Electrostatic Liquid Cleaner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432987 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electrostatic Liquid Cleaner Market Size

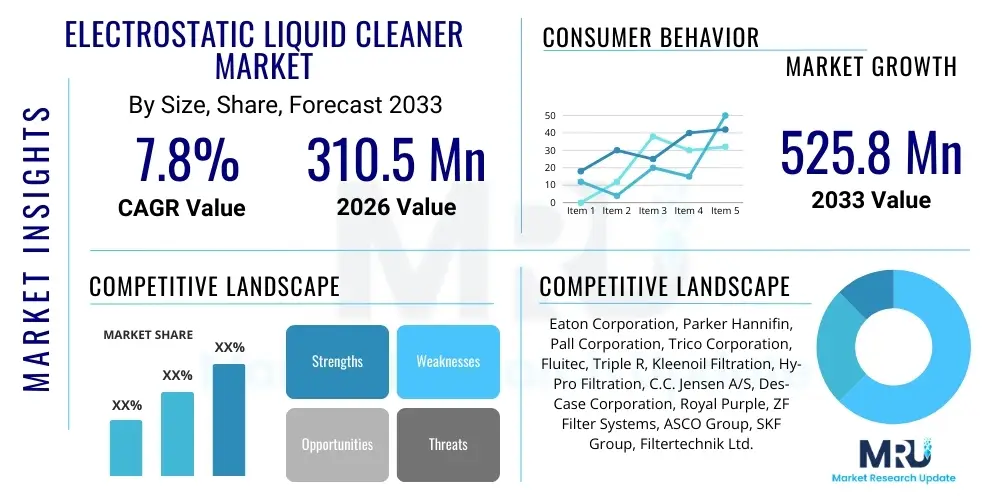

The Electrostatic Liquid Cleaner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at 310.5 Million USD in 2026 and is projected to reach 525.8 Million USD by the end of the forecast period in 2033.

Electrostatic Liquid Cleaner Market introduction

The Electrostatic Liquid Cleaner (ELC) Market encompasses specialized fluid purification systems designed to remove varnish, sludge, and sub-micron particulate contamination from industrial lubricating and hydraulic oils. These systems operate on the principle of applying a high-voltage electrostatic field across the fluid stream, which polarizes contaminants, causing them to migrate toward oppositely charged collection plates. Unlike conventional filtration methods that rely on pore size, ELCs are highly effective at capturing ultra-fine, soluble, and insoluble contaminants, particularly those smaller than one micron, which are often the precursors to varnish formation and equipment failure. This technology is critical for maintaining the operational integrity and longevity of high-precision machinery, especially in industries where hydraulic and lubricating fluids are subjected to extreme thermal stress and high operational cycles, leading to rapid fluid degradation and component wear.

Major applications for electrostatic liquid cleaners span high-demand sectors such as power generation (turbine oils), manufacturing (hydraulic systems, injection molding), marine propulsion, and heavy-duty mining equipment. These advanced cleaning systems are often deployed as kidney loop systems, continuously processing the oil reservoir offline to maintain ISO cleanliness codes far exceeding traditional bypass filtration capabilities. The product description highlights their solid-state construction, minimal disposable components, and ability to handle high fluid viscosity, ensuring cost-effective maintenance management and reduced reliance on frequent oil changes. By proactively eliminating varnish-forming precursors and insulating materials, ELCs significantly enhance the thermal stability and dielectric strength of the operational fluid.

The primary benefits driving the adoption of ELCs include substantial reductions in operational downtime, extended equipment life, and marked decreases in oil disposal costs, aligning directly with corporate sustainability goals. Driving factors center on the increasing complexity and precision of modern industrial machinery, which necessitates pristine fluid cleanliness standards, coupled with stringent environmental regulations promoting resource efficiency and waste minimization. Furthermore, the growing trend toward condition-based monitoring and predictive maintenance strategies makes the continuous, high-efficiency contaminant removal provided by ELC technology indispensable for achieving zero-fault operations in critical industrial infrastructure.

Electrostatic Liquid Cleaner Market Executive Summary

The Electrostatic Liquid Cleaner market is currently undergoing significant expansion, driven primarily by evolving business trends favoring proactive maintenance solutions and industrial decarbonization efforts. Key business trends include the shift from scheduled maintenance to condition-monitoring programs, positioning ELCs as essential tools for fluid reliability engineering. The market sees strong technological innovation focused on integrating IoT capabilities into ELC units for real-time performance monitoring and predictive filter plate saturation alerts. Manufacturers are increasingly focusing on developing mobile, compact systems that cater to diverse industrial environments and offer modular capacity scaling. Consolidation among fluid management service providers is also impacting distribution channels, leading to integrated service contracts that bundle ELC provision with routine maintenance and fluid analysis, thereby enhancing market penetration.

Regionally, the market exhibits robust growth across Asia Pacific (APAC), spurred by rapid industrialization, burgeoning manufacturing sectors in countries like China and India, and significant investments in new power generation infrastructure. North America and Europe remain mature markets, characterized by high adoption rates in demanding sectors like aerospace and precision manufacturing, where strict regulatory compliance and the high cost of machinery failure necessitate premium fluid cleaning solutions. European market growth is particularly supported by strict EU directives promoting sustainability and the circular economy, encouraging the refurbishment and longevity of industrial lubricants. Market growth is also influenced by geopolitical stability affecting global supply chains for raw materials and electronic components necessary for high-voltage systems.

Segment trends reveal a strong demand for ELCs targeting hydraulic oils and turbine oils, representing critical high-volume, high-value applications where varnish control is paramount. While dedicated ELC units dominate the market, the segment of combination units (integrating ELC with traditional filtration or dehydration) is showing rapid growth, appealing to end-users seeking comprehensive fluid rehabilitation systems. The manufacturing sector, including automotive and plastics, accounts for the largest end-user segment due to the pervasive use of hydraulic systems, whereas the power generation sector offers the highest average revenue per unit due to the large volumes and critical nature of turbine lubrication systems. Future growth is anticipated in specialized fluids used in robotics and data center cooling, which require extremely low levels of particulate and varnish contamination.

AI Impact Analysis on Electrostatic Liquid Cleaner Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the operational efficiency and predictive capabilities associated with electrostatic liquid cleaners. Common questions revolve around the use of machine learning algorithms to process complex oil analysis data (such as MPC varnish potential, particle count, and dielectric constant) generated by ELC systems, and how this data can translate into actionable insights regarding fluid health and cleaner performance. Users are keen to understand if AI can predict the precise moment of varnish formation before it is detectable by standard monitoring, or if AI can optimize the voltage settings and flow rates of the ELC unit based on real-time fluid contamination levels, thereby maximizing energy efficiency and cleaning speed. Concerns often center on the security of IoT-connected ELC systems and the necessary investment in sensors and infrastructure required to leverage AI capabilities effectively.

The consensus suggests that AI integration is transforming the maintenance paradigm from reactive or scheduled cleaning to fully predictive fluid management. AI algorithms analyze historical performance data, environmental factors, and operational loads to establish baseline fluid degradation curves. When the ELC monitoring system detects deviations from these curves—often due to sudden contamination ingress or accelerated thermal breakdown—the AI system triggers alerts or autonomously adjusts cleaning cycles. This eliminates unnecessary continuous operation, conserving energy and extending the life of internal components, while ensuring that the cleaning process is initiated exactly when needed to prevent critical varnish accumulation. This shift enhances the value proposition of ELC technology by moving it from being just a piece of hardware to an integral component of an advanced predictive maintenance ecosystem.

Furthermore, AI facilitates advanced fault diagnostics within the ELC unit itself. By monitoring power consumption fluctuations, temperature variances, and flow dynamics, AI can predict the failure of internal components, such as high-voltage power supplies or pumps, allowing for timely preventative repairs. This minimizes the risk of the cleaning system itself failing, ensuring continuous protection for the primary asset (e.g., turbine or hydraulic press). The integration of AI also supports the remote management of large fleets of ELC units across geographically dispersed industrial sites, providing centralized data visualization and performance benchmarking, which is critical for large multinational organizations seeking standardized maintenance protocols.

- AI-driven Predictive Maintenance: Enables ELC activation based on forecasted varnish potential rather than fixed schedules.

- Operational Parameter Optimization: Machine learning fine-tunes ELC voltage and flow rates relative to real-time contamination characteristics.

- Advanced Diagnostics: AI monitors ELC unit performance metrics to predict component failure within the cleaner system.

- Remote Fleet Management: Centralized control and performance benchmarking for geographically dispersed ELC installations using cloud-based data aggregation.

- Enhanced Reporting: Generative AI translates complex fluid analysis data into concise, actionable maintenance recommendations for operators.

DRO & Impact Forces Of Electrostatic Liquid Cleaner Market

The dynamics of the Electrostatic Liquid Cleaner market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the overall market trajectory. A primary driver is the pervasive demand for improved machine reliability and reduced operational expenditures in capital-intensive industries; as equipment complexity increases, the tolerance for contamination decreases dramatically, making highly efficient ELC technology essential. However, market growth is often restrained by the high initial capital investment required for these specialized systems compared to conventional, lower-efficiency filters, posing a barrier to entry for small and medium enterprises (SMEs). Significant opportunities exist in the rapid expansion of the electric vehicle (EV) battery manufacturing sector and in the optimization of wind turbine lubrication systems, both requiring exceptionally clean, varnish-free operational fluids. These forces necessitate strategic positioning by market players, balancing innovation in efficiency with competitive pricing strategies to maximize penetration across various industrial tiers.

Drivers

The imperative to maintain pristine fluid conditions in high-performance machinery, such as sophisticated CNC machines and large industrial turbines, is a core market driver. Modern hydraulic and lubrication systems operate at higher pressures and temperatures, accelerating oil degradation and increasing the propensity for varnish formation—a sticky residue that significantly hinders valve operation, heat transfer, and bearing lubrication. ELCs directly address this critical issue by removing the sub-micron, soluble contaminants that traditional mechanical filters miss, thereby dramatically extending oil life and reducing critical component wear. Furthermore, the rising global cost of industrial lubricants, particularly specialized synthetic oils, provides a strong financial incentive for companies to invest in purification technologies that minimize the need for frequent oil replacement, thereby making the total cost of ownership (TCO) of ELCs highly attractive over the long term.

Regulatory mandates and heightened corporate environmental responsibility also serve as crucial drivers. As governments globally enforce stricter waste disposal regulations (particularly concerning spent oil), industrial operators are motivated to reduce their oil consumption and waste generation. ELC technology supports sustainability objectives by enabling the reclamation and reuse of expensive lubricants, minimizing environmental footprint. The increasing adoption of ISO 4406 cleanliness standards, especially in high-reliability applications, further pressures industries to implement advanced purification solutions capable of consistently achieving and maintaining these demanding standards. This focus on reliability, cost savings through extended oil life, and environmental compliance firmly anchors the market's positive growth trajectory.

Restraints

The most significant restraint on market expansion is the perception of high upfront costs associated with purchasing and installing sophisticated ELC systems. While the long-term TCO is favorable, the initial capital expenditure can be prohibitive, especially for smaller industrial facilities operating on tight procurement budgets. This restraint is often exacerbated by a lack of comprehensive awareness or understanding among maintenance managers regarding the technical superiority and economic justification of ELCs over established, less costly filtration methods. Many potential users struggle to quantify the full financial impact of varnish-related failures, leading to underestimation of the return on investment (ROI) provided by electrostatic cleaning.

Another restraint involves the technical complexity related to fluid compatibility and maintenance protocols. ELC systems are highly effective but require precise operational settings and regular maintenance of the collector plates. Compatibility issues can arise with certain types of additive packages or synthetic fluids, requiring careful pre-installation fluid analysis and monitoring. Additionally, the need for specialized training for maintenance personnel to operate and troubleshoot these high-voltage systems efficiently can pose a logistical challenge, particularly in regions where skilled labor in fluid reliability engineering is scarce. The reliance on continuous power supply and the risk associated with high-voltage components also require strict adherence to safety protocols, adding layers of operational complexity.

Opportunities

The greatest opportunity lies in the rapid growth and expansion of new high-tech industrial sectors, notably the manufacturing of advanced semiconductor components and lithium-ion batteries, both of which demand ultra-clean environments and fluids. Fluids used in these processes, such as cooling liquids and highly specialized lubricants, require cleaning levels beyond the capability of standard filtration. ELCs are perfectly positioned to address this niche, offering superior sub-micron contaminant and varnish control, which translates directly into higher yield rates and improved product quality in these sensitive industries.

Furthermore, the integration of ELC technology with Industrial Internet of Things (IIoT) and AI platforms represents a powerful technological opportunity. By embedding smart sensors and connectivity capabilities, ELC manufacturers can offer sophisticated, data-driven service models, shifting the revenue stream from simple equipment sales to comprehensive fluid asset management services. This facilitates predictive maintenance contracts and allows for remote diagnostics and performance optimization, enhancing customer retention and market differentiation. Expanding into previously underserved geographic regions, particularly rapidly industrializing countries in Southeast Asia and parts of Latin America, also presents significant greenfield opportunities for market penetration.

Impact Forces

- High Asset Protection Demand (Driver): Increasing operational complexity and cost of industrial assets necessitate near-zero downtime, boosting demand for superior ELC protection.

- Varnish Mitigation Necessity (Driver): Varnish, a major cause of downtime in modern systems, is effectively handled only by ELCs, securing market relevance.

- High Initial CapEx (Restraint): The significant capital outlay restricts adoption by SMEs and budget-conscious industrial operations.

- Lack of Technical Awareness (Restraint): Limited understanding of the long-term ROI and technical benefits compared to conventional filters impedes broader market acceptance.

- IIoT and AI Integration (Opportunity): Integration of smart monitoring transforms ELCs into predictive assets, unlocking new service revenue models.

- Emerging High-Tech Sectors (Opportunity): New demanding industries (e.g., EV battery production, advanced robotics) require ultra-clean fluids, creating specialized high-growth niches.

Segmentation Analysis

The Electrostatic Liquid Cleaner Market is segmented primarily based on the Type of fluid being cleaned, the Application (where the fluid is used), the End-User Industry, and the Design Type (Dedicated vs. Portable). This segmentation is crucial for understanding specific market dynamics, as cleaning requirements and contaminant profiles vary significantly across fluid types and industrial applications. For instance, the market for turbine oils emphasizes extreme varnish removal capacity due to the high operating temperatures, whereas hydraulic oil cleaning focuses on precise particulate control. The continuous drive toward customized fluid management solutions is reinforcing the need for highly specific ELC segment offerings tailored to optimize performance for critical industrial fluids, thereby ensuring maximum asset uptime and minimum maintenance expenditure.

Analyzing the segmentation by end-user, the Power Generation and Manufacturing sectors dominate due to their heavy reliance on high-volume, critical lubrication and hydraulic systems. Within the Manufacturing segment, sub-sectors such as injection molding and large-scale metal forming are significant consumers. Segmentation by fluid type—Hydraulic Oil, Turbine Oil, Gear Oil, and Compressor Oil—reflects the inherent differences in fluid degradation mechanisms and required purification thresholds. The rise in synthetic fluid usage across various applications is impacting ELC design, requiring systems capable of effectively cleaning fluids with complex additive packages without removing essential components. The segment analysis confirms that future growth will be concentrated in segments prioritizing operational efficiency and component protection over initial investment cost.

- By Fluid Type:

- Hydraulic Oil

- Turbine Oil (Steam and Gas)

- Lubrication Oil (Engine and Machine Tool)

- Gear Oil

- Compressor Oil

- Transformer Oil / Insulating Fluids

- By End-User Industry:

- Power Generation (Utility and Renewable)

- Manufacturing (Heavy Machinery, Precision Machining, Automotive)

- Oil & Gas

- Marine and Shipping

- Mining

- Aerospace

- By Design Type:

- Dedicated/Fixed Systems (Kidney Loop)

- Portable/Mobile Systems (Service Carts)

Value Chain Analysis For Electrostatic Liquid Cleaner Market

The value chain for the Electrostatic Liquid Cleaner market begins with the upstream suppliers responsible for providing essential components, including high-voltage power supplies, specialized pumps, precision flow meters, and sensor technology. The quality and availability of these highly technical components are critical, as they directly influence the efficiency and reliability of the final ELC unit. Manufacturing and assembly activities follow, where core expertise in electrical engineering, fluid dynamics, and system integration is applied to build robust, compliant, and often customized cleaning systems. Manufacturers frequently partner with specialized electrical component suppliers to ensure compliance with global safety standards related to high-voltage equipment, making component sourcing a key vulnerability or differentiator in the upstream segment.

The midstream involves intricate distribution channels, which typically utilize a hybrid model. Direct sales are common for large, custom installations in major industrial clients (e.g., power plants, oil rigs), allowing manufacturers to offer technical consulting and bespoke system integration services. Indirect sales channels, utilizing specialized industrial equipment distributors, fluid analysis labs, and maintenance service contractors, dominate the SME market and regional sales. These indirect partners often provide value-added services such as fluid testing, installation, and ongoing maintenance contracts, acting as essential conduits to end-users who require localized technical support and immediate availability of consumable collector plates.

The downstream segment focuses on the end-user interaction and post-sales support. This includes installation, commissioning, regular maintenance of the ELC unit, and the provision of continuous fluid analysis services. Potential customers, particularly those in the Power Generation and heavy Manufacturing sectors, require long-term service agreements to ensure the perpetual cleanliness of their assets. The success in the downstream is increasingly linked to the quality of the data and insights provided—systems integrated with IIoT that offer predictive maintenance alerts command a premium, driving value further toward integrated service providers rather than purely hardware vendors. The ability to manage and dispose of saturated collector plates responsibly also forms a crucial part of the end-of-life cycle management in the downstream segment.

Electrostatic Liquid Cleaner Market Potential Customers

Potential customers for Electrostatic Liquid Cleaners are predominantly industrial entities that operate critical, high-value machinery reliant on hydraulic, lubrication, or insulating fluids, where operational failure carries severe financial and safety risks. Primary buyers include major utility companies managing gas and steam turbines, where varnish contamination is a leading cause of outages and efficiency loss. The manufacturing sector is a vast customer base, particularly companies involved in heavy stamping, injection molding, and continuous metal processing, which rely on large hydraulic reservoirs requiring constant particulate and oxidation control to protect sensitive servo valves and pumps.

Secondary buyers include the maritime industry, where ship propulsion and auxiliary systems operate under harsh conditions demanding robust lubrication cleaning, and the mining sector, which utilizes heavy mobile equipment with complex hydraulic systems susceptible to contamination from environmental ingress. Furthermore, the burgeoning wind energy sector represents a critical growth area, as gearboxes in wind turbines operate under immense stress, making ELCs essential for extending gearbox life and maximizing renewable energy output. These customers seek solutions that not only extend fluid life but, more critically, guarantee asset reliability and minimize the steep costs associated with unscheduled downtime and expensive component replacement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $310.5 Million USD |

| Market Forecast in 2033 | $525.8 Million USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin, Pall Corporation, Trico Corporation, Fluitec, Triple R, Kleenoil Filtration, Hy-Pro Filtration, C.C. Jensen A/S, Des-Case Corporation, Royal Purple, ZF Filter Systems, ASCO Group, SKF Group, Filtertechnik Ltd., Bosch Rexroth, Oil Filtration Systems Inc., IFH Group, Lubri-Clean Systems, Electrostatic Cleaners Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrostatic Liquid Cleaner Market Key Technology Landscape

The Electrostatic Liquid Cleaner market technology landscape is dominated by proprietary designs focusing on maximizing the electrostatic field strength and optimizing the collection surface area within compact units. The core technology involves the use of high-voltage (typically 10kV to 25kV DC) power supplies that generate an intense electric field across flow channels. Modern advancements focus on developing solid-state power supplies that offer improved energy efficiency, smaller footprints, and enhanced reliability compared to older transformer-based systems. Key technological differentiation revolves around the design of the collector plates; advanced systems use specialized composite or multilayer media that dramatically increase the charge differential and particle trapping capacity, allowing for the efficient removal of ultra-fine particulates (down to 0.01 micron) and soluble varnish precursors.

A crucial technological trend involves integrating sophisticated monitoring and control systems. Contemporary ELC units are often equipped with embedded sensors for real-time oil condition monitoring, measuring parameters such as temperature, moisture content, and varnish potential (using technologies like the Membrane Patch Colorimetry - MPC test). This data is often processed locally and transmitted via IoT protocols to cloud-based platforms, enabling operators to track cleaning efficiency remotely and initiate predictive maintenance actions. This integration transforms the ELC from a passive cleaner into an active, intelligent fluid conditioning asset, aligning with Industry 4.0 standards for manufacturing and industrial operations.

Further innovation is concentrated on developing robust fluid handling components capable of processing high-viscosity lubricants commonly found in gearbox and heavy machinery applications without compromising cleaning efficiency. Manufacturers are also experimenting with hybrid filtration systems, where electrostatic cleaning is coupled with vacuum dehydration or ion-exchange resin technology to address not only particulate and varnish issues but also water contamination and acid formation simultaneously. This comprehensive fluid rehabilitation approach is crucial for high-risk assets like steam turbines and large compressors, offering a single-unit solution for complete fluid restoration and extended lifespan.

Regional Highlights

- North America: This region is characterized by high technological maturity and strict industrial fluid cleanliness standards, particularly in the aerospace, defense, and power generation (nuclear and gas turbine) sectors. The high cost of labor and component replacement drives strong demand for preventative maintenance technologies like ELCs. Significant investments in infrastructure refurbishment and the expansion of data centers, which require specialized cooling fluid maintenance, ensure sustained market growth. Market players focus on providing fully integrated, IIoT-enabled systems and advanced service contracts to major corporate clients across the US and Canada.

- Europe: The European market is highly influenced by sustainability targets and circular economy principles, making extended oil life and waste minimization paramount. Strong regulatory frameworks, especially those governing industrial emissions and waste, incentivize the adoption of high-efficiency oil cleaning solutions. Germany, France, and the UK lead adoption, driven by their advanced manufacturing bases (automotive and precision engineering). The growth of the offshore wind energy sector is a crucial regional driver, requiring specialized ELC systems for critical gearbox lubrication in harsh marine environments.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth, fueled by rapid industrialization, massive investments in manufacturing capacity (especially in China, India, and Southeast Asia), and expansive infrastructure development. The high volume of new turbine installations in power generation and the immense scale of the region's hydraulic machinery use in construction and metal processing create a vast addressable market. While price sensitivity remains a factor, the increasing awareness of fluid reliability benefits among local industrial giants is accelerating the shift toward advanced ELC solutions, supported by local manufacturing and competitive pricing strategies.

- Latin America (LATAM): Growth in LATAM is concentrated in resource-intensive sectors like mining, petrochemicals, and heavy construction, where extreme operating conditions necessitate robust fluid management. Economic volatility often restricts immediate high-CapEx investments, favoring portable or rental ELC solutions, but the long-term protection of costly imported machinery drives underlying demand for high-performance cleaning.

- Middle East and Africa (MEA): The MEA market is dominated by the Oil & Gas and large-scale power generation sectors. High temperatures and remote operations demand extremely reliable machinery and effective cooling/lubrication systems. ELCs are critical for maintaining turbine reliability in power plants and compressors in remote upstream oil and gas facilities. Investment often correlates directly with global energy prices, leading to periods of rapid ELC adoption during capital expenditure cycles in the energy sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrostatic Liquid Cleaner Market.- Eaton Corporation

- Parker Hannifin

- Pall Corporation

- Trico Corporation

- Fluitec

- Triple R

- Kleenoil Filtration

- Hy-Pro Filtration

- C.C. Jensen A/S

- Des-Case Corporation

- Royal Purple

- ZF Filter Systems

- ASCO Group

- SKF Group

- Filtertechnik Ltd.

- Bosch Rexroth

- Oil Filtration Systems Inc.

- IFH Group

- Lubri-Clean Systems

- Electrostatic Cleaners Inc.

Frequently Asked Questions

Analyze common user questions about the Electrostatic Liquid Cleaner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Electrostatic Liquid Cleaners over conventional filtration?

Electrostatic Liquid Cleaners (ELCs) utilize high-voltage fields to remove soluble contaminants (varnish precursors) and ultra-fine particulates (below 1 micron) that mechanical filters cannot effectively capture. This prevents the formation of sticky varnish deposits and ensures superior fluid cleanliness, directly extending asset life.

Which industrial fluids benefit most from Electrostatic Cleaning technology?

Fluids subjected to high thermal stress and extended service intervals benefit most. Primary applications include hydraulic oils, large volume turbine lubrication oils used in power generation, compressor fluids, and specialized insulating fluids where varnish mitigation is critical for operational stability and heat transfer efficiency.

How does the use of ELCs affect an industrial facility's overall maintenance costs and ROI?

ELCs significantly reduce maintenance costs by extending the lifespan of expensive lubricants, minimizing the frequency of oil changes, and drastically reducing component failures (e.g., servo valves, bearings) caused by varnish and fine particles. The return on investment is achieved through reduced downtime and lower oil procurement and disposal expenses.

Is Electrostatic Liquid Cleaning compatible with synthetic lubricants and complex additive packages?

Generally, modern ELCs are designed to be compatible with most synthetic and mineral-based industrial lubricants. They specifically target degradation products and fine solids without removing essential fluid additives, which often have low polarity and remain unaffected by the electrostatic process. Consultation with the manufacturer regarding specific fluid chemistry is recommended.

What role does IIoT integration play in the future development of the Electrostatic Liquid Cleaner market?

IIoT integration allows ELC systems to provide real-time fluid analysis and performance data to operators remotely. This enables AI-driven predictive maintenance, optimizes cleaning cycles based on actual contamination levels, and facilitates centralized fleet management, enhancing system efficiency and minimizing energy consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager