Electronic Turnstile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432389 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electronic Turnstile Market Size

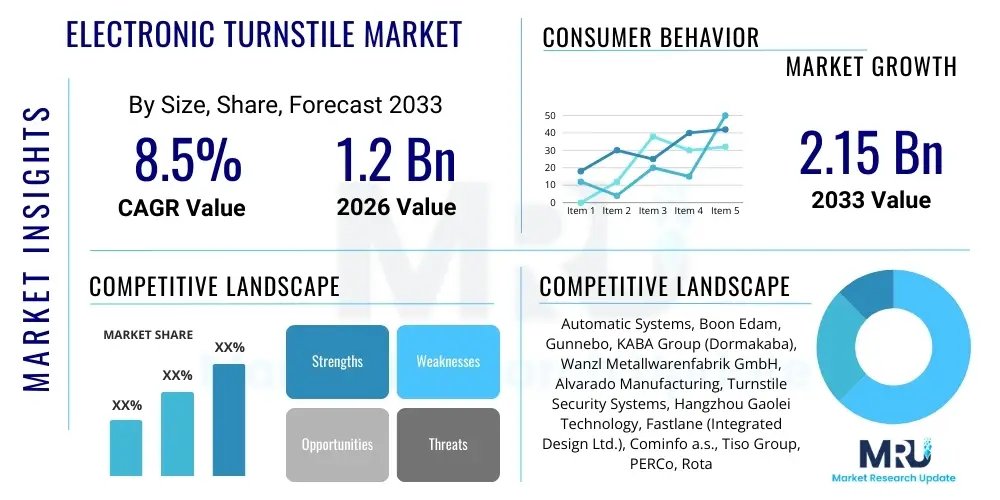

The Electronic Turnstile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by escalating security concerns across public and private infrastructure, coupled with the increasing integration of sophisticated access control technologies such as biometric authentication and facial recognition systems. The modernization of transportation hubs and commercial buildings globally necessitates efficient, high-throughput pedestrian flow management, establishing electronic turnstiles as critical components in modern security frameworks.

Electronic Turnstile Market introduction

The Electronic Turnstile Market encompasses the design, manufacture, and deployment of automated pedestrian gates utilized for controlling and monitoring foot traffic flow in secured or high-volume environments. These systems, ranging from traditional waist-high tripod turnstiles to advanced speed gates, serve as pivotal elements in integrated physical security systems. The primary function involves ensuring only authorized personnel gain entry, typically authenticated via RFID cards, biometric scans, or mobile credentials. The market offers a diverse product portfolio tailored for various security levels and aesthetic requirements, including optical turnstiles preferred in corporate lobbies and full-height turnstiles crucial for perimeter security in industrial settings and stadiums.

Key applications span critical infrastructure sectors, including mass transit systems (subways, bus stations), commercial buildings (corporate headquarters, data centers), entertainment venues (stadiums, amusement parks), and governmental facilities. The core benefit of electronic turnstiles lies in their ability to provide precise audit trails, reduce reliance on manual security personnel, and enhance overall operational efficiency through rapid, automated throughput. Furthermore, modern turnstiles are increasingly becoming integrated smart devices, capable of networking with centralized security management platforms (PSIM) and leveraging IoT capabilities for predictive maintenance and real-time status reporting. The evolving landscape of urban safety and smart city initiatives further cements their necessity.

Driving factors fueling this market expansion include the global surge in infrastructure development, particularly in emerging economies, alongside stringent regulatory mandates regarding public safety and access control in developed regions. The imperative to mitigate unauthorized access, coupled with technological advancements leading to faster processing speeds and improved aesthetic designs, makes electronic turnstiles a preferred choice over traditional mechanical gates. Furthermore, the rising adoption of contactless authentication methods, accelerated by post-pandemic health considerations, provides significant momentum for high-tech optical and speed gate segments which offer superior throughput and user experience.

Electronic Turnstile Market Executive Summary

The global Electronic Turnstile Market is experiencing robust expansion characterized by strong investment in automated security solutions across urban centers. Business trends indicate a pronounced shift towards integration capabilities, where turnstiles are no longer standalone devices but essential nodes within larger, interconnected security ecosystems, utilizing standardized communication protocols like ONVIF and API integration. This focus on seamless connectivity drives demand for high-end optical turnstiles and sophisticated speed gates in commercial real estate and corporate environments seeking both aesthetic appeal and advanced security features. The operational expenditure savings derived from automated access control systems further reinforce their long-term value proposition for businesses.

Regionally, North America and Europe maintain dominance, primarily due to well-established infrastructure, high security standards, and the early adoption of advanced biometric technologies. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), propelled by massive public transportation projects, rapid urbanization in countries like China and India, and increasing governmental focus on critical infrastructure security. Latin America, the Middle East, and Africa (MEA) are also emerging as vital markets, driven by modernization projects in key cities and the need to secure high-value assets suchiles as energy plants and ports. Regional competitive dynamics are shaped by local manufacturing capabilities and the ability of global players to customize solutions for specific climate and cultural requirements.

Segment trends reveal that the Full-Height Turnstile segment remains crucial for high-security applications, while the Speed Gates segment is witnessing the fastest uptake due to its high throughput rate and aesthetically pleasing design suitable for high-footfall areas like corporate headquarters and convention centers. Technology-wise, biometric authentication (fingerprint, facial, iris recognition) is displacing traditional proximity cards in high-security installations, offering unparalleled reliability and security. End-use segmentation confirms that the Transportation sector, encompassing airports, rail, and bus terminals, remains the largest consumer, while the burgeoning demand from the Retail and Commercial sector (e.g., data centers, co-working spaces) is driving innovation in integration and design.

AI Impact Analysis on Electronic Turnstile Market

User inquiries regarding the AI impact on the Electronic Turnstile Market frequently center on predictive maintenance, enhanced authentication reliability, and integration with broader smart building management systems. Users are keen to understand how AI-driven algorithms can reduce false positives in biometric scans, improve throughput efficiency by anticipating and managing peak foot traffic, and automate maintenance scheduling to prevent operational downtime. There is significant expectation that AI will transform turnstiles from simple access control barriers into intelligent data collection points capable of performing advanced analytics on pedestrian flow, density mapping, and queue management, thereby optimizing facility utilization and security response times.

The implementation of Artificial Intelligence, particularly Machine Learning (ML) and Deep Learning (DL), is moving electronic turnstiles into a new generation of smart security devices. AI algorithms are crucial for refining facial recognition accuracy, especially in challenging environments or when dealing with partially obscured faces, significantly enhancing the security level provided by speed gates. Furthermore, AI enables turnstiles to differentiate between standard authorized entry and tailgating incidents with greater precision than traditional sensor arrays, minimizing false alarms while ensuring strict adherence to one-person-per-entry protocols. This level of precision is paramount in high-security environments like data centers.

Beyond authentication, AI dramatically improves operational efficiency. Predictive algorithms analyze historical usage patterns, environmental factors, and component health to forecast potential mechanical failures, allowing facility managers to execute preventative maintenance before a critical failure occurs. This shift from reactive to proactive maintenance minimizes disruptions and extends the lifespan of the equipment. Moreover, AI integration facilitates real-time occupancy monitoring and dynamic access adjustments based on immediate security threats or localized crowd control needs, making the security infrastructure highly adaptable and responsive. This integration elevates the overall value proposition of electronic turnstile systems within the wider physical security market.

- AI-driven Predictive Maintenance: Forecasting mechanical failures based on operational data, minimizing downtime.

- Enhanced Biometric Accuracy: Improving reliability of facial recognition and iris scanning, reducing false rejection rates.

- Advanced Anti-Tailgating: Utilizing computer vision and deep learning to detect unauthorized dual entry with higher precision.

- Real-time Flow Optimization: Dynamically adjusting gate speeds and modes based on immediate pedestrian density analysis.

- Behavioral Analytics Integration: Connecting turnstile usage data with broader security analytics for anomaly detection and pattern recognition.

DRO & Impact Forces Of Electronic Turnstile Market

The Electronic Turnstile Market is dynamically influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces that shape investment and technology adoption. Key market drivers include the pervasive global need for enhanced security measures following geopolitical events and rising incidents of unauthorized access in public and private facilities. This is coupled with the continuous technological evolution, specifically the reduction in cost and increase in efficiency of biometric and smart credential systems, which seamlessly integrate with turnstile mechanisms. The mandate for efficient crowd management in mass transit and large venues also acts as a primary driving force, pushing the demand for high-throughput speed gates.

Conversely, significant restraints hinder uniform market growth. High initial capital investment required for deploying integrated, sophisticated electronic turnstile systems, particularly high-end optical barriers, presents a barrier for smaller organizations or those in developing regions with constrained budgets. Furthermore, privacy concerns related to biometric data collection and storage, especially under increasingly stringent regulations like GDPR, introduce implementation complexities and necessitate robust data security protocols, slowing adoption in sensitive sectors. The technical complexity involved in integrating new turnstile systems with legacy access control infrastructure also poses an implementation hurdle, requiring specialized technical expertise.

Opportunities for market expansion are primarily found in the rapid adoption of mobile access solutions (using smartphones as credentials) and the growing trend of smart city infrastructure development. This provides manufacturers with avenues to develop IoT-enabled turnstiles that offer connectivity, remote management, and diagnostic capabilities. The burgeoning retrofit market, where older mechanical turnstiles are upgraded with electronic components and smart authentication readers, represents a lucrative opportunity, particularly in mature infrastructure markets. The shift toward subscription-based security services, including remote maintenance and monitoring for turnstiles, also presents a novel business model enhancing revenue streams.

The primary impact forces are regulatory pressure favoring standardized security protocols, technological innovation accelerating the displacement of older mechanical systems, and economic feasibility driving the adoption in medium to high-traffic commercial environments. Geopolitical stability and local crime rates significantly influence governmental and private sector spending on physical security infrastructure. The market forces demand for highly durable, tamper-proof systems while simultaneously pushing for aesthetically pleasing and non-intrusive designs, creating a need for product differentiation based on both robustness and user experience.

Segmentation Analysis

The Electronic Turnstile Market is broadly segmented based on Type, Technology, and End-Use Industry, reflecting the varied requirements for security and throughput across different environments. Analyzing these segments provides a detailed understanding of market dynamics and areas of high growth potential. The Type segmentation distinguishes systems based on their physical configuration and security level, ranging from simple tripod barriers to advanced full-height revolving doors designed for maximum perimeter security. Technology segmentation highlights the evolving methods of user authentication, transitioning from traditional magnetic stripes to highly secure, integrated biometric and mobile credential systems. This detailed classification enables vendors to target specific vertical markets with precision-engineered solutions.

The End-Use Industry segment reveals where the predominant demand originates, with the Transportation sector traditionally dominating due to the immense scale and critical nature of passenger flow management in airports and metros. However, the Commercial & Industrial sector, fueled by the demand for controlled access in corporate campuses, R&D facilities, and manufacturing plants, is rapidly increasing its market share. This diversification is driven by the realization across multiple industries that automated access control is integral not only to security but also to regulatory compliance and internal process efficiency. Manufacturers are increasingly tailoring product features—such as throughput speed and aesthetic finish—to meet the distinct operational requirements of these varied end-use environments.

A crucial segmentation trend involves the convergence of physical security and IT networking within segments like Data Centers and Critical Infrastructure. These environments require turnstiles capable of handling multi-factor authentication seamlessly, often combining biometrics with proximity cards and leveraging encrypted network communication. This complexity drives the value higher in these segments compared to standard application areas like public transit. Furthermore, segmentation by sales channel—direct versus indirect distribution—shows that system integrators play a pivotal role in delivering complex, bespoke installations for large corporate clients, while direct sales often cater to governmental and defense organizations requiring highly customized and secure procurement processes.

- By Type:

- Tripod Turnstiles

- Full-Height Turnstiles

- Speed Gates (Optical Turnstiles)

- Waist-High Turnstiles

- Revolving Doors/Portals

- By Technology:

- Biometric Recognition (Fingerprint, Facial, Iris)

- RFID/Proximity Cards

- Barcode/QR Codes

- Mobile Access Credentials

- By End-Use Industry:

- Transportation (Airports, Railway Stations, Metro)

- Commercial & Industrial (Corporate Offices, Factories, Data Centers)

- Government & Defense

- Entertainment & Stadiums

- Education & Institutions

- Healthcare

- By Component:

- Hardware (Barrier Mechanisms, Housings)

- Software & Services (Access Control Management Systems, Maintenance)

Value Chain Analysis For Electronic Turnstile Market

The Electronic Turnstile market value chain begins with upstream activities involving the sourcing of core components, primarily specialized metals (stainless steel and aluminum for housing and barriers), sophisticated electronic components (sensors, microprocessors, motor drives), and high-resolution readers (biometric sensors, RFID antennae). Key suppliers in this segment include major semiconductor manufacturers and industrial motor specialists. The cost and quality of these raw materials and technological components significantly dictate the final product quality and manufacturing costs. Strategic supplier partnerships are crucial for ensuring a stable supply of advanced electronic components, especially given global supply chain volatilities affecting microchips and specialized sensors required for high-end optical gates.

The middle segment of the value chain is dominated by manufacturers who focus on design, assembly, software integration, and quality assurance. This phase involves extensive R&D to incorporate new technologies like advanced facial recognition algorithms, robust anti-tailgating sensors, and seamless networking capabilities. Manufacturing is increasingly specialized, with different firms focusing on specific product types, such as high-security full-height models versus aesthetically focused speed gates. Differentiation in this stage is achieved through product durability, compliance with international security standards (e.g., CE, UL), and the proprietary software platform used for management and integration with third-party security systems.

Downstream activities involve distribution, installation, and post-sales support, playing a critical role in market penetration and customer satisfaction. Distribution channels are typically bifurcated into direct sales for large governmental or critical infrastructure projects requiring specialized configuration, and indirect sales leveraging system integrators and distributors. System integrators are paramount, providing customized security solutions that combine the turnstile with video surveillance, alarm systems, and centralized access control software. Post-sales services, including maintenance contracts, software updates, and training, contribute significantly to recurring revenue streams and long-term customer relationships, completing the value cycle.

Electronic Turnstile Market Potential Customers

The potential customer base for electronic turnstiles is vast and diverse, spanning multiple verticals that prioritize controlled access, pedestrian throughput, and centralized security management. The primary and most significant end-users are large organizations managing high volumes of daily foot traffic, where both security and efficiency are non-negotiable. This includes operators of mass transit systems, which deploy rugged tripod and flap turnstiles to manage ticketed entry and exits across urban and intercity networks. Airports are also critical buyers, increasingly adopting advanced speed gates integrated with biometric e-gates to streamline passenger processing and border control, meeting stringent international security mandates.

The second major group of buyers resides within the Commercial and Corporate sector, encompassing multinational headquarters, technology parks, and co-working spaces. These customers predominantly favor optical turnstiles and speed gates due to their sleek aesthetic appeal, high throughput capacity, and seamless integration with modern building management systems (BMS). For these entities, the turnstile often serves as the first point of corporate identification and authentication, requiring robust, reliable, and aesthetically non-intrusive systems that reinforce the company's professional image. Data centers, which demand the highest level of security, are specific potential customers utilizing full-height and security portal turnstiles with multi-factor authentication protocols.

Furthermore, institutions like universities, large hospitals, and entertainment venues such as sports stadiums and concert halls constitute substantial potential customers. These facilities need efficient systems capable of handling large crowds during peak events while managing access for staff and authorized personnel during off-hours. Educational institutions, in particular, are increasingly investing in turnstiles for campus perimeter security and dormitory access control to enhance student safety. Government buildings, military bases, and critical infrastructure installations (power plants, water treatment facilities) also remain consistent buyers, demanding custom-built, tamper-proof systems that comply with national security standards and require specialized secure procurement processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Automatic Systems, Boon Edam, Gunnebo, KABA Group (Dormakaba), Wanzl Metallwarenfabrik GmbH, Alvarado Manufacturing, Turnstile Security Systems, Hangzhou Gaolei Technology, Fastlane (Integrated Design Ltd.), Cominfo a.s., Tiso Group, PERCo, Rotalok, Axess AG, IDEMIA, Gotschlich, Centurion Systems, Magnetic Autocontrol, Shenzhen Wejoin International Co., Ltd., ZK Teco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Turnstile Market Key Technology Landscape

The electronic turnstile market's technology landscape is defined by the critical reliance on robust authentication methods, sophisticated sensor technologies, and highly integrated networking capabilities. The transition from mechanical coin-operated systems to fully automated, electronic access points has been primarily driven by advancements in credential recognition systems. Biometric technologies, including high-speed facial recognition and precise fingerprint scanners, represent the pinnacle of current authentication, offering unparalleled security and eliminating the issues associated with lost or stolen access cards. These biometric readers necessitate advanced processing units embedded within the turnstile housing to ensure swift, real-time matching against centralized databases, thereby maintaining high throughput rates even in peak traffic periods.

Another pivotal technological component is the sensor array utilized for anti-tailgating and directionality control, particularly prevalent in optical turnstiles and speed gates. These systems employ infrared (IR) sensors, often combined with specialized algorithms, to accurately determine the passage of a single individual, distinguishing between authorized entry, unauthorized follow-through, and legitimate items like baggage or wheelchairs. The precision of these sensors is a key differentiator in the high-security segment, significantly impacting the operational reliability of the turnstile. Furthermore, the integration of IoT (Internet of Things) capabilities enables turnstiles to communicate real-time operational status, diagnostic data, and access logs over secure networks, allowing for centralized management and remote troubleshooting across vast corporate campuses or transportation networks.

The evolution towards seamless, mobile-first credentials is also rapidly reshaping the technological landscape. Mobile access solutions leverage technologies such as Near Field Communication (NFC) and Bluetooth Low Energy (BLE) to allow authorized users to gain entry using their smartphones or wearable devices. This shift provides enhanced convenience and scalability, enabling facility managers to issue and revoke access rights digitally without the need for physical card issuance. Moreover, the connectivity aspect is crucial, requiring turnstile controllers to support standardized communication protocols (e.g., Wiegand, OSDP) to ensure interoperability with a broad range of access control software platforms and building management systems, facilitating system upgrades and future-proofing investments.

Regional Highlights

The geographical analysis reveals distinct patterns of adoption and technological maturity across global regions, heavily influenced by urbanization rates, regulatory mandates, and infrastructure investment levels. North America, characterized by high security consciousness and significant private sector investment in corporate and critical infrastructure security, is a mature market leader. The region exhibits high demand for sophisticated speed gates and integrated biometric solutions, driven by corporate requirements for high-efficiency employee access management and stringent data center security standards.

- North America: Market maturity defined by high demand for biometric integration and optical turnstiles in commercial real estate and tech industry campuses. Stringent regulatory compliance for critical infrastructure drives demand for advanced security portals and full-height systems.

- Europe: Strong focus on standardization, driven by large-scale public transportation networks and smart city initiatives in countries like Germany, France, and the UK. Emphasis on aesthetically pleasing design and adherence to GDPR privacy regulations impacting biometric adoption strategies.

- Asia Pacific (APAC): Fastest-growing region globally, fueled by massive government investments in new airport and metro infrastructure (especially in China, India, and Southeast Asia). Demand is heterogeneous, ranging from high-volume, cost-effective tripod turnstiles in public areas to cutting-edge speed gates in newly built corporate towers and mixed-use developments.

- Latin America: Emerging market focused on enhancing security in public spaces and reducing theft in industrial facilities. Adoption is characterized by a gradual shift from mechanical to electronic systems, with price sensitivity playing a significant role in procurement decisions for mass transit systems.

- Middle East and Africa (MEA): High growth potential linked to mega-projects, including new city developments and tourism infrastructure (e.g., UAE, Saudi Arabia). Significant investment in state-of-the-art access control for critical energy infrastructure and governmental facilities, favoring advanced, durable systems suitable for harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Turnstile Market.- Automatic Systems

- Boon Edam

- Gunnebo

- Dormakaba (formerly KABA Group)

- Wanzl Metallwarenfabrik GmbH

- Alvarado Manufacturing

- Turnstile Security Systems

- Hangzhou Gaolei Technology

- Fastlane (Integrated Design Ltd.)

- Cominfo a.s.

- Tiso Group

- PERCo

- Rotalok

- Axess AG

- IDEMIA

- Gotschlich

- Centurion Systems

- Magnetic Autocontrol

- Shenzhen Wejoin International Co., Ltd.

- ZK Teco

Frequently Asked Questions

Analyze common user questions about the Electronic Turnstile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a speed gate and a tripod turnstile?

The primary difference lies in security level, throughput, and design. Tripod turnstiles offer moderate security and physically block passage using three arms, typically used in high-volume public transit. Speed gates (optical turnstiles) use invisible infrared sensors and retractable barriers, offering higher throughput, advanced anti-tailgating technology, and a premium aesthetic, making them ideal for corporate lobbies and secure access points where appearance and speed are critical.

How is biometric technology impacting the security level of electronic turnstiles?

Biometric technology, including facial and iris recognition, significantly elevates the security level by requiring unique physical identification, virtually eliminating credential sharing or loss. Integration of AI algorithms improves verification speed and accuracy, reducing false positives and strengthening identity confirmation compared to card-based systems, making turnstiles reliable checkpoints for high-security areas like data centers.

What are the key drivers for market growth in the Asia Pacific region?

Market growth in the Asia Pacific is primarily driven by massive infrastructure spending on public transportation (new metros and high-speed rail networks), rapid urbanization leading to the development of commercial hubs, and increasing government initiatives focused on securing critical infrastructure and improving urban mobility management systems.

What major challenges exist concerning data privacy and turnstile adoption?

The major challenges revolve around the collection, storage, and processing of sensitive biometric data used for authentication. Compliance with global regulations like GDPR and CCPA is paramount, requiring manufacturers and operators to implement robust encryption, anonymization techniques, and explicit consent mechanisms to address user concerns about data security and privacy infringement.

How does the Internet of Things (IoT) enhance the functionality of modern electronic turnstiles?

IoT integration allows modern turnstiles to function as smart, networked devices, enabling real-time remote diagnostics, centralized access management across multiple sites, and predictive maintenance alerts. This connectivity optimizes operational efficiency, minimizes downtime, and allows seamless integration with broader smart building and security management platforms (PSIM).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager