Elemental Impurities Identification Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439982 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Elemental Impurities Identification Market Size

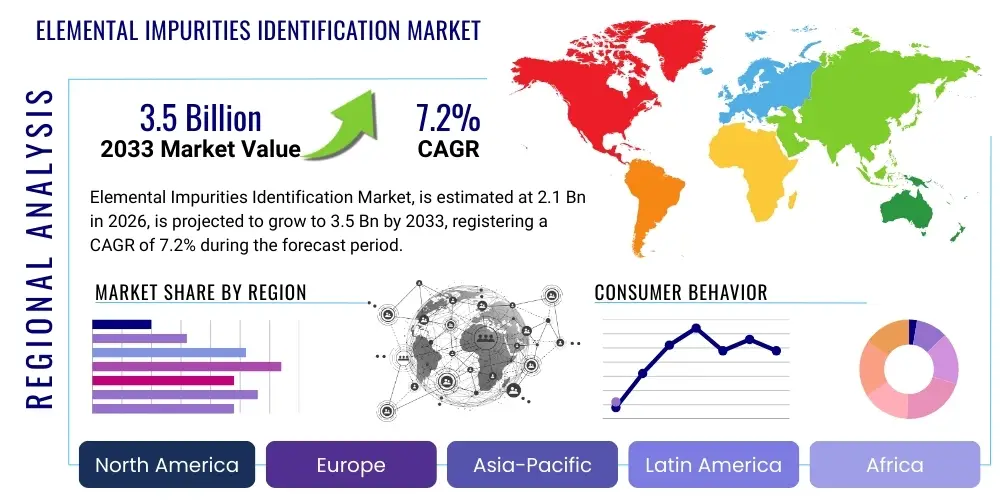

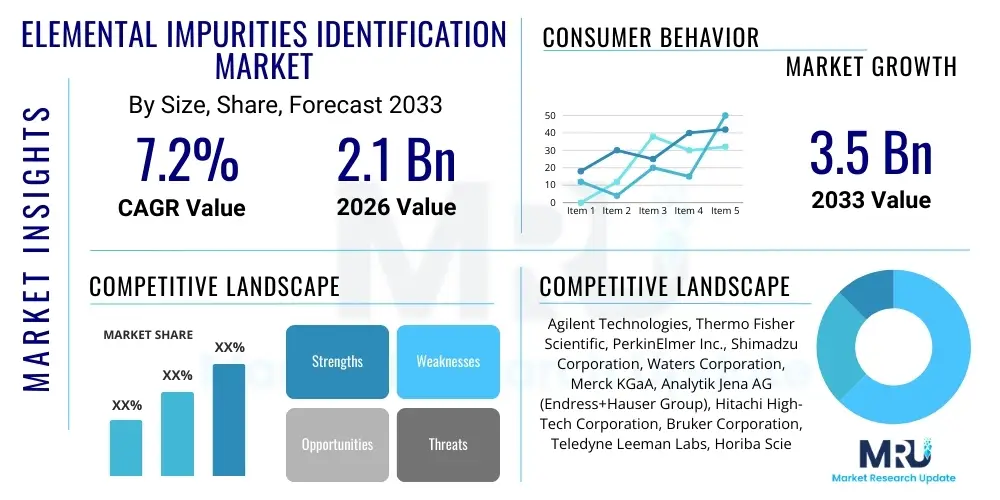

The Elemental Impurities Identification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 2.1 billion in 2026 and is projected to reach USD 3.5 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating regulatory stringency regarding product safety and quality across diverse industries, particularly pharmaceuticals, food and beverage, and environmental monitoring. The increasing adoption of advanced analytical techniques, coupled with a rising emphasis on research and development activities, further propels market growth, creating significant demand for precise and reliable elemental analysis solutions.

Elemental Impurities Identification Market introduction

The Elemental Impurities Identification Market encompasses the technologies, products, and services dedicated to detecting and quantifying trace metallic and non-metallic elements present in various matrices. This critical market plays a pivotal role in ensuring product quality, safety, and regulatory compliance across a multitude of industries. The primary objective is to identify and measure potentially harmful elements that could compromise the integrity or safety of a final product, affecting human health or the environment. The comprehensive range of analytical techniques employed, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS), Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), and Atomic Absorption Spectrometry (AAS), serves as the backbone of this market, offering unparalleled sensitivity and accuracy for a diverse array of applications.

Major applications of elemental impurities identification span across the pharmaceutical and biopharmaceutical sectors, where adherence to pharmacopeial guidelines like ICH Q3D and USP <232>/<233> is mandatory for drug safety and efficacy. In the food and beverage industry, it is crucial for detecting heavy metals and other contaminants to ensure consumer safety and product quality. Environmental testing laboratories utilize these methods to monitor pollution levels in water, soil, and air, complying with environmental regulations. Furthermore, materials science, chemical manufacturing, and clinical diagnostics also heavily rely on precise elemental analysis. The myriad benefits derived from robust elemental identification include enhanced patient and consumer safety, stringent quality control throughout the manufacturing process, reduced risk of product recalls, and assured regulatory compliance, all of which are paramount in today's highly regulated global economy.

The market's driving factors are multifaceted and interconnected. Foremost among these is the continuous evolution and tightening of global regulatory frameworks, which mandate the testing for an expanding list of elemental impurities. Innovations in analytical instrumentation, leading to higher sensitivity, improved throughput, and greater ease of use, are also significant contributors. The escalating complexity of global supply chains necessitates more rigorous testing at multiple stages to mitigate contamination risks. Additionally, a heightened public awareness regarding product safety and environmental impact further compels industries to invest in advanced elemental identification solutions. The growing R&D expenditures in life sciences and new material development also fuel the demand for sophisticated analytical tools capable of identifying and quantifying trace elements with exceptional precision.

Elemental Impurities Identification Market Executive Summary

The Elemental Impurities Identification Market is currently undergoing dynamic shifts influenced by several key business, regional, and segment trends. From a business perspective, the market is witnessing a strong drive towards automation and miniaturization of analytical instruments, aiming to enhance laboratory efficiency, reduce manual intervention, and improve data reproducibility. There's also a growing inclination towards integrated solutions that combine various analytical techniques and incorporate advanced software for data processing, method development, and regulatory compliance reporting. Furthermore, the expansion of contract testing organizations (CTOs) and contract research organizations (CROs) is a notable trend, as many companies, particularly small and medium-sized enterprises, opt to outsource their specialized analytical testing requirements due to the high capital investment and expertise needed for in-house capabilities. This outsourcing trend contributes to market accessibility and efficiency, fostering broader adoption of advanced identification services.

Regionally, the market exhibits varying growth trajectories and maturity levels. North America and Europe continue to represent significant market shares, characterized by well-established regulatory frameworks, advanced research infrastructure, and high adoption rates of sophisticated analytical instrumentation. These regions are often at the forefront of technological innovation and regulatory mandate implementation, driving consistent demand. However, the Asia Pacific (APAC) region is projected to demonstrate the highest growth rate during the forecast period, fueled by rapid industrialization, increasing investments in pharmaceutical and biotechnology sectors, a burgeoning food and beverage industry, and growing environmental concerns necessitating more stringent monitoring. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as they enhance their regulatory compliance and industrial quality control standards. This geographical expansion signifies a global acknowledgment of the importance of elemental impurities identification.

Regarding segment trends, Inductively Coupled Plasma Mass Spectrometry (ICP-MS) continues to dominate the technology segment due to its unparalleled sensitivity, multi-element detection capabilities, and wide dynamic range, making it the preferred method for ultra-trace elemental analysis, especially in pharmaceutical and environmental matrices. The demand for reagents and consumables remains consistently high, driven by the recurring need for standards, calibration solutions, and sample preparation kits essential for routine testing. The services segment, encompassing contract testing, consulting, and maintenance, is experiencing significant growth, reflecting the increasing complexity of regulatory requirements and the need for specialized expertise. End-user wise, the pharmaceutical and biotechnology sector remains the largest consumer, primarily due to rigorous regulatory guidelines, while the food and beverage industry and environmental testing laboratories are rapidly expanding their adoption of these sophisticated analytical techniques to meet evolving safety and quality standards. This segmented growth underscores the critical and diverse applications of elemental impurities identification.

AI Impact Analysis on Elemental Impurities Identification Market

User inquiries regarding AI's impact on the Elemental Impurities Identification Market frequently center on its potential to revolutionize data processing, improve method development, and enhance predictive capabilities. Common questions revolve around how AI can handle the vast datasets generated by high-throughput instruments, whether it can automate complex calibration and validation procedures, and its role in identifying novel contamination sources or predicting compliance issues. Users are particularly keen on understanding AI's ability to reduce analysis time, minimize human error, and provide deeper insights into sample matrices that traditional statistical methods might miss. Concerns often include the reliability of AI models, the need for robust training data, and the ethical implications of AI-driven decision-making in critical areas like product safety. The overarching theme is an expectation that AI will bring unprecedented efficiency, accuracy, and predictive power to elemental analysis, transforming the landscape of quality control and regulatory compliance.

- Enhanced Data Processing and Interpretation: AI algorithms can rapidly process and interpret complex spectroscopic data, identifying patterns and anomalies that might be overlooked by human analysts. This leads to faster, more accurate results and a deeper understanding of elemental profiles.

- Automated Method Development and Optimization: Machine learning models can optimize instrument parameters, develop robust analytical methods, and perform method validation more efficiently, significantly reducing the time and resources required for assay development.

- Predictive Maintenance and Diagnostics: AI can monitor instrument performance in real-time, predict potential malfunctions, and schedule proactive maintenance, thereby minimizing downtime, ensuring instrument reliability, and improving overall laboratory productivity.

- Improved Quality Control and Anomaly Detection: AI can be trained on extensive historical data to establish baseline elemental profiles, automatically flagging deviations or unexpected contaminants, which enhances quality control processes and aids in rapid problem identification.

- Streamlined Regulatory Compliance: AI-powered software can assist in generating compliance reports, ensuring data integrity, and navigating complex regulatory guidelines, thereby simplifying the audit process and reducing the risk of non-compliance.

- Advanced Spectral Deconvolution: For complex samples, AI can perform sophisticated spectral deconvolution, isolating signals from interfering elements or matrix components, leading to more accurate quantification of target impurities.

- Intelligent Sample Preparation: AI can guide the development of optimized sample preparation protocols, recommending the most effective digestion or extraction methods based on sample matrix and target elements, leading to improved recovery and reproducibility.

DRO & Impact Forces Of Elemental Impurities Identification Market

The Elemental Impurities Identification Market is profoundly shaped by a combination of driving factors, inherent restraints, promising opportunities, and overarching impact forces that dictate its trajectory. A primary driver is the pervasive and continually intensifying global regulatory landscape, exemplified by guidelines such as ICH Q3D for pharmaceuticals and various directives for food safety and environmental protection, which mandate stringent control over elemental impurities. These regulations compel industries to adopt advanced and highly sensitive analytical techniques, thereby creating sustained demand for sophisticated instruments, reagents, and services. Furthermore, the relentless pursuit of product quality and safety across all consumer-facing sectors, coupled with an increasing investment in research and development activities, particularly in novel materials and biopharmaceuticals, further fuels the market's expansion by necessitating more precise and comprehensive elemental characterization.

Despite robust growth drivers, the market faces several significant restraints. The high initial capital investment required for advanced elemental identification instruments, such as ICP-MS systems, can be prohibitive for smaller laboratories or companies, limiting wider adoption. Additionally, the operation and maintenance of these sophisticated instruments demand a specialized workforce with specific technical expertise in analytical chemistry and instrumentation, which can be scarce and costly to retain. The complexity of sample matrices often presents significant analytical challenges, requiring extensive sample preparation and potentially leading to interferences that complicate accurate elemental quantification. Moreover, the sheer volume of data generated by high-throughput analyses poses challenges in terms of data storage, interpretation, and management, requiring advanced software solutions and skilled data analysts. These factors collectively contribute to operational overheads and can impede market penetration in certain segments.

Opportunities for growth are abundant within this evolving market. The expanding pharmaceutical and biotechnology industries in emerging economies, particularly in Asia Pacific, present fertile ground for new installations and service contracts as these regions industrialize and align with global quality standards. The burgeoning trend of outsourcing analytical testing to contract testing organizations (CTOs) and contract research organizations (CROs) offers a significant avenue for market expansion, as these specialized entities can provide cost-effective and expert services to a broad client base. Technological advancements focusing on automation, miniaturization, and the integration of artificial intelligence and machine learning for data analysis and method development are creating novel solutions that enhance efficiency and precision. Furthermore, the increasing focus on environmental sustainability and the need for comprehensive monitoring of elemental contaminants in soil, water, and air continue to open new application areas and drive demand for advanced identification technologies, ensuring the market's long-term vitality and innovation.

Segmentation Analysis

The Elemental Impurities Identification Market is highly diversified, segmented across various parameters including technology, sample type, product type, and end-user. This segmentation provides a granular view of the market's structure, allowing for a detailed understanding of demand drivers, competitive landscapes, and growth opportunities within specific niches. Each segment plays a crucial role in the overall market ecosystem, catering to distinct analytical needs and industrial requirements. Understanding these segments is vital for stakeholders to strategize effectively, develop targeted solutions, and capitalize on emerging trends across the diverse applications of elemental analysis.

- By Technology

- ICP-MS (Inductively Coupled Plasma Mass Spectrometry)

- ICP-OES (Inductively Coupled Plasma Optical Emission Spectrometry)

- AAS (Atomic Absorption Spectrometry)

- XRF (X-ray Fluorescence Spectroscopy)

- UV-Vis Spectroscopy

- Other Technologies (e.g., GC-MS, LC-MS with elemental detection)

- By Sample Type

- Pharmaceutical & Biopharmaceutical Products

- Food & Beverage Products

- Environmental Samples (Water, Soil, Air)

- Clinical Samples

- Industrial Samples (Chemicals, Metals, Polymers)

- Others (e.g., Forensics, Geological)

- By Product Type

- Instruments

- ICP-MS Systems

- ICP-OES Systems

- AAS Systems

- XRF Systems

- Other Systems

- Reagents & Consumables

- Standards

- Calibration Solutions

- Solvents

- Sample Preparation Kits

- Other Consumables (e.g., plasma torches, tubing)

- Services

- Testing Services

- Consulting Services

- Training Services

- Maintenance & Support Services

- Instruments

- By End-User

- Pharmaceutical & Biotechnology Companies

- Food & Beverage Companies

- Environmental Testing Laboratories

- Contract Research Organizations (CROs) & Contract Testing Organizations (CTOs)

- Academic & Research Institutions

- Government & Regulatory Bodies

- Others (e.g., Manufacturing Industries)

Value Chain Analysis For Elemental Impurities Identification Market

The value chain for the Elemental Impurities Identification Market is intricate, involving multiple stages from raw material sourcing to end-user application, all contributing to the final delivery of accurate analytical solutions. At the upstream stage, key players include suppliers of high-purity chemicals, specialized electronic components, optical systems, and precision mechanical parts that form the foundation of sophisticated analytical instruments. Software developers providing data acquisition, processing, and laboratory information management systems (LIMS) are also crucial upstream contributors. These suppliers ensure the quality and performance of the core components that instrument manufacturers integrate into their elemental analysis platforms, setting the stage for high-performance and reliable testing capabilities essential for diverse industries.

Moving downstream, the value chain encompasses instrument manufacturers who assemble and market the elemental identification systems, along with reagent and consumables producers who supply necessary standards, calibration solutions, and sample preparation kits. Distribution channels play a critical role in connecting these products with end-users. Direct distribution, often through a manufacturer's own sales force, is prevalent for high-value, complex instrumentation, allowing for specialized technical support, installation, and training. Indirect distribution involves third-party distributors, resellers, and channel partners, particularly for consumables and instruments requiring broader market reach. These indirect channels leverage local expertise and established networks to efficiently deliver products and services, ensuring widespread accessibility of elemental identification tools across various geographical regions and diverse customer segments, thus optimizing market penetration and customer support.

The direct and indirect distribution strategies are tailored to the specific nature of the products and the needs of the customer base. Direct sales teams are often deployed for major capital equipment purchases, providing end-users with comprehensive pre-sales consultation, custom solution design, and post-sales technical assistance and training, which is crucial for complex analytical systems. In contrast, indirect channels are highly effective for recurring revenue streams like reagents, consumables, and maintenance services, where efficient logistics and localized support are paramount. Furthermore, contract testing organizations (CTOs) and contract research organizations (CROs) act as service providers, essentially extending the value chain by offering specialized elemental identification services to clients who prefer outsourcing rather than investing in in-house capabilities. This layered approach ensures that the market effectively caters to a wide spectrum of customer requirements, from direct procurement of instruments to flexible service-based solutions, thereby optimizing market reach and customer satisfaction.

Elemental Impurities Identification Market Potential Customers

The Elemental Impurities Identification Market serves a broad and diverse range of potential customers, primarily end-users and buyers who require precise and reliable elemental analysis for quality control, safety assurance, and regulatory compliance. The largest segment of potential customers resides within the pharmaceutical and biotechnology industries. These entities are under immense regulatory pressure to ensure that drug products and biologicals are free from harmful elemental contaminants, adhering strictly to global pharmacopeial standards such as ICH Q3D and USP <232>/<233>. Their demand spans from early-stage research and development to final product release testing, driving significant investment in advanced analytical instrumentation and outsourcing specialized testing services.

Another substantial customer base is the food and beverage industry, where the detection of heavy metals (e.g., lead, arsenic, cadmium, mercury) and other trace elements is critical for consumer health and product integrity. Food manufacturers, processors, and safety laboratories continuously monitor raw materials, intermediate products, and finished goods to meet national and international food safety standards. Environmental testing laboratories represent a growing segment, mandated by government regulations to monitor elemental pollutants in water, soil, and air, addressing public health concerns and environmental protection initiatives. These laboratories require high-throughput and sensitive instruments to analyze a vast array of samples accurately. Additionally, contract research organizations (CROs) and contract testing organizations (CTOs) are increasingly becoming key customers, as they offer specialized analytical services to companies that lack the in-house expertise or infrastructure, thus broadening the market reach.

Beyond these primary sectors, potential customers also include academic and research institutions engaged in fundamental and applied sciences, such as materials science, geochemistry, and clinical research, where elemental analysis is indispensable for characterization and discovery. Chemical and petrochemical industries utilize elemental identification for process control, catalyst analysis, and impurity profiling in their products. Forensic laboratories apply these techniques for trace evidence analysis, while mining and metallurgical industries rely on them for quality control of ores and refined metals. The widespread applicability across diverse scientific and industrial domains highlights the fundamental importance of elemental impurities identification, ensuring a continuously expanding customer base driven by both regulatory imperatives and the pursuit of scientific and industrial excellence. The versatility of analytical techniques ensures that a multitude of industries can leverage these solutions to meet their specific, critical needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Thermo Fisher Scientific, PerkinElmer Inc., Shimadzu Corporation, Waters Corporation, Merck KGaA, Analytik Jena AG (Endress+Hauser Group), Hitachi High-Tech Corporation, Bruker Corporation, Teledyne Leeman Labs, Horiba Scientific, Anton Paar GmbH, Rigaku Corporation, Jasco, Inc., GBC Scientific Equipment Pty Ltd, Spectro Analytical Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elemental Impurities Identification Market Key Technology Landscape

The Elemental Impurities Identification Market is defined by a dynamic and continuously evolving technology landscape, driven by the need for higher sensitivity, faster analysis, and improved accuracy in detecting trace elements. Inductively Coupled Plasma Mass Spectrometry (ICP-MS) stands as a cornerstone technology, revered for its ultra-trace detection limits, multi-element capabilities, and wide dynamic range, making it indispensable for pharmaceutical, environmental, and food safety testing where stringent regulations apply. Its ability to handle complex matrices and provide isotopic information further solidifies its position as a leading analytical tool. Alongside ICP-MS, Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) offers robust, high-throughput analysis, particularly favored for samples with higher impurity concentrations or where simultaneous multi-element analysis is crucial, providing a cost-effective alternative for many routine applications.

Atomic Absorption Spectrometry (AAS), including techniques like flame AAS, graphite furnace AAS (GF-AAS), and hydride generation AAS, continues to be a widely utilized and accessible technology. While generally less sensitive than ICP-MS for some elements, AAS remains a staple in many laboratories due to its lower operational cost, simplicity of use, and suitability for single-element analysis at part-per-billion levels. X-ray Fluorescence (XRF) spectroscopy offers a non-destructive method for elemental analysis, allowing for direct analysis of solid, liquid, and powder samples without extensive preparation. Its capabilities for rapid, non-contact analysis make it valuable for quality control in materials science, manufacturing, and even in-field environmental screening, providing a versatile option for elemental screening and quantification across a broad range of industries where sample integrity is paramount.

Emerging and complementary technologies are continuously enhancing the market's capabilities. Advancements in hyphenated techniques, such as GC-MS or LC-MS coupled with elemental detectors, are opening new avenues for speciation analysis, allowing not just the identification of an element but also its chemical form, which is critical for understanding toxicity and bioavailability. The integration of automation and robotics into sample preparation and instrument operation is significantly improving throughput and reproducibility, reducing human error, and freeing up skilled personnel for more complex tasks. Furthermore, the development of portable and handheld elemental analyzers, leveraging technologies like handheld XRF, is expanding the reach of elemental identification beyond traditional laboratory settings, enabling on-site testing and rapid screening for various industrial and environmental applications. This continuous innovation ensures that the market remains at the forefront of analytical science, addressing increasingly complex challenges with sophisticated and efficient solutions.

Regional Highlights

- North America: This region holds a dominant share in the Elemental Impurities Identification Market, characterized by stringent regulatory frameworks, particularly in the pharmaceutical and food & beverage sectors (e.g., FDA regulations). High R&D investments, the presence of numerous key market players, and advanced healthcare infrastructure further drive the adoption of sophisticated analytical instruments and services. The U.S. and Canada lead in technological advancements and early adoption of new methods.

- Europe: Similar to North America, Europe is a mature market with a significant share, propelled by robust environmental protection agencies (e.g., European Environment Agency) and stringent pharmacopeial guidelines (e.g., European Pharmacopoeia). Countries like Germany, the UK, and France are at the forefront of adopting advanced elemental analysis technologies due to strong research capabilities, well-established manufacturing industries, and a high emphasis on product quality and safety.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC's market expansion is fueled by rapid industrialization, increasing pharmaceutical manufacturing bases (especially in China and India), and growing awareness regarding food safety and environmental pollution. The region is witnessing rising investments in healthcare infrastructure and analytical laboratories, coupled with an increasing number of contract testing organizations, driving the demand for elemental identification solutions.

- Latin America: This region is an emerging market for elemental impurities identification, with countries like Brazil, Mexico, and Argentina showing increasing adoption driven by evolving regulatory standards and growing industrial sectors, including pharmaceuticals and food processing. Investment in modernizing analytical laboratories and enhancing quality control measures is gradually contributing to market growth.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily driven by increasing investments in the pharmaceutical and petrochemical industries, alongside a rising focus on environmental monitoring and water quality. While the market is currently smaller, developing regulatory landscapes and economic diversification efforts are creating new opportunities for elemental impurities identification technologies and services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elemental Impurities Identification Market.- Agilent Technologies

- Thermo Fisher Scientific

- PerkinElmer Inc.

- Shimadzu Corporation

- Waters Corporation

- Merck KGaA

- Analytik Jena AG (Endress+Hauser Group)

- Hitachi High-Tech Corporation

- Bruker Corporation

- Teledyne Leeman Labs

- Horiba Scientific

- Anton Paar GmbH

- Rigaku Corporation

- Jasco, Inc.

- GBC Scientific Equipment Pty Ltd

- Spectro Analytical Instruments

- Knauer GmbH

Frequently Asked Questions

Analyze common user questions about the Elemental Impurities Identification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are elemental impurities and why are they a concern?

Elemental impurities are trace levels of metallic and non-metallic elements that may be present in pharmaceutical products, food, environmental samples, or other materials. They are a concern due to their potential toxicity, which can pose significant health risks to consumers or impact environmental safety, necessitating strict identification and quantification for product quality and regulatory compliance.

Which analytical techniques are commonly used for elemental impurities identification?

The most common and effective analytical techniques include Inductively Coupled Plasma Mass Spectrometry (ICP-MS) for ultra-trace analysis, Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) for multi-element analysis, and Atomic Absorption Spectrometry (AAS) for specific element quantification. X-ray Fluorescence (XRF) is also utilized for rapid, non-destructive screening, providing a comprehensive toolkit for diverse analytical challenges.

What regulatory guidelines govern elemental impurities in pharmaceuticals?

The primary global regulatory guidelines for elemental impurities in pharmaceuticals are ICH Q3D (International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use), which establishes permissible daily exposures (PDEs) for specific elements, and pharmacopeial chapters like USP <232>/<233> (United States Pharmacopeia) and EP (European Pharmacopoeia), which detail methodology and limits to ensure patient safety.

How does automation improve elemental impurities identification?

Automation significantly enhances elemental impurities identification by streamlining sample preparation, optimizing instrument operation, and reducing manual intervention. This leads to increased sample throughput, improved reproducibility and accuracy, reduced human error, and overall laboratory efficiency, allowing analysts to focus on data interpretation and complex problem-solving rather than repetitive tasks.

What are the key drivers for growth in the Elemental Impurities Identification Market?

Key drivers include the escalating stringency of global regulatory standards across pharmaceuticals, food and beverage, and environmental sectors; continuous advancements in analytical instrumentation offering higher sensitivity and speed; increasing investments in research and development; and a growing public awareness regarding product safety and environmental impact, collectively fostering a robust demand for advanced elemental analysis solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager