EMT Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435574 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

EMT Fittings Market Size

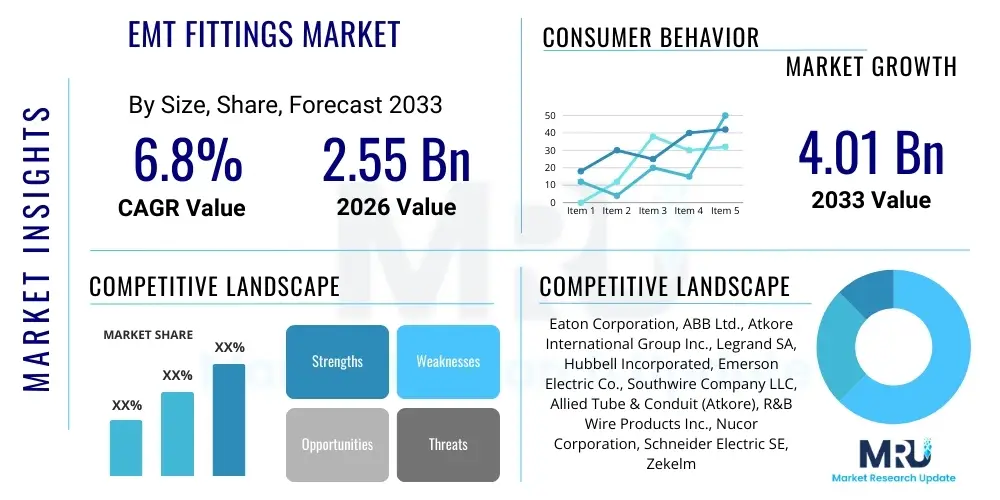

The EMT Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.55 Billion in 2026 and is projected to reach USD 4.01 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global construction activity, especially in developing economies, coupled with stringent safety regulations mandating the secure installation and protection of electrical wiring systems across residential, commercial, and industrial infrastructure.

EMT Fittings Market introduction

The Electrical Metallic Tubing (EMT) fittings market encompasses a range of crucial components used to connect, join, and secure sections of EMT conduit, ensuring the integrity and safety of electrical raceway systems. EMT fittings, including couplings, connectors, elbows, and conduit bodies, are indispensable for navigating electrical wiring through complex structural paths while shielding conductors from environmental damage, mechanical abrasion, and potential fire hazards. The primary function of these fittings is to maintain a continuous grounded system and facilitate seamless transitions between different sections of the conduit, adhering strictly to national and international electrical codes, such as those set by the National Electrical Code (NEC) in the United States and similar bodies globally. These components are predominantly utilized in non-hazardous locations and serve as a cost-effective, lightweight alternative to Rigid Metal Conduit (RMC), driving their widespread adoption.

Product variation within the EMT fittings segment is significant, catering to diverse installation requirements and environmental conditions. Key types include set-screw fittings, which are typically used in dry locations for quick and reliable connections, and compression fittings, often deployed where enhanced moisture protection and stronger mechanical bonds are necessary. Materials commonly employed in manufacturing include die-cast zinc, galvanized steel, and aluminum, each offering different levels of corrosion resistance, strength, and cost efficiency. The material choice often dictates the application environment; for instance, galvanized steel fittings are preferred in demanding industrial settings where mechanical abuse is a concern, while zinc fittings dominate general commercial and residential applications due to their balance of cost and performance.

Major applications of EMT fittings span the entire construction landscape. In commercial buildings, they are heavily used in office towers, retail centers, and data centers to manage extensive wiring networks for lighting, power distribution, and low-voltage systems. Residential construction utilizes them primarily in utility areas, basements, and garages to protect vital circuits. Industrially, applications include manufacturing plants, processing facilities, and utility infrastructure where protecting conductors against dust, humidity, and vibration is paramount. The increasing demand for resilient and energy-efficient building infrastructure, driven by urbanization and modernization efforts across Asia Pacific and the Middle East, serves as a fundamental driving factor for sustained market expansion, emphasizing safety and compliance in all electrical installations.

EMT Fittings Market Executive Summary

The EMT Fittings Market is experiencing robust expansion driven by global trends favoring smart infrastructure development and increased regulatory oversight concerning electrical safety. Business trends indicate a strong move toward lightweight, durable materials like specialized zinc alloys and enhanced corrosion-resistant coatings to improve product longevity and ease of installation, thereby reducing overall labor costs for electrical contractors. Manufacturers are focusing on developing innovative, tool-less connection systems, such as quick-snap or push-fit connectors, to optimize installation speed, particularly critical in large-scale commercial projects facing tight timelines. Consolidation among major players and strategic acquisitions of regional specialists are defining the competitive landscape, aiming to broaden product portfolios and strengthen supply chain resilience against fluctuating raw material prices, particularly steel and zinc.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily fueled by massive infrastructure investments in China, India, and Southeast Asian nations, focusing on urbanization, new factory construction, and modernization of electrical grids. North America, while mature, remains a cornerstone market, sustained by constant maintenance, renovation, and strict adherence to the National Electrical Code (NEC), which drives demand for high-quality, certified fittings. Europe demonstrates steady growth, concentrating on sustainable building practices and smart home technologies, which necessitate reliable and aesthetically integrated conduit systems. The Middle East and Africa (MEA) are emerging due to large-scale development projects, including mega-cities and industrial zones, demanding standardized and reliable electrical containment solutions.

Segment trends underscore the dominance of the set-screw fitting type due to its cost-effectiveness and rapid installation capabilities, though compression fittings are gaining traction in moisture-prone and critical environments. Zinc-based fittings maintain the largest market share by material, offering an optimal blend of performance and economy for general applications. However, galvanized steel fittings command significant value share in heavy industrial sectors where mechanical protection is paramount. The commercial application segment, encompassing office buildings, healthcare facilities, and retail spaces, remains the largest end-user segment, consistently requiring large volumes of diverse fittings to accommodate intricate wiring schematics associated with modern building management systems and enhanced connectivity requirements.

AI Impact Analysis on EMT Fittings Market

User queries regarding AI's impact on the EMT fittings market often center on how automation and digitization might transform manufacturing processes, supply chain management, and future product design. Common questions include the feasibility of using AI for predictive maintenance in electrical systems, optimizing material usage in fittings production to reduce waste, and leveraging generative design algorithms to create lighter yet stronger connector designs. Users are also concerned about the integration challenges of traditional conduit systems with AI-powered Building Management Systems (BMS) and whether smart fittings, capable of providing real-time diagnostic data, will become the industry standard. The collective expectation is that AI will primarily enhance operational efficiency and quality control rather than directly replacing the physical components themselves, while potentially disrupting traditional inventory and procurement models.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) in the EMT fittings sector is primarily realized upstream in the manufacturing and operational phases. AI-driven manufacturing processes enable highly precise quality control by analyzing real-time sensor data from casting or stamping machines, ensuring that the dimensional tolerances of fittings, critical for secure installation, are consistently met. This predictive quality assurance significantly reduces defects and material waste. Furthermore, AI algorithms are being employed in logistics and supply chain optimization, predicting demand fluctuations with higher accuracy, thus helping manufacturers maintain optimal inventory levels of raw materials (zinc, steel) and finished products, leading to reduced warehousing costs and improved order fulfillment rates for distributors and contractors.

Looking forward, AI is expected to play a crucial role in product innovation and application design. Generative AI tools can rapidly prototype thousands of potential fitting geometries, optimizing for weight reduction, material efficiency, and improved mechanical strength, particularly concerning pull-out resistance and seismic performance. While the fitting itself remains a passive component, the systems they support—data centers, smart factories, and modern urban infrastructure—are heavily reliant on AI. Consequently, ensuring that fittings support increasingly complex and data-heavy electrical installations (e.g., through superior shielding characteristics or ease of inspection using robotics) becomes a critical design parameter influenced indirectly by the proliferation of intelligent building technologies.

- AI enhances manufacturing quality control via real-time data analysis.

- Predictive modeling optimizes raw material inventory and logistics for zinc and steel.

- Generative design tools accelerate R&D for lighter, high-performance fitting geometries.

- Integration of ML in Building Management Systems (BMS) drives demand for compliant and reliable conduits.

- Automated inspection systems utilize computer vision for rapid, defect-free product verification.

DRO & Impact Forces Of EMT Fittings Market

The EMT Fittings Market dynamic is fundamentally shaped by a combination of powerful drivers, essential restraints, significant opportunities, and external impact forces. A primary driver is the accelerating pace of global urban development and infrastructure renewal, particularly evident in Asia and the Middle East, which mandates the installation of new electrical systems requiring extensive conduit and fitting networks. Complementary to this is the stringent regulatory environment worldwide, where safety codes like NEC continually evolve, compelling the use of certified and high-quality fittings to minimize electrical hazards, thereby sustaining demand for compliant products. Restraints mainly revolve around the volatile pricing of key raw materials, specifically zinc and steel, which directly impacts manufacturing costs and profit margins. Furthermore, the availability and competitive pricing of alternative wiring systems, such as flexible conduit or cable tray systems in specific industrial applications, pose a continuous competitive challenge to EMT systems.

Opportunities for market growth are strongly tied to the expansion of renewable energy infrastructure, notably solar and wind farms, which require robust and weather-resistant conduit systems for interconnection and power transmission. Additionally, the proliferation of data centers and the 5G rollout necessitate vast, reliable electrical infrastructure, driving demand for specialized fittings optimized for high-density wiring environments. Technological innovation in installation methods presents another opportunity; the move towards quick-connect and push-fit fittings minimizes installation time, making EMT systems more attractive to contractors seeking labor efficiency improvements. Manufacturers who successfully integrate superior corrosion resistance and fire-retardant properties into their products will be strategically positioned to capture high-value project segments in harsh or regulated environments.

Impact forces on the market include geopolitical instability affecting global trade routes and raw material procurement, as well as rapid technological shifts in the construction industry, such as modular construction techniques. The adoption of pre-fabricated electrical assemblies can either boost the use of specific, pre-attached fittings or potentially bypass traditional on-site conduit installation methods. Environmental regulations pushing for sustainable manufacturing practices necessitate the adoption of cleaner production technologies and the use of recyclable materials, impacting the overall cost structure and material sourcing strategy for fitting producers. The cumulative effect of these forces suggests a market leaning towards specialized, high-performance, and easily installable fittings that meet evolving safety standards while addressing supply chain vulnerabilities and cost pressures.

Segmentation Analysis

The EMT Fittings Market segmentation provides a granular view of market dynamics based on Type, Material, and Application, allowing stakeholders to identify high-growth sub-sectors and tailor their strategies effectively. The classification by Type—primarily Compression Fittings and Set-Screw Fittings—reflects the installation requirements, with Set-Screw fittings dominating volume due to ease of use and cost-effectiveness, while Compression fittings capture higher value in moisture-sensitive or vibration-prone installations. Material segmentation (Zinc, Steel, Aluminum) dictates performance attributes, where Zinc remains the volume leader, balancing cost and performance, but steel and aluminum cater to specialized needs requiring maximum durability or lightweight properties, respectively. This structural breakdown is crucial for understanding the product mix necessary to serve the diverse global construction sector.

Segmentation by Application is critical for revenue forecasting, differentiating demand across Commercial, Residential, and Industrial sectors. Commercial construction, encompassing everything from office buildings to hospitals, constitutes the largest and most stable segment due to continuous renovation and new build activity requiring sophisticated electrical networks. The Industrial segment, characterized by high safety and durability standards, demands premium, heavy-duty fittings often made of galvanized steel to withstand harsh operational environments. Although the Residential segment uses fewer fittings per structure compared to commercial projects, its vast scale in rapidly urbanizing areas worldwide ensures consistent baseline demand, typically for standard, cost-efficient zinc fittings.

Detailed analysis of these segments reveals shifts in purchasing behavior. For instance, increasing digitalization and the need for reliable power in data centers drive demand within the commercial segment for high-specification, low-profile fittings that maximize space efficiency within tight wall cavities and plenum spaces. Meanwhile, the growing emphasis on worker safety and efficiency in all segments is accelerating the transition from traditional labor-intensive fitting methods to innovative, tool-less solutions. Manufacturers are strategically targeting these high-growth niches, investing in specific product lines that comply with regional seismic and fire codes, enhancing market penetration within defined application segments globally.

- Type:

- Compression Fittings

- Set-Screw Fittings

- Threaded Fittings

- Couplings

- Connectors

- Elbows and Bends

- Material:

- Zinc (Die-Cast)

- Steel (Galvanized)

- Aluminum

- Non-Metallic (Limited Use)

- Application:

- Commercial Construction (Office, Retail, Healthcare)

- Residential Construction (Homes, Apartments)

- Industrial Facilities (Manufacturing, Utilities, Processing Plants)

Value Chain Analysis For EMT Fittings Market

The value chain for the EMT Fittings market begins with the upstream sourcing of raw materials, primarily zinc ingots, steel coils (for galvanized products), and aluminum alloys. Material suppliers, often large global commodity companies, exert significant influence over the initial cost structure due to volatile pricing and supply chain complexities. Manufacturers of EMT fittings then perform crucial conversion processes, including die-casting (for zinc/aluminum), stamping, machining, and surface treatment (e.g., electroplating or galvanizing) to produce finished, highly standardized components. Operational efficiency and energy costs at the manufacturing stage are key determinants of profitability. Ensuring compliance with quality standards like UL, CSA, and CE marking at this stage is mandatory before products enter the distribution channels.

Midstream activities involve sophisticated distribution networks designed to reach the fragmented customer base of electrical contractors and builders. The distribution channel is typically multi-tiered, involving large national and international electrical wholesalers (indirect sales) who maintain extensive inventories and provide rapid fulfillment services. Direct sales channels, though less common for standardized fittings, are often used for very large-scale infrastructure projects or specialized product lines, allowing manufacturers greater control over pricing and technical support. The effectiveness of the distribution network is paramount, as electrical fittings are typically high-volume, low-margin components that require just-in-time delivery to construction sites to avoid project delays.

Downstream, the end-users—electrical contractors and construction companies—select fittings based on project specifications, cost, ease of installation, and compliance requirements. Their purchasing decisions are heavily influenced by the availability of stock at local distributors and the long-term reliability of the fitting, which directly impacts the structural integrity of the electrical system. The value chain concludes with installation, where labor costs form a significant part of the overall project expenditure, thereby favoring innovative fittings that minimize installation time. Continuous feedback loops from contractors regarding product handling and performance are vital for manufacturers to drive future product improvements and maintain market relevance.

EMT Fittings Market Potential Customers

The primary consumers and buyers in the EMT Fittings Market are specialized entities within the construction and infrastructure development sectors globally. The largest volume buyers are electrical contractors and subcontractors who are responsible for the on-site installation of electrical raceway systems in new construction and renovation projects. These professionals typically purchase fittings in bulk through regional or national electrical wholesalers, prioritizing product availability, adherence to local building codes (like NEC compliance), price, and ease of use. Their demand is directly correlated with the cyclical nature of the construction industry and the volume of commercial and residential permits issued in a given area. For contractors, the quality and reliability of the fitting are crucial, as failure can lead to costly rework and safety issues.

Institutional and industrial end-users also constitute a significant customer base, often involving facility maintenance managers or specialized engineering firms. Large organizations, such as hospitals, universities, data center operators, and utility companies, frequently purchase fittings for maintenance, upgrades, and large internal projects. These customers often demand fittings with specific performance criteria, such as superior corrosion resistance, fire resistance, or heavy-duty mechanical protection, especially in critical infrastructure where downtime is unacceptable. They often engage in direct procurement or work through high-tier industrial distributors capable of handling complex technical specifications and large procurement contracts.

Additionally, original equipment manufacturers (OEMs) who produce electrical panels, machinery, and pre-fabricated building modules represent a growing customer segment. These OEMs integrate EMT fittings into their manufactured assemblies before they reach the final installation site, seeking highly standardized, reliable components that integrate seamlessly with their production processes. The decision-making unit for this segment focuses heavily on consistency of supply, bulk pricing discounts, and standardized packaging tailored for assembly line efficiency. The collective needs of these diverse customer segments drive innovation in manufacturing and distribution strategies across the entire EMT fittings value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.55 Billion |

| Market Forecast in 2033 | USD 4.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, ABB Ltd., Atkore International Group Inc., Legrand SA, Hubbell Incorporated, Emerson Electric Co., Southwire Company LLC, Allied Tube & Conduit (Atkore), R&B Wire Products Inc., Nucor Corporation, Schneider Electric SE, Zekelman Industries, Galaxy Wire & Cable Inc., Calpipe Industries, AFC Cable Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EMT Fittings Market Key Technology Landscape

The technology landscape within the EMT Fittings market is characterized less by fundamental component invention and more by continuous process innovation, material science advancements, and design optimization focused on ease of installation and regulatory compliance. A key technological focus remains on advanced die-casting techniques, particularly for zinc fittings, where high-pressure and vacuum casting methods are utilized to produce components with superior surface finish, tighter dimensional tolerances, and improved mechanical properties, reducing the likelihood of cracking or premature failure during installation. Surface treatment technology, including specialized galvanization processes and eco-friendly electroplating, is also critical for enhancing the corrosion resistance of fittings, thereby expanding their applicability in humid or exposed environments without significantly increasing costs.

A significant technological development driving market adoption is the evolution of quick-installation mechanisms. Traditional set-screw fittings, while common, are giving way to innovative push-fit or snap-on technologies. These advanced fittings utilize specialized internal spring mechanisms, gripping rings, or proprietary locking systems that allow contractors to connect conduit sections merely by pushing them together, eliminating the need for extensive threading, tightening, or specialized tools. This shift drastically reduces labor time on site, translating directly into project cost savings, making these high-technology fittings increasingly preferred in large commercial and data center projects where speed is critical. Furthermore, the standardization of these connection methods ensures consistent mechanical and electrical bonding, enhancing overall system safety and adherence to performance standards.

The manufacturing process is also being heavily influenced by Industry 4.0 technologies. Robotics and highly automated assembly lines ensure consistent high-volume production with minimal variance. Digital twin technology is increasingly applied in complex mold design for fittings, allowing manufacturers to simulate material flow and cooling processes to optimize cycle times and prevent casting defects before physical production begins. While EMT fittings themselves are non-electronic, the technology behind their production—focused on precision engineering, material durability, and standardized performance testing (e.g., pull-out testing, continuity testing)—remains central to maintaining market competitiveness and addressing the strict quality demands imposed by global electrical safety codes.

Regional Highlights

- North America: North America, particularly the United States, holds a significant and mature share of the EMT Fittings market, driven primarily by strict adherence to the National Electrical Code (NEC) and frequent renovation cycles of existing commercial infrastructure. The market is characterized by high demand for UL-listed products and an increasing preference for labor-saving devices, such as specialized quick-connect fittings, due to high labor costs. Sustained investment in data center expansion and sophisticated building automation systems ensures stable, high-value demand.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is attributable to massive government investment in infrastructure (railways, smart cities, power grids) and exponential growth in industrial and commercial construction, particularly in India, China, and Southeast Asian economies like Vietnam and Indonesia. While price sensitivity is higher here, the sheer volume of construction activity provides unparalleled market expansion opportunities, favoring standardized and high-volume zinc fittings.

- Europe: The European market demonstrates steady, quality-focused growth, influenced by rigorous CE certification requirements and a strong emphasis on sustainability and energy efficiency in construction. Demand is stable, supported by infrastructure maintenance and the ongoing transition toward smart building technologies. Germany, France, and the UK are key markets, prioritizing high-quality, corrosion-resistant steel fittings for industrial and specialized commercial installations.

- Middle East and Africa (MEA): The MEA region is an emerging high-potential market, fueled by large-scale, long-term development projects such as Saudi Vision 2030 and significant construction in the UAE. Demand in this region is characterized by the need for robust, durable fittings capable of withstanding extreme environmental conditions (high heat, humidity, and salinity), driving the adoption of premium galvanized and treated steel products.

- Latin America: Latin America shows moderate growth, recovering from economic volatility, with Brazil and Mexico being the key contributors. Market expansion is closely tied to residential expansion and local manufacturing growth. Challenges include varying regional electrical standards, but increasing regulatory harmonization efforts are gradually driving demand for internationally certified, standardized EMT fittings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EMT Fittings Market.- Eaton Corporation

- ABB Ltd.

- Atkore International Group Inc.

- Legrand SA

- Hubbell Incorporated

- Emerson Electric Co.

- Southwire Company LLC

- Allied Tube & Conduit (Atkore)

- R&B Wire Products Inc.

- Nucor Corporation

- Schneider Electric SE

- Zekelman Industries

- Calpipe Industries

- AFC Cable Systems

- T&B Fittings (A Division of ABB)

- Anvil International

- Picoma Industries

- Wheatland Tube Company

- Champion Fiberglass Inc.

- Garvin Industries

Frequently Asked Questions

Analyze common user questions about the EMT Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between set-screw and compression EMT fittings?

Set-screw fittings utilize one or more screws to secure the conduit, offering a faster, lower-cost connection suitable for dry locations. Compression fittings, conversely, use a nut that tightens down on a compression ring, providing a superior mechanical bond and enhanced protection against moisture and dust, making them preferred for damp or outdoor environments and critical applications requiring higher vibration resistance and superior grounding integrity. Compression types generally have a higher initial cost but offer enhanced longevity and system protection.

Which material dominates the EMT Fittings Market and why are zinc fittings so widely used?

Die-cast zinc dominates the EMT fittings market by volume due to its optimal balance of cost-effectiveness, lightweight properties, and sufficient corrosion resistance for standard indoor commercial and residential applications. Zinc fittings are easily manufactured through high-speed casting processes, allowing for economical mass production. While galvanized steel offers superior mechanical strength and corrosion resistance for industrial use, zinc remains the default choice for general-purpose applications where cost and installation speed are primary considerations for electrical contractors.

How do global electrical safety standards impact the demand for EMT fittings?

Global standards, such as the U.S. National Electrical Code (NEC) and regional regulations like UL, CSA, and CE marking, fundamentally drive market demand. These standards mandate the use of certified fittings to ensure system grounding, prevent mechanical damage to conductors, and limit fire spread. Compliance is non-negotiable for project approval, compelling contractors to purchase high-quality, certified products, thus sustaining demand and limiting the penetration of uncertified or inferior products in regulated markets.

What major opportunities are driving growth in the APAC region for EMT fittings manufacturers?

The APAC region's growth is primarily fueled by rapid urbanization, massive state-backed infrastructure projects (e.g., smart city development, high-speed rail networks), and the expansion of the regional manufacturing base. Specifically, the accelerated rollout of large commercial data centers and telecommunications infrastructure across nations like India and Indonesia requires extensive, standardized electrical containment systems, creating high-volume demand for both standard and specialized EMT fittings.

Are innovative, tool-less fittings replacing traditional EMT connections, and what is the benefit?

Yes, innovative quick-connect, push-fit, and snap-on fittings are increasingly replacing traditional set-screw and labor-intensive connection methods, particularly in high-volume commercial construction projects. The main benefit is a dramatic reduction in installation labor time and associated costs. These modern designs often ensure a more reliable and consistent connection quality, minimizing the potential for human error during the tightening process and contributing significantly to overall project efficiency and timely completion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager