Electrostatic Aerosol Neutralizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433411 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Electrostatic Aerosol Neutralizer Market Size

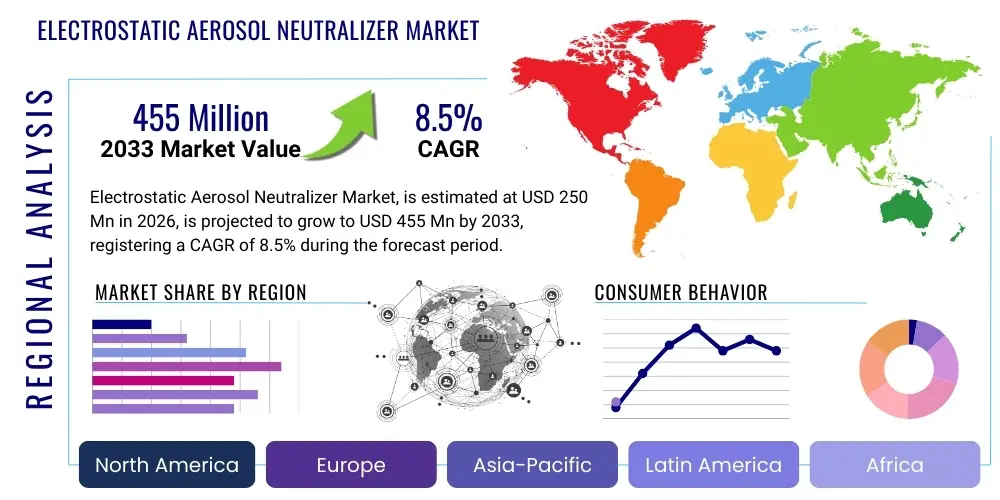

The Electrostatic Aerosol Neutralizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 455 Million by the end of the forecast period in 2033.

Electrostatic Aerosol Neutralizer Market introduction

The Electrostatic Aerosol Neutralizer Market encompasses instruments designed to remove or control the electrical charge carried by airborne particulate matter, commonly known as aerosols. These devices are critical in applications where charged particles interfere with measurement accuracy, deposition control, or process purity. Aerosol neutralizers function by introducing a high concentration of both positive and negative ions into the aerosol stream, facilitating charge equilibration via collision and recombination mechanisms. This process brings the aerosol closer to a Boltzmann charge distribution, which is essential for consistent particle sizing and counting, particularly in submicron and ultrafine particle analysis.

The product portfolio within this market primarily includes devices based on three core technologies: radioactive sources (such as Americium-241 or Krypton-85), which provide a steady stream of ionizing radiation; corona discharge neutralizers, which generate ions using high voltage; and emerging soft X-ray neutralizers, which offer non-radioactive alternatives with precise control over ionization levels. Major applications span high-technology manufacturing, environmental monitoring, pharmaceutical sterile processing, and atmospheric science research. The necessity for precise aerosol control in advanced manufacturing environments, notably in semiconductor fabrication where nanometer-scale contaminants can ruin entire batches, heavily drives the adoption of these sophisticated neutralization systems.

The key benefits derived from using electrostatic aerosol neutralizers include enhanced accuracy in particle measurements, improved yield rates in contamination-sensitive industries, and standardization of aerosol sampling procedures across various research fields. Driving factors fueling market growth include stringent global air quality regulations, the proliferation of nanotechnology requiring ultra-clean environments, and significant investment in atmospheric and climate change research globally. Furthermore, the push for non-radioactive ionization alternatives due to safety and disposal concerns is stimulating innovation and replacement cycles within key end-user segments, pushing the market toward technologically advanced, highly efficient corona and soft X-ray solutions.

Electrostatic Aerosol Neutralizer Market Executive Summary

The global Electrostatic Aerosol Neutralizer market is poised for robust expansion, driven primarily by the escalating demand for ultra-clean air environments across high-tech manufacturing sectors and increasingly rigorous public health standards concerning airborne particulates. Business trends indicate a definitive shift away from traditional radioactive neutralizers towards safer, highly controllable soft X-ray and high-frequency corona discharge technologies. Manufacturers are heavily investing in miniaturization and integration capabilities, allowing these neutralizers to be seamlessly incorporated into portable monitoring devices and complex cleanroom air handling systems. The competitive landscape is characterized by a mix of established scientific instrumentation providers and specialized technology firms focusing on regulatory compliance and enhanced user safety, leading to highly optimized and application-specific product offerings.

Regionally, the market dynamics are dominated by the Asia Pacific (APAC) region, particularly driven by substantial investments in semiconductor foundries and advanced material fabrication facilities in countries like South Korea, Taiwan, China, and Japan. North America and Europe maintain significant market shares, characterized by strong research infrastructure, stringent Occupational Safety and Health Administration (OSHA) and European Union (EU) standards for worker safety, and widespread adoption in pharmaceutical and biomedical research sectors. Emerging economies in Latin America and the Middle East and Africa (MEA) are showing increasing adoption, particularly in oil and gas particulate matter monitoring and nascent high-value manufacturing initiatives, though growth remains localized and dependent on foreign direct investment in infrastructure.

Segmentation trends highlight the increasing prominence of corona discharge neutralizers due to their cost-effectiveness and flexibility, positioning them as the largest segment by volume, particularly for industrial safety and general atmospheric research. However, the soft X-ray segment is projected to exhibit the fastest growth CAGR, propelled by zero-radioactivity concerns and superior performance in highly specialized, contamination-intolerant environments such as lithography processes and advanced metrology. Application-wise, the semiconductor and electronics segment remains the primary revenue generator, but environmental monitoring and pharmaceutical manufacturing are accelerating rapidly, demanding high-throughput, reliable neutralization solutions to ensure product integrity and regulatory compliance. The market's overall trajectory reflects a balance between regulatory pressures, technological substitution, and expanding industrial application bases globally.

AI Impact Analysis on Electrostatic Aerosol Neutralizer Market

Common user inquiries regarding the impact of Artificial Intelligence on the Electrostatic Aerosol Neutralizer Market center around the automation of contamination control, predictive maintenance of instrumentation, and the optimization of cleanroom operational parameters. Users frequently ask how AI can improve the efficiency of neutralizing systems in dynamic environments, inquiring about algorithms that can adapt ion generation rates in real-time based on fluctuating aerosol concentrations or external variables like humidity and temperature. Key concerns revolve around integrating proprietary neutralizer sensor data with broader AI-driven cleanroom management platforms (FMS or Fab Management Systems) and leveraging machine learning to predict potential equipment failures before they cause costly downtimes or contamination excursions. The general expectation is that AI will transform neutralizers from standalone components into fully integrated, smart, self-optimizing subsystems essential for achieving next-generation process yields in areas like 3nm and 2nm semiconductor node fabrication.

AI's influence is anticipated to be transformative, moving beyond simple data logging to complex, closed-loop control systems. AI algorithms can analyze vast datasets concerning aerosol charge distribution patterns, processing environmental variables, and historical cleanroom particle counts. This allows the neutralizer's performance to be precisely tuned, ensuring optimal charge balance for the specific type of aerosol present (e.g., metallic dust versus organic residues) and minimizing energy consumption by avoiding continuous high-power operation. Such adaptive control is crucial in large-scale facilities where environmental stability is hard to maintain across expansive areas and multiple operational shifts, contributing directly to higher quality assurance and reduced operational expenditure through predictive adjustments rather than reactive corrections.

Furthermore, AI-powered diagnostics enhance the longevity and reliability of the neutralizer components, particularly in high-voltage corona systems prone to electrode degradation or in soft X-ray systems requiring consistent tube performance. Machine learning models can detect subtle deviations in current draw, voltage stability, or ion current output—indicators that precede outright component failure. By providing early warnings and maintenance schedules optimized for actual wear and tear rather than fixed intervals, AI minimizes unexpected system outages, which is a major concern in 24/7 manufacturing environments. The deployment of AI also streamlines compliance reporting by automatically correlating neutralization performance with required standards, simplifying audits and enhancing overall operational accountability.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to forecast component degradation (e.g., electrode lifespan, X-ray tube aging) in neutralizers, maximizing uptime and reducing unplanned outages.

- Real-time Adaptive Neutralization: Dynamic adjustment of ion generation parameters (voltage, frequency) based on instantaneous particle size distribution and concentration inputs from ancillary sensors.

- Cleanroom Optimization Integration: Seamless data flow between neutralizer sensors and centralized Fab Management Systems (FMS) for holistic contamination control strategy development.

- Automated Compliance Reporting: AI models automatically generating verifiable records of charge balance attainment and system performance for regulatory audits.

- Energy Efficiency Management: Machine learning tuning neutralizer operation to the minimum required ionization level, resulting in significant power savings in large-scale installations.

DRO & Impact Forces Of Electrostatic Aerosol Neutralizer Market

The market for electrostatic aerosol neutralizers is significantly shaped by a confluence of driving factors, internal constraints, and burgeoning opportunities, all interacting under intense competitive and regulatory impact forces. The primary driver is the unrelenting miniaturization trend across the semiconductor and electronics industries, which necessitates unparalleled levels of particulate control to prevent catastrophic yield losses associated with nanoscale contamination. Secondly, the global escalation in research related to atmospheric science, air pollution modeling, and health studies regarding ultrafine particles (UFP) mandates the use of highly accurate neutralization instruments to ensure reliable data acquisition. These drivers are amplified by strict governmental regulations regarding cleanroom standards (ISO 14644) and occupational exposure limits, forcing industries to adopt advanced neutralization technology as a prerequisite for operational licensing and safety compliance.

Despite these powerful drivers, the market faces significant restraints. A key constraint is the relatively high initial capital expenditure associated with advanced neutralizers, particularly the non-radioactive soft X-ray variants, making adoption challenging for smaller research laboratories or manufacturers with limited budgets. Furthermore, the inherent safety and regulatory complexity associated with traditional radioactive neutralizers (Am-241), including handling, disposal, and licensing requirements, act as a drag on that specific segment, pushing users toward substitutes but also creating market inertia due to the established reliability of older systems. The lack of standardized, global calibration protocols across all neutralizer technologies also poses a minor technical restraint, complicating inter-instrument comparison and cross-border regulatory acceptance.

Opportunities for expansion are predominantly focused on technological innovation and market diversification. The largest opportunities lie in developing cost-effective, high-throughput soft X-ray or novel plasma-based neutralizers that bypass radioactive risks entirely while offering superior performance in high-flow environments. Secondly, the expansion into emerging applications, such as medical device manufacturing, bio-aerosol research, and advanced filtration testing (e.g., HEPA and ULPA filter testing protocols), offers new revenue streams outside the mature semiconductor sector. The major impact force is supplier power, exerted by a few specialized firms holding core technological patents and dictating pricing and service requirements, while the increasing buyer scrutiny over long-term operating costs and safety is pressuring innovation toward safer, lower-maintenance alternatives. Overall, regulatory mandates and the technological race in clean manufacturing define the competitive impact forces in this niche market.

Segmentation Analysis

The Electrostatic Aerosol Neutralizer Market is comprehensively segmented based on technology type, the nature of the application, the portability of the device, and the geographic region of deployment. This multidimensional segmentation allows for a detailed understanding of consumer preferences, technological adoption rates, and regional expenditure patterns. The segmentation by technology—radioactive source, corona discharge, and soft X-ray—is perhaps the most critical, reflecting the fundamental trade-offs between cost, ionization efficiency, safety compliance, and regulatory burdens. Radioactive neutralizers, while highly stable, are steadily being replaced by the rising popularity of corona discharge neutralizers, which offer flexibility and lower operating costs, and the premium performance segment of soft X-ray neutralizers, which guarantee zero radiation risk and precise ion control essential for high-end applications like EUV lithography.

Segmentation by application clarifies the diverse end-user base driving the market. The semiconductor and electronics segment dominates, given the extreme sensitivity of wafer fabrication processes to charged particle contamination. However, substantial growth is being observed in the pharmaceutical and life sciences sector, particularly in aerosol drug delivery research and sterile filling processes where precise particle sizing is mandatory. Environmental monitoring and atmospheric research form a stable third segment, relying on neutralizers for accurate climate data collection and air quality assessment. Finally, industrial health and safety monitoring in environments with high exposure to welding fumes or engineered nanomaterials represents a consistently growing niche, demanding robust, often portable, neutralization solutions.

The segmentation structure not only maps the current market landscape but also provides a framework for forecasting technological transition and market growth potential. The shift toward non-radioactive technologies is a central theme across all segments, necessitating R&D focus on improving the lifespan and stability of corona and X-ray based ion sources. Furthermore, the increasing need for portability in environmental and workplace monitoring is driving innovation in battery life and ruggedized design for neutralizers, contrasting sharply with the stable, high-precision benchtop units required for cleanroom metrology. Understanding these segment-specific requirements is vital for manufacturers seeking to optimize their product development roadmap and market penetration strategies.

- By Technology Type:

- Radioactive Source Neutralizers (e.g., Americium-241, Krypton-85)

- Corona Discharge Neutralizers (Bipolar Ionization)

- Soft X-ray Neutralizers

- By Application:

- Semiconductor and Electronics Manufacturing (Cleanroom environments, Lithography)

- Pharmaceutical and Life Sciences (Sterile Fill/Finish, Drug Delivery Systems)

- Environmental Monitoring and Atmospheric Research

- Industrial Safety and Occupational Health Monitoring

- Advanced Materials and Nanotechnology Research

- By Portability:

- Benchtop/Fixed Systems

- Portable/Handheld Units

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Electrostatic Aerosol Neutralizer Market

The value chain for the Electrostatic Aerosol Neutralizer market begins with raw material sourcing and component manufacturing, focusing heavily on specialized high-voltage components (for corona systems), radiation shielding/sources (for legacy systems), and precision X-ray tubes (for advanced systems). Upstream analysis reveals that suppliers of specialized materials—such as high-purity metals for electrodes, radiation sources procured under strict international guidelines, and sensitive electronics for control units—wield moderate power due to the niche nature and high quality standards required. Component integration involves complex assembly and rigorous testing, often carried out by specialized Original Equipment Manufacturers (OEMs) who possess the core intellectual property regarding ion generation efficiency and stability. R&D activities are paramount at this stage, focusing on improving ion current stability, reducing maintenance requirements, and adhering to evolving safety standards.

The distribution channel is multifaceted, relying on a combination of direct sales and a strong network of specialized indirect distributors and technical representatives. Direct sales are typically employed for major semiconductor clients and large government research labs that require high-level technical consultation, custom integration, and post-sales technical training. Indirect channels, consisting of scientific equipment distributors and resellers, are crucial for reaching smaller academic institutions, industrial safety consultants, and emerging market customers. These indirect partners often provide localized support, calibration services, and faster fulfillment, acting as vital links between the highly specialized OEM manufacturers and the diverse end-user base. The choice of channel is heavily influenced by the complexity and cost of the neutralizer; simpler corona systems are more suited for mass distribution, while advanced soft X-ray units require dedicated technical sales teams.

Downstream analysis centers on the end-user applications—semiconductor, pharma, and research—where the neutralizers are integrated into larger systems like Scanning Mobility Particle Sizers (SMPS), Differential Mobility Analyzers (DMA), or advanced cleanroom monitoring arrays. The value addition at this stage involves system integration, calibration services, and ongoing maintenance contracts, ensuring the devices maintain accuracy and regulatory compliance over their operational life. Service and calibration constitute a significant portion of the recurring revenue, as the performance of neutralizers must be periodically verified against industry standards. The entire value chain is characterized by a high barrier to entry due to the specialized scientific knowledge required and the importance of certification and accreditation in highly regulated end markets, ensuring quality and reliability from component sourcing through to final customer deployment.

Electrostatic Aerosol Neutralizer Market Potential Customers

The primary end-users and buyers of electrostatic aerosol neutralizers are sophisticated organizations operating in highly regulated or technologically advanced environments where precise aerosol control is non-negotiable for product quality, research integrity, or worker safety. Semiconductor fabrication plants, particularly those operating at sub-10 nanometer nodes, represent the largest and most revenue-intensive customer base. These facilities utilize neutralizers as indispensable components in particle monitoring systems (like condensation particle counters) and process equipment to ensure wafers remain contamination-free and maximize production yield, often purchasing high-end soft X-ray neutralizers due to their performance superiority and non-radioactive profile.

Another major customer segment includes government-funded research institutions and academic universities focused on atmospheric chemistry, climate change modeling, and air pollution studies. These users rely on highly stable, accurate neutralizers to ensure that their measurements of airborne particulate matter, especially ultrafine particles (UFP), are unbiased by the natural charge aerosols carry. Their purchasing decisions often prioritize long-term stability and compatibility with established scientific measurement protocols, often leading them to utilize both radioactive (for stability) and corona discharge neutralizers (for portability and cost).

Furthermore, the pharmaceutical and biotechnology industry constitutes a rapidly growing customer segment. Companies involved in manufacturing sterile injectable drugs, producing aerosolized medication delivery systems, or managing bio-safety level laboratories require rigorous control over airborne particulates and bio-aerosols. Neutralizers are employed here to ensure that particle measurements used for cleanroom validation (ISO classification) and drug consistency testing are reliable. The stringent regulatory environment (e.g., FDA requirements) makes these customers highly focused on documented calibration, reliable uptime, and systems that minimize any risk of material or radiation contamination, influencing purchasing towards highly certifiable, non-radioactive solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 455 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TSI Incorporated, Air Techniques International, HCT Instruments, Testo SE & Co. KGaA, Topas GmbH, Palas GmbH, Kanomax USA Inc., Thermo Fisher Scientific, Dekati Ltd., Grimm Aerosol Technik, FAI Instruments, IUTA e.V., Teledyne API, Met One Instruments, Inc., Lighthouse Worldwide Solutions, Rion Co., Ltd., PCE Instruments, Suzhou Sanfang Measuring Instrument Co., Ltd., Beijing Keliang Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrostatic Aerosol Neutralizer Market Key Technology Landscape

The technology landscape of the Electrostatic Aerosol Neutralizer market is defined by a fierce competition between three core ionization methods, each offering distinct operational characteristics and application suitability. The oldest technology, relying on radioactive sources like Americium-241 (Am-241) or Krypton-85 (Kr-85), provides extremely stable and predictable ionization, often considered the gold standard for calibration and high-precision scientific research due to the consistent energy of the emitted alpha or beta particles. However, the regulatory burden associated with radioactive material handling, storage, transport, and disposal—mandated by agencies such as the Nuclear Regulatory Commission (NRC) in the US and equivalent international bodies—is increasingly limiting their commercial viability and driving innovation towards non-isotopic alternatives, particularly in non-research environments.

The second major technology involves Corona Discharge neutralization, utilizing high voltage to ionize the surrounding air, generating bipolar ions for charge equilibration. Corona neutralizers are cost-effective, easy to operate, and pose no radioactive risk, making them highly popular for general industrial safety monitoring and budget-sensitive applications. Recent technological advancements in corona systems focus on pulsed discharge mechanisms and optimized electrode geometry to improve ion balance and reduce unwanted particle generation (e.g., ozone or NOx), thereby enhancing their applicability in ultra-clean environments. Despite these improvements, maintaining perfect ion balance and stable output over long operational periods can be challenging compared to radioactive sources, requiring sophisticated feedback loops and control electronics.

The most advanced and rapidly growing segment is Soft X-ray neutralization, which leverages low-energy X-rays (typically below 10 keV) to ionize the gas molecules within the aerosol stream. This technology provides the critical benefits of being non-radioactive while offering a highly controllable and stable ion source, rivaling or exceeding the stability of radioactive neutralizers without the associated regulatory baggage. Soft X-ray systems are the preferred choice for contamination-critical processes in semiconductor manufacturing, such such as photolithography and wafer inspection, where minimizing system downtime and maximizing purity are paramount. Innovation in this area centers on enhancing the lifespan of X-ray tubes, optimizing shielding for safety, and integrating intelligent controls to maintain precise charge distributions even under rapidly changing flow conditions, justifying the higher upfront cost of these specialized instruments.

Regional Highlights

- Asia Pacific (APAC): Dominance in High-Tech Manufacturing and Growth Driver

The APAC region currently dominates the Electrostatic Aerosol Neutralizer market, accounting for the largest revenue share and exhibiting the highest projected growth rate throughout the forecast period. This dominance is intrinsically linked to the region's status as the global hub for semiconductor manufacturing, particularly in Taiwan, South Korea, and China, where massive capital investments are directed towards developing leading-edge fabrication facilities. These facilities, focusing on advanced nodes (e.g., 5nm, 3nm), demand ultra-low contamination environments, making high-precision neutralizers—especially the soft X-ray variants—critical components of their contamination control strategies. Furthermore, rapid industrialization and escalating air quality concerns in major urban centers across China and India are driving significant governmental procurement of neutralizers for environmental monitoring stations, fueling demand in the environmental application segment. Local regulatory pushes for worker safety and the control of pollution from industrial emissions also contribute substantially to the region's overall market strength, creating a dual demand profile driven by both high-tech necessity and environmental compliance.

The region’s competitive landscape is evolving, with both global market leaders maintaining strong sales infrastructure and local players gaining traction by offering competitive pricing and custom solutions tailored to regional industrial standards. Countries like Japan, while possessing a mature clean manufacturing base, maintain high spending on R&D for nanotechnology and advanced materials, ensuring a steady, high-value demand for precise neutralizers in research settings. The emphasis on efficiency and throughput in APAC manufacturing means there is a high uptake rate for neutralizers that can be easily integrated into automated process lines and offer robust data connectivity for centralized management systems. Future growth is expected to be maintained by continued expansion in advanced electronics manufacturing and the rising deployment of smart city initiatives requiring dense networks of air quality monitoring equipment across Southeast Asia.

- North America: Innovation and Strict Regulatory Framework

North America holds a substantial market share, characterized by its mature life sciences sector, robust academic and government research funding (e.g., EPA, NOAA), and a strong early adoption rate of technological innovation. The US, in particular, drives demand through significant investment in advanced manufacturing, including aerospace and medical device fabrication, where strict adherence to ISO cleanroom standards is mandatory. The region displays a strong preference for non-radioactive neutralizers due to heightened institutional safety policies and the complexities of managing radioactive inventories under federal and state regulations. This strong regulatory framework and high safety consciousness have accelerated the transition to corona discharge and soft X-ray technologies across commercial and governmental laboratories.

Market growth in North America is sustained by consistent R&D spending, particularly in the fields of aerosol drug delivery and bio-aerosol research, where accurate particle charging and sizing are paramount for developing new therapeutic agents. Key players, predominantly based in the US, leverage their proximity to major research universities and national laboratories to continuously develop and iterate on sensor integration and software capabilities, positioning them at the forefront of the smart instrument market. The emphasis is less on volume and more on high-performance, precision instruments capable of meeting the rigorous demands of military defense research, advanced material characterization, and pioneering academic projects, thereby securing the region’s position as a high-value market segment.

- Europe: Focus on Industrial Safety and Environmental Standards

The European market is defined by some of the world's most comprehensive and strictly enforced environmental and occupational safety regulations, driving the necessary adoption of advanced aerosol monitoring and control systems. Countries like Germany, France, and the UK are major consumers, particularly in the automotive, chemical processing, and pharmaceutical sectors. The European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations and various directives concerning worker exposure to particulates and engineered nanomaterials necessitate widespread deployment of neutralizers in industrial health monitoring and hazard assessment applications, driving strong demand for rugged, reliable, and portable corona discharge neutralizers.

Furthermore, Europe is a major hub for atmospheric research, climate science, and advanced instrumentation manufacturing, fostering a strong market for high-end benchtop neutralizers used in sophisticated laboratory experiments and calibration facilities. The region has shown a proactive approach to phasing out radioactive sources, strongly favoring soft X-ray technology where high precision is required, aligning with general EU policy on nuclear material control. Market expansion is bolstered by initiatives focused on smart factory deployments and indoor air quality (IAQ) monitoring, leading to increasing integration of neutralizer technology into building management systems and advanced air filtration units, ensuring the market remains stable and growth-oriented throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrostatic Aerosol Neutralizer Market.- TSI Incorporated

- Palas GmbH

- Kanomax USA Inc.

- Thermo Fisher Scientific (through proprietary instrumentation lines)

- Dekati Ltd.

- Topas GmbH

- Grimm Aerosol Technik Ainring GmbH & Co. KG

- Met One Instruments, Inc.

- Testo SE & Co. KGaA

- Air Techniques International (ATI)

- Lighthouse Worldwide Solutions

- Rion Co., Ltd.

- FAI Instruments

- HCT Instruments

- PCE Instruments

- TSI Instruments (Shanghai) Co., Ltd.

- TSI Instruments India Pvt. Ltd.

- TSI Instruments Europe GmbH

- Entegris, Inc. (In contamination control space)

- IUTA e.V.

Frequently Asked Questions

Analyze common user questions about the Electrostatic Aerosol Neutralizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an electrostatic aerosol neutralizer?

The primary function is to bring airborne particles (aerosols) to a state of charge equilibrium, typically the Boltzmann charge distribution, by introducing a controlled balance of positive and negative ions. This ensures accurate particle size and concentration measurements, as charged particles interfere with standardized analytical instruments like DMAs and CPCs.

Why are non-radioactive neutralizers, like Soft X-ray technology, gaining market share?

Non-radioactive neutralizers are favored due to increased safety protocols, elimination of complex regulatory licensing requirements (like NRC approvals), and simplified disposal procedures compared to systems using isotopic sources (e.g., Am-241). Soft X-ray technology specifically offers highly stable ionization crucial for advanced semiconductor manufacturing without radiation risk.

Which industry is the largest end-user of electrostatic aerosol neutralizers?

The semiconductor and electronics manufacturing industry is the largest end-user, heavily utilizing these devices in cleanroom environments and quality control systems to prevent charged particle contamination, which is a critical threat to the yield of advanced integrated circuits and microprocessors.

How does the choice of neutralizer technology affect operating costs?

Radioactive neutralizers have low direct running costs but high lifetime costs due to licensing and disposal fees. Corona discharge neutralizers offer the lowest initial and operational costs but require occasional electrode maintenance. Soft X-ray neutralizers have the highest initial investment but offer low maintenance and zero radiation disposal costs, providing the best long-term value for contamination-critical processes.

What is the Compound Annual Growth Rate (CAGR) projected for this market?

The Electrostatic Aerosol Neutralizer Market is projected to grow at a CAGR of 8.5% between 2026 and 2033, driven largely by technological shifts toward non-radioactive alternatives and continuous expansion in cleanroom dependent industries across the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager