Emission Control Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432870 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Emission Control Technology Market Size

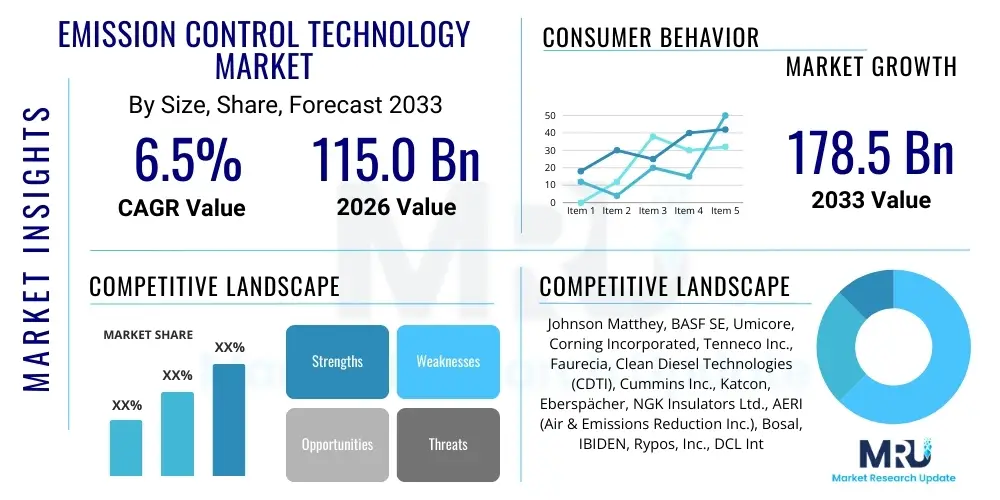

The Emission Control Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 115.0 Billion in 2026 and is projected to reach USD 178.5 Billion by the end of the forecast period in 2033.

Emission Control Technology Market introduction

The Emission Control Technology Market encompasses a range of sophisticated devices, systems, and chemical processes designed to reduce the release of harmful pollutants, such as nitrogen oxides (NOx), sulfur oxides (SOx), carbon monoxide (CO), and particulate matter (PM), into the atmosphere from mobile and stationary sources. These technologies are crucial for meeting increasingly strict global environmental mandates, particularly those governing vehicular emissions (like Euro 7 and EPA standards) and industrial stack emissions. Key products include catalytic converters, selective catalytic reduction (SCR) systems, diesel particulate filters (DPF), exhaust gas recirculation (EGR) systems, and air pollution control equipment utilized across diverse sectors, including automotive, marine transport, power generation, and chemical processing.

The core objective of emission control technologies is to convert toxic components generated during combustion or industrial processes into less harmful substances, thereby mitigating air pollution and its subsequent impact on public health and climate change. The efficiency and complexity of these systems are continuously evolving, driven by advancements in material science—especially in catalyst development using platinum group metals (PGMs)—and improved engine management integration. Furthermore, the rising global focus on climate change mitigation has accelerated the demand for technologies that not only control traditional pollutants but also address greenhouse gases, positioning this market as pivotal in the global transition towards sustainable industrial and transportation practices.

Major applications of emission control systems span heavy-duty and light-duty vehicles, marine engines, stationary diesel generators, and large industrial facilities such as refineries and cement plants. The primary benefits derived from these technologies include regulatory compliance, enhanced public health outcomes due to cleaner air, improved corporate environmental responsibility, and, often, optimized operational efficiency in combustion processes. The market growth is predominantly driven by escalating regulatory stringency worldwide, rapid industrialization in emerging economies, and persistent public awareness regarding environmental degradation caused by anthropogenic emissions.

Emission Control Technology Market Executive Summary

The Emission Control Technology Market is experiencing robust expansion, primarily fueled by global policy harmonization towards net-zero emissions targets and the subsequent adoption of advanced pollution abatement strategies across mobility and industrial sectors. Business trends indicate a significant shift toward selective catalytic reduction (SCR) systems and diesel particulate filters (DPF) as essential components for complying with stringent regulations like Tier 4 Final and Euro VI/VII, particularly within the heavy-duty vehicle and off-road equipment segments. Manufacturers are heavily investing in developing cost-effective catalysts and filter regeneration methods, emphasizing PGM reduction and alternative material substitution to stabilize supply chain vulnerabilities and manage operational costs for end-users. Consolidation within the supply chain, particularly among major Tier 1 and Tier 2 suppliers specializing in exhaust aftertreatment systems, is a noticeable trend aiming to leverage economies of scale and integrate advanced sensor and diagnostic technologies.

Regionally, the market dynamic is dominated by regulatory mandates. Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by the rapid urbanization, increasing vehicle population, and the implementation of stricter emission standards (e.g., China V/VI, Bharat Stage VI) replacing older, less controlled regimes. North America and Europe, already mature markets, drive demand through innovation, focusing on retrofitting older fleets and pioneering technologies for non-road mobile machinery (NRMM) and specialized industrial applications. The European Union's Green Deal and subsequent carbon border adjustments are creating a significant pull for best-in-class industrial emission controls, particularly in high-emitting sectors like steel and cement production, thereby driving segment trends toward highly efficient, multi-pollutant control systems capable of addressing both primary air pollutants and secondary greenhouse gases.

Segment analysis highlights the dominance of the automotive sector, specifically the diesel vehicle segment, due to the mandatory requirement of complex aftertreatment systems. However, the rise of electric vehicles (EVs) introduces a long-term structural challenge to the traditional catalytic converter market, prompting technology providers to pivot towards industrial applications, marine transport (IMO Tier III regulations), and specialized stationary sources. Furthermore, the integration of digital technologies, including sensors and AI-driven monitoring, is defining the latest segment trends, enabling real-time performance optimization and compliance reporting, which are crucial for large fleet operators and industrial site managers.

AI Impact Analysis on Emission Control Technology Market

User inquiries frequently center on how artificial intelligence and machine learning (ML) can enhance the efficiency and longevity of complex aftertreatment systems, moving beyond passive regulatory compliance to active environmental management. Key questions revolve around utilizing AI for predictive maintenance of catalysts and filters, optimizing the injection rates of reduction agents (like urea in SCR systems), and developing smart diagnostic tools capable of identifying and mitigating performance degradation before failure occurs. Users are also keen on understanding how AI can facilitate faster development cycles for novel catalyst materials by simulating chemical reactions and optimizing material composition, addressing the dual concern of performance maximization and cost reduction in PGM-dependent systems.

- AI-powered predictive maintenance reduces downtime and extends the lifespan of expensive components like DPFs and SCR catalysts by analyzing real-time sensor data and operational patterns.

- Machine learning algorithms optimize the dosage and timing of reductant injection in SCR systems, improving NOx conversion efficiency while minimizing urea consumption and potential ammonia slip.

- AI facilitates the rapid analysis of regulatory changes and compliance tracking, offering automated reporting and alerts for industrial sites and large transportation fleets.

- Advanced AI simulation tools accelerate the discovery and testing of new, lower-cost catalyst formulations, reducing reliance on volatile platinum group metals.

- Real-time data analytics, driven by AI, enable optimal engine calibration and exhaust temperature management, ensuring aftertreatment systems operate within their optimal efficiency window under varying load conditions.

DRO & Impact Forces Of Emission Control Technology Market

The trajectory of the Emission Control Technology Market is strongly dictated by stringent regulatory drivers and impactful forces stemming from environmental consciousness, offset by significant implementation challenges and operational costs. The primary drivers include the global adoption of strict emission standards (such as Euro 7 in Europe, CAFE standards in the US, and national emission norms in high-growth economies like India and China) compelling the mandatory integration of advanced exhaust aftertreatment systems across all new vehicular production and industrial facilities. Environmental accountability, driven by global climate agreements and increasing public pressure concerning air quality in urban centers, further accelerates the demand for robust pollutant reduction technologies, reinforcing the market's fundamental growth mechanism.

Restraints, however, pose significant challenges to continuous market expansion. The high initial capital expenditure associated with implementing advanced emission control systems, particularly SCR and complex DPF setups, acts as a barrier for small and medium-sized enterprises (SMEs) and developing economies. Furthermore, the volatility and high cost of raw materials, specifically the reliance on platinum group metals (PGMs) used in catalytic converters, create uncertainty in the manufacturing supply chain and final product pricing. The operational complexities, including the maintenance requirements and potential for 'tampering' or system deactivation by end-users seeking to reduce fuel consumption or maintenance costs, present ongoing regulatory enforcement challenges.

Opportunities for innovation and market penetration are vast, driven primarily by the transition toward cleaner energy sources and the increasing need for retrofitting existing, non-compliant fleets and industrial infrastructure. The development of advanced non-PGM catalysts and highly efficient filtration technologies, alongside the integration of digital monitoring and optimization solutions (Telematics and IoT), represent key growth avenues. Impact forces are currently dominated by regulatory shifts and technological leapfrogging; the global push towards electrification subtly restructures the mobile emission market over the long term, pushing technology providers to specialize in industrial, marine, and power generation solutions where conventional combustion sources will remain prevalent for decades. The force of political commitment to air quality standards remains the most significant external determinant of market performance.

Segmentation Analysis

The Emission Control Technology Market is segmented based on the specific technology deployed, the application sector utilizing the technology, and the fuel type associated with the source of emissions. This granular segmentation allows market participants to tailor their offerings to precise regulatory requirements and operational demands across different industrial and mobility environments. The technology segment is highly dynamic, reflecting ongoing innovation aimed at increasing pollutant conversion efficiency and durability under harsh operating conditions, moving beyond rudimentary oxidation catalysts to complex multi-stage aftertreatment trains.

Key segments include mature technologies like catalytic converters and EGR systems, which are foundational, alongside high-growth segments such as Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF), which are mandatory for meeting the strictest global standards for NOx and PM abatement, respectively. The application sector provides crucial insight into end-user spending power and regulatory priority, differentiating between the high volume, compliance-driven automotive market and the specialized, often custom-engineered industrial and marine segments. Understanding these segments is vital for strategic investment, especially concerning capacity planning for catalyst production and the development of specialized monitoring software compatible with diverse operational protocols.

- By Technology:

- Catalytic Converter (Two-Way, Three-Way Oxidation)

- Selective Catalytic Reduction (SCR)

- Exhaust Gas Recirculation (EGR)

- Diesel Particulate Filter (DPF) / Gasoline Particulate Filter (GPF)

- Flares and Thermal Oxidizers

- Scrubbers

- By Application:

- Automotive (Light-Duty Vehicle, Heavy-Duty Vehicle, Off-Road)

- Industrial (Chemical, Cement, Metal Processing, Refinery)

- Marine

- Power Generation

- By Fuel Type:

- Diesel

- Gasoline

- Alternative Fuels (CNG, LNG, Hydrogen)

Value Chain Analysis For Emission Control Technology Market

The value chain for the Emission Control Technology Market begins with the upstream sourcing of critical raw materials, most notably the highly specialized platinum group metals (PGMs)—platinum, palladium, and rhodium—which are central to catalyst production. Upstream analysis involves mining companies, specialized chemical processors, and refiners who manage the supply and preparation of these finite, volatile commodities. The stability of PGM supply and pricing significantly impacts the manufacturing margins of Tier 1 suppliers. Other critical upstream inputs include high-temperature ceramics for substrates (used in catalytic converters and filters) and proprietary chemical formulations for urea/DEF (Diesel Exhaust Fluid) required for SCR systems.

Midstream activities involve the core manufacturing processes, dominated by major Tier 1 automotive and industrial suppliers who specialize in the design, coating, and assembly of complex aftertreatment systems (e.g., mufflers, catalytic converters, filters, and dosing units). These manufacturers invest heavily in research and development to optimize catalyst loading, improve thermal durability, and integrate sophisticated electronic controls. Distribution channels are varied: Direct sales are common for large industrial projects and OEMs (Original Equipment Manufacturers) in the automotive sector, where systems are tailored and integrated during vehicle or engine assembly. Indirect channels involve aftermarket distribution through authorized service centers, parts retailers, and independent repair shops for replacement and retrofitting purposes.

Downstream analysis focuses on the final integration, use, and maintenance of the emission control equipment. End-users—including vehicle manufacturers, fleet operators, industrial plant managers, and ship owners—dictate the demand based on regulatory deadlines and operational efficiency goals. The aftermarket service segment is crucial for revenue generation, covering diagnostics, filter cleaning/regeneration, and replacement of catalytic components. The direct channel ensures tight quality control and seamless integration for new equipment, while the indirect channel serves the vast, decentralized global fleet and existing industrial base, emphasizing accessibility and competitive pricing for maintenance components.

Emission Control Technology Market Potential Customers

The potential customer base for the Emission Control Technology Market is extremely broad, spanning all sectors that rely on combustion engines or high-temperature industrial processes, as these inherently generate regulated atmospheric pollutants. The largest and most consistently demanding customer segment consists of Original Equipment Manufacturers (OEMs) in the automotive and engine manufacturing industries, including producers of passenger vehicles, commercial trucks, buses, and off-road mobile machinery (construction, agriculture, mining). These customers purchase integrated aftertreatment systems in massive volumes to meet new vehicle certification standards.

Beyond the transportation sector, major industrial corporations form a significant customer base. This includes firms operating in energy generation (coal-fired and gas-fired power plants), heavy industry (steel, cement, glass manufacturing), and chemical processing (refineries and petrochemical plants). These stationary sources require large-scale, custom-engineered solutions like scrubbers, thermal oxidizers, and industrial SCR units to manage stack emissions, driven primarily by localized environmental permits and national industrial mandates. Lastly, the marine industry, responding to IMO Tier III regulations, represents a growing niche for robust, corrosive-resistant emission control solutions for large vessel engines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.0 Billion |

| Market Forecast in 2033 | USD 178.5 Billion |

| Growth Rate | CAGR 6.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, BASF SE, Umicore, Corning Incorporated, Tenneco Inc., Faurecia, Clean Diesel Technologies (CDTI), Cummins Inc., Katcon, Eberspächer, NGK Insulators Ltd., AERI (Air & Emissions Reduction Inc.), Bosal, IBIDEN, Rypos, Inc., DCL International Inc., Hug Engineering, Nett Technologies, CDTi Advanced Materials, Purem by Eberspächer |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Emission Control Technology Market Key Technology Landscape

The technological landscape of the emission control market is characterized by a rapid evolution toward highly integrated, multi-stage aftertreatment systems necessary to meet near-zero emission targets. The current core technologies rely heavily on chemical conversion and physical filtration. Selective Catalytic Reduction (SCR) technology remains paramount for reducing nitrogen oxide (NOx) emissions, particularly in diesel engines and industrial applications. Innovations in SCR focus on optimizing catalyst geometry and composition to improve low-temperature performance and reduce the overall system size and weight, addressing concerns related to packaging constraints in mobile applications. The dosing systems for Diesel Exhaust Fluid (DEF/Urea) are also becoming smarter, utilizing advanced sensors and closed-loop control algorithms to ensure precise injection and maximize efficiency while preventing ammonia slip.

Diesel Particulate Filters (DPF) and their gasoline counterparts, Gasoline Particulate Filters (GPF), form the foundation for particulate matter (PM) control. Technological advancements here center on materials science, particularly the development of high-porosity ceramic wall-flow filters that offer high filtration efficiency with minimal back pressure, thereby preserving engine performance and fuel economy. Research is intensely focused on passive and active regeneration strategies for DPFs, aiming to lower the temperature required for soot oxidation and reduce the frequency of energy-intensive active regeneration cycles. This includes using specialized catalysts coated onto the filter surface (catalyzed DPFs) to enhance low-temperature oxidation.

Beyond vehicle technologies, the industrial sector relies on robust solutions such as scrubbers for SOx removal, particularly in marine applications using heavy fuel oil, and thermal oxidizers for volatile organic compound (VOC) abatement in chemical and paint manufacturing. The emerging trend across both mobile and stationary sources is the integration of digital twins and IoT monitoring systems. These tools provide continuous emissions monitoring (CEM), predictive diagnostics, and remote optimization capabilities, shifting the paradigm from periodic compliance checks to proactive environmental performance management. This convergence of chemical engineering, material science, and digital intelligence defines the leading edge of the emission control technology landscape.

Regional Highlights

The global Emission Control Technology Market exhibits distinct regional dynamics driven by varying levels of industrial maturity, regulatory frameworks, and urbanization rates. Each major region contributes uniquely to market demand and technological innovation, making regional strategy crucial for global market players.

- Asia Pacific (APAC): Positioned as the fastest-growing region, driven by massive increases in vehicular density, rapid industrial expansion (especially in China, India, and Southeast Asia), and the critical transition from older, basic emission standards to modern, stringent norms (e.g., Bharat Stage VI and China VI). This region represents the largest volume opportunity for new system installations, particularly SCR and DPF solutions for commercial vehicles and two-wheelers.

- North America: A highly mature market characterized by extremely strict federal and state-level regulations (EPA and CARB), particularly for heavy-duty engines, off-road equipment, and industrial facilities. Demand here is dominated by technological upgrades, compliance-driven retrofitting of existing fleets, and the continuous adoption of advanced monitoring and diagnostic systems.

- Europe: The leading region for technological innovation, propelled by the European Green Deal and the upcoming Euro 7 standards, which target ultra-low emissions. Europe shows high demand for sophisticated gasoline and diesel aftertreatment, including GPFs and advanced NOx sensors, reflecting its early and robust commitment to tackling urban air quality issues.

- Latin America (LATAM): A developing market where implementation lags slightly behind APAC and Western markets, but is accelerating due to international pressure and local concerns about mega-city air quality. Market growth is driven by the gradual phase-in of cleaner fuel standards and the subsequent adoption of catalytic converters and entry-level SCR technology.

- Middle East and Africa (MEA): Growth is primarily centered around the oil and gas sector (industrial flaring control) and urbanization in key economies (Saudi Arabia, UAE, South Africa). The region is a significant importer of vehicles, necessitating localized adoption of international standards, leading to steady, compliance-driven demand for basic and intermediate control technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Emission Control Technology Market.- Johnson Matthey

- BASF SE

- Umicore

- Corning Incorporated

- Tenneco Inc. (now part of Aptiv)

- Faurecia (now part of Forvia)

- Clean Diesel Technologies (CDTI)

- Cummins Inc.

- Katcon

- Eberspächer

- NGK Insulators Ltd.

- AERI (Air & Emissions Reduction Inc.)

- Bosal

- IBIDEN

- Rypos, Inc.

- DCL International Inc.

- Hug Engineering

- Nett Technologies

- CDTi Advanced Materials

- Purem by Eberspächer

Frequently Asked Questions

Analyze common user questions about the Emission Control Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Emission Control Technology Market?

The market is primarily driven by increasingly stringent global and regional emission regulations (such as Euro 7, China VI, and EPA standards) mandating the reduction of pollutants like NOx, PM, and CO. Growth is further accelerated by rising public health concerns regarding air quality and rapid industrialization, particularly in the Asia Pacific region, necessitating compliance technologies.

How does the shift towards electric vehicles (EVs) impact the traditional emission control market?

While the long-term rise of EVs poses a threat to traditional catalytic converter demand in the passenger car segment, the overall market remains robust due to persistent demand in heavy-duty commercial vehicles, marine transport, power generation, and specialized industrial sectors, which will continue to rely on combustion technologies and require advanced pollution abatement solutions for the foreseeable future.

What role does Selective Catalytic Reduction (SCR) technology play in modern emission control?

SCR is a critical technology used primarily in diesel and stationary applications to reduce nitrogen oxide (NOx) emissions by converting them into inert nitrogen and water vapor using a liquid reductant (Diesel Exhaust Fluid/Urea). It is essential for meeting the latest stringent NOx standards worldwide and represents a dominant segment in the heavy-duty and industrial aftertreatment market.

What are the main challenges facing manufacturers in the Emission Control Technology value chain?

Key challenges include the high and volatile costs associated with crucial raw materials, particularly platinum group metals (PGMs), which are necessary for catalyst production. Additionally, manufacturers face continuous pressure to innovate cost-effectively, improve low-temperature performance, and design durable systems capable of operating reliably under diverse, real-world driving and industrial conditions.

Which geographical region is expected to demonstrate the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive ongoing investments in infrastructure, rapid fleet expansion, and the decisive transition by major economies like China and India to implement stricter, internationally harmonized emission standards.

Detailed Market Dynamics and Future Outlook

The dynamics of the Emission Control Technology Market are intricately linked to global legislative movements and macroeconomic shifts, particularly those influencing industrial production and transportation logistics. The current market is navigating a complex transition where the mandate for cleaner air intersects with the logistical and financial hurdles of widespread technological adoption. This environment necessitates continuous collaboration between regulatory bodies, engine manufacturers, and technology suppliers to ensure feasible and effective compliance strategies. The ongoing debate surrounding the longevity of internal combustion engines (ICEs) in the light-duty segment compels suppliers to strategically diversify their portfolios, focusing on the highly regulated and capital-intensive segments of marine, rail, and stationary power generation, where ICEs will maintain dominance for decades.

A critical trend shaping the market is the integration of high-fidelity sensors and onboard diagnostics (OBD) systems, moving emission control from a passive after-treatment step to an integrated, continuously monitored process. Future regulations, such as the proposed Euro 7, are expected to introduce real-driving emission (RDE) testing under even broader operational conditions, requiring systems that maintain high efficiency immediately upon startup and across extreme temperature variations. This places immense pressure on catalyst technology to function optimally at much lower temperatures, spurring investment in cold-start technology and electrically heated catalyst (EHC) systems. Furthermore, the focus is expanding beyond traditional pollutants to include secondary emissions like nitrous oxide (N2O), which has a high global warming potential, demanding new, multi-function catalytic solutions.

The future outlook remains highly positive despite the structural challenges posed by electrification. The industrial segment, covering high-emitting sectors like steel, cement, and petrochemicals, presents an enormous untapped potential for growth, driven by tightening mandates related to carbon capture, utilization, and storage (CCUS) and localized air quality management. The marine sector, under the stringent requirements of the IMO 2020 sulfur cap and Tier III NOx limits, continues to demand robust scrubber and SCR installations. Therefore, while automotive segment composition changes, the total addressable market for emission abatement expertise expands significantly into heavier, capital-intensive industrial applications, ensuring sustained revenue streams for specialized technology providers.

The Challenge of PGM Reliance and Material Innovation

Reliance on Platinum Group Metals (PGMs) constitutes a significant vulnerability and cost driver within the emission control market, particularly for three-way catalytic converters and diesel oxidation catalysts (DOCs). Platinum, palladium, and rhodium offer unparalleled catalytic activity, but their scarcity, geopolitical sensitivity, and high price volatility introduce considerable risk for manufacturers and, ultimately, consumers. This dependency motivates intense research into material innovation aimed at reducing PGM loading, partially substituting PGMs with base metals, or developing entirely PGM-free catalyst systems.

Innovations in PGM reduction involve optimizing the washcoat structure and dispersion techniques to maximize the active surface area, allowing for equivalent conversion efficiency with less metal. Research into perovskite materials, zeolites, and various mixed oxides offers promising avenues for partial PGM replacement, especially in high-temperature applications. Addressing this challenge is vital not only for cost stability but also for securing the long-term sustainability of the entire exhaust aftertreatment supply chain. Successful material substitution represents a major opportunity to disrupt established market shares and significantly lower the barriers to advanced emission control adoption in price-sensitive developing markets.

Digitalization and IoT Integration in Monitoring

The digital transformation is fundamentally changing how emission control systems are monitored, optimized, and maintained across both mobile and stationary applications. The integration of the Internet of Things (IoT), advanced sensor networks, and cloud-based data analytics allows for Continuous Emissions Monitoring (CEM) that provides regulatory agencies and operators with real-time verification of compliance and performance. This capability is paramount for preventing system failures and managing complex aftertreatment trains efficiently.

IoT sensors gather data on key parameters such as exhaust temperature, NOx levels, back pressure, and reductant consumption. This data is fed into sophisticated software platforms that utilize AI and machine learning to diagnose potential issues, predict maintenance needs (e.g., DPF cleaning schedules), and fine-tune operating parameters for peak efficiency. For large fleet operators, this digitalization translates into substantial operational savings through reduced fuel consumption, minimized unscheduled downtime, and accurate compliance reporting, transforming the emission system from a regulatory burden into a performance management asset.

Impact of Global Regulatory Harmonization

Global emission control regulations, while stringent, often lack complete harmonization, leading to complexities in manufacturing and compliance for multinational corporations. However, there is a clear trend toward convergence, exemplified by many regions adopting standards closely mirroring the European (Euro) or US (EPA/CARB) frameworks. This harmonization is a powerful market driver because it streamlines R&D efforts and allows for greater economies of scale in the production of standardized aftertreatment components.

The introduction of robust durability requirements and lifetime emission limits in the latest standards (e.g., 10+ years/300,000 miles for heavy-duty systems) is forcing technological improvements in material integrity and system robustness. Furthermore, the focus on non-road mobile machinery (NRMM) and specialized industrial sources is broadening the scope of the market, ensuring that even niche application segments must adhere to high environmental thresholds. Regulatory action is thus the ultimate forcing function, compelling continuous technological innovation and market growth.

Market Analysis by Technology Segment Detail

The diversity in emission control requirements necessitates a specialized portfolio of technologies, each targeting specific pollutants under different operational conditions. Catalytic converters, though mature, remain the cornerstone of gasoline and some diesel light-duty vehicle systems, relying on complex chemical reactions over noble metal surfaces. Three-way catalytic converters efficiently manage NOx, CO, and unburnt hydrocarbons (HC) simultaneously, but require precise air-to-fuel ratio control, a condition challenging to maintain during rapid transient driving cycles.

The shift to Selective Catalytic Reduction (SCR) has fundamentally addressed the challenge of high NOx emissions from lean-burn diesel engines, a critical requirement for heavy-duty commercial vehicles and off-road applications. SCR systems involve injecting a reducing agent, typically urea, into the exhaust stream ahead of a specialized catalyst. The efficacy of SCR systems is heavily dependent on the dosing control unit and the uniformity of the reductant distribution, which are areas of intense optimization. This segment continues to grow rapidly due to its high conversion efficiency and mandatory status under advanced diesel regulations globally.

Diesel Particulate Filters (DPFs) and their gasoline counterparts, GPFs, address particulate matter, trapping solid carbon soot and ash. DPF systems require periodic regeneration—burning off the accumulated soot—which can be achieved passively (using catalyst coatings and inherent exhaust heat) or actively (requiring external heat injection). Innovations focus on developing filters that minimize back pressure, thus improving fuel efficiency, and optimizing regeneration frequency to extend filter lifespan. The evolution of these technologies ensures that the market remains highly technical and dependent on specialized chemical and material engineering expertise.

Market Analysis by Application Segment Detail

The automotive sector dominates the Emission Control Technology Market volume, driven by the sheer scale of global vehicle production and the rapid pace of regulatory updates. Within this application segment, heavy-duty vehicles (trucks and buses) are the primary drivers of advanced SCR and DPF demand, given their high mileage accumulation and significant contribution to urban pollution. Light-duty vehicles are transitioning towards GPFs, sophisticated three-way catalysts, and sometimes hybrid SCR-LNT (Lean NOx Trap) systems to meet ever-tightening limits.

The industrial application segment is characterized by highly diverse and customized solutions tailored to the specific pollutants and volume throughput of the facility. For example, power plants require large-scale SCR and flue gas desulfurization (FGD) scrubbers, while cement kilns and refineries might utilize thermal oxidizers and fabric filters. This segment demands robust engineering and high capital investment, offering stable, long-term maintenance revenue streams. The marine application segment is experiencing significant growth due to the IMO's implementation of stricter limits on sulfur content (IMO 2020) and NOx (Tier III), leading to widespread adoption of open- and closed-loop scrubbers and marine-specific SCR systems designed to withstand corrosive environments.

Market Analysis by Fuel Type Segment Detail

Segmentation by fuel type provides insight into the specific technological needs and regulatory pressures exerted across different energy sources. The diesel segment historically represents the largest market share, requiring the most complex and expensive aftertreatment chains, typically involving DOC, DPF, and SCR systems to manage high levels of NOx and PM. Despite long-term challenges from electrification, the sheer number of existing diesel commercial vehicles and the necessity of diesel in off-road and high-load applications ensures sustained demand for these advanced components.

The gasoline segment relies heavily on three-way catalytic converters. However, the introduction of Gasoline Direct Injection (GDI) engines, while efficient, necessitated the addition of Gasoline Particulate Filters (GPFs) to address increased PM output. This expansion ensures continued innovation in catalyst materials and filter technology within the gasoline segment. Alternative fuels, including Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG), are gaining traction, especially in bus and refuse truck fleets. While inherently cleaner, these engines still require specialized oxidation catalysts and sometimes methane slip reduction technologies to comply with comprehensive emission standards, representing a specialized, high-growth niche within the overall market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager