluke Corporation

- Wintact Instruments

- Ecom Instruments GmbH

- UEi Test Instruments

Frequently Asked Questions

Analyze common user questions about the Electronic Refrigerant Leak Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective technology for detecting HFO refrigerants like R-1234yf?

Infrared (IR) sensor technology is the most effective and recommended method for detecting new-generation HFO refrigerants (like R-1234yf and R-452B). IR detectors offer superior selectivity and sensitivity necessary to accurately detect these refrigerants without high rates of false alarms caused by airborne contaminants.

How often should an electronic refrigerant leak detector be calibrated?

The calibration frequency depends on the sensor type and usage intensity, but professional best practices recommend recalibration or sensor verification at least once a year, or immediately after a known exposure to high concentrations of refrigerant or contaminants, to ensure ongoing accuracy and regulatory compliance.

What are the primary drivers of growth in the refrigerant leak detector market?

The market is primarily driven by stringent global environmental regulations, particularly the phase-down mandates of high Global Warming Potential (GWP) refrigerants under agreements like the Kigali Amendment, necessitating certified leak detection and repair procedures across all cooling sectors.

Are handheld or stationary leak detectors more suitable for industrial applications?

Industrial applications, especially in large chemical or food processing plants, typically require fixed, stationary leak detection systems for continuous, automated monitoring of critical infrastructure. Handheld detectors are used primarily for pinpointing the exact location of the leak once a general area is identified by the fixed system.

What distinguishes heated diode technology from infrared technology in terms of operational lifespan?

Heated diode sensors typically have a much shorter operational lifespan, as the sensing element can be degraded or "poisoned" by prolonged exposure to high concentrations of refrigerants or oils, requiring frequent replacement. Infrared sensors, conversely, utilize optical components and generally last several years with minimal degradation, offering superior longevity and stability.

What role does IoT integration play in the current electronic leak detection market?

IoT integration allows high-end detectors to connect wirelessly to smartphones or centralized systems, enabling automatic data logging, trend analysis, remote diagnostics, and standardized report generation, significantly improving the efficiency of compliance documentation and preventive maintenance scheduling.

Which geographic region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to massive infrastructural investment in commercial buildings, rapid expansion of the cold chain logistics sector, and rising adoption of HVAC systems in densely populated countries like China and India.

What are the main challenges restraining the adoption of advanced leak detection equipment?

Key challenges include the high initial purchasing cost of advanced, high-sensitivity Infrared (IR) detectors compared to traditional methods, and the ongoing challenge for technicians to accurately calibrate and use detectors designed for the increasing number of diverse and complex refrigerant blends entering the market.

How is the automotive sector influencing the demand for specialized detectors?

The automotive sector's mandatory shift toward low-GWP refrigerants, such as R-1234yf, has created a significant demand for highly sensitive and selective detectors certified specifically for these newer, mildly flammable gases, driving the adoption of specialized IR detection technology in repair garages globally.

What is the significance of sensitivity level in selecting a professional leak detector?

Sensitivity, typically measured in grams per year (g/yr), is crucial as regulatory standards increasingly require the detection of very small leak rates to minimize environmental impact. High sensitivity ensures even minor, developing leaks are identified early, preventing system failure and non-compliance penalties.

What types of natural refrigerants require specialized electronic detection?

Natural refrigerants such as Ammonia (R-717) and Hydrocarbons (R-290 Propane, R-600a Isobutane) require specialized electronic detectors, often utilizing electrochemical or catalytic bead sensors, due to their unique chemical properties, toxicity (Ammonia), or flammability risks (Hydrocarbons).

How do manufacturers ensure the reliability and accuracy of detectors for multiple refrigerants?

Manufacturers achieve multi-refrigerant accuracy primarily through Infrared (IR) technology, which can be tuned or programmed to recognize the distinct absorption spectra of various gas types (HFCs, HFOs, CO2), often featuring selectable modes for different refrigerant families to optimize performance.

What impact does refrigerant toxicity and flammability have on detector design?

For flammable (A2L, A3) and toxic (B2) refrigerants, detectors must not only be highly sensitive but also engineered to meet safety standards (e.g., intrinsically safe certification) to prevent them from acting as an ignition source in potentially explosive environments, requiring robust housing and sensor isolation.

In the Value Chain, why is the calibration step considered critical for electronic leak detectors?

Calibration is critical because it ensures the detector meets its advertised sensitivity specifications and adheres to required regulatory standards (like those set by SAE or EPA). Improper calibration leads to inaccurate readings, risking non-compliance fines or failure to detect serious leaks, undermining the device's fundamental utility.

What market segment is dominated by the handheld detector type?

The handheld detector segment overwhelmingly dominates the general HVACR service and maintenance sector. Their portability, ease of use, and ability to pinpoint leaks in diverse field settings make them the standard tool for mobile technicians and small to medium-sized repair contractors.

How is AI expected to reduce false alarm rates in leak detection?

AI algorithms analyze sensor data patterns and environmental variables (humidity, temperature changes, non-refrigerant VOCs) over time. By learning to recognize the signature of true refrigerant leaks versus ambient noise or interference, AI filters out these false positives, leading to significantly higher diagnostic confidence.

What is the primary difference between stationary and fixed leak detection systems?

While often used interchangeably, fixed systems generally refer to permanently installed units monitoring a specific point (e.g., a pump), whereas stationary systems may imply broader continuous monitoring networks deployed within a large room or facility, integrated with a central control panel for comprehensive coverage.

How do environmental regulations affect the product life cycle of leak detectors?

Environmental regulations, particularly those phasing down older refrigerants and introducing new ones, force manufacturers to continuously innovate and update their product lines. This results in shorter product life cycles for specialized detectors that only handle legacy gases, pushing demand toward flexible, multi-gas capable units.

Which application segment holds the largest market share?

The HVACR Service and Maintenance application segment holds the largest market share, driven by the sheer volume of installed residential and commercial air conditioning and heat pump units globally, all of which require periodic service, inspection, and leak checking.

What are the limitations of corona discharge technology compared to IR?

Corona discharge detectors are highly sensitive but are non-selective, reacting to various halogenated compounds, moisture, and smoke, leading to frequent false alarms. They also consume the sensing element over time, whereas IR technology offers high selectivity and does not degrade through normal use, providing better long-term performance.

Why is data logging capability becoming important for professional leak detectors?

Data logging is crucial for demonstrating compliance. It provides an indisputable record (time, date, location, concentration) of the leak event and the subsequent repair process, which is often required documentation by environmental protection agencies for large system owners.

What financial restraint affects small service companies purchasing advanced detectors?

The major financial restraint for small service companies is the high capital expenditure required for premium Infrared detectors, which can cost significantly more than traditional heated diode models, often leading them to choose less sensitive but cheaper alternatives despite regulatory incentives.

How does the cold chain expansion in APAC influence detector demand?

The explosive growth of the cold chain (refrigerated warehousing, transport, and logistics) in APAC directly increases the number of large-scale, critical refrigeration installations. This necessitates investment in reliable, often fixed, leak detection systems to protect perishable goods and ensure system uptime.

What is the role of sensor replacement in the detector market?

Sensor replacement constitutes a significant recurring revenue stream, particularly for heated diode and corona discharge detectors due to their limited lifespan. It is a necessary cost for end-users to maintain detector functionality and is a key factor influencing long-term ownership costs.

Which sub-segment of technology is currently driving market value growth?

The Infrared (IR) Sensor technology sub-segment is currently driving market value growth. Its adoption is accelerating due to superior performance characteristics, mandated use for specific new refrigerants, and the strong preference among high-volume users for highly reliable instruments.

What is the primary motivation for industrial users to adopt continuous monitoring systems?

Industrial users adopt continuous monitoring systems primarily to ensure operational safety, minimize costly downtime of mission-critical refrigeration processes, and guarantee immediate detection of large leaks to prevent significant financial loss and environmental penalties.

How does the complexity of refrigerant blends affect detection accuracy?

Complex refrigerant blends (e.g., R-407C, R-410A) can challenge detectors, as they may evaporate at different rates, potentially leading to fractionalization and inaccurate concentration readings. Advanced detectors mitigate this by targeting multiple molecular components or being calibrated specifically for the blend's unique molecular signature.

What competitive advantage do manufacturers gain from offering superior post-sale calibration services?

Superior post-sale calibration services build strong customer loyalty and establish a reliable, recurring revenue stream. It ensures technicians keep their certified tools accurate, which is essential for regulated industries, thereby increasing the Total Cost of Ownership (TCO) value proposition for the manufacturer.

Which key end-users are categorized under the Industrial Refrigeration segment?

Key end-users in the Industrial Refrigeration segment include food and beverage production facilities, pharmaceutical manufacturing plants, chemical processing industries, cold storage warehouses, and large-scale data centers relying on substantial cooling infrastructure.

What is the anticipated effect of MEMS technology on future leak detector designs?

MEMS (Micro-Electromechanical Systems) technology is expected to miniaturize sensor components significantly, leading to the development of smaller, lighter, lower-power consumption, and potentially more cost-effective electronic leak detectors without sacrificing the required sensitivity levels.

How do varying regional regulatory standards impact global product strategies?

Varying regional standards (e.g., stricter EU F-Gas vs. specific US EPA rules) compel global manufacturers to develop modular or configurable detectors that can be certified to meet multiple, distinct regional requirements, leading to complex but globally marketable product portfolios.

In the context of the supply chain, what risk is associated with the procurement of specialized sensors?

The primary risk associated with specialized sensor procurement is reliance on a limited number of high-tech suppliers, which can lead to supply chain bottlenecks, price volatility, and potential delays in manufacturing if a single source experiences production issues or technological obsolescence.

Why is the service life of the detector head a crucial consideration for buyers?

The service life of the detector head directly impacts the long-term maintenance cost. Buyers prefer IR detectors with long sensor lives to minimize the frequency and expense of replacing costly sensor elements, thereby maximizing the return on investment over the device's operational period.

What role does noise filtering play in high-performance electronic leak detection?

Noise filtering technology is essential in high-performance detectors, especially in noisy industrial or outdoor environments. It electronically isolates the signal of the target refrigerant from background electrical noise, wind effects, or interference from other chemical vapors, ensuring reliable detection integrity.

How is the move towards natural refrigerants creating new market opportunities?

The shift towards natural refrigerants (like CO2, propane, ammonia) creates opportunities for specialized sensor manufacturers, as these gases require completely different detection technologies (e.g., NDIR for CO2, catalytic bead for hydrocarbons) than traditional halogenated refrigerants, necessitating new product lines.

What are the key differences in purchasing motivation between a residential HVAC technician and a large food processing plant?

The residential technician prioritizes portability, speed, and cost-effectiveness (handheld), whereas the food processing plant prioritizes continuous reliability, regulatory compliance reporting, and integration into safety systems (stationary, high-accuracy IR or electrochemical units).

What technological feature is often bundled with Bluetooth connectivity in modern detectors?

Bluetooth connectivity in modern detectors is often bundled with proprietary mobile applications that allow technicians to visualize leak rates, input client data, automatically generate compliant service reports, and manage the device's operational settings and firmware updates remotely.

How does the price of refrigerants influence the demand for electronic detectors?

As the phasedown increases the scarcity and cost of high-GWP refrigerants (due to tariffs and quotas), the financial incentive to prevent and detect leaks immediately grows significantly, thereby boosting demand for accurate electronic detectors as a cost-saving measure.

Which regulatory bodies most influence the standards for leak detectors in the US?

In the US, the Environmental Protection Agency (EPA), specifically through Section 608 of the Clean Air Act, and the Society of Automotive Engineers (SAE), which sets technical performance standards (e.g., SAE J2791, J2913) for automotive refrigerant detectors, are the most influential regulatory bodies.

What is the risk of using an old detector calibrated for CFCs on modern HFO systems?

The risk is severe inaccuracy. Older detectors may not be tuned to the molecular structure of HFOs, leading to either failure to detect a large leak or generating false positive readings. Furthermore, they may lack the necessary sensitivity required by modern environmental standards for HFOs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Refrigerant Leak Detector Market Statistics 2025 Analysis By Application (Resident, Commercial, Industrial), By Type (Handheld Type, Desktop Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Electronic Refrigerant Leak Detector Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Infrared Refrigerant Leak Detector, Electronic Refrigerant Leak Detector), By Application (Resident, Commercial Field, Industrial Field), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager