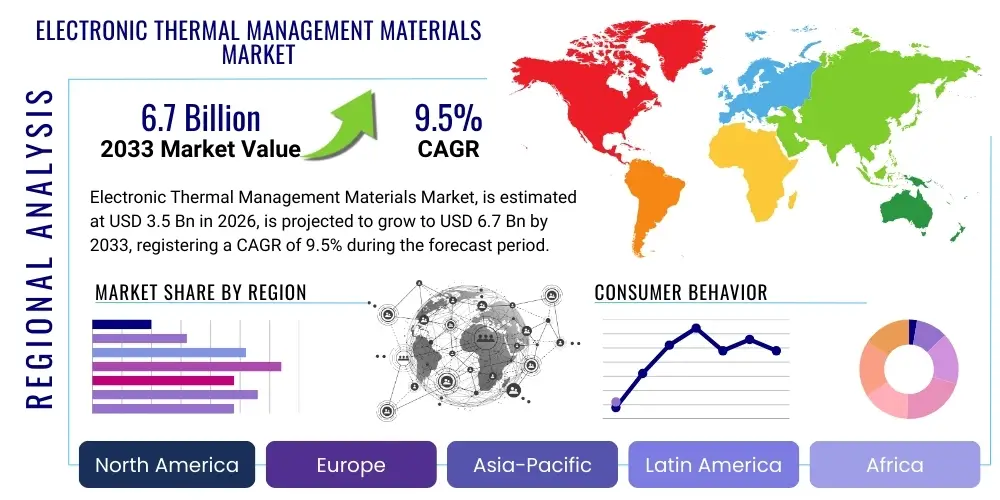

Electronic Thermal Management Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431690 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Electronic Thermal Management Materials Market Size

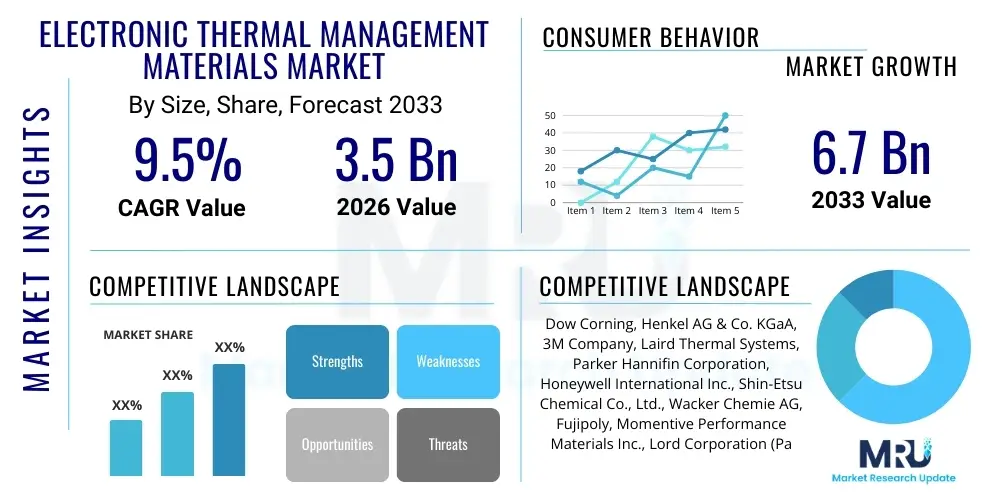

The Electronic Thermal Management Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the relentless demand for higher performance and miniaturization across critical sectors, including 5G infrastructure, electric vehicles (EVs), and advanced computing, all of which generate significant waste heat that must be managed efficiently to ensure operational reliability and device longevity.

Electronic Thermal Management Materials Market introduction

Electronic Thermal Management Materials (ETMM) encompass a diverse range of specialized substances and components designed to dissipate or transfer heat away from critical electronic components, thereby maintaining optimal operating temperatures. These materials are fundamental to modern electronics, especially as power densities increase exponentially in advanced semiconductors, power modules, and battery systems. The necessity for effective thermal management arises directly from the inverse relationship between temperature and electronic device reliability; for every 10-degree Celsius increase in operating temperature, the failure rate of a semiconductor device can potentially double. ETMM solutions mitigate this risk, ensuring sustained performance and extended lifespan for high-value electronic systems.

The product portfolio of ETMM includes Thermal Interface Materials (TIMs) such as thermal greases, gap fillers, thermal pads, and phase change materials; thermal dissipation elements like heat sinks, heat pipes, and cooling fans; and specialized substrates such as ceramic and metal matrix composites. Major applications span telecommunications (5G base stations, optical networking equipment), automotive electronics (inverters, converters, battery thermal management systems in EVs), consumer electronics (high-end smartphones, laptops, gaming consoles), and industrial sectors (high-power LEDs, medical imaging equipment). The primary benefit delivered by these materials is the enhanced thermal conductivity across interfaces, reducing thermal resistance and facilitating rapid heat transfer to ambient environments or dedicated cooling loops.

Driving factors for this market are multifaceted, centered around technological evolution and regulatory pushes. The proliferation of 5G technology necessitates high-power radio frequency components requiring stringent thermal control. Similarly, the global shift towards electric mobility fuels demand for robust thermal management systems within EV batteries and power electronics, crucial for both safety and range optimization. Furthermore, the exponential growth of data centers and cloud computing, relying on dense racks of powerful servers, exerts continuous pressure on manufacturers to develop next-generation thermal materials capable of handling heat fluxes exceeding 300 W/cm², thereby maintaining the stability and efficiency of mission-critical digital infrastructure.

Electronic Thermal Management Materials Market Executive Summary

The Electronic Thermal Management Materials market is currently undergoing significant transformation, characterized by a rapid shift toward high-performance, exotic materials aimed at ultra-low thermal resistance applications. Business trends indicate strong merger and acquisition activity among specialty chemical and material science companies seeking to integrate expertise in advanced fillers, such as synthetic diamonds, boron nitride, and carbon nanotubes, to achieve superior thermal conductivity (W/mK). Market participants are heavily investing in research and development to commercialize liquid cooling solutions, specifically single-phase and two-phase immersion cooling fluids, which are becoming mandatory for hyperscale data centers and demanding high-performance computing (HPC) environments.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, driven primarily by the colossal manufacturing base for consumer electronics, automotive electronics, and semiconductor fabrication in countries like China, South Korea, Japan, and Taiwan. North America and Europe maintain strong positions due to significant investments in data center expansion and EV production, though they primarily focus on high-margin, specialized materials and advanced cooling techniques. In terms of segments, Thermal Interface Materials (TIMs) remain the largest product category, but within this segment, there is a distinct move away from traditional thermal greases toward more stable, high-reliability products like thermal gap pads and phase change materials (PCMs) tailored for long-term industrial and automotive use.

The market faces a persistent challenge concerning the balance between thermal performance and cost-effectiveness. While materials like diamond and advanced ceramics offer superior thermal properties, their high production costs can limit adoption in mainstream consumer applications. Future growth is strongly linked to advancements in material deposition techniques and the development of composite materials that can integrate high thermal conductivity fillers into polymer matrices efficiently and affordably. Additionally, sustainability requirements are beginning to influence material selection, pushing manufacturers toward halogen-free and environmentally conscious thermal management solutions suitable for end-of-life recycling.

AI Impact Analysis on Electronic Thermal Management Materials Market

The advent and widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies are exerting profound and unique pressures on the Electronic Thermal Management Materials market, primarily due to the specialized hardware required for AI processing. Common user questions frequently revolve around the thermal demands of next-generation AI accelerators, particularly GPUs and Tensor Processing Units (TPUs), which operate with unprecedented power densities, often exceeding 700 watts per chip in server configurations. Users are concerned about whether current standard thermal solutions, such as conventional thermal pads and metal heat sinks, are capable of sustaining the high operational loads and transient heat spikes typical of continuous AI model training and inference. Key themes emerging from these inquiries include the necessity for TIMs with ultra-thin bond lines (sub-10 microns) to minimize thermal resistance, the reliability of cooling solutions under 24/7 high-load operation, and the viability of transitioning from air cooling to liquid or immersion cooling systems specifically optimized for dense AI server clusters.

AI hardware generates heat fluxes that push the boundaries of conventional thermal material science. The heat must be transferred across multiple interfaces—from the die to the integrated heat spreader (IHS), from the IHS to the heat sink or cold plate. Each interface requires a thermal material with extremely high thermal conductivity (often >10 W/mK) and excellent wet-out properties. Furthermore, the physical constraints imposed by server rack density necessitate compact, highly efficient thermal solutions, often driving the adoption of specialized vapor chambers and advanced micro-channel cold plates. This technological shift means that traditional material suppliers must rapidly innovate to meet the stringent, application-specific requirements of major AI hardware developers like Nvidia, AMD, and Intel, whose thermal specifications dictate the materials used in the final electronic systems.

The overarching expectation is that AI technology will not only drive volume growth but also fundamentally alter the product mix toward premium, high-performance ETMMs. The demand signal generated by massive AI data centers guarantees sustained investment in advanced cooling techniques, moving the industry away from incremental improvements in existing materials towards disruptive technologies. This necessitates collaboration between material scientists and semiconductor packaging engineers to develop co-designed thermal solutions integrated directly into the chip packaging, ensuring maximum thermal dissipation efficiency right at the heat source, thereby stabilizing AI computational performance under extreme conditions.

- AI accelerators necessitate TIMs capable of handling extreme heat flux densities (up to 300 W/cm²).

- Increased adoption of liquid cooling (cold plates, immersion systems) for AI data centers drives demand for specialized coolants and high-performance gap fillers compatible with liquid environments.

- Demand for ultra-low thermal resistance solutions accelerates R&D in materials like liquid metal alloys and advanced graphite sheets.

- AI-driven optimization algorithms are increasingly used in designing complex thermal systems and predicting material fatigue under operational stress.

- The need for high reliability in mission-critical AI servers drives demand for long-life, non-pump-out thermal materials, particularly Phase Change Materials (PCMs) and specialized thermal pads.

DRO & Impact Forces Of Electronic Thermal Management Materials Market

The Electronic Thermal Management Materials market is propelled by powerful technological drivers, faces persistent cost and complexity restraints, yet holds substantial opportunities derived from emerging technology adoption, collectively shaping the competitive landscape through significant impact forces. The primary drivers are the miniaturization trend coupled with rising power density in semiconductor devices across all electronics sectors, including 5G communications and consumer IoT devices. A second major driver is the accelerating electrification of the automotive sector, where stringent requirements for battery safety, fast charging, and power module efficiency necessitate highly reliable, robust thermal management solutions capable of withstanding harsh environmental conditions. These drivers ensure continuous, non-negotiable demand for ETMMs that improve performance and extend the operational life of expensive electronic systems.

However, the market growth is partially restricted by several factors. A significant restraint is the high cost and complex manufacturing processes associated with advanced thermal materials, such as specific ceramic fillers (e.g., highly crystalline aluminum nitride, boron nitride) and synthetic diamond composites. Achieving high thermal conductivity often requires proprietary compounding techniques, driving up material costs and limiting widespread adoption in cost-sensitive segments like mainstream consumer electronics. Another key restraint is the industry standardization challenge; the thermal requirements vary drastically between different applications (e.g., a low-power LED versus a high-power IGBT module), making it difficult for material suppliers to achieve economies of scale for highly specialized products and requiring extensive customization and validation.

Opportunities in this market center on disruptive innovation and market expansion into underdeveloped segments. The most lucrative opportunities lie in the development of next-generation hybrid cooling solutions that integrate active (liquid cooling) and passive (advanced TIMs, vapor chambers) elements, particularly for high-performance computing and edge AI deployments. Furthermore, the development of sustainable, recyclable, and bio-based thermal management materials represents an opportunity to address environmental concerns and appeal to manufacturers committed to green initiatives. The collective impact forces compel constant material innovation, pushing the average thermal conductivity specifications upward year after year, demanding tighter process controls, and driving strategic vertical integration among component manufacturers and material suppliers to secure supply chains for critical raw materials.

Segmentation Analysis

The Electronic Thermal Management Materials market is intricately segmented across product type, material composition, form factor, and end-user application, reflecting the diverse and highly specialized requirements of various electronic systems. Product segmentation details the functional category of the solution, ranging from materials that bridge microscopic gaps (TIMs) to full-scale heat rejection apparatuses (heat sinks and heat spreaders). This complexity underscores the fact that thermal management often involves a layered approach, utilizing multiple material types in conjunction to efficiently move heat from the source (die) to the ambient environment. Analyzing these segments is critical for manufacturers to align their product portfolios with high-growth sectors, particularly those demanding high-reliability and extreme performance characteristics.

Segmentation by material composition reveals the core chemical science driving performance. This involves polymers (silicone, epoxy), ceramics (alumina, boron nitride), carbon-based materials (graphite, carbon nanotubes), and metals (copper, aluminum, liquid metal alloys). The ongoing trend is the combination of these materials into advanced composites, aiming to leverage the excellent thermal properties of ceramic or carbon fillers while maintaining the physical flexibility and adhesion properties of polymer matrices. End-user application segmentation is arguably the most dynamic, showing a pronounced shift in demand intensity from traditional consumer electronics towards automotive power electronics and IT infrastructure, segments characterized by long product lifecycles and stringent thermal endurance standards.

The fastest-growing segment is Thermal Interface Materials (TIMs), particularly those targeting high-end CPUs, GPUs, and power modules. Within TIMs, thermal gap fillers and pads, which offer ease of application and reworkability, are gaining traction, especially in mass-produced items where automated assembly is crucial. Geographically, APAC dominates due to semiconductor production volume, but the most intense technological demand often originates from North American and European data center and specialized automotive markets, driving premium pricing for specialized, high-W/mK materials across all segment categories.

- By Product Type:

- Thermal Interface Materials (TIMs)

- Greases and Adhesives

- Gap Fillers and Pads

- Phase Change Materials (PCMs)

- Thermal Tapes

- Heat Spreading Materials

- Heat Sinks (Extruded, Stamped, Forged, Bonded Fin)

- Heat Pipes and Vapor Chambers

- Thermal Substrates (e.g., DBC, AMC)

- Active Cooling Devices

- Fans and Blowers

- Liquid Cooling Systems (Pumps, Cold Plates, Chillers)

- By Material Type:

- Ceramics (Aluminum Oxide, Aluminum Nitride, Boron Nitride)

- Metals and Alloys (Copper, Aluminum, Liquid Metals)

- Polymers and Composites (Silicone, Epoxy, Polyurethane)

- Carbon-Based Materials (Graphite, Graphene, Carbon Nanotubes)

- By End-Use Application:

- Consumer Electronics (Smartphones, Laptops, Gaming)

- Automotive (EV Batteries, Power Electronics, LiDAR)

- Telecommunications (5G Base Stations, Servers)

- Aerospace and Defense

- Industrial and Power Electronics (IGBTs, Converters)

- LED Lighting

Value Chain Analysis For Electronic Thermal Management Materials Market

The value chain for Electronic Thermal Management Materials is complex, stretching from the sourcing of exotic raw materials through specialized compounding, manufacturing, and integration into final electronic assemblies. The upstream segment involves the extraction and refinement of base metals (copper, aluminum) and the specialized synthesis of thermal fillers, particularly high-purity ceramic powders like boron nitride, alumina, and micro- or nano-sized diamond particles. This upstream phase is highly capital-intensive and requires significant intellectual property regarding particle surface modification and dispersion techniques to ensure maximum thermal performance when blended into matrices. The quality and cost of these fundamental raw materials dictate the final product attributes, establishing a critical dependence on a few specialized chemical and material suppliers globally.

Midstream activities focus on the material compounding and component manufacturing. This involves formulating polymer resins with optimal thermal fillers to create TIMs, or designing and fabricating complex components like vapor chambers and heat sinks using advanced manufacturing techniques such as vacuum soldering, stamping, and CNC machining. Manufacturers in this stage must possess expertise in polymer chemistry, metallurgy, and thermal engineering simulation to meet specific application requirements regarding thickness, flexibility, adhesion, and thermal impedance. Quality control, particularly ensuring minimal void formation and consistent thermal performance batch-to-batch, is a critical bottleneck in the midstream segment.

The downstream distribution channels are dual: direct sales and indirect distribution. Direct channels are prevalent for high-volume, highly customized solutions destined for Tier 1 original equipment manufacturers (OEMs) in the automotive, telecom, and HPC sectors, where thermal materials are co-designed with the electronic package. Indirect distribution relies on global material distributors and specialized component distributors who serve smaller manufacturers, aftermarket needs, and maintenance/repair operations (MRO). Final integration involves applying the ETMM onto the electronic module during the assembly phase, where precision application (e.g., using automated dispensing equipment for liquid TIMs) is paramount to achieve the specified thermal performance and ensuring the longevity and reliability of the end device.

Electronic Thermal Management Materials Market Potential Customers

Potential customers for Electronic Thermal Management Materials span a wide spectrum of industries, but are primarily concentrated in sectors where high-power density and operational reliability are non-negotiable performance parameters. The dominant customer base includes manufacturers of high-performance computing hardware, such as data center operators and server manufacturers who deploy systems utilizing powerful GPUs and specialized AI accelerators. These customers require materials with the absolute highest thermal conductivity (W/mK) and often necessitate customized liquid cooling infrastructure, making them key purchasers of advanced cold plates, high-efficiency pumps, and specialized thermal greases and pads designed for server architectures.

The automotive industry represents a rapidly expanding customer segment, particularly driven by Electric Vehicles (EVs) and hybrid vehicles. EV manufacturers and their Tier 1 suppliers are significant consumers of ETMMs for battery thermal management systems (BTMS), motor control units, inverters, and onboard chargers. These applications demand materials that offer not only excellent thermal performance but also high dielectric strength, flame retardancy, and vibration resistance to ensure safety and durability over the vehicle's lifespan. The demand here is shifting towards gap fillers and encapsulated phase change materials that provide long-term reliability and shock absorption in harsh vehicular environments.

Furthermore, manufacturers of consumer electronics (smartphones, gaming laptops, tablets), telecommunication equipment providers (5G infrastructure, network routers), and aerospace/defense contractors are consistent and high-volume purchasers. In consumer electronics, the focus is often on thinness and lightweight materials (e.g., graphite sheets, thin vapor chambers) to enable sleeker designs while managing the heat from increasingly powerful mobile processors. Telecommunications requires robust, outdoor-rated thermal solutions for base station antennas and remote radio units (RRUs), typically utilizing specialized thermal potting compounds and ruggedized heat sinks capable of enduring extreme temperature fluctuations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Corning, Henkel AG & Co. KGaA, 3M Company, Laird Thermal Systems, Parker Hannifin Corporation, Honeywell International Inc., Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Fujipoly, Momentive Performance Materials Inc., Lord Corporation (Parker Hannifin), BASF SE, DuPont de Nemours, Inc., Hitachi Chemical Co., Ltd., Aavid Thermalloy, Mersen, Timtronics, Z-World, Boyd Corporation, Thermalright. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Thermal Management Materials Market Key Technology Landscape

The technology landscape of the Electronic Thermal Management Materials market is characterized by continuous refinement of existing solutions and the emergence of disruptive, high-efficiency cooling technologies essential for handling the exponential increase in chip power density. Current leading technologies heavily rely on advanced composite materials where high thermal conductivity fillers are embedded in organic or inorganic matrices. Specifically, the innovation focus within Thermal Interface Materials (TIMs) is centered on reducing bond line thickness (BLT) and achieving higher thermal conductivity (W/mK) without sacrificing reliability or manufacturability. This involves leveraging materials such as advanced aluminum nitride (AlN) and boron nitride (BN) powders, which exhibit excellent thermal properties and electrical isolation, incorporated into silicone or acrylic polymers optimized for automated dispensing and curing.

Beyond traditional TIMs, significant technological advancements are occurring in passive heat spreading and active cooling components. Vapor chambers and high-performance heat pipes, which utilize the principles of phase change heat transfer, are becoming standard in high-power mobile devices and dense server racks. These technologies offer superior isothermalization, effectively spreading localized heat loads across a larger surface area for more efficient dissipation. Simultaneously, the adoption of liquid cooling technologies, including direct-to-chip micro-channel cold plates and single-phase and two-phase immersion cooling systems, is rapidly accelerating, driven by hyperscale data centers. This shift demands new materials, such as specialized coolants with high dielectric strength and chemical compatibility with various plastic and metallic components within the loop.

The future technology roadmap points toward integrating thermal management solutions directly into the semiconductor package itself. Technologies like embedded cooling channels, three-dimensional (3D) integrated heat spreaders, and the use of liquid metal TIMs (e.g., gallium-indium alloys) offer pathways to drastically reduce thermal resistance at the source, moving the industry closer to achieving sustainable cooling for exascale computing and highly dense mobile processors. Furthermore, the development of intelligent thermal management systems, incorporating sensors and AI-driven predictive control to dynamically adjust cooling parameters based on operational load, represents a significant technological leap toward optimized energy consumption and enhanced system lifespan across various applications.

Regional Highlights

The global Electronic Thermal Management Materials market exhibits diverse regional dynamics influenced by manufacturing capabilities, technological adoption rates, and regulatory environments.

- Asia Pacific (APAC): APAC is the largest market shareholder and is projected to register the highest growth rate during the forecast period. This dominance is attributed to the region's concentration of semiconductor foundries, vast consumer electronics manufacturing hubs (China, South Korea), and the explosive growth in EV production in China. The demand spans from high-volume, cost-effective TIMs for smartphones to high-performance heat sinks and gap fillers for automotive power modules.

- North America: North America holds a substantial share, primarily driven by investments in hyperscale data centers, advanced high-performance computing (HPC), and cutting-edge aerospace/defense electronics. This region leads in the adoption of next-generation cooling technologies, including liquid and immersion cooling solutions, and demands premium, specialized thermal materials often co-developed with leading technology firms like NVIDIA and Intel.

- Europe: Europe is a mature market characterized by robust automotive R&D, focusing heavily on EV battery thermal management and industrial automation. The region is driven by stringent environmental regulations, favoring sustainable and environmentally compliant thermal materials. Germany and France are key consumers, particularly in high-reliability industrial and power electronics applications, necessitating high-durability thermal substrates.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, primarily driven by expanding telecommunications infrastructure (4G/5G deployment) and localized manufacturing of consumer electronics. The market generally favors established, cost-effective thermal solutions, though demand for specialized materials related to local data center expansion is growing.

- Middle East and Africa (MEA): Growth in MEA is spurred by digitalization initiatives, investments in smart city projects, and significant infrastructural development requiring power electronics and cooling solutions resistant to high ambient temperatures and harsh environmental conditions. Demand is concentrated in the telecom and industrial sectors, prioritizing robust and reliable thermal management systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Thermal Management Materials Market.- Dow Corning (A part of Dow Inc.)

- Henkel AG & Co. KGaA

- 3M Company

- Laird Thermal Systems (A part of Advent International)

- Parker Hannifin Corporation

- Honeywell International Inc.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Fujipoly (Fuji Polymer Industries Co., Ltd.)

- Momentive Performance Materials Inc.

- Lord Corporation (Now Parker Hannifin)

- BASF SE

- DuPont de Nemours, Inc.

- Hitachi Chemical Co., Ltd. (Showa Denko Materials)

- Aavid Thermalloy (A part of Boyd Corporation)

- Mersen

- Timtronics

- Z-World (Z-Thermal)

- Boyd Corporation

- Thermalright

Frequently Asked Questions

Analyze common user questions about the Electronic Thermal Management Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced Electronic Thermal Management Materials (ETMM)?

The primary driver is the necessity to manage exponentially increasing heat flux density in modern electronic devices, particularly in high-performance computing (HPC), 5G infrastructure components, and power electronics within Electric Vehicles (EVs). Effective thermal management is crucial for maintaining device reliability and achieving optimal performance specifications.

How are Thermal Interface Materials (TIMs) classified, and which segment is experiencing the fastest growth?

TIMs are classified based on their form factor and material, including greases, pads, gap fillers, and Phase Change Materials (PCMs). The fastest-growing subsegment is high-performance thermal gap fillers and PCMs, favored for their superior compliance, ease of manufacturing automation, and reliability in critical automotive and industrial applications.

What role do advanced materials like graphene and carbon nanotubes play in thermal management?

Graphene and carbon nanotubes (CNTs) serve as next-generation thermal fillers. Due to their exceptional intrinsic thermal conductivity, they are incorporated into polymer matrices to create high-W/mK thermal composites, enabling ultra-thin, highly efficient heat dissipation layers essential for miniaturized electronics.

How is the Electric Vehicle (EV) industry influencing the ETMM market?

The EV industry demands specialized ETMMs for Battery Thermal Management Systems (BTMS) and power modules (inverters/converters). This application requires materials with high thermal conductivity, electrical isolation, superior durability, and inherent flame retardancy to ensure vehicle safety and extend battery life under rapid charging and varying ambient conditions.

What is the long-term forecast regarding the transition from air cooling to liquid cooling in data centers?

The long-term forecast indicates a significant transition towards hybrid and liquid cooling, specifically direct-to-chip and immersion cooling, within hyperscale and AI data centers. This shift is mandatory as power densities surpass the capabilities of traditional air-cooling architectures, driving demand for specialized coolants and compatible cold plate assemblies to ensure operational efficiency and energy savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager