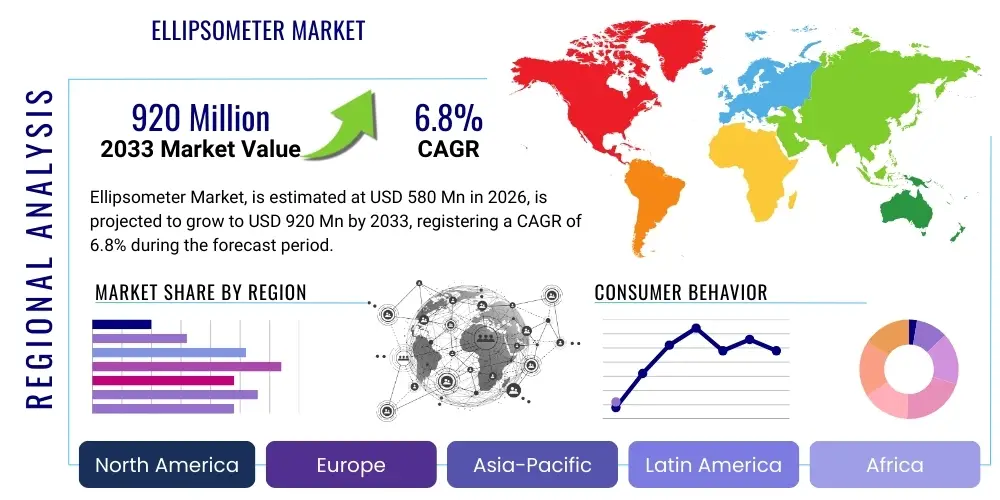

Ellipsometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436896 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ellipsometer Market Size

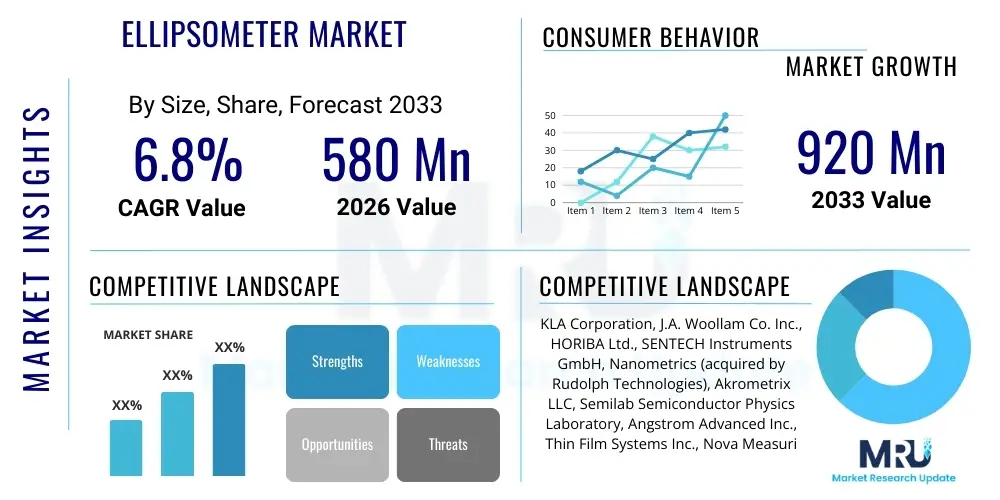

The Ellipsometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $920 Million by the end of the forecast period in 2033.

Ellipsometer Market introduction

Ellipsometers are advanced optical instruments utilized for characterizing thin films, surfaces, and interfaces by measuring the change in polarization state of light upon reflection or transmission. These instruments are crucial across various high-technology sectors, providing non-destructive, highly accurate measurements of critical properties such as film thickness, refractive index, extinction coefficient, and surface roughness. The fundamental operational principle hinges on analyzing the complex reflectance ratio, which encapsulates the material’s optical response to polarized incident light. This ratio is typically expressed in terms of amplitude ratio (Psi, $\Psi$) and phase difference (Delta, $\Delta$), offering precise quantification of layer properties based on fundamental optical physics and rigorous modeling. The market growth is inherently linked to the escalating global demand for miniaturization, performance enhancement, and precision in semiconductor manufacturing, microelectronics, and advanced material research where accurate, sub-nanometer level thin film metrology is absolutely indispensable for guaranteeing device functionality and lifetime reliability. The shift toward complex multilayer stacks and novel materials in electronics necessitates highly sophisticated metrology tools capable of addressing these intricate structures. The major applications of ellipsometry span multiple critical industries, including the fabrication of integrated circuits (ICs) utilizing deep submicron nodes, the high-volume production of advanced flat panel displays (FPDs) such as flexible and rigid OLEDs, research into photovoltaic energy generation, and the development of specialized coatings for optics and medical devices. In the semiconductor industry, ellipsometers are essential for monitoring ultra-thin gate oxide layers, precise measurement of photoresist thickness after lithography, and the characterization of complex high-k/metal gate stacks, thereby ensuring stringent quality control, process uniformity, and high yield rates. Furthermore, the burgeoning field of nanotechnology, particularly the synthesis and analysis of 2D materials like graphene, MoS2, and topological insulators, heavily relies on the sensitivity and non-contact nature of advanced spectroscopic ellipsometry to determine layer count and optical constants with unprecedented accuracy. The key benefits driving the accelerated adoption of modern ellipsometers include their superior measurement precision, which often reaches the angstrom level, their non-contact and non-destructive nature, and their vital suitability for real-time, in-situ monitoring within complex processing environments such as ultra-high vacuum or high-temperature deposition chambers (e.g., ALD, CVD). Driving factors for market expansion include the substantial, continuous investment surge in advanced semiconductor fabs globally, particularly concentrated in Asian manufacturing hubs. Furthermore, the increasing structural complexity of materials used in next-generation devices (e.g., EUV photoresists, complex compound semiconductors) and the rapid proliferation of demanding display technologies, coupled with the need for better quality control in highly automated facilities, underpin the persistent market need for sophisticated metrology solutions that only advanced ellipsometry can adequately satisfy.Ellipsometer Market Executive Summary

The Ellipsometer Market is currently characterized by intense competitive dynamics driven by the need for increased speed, superior spatial resolution, and broader spectral range capabilities to address the challenges posed by continuous technology scaling. Major business trends show leading manufacturers focusing intensely on developing fully automated, high-throughput inline tools that are compatible with the latest 300mm and experimental 450mm silicon wafer production infrastructures. This focus is motivated by the necessity for metrology solutions that offer maximum integration stability and minimal measurement delay within high-volume manufacturing environments. Strategic maneuvers include aggressive mergers and acquisitions, such as KLA Corporation's expansion through the acquisition of key metrology firms, designed to consolidate technological expertise and provide comprehensive, multi-technique metrology platforms that cover both critical dimension (CD) and thin film measurements simultaneously. The convergence of hardware development with sophisticated software, incorporating machine learning for better model fitting and faster data analysis, is a defining trend across the industry. Regionally, the Asia Pacific (APAC) region continues to dominate the global demand landscape, acting as the primary revenue generator for the Ellipsometer Market. This dominance stems directly from the exponential capacity expansion and technological leadership held by semiconductor manufacturers and display panel fabricators situated in countries such as South Korea, Taiwan, and mainland China. These regional players are consistently investing billions of dollars annually into new fabrication plants (Fabs) and technology upgrades, creating a sustained, high-volume requirement for advanced process control equipment, including spectroscopic ellipsometers utilized for critical layer monitoring. While North America and Europe maintain critical importance in pioneering research, especially in advanced R&D phases and novel material studies, the sheer scale of production purchasing power resides predominantly within the dynamic APAC manufacturing cluster, necessitating localized support and service centers from global equipment vendors to ensure smooth operations. Segmentation analysis reveals a definitive market preference for Spectroscopic Ellipsometry (SE), which constitutes the largest revenue segment. This preference is attributed to SE's indispensable ability to analyze complex multi-layer structures, provide depth profiling, and accurately determine the optical dispersion properties of advanced materials across an extended spectral bandwidth. Simultaneously, the market for Imaging Ellipsometry is experiencing robust double-digit growth, driven by its suitability for large-area inspection necessary in display manufacturing and its increasing adoption in label-free biological sensing applications, where spatial variations in film deposition or molecular binding events must be visualized and quantified across a surface area. This trend underscores a market shift towards tools that combine high spectral precision with necessary spatial context for defect analysis and process uniformity mapping across expansive substrates, maximizing diagnostic capability.AI Impact Analysis on Ellipsometer Market

Common user inquiries regarding AI’s influence on the Ellipsometer Market center around optimizing the notoriously complex data processing steps, improving measurement precision in highly variable production environments, and drastically accelerating the time required for developing and refining complex material models. Users frequently express concerns about the limitations of classical model fitting methods when confronted with new, non-ideal, or complex anisotropic films, asking how machine learning (ML) algorithms can be effectively deployed to handle the massive, high-dimensional datasets generated by advanced high-speed spectroscopic ellipsometry systems. Key themes synthesized from user expectations focus on leveraging AI to automate the challenging inverse modeling process—determining film properties from raw spectral data—reduce reliance on highly specialized metrology engineers, provide predictive insights into process deviations before they result in yield loss, and foster the development of smarter, self-optimizing measurement protocols capable of adapting to real-time changes in the manufacturing environment. The successful integration of Artificial Intelligence and Machine Learning (AI/ML) techniques is fundamentally poised to revolutionize the operational efficiency, analytical accuracy, and overall throughput of modern ellipsometry systems. Traditional data analysis and model generation often involve time-consuming iterative processes and heavy dependence on pre-existing physical models and library data. In stark contrast, AI can efficiently and rapidly process immense volumes of spectral data, autonomously identify subtle correlational patterns that might be missed by human analysis, and significantly optimize the complex parameter selection required for accurate model fitting, especially for complex material stacks where traditional regression algorithms frequently encounter convergence issues or non-uniqueness problems. This enhanced analytical capability is critically important in contemporary advanced semiconductor manufacturing, where process control windows are becoming extraordinarily tight, and the precise characterization of novel materials utilized in advanced logic and memory architectures is indispensable. Furthermore, AI integration extends its influence beyond data interpretation to include advanced system diagnostics, enabling sophisticated anomaly detection and crucial predictive maintenance capabilities for the expensive metrology equipment itself. By continuously monitoring and analyzing sensor data related to light source stability, stage movement precision, and measurement repeatability, sophisticated AI models can predict incipient system drifts, potential component degradation, or impending alignment failures, allowing for proactive intervention and significantly ensuring maximum equipment uptime and consistent measurement reliability in critical, high-volume production lines. Beyond hardware maintenance, AI profoundly assists both R&D and manufacturing engineers by automating the challenging, labor-intensive process of material library creation and optimizing the initial structural and optical model selection, thereby substantially accelerating the pace of research and development for novel thin films and nanomaterials, and consequentially maximizing the overall utility and efficiency of high-end research and production ellipsometers.- AI-driven optimization of model fitting algorithms, employing neural networks to rapidly solve complex inverse problems and dramatically reducing analysis time for intricate multi-layer stacks used in 3D NAND and advanced logic circuits.

- Development of comprehensive predictive maintenance systems utilizing ML to monitor optical component health and stability, drastically improving system uptime for high-throughput production ellipsometers integrated into semiconductor fabs.

- Automated quality control and real-time process monitoring facilitated by deep learning, enabling instantaneous anomaly detection in large-area substrates used in advanced flat panel display manufacturing.

- Machine learning integration for advanced classification and kinetic analysis of bio-sensing data, particularly for characterizing protein adsorption and complex chemical reaction kinetics on functionalized surfaces.

- Deployment of self-calibrating and adaptive measurement protocols based on AI assessment of environmental factors (temperature, vibration) and real-time variations in sample characteristics.

- Improved capability for characterizing complex, non-ideal optical systems and robust filtering of stochastic noise and light scattering effects through advanced convolutional neural network (CNN) architectures.

- AI-powered virtual metrology tools that correlate ellipsometry data with upstream process parameters to predict film properties without direct measurement, increasing overall factory throughput.

DRO & Impact Forces Of Ellipsometer Market

The fundamental trajectory of the Ellipsometer Market is decisively propelled by several substantial drivers centered on unprecedented technological leaps in microelectronics, optoelectronics, and next-generation display manufacturing. The overarching industrial mandate for persistent device miniaturization in the semiconductor sector—evidenced by the transition to sub-5nm technology nodes, the implementation of complex FinFET and Gate-All-Around (GAA) architectures, and the widespread adoption of novel high-mobility and high-k dielectric materials—mandates metrology tools that offer unparalleled measurement precision, spatial resolution, and material differentiation capabilities. This intense demand is further robustly amplified by the rapid global expansion of sophisticated, high-end display technologies, particularly flexible and foldable OLEDs and emerging MicroLED displays, which require ultra-accurate, non-destructive measurement of critical thin film encapsulation layers, optical barrier films, and transparent conductive oxides (TCOs) for functional optimization and long-term durability. These drivers ensure a baseline sustained demand for continuous technological advancement in metrology solutions, securing ellipsometry’s role as an essential process control tool. However, the sustained growth trajectory of the market is inevitably moderated by several significant restraints, notably the exceedingly high initial capital investment required to procure advanced spectroscopic and specialized imaging ellipsometers, which often costs hundreds of thousands of dollars, placing a substantial strain on organizational budgets. This financial barrier poses a significant challenge for smaller research institutions, startup manufacturing facilities, and academic laboratories operating under tighter budgetary constraints. Furthermore, a crucial operational restraint involves the inherent complexity associated with accurately performing data interpretation, generating sophisticated physical models (e.g., dispersion models), and ensuring robust analysis for multilayer stacks. This complexity requires access to highly specialized optical and material science expertise, creating a significant labor and knowledge bottleneck that limits the potential widespread adoption and efficient operation of these high-end tools across less specialized industrial environments. The requisite need for highly controlled environments (vibration isolation, temperature control) to maintain measurement integrity adds further to the total operational expenditure. Despite these prevailing challenges, the market is rich with substantial commercial opportunities that promise to unlock new revenue streams and drive product diversification and technological innovation. A primary opportunity lies in the burgeoning field of biomedical and chemical sensing, powered by functionalized thin films and engineered surfaces. The high sensitivity of ellipsometry to surface adsorption events makes it an ideal technique for characterizing biosensors, analyzing molecular interaction kinetics (e.g., drug binding), and monitoring protein adsorption in a label-free manner. Additionally, a lucrative opportunity exists in the development of highly integrated, ruggedized in-situ monitoring solutions. Integrating compact ellipsometers directly into extreme environment processing tools, such as high-vacuum Atomic Layer Deposition (ALD) or Plasma Enhanced Chemical Vapor Deposition (PECVD) chambers, allows for critical, real-time process control, which drastically minimizes waste and shortens development cycles, creating a strong pull for suppliers who can successfully miniaturize and enhance the ruggedness of their systems while maintaining high precision. These opportunities, coupled with ongoing technological scaling, reinforce the strong positive impact forces driving the market forward.Segmentation Analysis

The Ellipsometer market is comprehensively segmented based on Type, Application, and End-Use Industry, allowing for granular analysis of demand patterns, technological priorities, and commercial value across different high-tech sectors. Spectroscopic ellipsometers currently hold the largest market share and revenue stream due to their superior capability in analyzing complex multi-layer film stacks and providing detailed, broadband spectral information necessary for sophisticated material characterization and inverse modeling. However, specialized systems such as imaging ellipsometers and phase-modulated tools are capturing niche high-growth segments. The semiconductor industry remains the dominant consuming segment globally, although robust growth rates are increasingly observed in biomedical diagnostics, advanced solar energy manufacturing, and specialized optical coating applications, indicating market diversification beyond core microelectronics.- By Type

- Spectroscopic Ellipsometer (SE): Dominant segment offering wide spectral range analysis for complex films.

- Single Wavelength Ellipsometer (SWE): Used primarily for simple, rapid measurements of known single layers.

- Imaging Ellipsometer: Key for large area mapping, defect inspection, and bio-sensing applications.

- Generalized Ellipsometer (GE): Essential for characterizing anisotropic and structured materials.

- Phase-Modulated Ellipsometer: Known for high measurement speed and sensitivity.

- Rotating Analyzer Ellipsometer (RAE): Classical, robust system design.

- Rotating Polarizer Ellipsometer (RPE): Variation of rotating element architecture.

- By Application

- Film Thickness Measurement: Core application, critical for semiconductor gate oxides and display encapsulation layers.

- Optical Constant Measurement (Refractive Index and Extinction Coefficient): Necessary for material identification and quality control.

- Material Composition Analysis: Determining stoichiometry and density of complex alloys and compounds.

- Surface Roughness Determination: Assessing interface quality and scattering characteristics.

- Etch Depth Measurement: Monitoring trench and line dimensions after etching processes.

- Anisotropy and Strain Analysis: Characterizing stressed films and textured materials using GE.

- By End-Use Industry

- Semiconductor and Microelectronics

- Logic Devices: Controlling high-k dielectrics and critical gate dimensions.

- Memory Devices (NAND, DRAM): Monitoring high-aspect ratio structures and complex layer stacks.

- Advanced Packaging: Characterization of interposer and redistribution layers (RDL).

- Flat Panel Displays (FPD)

- OLED: Encapsulation layer, TCO thickness, and organic film analysis.

- LCD: Liquid crystal alignment layer and barrier film analysis.

- MicroLED: Characterization of transfer layers and epitaxy.

- Solar Cells and Photovoltaics: Optimization of anti-reflection coatings and absorber layers (e.g., CIGS, Perovskite).

- Research and Academia: Materials science, physics, chemistry, and nanotechnology studies.

- Optical Coatings and Filters: Quality control of anti-reflective, high-reflection, and bandpass filters.

- Biomedical and Life Sciences

- Biosensors: Monitoring molecular binding and surface functionalization.

- Drug Delivery Systems: Analyzing surface properties of drug carriers and films.

- Automotive and Aerospace: Characterization of protective and thermal barrier coatings.

- Semiconductor and Microelectronics

Value Chain Analysis For Ellipsometer Market

The value chain for the Ellipsometer Market commences critically with the upstream suppliers of specialized, high-precision optoelectronic and mechanical components. This includes manufacturers providing high-quality, stable light sources (such as Xenon arc lamps, tungsten-halogen lamps, and deep UV lasers), ultra-sensitive detectors (like CCD arrays, photodiodes, and PMTs), and highly accurate polarization optics (including robust polarizers and compensators that operate across wide spectral ranges). The performance stability and optical purity of these core components are non-negotiable, as they directly dictate the fundamental accuracy and noise floor of the resultant ellipsometry measurements. Key players maintain stringent quality control over these components, often engaging in proprietary design or customization to ensure spectral stability and low mechanical drift, which are essential for angstrom-level precision. The central segment of the value chain is occupied by the Original Equipment Manufacturers (OEMs) and system integrators who undertake the complex task of designing the integrated optical bench, developing sophisticated control software, implementing advanced automation features, and packaging the final metrology tool. This stage represents the primary value addition, emphasizing intensive investment in research and development to create proprietary modeling software capable of solving highly complex inverse optical problems, managing extensive material databases, and integrating AI/ML routines for enhanced data fitting speed and accuracy. The system integration process also focuses heavily on providing mechanical ruggedness necessary for installation in high-vibration manufacturing environments, such as active semiconductor fabs. Downstream activities involve the crucial steps of distribution, installation, calibration, and long-term customer support. Distribution channels are largely bifurcated: major semiconductor and display clients typically receive products through direct sales teams, necessitating highly customized solutions, application engineering support, and integration into existing factory automation systems (FAS). Indirect channels, utilizing specialized scientific equipment distributors, are more common for sales directed towards academic research institutions, smaller industrial labs, and emerging markets. Due to the high criticality of these tools in production, superior after-sales service, regular recalibration, timely software upgrades, and preventative maintenance contracts form a substantial and necessary component of the overall market value.Ellipsometer Market Potential Customers

The primary and most high-value customer segment for advanced ellipsometers consists of entities profoundly invested in microfabrication and leading-edge material science, predominantly commanded by the global semiconductor industry. Integrated Device Manufacturers (IDMs) like Intel and Samsung, alongside pure-play foundries such as TSMC, constitute the largest organizational purchasers. These facilities mandate high-throughput, fully automated spectroscopic ellipsometry systems for critical dimension (CD) monitoring, complex film thickness measurement, and sophisticated process control across hundreds of distinct steps in advanced wafer fabrication, including shallow trench isolation (STI) and chemical mechanical polishing (CMP) monitoring. Their purchasing criteria heavily emphasize speed, reliability, long-term stability, and seamless integration capability within a demanding 24/7 manufacturing infrastructure, driving continuous demand for the latest inline metrology solutions. Beyond the semiconductor core, major flat panel display manufacturers, particularly those specializing in advanced display types like flexible OLEDs, foldable screens, and MicroLED arrays, form another critical customer segment. These buyers require specialized large-area metrology solutions to accurately characterize the uniformity and integrity of deposited thin film transistor (TFT) stacks, organic emissive layers, and crucial moisture barrier films that dictate display longevity and performance. Additionally, the global network of academic, governmental, and corporate research institutions maintains a sustained, steady demand for highly flexible, research-grade spectroscopic ellipsometers and generalized ellipsometers, which are essential tools for exploring novel materials, characterizing surface modification kinetics, and optimizing early-stage deposition parameters for future technologies. Emerging customer segments are increasingly diversifying the market landscape, notably including organizations within the biotechnology, pharmaceutical, and clean energy sectors. Biotechnology companies utilize imaging and specialized ellipsometers for characterizing biosensors, studying protein adsorption phenomena (label-free sensing), and monitoring the interaction of complex biological molecules with various engineered surfaces. Concurrently, solar cell manufacturers, spanning both traditional crystalline silicon and advanced thin-film PV technologies, are significantly increasing their adoption of ellipsometry for optimizing the optical performance of anti-reflection coatings and precisely characterizing the thickness and composition of complex semiconductor absorber layers (e.g., CdTe, CIGS, Perovskites), underscoring the technique's versatility across multiple high-tech applications.| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $920 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, J.A. Woollam Co. Inc., HORIBA Ltd., SENTECH Instruments GmbH, Nanometrics (acquired by Rudolph Technologies), Akrometrix LLC, Semilab Semiconductor Physics Laboratory, Angstrom Advanced Inc., Thin Film Systems Inc., Nova Measuring Instruments, Advanced Micro-Fabrication Equipment Inc. (AMEC), LayTec AG, Filmetrics (a KLA company), Ocean Optics Inc., Holmarc Opto-Mechatronics, Beijing Zhongke Chuangxing Technology Co. Ltd., Rk-TEC Co. Ltd., Cofra Inc., Optosurf GmbH, P.A. Hilger. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ellipsometer Market Key Technology Landscape

The technological landscape of the Ellipsometer Market is profoundly shaped by the relentless push for better performance across three primary vectors: speed, spectral range, and spatial resolution. Spectroscopic Ellipsometry (SE) remains the core technology, consistently evolving to provide more comprehensive spectral information—spanning often from 190 nm (Deep UV) up to 3300 nm (Mid-Infrared)—necessary for characterizing complex optical properties and precisely identifying the material composition of complex, graded, and multi-interface structures. Current innovations in SE focus intensely on maximizing measurement speed to align with high-volume manufacturing requirements, achieved through the implementation of faster rotating component designs, advanced multichannel detector arrays (e.g., CCD and CMOS linear arrays), and highly optimized parallel processing of spectral data, ultimately facilitating true real-time, high-rate process monitoring directly on the production floor, crucial for maximizing throughput in high-volume fabs. A crucial and rapidly advancing technological segment is the refinement and expansion of Generalized Ellipsometry (GE), a necessity for accurately characterizing anisotropic (non-isotropic) materials, such as textured silicon, crystalline substrates, complex photonic structures, and the advanced materials utilized in leading-edge memory devices. GE measures all four elements of the Jones matrix or, more commonly, the full Mueller matrix, providing a far more exhaustive analysis of sample optical properties, including birefringence, dichroism, and cross-polarization effects that simple SE cannot resolve. This capability is paramount as device complexity increasingly incorporates structured materials that exhibit significant anisotropy, demanding rigorous characterization for performance prediction and quality control in critical manufacturing stages. Furthermore, the technology trend towards high-resolution Imaging Ellipsometry (IE) is gaining significant commercial traction, moving beyond the limitation of traditional spot measurements. IE systems utilize high-magnification optics and specialized cameras to capture two-dimensional maps of film properties across a large substrate area, which is indispensable for identifying microscopic defects, characterizing localized non-uniformity in thin film deposition, and performing critical quality control in the fabrication of large-area substrates like flat panel displays and micro-sensors. Simultaneously, the focus on developing more robust and user-friendly software for simulation, material library management, and automated model generation, often integrating AI/ML modules, is key to lowering the operational barrier and maximizing the utility of these sophisticated metrology instruments across diverse industrial and research environments, providing faster time-to-result.Regional Highlights

The global distribution of the ellipsometer market exhibits a clear concentration of demand corresponding directly to global semiconductor and display manufacturing capacity, establishing distinct regional dominance patterns governed by local industrial concentration and technological priorities.- Asia Pacific (APAC): APAC secures its position as the largest and most dynamically growing market globally, a status driven by monumental government initiatives and substantial private sector investments aimed at expanding and upgrading semiconductor fabrication facilities in key nations. Taiwan (led by giants like TSMC and UMC) remains the uncontested leader in foundry services, generating massive continuous demand for the most advanced, fully automated in-line spectroscopic metrology tools required to control cutting-edge sub-5nm and 3nm process nodes. South Korea (Samsung, SK Hynix) similarly drives high-volume purchases for both advanced logic and memory (DRAM, 3D NAND) manufacturing, where precise characterization of high-aspect ratio structures is essential. Simultaneously, China’s ambitious plan to achieve technological self-sufficiency in chip production translates into continuous, major capital expenditure on sophisticated metrology equipment, including specialized ellipsometers for high-aspect ratio structures and EUV resist characterization. The region also hosts the majority of global flat panel display production, particularly next-generation flexible OLED technology, which heavily boosts demand for specialized large-area imaging ellipsometers used for encapsulant layer thickness and uniformity mapping. The aggressive production scaling and continuous technological node migration in APAC ensure its market leadership throughout the forecast period.

- North America: This region maintains its critical status as a global hub for high-value research and development, specialized scientific instrumentation manufacturing, and the early adoption of highly novel metrology techniques, often before commercialization scales globally. Demand here is fundamentally driven by leading US-based semiconductor equipment manufacturers, pioneering material science university research programs, and the robust aerospace and defense sectors, focusing heavily on bespoke, high-precision applications such as advanced photonics research, quantum computing device characterization, and the development of exotic 2D and composite materials. North American market players prioritize software intelligence, focusing intensely on integrating advanced data analytics and sophisticated AI algorithms into metrology workflows to optimize R&D efficiency and ensure compliance with stringent quality standards. Furthermore, the recent resurgence of US domestic chip manufacturing through governmental initiatives is expected to significantly increase demand for localized, high-end metrology tool procurement in the industrial segment of the forecast period, shifting some investment from R&D to production capacity.

- Europe: The European market is characterized by a high concentration of world-class academic research centers and strong, technologically advanced niche manufacturing sectors, particularly in specialized automotive electronics, industrial sensors, and high-end photonics components. Key economies such as Germany, the Netherlands, and France are the main drivers of demand for advanced ellipsometers, often emphasizing highly specialized in-situ monitoring solutions that are seamlessly integrated into advanced deposition reactors (like ALD/CVD) used for industrial processing of functional coatings. The European market exhibits a particular demand for tools capable of high-temperature measurements and those suitable for characterizing materials utilized in emerging energy storage technologies, high-efficiency solar cells, and advanced aerospace components, valuing robustness, adaptability, and high measurement accuracy in challenging industrial settings. Collaboration between industry and academic partners drives custom system development for highly specialized applications.

- Latin America: Representing a comparatively smaller share of the global ellipsometer market, the demand within Latin America is primarily concentrated within major federal and state-funded academic research laboratories, key universities focused on material science and physics, and nascent industrial initiatives in sustainable energy sectors, particularly solar energy manufacturing and specialized coatings. Market growth remains modest but stable, largely propelled by increasing government investments aimed at modernizing scientific infrastructure and expanding advanced material science education and research capabilities, although the lack of major, scaled semiconductor fabrication facilities limits the high-volume industrial purchasing common in Asia. Demand is typically fulfilled through indirect distribution channels focused on standard research instruments rather than specialized production lines.

- Middle East and Africa (MEA): MEA currently holds the smallest market share, with the demand profile heavily focused on specialized applications in the energy sector, including detailed corrosion studies in petroleum and chemical processing environments, and concentrated within university research facilities located in rapidly developing technological hubs such as the UAE, Israel (which hosts some global R&D centers), and Saudi Arabia. While infrastructure development is accelerating, large-scale, high-volume industrial demand for advanced semiconductor metrology equipment is severely limited as localized microelectronics manufacturing capabilities remain in very early stages of development, focusing primarily on maintenance and scientific research rather than production scale control. Future growth potential lies in diversification into regional solar and water treatment technologies requiring advanced thin film coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ellipsometer Market.- KLA Corporation

- J.A. Woollam Co. Inc.

- HORIBA Ltd.

- SENTECH Instruments GmbH

- Nanometrics (now part of Rudolph Technologies/KLA)

- Akrometrix LLC

- Semilab Semiconductor Physics Laboratory

- Angstrom Advanced Inc.

- Thin Film Systems Inc.

- Nova Measuring Instruments

- Advanced Micro-Fabrication Equipment Inc. (AMEC)

- LayTec AG

- Filmetrics (a KLA company)

- Ocean Optics Inc.

- Holmarc Opto-Mechatronics

- Beijing Zhongke Chuangxing Technology Co. Ltd.

- Rk-TEC Co. Ltd.

- Cofra Inc.

- Optosurf GmbH

- P.A. Hilger

Frequently Asked Questions

Analyze common user questions about the Ellipsometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an ellipsometer in semiconductor manufacturing?

The primary function is non-destructive, ultra-precise measurement of critical thin film properties, including thickness (down to sub-nanometer resolution), refractive index, and material composition of layers such as gate oxides, photoresists, and high-k dielectrics, ensuring stringent process control and maximizing yield in advanced wafer fabrication, especially for sub-10nm nodes.

How does Spectroscopic Ellipsometry (SE) differ from Single Wavelength Ellipsometry (SWE)?

SWE measures polarization changes at only one wavelength, providing limited information, typically sufficient only for simple, known single-layer films. In contrast, SE measures across a broad spectrum of wavelengths, enabling the detailed characterization and modeling of complex multilayer stacks, graded interfaces, and materials with unknown optical constants, making it essential for high-end R&D and advanced manufacturing process control.

Which geographical region exhibits the highest growth potential for ellipsometers?

The Asia Pacific (APAC) region, driven overwhelmingly by massive investments and capacity expansion in semiconductor and flat panel display manufacturing hubs (specifically China, Taiwan, and South Korea), presents the highest sustained growth potential for high-volume, automated ellipsometry systems due to continuous demand for process control in advanced fabs.

What are the main technical challenges restraining market adoption?

Major technical restraints include the complexity of optical modeling required to accurately interpret data from novel or anisotropic materials, the high initial acquisition cost of advanced, high-throughput systems, and the necessity for highly trained personnel to operate and maintain the complex metrology equipment effectively, which creates a specialized labor demand.

Can ellipsometers be used for real-time, in-situ monitoring?

Yes, modern ellipsometers are increasingly designed for in-situ monitoring, allowing real-time characterization of film growth and etching processes directly within deposition (e.g., ALD, CVD) or vacuum chambers. This capability provides immediate feedback for process correction and optimization, crucial for highly sensitive manufacturing steps and increasing overall process yield.

What role does Generalized Ellipsometry (GE) play in advanced materials analysis?

Generalized Ellipsometry (GE) is vital for characterizing materials that exhibit anisotropy, meaning their optical properties depend on the direction of light propagation, such as crystalline films, patterned structures, or strained layers. GE measures the full Mueller matrix, providing comprehensive data necessary for accurate analysis of complex structures that cannot be solved using standard isotropic models.

How does the adoption of AI enhance the performance of ellipsometry systems?

AI significantly enhances performance by accelerating the complex inverse modeling process, allowing for faster and more accurate determination of film parameters from spectral data. Furthermore, AI improves system reliability through predictive maintenance and enables automated anomaly detection, reducing reliance on manual data validation and increasing system uptime in critical manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ellipsometer Market Size Report By Type (Laser Ellipsometer, Spectroscopic Ellipsometer), By Application (Semiconductors and Electronics, Academia and Labs, Photovoltaics and Solar Cells, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ellipsometer Market Statistics 2025 Analysis By Application (Semiconductors and Electronics, Academia and Labs, Photovoltaics and Solar Cells), By Type (Spectroscopic Ellipsometer, Laser Ellipsometer), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager