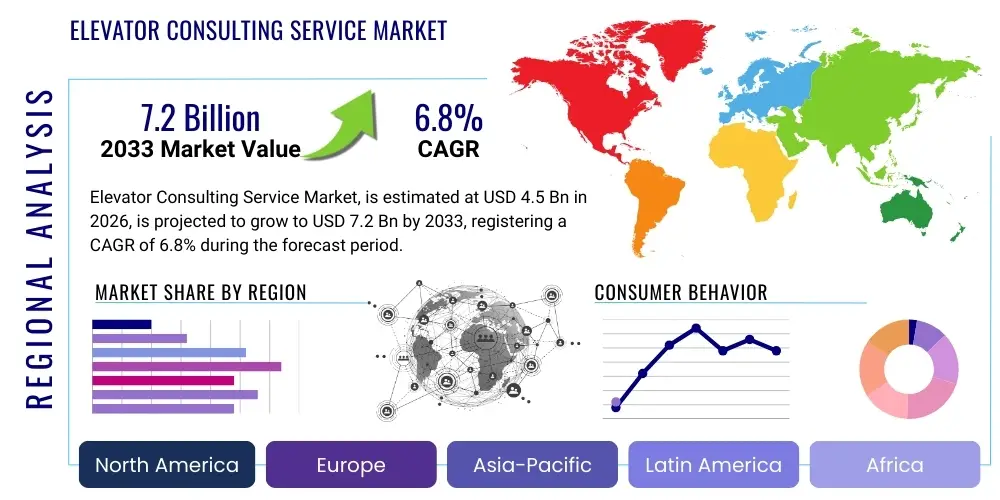

Elevator Consulting Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435358 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Elevator Consulting Service Market Size

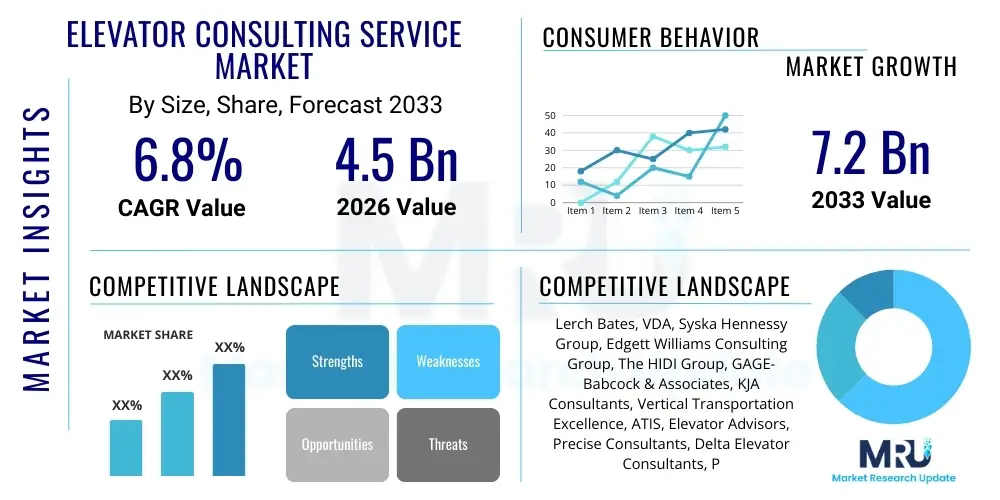

The Elevator Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Elevator Consulting Service Market introduction

The Elevator Consulting Service Market encompasses specialized advisory services related to the design, installation, maintenance, modernization, and compliance of vertical transportation systems, including elevators, escalators, and moving walks. These services are critical for property owners, developers, and facility managers who require expert guidance to navigate complex safety regulations, optimize operational efficiency, and ensure the longevity of their assets. The core product of this market is intellectual property and expert technical advice, focusing heavily on safety audits, traffic analysis, performance specifications, and contract management for new installations or existing equipment upgrades. Demand for these services is inherently linked to construction activity in commercial and residential sectors, coupled with mandatory modernization cycles for aging building infrastructure across developed economies.

Major applications of elevator consulting services span across various phases of a building's lifecycle. In the initial design phase, consultants ensure systems are appropriately sized, energy-efficient, and meet local building codes (e.g., ASME A17.1 in North America or EN 81 series in Europe). During the operation phase, services shift toward maintenance contract reviews, quality control inspections, and litigation support related to equipment failure or accidents. The primary benefit derived from utilizing these services is risk mitigation—reducing liability exposure associated with unsafe or non-compliant equipment—and achieving significant long-term cost savings by negotiating favorable service contracts and extending equipment lifespan through preventative strategies.

Key driving factors accelerating market expansion include the global trend toward urbanization, leading to higher density and taller buildings which necessitate sophisticated vertical transport planning. Furthermore, increasingly stringent global safety and energy efficiency regulations compel building owners to seek expert guidance for compliance and upgrades. The growing awareness among facility managers regarding the high cost of inefficient maintenance contracts and the complexity involved in modernizing legacy systems also fuels the reliance on independent consulting expertise. The transition towards smart building technologies, requiring integration of IoT-enabled elevators, presents a significant technological driver influencing the consulting scope.

Elevator Consulting Service Market Executive Summary

The Elevator Consulting Service Market is poised for sustained growth, driven primarily by evolving regulatory landscapes and substantial investments in smart building infrastructure across key urban centers. Business trends indicate a shift towards specialized consulting firms offering expertise in specific areas such as predictive maintenance integration, digital twin implementation for system management, and sustainable design practices focused on energy recovery systems. Fragmentation remains a characteristic of this market, although strategic partnerships and regional consolidation among leading firms are increasing to service multinational real estate portfolios. Clients are increasingly demanding technology-agnostic advice that prioritizes long-term total cost of ownership (TCO) over immediate capital expenditure.

Regionally, North America and Europe currently dominate the market due to the high density of aging commercial buildings requiring mandated modernization cycles and strict adherence to established safety codes. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive infrastructure development, rapid urbanization, and the construction of numerous super-tall skyscrapers in countries like China, India, and Southeast Asia. Regulatory harmonization efforts within economic blocks, such as the European Union, also influence the standardization of consulting practices, facilitating cross-border service delivery and increasing market efficiency.

Segment trends reveal that the modernization and maintenance consulting segments collectively account for the largest market share, reflecting the vast installed base of elevators globally that continually requires upgrades and performance optimization. The new installation segment, while highly correlated with construction cycles, drives demand for sophisticated traffic analysis and BIM integration expertise. Furthermore, the commercial end-user segment, including high-rise offices, hotels, and healthcare facilities, remains the most lucrative due to the criticality of vertical transport reliability and the complexity of their traffic demands, requiring high-level strategic input from consultants to manage passenger flow and safety protocols effectively.

AI Impact Analysis on Elevator Consulting Service Market

Common user questions regarding AI's impact on elevator consulting revolve around its potential to automate traditional inspection roles, enhance predictive maintenance recommendations, and influence liability assessment following incidents. Users frequently inquire about the reliability of AI-driven anomaly detection compared to human inspection, the integration challenges of incorporating machine learning algorithms into legacy elevator systems, and the consulting fees associated with digital transformation projects utilizing AI tools like digital twins. A primary concern is whether AI will reduce the necessity for ongoing maintenance contract reviews performed by consultants, or if it will simply elevate the expertise required, focusing consulting efforts on interpreting complex data outputs and validating algorithmic performance. Users expect AI to streamline compliance checks and reduce downtime but are wary of data privacy implications and the specialized skill set required to manage these advanced systems.

The integration of Artificial Intelligence, particularly Machine Learning (ML) and Computer Vision, fundamentally transforms how consultants approach elevator diagnostics and performance optimization. AI enables true condition-based monitoring by processing vast amounts of sensor data (vibration, temperature, door cycling patterns) in real-time to accurately predict component failure probabilities, moving beyond scheduled preventative maintenance. This shift allows consultants to provide highly precise, data-backed recommendations for maintenance scopes and modernization timing, thereby maximizing Return on Investment (ROI) for building owners. Furthermore, AI tools are used to simulate complex traffic flow scenarios in new building designs, offering optimal equipment configurations far more efficiently than traditional modeling methods, influencing the consulting strategy from the conceptual stage.

However, AI introduction also creates new consulting niches. Consultants are now required to audit the performance of AI algorithms themselves—ensuring the data models are unbiased, accurate, and comply with safety standards, especially when these models dictate operational parameters or critical repair schedules. This involves expertise in data governance, cybersecurity specific to IoT-enabled vertical transport systems, and the legal implications of relying on machine-generated fault reports. AI shifts the consultant's role from inspecting physical assets to auditing digital performance, requiring a higher level of technical sophistication in data science and integration architecture. The consulting mandate expands from mechanical engineering to full digital systems integrity assurance, presenting both challenges and lucrative specialized opportunities.

- AI Impact on Consulting Services:

- Enables Predictive Maintenance Consulting: Shifting from calendar-based maintenance reviews to real-time, condition-based recommendations.

- Digital Twin Development: Consultants utilize AI to create virtual models of elevator systems for simulation, testing modernization scenarios, and failure analysis.

- Automated Compliance Audits: AI-powered tools rapidly scan maintenance logs and operational data against regulatory checklists, streamlining the auditing process.

- Enhanced Traffic Optimization: ML algorithms refine elevator grouping, dispatching logic, and waiting time predictions in real-time, requiring consultant validation.

- Data Governance and Cybersecurity Consulting: New service lines emerge focused on securing sensor data and ensuring the integrity of ML models controlling critical systems.

- Risk Assessment Accuracy: Improved failure prediction leads to more accurate actuarial and liability risk assessments provided by consulting firms.

DRO & Impact Forces Of Elevator Consulting Service Market

The Elevator Consulting Service Market is primarily driven by stringent global safety regulations and the widespread aging of existing building stock, necessitating mandatory upgrades and thorough inspections to meet compliance standards. Restraints include the high initial costs associated with hiring independent consultants, particularly for smaller property owners, and the high fragmentation of the market, which can lead to inconsistencies in service quality and pricing across different geographical regions. Opportunities are abundant in the areas of smart city development, where integrated vertical transport systems require expert planning, and the increasing global focus on energy efficiency, demanding specialized consulting on regenerative drives and smart standby modes. These forces collectively exert significant pressure on the market, pushing consultants toward specialization and technological adoption to maintain relevance and provide measurable value.

Key drivers center on regulatory enforcement and the growing complexity of elevator technology. Laws such as the Americans with Disabilities Act (ADA) or equivalent accessibility standards globally necessitate continuous consultation on design and modernization to ensure full compliance. Furthermore, as major OEM manufacturers integrate proprietary IoT and cloud services into their equipment, building owners require independent, unbiased consultants to decode complex service contracts, audit system performance, and ensure vendor lock-in is minimized. The increasing average age of elevators in North America and Europe—many exceeding 20 or 30 years—mandates substantial modernization programs that are typically managed and supervised by third-party consultants to ensure competitive bidding and quality control.

Conversely, significant market restraints include economic volatility affecting new construction (the primary source for new installation consulting) and the challenge of proving the tangible ROI of consulting fees, especially in preventative maintenance reviews. Impact forces such as rapid technological change (e.g., ropeless elevators, magnet levitation systems) constantly require consultants to update their technical knowledge, creating high barriers to entry for new firms. Opportunities lie specifically in emerging markets where construction booms are occurring without established regulatory frameworks, allowing consultants to define best practices and secure long-term, high-value contracts related to safety and specification development. The overall market trajectory is strongly dictated by regulatory cycles and the pace of smart building adoption.

Segmentation Analysis

The Elevator Consulting Service Market is broadly segmented based on the type of service provided, the application (or end-use sector), and the type of building asset. Service segmentation reflects the lifecycle stage of the vertical transport system, ranging from conceptual design to ongoing operational management and eventual replacement. Application segmentation is crucial as the needs of commercial high-rise buildings (focusing on high traffic and speed) differ vastly from residential complexes (focusing on reliability and lower operating costs) or industrial facilities (focusing on heavy-duty and specialized transport). Understanding these segments is key for consulting firms to tailor their expertise and marketing efforts effectively.

- Service Type:

- New Installation Consulting (Design review, traffic analysis, specification writing, bid management)

- Modernization Consulting (Scope definition, contractor oversight, performance upgrades)

- Maintenance and Performance Audits (Contract review, quality control inspection, preventative maintenance analysis)

- Safety and Compliance Audits (Code adherence verification, liability assessment, expert witness services)

- Application/End-Use:

- Commercial (Office buildings, hotels, retail centers)

- Residential (Multi-family housing, luxury apartments)

- Institutional (Hospitals, universities, government buildings)

- Industrial (Manufacturing plants, warehouses, specialized facilities)

- Asset Type:

- Elevators (Passenger, Freight, Hydraulic, Traction)

- Escalators and Moving Walks

Value Chain Analysis For Elevator Consulting Service Market

The value chain for the Elevator Consulting Service Market begins upstream with technology providers, including sensor manufacturers, software developers creating BIM tools and traffic analysis programs, and regulatory bodies setting compliance standards. These upstream elements provide the necessary inputs—data, technical specifications, and legal frameworks—that consultants utilize to formulate their advice. Consultants sit centrally within the chain, synthesizing complex technical data and regulatory requirements into actionable strategies for their clients (the downstream segment).

The downstream part of the chain involves the direct clients, typically property owners, facility management companies, and general contractors who consume the consulting services. Following consulting advice, clients engage with OEMs (Original Equipment Manufacturers) like Otis or Schindler, or independent service providers (ISPs) to execute the installation, maintenance, or modernization projects. Consultants often act as the quality control intermediary, supervising the execution phase to ensure the installed product meets the specified criteria and contractual obligations. The distribution channel for consulting services is predominantly direct, relying on personal reputation, long-term relationships, and referral networks, although digital platforms are beginning to facilitate indirect connections for specialized, small-scale projects.

The efficiency of the value chain is highly dependent on the effective collaboration between the consultant and the maintenance providers. Direct distribution through specialized consulting firms allows for high customization and expertise matching specific client needs (e.g., expertise in high-speed, dual-deck systems). Indirect channels, such as architectural firms or engineering procurement and construction (EPC) companies subcontracting consulting needs, are less common but exist for integrated project delivery. Optimization of this chain is increasingly focused on digital collaboration tools, such as shared BIM models and centralized data platforms, to streamline communication between design, consulting, and installation phases, ultimately delivering superior asset performance and minimized lifetime costs for the end-user.

Elevator Consulting Service Market Potential Customers

The primary customers for elevator consulting services are entities responsible for the ownership, management, or development of properties containing vertical transportation systems. This includes large commercial real estate investment trusts (REITs), major corporate facility management departments managing global portfolios, and local government bodies overseeing public infrastructure like subways and airports. These clients seek specialized knowledge to manage significant capital expenditure related to modernization or replacement, reduce operational risks, and ensure uninterrupted service critical to their business operations. The complexity of modern elevator systems, coupled with high operational costs and significant safety liabilities, makes independent consulting an indispensable service for these large-scale buyers.

Secondary potential customers include mid-sized residential property management companies and institutional clients such as hospital networks and university campuses. Hospitals, for instance, rely heavily on constant elevator uptime for patient movement and emergency services, making detailed maintenance audits and redundancy planning essential consulting services. Similarly, developers of new mixed-use properties frequently employ consultants early in the design process to conduct thorough traffic studies and write performance specifications that future-proof the building against evolving technological standards. The key purchasing criteria for these buyers are demonstrated expertise, independence from OEMs, and a proven track record in achieving compliance and cost reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lerch Bates, VDA, Syska Hennessy Group, Edgett Williams Consulting Group, The HIDI Group, GAGE-Babcock & Associates, KJA Consultants, Vertical Transportation Excellence, ATIS, Elevator Advisors, Precise Consultants, Delta Elevator Consultants, Performance Elevator Consulting, Liftinstituut, TÜV SÜD. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elevator Consulting Service Market Key Technology Landscape

The technological landscape impacting elevator consulting is primarily centered around the integration of Internet of Things (IoT) sensors, Building Information Modeling (BIM), and sophisticated data analytics platforms. IoT devices installed on elevator components generate massive datasets concerning performance metrics, vibration levels, and component wear, which consultants leverage to perform non-intrusive, data-driven audits. This shift from physical, scheduled inspections to continuous remote monitoring is revolutionizing the maintenance consulting segment, allowing firms to identify potential issues before they cause service interruptions and validate the service quality provided by maintenance contractors through objective, verifiable data.

BIM technology is increasingly essential, particularly in the new installation and modernization consulting segments. Consultants use BIM models to integrate vertical transportation systems seamlessly into the overall building design, optimizing shaft space, ensuring structural compliance, and accurately simulating pedestrian traffic flow patterns under various conditions. This digital collaboration framework minimizes design conflicts and allows stakeholders to visualize and validate the operational parameters before construction begins. The use of BIM ensures that consulting advice is highly integrated, reducing project delays and change orders, and ensuring the final system meets performance specifications precisely.

Furthermore, specialized consulting firms are adopting digital twin technology, which creates a living, virtual replica of a physical elevator system. This allows consultants to run "what-if" scenarios, test software updates, and simulate the effects of modernization components (such as new controllers or drives) without impacting the live system. Coupled with augmented reality (AR) tools for on-site inspections, these technologies enable consultants to deliver more accurate assessments, faster diagnostics, and superior oversight of complex modernization projects, thereby increasing the value proposition of the consulting service dramatically in the competitive market environment. These technological advancements necessitate that consulting professionals possess specialized software and data analysis skills.

Regional Highlights

- North America: This region holds a substantial market share, primarily due to the large installed base of aging commercial and institutional infrastructure, particularly in major metropolitan areas like New York, Chicago, and Toronto. Strict enforcement of ASME A17.1 safety codes drives mandatory modernization consulting, ensuring compliance with evolving technical standards and accessibility requirements (ADA). The U.S. market is characterized by mature professional consulting standards and high client awareness regarding liability risks associated with outdated equipment, sustaining strong demand for maintenance contract reviews and litigation support services.

- Europe: Europe is another dominant region, characterized by high regulatory uniformity (EN 81 standards) and a strong emphasis on energy efficiency and sustainable building operations. Mandatory inspection schemes and directives promoting energy recovery systems fuel demand for specialized consulting services focused on green modernization projects. Germany, France, and the UK are key contributors, possessing high density of older buildings requiring significant capital expenditure management and technical oversight to ensure regulatory adherence and extended operational life.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, driven by unprecedented urbanization, massive investment in residential and commercial high-rise construction, and the emergence of smart cities (e.g., Singapore, Shenzhen). While the consulting market is less mature than in the West, rapid growth in new installations creates immense demand for traffic analysis, specification writing, and quality control during construction. Regulatory environments are quickly maturing, particularly in China and India, suggesting a robust future for safety and compliance consulting as the vast installed base ages.

- Latin America (LATAM): Growth in LATAM is driven by localized infrastructure projects and residential developments in major economies like Brazil and Mexico. The market is often highly sensitive to economic fluctuations, but modernization requirements in older business districts provide a stable baseline demand. Consultants often focus on optimizing maintenance budgets and implementing robust safety protocols tailored to local construction practices and regulatory variations across different countries.

- Middle East and Africa (MEA): MEA exhibits strong demand linked to iconic mega-projects and luxury high-rise construction in the Gulf Cooperation Council (GCC) countries. Consultants here specialize in advising on high-speed, specialized vertical transport systems and ensuring adherence to international standards (often leveraging Euro or U.S. codes). Safety and quality assurance consulting during the construction phase of these large, complex projects represent the major market driver, although maintenance consulting for the expanding building stock is rapidly increasing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elevator Consulting Service Market.- Lerch Bates

- VDA

- Syska Hennessy Group

- Edgett Williams Consulting Group

- KJA Consultants

- The HIDI Group

- GAGE-Babcock & Associates

- Vertical Transportation Excellence (VTX)

- ATIS

- Elevator Advisors

- Precise Consultants

- Delta Elevator Consultants

- Performance Elevator Consulting

- Liftinstituut

- TÜV SÜD

- Soderberg Elevator Consulting

- Gresham Smith

- ELEVATOR WORLD

- Pomeroy Specifications

- ELEVATE Consult

Frequently Asked Questions

Analyze common user questions about the Elevator Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of an independent elevator consultant?

The primary role of an independent elevator consultant is to provide unbiased, expert technical advice to building owners and managers regarding the design, safety compliance, modernization, and maintenance contracting of vertical transportation systems, ensuring optimal performance and risk mitigation.

How does AI technology influence elevator maintenance consulting?

AI influences maintenance consulting by enabling predictive analytics based on IoT sensor data, allowing consultants to shift recommendations from scheduled preventative maintenance to accurate, condition-based maintenance, thereby reducing unexpected downtime and optimizing maintenance spending significantly.

Which geographical region is expected to show the fastest growth in the market?

The Asia Pacific (APAC) region is expected to show the fastest market growth, driven by extensive urbanization, massive investments in commercial and residential high-rise construction projects, and the maturation of regulatory standards across key economies like China and India.

What are the key drivers for modernization consulting services?

The key drivers for modernization consulting are the aging elevator stock globally (often exceeding 25 years), increasingly stringent safety and accessibility regulations (e.g., ASME A17.1 updates), and the demand for energy efficiency upgrades utilizing modern control systems and regenerative drives.

What is Value Engineering in the context of elevator consulting?

Value Engineering in elevator consulting involves reviewing design specifications and proposed technologies to ensure the most efficient, cost-effective system meets performance requirements without compromising safety or compliance, often resulting in optimized equipment selection and reduced long-term operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager