EMI Absorber Sheets & Tiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431500 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

EMI Absorber Sheets & Tiles Market Size

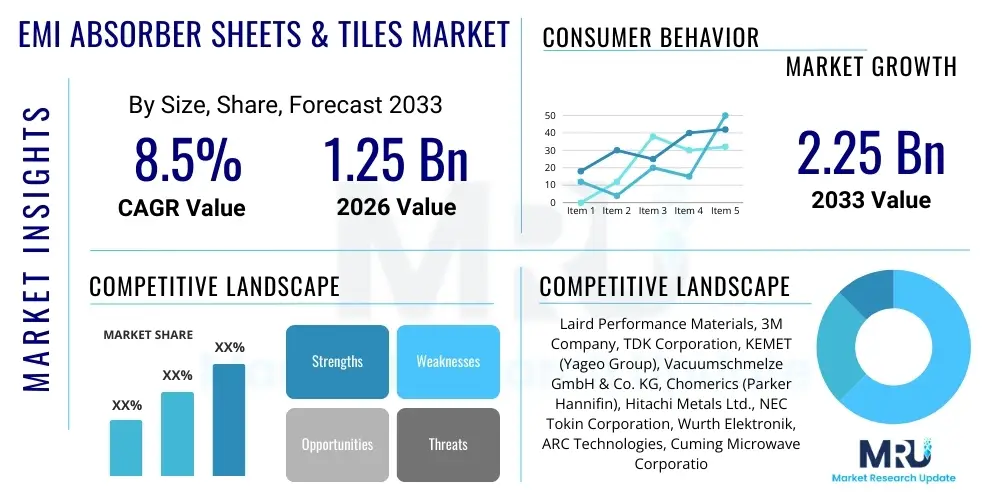

The EMI Absorber Sheets & Tiles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.25 Billion by the end of the forecast period in 2033.

EMI Absorber Sheets & Tiles Market introduction

The EMI Absorber Sheets & Tiles Market encompasses advanced material solutions designed to mitigate electromagnetic interference (EMI) and radio frequency interference (RFI) within electronic devices and systems. These materials, often composite structures incorporating ferrite, carbon-based elements, or specialized polymers, function by converting incident electromagnetic energy into heat, thereby reducing reflections and transmissions that could compromise system performance or violate regulatory standards. The primary goal of deploying EMI absorbers is to ensure electromagnetic compatibility (EMC) in increasingly dense electronic environments, where high operating frequencies and compact designs exacerbate cross-talk and noise issues.

EMI absorber products range from flexible sheets suitable for internal component shielding in smartphones and tablets to rigid tiles used in anechoic chambers, radar cross-section reduction (stealth technology), and industrial test facilities. Key applications span high-frequency telecommunications equipment, advanced driver-assistance systems (ADAS) in automotive, medical imaging devices, and high-speed data servers. The increasing complexity and speed of modern electronics, particularly with the rollout of 5G networks, the proliferation of Internet of Things (IoT) devices, and the rapid expansion of electric vehicles (EVs), necessitate robust and effective EMI suppression techniques, driving the demand for specialized absorbing materials.

The core benefits of these materials include improved signal integrity, enhanced system reliability, compliance with international EMC standards (such as FCC, CE, and CISPR), and miniaturization potential by allowing closer placement of components without performance degradation. Driving factors accelerating market growth include the transition to higher frequency bands (mmWave), the requirement for lighter and thinner shielding solutions in portable electronics, and critical applications in defense and aerospace sectors where radar stealth and sensor protection are paramount. Continuous innovation in material science, focusing on thinner, more flexible, and highly permeable composites, remains crucial for market evolution.

EMI Absorber Sheets & Tiles Market Executive Summary

The global EMI Absorber Sheets & Tiles Market is characterized by strong growth fueled primarily by the exponential expansion of high-speed data transmission technologies and the stringent electromagnetic compatibility (EMC) requirements across diverse industries. Business trends indicate a significant shift toward developing thinner, lighter, and flexible absorber solutions, utilizing advanced nanotechnology and composite materials (like carbon nanotubes and specialized ferrites) to meet the demanding form factors of modern consumer electronics and sophisticated aerospace equipment. Strategic mergers and acquisitions focused on materials science patents and specialized manufacturing techniques are prevalent, as key players seek to optimize supply chain resilience and enhance product performance for high-frequency applications (e.g., 28 GHz and above).

Regionally, the Asia Pacific (APAC) dominates the market, largely driven by its established position as the global manufacturing hub for consumer electronics, telecommunications infrastructure, and high-volume automotive production (particularly electric vehicles). North America and Europe demonstrate robust demand, propelled by significant investments in defense (stealth technology), advanced communication systems (5G/6G research), and highly regulated sectors such as medical devices and industrial automation. The intense competition mandates continuous research and development, particularly concerning cost-effective, high-attenuation materials that can operate reliably across extreme temperature and humidity ranges prevalent in automotive and aerospace applications.

Segment trends highlight the dominance of the polymer-based absorber segment due to its excellent flexibility, ease of processing, and applicability in compact devices, although the ferrite-based segment remains critical for high-power, low-frequency suppression requirements. The consumer electronics and telecommunications segments constitute the largest end-user base, consistently demanding high-performance shielding solutions to manage increasing power densities and faster processing speeds. Furthermore, the burgeoning demand for specialized thermal interface materials integrated with EMI shielding capabilities represents a major trend, offering dual functionality required in high-performance computing and complex EV battery management systems.

AI Impact Analysis on EMI Absorber Sheets & Tiles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the EMI Absorber Sheets & Tiles Market frequently revolve around three core themes: optimized material design, predictive performance modeling, and automated manufacturing quality control. Users are keen to understand how AI algorithms can shorten the lengthy R&D cycle currently required for new composite materials, particularly those integrating metamaterials or nanomaterials. Key concerns often address whether AI can accurately predict the absorption performance (attenuation characteristics) of a novel material structure before costly physical prototyping and testing are undertaken, thereby streamlining material selection for specific frequency ranges and application environments (e.g., high temperature, mechanical stress). Expectations center on AI driving the shift towards ultra-precise, application-specific EMI suppression solutions that minimize material waste and improve overall EMC compliance rates during the design phase of complex electronic assemblies.

- AI accelerates the discovery of novel composite materials with optimized electromagnetic properties by analyzing vast datasets of material chemistry and structural parameters.

- Generative AI tools are utilized for designing complex geometric patterns (e.g., in frequency selective surfaces or metamaterials) to achieve highly targeted frequency absorption profiles.

- Machine Learning (ML) algorithms enable predictive modeling of absorber performance under various operational conditions, reducing the need for extensive physical testing and simulation time.

- AI-driven optimization of manufacturing processes, including automated material deposition and curing stages, ensures high quality and uniformity in sheet and tile production.

- Integration of AI in electronic design automation (EDA) tools allows for real-time placement and sizing optimization of EMI absorbers within dense circuit board layouts to minimize noise.

- AI contributes to supply chain efficiency by predicting material demand and optimizing inventory levels for specialized raw materials like high-purity iron powders or magnetic polymers.

DRO & Impact Forces Of EMI Absorber Sheets & Tiles Market

The EMI Absorber Sheets & Tiles Market is significantly influenced by a powerful combination of technology drivers and inherent market restraints, balanced by emerging opportunities that shape its growth trajectory and competitive landscape. The primary drivers include the global deployment of 5G and future 6G communication networks, which operate at higher frequencies and demand advanced shielding; the exponential growth of data centers and cloud infrastructure requiring robust EMC solutions; and the mass production of electric vehicles (EVs) where complex power electronics (inverters, battery management systems) generate intense EMI that must be contained for safety and performance. These drivers exert a strong positive impact force, continually increasing the baseline demand for high-performance, compact absorbing materials.

Restraints, however, temper this growth. The major challenges involve the high cost associated with producing specialized absorbing composites, particularly those incorporating rare earth elements or complex nanostructures, which affects mass-market adoption in cost-sensitive consumer electronics. Furthermore, the integration complexity of absorbers into increasingly miniaturized and flexible electronic assemblies presents a technical hurdle. Regulatory inconsistencies across different global regions regarding EMC standards and testing protocols can also slow market entry for new products. These restraints act as friction points, requiring manufacturers to invest heavily in cost-reduction technologies and standardization efforts.

Opportunities for expansion are abundant, centered on material innovation and application diversification. Significant potential lies in developing flexible, wearable electronics and smart textiles, which require conformal and ultra-thin shielding. The growth of industrial IoT (IIoT) and sophisticated robotics mandates customized electromagnetic solutions for factory floors. Moreover, the critical demand from defense sectors for advanced signature management (stealth technology) materials offers high-value, niche market penetration. The overall impact forces suggest a market moving towards specialization and higher performance density, where material science breakthroughs will be the key differentiator between market leaders.

Segmentation Analysis

The EMI Absorber Sheets & Tiles Market is strategically segmented based on crucial attributes including material type, product form, application technology, and end-user industry, providing a granular view of market dynamics and adoption patterns. Material segmentation, which includes ferrite, polymeric composites, and carbon/metal powder-based materials, defines the fundamental electromagnetic properties and frequency response of the absorber. Ferrite materials are traditionally strong at lower frequencies but are heavy, while polymeric and advanced composites offer flexibility and light weight, critical for high-frequency applications like 5G communication modules and portable devices.

The product form segmentation distinguishes between thin sheets (often used inside electronic housings) and tiles (rigid structures typically deployed in anechoic chambers or specialized large-scale systems). Application segmentation focuses on the frequency range and environment, classifying products for suppression, reflection reduction, and radar cross-section (RCS) reduction. End-user industries are broad, spanning Telecommunications, Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, and Industrial, with each sector presenting unique requirements regarding temperature stability, mechanical stress tolerance, and regulatory compliance.

- By Material Type:

- Ferrite Based Absorbers (e.g., Nickel Zinc Ferrite, Manganese Zinc Ferrite)

- Polymer Based Absorbers (e.g., Silicone, Elastomer, Rubber loaded with particles)

- Carbon Based Absorbers (e.g., Carbon Nanotubes, Carbonyl Iron Powder)

- Hybrid and Composite Materials (e.g., Metamaterials, Nanocomposites)

- By Product Form:

- Sheets (Flexible and Conformal)

- Tiles (Rigid and Anechoic)

- Rolls and Tapes

- By Application:

- EMI/RFI Suppression (Internal Component Level)

- Radar Cross-Section (RCS) Reduction (Stealth Applications)

- Anechoic Chambers and Test Facilities

- By End-User Industry:

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Telecommunications and IT (5G Infrastructure, Data Centers)

- Automotive (EV/Hybrid, ADAS, Infotainment)

- Aerospace and Defense (Avionics, Radar Systems, Stealth Platforms)

- Healthcare (MRI, Diagnostic Equipment)

- Industrial and Automation

Value Chain Analysis For EMI Absorber Sheets & Tiles Market

The value chain for the EMI Absorber Sheets & Tiles Market begins with the highly specialized Upstream Analysis, which focuses on the sourcing and processing of core raw materials. This includes high-purity magnetic materials (ferrite powders like carbonyl iron or nickel-zinc), conductive fillers (carbon black, silver, graphene, or carbon nanotubes), and matrix materials (silicone elastomers, epoxy resins, or specialized polymers). The cost and quality of these primary inputs significantly influence the final product performance and manufacturing profitability. Key upstream players are chemical companies and specialized powder manufacturers who control the intellectual property related to material synthesis and particle size optimization.

The midstream phase involves the core manufacturing process, where material synthesis, compounding, calendaring, and final cutting or molding occur. Manufacturers develop proprietary formulations, mixing specific ratios of absorbing fillers into polymer matrices to achieve targeted permeability and permittivity characteristics. This stage is crucial as it determines the physical form, flexibility, thickness, and electromagnetic attenuation capability of the final sheet or tile. Quality control, especially regarding thickness uniformity and material stability, is paramount during manufacturing.

Downstream Analysis focuses on distribution channels and end-user integration. Products are typically distributed through direct sales channels for large defense, aerospace, and high-volume automotive contracts, or through specialized electronic component distributors and engineering design firms for smaller or customized applications in consumer electronics. Direct and indirect channels both play vital roles; direct channels ensure technical support and customization, while indirect channels provide broad market access and inventory management. The final stage involves integration by OEM designers and system integrators, who select and apply the absorbers based on rigorous EMC testing requirements for the end electronic product.

EMI Absorber Sheets & Tiles Market Potential Customers

Potential customers for EMI Absorber Sheets & Tiles are diverse organizations operating sophisticated electronic systems where electromagnetic interference poses a significant risk to performance, reliability, or safety. The primary buyers fall into large-scale original equipment manufacturers (OEMs) who integrate these materials directly into their products during the assembly phase, such as Apple, Samsung, Huawei, and major automotive manufacturers like Tesla, BMW, and Toyota for their EV and ADAS modules. These buyers demand high volumes, stringent quality controls, and customized absorber formulations specific to the operating frequencies of their internal components.

A second major segment comprises defense contractors and aerospace organizations (e.g., Lockheed Martin, Boeing, Airbus) requiring materials for radar cross-section reduction (stealth applications) in military aircraft, ships, and ground systems, as well as high-reliability shielding for avionics and secure communication systems. Furthermore, network infrastructure providers (telecom companies like Ericsson, Nokia, and Cisco) are critical customers, purchasing significant volumes of high-frequency absorbers for base stations, microcells, and data center servers to maintain signal integrity in dense urban 5G environments.

Finally, specialized test houses and academic research institutions represent a smaller but critical customer base, relying on high-performance rigid absorbing tiles to construct anechoic chambers necessary for regulatory EMC testing and advanced antenna development. The purchasing decision for all these end-users is driven not merely by cost, but primarily by technical specifications, including attenuation effectiveness (measured in dB), operational frequency range, mechanical flexibility, and compliance with industry standards like MIL-STD for military applications or CISPR for commercial devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laird Performance Materials, 3M Company, TDK Corporation, KEMET (Yageo Group), Vacuumschmelze GmbH & Co. KG, Chomerics (Parker Hannifin), Hitachi Metals Ltd., NEC Tokin Corporation, Wurth Elektronik, ARC Technologies, Cuming Microwave Corporation, Morgan Advanced Materials, KITAGAWA INDUSTRIES Co., Ltd., Totoku Toryo Co., Ltd., Maida’s Magnetics Inc., Shenzhen Kingsun Technology Co., Ltd., Leader Tech Inc., A.R.K. Tech., W. L. Gore & Associates, Inc., Panasonic Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EMI Absorber Sheets & Tiles Market Key Technology Landscape

The technology landscape of the EMI Absorber Sheets & Tiles Market is rapidly evolving, driven by material science innovations aimed at improving electromagnetic absorption efficiency across ultra-high frequency (UHF) and super high frequency (SHF) bands while minimizing weight and thickness. One pivotal area of development is the utilization of Nanomaterials, specifically Carbon Nanotubes (CNTs) and Graphene, which offer exceptionally high electrical conductivity and surface area. When integrated into polymer matrices, these structures enable highly efficient impedance matching and dielectric loss mechanisms, leading to thinner absorbers that maintain high attenuation levels, a critical requirement for compact portable electronics and aerospace applications.

Another significant technological advancement involves Metamaterials and Frequency Selective Surfaces (FSS). Metamaterials are engineered composites with structure-defined properties rather than composition-defined properties, allowing for the design of absorbers that exhibit negative permittivity or permeability at specific frequencies. FSS utilizes periodically arranged metallic patterns to selectively reflect or absorb electromagnetic waves. These technologies allow for unprecedented control over the wave propagation, enabling the creation of ultra-thin, highly selective absorbers tailored for specific threat frequencies, which is vital for sophisticated radar and stealth applications.

Furthermore, advancements in manufacturing techniques, particularly Roll-to-Roll (R2R) processing and additive manufacturing (3D printing), are transforming production efficiency and customization capabilities. R2R processing allows for continuous, high-volume, and cost-effective production of flexible absorber sheets, improving scalability. Additive manufacturing opens doors for creating complex, three-dimensional geometric structures within the absorber material, optimizing the internal energy dissipation pathways and facilitating the integration of thermal management features alongside EMI suppression, thereby providing multi-functional material solutions critical for next-generation electronic systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market region due to its dominant role in global electronic manufacturing (China, South Korea, Taiwan). The rapid deployment of 5G infrastructure, massive production bases for electric vehicles, and high demand for consumer electronics drive the consumption of EMI absorber sheets. Countries like China and Japan are also leading in the development and adoption of advanced magnetic materials and specialized nanocomposites for high-frequency applications.

- North America: North America holds a significant market share, characterized by high investment in defense, aerospace, and advanced telecommunications research. Strict government regulations regarding EMC compliance (especially in military and medical sectors) necessitate the use of premium, high-performance absorber tiles and sheets. The region is a leader in R&D for stealth technology (RCS reduction) and complex system integration, driving demand for innovative, customized composite solutions.

- Europe: Europe is a mature market driven primarily by the automotive industry (EV production, complex sensor integration for ADAS) and stringent EU EMC directives. Western European countries, particularly Germany and France, focus on high-reliability industrial automation and medical technology, demanding absorbers that meet exacting specifications for quality and longevity. Innovation focuses heavily on integrating thermal management functionality with electromagnetic shielding in critical power electronic modules.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, primarily focused on the expansion of mobile communication networks and local manufacturing of basic consumer electronics and automotive components. The adoption rate is steadily increasing as local industries adhere more closely to international EMC standards, supported by foreign investments in telecom infrastructure.

- Middle East and Africa (MEA): MEA is currently the smallest market but shows high potential, driven by significant defense spending in the GCC countries and investments in smart city projects and high-speed data centers. Demand centers on high-reliability telecom equipment and specialized absorbers for military communication systems, often requiring high-temperature and harsh-environment material stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EMI Absorber Sheets & Tiles Market.- Laird Performance Materials (DuPont)

- 3M Company

- TDK Corporation

- KEMET (Yageo Group)

- Vacuumschmelze GmbH & Co. KG

- Chomerics (Parker Hannifin)

- Hitachi Metals Ltd.

- NEC Tokin Corporation

- Wurth Elektronik

- ARC Technologies

- Cuming Microwave Corporation

- Morgan Advanced Materials

- KITAGAWA INDUSTRIES Co., Ltd.

- Totoku Toryo Co., Ltd.

- Maida’s Magnetics Inc.

- Shenzhen Kingsun Technology Co., Ltd.

- Leader Tech Inc.

- A.R.K. Tech.

- W. L. Gore & Associates, Inc.

- Panasonic Corporation

Frequently Asked Questions

Analyze common user questions about the EMI Absorber Sheets & Tiles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an EMI absorber sheet?

The primary function is to suppress electromagnetic interference (EMI) by absorbing incident electromagnetic energy and converting it into negligible heat, thus preventing noise, ensuring signal integrity, and maintaining electromagnetic compatibility (EMC) in electronic systems.

How do 5G and 6G networks impact the demand for EMI absorbers?

5G and 6G operate at significantly higher frequencies (mmWave bands), where traditional shielding methods are less effective. This necessitates the use of advanced, ultra-thin, and broadband EMI absorber sheets to manage internal noise and minimize antenna interference within compact base stations and mobile devices.

What material types are leading the innovation in this market?

The market is rapidly innovating through the use of polymeric composites loaded with nanomaterials, such as Carbon Nanotubes (CNTs) and Graphene, and the development of Metamaterials for highly selective, frequency-specific electromagnetic absorption across a wide range of operational conditions.

Which end-user segment drives the highest demand volume?

The Consumer Electronics and Telecommunications segments collectively drive the highest demand volume, largely due to the high-volume manufacturing of smartphones, wearables, laptops, and the dense infrastructure required for global 5G network deployment.

What is the key differentiator between EMI absorber sheets and simple EMI shielding materials?

EMI absorber sheets reduce interference primarily through absorption (dissipating energy internally), minimizing reflections; conversely, simple EMI shielding (like metal casings) works mainly by reflection. Absorbers are crucial in environments where reflections (which can cause secondary interference) must be minimized, such as near antennas or sensitive high-speed components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager