EMEA Binoculars Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437546 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

EMEA Binoculars Market Size

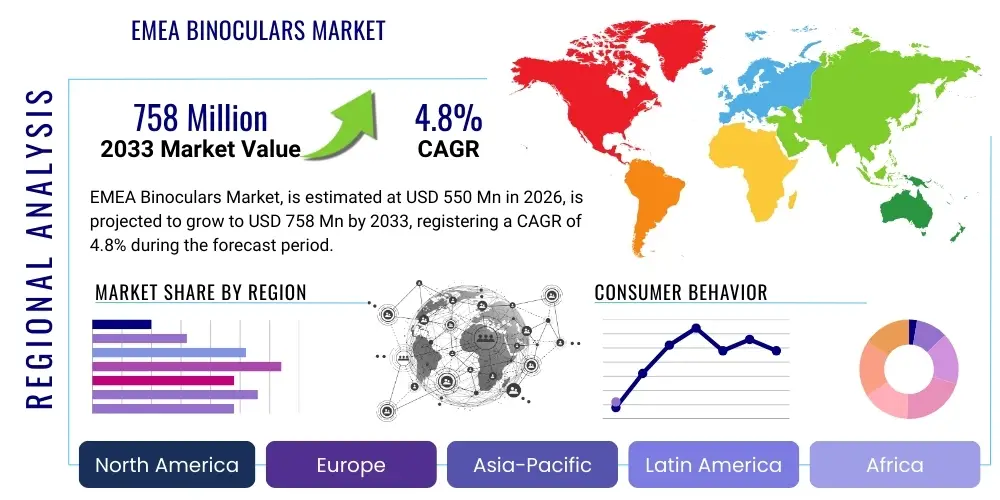

The EMEA Binoculars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 758 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the rising disposable incomes in key European economies, coupled with expanding interest in outdoor recreational activities such as bird watching, hunting, and amateur astronomy. Furthermore, the defense and maritime sectors within the EMEA region consistently drive demand for high-specification, durable optical equipment, maintaining a stable baseline for market expansion.

EMEA Binoculars Market introduction

The EMEA Binoculars Market encompasses the sale and distribution of optical instruments designed for magnifying distant objects across Europe, the Middle East, and Africa. These devices, primarily categorized by prism type (Porro and Roof) and magnification power, serve a vast array of professional and recreational applications. The core product provides enhanced visual observation capabilities, relying on complex lens systems and coatings to ensure optimal light transmission, image brightness, and field of view. Recent advancements in lens technology, anti-reflection coatings, and chassis materials have led to lighter, more ergonomic, and technologically integrated binoculars, meeting the stringent requirements of professional users and the growing expectations of serious hobbyists.

Major applications driving the market include wildlife observation and conservation efforts, particularly in densely populated European nations where eco-tourism is burgeoning. Hunting remains a steadfast application, especially in Central and Eastern Europe, requiring rugged, high-magnification models with low-light performance capabilities. From a professional standpoint, military and defense organizations across the Middle East and specific NATO members in Europe are crucial consumers, purchasing specialized, often stabilized or night vision-enabled, binoculars for surveillance, targeting, and reconnaissance. The benefits of modern binoculars—including portability, superior optical clarity (especially in extra-low dispersion glass models), and robust waterproofing—make them indispensable tools across these diverse sectors.

Driving factors for sustained market growth in EMEA include the increasing accessibility of premium optics due to competitive manufacturing practices, coupled with significant marketing efforts targeting specialized niche communities. The rise of affluent middle classes in the GCC (Gulf Cooperation Council) countries, fostering demand for luxury goods and high-end outdoor gear, also contributes substantially. Regulatory support for conservation areas and the subsequent infrastructure development for eco-tourism further solidify the market foundation. Additionally, the replacement cycle for military-grade equipment, often mandated by geopolitical security requirements, provides continuous high-value revenue streams for key market participants.

- Product Description: Handheld optical instruments used for viewing distant objects, utilizing prisms (Roof or Porro) to correct image orientation and reduce overall size.

- Major Applications: Hunting and shooting sports, bird watching and wildlife monitoring, marine navigation and surveillance, astronomical observation, and tactical military use.

- Benefits: Enhanced magnification and visual detail, improved light gathering capacity (especially for low-light conditions), portability, and rugged durability (waterproof/fog-proof construction).

- Driving Factors: Expansion of outdoor recreational activities, technological advancements in lens and coating materials, increasing disposable income, and sustained defense spending.

EMEA Binoculars Market Executive Summary

The EMEA Binoculars Market is characterized by a high degree of technological sophistication, particularly within the premium European segment, led by brands specializing in exceptional optical performance and durability. Market maturity varies significantly across the region; while Western Europe and Scandinavia exhibit strong demand for high-end specialized binoculars (driven by eco-tourism and professional hunting), the Middle East focuses heavily on military and high-power surveillance equipment. African markets show nascent growth, driven primarily by tourism operators and conservation projects requiring durable, entry-to-mid-level optics. The overall business trend leans towards digitalization, with hybrid models incorporating features like rangefinders, GPS capabilities, and thermal imaging becoming increasingly popular and commanding higher average selling prices.

Regional trends indicate Europe remains the dominant revenue generator, benefitting from a dense population of enthusiasts and the presence of historically significant manufacturing hubs (Germany, Austria, Switzerland). Central and Eastern Europe are experiencing accelerated growth fueled by increasing consumer spending and a strong tradition of hunting. The Middle East segment, while smaller in volume, holds significant value due to large-scale procurement contracts from defense ministries, often demanding bespoke, highly ruggedized equipment tailored for harsh desert environments. Africa's market dynamic is complex, influenced by conservation funding and geopolitical stability, primarily focusing on robust utility binoculars for fieldwork and guided safaris.

Segment trends highlight the continuous dominance of Roof Prism binoculars due to their compact size and ergonomic form factor, though Porro Prisms maintain strong traction in specific low-budget and astronomy segments where light path efficiency is paramount. Application segmentation shows steady growth in the bird watching and general nature viewing categories, propelled by global trends in wellness and outdoor leisure. The premium price segment is growing faster than volume sales, reflecting consumer willingness to invest in superior optical quality (using Fluorite glass or proprietary coatings) for specialized applications. Distribution channels are shifting slightly, with e-commerce platforms gaining market share, providing consumers with detailed reviews and comparative data, although specialty optical stores remain crucial for high-value sales requiring expert consultation.

AI Impact Analysis on EMEA Binoculars Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the EMEA Binoculars Market predominantly center on automated object identification, real-time data integration, and enhanced surveillance capabilities. Users are keen to understand how AI algorithms can process visual data captured through binoculars to instantly identify bird species, calculate ballistic solutions for hunting, or flag unauthorized activity in perimeter security applications. A significant concern revolves around the computational power, battery life, and cost associated with integrating sophisticated AI processors into a traditionally passive optical device. Furthermore, users question the ethical and regulatory framework, particularly in Europe, concerning AI-enabled facial recognition or automated surveillance carried out using such devices, seeking clarity on data privacy compliance.

The core theme summarizing user expectations is the shift from passive viewing to active, augmented observation. Consumers anticipate binoculars evolving into intelligent visual assistants, minimizing human error and reaction time. For instance, in maritime applications, users expect AI to quickly filter out irrelevant visual noise and highlight potential collision risks or specific vessel types based on learned patterns. In the realm of wildlife, AI integration offers the potential for automated species logging and tracking, dramatically improving the efficiency of field research and conservation projects. Manufacturers are responding by developing integrated smart optics that offload processing to connected smartphones or incorporate low-power, edge-computing chips directly into the binoculars chassis, specifically targeting professional and high-end enthusiast segments.

While full-scale AI integration remains nascent, its impact is already being felt in advanced features. Predictive tracking systems and digitally stabilized imagery benefit significantly from computational enhancement, offering superior user experience compared to purely mechanical stabilization. The competitive advantage in the EMEA market will increasingly shift toward companies that can successfully bridge high-quality traditional optics with reliable, field-tested AI functionalities, particularly those enhancing low-visibility performance or providing instant data feedback in critical environments such as search and rescue or tactical operations. This technological convergence is set to redefine the premium price point and stimulate substantial research and development investment within European optical giants.

- AI impacts in concise points

- Enhanced image recognition and automated object classification (e.g., bird species identification, vehicle type recognition).

- Integration of real-time data overlays (ballistics, GPS coordinates, compass headings) via augmented reality interfaces.

- Improved low-light performance and image stabilization through computational photography and noise reduction algorithms.

- Development of smart optics for military and surveillance applications enabling automated threat detection and tracking.

- Optimization of focus and depth-of-field using machine learning models for quicker acquisition of targets.

- Customized user profiles and preference settings based on environmental conditions and historical viewing data.

DRO & Impact Forces Of EMEA Binoculars Market

The EMEA Binoculars Market is influenced by a dynamic interplay of factors encompassing strong consumer interest in specialized outdoor activities, regulatory constraints on usage (particularly hunting in specific European nations), and ongoing technological breakthroughs enhancing product performance. Drivers, such as the increasing popularity of high-value eco-tourism and the expansion of the luxury hunting gear market, provide sustained demand, particularly for high-definition and laser rangefinding integrated models. Simultaneously, continuous modernization initiatives within NATO member defense forces ensure a steady procurement pipeline for tactical binoculars, often featuring advanced night vision or thermal capabilities. These factors, combined with brand loyalty towards established European optical manufacturers, strongly support market valuation and innovation.

However, the market faces several notable restraints. High manufacturing costs, particularly associated with producing premium Extra-low Dispersion (ED) or Fluorite glass optics, translate into elevated retail prices, potentially limiting mass adoption. Furthermore, regulatory hurdles, such as restrictions on importing certain high-powered optics or night vision equipment across national borders, complicate distribution within the EMEA geography. Economic volatility in certain African and Middle Eastern nations, coupled with currency fluctuations against the Euro, also impacts the purchasing power of commercial buyers and defense departments. Another restraint is the growing competition from sophisticated digital cameras and high-zoom smartphone optics, which, while not direct substitutes, offer compelling alternatives for casual viewing and photography.

Opportunities for market growth are vast, predominantly focusing on the integration of smart features and connectivity. Developing lightweight, affordable thermal binoculars for search and rescue operations or wildlife management presents a significant opportunity. Penetration into emerging markets in Africa through partnerships with conservation organizations or local government agencies represents an untapped growth vector. Furthermore, addressing the specialized needs of the marine sector, specifically developing highly stabilized and fog-proof binoculars designed for commercial shipping and deep-sea fishing, can unlock new revenue streams. The rising consumer awareness regarding environmental protection also creates opportunities for marketing optics aligned with sustainability and ethical viewing practices, appealing to the growing demographic of environmentally conscious buyers.

Segmentation Analysis

The EMEA Binoculars Market is fundamentally segmented based on critical functional and application attributes, defining distinct user groups and competitive landscapes. Segmentation by Type (Roof Prism vs. Porro Prism) illustrates a clear preference for the compact, streamlined form of Roof Prism binoculars in general outdoor and tactical applications, although Porro Prisms remain valuable for specific requirements due to their superior depth perception and simpler construction. Application segmentation provides the most detailed view of consumption patterns, ranging from the high volume, recreational segment (Bird Watching) to the high-value, specialized segment (Military and Defense). Analyzing these segments allows market participants to tailor their optical specifications, price points, and distribution strategies precisely to the needs of the target end-users, ensuring optimal market penetration and inventory management across the diverse EMEA landscape.

- By Type: Roof Prism, Porro Prism

- By Application: Hunting, Bird Watching and Wildlife Viewing, Astronomy, Marine, Military and Surveillance, General Observation

- By Magnification Range: Low Power (Under 8x), Mid Power (8x to 12x), High Power (Above 12x)

- By Distribution Channel: Offline Retail (Specialty Stores, Sporting Goods Stores), Online Retail (E-commerce Platforms, Brand Websites)

- By Price Range: Premium (Above €1,500), Mid-Range (€300 - €1,500), Budget (Below €300)

- By Technology: Conventional, Image Stabilized, Digital/Smart Optics (Integrated Rangefinders, Thermal Imaging)

Value Chain Analysis For EMEA Binoculars Market

The value chain for the EMEA Binoculars Market begins with upstream activities dominated by the procurement and processing of highly specialized raw materials, primarily optical glass (such as Schott glass, often incorporating ED or Fluorite elements), proprietary lens coatings (multi-layer dielectric coatings), and lightweight, durable housing materials (magnesium alloy or advanced polymers). Key European players maintain tight control over this initial stage, often utilizing in-house grinding and polishing facilities to ensure precision and quality, a critical differentiator in the premium segment. High investment in R&D is required upstream to develop new prism designs and anti-reflection technology, providing a significant barrier to entry for new competitors aiming at the luxury segment.

Midstream activities involve the assembly, quality control, and testing of the final product. Manufacturing is highly automated but still requires skilled labor for precise alignment and sealing (crucial for waterproofing and fog-proofing). Post-manufacturing, distribution channels are diverse. Direct distribution involves established manufacturers selling through their proprietary brand stores or specialized B2B channels, particularly for military contracts, ensuring quality assurance and specialized servicing. Indirect distribution relies heavily on regional wholesalers, major sporting goods retail chains (e.g., Decathlon in Europe), and increasingly, large international e-commerce platforms like Amazon and specialized optics websites, which cater to the majority of recreational consumers.

Downstream activities focus on end-user engagement, including after-sales service, warranty provisions, and consumer education. Specialty optical stores play a crucial role in the downstream process, particularly for high-end buyers, offering hands-on testing and expert advice regarding magnification, aperture, and field of view suitability for specific applications like astronomy or dangerous game hunting. The rise of online channels has increased price transparency, putting pressure on retailers but simultaneously broadening market access. Effective supply chain management, particularly managing inventory levels for seasonally driven segments (like hunting optics in autumn), is vital to maintaining competitiveness across the EMEA region.

EMEA Binoculars Market Potential Customers

The EMEA Binoculars Market serves a broad spectrum of end-users, ranging from highly affluent individuals seeking luxury recreational gear to governmental and professional entities requiring mission-critical observation tools. A significant segment comprises dedicated outdoor enthusiasts, including bird watchers, hikers, and amateur astronomers who prioritize lightweight design and superior optical clarity for prolonged viewing sessions. These users often look for mid-to-high range binoculars with good eye relief and wide fields of view. Furthermore, professional hunters and shooting sports participants constitute a high-value customer base, demanding specialized features such as integrated laser rangefinders, ballistic calculators, and extreme ruggedness to withstand harsh field conditions typical across various European and African hunting terrains.

On the institutional and commercial front, the defense and security sectors represent a cornerstone of the professional market. Military procurement agencies in countries like France, Germany, the UK, and GCC nations regularly upgrade their inventory, focusing on tactical binoculars with night vision augmentation, thermal capabilities, and MIL-SPEC durability standards. Similarly, marine professionals, including commercial sailors, coast guards, and search and rescue teams, are essential buyers, requiring stabilized, fully waterproof, and buoyant models optimized for the challenging conditions of the North Sea and the Mediterranean. These professional segments typically prioritize reliability, longevity, and governmental regulatory compliance over retail price sensitivity.

Emerging potential customer groups include infrastructure maintenance and inspection teams (e.g., power line, bridge, and telecommunications inspectors) who utilize high-powered optics for remote visual checks, reducing the need for direct physical access. Moreover, the increasing focus on ecotourism and conservation efforts in African nations has driven demand from wildlife lodges and national park rangers, often supported by international funding. Successful market entry strategies for manufacturers involve targeted advertising that highlights durability guarantees and specific application-based performance metrics, ensuring the product resonates deeply with the distinct needs and purchasing criteria of each highly specialized customer segment within EMEA.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 758 Million |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Leica Camera AG, Swarovski Optik, Nikon Corporation, Canon Inc., Bushnell Corporation, Steiner Optik GmbH, Fujifilm Holdings Corporation, Celestron LLC, Pentax (Ricoh Imaging), Olympus Corporation, Opticron, Vortex Optics, Kowa Company Ltd., Meopta, Minox GmbH, Kite Optics, Delta Optical, Bresser GmbH, Hawke Optics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EMEA Binoculars Market Key Technology Landscape

The EMEA Binoculars Market is undergoing a rapid technological evolution, moving beyond traditional purely analog optics toward sophisticated digital integration. A primary technological focus remains centered on enhancing optical performance through advanced glass formulations. The widespread adoption of Extra-low Dispersion (ED) glass and specialized Fluorite crystal optics has become a necessity in the mid-to-premium segments, significantly reducing chromatic aberration and providing superior color fidelity and image sharpness, critical factors for demanding applications like bird watching and high-precision hunting. Furthermore, manufacturers continue to innovate in lens coatings, utilizing proprietary multi-layer dielectric coatings to maximize light transmission (often exceeding 95%) and improve low-light performance, a key competitive battleground in Northern European markets where daylight hours vary drastically.

Another crucial technological development is the implementation of stabilization mechanisms. Image-stabilized (IS) binoculars, particularly those utilizing gyroscopic or electronic stabilization systems developed by companies like Canon, have found increasing traction in marine and aerial observation, effectively canceling out hand shake and environmental vibrations, which is vital for high-magnification viewing. Alongside stabilization, integration is defining the future of high-end binoculars. Smart optics now frequently feature embedded laser rangefinders (LRF), providing instant distance measurements crucial for hunting safety and precision. Some tactical models are incorporating GPS and electronic compasses, allowing for geo-tagging of observations, which appeals directly to professional surveyors and defense users across the Middle East.

Looking ahead, the market is poised to see wider commercialization of thermal and fusion technology. While traditionally confined to military use, miniaturized and affordable thermal imaging sensors are now being integrated into hunting and surveillance binoculars, offering crucial visibility in absolute darkness or through fog and dense foliage. This fusion technology, combining a visible light image with a thermal overlay, provides unparalleled situational awareness. Furthermore, the incorporation of Wi-Fi and Bluetooth connectivity allows binoculars to interface seamlessly with mobile devices, facilitating the transfer of images, video recording, and real-time data analysis, driving demand among tech-savvy professional users in metropolitan and remote environments alike throughout the EMEA region.

Regional Highlights

The EMEA market is highly heterogeneous, with distinct consumption patterns and technological demands in its three core sub-regions.

- Western Europe: Characterized by high market maturity, strong brand loyalty towards established domestic and Central European manufacturers (Zeiss, Leica, Swarovski), and robust demand for premium, specialized binoculars. The market is driven primarily by sophisticated recreational activities (bird watching, yachting) and significant disposable income. Countries like Germany, the UK, and France are the largest consumers of ED glass and image-stabilized models. Regulatory frameworks are strict regarding the import/export of night vision and thermal gear, but general optical sales are robust.

- Central and Eastern Europe (CEE): This region exhibits rapid growth, driven by an expanding middle class and strong cultural traditions, especially in hunting and shooting sports (Poland, Czech Republic, Hungary). Demand focuses on mid-to-high range durability and reliability. Price sensitivity is higher than in Western Europe, leading to greater adoption of capable mid-tier brands. CEE is a vital manufacturing base for several regional optical companies, often offering good value performance.

- Middle East (ME): The market here is dominated by government and defense spending. Large-volume, high-value contracts for surveillance, border security, and reconnaissance equipment featuring thermal imaging and heavy-duty ruggedization are common. Key buyers include Saudi Arabia, UAE, and Israel. The civilian market is smaller but shows growth in luxury outdoor activities and professional maritime surveillance, often demanding highly specified, expensive equipment.

- Africa (A): Characterized by lower overall market penetration but significant potential linked to conservation, ecotourism, and infrastructure projects. The bulk of demand comes from wildlife parks, safari operators, and governmental agencies focused on resource management. Products must be exceptionally durable, resistant to dust and extreme heat, and often represent utility-grade models rather than high-tech specialized optics. Funding often originates from international aid or tourism revenue.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EMEA Binoculars Market.- Carl Zeiss AG

- Leica Camera AG

- Swarovski Optik

- Nikon Corporation

- Canon Inc.

- Bushnell Corporation

- Steiner Optik GmbH

- Fujifilm Holdings Corporation

- Celestron LLC

- Pentax (Ricoh Imaging)

- Olympus Corporation

- Opticron

- Vortex Optics

- Kowa Company Ltd.

- Meopta

- Minox GmbH

- Kite Optics

- Delta Optical

- Bresser GmbH

- Hawke Optics

Frequently Asked Questions

Analyze common user questions about the EMEA Binoculars market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the premium binoculars segment in Europe?

The premium segment growth is primarily driven by affluent consumer demand for high-quality recreational gear, specifically in specialized hobbies like precision hunting and advanced bird watching. Key drivers include technological advancements such as Fluorite glass, superior anti-reflection coatings, and integrated laser rangefinders, justifying higher price points for superior optical performance and durable craftsmanship, often provided by heritage European brands.

How does the demand for binoculars in the Middle East differ from that in Western Europe?

Demand in the Middle East is heavily concentrated in the military and defense sectors, focusing on high-specification tactical binoculars featuring night vision, thermal imaging, and extreme ruggedization suitable for harsh environmental conditions. In contrast, Western European demand is more diversified, emphasizing recreational use, optical clarity, lightweight design, and image stabilization for general outdoor and leisure activities.

What impact is e-commerce having on the distribution landscape of the EMEA Binoculars Market?

E-commerce is increasingly important, offering greater price transparency, extensive product reviews, and direct-to-consumer access, particularly for mid-range and budget binoculars. While specialty retail stores remain crucial for high-end product consultation and tactile experience, online platforms are expanding market reach and accelerating the replacement cycle for standard-use optics across the region, necessitating a robust omnichannel strategy for market players.

Which technological innovation is expected to most significantly influence market expansion in the next five years?

The most significant influence is expected to come from the integration of smart technologies, specifically AI-enabled features like automated object recognition and real-time data overlays. This fusion of digital intelligence with high-performance optics, particularly in rangefinding and thermal observation models, is set to create new sub-segments for tactical and specialized professional applications, enhancing user efficiency and situational awareness across EMEA.

What role do environmental regulations play in shaping the African Binoculars Market?

Environmental regulations and conservation initiatives play a pivotal role in the African market. Demand is often dictated by the needs of national parks, anti-poaching units, and ecotourism operators, requiring durable, reliable, and sometimes low-cost binoculars. International conservation funding frequently influences procurement, creating a steady, though often value-conscious, market for specialized fieldwork optics resistant to extreme weather and dust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager