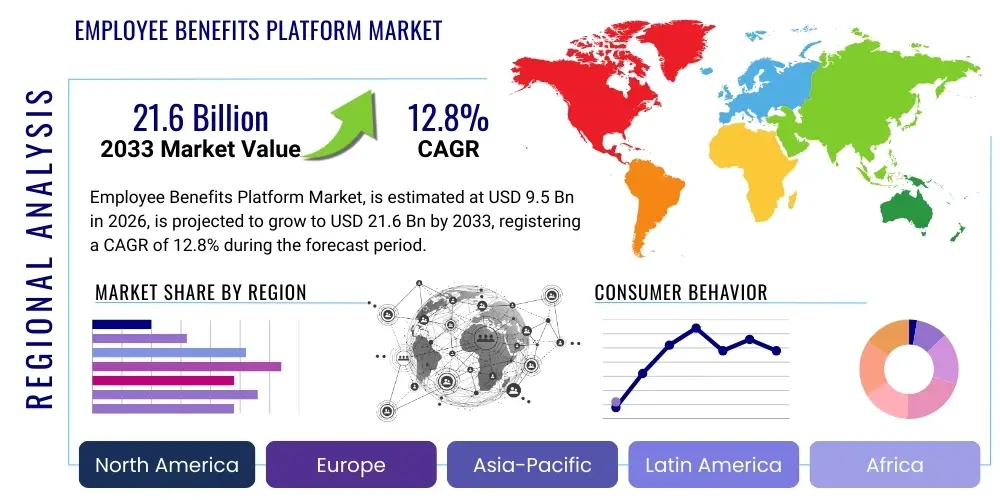

Employee Benefits Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436644 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Employee Benefits Platform Market Size

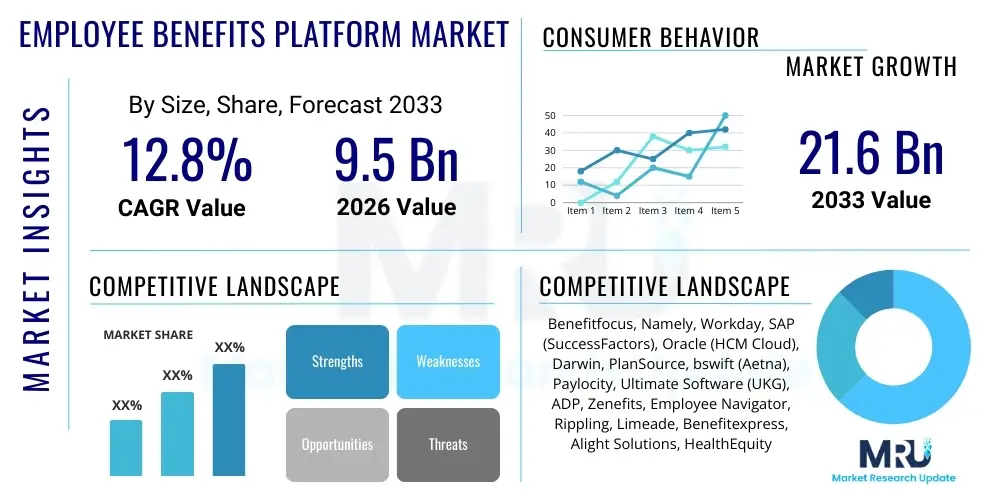

The Employee Benefits Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 21.6 Billion by the end of the forecast period in 2033.

Employee Benefits Platform Market introduction

The Employee Benefits Platform Market encompasses specialized software solutions designed to streamline the administration, communication, and management of employee benefits programs. These platforms offer a centralized, digital interface for HR departments and employees, covering a wide range of offerings from mandatory benefits like health insurance and retirement plans to voluntary benefits such as wellness programs, flexible spending accounts (FSAs), and commuter benefits. The core product provides automation of enrollment processes, regulatory compliance checking, and personalized employee experiences, significantly reducing the administrative burden traditionally associated with complex benefits management. Integration capabilities with existing HRIS (Human Resource Information Systems) and payroll systems are crucial components that define the utility and efficiency of these platforms, enabling a seamless flow of data across organizational functions.

Major applications of these platforms span across small, medium, and large enterprises seeking to enhance employee engagement, retention, and recruitment efforts. Beyond basic enrollment, these systems are vital for benefits optimization, providing employees with educational resources and tools to make informed decisions about their compensation packages. The increasing complexity of benefits packages, driven by a global shift towards flexible work models and personalized wellness expectations, has solidified the platform’s role as an essential HR technology tool. Key benefits derived from adoption include enhanced data accuracy, improved compliance with regional labor laws (like ACA in the US or similar mandates globally), and substantial cost savings realized through reduced manual processing and error minimization.

Driving factors for market acceleration include the rapid global adoption of cloud-based solutions, the necessity for decentralized benefits access to support remote and hybrid workforces, and the competitive pressure on employers to offer differentiated and attractive benefits portfolios. Furthermore, regulatory mandates requiring transparent and verifiable benefits communication are pushing companies toward sophisticated, audit-ready digital platforms. The convergence of financial wellness tools, mental health support features, and physical health tracking within a single accessible platform is transforming how employees perceive and interact with their total rewards, propelling sustained market growth over the forecast period.

Employee Benefits Platform Market Executive Summary

The global Employee Benefits Platform Market is experiencing robust expansion driven by digital transformation initiatives across HR functions and a heightened focus on employee experience (EX). Business trends indicate a strong shift toward highly configurable, modular, and AI-integrated platforms that offer hyper-personalization of benefits packages, moving away from monolithic, one-size-fits-all systems. SaaS deployment models dominate the market due to their scalability, lower upfront costs, and continuous update cycle, making them particularly attractive to mid-sized enterprises. Regionally, North America maintains the largest market share due to stringent compliance requirements, high benefit costs, and early adoption of HR technology, while the Asia Pacific region is poised for the highest growth rate, fueled by expanding corporate sectors and increasing awareness of employee retention strategies in emerging economies. Investment in platforms that handle global regulatory variance and multi-currency transactions is a key regional trend, especially for multinational corporations.

Segment trends highlight the significant growth of the voluntary benefits management segment, where platforms facilitate the integration of niche services like pet insurance, student loan repayment assistance, and subsidized professional development courses. The large enterprise segment continues to be the largest consumer base, demanding advanced analytics, seamless integration with proprietary legacy systems, and robust security features compliant with international standards such as GDPR and CCPA. However, the SME segment is rapidly accelerating its adoption, supported by user-friendly, affordable, and quick-to-deploy cloud-native solutions. Technology trends underscore the incorporation of predictive analytics for benefits utilization forecasting and natural language processing (NLP) for enhanced employee support chatbots, optimizing platform efficiency and employee self-service capabilities.

Overall, the market trajectory is characterized by fierce competition among established HR tech giants and agile niche providers specializing in benefits administration simplification. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach and integrating specialized financial wellness or healthcare technologies are defining the competitive landscape. Success in this environment relies heavily on providing platforms that not only reduce HR administration time but also demonstrably improve employee satisfaction and comprehension of their total rewards. The future growth will be fundamentally tied to the platform's ability to evolve continuously, incorporating emerging regulatory changes and adapting to shifting generational expectations regarding work-life balance and holistic well-being.

AI Impact Analysis on Employee Benefits Platform Market

User queries regarding the impact of Artificial Intelligence (AI) on the Employee Benefits Platform Market primarily revolve around automation efficiency, personalization, and data security. Common questions inquire how AI can automate complex compliance checks across different jurisdictions, whether machine learning can truly personalize benefits recommendations based on individual life events and past behavior, and what the inherent risks are concerning the security and ethical use of sensitive employee health and financial data. There is significant user interest in AI's role in predictive modeling—specifically, forecasting benefits utilization rates, predicting employee turnover based on benefits satisfaction metrics, and optimizing benefit costs through automated plan adjustments. The key theme is the shift from static, reactive benefits administration toward dynamic, personalized, and predictive benefits strategies powered by AI, while managing the attendant complexities of data privacy and algorithmic transparency.

The integration of AI into employee benefits platforms is fundamentally transforming benefits delivery by optimizing administrative workflows and enhancing the employee decision-making process. AI-driven chatbots and virtual assistants provide instantaneous, 24/7 support, answering common queries about plan details, eligibility, and enrollment timelines, thereby drastically reducing the workload on HR personnel. Furthermore, machine learning algorithms analyze vast datasets related to employee demographics, compensation levels, geographic location, and usage patterns to identify optimal plan designs and suggest highly relevant voluntary benefits. This level of personalization significantly increases the perceived value of the benefits package and contributes directly to higher employee engagement and reduced benefits wastage.

Beyond engagement, AI is crucial for maintaining real-time regulatory compliance and mitigating financial risk. Predictive analytics can flag potential issues before they become compliance violations, especially in organizations operating across multiple states or countries with varying legal requirements. For instance, AI can automatically assess if a new employee's profile meets the complex eligibility criteria for various plan tiers or subsidies. Furthermore, AI tools are being deployed to detect anomalies or fraudulent claims patterns within healthcare and insurance data, safeguarding the financial health of the employer's benefits pool. This dual impact—improving both the employee experience and operational integrity—positions AI as an indispensable technological cornerstone for the future growth of the benefits platform market.

- AI-driven Hyper-Personalization: Customizing benefits recommendations based on individual risk profile, life stage, and utilization history, maximizing perceived employee value.

- Automated Compliance Management: Real-time monitoring and alerting for regulatory changes across multiple jurisdictions, reducing compliance risk associated with complex labor laws.

- Enhanced Employee Support: Deployment of NLP-enabled chatbots for instant, accurate answers to common benefits inquiries (enrollment status, claim procedures), improving self-service rates.

- Predictive Benefits Modeling: Utilizing machine learning to forecast benefits utilization, predict future premium costs, and model the impact of plan changes on employee satisfaction and retention.

- Fraud Detection and Anomaly Analysis: Using algorithms to identify suspicious activity or patterns in claims data, optimizing claims processing integrity and reducing healthcare costs.

- Seamless Integration: Facilitating automated data synchronization and mapping between benefits platforms, payroll systems, and carrier networks without manual intervention.

DRO & Impact Forces Of Employee Benefits Platform Market

The market for Employee Benefits Platforms is significantly influenced by a powerful combination of digitalization mandates and workforce shifts, while constrained by data security concerns and complexity of integration. Driving forces center on the urgent need for operational efficiency in HR, the shift towards personalized and holistic employee wellness packages, and the necessity to manage compliance across diverse regulatory landscapes. Restraints primarily involve the high initial investment costs for comprehensive systems, the complexity of integrating new platforms with fragmented legacy HR systems already in place within large organizations, and the persistent challenge of ensuring robust data privacy in handling sensitive health and financial information. Opportunities lie heavily in offering niche, modular solutions, particularly those focused on financial wellness and mental health support, and expanding services to the burgeoning SME segment through simplified, subscription-based SaaS models. These factors collectively exert substantial impact forces, pushing the market toward specialized, cloud-based, and highly secure digital ecosystems.

Drivers: The most significant driver is the increasing recognition among employers that robust, well-communicated benefits are crucial for talent acquisition and retention in a highly competitive labor market. Employers are leveraging these platforms not just as administrative tools but as strategic assets to communicate total rewards effectively. The global proliferation of hybrid and remote work models further necessitates cloud-based platforms that provide equitable access to benefits information and enrollment processes regardless of geographical location. Furthermore, evolving generational expectations (Millennials and Gen Z) demand digital, intuitive self-service tools, abandoning paper-based processes entirely. Regulatory pressures, particularly in sectors like finance and healthcare, requiring auditable, transparent records of employee enrollment and communication also compel organizations to adopt advanced digital platforms.

Restraints: Despite the benefits of modernization, several factors impede market growth. Data security and the risk of breaches represent a major restraint, particularly concerning HIPAA, GDPR, and other strict privacy regulations, leading organizations to exercise extreme caution in adopting new vendors. Another substantial barrier is the inherent complexity and cost associated with migrating from deeply embedded legacy HR and payroll systems to a modern, integrated benefits platform. Often, older systems lack the necessary APIs or data structures for smooth integration, resulting in significant downtime, high implementation costs, and the need for extensive custom development. Additionally, skepticism regarding the ROI of new HR technology, especially in smaller organizations with limited technology budgets, acts as a brake on rapid adoption.

Opportunities: The market presents significant opportunities through specialization and geographical expansion. There is immense potential in developing platforms specifically tailored for niche, voluntary benefits that address contemporary employee needs, such as fertility benefits, student loan contributions, or personalized lifestyle spending accounts (LSAs). Expanding penetration into the rapidly growing Asian and Latin American markets, which are currently lagging in HR digitalization compared to North America and Europe, offers substantial revenue opportunities. Moreover, the shift toward providing integrated financial wellness coaching and fiduciary guidance directly through the benefits platform creates a valuable service differentiation. Finally, targeting the mid-market segment with 'out-of-the-box,' scalable, yet affordable solutions optimized for minimal configuration represents a highly exploitable segment.

Impact Forces: The combined effect of these factors creates a strong impact force favoring rapid consolidation and technological advancement. The intensity of market rivalry is high, forcing vendors to constantly innovate by incorporating AI and advanced data analytics. The bargaining power of employees (buyers) is increasing, as they demand more flexible and customizable benefits, which translates into increased demand for sophisticated platform capabilities. The threat of substitutes remains relatively low as internal manual administration is highly inefficient, and generalized HRIS systems often lack the specialized compliance and carrier integration features required for benefits management. Overall, the dominant impact is the acceleration of the shift towards comprehensive, unified, and employee-centric total rewards platforms, mandatory for attracting and retaining high-quality talent.

Segmentation Analysis

The Employee Benefits Platform Market is segmented based on component type, deployment model, enterprise size, and application type, reflecting the diverse needs across the organizational spectrum. The analysis highlights that the software component segment holds the largest share due to the recurring nature of platform subscriptions and continuous feature upgrades, while the services segment (implementation, consulting, support) is growing rapidly, driven by the need for complex customization and integration expertise. Cloud-based deployment models overwhelmingly dominate the market, offering the flexibility and scalability essential for modern HR operations, especially those supporting geographically dispersed teams. Segmentation by enterprise size reveals the large enterprise segment as the primary revenue generator, although the SME segment is anticipated to exhibit the fastest CAGR, stimulated by accessible SaaS offerings and packaged, easy-to-implement solutions tailored for smaller teams.

Application-wise, the core benefits administration segment remains the foundational element, handling crucial tasks like enrollment, eligibility tracking, and claims processing. However, significant momentum is observed in emerging segments like wellness management and retirement benefits management, as organizations adopt a holistic approach to employee well-being. Segmentation by application type clearly demonstrates the market's evolution from purely transactional systems to integrated total rewards management platforms that address both mandatory and voluntary benefits within a unified ecosystem. Geographic segmentation reinforces the dominance of technologically mature regions like North America and Europe, while acknowledging the high future growth potential in the Asia Pacific region, fueled by increasing industrialization and regulatory standardization.

Understanding these segments is crucial for vendors to tailor their marketing and product development strategies effectively. For instance, platforms targeting large enterprises must prioritize robust API capabilities, stringent security certifications, and global scalability, whereas platforms focusing on SMEs must emphasize low total cost of ownership (TCO), intuitive user interfaces, and rapid deployment cycles. The continuous blurring of lines between mandatory benefits, voluntary perks, and holistic wellness offerings necessitates platforms capable of supporting highly flexible plan structures and complex eligibility rules, ensuring that segmentation strategies align with evolving corporate demands for employee personalization and streamlined HR management.

- By Component:

- Software (Platform Subscriptions)

- Services (Consulting, Implementation, Maintenance, Support)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Core Benefits Administration (Health, Dental, Vision)

- Retirement Benefits Management (401(k), Pensions)

- Voluntary Benefits Management (Life Insurance, Disability, Pet Insurance)

- Wellness Management (Fitness Programs, Mental Health Support)

- Others (FSA/HSA Administration, Leave Management)

- By Industry Vertical:

- IT and Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Others (Government, Education)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Employee Benefits Platform Market

The value chain for the Employee Benefits Platform Market begins with upstream activities focused on technology development and intellectual property creation, primarily involving software architecture design, specialized regulatory compliance modules, and advanced data analytics engine creation. Key upstream players include specialized software developers, data scientists, and AI/ML firms that provide the core intellectual property necessary for platform functionality, compliance tracking, and personalization capabilities. This stage requires significant investment in R&D to ensure the platform remains current with evolving technology standards and complex, localized regulatory changes, which are central to the platform’s core value proposition. The quality of this initial technology input—especially API robustness and security standards—directly determines the platform's market viability and integration potential downstream.

The midstream phase involves the core operations of platform development, including coding, quality assurance, system integration, and configuration for specific client needs. Platform providers acquire technology components from upstream suppliers and transform them into deployable solutions. This stage relies heavily on service delivery capabilities, including project management for large-scale enterprise deployments and ensuring seamless connectivity with thousands of disparate benefits carriers, payroll systems, and healthcare providers globally. Effective vendor management and establishing secure data exchange protocols are critical operational tasks. Furthermore, the midstream phase also incorporates marketing, sales, and channel management, often relying on specialized consultants and brokerage firms that act as indirect distribution channels, advising employers on platform selection and implementation strategy.

The downstream phase is characterized by the delivery of the platform to the end-users (employers and their employees) and continuous post-sales support. Distribution channels are typically dual: direct sales models involving the platform vendor selling directly to large enterprises seeking bespoke configurations, and indirect channels leveraging broker partners, resellers, and systems integrators who facilitate adoption for SMEs and mid-market companies. Post-sales support includes technical maintenance, continuous regulatory updates, and employee training modules. The efficacy of the downstream activities—measured by platform adoption rate, user satisfaction, and effective benefits utilization—is essential for client retention and market reputation. The value generated ultimately flows back to the employer through reduced administrative cost, improved compliance, and enhanced employee retention.

Employee Benefits Platform Market Potential Customers

The primary potential customers and end-users of Employee Benefits Platforms are Human Resources (HR) departments and Chief Financial Officers (CFOs) within organizations of all sizes, though their needs and consumption patterns vary significantly. HR departments are the operational purchasers, seeking platforms to automate enrollment, manage eligibility, ensure compliance, and communicate benefits effectively to employees. Their key purchase criteria revolve around ease of use, integration with existing HRIS, and features that enhance employee engagement, such as mobile access and personalized communication tools. CFOs, conversely, act as strategic approvers, focused on the platform's ability to demonstrate a clear return on investment (ROI) through cost reduction, optimized benefits utilization, and accurate financial forecasting related to employee compensation and risk management.

The target market is fundamentally segmented by enterprise size. Large enterprises (over 1,000 employees) represent the largest revenue segment, requiring highly customizable, complex platforms capable of managing global workforces, multi-currency transactions, and sophisticated self-insurance models. These customers prioritize vendors with strong security certifications (e.g., ISO 27001), deep integration expertise for legacy systems, and comprehensive API documentation. Conversely, Small and Medium Enterprises (SMEs) constitute a massive, untapped opportunity pool. SMEs require platforms that are highly intuitive, offer rapid, standardized deployment (often 'out-of-the-box'), and operate on a predictable, low-cost subscription model, focusing on fulfilling basic compliance and core benefits administration without requiring dedicated IT teams.

Beyond enterprise size, specific industry verticals show heightened demand. The Banking, Financial Services, and Insurance (BFSI) sector, along with Healthcare and Life Sciences, are critical buyers due to stringent regulatory environments (HIPAA, SOX) and the necessity of attracting highly skilled, specialized talent through competitive benefits packages. Additionally, the rapid growth in the Information Technology (IT) and Telecommunications sector globally mandates advanced benefits platforms to support highly distributed and geographically fluid workforces. Ultimately, any organization prioritizing talent retention, regulatory adherence, and operational efficiency in managing employee total rewards is considered a prime potential customer for modern benefits platform solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Benefitfocus, Namely, Workday, SAP (SuccessFactors), Oracle (HCM Cloud), Darwin, PlanSource, bswift (Aetna), Paylocity, Ultimate Software (UKG), ADP, Zenefits, Employee Navigator, Rippling, Limeade, Benefitexpress, Alight Solutions, HealthEquity, ConnectYourCare, ThrivePass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Employee Benefits Platform Market Key Technology Landscape

The contemporary Employee Benefits Platform market is defined by a technological landscape centered on cloud-native architecture, advanced security protocols, and the pervasive integration of intelligent tools. Cloud computing, particularly multi-tenant Software-as-a-Service (SaaS) models, forms the bedrock of modern platforms, offering unparalleled scalability, reliable uptime, and continuous deployment of updates and regulatory patches. This architecture enables organizations to rapidly deploy and scale their benefits administration without substantial in-house infrastructure investment, a crucial requirement for managing peak enrollment periods. The shift to microservices architecture further enhances platform resilience and allows vendors to deploy specialized functionality (like complex tax calculations or carrier connections) independently, speeding up innovation cycles and improving system stability. Security remains paramount, with platforms increasingly relying on multi-factor authentication, robust encryption (both in transit and at rest), and compliance with global data sovereignty laws (e.g., ensuring data residency requirements are met for specific regions).

A second critical technological pillar involves sophisticated integration capabilities, leveraging Application Programming Interfaces (APIs). Modern platforms must offer robust, standardized APIs to facilitate seamless, real-time data exchange with a complex ecosystem of third-party systems, including payroll providers, external healthcare carriers, financial institutions managing retirement accounts, and various HR Information Systems (HRIS). This interoperability is essential to minimize data entry errors, maintain data consistency across organizational systems, and automate crucial workflows such as new hire reporting and termination processing. Furthermore, many platforms are adopting an open API framework, encouraging third-party developers to build niche applications (e.g., specialized financial planners or telehealth integrations) directly onto the benefits platform, creating a more comprehensive and flexible ecosystem for the employer and employee alike.

Finally, the user experience (UX) layer is being revolutionized through mobile-first design and the implementation of Artificial Intelligence (AI) and Machine Learning (ML). Mobile applications are no longer optional but mandatory, providing employees with 24/7, intuitive access to enrollment, plan details, and digital ID cards. AI and ML technologies underpin advanced features such as predictive analytics for benefits modeling, automated helpdesk functionality via conversational AI, and personalized communications delivered through integrated omnichannel campaigns (email, SMS, platform notifications). These technologies dramatically improve employee self-service capabilities, driving higher rates of benefits comprehension and utilization, transforming the platform from a mere administrative tool into an essential employee engagement resource.

Regional Highlights

- North America: Market Dominance and Innovation Hub

- Europe: Focus on Compliance and Work-Life Balance

- Asia Pacific (APAC): Fastest Growth Trajectory

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging Market Penetration

North America, led by the United States, holds the largest market share in the Employee Benefits Platform market. This dominance is attributed to several factors: high healthcare costs necessitating complex plan management; stringent and evolving regulatory requirements (such as the Affordable Care Act and state-specific mandates) that demand sophisticated compliance tracking software; and the widespread early adoption of advanced HR technology solutions. The U.S. market is characterized by a fragmented and highly competitive insurance landscape, requiring platforms with extensive and reliable carrier integration capabilities. Furthermore, the region is a hotbed for technological innovation, with vendors rapidly incorporating AI, blockchain for secure data management, and sophisticated predictive analytics to optimize benefits strategy and cost containment. The mature ecosystem means employers constantly seek platforms that integrate voluntary, compliance, and core benefits into a single, seamless digital experience, driving continuous investment in platform upgrades.

The European market is marked by high diversity in national labor laws, social security systems, and data protection regulations (GDPR). This complexity drives demand for highly localized and configurable platforms capable of managing multi-country benefits administration while maintaining regional compliance. While less focused on complex healthcare plan administration compared to the US, the European market places significant emphasis on work-life balance benefits, flexible working arrangements, and statutory entitlements (e.g., parental leave, holiday allowance). Demand is strong for platforms that automate compensation and leave management and integrate total reward statements transparently. The UK, Germany, and France are the major contributors, with the market shifting rapidly towards cloud-based solutions to replace older, decentralized on-premise systems.

The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, industrialization, increasing foreign investment, and the subsequent standardization of HR practices across major economies like China, India, and Southeast Asian nations. Although many organizations in this region still rely on manual or localized systems, the increasing presence of multinational corporations is accelerating the need for global, scalable benefits platforms. Key growth drivers include rising employee expectations for structured benefits, increasing competitive pressure for skilled labor, and the growing regulatory push towards formalized employee welfare programs. The market here demands flexible platforms that can manage unique regional statutory requirements and adapt to diverse language and cultural contexts.

The LATAM and MEA regions represent emerging opportunities, characterized by lower current penetration but significant potential for rapid expansion. Growth in these areas is spurred by modernization efforts within the corporate sector, increasing internet penetration, and the need for standardized HR practices across local subsidiaries of international firms. LATAM markets, such as Brazil and Mexico, are focusing on adopting cloud platforms to manage complex labor laws and local taxation requirements efficiently. In the MEA, particularly the GCC countries, large governmental and private sector investments in diversified economies are increasing the demand for world-class employee benefits to attract global talent. Vendors entering these markets must prioritize localization, adherence to nascent data protection laws, and flexibility in managing rapidly changing economic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Employee Benefits Platform Market.- Workday, Inc.

- SAP SE (SuccessFactors)

- Oracle Corporation (HCM Cloud)

- Automatic Data Processing, LLC (ADP)

- UKG (Ultimate Kronos Group)

- Benefitfocus, Inc.

- Namely, Inc.

- PlanSource, Inc.

- bswift (Aetna/CVS Health)

- Alight Solutions LLC

- Darwin (owned by Mercer)

- Zenefits (TriNet)

- Rippling

- Employee Navigator, LLC

- Paylocity Holding Corporation

- Limeade, Inc.

- HealthEquity, Inc.

- Voya Financial

- ConnectYourCare

- ThrivePass

Frequently Asked Questions

Analyze common user questions about the Employee Benefits Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of adopting a cloud-based Employee Benefits Platform?

The primary benefit of adopting a cloud-based Employee Benefits Platform is enhanced operational scalability, coupled with reduced IT overhead and guaranteed real-time compliance updates. Cloud platforms facilitate seamless access for remote employees, ensure robust data security via centralized encryption, and allow for rapid integration with existing HR and payroll systems via open APIs, significantly lowering the total cost of ownership (TCO) compared to legacy on-premise solutions. Furthermore, they provide continuous access to the latest technological innovations, including AI-driven personalization tools, without requiring manual software installation or updates.

How does an Employee Benefits Platform ensure regulatory compliance in multinational organizations?

An Employee Benefits Platform ensures regulatory compliance in multinational organizations through automated, geographically targeted compliance modules. These platforms centralize regulatory data, automatically applying local tax laws, statutory contribution rules, and reporting requirements (such as ACA in the US or GDPR in Europe) based on the employee's location. By integrating a dynamic compliance engine, the platform minimizes the risk of human error during enrollment and reporting, providing auditable records and proactive alerts when potential violations or regulatory deadlines approach in diverse jurisdictions, which is critical for mitigating costly penalties.

What role does AI and Machine Learning play in optimizing employee benefits strategy?

AI and Machine Learning (ML) optimize employee benefits strategy by enabling highly accurate predictive modeling and hyper-personalization. ML algorithms analyze historical enrollment data, demographic factors, and utilization patterns to forecast future cost liabilities and identify areas of low engagement, allowing employers to adjust plan designs strategically. AI-driven recommendation engines guide employees to the most suitable plan options based on their personal profile and life events, increasing benefits perceived value, boosting employee satisfaction, and ensuring resources are allocated efficiently rather than relying on generalized plan offerings.

What are the key challenges when integrating a new Benefits Platform with existing HRIS systems?

The key challenges when integrating a new Benefits Platform with existing HRIS systems typically revolve around data mapping complexities and the lack of robust API access in legacy systems. Older HRIS platforms often use proprietary data structures, making the synchronization of employee data (eligibility, compensation, life events) cumbersome and prone to error. Successful integration requires meticulous data cleansing, custom middleware development, and comprehensive testing to ensure real-time, bidirectional data flow between the benefits platform and the core HR system without compromising data integrity or security protocols during the migration process.

How are benefits platforms supporting the demand for financial wellness and voluntary benefits?

Benefits platforms are supporting the growing demand for financial wellness and voluntary benefits by offering flexible, modular architecture that easily integrates third-party financial tools and non-traditional perks. They provide unified access to voluntary plans (like pet insurance or student loan repayment assistance) alongside core benefits, using personalized dashboards and decision support tools. Many platforms now embed features like budgeting calculators, educational content on financial literacy, and connections to certified financial advisors, consolidating the total rewards package and empowering employees to improve their holistic financial health directly within the HR technology ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager