Electroplating Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439115 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electroplating Equipment Market Size

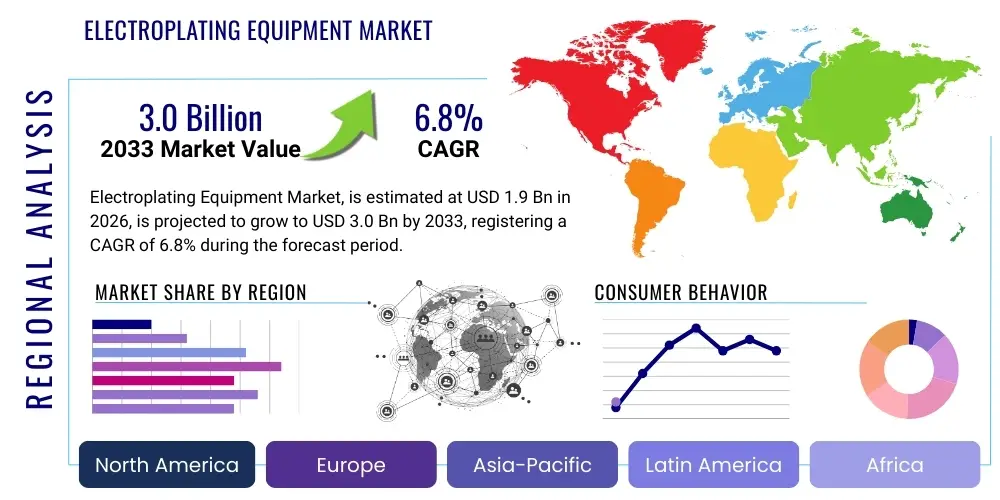

The Electroplating Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033.

Electroplating Equipment Market introduction

The electroplating equipment market encompasses machinery, systems, and accessories utilized for depositing a thin layer of metal onto a substrate through an electrochemical process. This process, known as electroplating or electrodeposition, is essential for improving surface characteristics such as corrosion resistance, wear resistance, conductivity, and aesthetic appeal. Key products within this market include rectifiers, tanks, filtration systems, chemical feeders, automated hoist systems, and specialized control software. The foundational demand for this equipment stems from industries requiring high-performance surface finishes, particularly electronics, automotive, aerospace, and general manufacturing, where component reliability is paramount. The market is increasingly driven by the need for advanced surface treatments that comply with stringent environmental regulations, pushing manufacturers toward more efficient and closed-loop systems, such as advanced waste treatment and metal recovery units.

The product description spans a wide range of complexity, from simple manual plating lines used in small job shops to fully automated, highly sophisticated reel-to-reel and robotic plating systems utilized by major electronics and automotive component suppliers. Automated systems, featuring Programmable Logic Controllers (PLCs) and HMI interfaces, offer enhanced precision, reduced human error, and superior repeatability, which is critical for mass production environments. Major applications involve decorative coatings (e.g., chrome, nickel), functional coatings (e.g., zinc, cadmium substitutes for corrosion protection), and technical coatings (e.g., gold, silver, palladium for electronic connectivity). The adoption of sustainable plating chemistries, such as trivalent chromium replacements for hexavalent chromium, necessitates parallel upgrades in equipment design to handle new chemical compositions and operational parameters, further stimulating market demand for state-of-the-art machinery. Furthermore, the integration of advanced process monitoring tools, including automated titration systems and spectrometric analyzers, ensures precise bath chemistry control, a vital factor for achieving consistent and high-quality deposition across all types of substrates, ranging from plastics to complex alloyed metals.

The principal driving factors include the rapid expansion of the electric vehicle (EV) sector, which requires specialized corrosion and thermal management coatings for battery components and power electronics, and the miniaturization trend in the semiconductor and consumer electronics industries. The inherent benefits of electroplating—providing superior surface hardness and electrical properties at a relatively low cost compared to other coating methods—ensure its continued relevance. Furthermore, advancements in process control technology, including real-time bath analysis and digital twins for predictive maintenance, enhance operational efficiency and resource utilization, making new equipment acquisition an attractive investment for global manufacturers aiming for optimized supply chains and superior product quality compliance. The transition towards Industry 4.0 standards is compelling users to invest in connected, data-gathering electroplating lines, which can communicate directly with enterprise resource planning (ERP) systems, streamlining production planning and quality assurance documentation. This integration is crucial for maintaining competitive edge in a globalized manufacturing landscape where speed and quality traceability are non-negotiable requirements for tier-one suppliers across critical industrial verticals.

Electroplating Equipment Market Executive Summary

The global electroplating equipment market exhibits strong growth momentum, primarily fueled by robust demand from the Asian Pacific electronics and automotive sectors. Business trends highlight a pronounced shift towards customized and modular plating systems that can accommodate varied production volumes and rapidly evolving coating specifications, such as those demanded by advanced semiconductor packaging and specialized medical devices. Key market participants are focusing their research and development efforts on enhancing energy efficiency, particularly in power supply units (rectifiers), and integrating sophisticated process monitoring software to ensure optimal chemical balance and waste minimization. Strategic mergers and acquisitions are common as companies seek to expand their geographical footprint and acquire specialized technologies, especially in the niche areas of advanced surface preparation and post-treatment finishing. The market environment favors vendors who can provide end-to-end solutions, combining equipment, chemistry, and technical support, offering a single point of responsibility for complex finishing operations. This strategy mitigates operational risk for end-users and accelerates the adoption curve for new, complex plating processes, ensuring rapid return on investment for large-scale capital projects.

Regionally, Asia Pacific maintains its dominance, driven by massive manufacturing output in China, South Korea, and Japan, coupled with substantial government investments in domestic EV infrastructure and 5G network expansion, both highly dependent on high-quality plated components. North America and Europe are characterized by high regulatory pressure, particularly concerning the Restriction of Hazardous Substances (RoHS) and REACH compliance, leading to substantial investment in environmental upgrades and the replacement of older equipment with environmentally compliant alternatives. These mature markets focus heavily on automation and precision for aerospace and defense applications, prioritizing reliability and traceability over pure volume. Emerging regional trends include the growth of localized supply chains post-pandemic, prompting new installations of mid-scale plating facilities in regions like Southeast Asia and Latin America to serve local manufacturing clusters and reduce reliance on overseas processing capabilities. Furthermore, regulatory divergence between regions creates market opportunities for equipment tailored specifically to local compliance regimes, such as zero liquid discharge (ZLD) systems increasingly demanded in water-stressed or highly regulated industrial zones globally.

Segment trends underscore the increasing preference for automated systems over manual or semi-automatic installations, reflecting the industry’s pursuit of consistency and labor efficiency. The rectifier segment, particularly DC and Pulse Plating rectifiers, sees technological innovation focusing on high-frequency switching technology for improved energy conversion and deposition quality. By material plated, copper, nickel, and zinc plating applications continue to hold the largest market share due to their widespread use in automotive anti-corrosion and general engineering applications. However, the fastest growth is observed in precious metal plating (gold, silver, palladium) and specialty alloys, driven by sophisticated requirements in microelectronics and sensors. The adoption rate of continuous plating processes, such as reel-to-reel plating, is accelerating within the electronics segment, providing high throughput capabilities essential for components like connectors and lead frames. This transition towards continuous processing demands highly robust and reliable components, including specialized plating cells and high-precision chemical metering pumps, further driving technological complexity and capital investment within the equipment manufacturing sector.

AI Impact Analysis on Electroplating Equipment Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and electroplating predominantly revolve around how AI can enhance process control, predict equipment failure, and optimize chemical usage to reduce operating costs and environmental impact. Common themes include the feasibility of using machine learning (ML) models to correlate bath parameters (temperature, pH, concentration) with real-time coating quality, thereby eliminating human subjectivity and improving first-pass yield. Users also express interest in AI-powered vision systems for automated defect detection, aiming for quality inspection speeds that surpass manual methods. Furthermore, there is significant curiosity about predictive maintenance schedules for critical components like pumps, filters, and rectifiers, leveraging historical operational data to prevent unplanned downtime, a critical factor in capital-intensive plating lines. The overall expectation is that AI will transform electroplating from a process heavily reliant on empirical knowledge and manual adjustment into a data-driven, highly optimized manufacturing step, ensuring tighter adherence to increasingly stringent industry standards.

The key themes emerging from user concerns center on the investment cost associated with integrating AI, the requirement for standardized data collection protocols across heterogeneous legacy equipment, and the need for specialized training for technical staff to manage complex ML systems. While the benefits in defect reduction and resource optimization are clear, users are concerned about the implementation challenge, particularly in smaller job shops that lack the necessary IT infrastructure or capital for major system overhauls. Expectations are high regarding process stability; specifically, users anticipate AI will significantly mitigate issues related to dendritic growth, burning, and pitting by proactively adjusting current density and agitation based on environmental variables or incoming part quality variations. This proactive control shifts the focus from reactive problem-solving to preventive optimization, ensuring stricter adherence to demanding specifications like those found in mil-spec or aerospace components, where failure is catastrophic. The long-term integration of AI promises to unlock efficiencies previously unattainable, making quality control a continuous, autonomous activity rather than an intermittent inspection task.

AI’s influence is expected to dramatically redefine the skill requirements within the plating industry, shifting the focus from manual chemical analysis and tank tending to data interpretation and system management. AI algorithms can analyze hundreds of data points from sensors, including proprietary spectral data and voltage patterns, which are impossible for human operators to process simultaneously. This capability allows for micro-adjustments in real-time, leading to cleaner, more uniform deposits, which is crucial for advanced packaging technologies where layer thickness tolerance is measured in nanometers. Moreover, AI simulation tools are beginning to allow engineers to model the electrodeposition process under various conditions (digital twins), reducing the time and cost associated with physical prototyping and testing of new plating chemistries or rack designs, thereby accelerating R&D cycles and time-to-market for specialized coatings. This simulation capability minimizes the use of expensive materials during development and optimizes the operational footprint of the eventual physical line, offering a substantial competitive advantage to early adopters of these digital tools in the equipment sector.

- AI-driven Predictive Maintenance: Minimizing rectifier failure and downtime by analyzing voltage and temperature fluctuations in real-time, ensuring maximum equipment uptime.

- Real-time Quality Control: Using machine vision and ML for automated, high-speed defect identification and classification, often replacing time-consuming manual microscopic inspection.

- Process Optimization: Dynamic adjustment of current density, chemical concentration, and temperature based on anticipated coating anomalies, optimizing layer uniformity and throwing power.

- Resource Management: Predictive modeling of chemical replenishment cycles to optimize inventory, minimize consumption variance, and reduce overall waste effluent volume.

- Simulation and Digital Twins: Modeling plating bath hydrodynamics and current distribution to optimize rack design and process parameters virtually, significantly shortening R&D cycles.

DRO & Impact Forces Of Electroplating Equipment Market

The electroplating equipment market is shaped by a strong interplay of influential factors encompassing technical necessity, regulatory compliance, and macroeconomic dynamics. The primary drivers include the accelerated production in the electronics sector, particularly in components requiring highly conductive and corrosion-resistant finishes like those used in 5G infrastructure, IoT devices, and advanced printed circuit boards. Restraints largely center on the environmental and health risks associated with traditional plating chemistries, such as the use of highly regulated substances like hexavalent chromium and cyanide, leading to substantial compliance costs and hindering market expansion in regions with strict environmental enforcement. Significant opportunities arise from the global push toward electrification in transportation, creating massive demand for specialized, high-performance coatings for Li-ion battery components, fuel cells, and high-voltage interconnects, necessitating investment in new, highly automated plating lines optimized for these novel applications. These factors combine to create a significant impact force compelling manufacturers to innovate towards cleaner, safer, and more automated electroplating solutions, often requiring complete systemic redesigns rather than incremental upgrades.

The drivers are fundamentally linked to technological progression. The trend toward miniaturization in electronics demands plating processes capable of achieving ultra-fine pitch deposition and exceptional uniformity across complex geometries, favoring advanced equipment such as pulse plating rectifiers and precise chemical dosing systems. Furthermore, the rising adoption of specialized functional coatings—such as amorphous alloys and composite deposits—for engineering applications requires new generations of plating machinery designed for complex bath compositions and controlled agitation techniques. Conversely, restraints include the high capital expenditure required for installing advanced automated plating lines, which poses a barrier to entry for smaller enterprises and job shops. Moreover, the inherent complexity and operational sensitivity of the electroplating process, requiring highly skilled labor, presents an additional constraint, particularly in developing economies where specialized technical expertise may be scarce, impacting the effective utilization and maintenance of sophisticated equipment. The variability in global energy prices also acts as a constraint, as electroplating is an inherently energy-intensive process, making energy efficiency a crucial factor in new equipment procurement decisions.

The most compelling opportunity lies in sustainability and efficiency. The mandate to minimize water usage and chemical waste drives the development of advanced filtration and ion exchange systems, alongside closed-loop rinsing technologies. Equipment vendors who can deliver solutions that significantly reduce the operational environmental footprint gain a considerable competitive edge, capitalizing on the industrial focus on ESG (Environmental, Social, and Governance) criteria. The increasing geopolitical emphasis on reshoring or nearshoring critical manufacturing capabilities, especially in high-tech and defense sectors, necessitates the establishment of new, modern plating facilities equipped with the latest technology, thereby generating substantial procurement opportunities for electroplating system suppliers in North America and Europe. The collective impact forces push the industry away from conventional, batch-oriented methods toward continuous, high-precision, and environmentally sound automated plating platforms that integrate seamlessly into modern manufacturing ecosystems governed by Industry 4.0 principles, ensuring high process transparency and traceability essential for compliance and quality assurance in critical components.

Segmentation Analysis

The electroplating equipment market is segmented based on the type of equipment, the plating process utilized, the material deposited, and the end-use industry served. This multi-faceted segmentation allows for a granular understanding of demand patterns and technological adoption across various manufacturing domains. The equipment type segment, including rectifiers, tanks, filters, and heating systems, reveals where capital investment is primarily directed, often showing rectifiers as the key technological differentiator due to their role in controlling deposition quality. Process segmentation, distinguishing between barrel plating, rack plating, and continuous plating, reflects the scale and geometry requirements of the parts being processed, with continuous (reel-to-reel) plating dominating high-volume electronics applications, particularly for manufacturing continuous strips of connectors and lead frames requiring consistent, high-speed deposition.

Segmentation by material provides insight into raw material market trends and functional requirements. Copper, nickel, and zinc are staple materials for general corrosion protection and conductivity, dominating automotive and general engineering demand. Conversely, the growth of high-value applications, such as semiconductor manufacturing, fuels demand for equipment tailored for precise precious metal (gold, palladium) or exotic alloy plating, requiring extremely tight tolerance control and advanced containment systems to manage expensive bath chemistries efficiently. This segment analysis helps manufacturers align their product development efforts with the specific functional needs of rapidly evolving sectors like electric vehicle battery production, which requires specialized nickel and copper coatings designed for thermal management, high current transfer, and superior adhesion to battery contacts, demanding highly specialized deposition parameters and bath maintenance systems.

The end-use industry segmentation confirms the market's reliance on high-tech manufacturing, with Automotive and Electronics being the largest contributors. However, other critical sectors, including Aerospace & Defense (requiring robust, specialized coatings for extreme environments, such as corrosion-resistant finishes for landing gear and turbine components) and Medical Devices (demanding biocompatible, high-purity plating for surgical tools and implants, often using gold or platinum), also represent significant, albeit niche, market segments driving demand for highly specialized, often small-batch, precision equipment. The continuous need for improved performance characteristics, driven by intense industry competition, ensures sustained investment in upgrading existing electroplating lines or installing entirely new facilities optimized for specific advanced coating chemistries, such as those required for micromachining and microfluidic devices where surface smoothness and homogeneity are paramount for device function.

- By Equipment Type:

- Rectifiers (DC, Pulse, Pulse Reverse)

- Tanks and Plating Lines (Manual, Semi-Automatic, Fully Automatic)

- Filtration and Pumping Systems (Depth filtration, Carbon treatment, RO systems)

- Heating and Cooling Systems (Heat Exchangers, Chillers)

- Automation and Handling Systems (Hoists, Robotics, Conveyors)

- Anodes and Accessories (Insoluble and Soluble Anodes)

- Chemical Dosing and Monitoring Systems

- By Plating Process:

- Rack Plating (For large or intricate parts)

- Barrel Plating (For small bulk components)

- Continuous Plating (Reel-to-Reel, Wire Plating)

- Electroless Plating Equipment (Supporting infrastructure and pre-treatment units)

- By Plated Material:

- Copper and Copper Alloys

- Nickel and Nickel Alloys (Electroless Nickel, Sulfamate Nickel)

- Zinc and Zinc Alloys (Zinc-Nickel, Zinc-Iron for automotive corrosion resistance)

- Precious Metals (Gold, Silver, Palladium, Platinum)

- Chromium and Chromium Substitutes (Trivalent Chromium)

- By End-Use Industry:

- Automotive (EV components, Chassis parts, Decorative trim, Fasteners)

- Electronics and Telecommunications (PCBs, Connectors, Semiconductors, 5G Infrastructure)

- Aerospace and Defense (Wear resistance, specialized corrosion coatings)

- Machinery and Equipment Manufacturing (Hydraulics, Tools)

- Medical Devices (Implants, Surgical instruments)

- Jewelry and Decorative

Value Chain Analysis For Electroplating Equipment Market

The value chain for electroplating equipment begins with the upstream suppliers, focusing on raw materials such as specialized metals (stainless steel, titanium) for tank and fixture construction, high-performance electronic components for rectifiers (semiconductors, transformers, IGBTs), and industrial plastics (Polypropylene, PVC, PVDF) for lining, piping, and barrels. Crucial upstream activities include the design and manufacturing of high-efficiency power electronics (rectifiers) where technological differentiation, particularly in switching technology, provides a significant competitive advantage in energy consumption and waveform stability. Material procurement and component standardization are vital for cost control and quality assurance, given the harsh chemical operating environments these products must withstand. Strong relationships with suppliers of corrosion-resistant materials are necessary to ensure the longevity and reliability of the final equipment systems, particularly for equipment exposed to highly acidic, alkaline, or high-temperature processing baths, reducing the total lifecycle cost for the end-user.

The core value addition occurs in the equipment manufacturing and system integration phase. Equipment manufacturers take specialized components and assemble them into complete plating lines, often involving custom engineering to match the client's specific process requirements, such as throughput, part geometry, and chemistry compatibility. This phase includes the integration of advanced automation software, sophisticated safety interlocks, and environmental compliance features (e.g., highly efficient ventilation systems, chemical containment bunds, and waste minimization modules). Distribution channels vary significantly; direct sales are predominant for large, highly customized, automated lines, especially in the automotive and aerospace sectors, where direct technical consultation, complex project management, and specialized installation support are mandatory. Indirect channels, involving specialized regional distributors or agents, are often utilized for standardized equipment, spare parts, and smaller scale manual or semi-automatic systems, allowing manufacturers to penetrate diverse geographic markets without establishing expansive local sales offices, thereby optimizing market reach and speed of delivery for standard products.

The downstream activities involve installation, rigorous commissioning, operator training, and long-term after-sales service, which is a critical profitability driver in this sector. Because electroplating processes are chemically complex and equipment operation is critical to the customer’s production schedule, comprehensive service contracts, preventative maintenance programs, and the immediate availability of specialized spare parts represent a significant and stable recurring revenue stream. End-users (potential customers) are highly reliant on the manufacturer or integrator for ongoing technical support to maintain bath chemistry integrity and equipment uptime, often utilizing remote diagnostics capabilities. The performance and reliability of the equipment directly impact the end-user's product quality, certification status (e.g., ISO, Nadcap), and cost of ownership. Consequently, providers offering comprehensive lifecycle support—from initial bath setup guidance and process optimization to remote diagnostics and predictive maintenance services powered by AI—capture higher downstream value and foster greater customer loyalty, solidifying their position as essential partners within the complex industrial finishing infrastructure.

Electroplating Equipment Market Potential Customers

Potential customers for electroplating equipment span a diverse array of highly industrialized sectors, all sharing the fundamental requirement for enhanced surface functionality and durability of manufactured components. The primary buying demographic includes large-scale component manufacturers in the automotive industry, particularly those focused on electric vehicle battery casings, motor magnet coatings, and internal power electronics, demanding robust corrosion protection and specified electrical conductivity. Within the electronics sector, major buyers are printed circuit board (PCB) fabricators, semiconductor packaging houses, and connector manufacturers, all of whom necessitate ultra-precise equipment for depositing materials like gold, palladium, and copper with exceptional uniformity on intricate geometries. These customers typically prioritize automation, throughput speed, and the capacity for ultra-fine tolerance control, often opting for high-end, customized, continuous plating lines to integrate seamlessly into their automated assembly processes, ensuring the millions of components produced annually meet zero-defect quality targets.

Secondary but equally crucial customer bases are found in the aerospace and defense sectors, where component performance under extreme conditions dictates material selection and processing standards. These customers require highly reliable equipment capable of handling complex, low-volume plating runs of materials such as hard chrome replacements (HVOF coatings, composite plating) and cadmium substitutes, adhering strictly to military and aerospace specifications (e.g., Nadcap accreditation). Procurement decisions in these sectors are heavily influenced by the equipment vendor's proven track record, quality assurance certifications, and the ability to provide extensive documentation and traceability for every batch processed. The emphasis here is on precision, safety, and absolute compliance with stringent operational standards, often leading to purchases of dedicated, highly controlled rack plating or specialized barrel plating systems designed specifically for high-integrity, mission-critical components where cost is secondary to reliability and certified performance under operational stress.

A significant customer segment also comprises thousands of independent job shops and contract electroplaters globally. These facilities serve as outsourced finishing providers for diverse manufacturing clients, ranging from general engineering parts to decorative consumer goods. Their purchasing decisions are often driven by versatility, ease of use, and overall cost-efficiency, opting for standardized, modular plating lines that can be configured to handle a variety of metals and processes, offering flexibility to meet varied customer needs. As regulations tighten, these smaller enterprises represent a growing market for upgrades to environmentally compliant equipment, such as closed-loop rinse systems, waste treatment modules, and conversions to non-cyanide or trivalent chromium chemistries. The continued consolidation of manufacturing supply chains drives the need for these job shops to maintain state-of-the-art equipment to compete effectively on quality and turnaround time, thereby ensuring continuous market activity and demand for mid-range automated equipment packages that offer advanced features without the extreme customization complexity of tier-one automotive systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Technic Inc., Atotech, Enthone (now MacDermid Enthone Industrial Solutions), Schlötter, JCU Corporation, Coventya (now Quaker Houghton), EPI Electrochemical Products Inc., Plating Electronic GmbH, Dürr Group, Pioneer-Chemfac, SMT Srl, PAL Plating Systems, Höganäs AB, Okuno Chemical Industries, Columbia Chemical, Advanced Chemical Company, Reliant Aluminum Products, Jessup Plating Systems, Asterion, Chem-Plate Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electroplating Equipment Market Key Technology Landscape

The technological landscape of the electroplating equipment market is defined by innovation aimed at enhancing precision, increasing energy efficiency, and improving environmental performance. A cornerstone technology is the evolution of rectifiers, moving away from traditional thyristor-based power supplies to high-frequency, switch-mode power supplies (SMPS) utilizing Insulated Gate Bipolar Transistors (IGBTs). These advanced rectifiers offer significantly higher energy efficiency, reduced footprint, and, critically, enable sophisticated waveform control necessary for pulse plating and pulse reverse plating techniques. Pulse plating technology allows for improved metal distribution (throwing power), reduced porosity, and the ability to control crystallite size and morphology, yielding superior mechanical and electrical properties, essential for demanding applications in semiconductor manufacturing and advanced automotive coatings where deposit quality is paramount. The precision afforded by these modern power systems ensures consistent performance across multi-shift operations and reduces energy waste associated with older, less efficient technologies.

Another dominant technological trend is the pervasive implementation of automation and Industry 4.0 connectivity. Modern electroplating lines integrate robotics, automated material handling systems (hoists, conveyors), and centralized process control software (SCADA or PLC-based systems). This integration allows for precise control of immersion times, temperature profiles, and chemical additions, significantly reducing variability and human intervention. Key developments include the integration of advanced sensors for real-time monitoring of bath chemistry, such such as Continuous Online Analytical Systems (COLAS) and spectral analysis tools, which provide immediate feedback to dosing pumps and filtration units. This move towards closed-loop control minimizes chemical consumption, optimizes bath life, and ensures consistent quality output, directly addressing the industry’s need for cost reduction and waste minimization while providing comprehensive data logs required for compliance and quality auditing processes essential in high-stakes manufacturing environments like aerospace and defense.

Furthermore, significant technological advancements are centered on environmental compliance and waste management. This includes the development of highly efficient membrane filtration systems, sophisticated ion exchange resins, and advanced electrowinning units designed to recover valuable metals (e.g., gold, nickel, copper) from spent process baths and rinse waters. This equipment not only ensures regulatory adherence but also transforms waste streams into valuable secondary raw materials, contributing to a circular economy model within the industry. The deployment of plasma electrolytic oxidation (PEO) and other non-traditional coating technologies is also increasing, particularly for light metals like aluminum and magnesium, requiring new, specialized power supplies and tank designs that complement the core conventional electroplating offerings, demonstrating the market's continuous drive for novel surface finishing solutions tailored to modern material science challenges, thereby diversifying the technological portfolio available to industrial customers seeking specific functional improvements beyond traditional metallic finishes.

Regional Highlights

The market dynamics for electroplating equipment are strongly regional, dictated by manufacturing volumes, technological maturity, and regulatory environments. Asia Pacific (APAC) stands as the undisputed leader, accounting for the largest share of the global market. This dominance is attributable to the region’s massive, sustained investment in high-volume manufacturing across consumer electronics, automotive assembly, and complex semiconductor fabrication, particularly in countries like China, South Korea, and Taiwan. APAC manufacturers prioritize high-throughput, automated reel-to-reel and continuous plating systems to meet the aggressive production schedules of global supply chains. Government initiatives supporting domestic manufacturing expansion and infrastructure development, especially in the EV space and 5G deployment, further solidify the region's strong position as both a consumer and producer of electroplating equipment, leading to high capital expenditures on new installations and capacity upgrades necessary to maintain global production dominance in high-tech manufactured goods.

North America and Europe represent mature markets characterized by stringent quality requirements and highly protective environmental regulations (REACH, RoHS, specific national air and water quality standards). Demand in these regions is driven less by sheer volume and more by the need for advanced, high-precision finishing required by the aerospace, defense, and medical device industries, which demand certified plating processes and traceability. European manufacturers are leaders in developing highly efficient, environmentally friendly equipment, focusing heavily on advanced waste treatment, closed-loop systems, and equipment designed to handle non-toxic or compliant chemistries (e.g., trivalent chromium). The continuous need to replace aging infrastructure and comply with evolving sustainability standards provides a consistent demand floor for modern, energy-efficient automated plating lines in these Western economies, favoring specialized local suppliers who can offer sophisticated engineering solutions and robust, localized technical and service support, particularly for complex regulatory navigation.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing moderate growth. Growth in Latin America is tied primarily to the automotive and general manufacturing sectors in countries like Mexico and Brazil, often serving as intermediate hubs for global supply chains, driving demand for both semi-automated and mid-level automated plating equipment. The MEA region's demand is gradually increasing, fueled by diversification efforts away from oil dependence, leading to investments in infrastructure, electronics assembly, and specialized repair facilities, particularly in the UAE and Saudi Arabia. Equipment sales in these regions often focus on robust, easy-to-maintain semi-automatic or manual systems due to fluctuating technical labor availability, though major industrial projects are increasingly opting for modern, automated European or North American standard systems to meet international quality benchmarks. The ongoing development of industrial zones and localized supply chains in these regions promises sustained, albeit slower, expansion of the electroplating equipment market over the forecast period as local processing capabilities are established.

- Asia Pacific (APAC): Market volume leader; driven by consumer electronics, semiconductor growth, and high-volume automotive manufacturing (especially EV components), necessitating continuous, high-speed plating equipment.

- Europe: Focus on environmental compliance, precision engineering for aerospace and defense, and replacement of older lines with energy-efficient, closed-loop systems due to strict regulatory mandates.

- North America: High demand from defense, medical devices, and high-tech automotive sectors; emphasis on automation, quality traceability, and specific regulatory compliance tailored to critical applications.

- Latin America: Growth driven by domestic automotive production and industrial infrastructure upgrades, often preferring modular and robust semi-automated plating solutions for operational flexibility.

- Middle East and Africa (MEA): Emerging market characterized by nascent industrialization and reliance on specialized equipment for infrastructure, oil and gas component repair, and localized high-value manufacturing projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroplating Equipment Market.- Technic Inc.

- Atotech

- Enthone (now MacDermid Enthone Industrial Solutions)

- Schlötter

- JCU Corporation

- Coventya (now Quaker Houghton)

- EPI Electrochemical Products Inc.

- Plating Electronic GmbH

- Dürr Group

- Pioneer-Chemfac

- SMT Srl

- PAL Plating Systems

- Höganäs AB

- Okuno Chemical Industries

- Columbia Chemical

- Advanced Chemical Company

- Reliant Aluminum Products

- Jessup Plating Systems

- Asterion

- Chem-Plate Industries

Frequently Asked Questions

Analyze common user questions about the Electroplating Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological advancements driving electroplating equipment innovation?

The primary technological advancements include the widespread adoption of high-frequency, IGBT-based Pulse Plating Rectifiers for superior deposit quality, and the integration of advanced automation and Industry 4.0 sensors (AI/ML) for real-time process control, predictive maintenance, and chemical optimization. These technologies enhance efficiency and precision while reducing variability in component finishing.

How do global environmental regulations impact the purchasing decisions for new electroplating systems?

Environmental regulations, particularly regarding the phase-out of substances like hexavalent chromium (REACH/RoHS), force manufacturers to invest in new equipment designed for compliant chemistries (e.g., trivalent chromium and alternatives). This drives demand for closed-loop filtration, ion exchange systems, and specialized waste treatment modules to minimize hazardous effluent and ensure strict regulatory adherence globally.

Which end-use industry is the fastest growing segment for electroplating equipment?

The Electronics and Automotive sectors, particularly the Electric Vehicle (EV) segment, represent the fastest-growing end-use industries. The rapid expansion of EV battery manufacturing and power electronics requires massive investments in continuous plating lines and highly specialized equipment for high-performance coatings crucial for thermal management and electrical conductivity requirements.

What is the difference between rack plating and barrel plating equipment and their respective applications?

Rack plating equipment is used for large, delicate, or complex parts where uniform coating and precise contact are necessary, such as automotive bumpers or aerospace components. Barrel plating equipment is utilized for processing large quantities of small, durable parts (e.g., fasteners, small connectors) in bulk, prioritizing high throughput and cost efficiency over ultra-precision on individual pieces.

How does the cost of ownership influence the adoption of fully automated electroplating lines?

While fully automated lines require higher initial capital expenditure (CAPEX), their adoption is favored due to significantly lower operating costs (OPEX) over the long term. Automation reduces labor dependency, minimizes chemical wastage through precise dosing, increases consistency, and reduces scrap rates, providing a superior total cost of ownership (TCO) compared to manual or semi-automatic systems in high-volume environments that demand operational reliability and quality repeatability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager