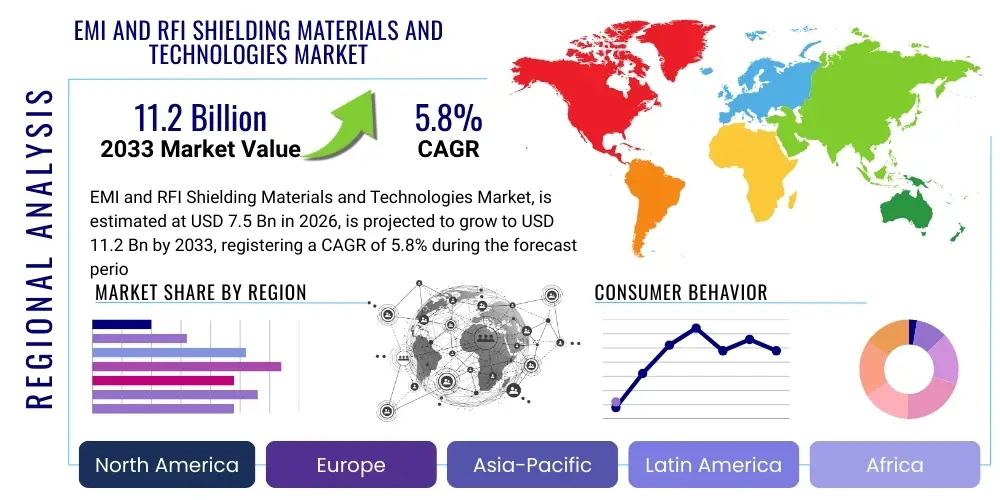

EMI and RFI Shielding Materials and Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435238 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

EMI and RFI Shielding Materials and Technologies Market Size

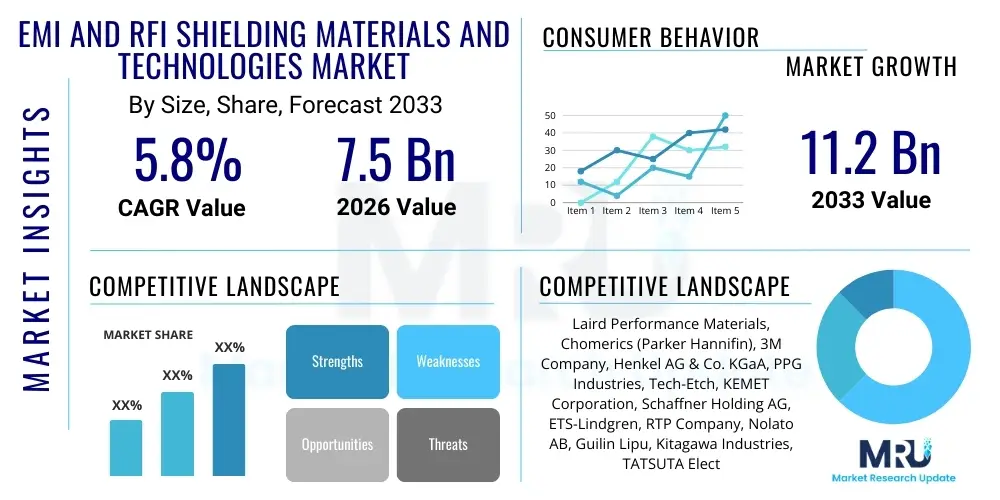

The EMI and RFI Shielding Materials and Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

EMI and RFI Shielding Materials and Technologies Market introduction

The EMI (Electromagnetic Interference) and RFI (Radio Frequency Interference) Shielding Materials and Technologies Market encompasses a diverse range of products designed to suppress electromagnetic noise generated by electronic devices or to protect sensitive components from external radiation. These materials—including conductive coatings, metal gaskets, specialized foils, and elastomers—are critical components in modern electronic systems, ensuring signal integrity, regulatory compliance (such as FCC and CE standards), and the reliable operation of interconnected devices. The core product function is to mitigate crosstalk and interference, which is increasingly prevalent due to the miniaturization of electronics and the proliferation of high-frequency communication technologies like 5G and IoT.

Major applications span vital industry verticals such as consumer electronics (smartphones, tablets), telecommunications infrastructure (base stations, networking equipment), automotive systems (ADAS, electric vehicle control units), aerospace and defense (avionics, military communication gear), and healthcare (MRI machines, patient monitoring systems). The primary benefits derived from effective EMI/RFI shielding include enhanced product reliability, improved data transmission quality, extended operational life of components, and compliance with stringent electromagnetic compatibility (EMC) requirements globally. Without adequate shielding, electronic devices can suffer catastrophic performance degradation, posing significant safety risks in critical applications.

Driving factors propelling this market include the global expansion of 5G networks, which operate at higher frequencies and necessitate advanced shielding solutions; the exponential growth of the Internet of Things (IoT) ecosystem, increasing the density of interconnected devices; and the rapid adoption of electric vehicles (EVs) that utilize high-power electronics requiring robust shielding against internal electromagnetic noise. Furthermore, increasingly stringent governmental regulations concerning EMC across sectors like medical devices and consumer electronics continue to mandate the integration of high-performance shielding solutions, sustaining consistent demand across the forecast period.

EMI and RFI Shielding Materials and Technologies Market Executive Summary

The EMI and RFI Shielding Materials and Technologies Market is characterized by robust technological innovation focusing on thinner, lighter, and more environmentally compliant materials suitable for complex geometrical designs prevalent in miniaturized electronics. Key business trends include the shift towards sophisticated, multi-functional shielding composites, such as highly conductive polymers and carbon-based materials, offering superior shielding effectiveness (SE) across a wider frequency spectrum, particularly above 10 GHz. Consolidation among material suppliers and technology providers is observable, driven by the need to offer integrated solutions to large OEMs in the automotive and telecommunications sectors. Furthermore, sustainability is becoming a critical factor, with increasing scrutiny on the environmental impact of traditional metallic coatings, pushing research into recyclable and non-toxic alternatives.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by the massive concentration of consumer electronics manufacturing and the rapid deployment of 5G infrastructure in countries like China, South Korea, and Japan. North America and Europe, while mature, exhibit strong demand primarily driven by high-reliability applications in aerospace, defense, and advanced automotive electronics, often requiring customized, high-specification shielding solutions. Segment trends indicate that the Material Type segment is led by conductive coatings and paints due to their cost-effectiveness and ease of application over large or irregularly shaped surfaces, while the Technology segment is witnessing explosive growth in conductive elastomers and specialized shielding gaskets, essential for sealing enclosures in harsh environments like EV battery compartments and industrial IoT sensors.

The market faces concurrent pressures from escalating raw material costs, particularly for specialty metals, and the constant demand from OEMs for lower-cost, yet higher-performing, shielding integration techniques. Successful market players are those investing heavily in automated manufacturing processes, developing proprietary composite materials, and offering engineering consultation services to ensure optimal shielding design during the early stages of product development. The transition to higher frequency operation in communication technology is the single most important factor shaping R&D efforts, demanding solutions that effectively address both near-field and far-field interference up to millimeter-wave frequencies.

AI Impact Analysis on EMI and RFI Shielding Materials and Technologies Market

User queries regarding AI's influence on the EMI/RFI shielding market typically revolve around the use of AI in optimizing material composition, the impact of AI-driven electronics (like autonomous vehicles and advanced robotics) on shielding demand, and whether AI can predict and mitigate electromagnetic interference patterns. The core themes coalesce around optimization, design automation, and forecasting complexity. Users are keen to understand if AI can accelerate the development cycle of novel shielding composites, enabling faster time-to-market for complex electronic systems. There is also significant interest in how the massive computational demands and high-density packaging required for AI hardware (such as specialized GPUs and accelerators) fundamentally increase the internal EMI generation, thereby escalating the need for highly efficient and localized shielding solutions.

AI is beginning to revolutionize the material science aspect of the shielding market by enabling sophisticated computational modeling and predictive material discovery. Machine learning algorithms can analyze vast datasets concerning material properties, frequency response, and structural integrity under varying environmental conditions, drastically reducing the traditional trial-and-error approach to developing new conductive composites or metamaterials. This accelerates the identification of optimal material compositions—such as carbon nanotube structures or optimized particle loading in conductive polymers—that achieve superior shielding effectiveness (SE) with minimal weight and cost, addressing critical industry constraints, especially in aerospace and portable electronics.

Furthermore, AI-driven tools are essential for advanced electromagnetic compatibility (EMC) simulation and design optimization. AI algorithms can rapidly iterate through thousands of potential shielding layouts, material thicknesses, and gasket placements within complex device enclosures, ensuring regulatory compliance and maximizing performance before physical prototyping begins. This capability is paramount in systems like autonomous driving platforms, where safety-critical sensors and computing units must operate flawlessly amidst intense electromagnetic environments. The overall impact of AI is two-fold: it increases the complexity (and thus demand) for shielding in high-power AI hardware, and it provides sophisticated tools for developing the necessary shielding solutions efficiently.

- AI algorithms accelerate the discovery and optimization of novel conductive materials (e.g., lightweight nanocomposites).

- Machine learning models enhance EMC simulation and design validation, reducing physical prototyping cycles.

- High-density AI computing hardware (data centers, autonomous vehicle processors) significantly increases internal EMI generation, driving demand for high-performance shielding.

- AI-powered systems improve quality control in the manufacturing of shielding components, ensuring consistent material specifications.

- Predictive maintenance analytics, enabled by AI in industrial settings, rely on robust shielding to protect sensitive sensor networks from environmental noise.

DRO & Impact Forces Of EMI and RFI Shielding Materials and Technologies Market

The EMI and RFI Shielding Materials and Technologies Market is subject to powerful internal and external dynamics (DRO: Drivers, Restraints, Opportunities) that dictate its trajectory, modulated by impact forces stemming primarily from technological evolution and regulatory mandates. The core drivers are the exponential growth in wireless communication standards (5G/6G), the pervasive integration of electronic systems in safety-critical sectors like automotive and healthcare, and the corresponding global tightening of electromagnetic compatibility (EMC) standards. These forces necessitate lighter, more efficient, and structurally integrated shielding solutions, pushing manufacturers to innovate beyond traditional metal casings.

However, the market faces significant restraints. The complexity and cost associated with integrating shielding materials into highly miniaturized devices present a persistent challenge, often requiring highly customized, application-specific designs rather than standardized solutions. Fluctuations in the prices of key raw materials—such as copper, silver, and nickel—used in conductive fillers and coatings introduce volatility in manufacturing costs. Moreover, the constant pursuit of thinner materials to meet aesthetic and weight requirements often compromises shielding effectiveness, forcing a difficult trade-off for product developers, thereby restraining the universal adoption of certain high-performance, yet thicker, composite materials.

Opportunities abound, particularly in the realm of advanced materials and emerging application areas. The growing electric vehicle market represents a massive opportunity, requiring comprehensive shielding solutions for battery packs, power electronics, and high-voltage cabling to manage extremely high-frequency noise and thermal issues simultaneously. Furthermore, the development of functionalized materials, such as self-healing or multi-layer composite shielding integrated directly into circuit boards (PCB shielding), offers higher value propositions. The impact forces emphasize technological advancement; as frequencies move into the millimeter-wave range (above 24 GHz), traditional shielding techniques become less effective, compelling rapid material science breakthroughs to maintain signal integrity and ensure global interoperability of devices.

Segmentation Analysis

The EMI and RFI Shielding Materials and Technologies Market is segmented based on the type of material utilized, the specific technology employed to achieve shielding, and the diverse range of end-use applications where these solutions are deployed. This segmentation highlights the specialized nature of the market, where performance requirements—such as shielding effectiveness (SE), environmental resilience, and mechanical flexibility—vary dramatically depending on the final application, from consumer wearables to harsh environment defense systems. The market structure emphasizes the interplay between material science innovations and advanced integration techniques to address complex electromagnetic challenges across industrial sectors.

By Material Type, the market is broadly categorized into conductive polymers, vital for flexible and lightweight applications; metal shielding products, which offer high durability and excellent SE; and conductive coatings and paints, favored for their ability to cover large, complex surfaces cost-effectively. The segment based on Technology differentiates between the mechanical components, such as shielding gaskets and tapes, used primarily for sealing enclosures, and electrical components like EMI filters, designed to suppress noise transmitted through power or signal lines. The dynamic shift toward integrated shielding solutions is causing rapid growth in the conductive elastomer and shielding tape categories, essential for modern compact electronics.

Application segmentation reveals the primary demand drivers, with consumer electronics historically being the largest volume purchaser, though sectors like automotive and telecommunications are exhibiting the fastest growth rates due to regulatory requirements and technological advancements (e.g., ADAS in vehicles and 5G base station deployment). Understanding these segments is crucial for manufacturers to tailor product characteristics—such as temperature resistance, corrosion inhibition, and geometric conformity—to meet the specific operating environments and performance thresholds required by different industry standards and consumer expectations.

- Material Type

- Conductive Polymers

- Metal Shielding Products (Sheets, Foils, Castings)

- Laminated/Metal Foils

- Conductive Coatings & Paints

- EMI Shielding Tapes & Laminates

- Others (e.g., Carbon-based materials)

- Technology

- Shielding Gaskets (Fabric-over-foam, Wire Mesh)

- EMI Filters

- Conductive Elastomers

- Ventilation Panels and Air Filters

- Metal Fabric

- Others (e.g., Board Level Shielding)

- Application

- Consumer Electronics (Smartphones, Wearables)

- Telecom & IT (5G Infrastructure, Data Centers)

- Automotive (EVs, ADAS, Infotainment)

- Aerospace & Defense (Avionics, Radar Systems)

- Healthcare (Medical Imaging, Monitoring Devices)

- Industrial & Manufacturing (Robotics, IoT Sensors)

Value Chain Analysis For EMI and RFI Shielding Materials and Technologies Market

The value chain for EMI and RFI shielding solutions begins with the sourcing and refinement of specialized raw materials, primarily focusing on high-purity metals (nickel, silver, copper), synthetic elastomers, polymers, and carbon-based conductive fillers. Upstream suppliers are focused on chemical synthesis and material compounding to ensure the precise conductivity, flexibility, and environmental resilience required by the shielding material manufacturers. This upstream segment is characterized by intense R&D investment aimed at reducing material costs while enhancing specific properties, particularly the ratio of conductivity to weight. The quality and cost stability of these foundational materials directly impact the profitability and performance capability of the final shielding product.

The midstream segment involves specialized material fabrication, where raw materials are transformed into specific shielding technologies such as conductive coatings, extruded gaskets, stamped metal foils, or customized elastomers. This stage requires advanced manufacturing techniques, including precision coating processes, automated cutting, and molding, to achieve the necessary tight tolerances for effective electromagnetic sealing. Direct sales and distribution channels often involve high-level engineering consultation, as OEMs frequently require customized design integration advice to optimize shielding effectiveness within their specific device geometry. Indirect channels rely on specialized distributors and resellers who manage regional inventory and supply smaller-scale manufacturing operations.

Downstream analysis centers on the integration of these shielding solutions into the final product assemblies by Original Equipment Manufacturers (OEMs) across diverse sectors—the primary end-users. This stage involves complex installation procedures, such as applying conductive paints or integrating highly precise shielding gaskets around interfaces and seams. The effectiveness of the solution relies heavily on the correct design implementation, positioning the relationship between the shielding material provider and the OEM engineering team as critical. Post-sale support often involves monitoring and compliance testing to ensure products adhere to evolving international EMC standards throughout their lifecycle, making robust documentation and technical expertise essential components of the value delivered.

EMI and RFI Shielding Materials and Technologies Market Potential Customers

Potential customers for EMI and RFI shielding materials and technologies span virtually every sector that utilizes advanced electronic components, given the universal necessity for electromagnetic compatibility (EMC) in modern digital infrastructure. The most significant customer cohort comprises consumer electronics manufacturers, including global giants producing smartphones, tablets, wearables, and home automation devices. These buyers prioritize solutions that are thin, lightweight, aesthetically neutral, and suitable for high-volume, automated assembly lines, typically favoring conductive polymers, thin foils, and board-level shielding techniques to manage space constraints and production costs effectively.

Another major segment is the automotive industry, specifically manufacturers of electric vehicles (EVs) and vehicles equipped with advanced driver-assistance systems (ADAS). These customers require high-reliability shielding capable of operating effectively under severe thermal stress, vibration, and chemical exposure. Their specific needs include shielding for power inverter modules, battery management systems (BMS), high-speed data buses, and critical sensor systems (radar, LiDAR). The focus here is on conductive elastomers and specialized high-temperature gaskets that provide both environmental sealing and superior electromagnetic attenuation in safety-critical applications.

The aerospace and defense sector represents a high-value, stringent-requirement customer base. These organizations demand customized, military-grade shielding solutions for avionics, radar systems, satellite communications, and specialized electronic warfare equipment. Customers in this domain place paramount importance on material ruggedness, performance across extreme temperature ranges, resistance to corrosive fluids, and strict adherence to military standards (e.g., MIL-STD-461). Their procurement often involves highly tailored metal shielding enclosures and exotic materials capable of providing exceptional shielding effectiveness (SE) over a vast frequency spectrum for critical national security and operational readiness applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laird Performance Materials, Chomerics (Parker Hannifin), 3M Company, Henkel AG & Co. KGaA, PPG Industries, Tech-Etch, KEMET Corporation, Schaffner Holding AG, ETS-Lindgren, RTP Company, Nolato AB, Guilin Lipu, Kitagawa Industries, TATSUTA Electric Wire & Cable Co., Ltd., Zippertubing, Leader Tech, Spira Manufacturing, Holland Shielding Systems, W. L. Gore & Associates, MG Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EMI and RFI Shielding Materials and Technologies Market Key Technology Landscape

The current technology landscape in EMI and RFI shielding is defined by a critical pivot toward advanced material science designed to address the challenges posed by high-frequency operations and extreme miniaturization. Traditional technologies, primarily relying on bulk metallic enclosures and heavy plating, are being supplemented or replaced by sophisticated composite materials and precision application methods. Key technological advancements include the maturation of conductive coatings utilizing silver-plated copper or nickel fillers embedded in polymer matrices, which provide excellent attenuation while significantly reducing weight compared to solid metals. Furthermore, the development of highly flexible and recoverable conductive elastomers is crucial for sealing complex joints and maintaining shielding integrity under continuous mechanical stress, particularly in military and aerospace applications where reliable sealing is paramount.

Another significant technological focus lies in Board Level Shielding (BLS), which involves integrating small, precise metal cans or conductive polymer frames directly onto the printed circuit board (PCB) to isolate sensitive components locally. This approach is essential for managing the dense signal paths and high internal interference generated by modern high-speed processors and RF modules in smartphones and wearables. Additionally, advancements in metamaterials and nanotechnology—such as thin films embedded with carbon nanotubes (CNTs) or graphene—are gaining traction, offering the potential for ultra-thin shielding with exceptional broadband absorption and reflection capabilities, pushing the envelope of shielding effectiveness at millimeter-wave frequencies (e.g., above 30 GHz).

In the domain of passive components, sophisticated EMI filters, including common-mode and differential-mode chokes, are leveraging advanced ferrite materials and optimized winding techniques to suppress conducted noise effectively on power and signal lines, crucial for electric vehicle systems and industrial automation. The overall technological trend favors tailored, multi-functional solutions. Instead of a single shielding layer, modern systems often employ a combination of technologies—conductive paints for the outer casing, fabric-over-foam gaskets for access panels, and specialized filters on the power input—to create a comprehensive and cost-efficient electromagnetic defense strategy suitable for the complex operating environment of the device.

Regional Highlights

The global distribution of the EMI and RFI Shielding Materials and Technologies Market showcases distinct regional dynamics driven by manufacturing hubs, regulatory environments, and the concentration of high-technology industries. Asia Pacific (APAC) stands as the undisputed market leader, primarily due to the vast scale of consumer electronics and telecommunications equipment manufacturing concentrated in countries like China, Taiwan, South Korea, and Japan. The rapid and comprehensive rollout of 5G infrastructure and the growing production of low-cost, high-volume electronics for global export underpin the region's immense demand for both basic and advanced shielding materials. Furthermore, governmental initiatives promoting domestic semiconductor manufacturing in China contribute heavily to the demand for high-specification shielding solutions for cleanroom environments and complex chip-making equipment.

North America maintains a strong position, characterized by high demand for high-specification, reliable shielding solutions, predominantly in the aerospace and defense sectors, where stringent military standards and high-frequency communication systems dictate material choice. The significant presence of leading global technology firms and the burgeoning electric vehicle market, particularly in the United States, drives innovation in specialized conductive elastomers and advanced composite shielding technologies suitable for safety-critical applications. The regional market is less volume-driven than APAC but focuses intensely on product performance, regulatory compliance, and customized engineering services, supporting a premium pricing structure for advanced shielding products.

Europe represents a mature and highly regulated market, with strong demand stemming from the automotive industry (especially premium and luxury EVs), advanced industrial manufacturing (Industry 4.0), and healthcare sectors (medical imaging). European regulations concerning EMC are rigorous, mandating high levels of shielding integration across industrial machinery and medical devices, thereby driving continuous demand for high-quality gaskets, filters, and conductive plastics. Germany and France are key contributors, focused on precision engineering and robust compliance. Meanwhile, the Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, with growth linked to increasing investment in telecommunications infrastructure upgrades (4G/5G deployment) and localized assembly of consumer electronics, though their current market share remains relatively smaller compared to the industrialized regions.

- North America (NA): Driven by Aerospace, Defense, and high-reliability EV electronics; focus on custom, high-performance solutions and adherence to strict regulatory standards.

- Europe (EU): Strong emphasis on high-end Automotive (EV/ADAS), Industrial IoT, and Medical device compliance; strict EMC regulations ensure consistent demand for premium shielding technologies.

- Asia Pacific (APAC): Dominant market share due to mass manufacturing of Consumer Electronics and Telecom infrastructure (5G); volume-driven demand for coatings, foils, and conductive polymers.

- Latin America (LATAM): Emerging market growth linked to increased urbanization, IT infrastructure development, and growing local assembly operations for consumer goods.

- Middle East and Africa (MEA): Growth primarily catalyzed by investments in telecommunication modernization and smart city initiatives, requiring robust shielding for critical infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EMI and RFI Shielding Materials and Technologies Market.- Laird Performance Materials (A DuPont Business)

- Chomerics (A Division of Parker Hannifin)

- 3M Company

- Henkel AG & Co. KGaA

- PPG Industries Inc.

- Tech-Etch, Inc.

- KEMET Corporation (A Yageo Company)

- Schaffner Holding AG

- ETS-Lindgren

- RTP Company

- Nolato AB

- Guilin Lipu Chemical Co., Ltd.

- Kitagawa Industries Co., Ltd.

- TATSUTA Electric Wire & Cable Co., Ltd.

- Zippertubing L.P.

- Leader Tech, Inc.

- Spira Manufacturing Corporation

- Holland Shielding Systems B.V.

- W. L. Gore & Associates

- MG Chemicals

Frequently Asked Questions

Analyze common user questions about the EMI and RFI Shielding Materials and Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for EMI shielding materials in the current market?

The primary driver is the global proliferation of high-frequency wireless communication technologies, particularly 5G and the extensive adoption of connected devices (IoT), which significantly increases electromagnetic noise and necessitates effective shielding to maintain signal integrity and ensure regulatory compliance.

How does the shift towards electric vehicles (EVs) impact the EMI shielding market?

EVs introduce high-power electronics, such as inverters and battery management systems, which generate intense electromagnetic interference. This drives robust demand for specialized, high-reliability shielding materials, particularly conductive elastomers and durable gaskets, capable of withstanding severe operational conditions.

What are the main advantages of using conductive coatings and paints over traditional metal shielding?

Conductive coatings offer superior cost-effectiveness, ease of application over large or geometrically complex surfaces, and significantly reduced weight compared to solid metal enclosures, making them ideal for high-volume consumer electronics and lightweight enclosures.

Which region holds the largest market share for EMI and RFI shielding materials, and why?

Asia Pacific (APAC) holds the largest market share, driven by the concentration of global manufacturing hubs for consumer electronics and telecommunications equipment, coupled with rapid infrastructure deployment for 5G networks across the region.

What is Board Level Shielding (BLS), and why is it increasingly important?

Board Level Shielding (BLS) involves placing precise shielding components directly onto the PCB to isolate individual sensitive components or circuit sections. It is critical for miniaturized electronics, such as smartphones, where high-density integration causes severe internal crosstalk and interference that traditional external shielding cannot adequately manage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager