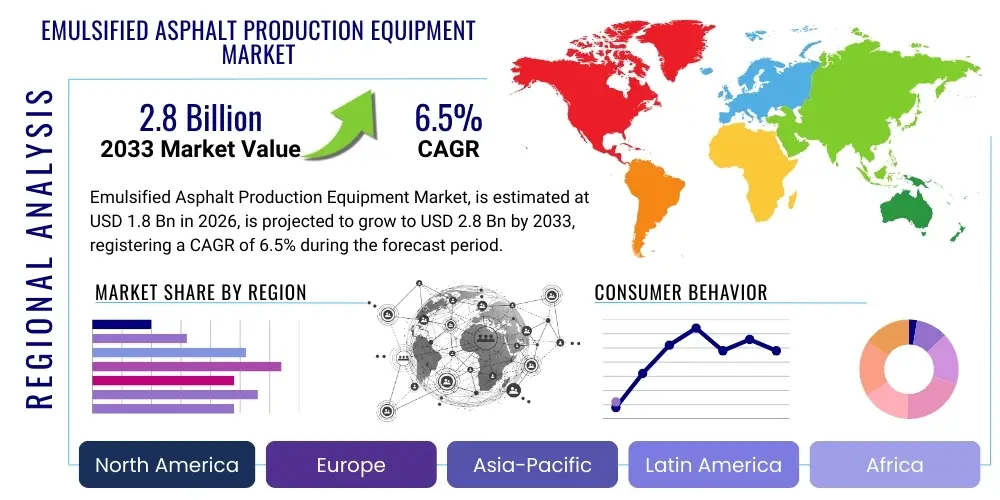

Emulsified Asphalt Production Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437652 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Emulsified Asphalt Production Equipment Market Size

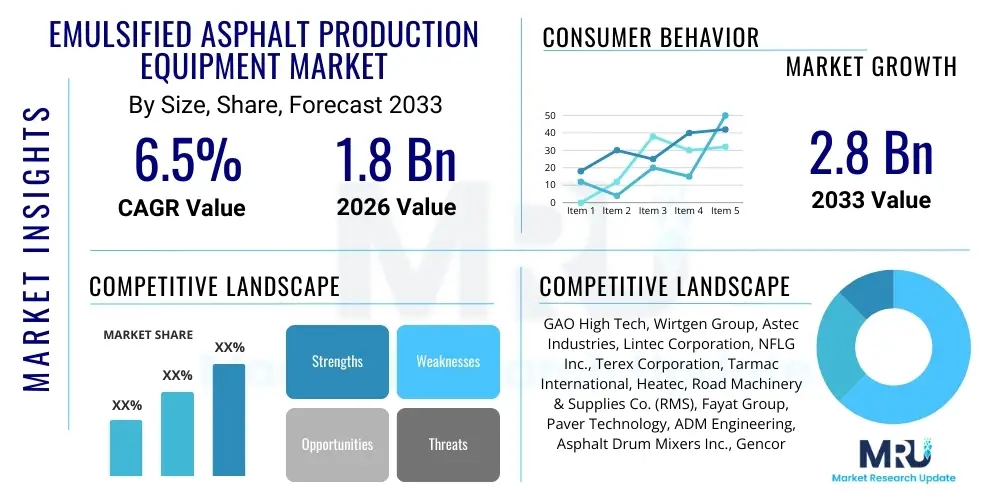

The Emulsified Asphalt Production Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Emulsified Asphalt Production Equipment Market introduction

The Emulsified Asphalt Production Equipment Market encompasses machinery essential for creating asphalt emulsions—stable mixtures of asphalt binder, water, and an emulsifying agent. These emulsions are crucial for sustainable and low-temperature road construction and maintenance, offering significant environmental benefits compared to traditional hot-mix asphalt (HMA). Key equipment includes high-shear colloid mills, specialized mixers, heating systems, proportioning units, and storage tanks, all integrated into complex plants designed to handle precise chemical dosing and temperature control required for stable emulsion formulation. The introduction of standardized equipment has accelerated the adoption of surface treatments like chip seals, slurry seals, and micro-surfacing globally, driving consistent market demand.

The primary product function of this equipment is the mechanical reduction of hot asphalt cement into microscopic particles (typically 0.1 to 5 microns) that are dispersed uniformly throughout a continuous aqueous phase. This process requires robust and highly accurate machinery, particularly the colloid mill, which determines the stability and performance characteristics of the final emulsion. Major applications span government infrastructure projects, private commercial developments, and airfield maintenance. The market’s growth is fundamentally tied to increasing global emphasis on infrastructure repair, coupled with stringent environmental regulations pushing for cooler application technologies.

Benefits derived from emulsified asphalt include reduced energy consumption during pavement operations, lower volatile organic compound (VOC) emissions, and improved safety due to reduced required working temperatures. Driving factors for the equipment market growth include massive global investment in road network expansion and rehabilitation, particularly in developing economies, the technological advancement in polymer-modified emulsions (PMEs) demanding more sophisticated mixing equipment, and the operational efficiency improvements offered by automated, high-capacity production plants. Furthermore, the life cycle cost-effectiveness of asphalt emulsions in pavement preservation techniques encourages continued investment in modern production equipment capable of manufacturing high-quality, specialty emulsions.

Emulsified Asphalt Production Equipment Market Executive Summary

The Emulsified Asphalt Production Equipment Market is experiencing robust expansion driven primarily by escalating global infrastructure spending and the persistent need for sustainable pavement preservation techniques. Key business trends indicate a definitive shift toward automated, modular, and higher-capacity production units that can handle complex polymer-modified asphalt (PMA) formulations, catering to the demand for durable, long-life pavements. Manufacturers are increasingly focusing on integrating advanced process control systems and IoT capabilities to enhance operational efficiency, material precision, and remote diagnostics, thus lowering overall production costs for end-users like national road agencies and private contractors. Strategic mergers and acquisitions among equipment providers are leading to consolidated market expertise and wider geographical distribution capabilities, influencing competitive dynamics significantly.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, extensive government-backed road development programs in countries like China and India, and a burgeoning acceptance of emulsion technologies over traditional methods. North America and Europe, characterized by mature infrastructure, exhibit high demand for advanced, precision-focused equipment tailored for specialized maintenance activities, such particularly micro-surfacing and thin overlays. Trends in these mature markets highlight the necessity for equipment compliance with rigorous sustainability standards and the capacity to produce emulsions suitable for specialized high-traffic urban environments. Investment in localized production facilities across emerging regions is a significant trend enhancing market penetration.

Segmentation trends indicate that medium-capacity mobile plants remain crucial for localized, decentralized production, especially in rural or geographically challenging areas, offering flexibility and lower mobilization costs. However, the high-capacity, permanent plant segment is dominating revenue due to its superior output rates and ability to produce complex, high-performance emulsions required for large-scale highway projects. Technologically, the shift towards continuous operation plants utilizing high-shear colloid mills is undeniable, optimizing particle size distribution and emulsion stability. Applications within pavement maintenance are expanding faster than new road construction, necessitating versatile equipment capable of handling a wide range of aggregate and binder combinations essential for various surface treatments.

AI Impact Analysis on Emulsified Asphalt Production Equipment Market

Common user questions regarding AI's impact on this market revolve around predictive maintenance capabilities, optimization of production recipes, and enhanced quality control during the emulsification process. Users are keen to understand how AI algorithms can analyze real-time data streams from temperature sensors, flow meters, and chemical dosing systems to prevent equipment failure and ensure emulsion stability, which is highly sensitive to input variations. Key concerns include the initial cost of implementing AI-driven sensors and software, data security, and the necessity for specialized operator training. Expectations are high that AI will move asphalt emulsification from an empirical process to a data-driven science, dramatically improving material consistency and reducing costly batch failures that are endemic to traditional manufacturing methods. The integration of AI is expected to standardize global production quality, making specialized emulsions more accessible and reliable.

The deployment of Artificial Intelligence and machine learning models within the emulsified asphalt production domain focuses predominantly on optimizing material inputs and process parameters. AI systems can continuously monitor raw material quality—specifically the properties of the base asphalt cement and the aqueous phase components—and dynamically adjust mixing ratios, shear rates, and heating profiles in real-time. This dynamic control ensures the manufactured emulsion meets precise specifications (such as viscosity, settlement, and storage stability) even when input materials show minor deviations. This level of optimization significantly reduces material wastage and enhances the overall shelf life and performance of the final asphalt product. Furthermore, AI is critical for automating compliance checks against various international standards.

Beyond process optimization, AI systems are revolutionizing equipment maintenance schedules. By analyzing historical performance data, operational loads, vibration signatures, and thermal patterns of critical components like colloid mills and high-pressure pumps, AI can accurately predict the remaining useful life (RUL) of machinery parts. This enables a shift from reactive or time-based maintenance to true predictive maintenance, minimizing unplanned downtime—a major operational cost factor in continuous production environments. The ability of AI to diagnose subtle component degradation before catastrophic failure ensures higher utilization rates and prolongs the service life of high-value production equipment, representing a significant enhancement in asset management efficiency for plant owners.

- AI enables predictive maintenance, forecasting equipment failures and minimizing unplanned downtime in colloid mills and pumps.

- Machine learning optimizes emulsion formulation recipes by analyzing real-time input variables (temperature, flow, chemical concentration).

- Advanced pattern recognition improves quality control, ensuring consistent particle size distribution and stability across batches.

- Automated process control reduces human error and standardizes output quality, critical for polymer-modified emulsions (PMEs).

- AI-driven energy management systems optimize heating and mixing cycles, reducing overall power consumption per ton of emulsion produced.

DRO & Impact Forces Of Emulsified Asphalt Production Equipment Market

The market for Emulsified Asphalt Production Equipment is shaped by a powerful confluence of infrastructural demands, environmental mandates, technological innovation, and economic constraints. The primary drivers include massive global highway construction and rehabilitation programs, especially those emphasizing pavement preservation technologies which rely heavily on emulsions for cost-effective, durable surface treatments. The increasing global awareness and regulatory push towards sustainable construction practices—specifically reducing dependence on high-temperature hot-mix asphalt (HMA)—provide a substantial tailwind. Opportunities exist in developing modular, highly mobile equipment for rapid deployment in geographically remote areas and integrating smart manufacturing capabilities for process automation and quality assurance. However, the market faces restraints such as the high initial capital investment required for sophisticated, high-capacity plants and the inherent complexity of managing chemical inputs, requiring highly skilled labor for operation and maintenance.

Driving forces center on the economic advantages of asphalt emulsions. Emulsified asphalt allows pavement maintenance to be carried out at ambient temperatures, translating to lower fuel costs, reduced greenhouse gas emissions, and safer working conditions compared to hot processes. Furthermore, the effectiveness of specialty emulsions in complex applications like cold-mix recycling and soil stabilization mandates the use of specialized, high-precision manufacturing equipment, bolstering demand. Regional governments' long-term maintenance budgets often favor emulsion-based solutions due to their excellent cost-to-performance ratio for low-volume roads and preventive maintenance schedules. This macroeconomic stability in infrastructure investment is a key driver for equipment procurement cycles.

Restraints are often technical and logistical. The stability and performance of asphalt emulsions are highly sensitive to raw material quality (especially water hardness, pH, and asphalt source), demanding complex chemical controls that increase equipment sophistication and operational cost. Moreover, fluctuations in crude oil prices directly impact the cost of base asphalt, introducing volatility into the return on investment calculations for plant operators. Impact forces, therefore, include technological change (the rapid evolution of polymer modifiers requiring new equipment designs), regulatory shifts (stricter environmental rules favoring low-emission technologies), and competitive intensity (manufacturers innovating to offer lower life-cycle cost solutions through enhanced durability and modularity). The market dynamism is such that technology compliance and energy efficiency are rapidly becoming non-negotiable purchasing criteria.

Segmentation Analysis

The Emulsified Asphalt Production Equipment Market is segmented based on the operational capacity of the plant, the core technological method utilized for emulsification, and the end-use application of the resulting emulsion. Capacity segmentation (High, Medium, Low) reflects the varying needs of contractors and government agencies, from major highway projects requiring continuous, high-volume output to local road agencies needing flexible, smaller batch production. Technology segmentation is critical as it defines the quality and complexity of the emulsions that can be produced, primarily focusing on the effectiveness of the shearing mechanism (colloid mill vs. high-shear mixer). Application segmentation highlights the diverse utilization across road infrastructure, where pavement maintenance (e.g., chip seals, slurry seals) currently dominates demand.

This market structure allows manufacturers to cater to specific niche requirements. For instance, sophisticated continuous plants are essential for producing advanced polymer-modified cationic emulsions (PCEs), which are increasingly specified for high-performance applications like micro-surfacing in heavy traffic corridors. In contrast, smaller, mobile batch plants are optimized for rapid deployment and localized production, minimizing transportation costs associated with the finished emulsion. Understanding the interplay between these segments is vital for competitive strategy, as demand growth in certain regions (e.g., Asia Pacific) favors high-capacity plants, while mature markets (e.g., Europe) prioritize the precision offered by advanced technological systems.

The segmentation reflects a global trend toward specialization within asphalt chemistry. As regulatory standards demand superior pavement longevity and performance under extreme weather conditions, the technological segment, particularly the sophistication of the colloid mill and the efficiency of the polymer dosing systems, becomes the primary differentiator. Equipment must not only produce stable standard emulsions but also reliably incorporate latex, crumb rubber, and other modifiers, expanding the functional envelope of asphalt pavements and driving the demand for the most advanced, highly controlled equipment available on the market today. This specialization drives premium pricing and technological leadership among key vendors.

- By Capacity:

- High-Capacity Plants (20-40+ Tons/Hour)

- Medium-Capacity Plants (10-20 Tons/Hour)

- Low-Capacity/Mobile Batch Plants (1-10 Tons/Hour)

- By Technology:

- Colloid Mill Equipment (Standard and High-Shear)

- High-Shear Mixer Systems

- Polymer Modification Integration Units

- By Application:

- Road Construction and Rehabilitation

- Pavement Maintenance (Chip Seals, Slurry Seals, Micro-surfacing)

- Roofing and Waterproofing Applications

- Industrial and Specialty Applications

- By Operation Type:

- Batch Production Systems

- Continuous Production Systems

Value Chain Analysis For Emulsified Asphalt Production Equipment Market

The value chain for Emulsified Asphalt Production Equipment starts with upstream activities involving the sourcing of highly specialized mechanical components, including high-grade steel, precision-machined colloid mill rotors and stators, high-pressure pumps, and advanced industrial control systems (PLCs, sensors). Equipment manufacturers then engage in design, engineering, and assembly, focusing on modularity, durability, and compliance with local environmental and safety standards. Critical value addition at this stage includes the integration of proprietary colloid mill designs that ensure optimum shear rate and particle size distribution—a primary determinant of emulsion quality. Competition upstream is moderate, driven by precision engineering requirements for high-wear components.

Downstream activities involve the distribution, installation, commissioning, and long-term service and maintenance of the plants. Distribution channels are typically a mix of direct sales teams for large, complex, custom-engineered plants and specialized regional distributors who handle sales, parts inventory, and support for standard and mobile units. Direct sales ensure deep technical consultancy and customized solutions, particularly important for national road agencies or large industrial customers. The efficiency of the downstream servicing network is a crucial competitive factor, as plant uptime is paramount for end-users, especially during short construction seasons. Aftermarket services, including the supply of replacement parts for high-wear components like rotors and stators, form a significant revenue stream.

The distribution channel landscape shows a clear differentiation between direct and indirect sales. High-capacity, technologically advanced, continuous plants are almost exclusively sold directly by the original equipment manufacturer (OEM) to ensure proper installation, integration with existing infrastructure, and comprehensive training. Conversely, smaller, more standardized mobile batch plants often utilize indirect channels, leveraging local distributors who have established relationships with smaller contractors and regional municipalities. The critical link in the value chain remains the technical support and training offered to end-users, ensuring that the sophisticated equipment is operated correctly to produce stable, compliant asphalt emulsions, thereby enhancing the overall value proposition of the equipment.

Emulsified Asphalt Production Equipment Market Potential Customers

The primary customers for Emulsified Asphalt Production Equipment are entities involved directly or indirectly in large-scale infrastructure development, maintenance, and materials supply. These include national and state-level highway authorities and public works departments, which often procure equipment for captive production or mandate its use through contractor specifications. Large civil engineering and road construction contractors form a significant customer base, investing in high-capacity, mobile plants to support large-scale road projects where on-site production capability offers logistical and cost advantages. These contractors seek reliable, high-throughput equipment that can handle diverse geographic and climatic conditions and meet stringent performance specifications.

Another crucial customer segment consists of specialized asphalt material producers and chemical companies that operate as merchant suppliers. These entities run permanent, high-volume production facilities to supply asphalt emulsions, modified binders, and specialty chemicals to smaller contractors and municipalities who do not possess their own manufacturing capabilities. These merchant producers demand the most technologically advanced continuous production systems, capable of automated blending and quality control for polymer-modified and cationic emulsions, ensuring maximum stability and profitability from large-scale operations. Their investment decisions are heavily influenced by equipment efficiency, uptime guarantees, and the capability to rapidly switch between different emulsion types.

Finally, niche segments include companies involved in waterproofing, roofing, and specialty industrial coatings where asphalt emulsions are utilized as binders or protective layers. Although smaller in volume compared to the road industry, this segment demands equipment capable of producing highly specific, often highly modified, emulsions with low environmental impact. International aid organizations and military engineering corps also constitute a potential customer base, particularly favoring robust, containerized, and easily deployable mobile plants for rapid infrastructure deployment in remote or emergency situations, prioritizing robustness and ease of operation over extreme capacity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GAO High Tech, Wirtgen Group, Astec Industries, Lintec Corporation, NFLG Inc., Terex Corporation, Tarmac International, Heatec, Road Machinery & Supplies Co. (RMS), Fayat Group, Paver Technology, ADM Engineering, Asphalt Drum Mixers Inc., Gencor Industries, Stansteel, BJD Group, Maxam Equipment, Metong Road & Bridge Technology, Sino Road Machinery, Marini S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Emulsified Asphalt Production Equipment Market Key Technology Landscape

The core technology defining the Emulsified Asphalt Production Equipment market is the high-shear colloid mill, which is indispensable for achieving the required stability and performance of the emulsion. Modern colloid mills feature adjustable rotor-stator gaps, allowing operators precise control over the shear rate, which directly impacts the particle size distribution of the asphalt droplet phase. Technological advancements focus heavily on mill geometry optimization (e.g., specialized tooth patterns) and material science (using ceramics or hardened alloys) to enhance durability, reduce maintenance frequency, and improve energy efficiency. The capability to handle varying viscosities and rapidly incorporate high percentages of polymer modifiers (such as SBR latex or natural rubber) without compromising stability is a major technological differentiator among leading equipment manufacturers.

Further technological integration involves sophisticated automation and process control systems. PLC (Programmable Logic Controller) based control panels allow for automated, closed-loop control of critical variables: asphalt temperature, water temperature, emulsifier dosing rate, acid concentration, and flow rates for all input streams. These integrated systems ensure highly repeatable production, minimizing the risk of off-spec batches and maximizing material utilization. Continuous production plants, utilizing gravimetric or magnetic flow meters for extreme precision, represent the current apex of technological deployment, enabling high-volume output with minimal supervision and rigorous adherence to required standards such as ASTM or EN specifications.

The increasing prominence of cationic and specialized emulsions for cold-mix asphalt and recycling applications is driving innovation in auxiliary components, particularly in the chemical dosing and mixing stages. New equipment includes highly accurate, corrosion-resistant chemical storage and injection systems capable of handling corrosive acid catalysts and complex stabilizer blends. Furthermore, the integration of heating systems, such as thermal fluid heaters, is critical for maintaining precise asphalt cement temperatures before emulsification without causing thermal degradation. Overall, the technological trajectory points towards greater intelligence, modularity, energy recovery, and enhanced material compatibility to produce next-generation, environmentally friendly asphalt binders.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, fueled by unprecedented investment in infrastructure development, including national highway expansion programs (e.g., India's Bharatmala project and China's Belt and Road Initiative). The region exhibits massive demand for high-capacity, reliable continuous plants to support large-scale projects and a growing acceptance of sustainable, emulsion-based road treatments. Government incentives promoting low-VOC construction are accelerating market adoption. Key manufacturing hubs in China and South Korea also contribute significantly to global equipment supply, creating intense competitive pricing dynamics.

- North America: The North American market is characterized by high maturity and strong emphasis on pavement preservation and recycling technologies. Demand is driven by the necessity to maintain vast, aging highway networks, focusing heavily on high-performance, polymer-modified emulsions for micro-surfacing and thin overlays. The regional market demands technologically sophisticated equipment featuring advanced automation, high mobility (especially in the US), and strict compliance with state DOT specifications. The region sees steady replacement and upgrade cycles for existing equipment, prioritizing energy efficiency and reduced operational complexity.

- Europe: Europe is defined by stringent environmental regulations and a high preference for cold-mix and cold recycling technologies utilizing specialized emulsions. The market mandates high precision equipment capable of producing highly stable, customized emulsions that meet complex EN standards. Western European countries demonstrate high demand for medium-to-low capacity mobile plants for localized pavement preservation works, emphasizing reduced noise and lower energy footprint. Eastern Europe, currently undertaking significant EU-funded infrastructure modernization, represents a substantial growth opportunity, driving procurement of new, compliant continuous production plants.

- Latin America (LATAM): Growth in LATAM is closely linked to national economic stability and government investment cycles in road infrastructure, particularly in Brazil, Mexico, and Argentina. The region often favors cost-effective, durable equipment suitable for remote operation and varying climate zones. There is a rising trend towards adopting emulsion-based technologies for low-volume rural road rehabilitation, creating demand for robust, easy-to-maintain medium and mobile batch plants. Market expansion is dependent on technology transfer and localized service support provided by international OEMs.

- Middle East and Africa (MEA): The MEA region presents a diverse market. The Middle East segment, driven by large-scale urban development projects in the Gulf Cooperation Council (GCC) states, demands high-capacity equipment capable of producing specialized emulsions resilient to extreme heat and desert conditions. Africa's market is nascent but rapidly developing, driven by national initiatives to connect key economic centers, creating significant potential for basic, rugged, and highly mobile emulsion equipment suitable for infrastructure growth rather than just preservation. Political stability and crude oil prices significantly influence investment cycles in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Emulsified Asphalt Production Equipment Market.- GAO High Tech

- Wirtgen Group

- Astec Industries

- Lintec Corporation

- Terex Corporation

- Fayat Group (Marini S.p.A.)

- NFLG Inc.

- Tarmac International

- Heatec Inc.

- Road Machinery & Supplies Co. (RMS)

- Paver Technology

- ADM Engineering

- Asphalt Drum Mixers Inc.

- Gencor Industries

- Stansteel

- BJD Group

- Maxam Equipment

- Metong Road & Bridge Technology

- Sino Road Machinery

- Dalian Huaming Road Construction Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Emulsified Asphalt Production Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Emulsified Asphalt Production Equipment?

The key driving factor is the global imperative for sustainable infrastructure maintenance and expansion, coupled with stricter environmental regulations favoring cold-applied, low-emission pavement preservation technologies such as chip seals and micro-surfacing over traditional hot-mix asphalt (HMA).

How does the capacity of the production equipment affect purchasing decisions?

Equipment capacity directly correlates with project scale and operational strategy. High-capacity continuous plants are favored by large material suppliers and national contractors for highway projects, while medium and mobile batch plants are preferred by regional municipalities and smaller contractors requiring flexible, localized production to minimize logistics costs.

What role do Colloid Mills play in the emulsified asphalt production process?

Colloid mills are the most critical component, providing the high shear energy necessary to break down hot asphalt cement into stable, microscopic particles (emulsion droplets). The mill’s precision directly determines the quality, stability, and performance characteristics (viscosity, storage life) of the final asphalt emulsion product.

Which geographical region shows the fastest market growth for this equipment?

Asia Pacific (APAC), particularly driven by expansive road network development and urbanization projects in countries such as China, India, and Southeast Asian nations, exhibits the fastest growth due to high capital investment in new infrastructure.

How are technological advancements impacting equipment efficiency and cost?

Technological advancements, including the integration of PLC-based automation, predictive maintenance, and high-precision polymer dosing systems, are increasing operational efficiency, reducing material wastage, ensuring higher emulsion quality, and ultimately lowering the overall life-cycle operating costs for plant owners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager