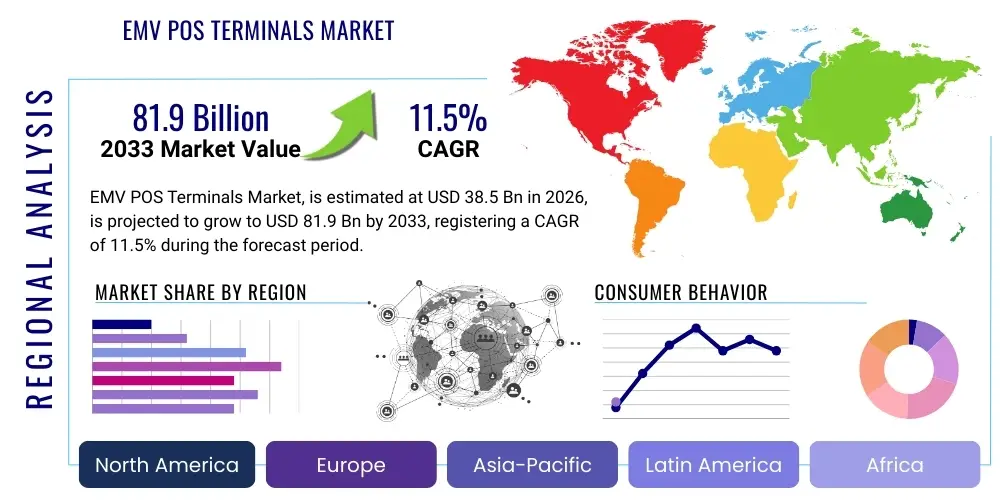

EMV POS Terminals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437174 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

EMV POS Terminals Market Size

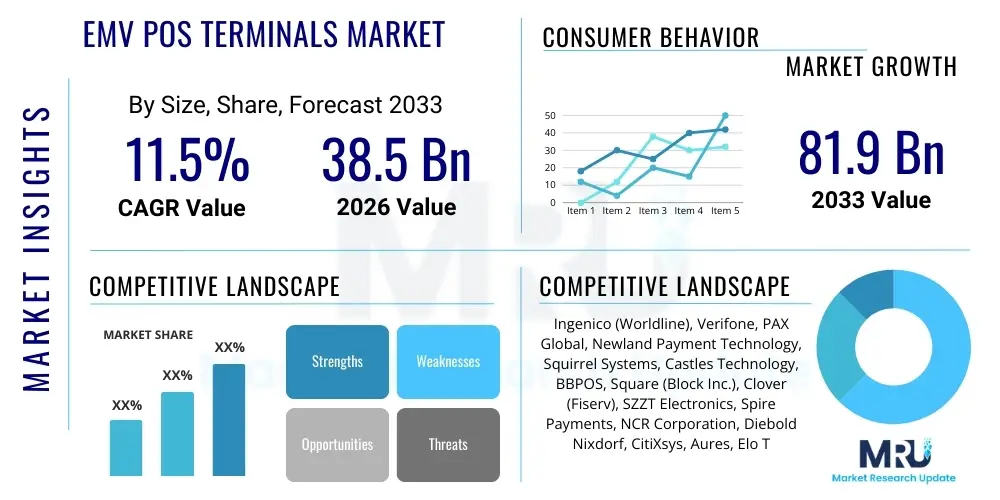

The EMV POS Terminals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $81.9 Billion by the end of the forecast period in 2033.

EMV POS Terminals Market introduction

The EMV POS Terminals Market encompasses the sale and deployment of payment terminals compliant with the Europay, MasterCard, and Visa (EMV) standard, which utilizes microchips embedded in payment cards to perform dynamic data authentication for every transaction, dramatically enhancing security against counterfeit card fraud compared to legacy magnetic stripe technology. The core principle of EMV lies in its sophisticated cryptographic capabilities, where a unique cryptogram is generated for each transaction, rendering stolen data virtually useless for replication. These sophisticated terminals are foundational components of modern retail and financial infrastructure, facilitating secure, real-time electronic payments across diverse commercial environments globally. The comprehensive product portfolio within this market spans robust, static countertop terminals designed for high-volume checkouts to highly flexible, integrated mobile POS (mPOS) solutions that allow transactions anywhere within a commercial perimeter. The critical differentiating factor is the terminal's certification, requiring adherence to stringent PCI (Payment Card Industry) standards, particularly PCI PTS (PIN Transaction Security), which governs the protection of sensitive cardholder data and PIN entry devices, ensuring data integrity and customer confidence in the payment process.

Major applications of EMV POS terminals are deeply entrenched across high-transaction volume sectors, including large-scale supermarket chains, big-box retailers, quick-service dining establishments (QSRs), and gasoline stations, where processing speed, reliability, and cryptographic security are non-negotiable operational requirements. Beyond traditional retail, niche segments such as public transportation utilize integrated EMV systems for seamless fare collection and transit management, and healthcare providers adopt them for secure patient co-pay processing and billing management, requiring compliance with industry-specific data privacy regulations like HIPAA in the United States. The terminals are engineered to offer multi-faceted communication capabilities, routinely supporting robust connectivity options including dedicated Ethernet lines, high-speed Wi-Fi, and advanced cellular standards (4G/5G) to ensure uninterrupted service delivery and real-time transaction reconciliation, regardless of the physical environment. The overarching benefits driving merchant investment include substantial risk mitigation through reduced fraudulent chargebacks resulting from the global liability shift, demonstrable increases in customer trust fostered by visible security features, and optimized checkout flow through support for ultra-fast contactless (NFC) and increasingly prevalent digital wallet acceptance, directly contributing to improved merchant operational metrics and customer throughput.

The primary driving forces propelling the market forward stem from unwavering regulatory pressure and the rapid pace of continuous payment innovation. Global regulatory bodies and payment networks are continuously updating compliance mandates, necessitating ongoing hardware and software refreshes to meet evolving standards like PCI DSS 4.0. Specifically, the widespread and ongoing enforcement of the EMV liability shift in major consumer markets forces merchants to upgrade their infrastructure or bear the entirety of the financial burden of associated fraud losses, acting as a powerful non-discretionary driver. Simultaneously, consumer behavior is shifting rapidly towards convenience, demanding ubiquitous acceptance of mobile and tap-to-pay methods, which inherently requires certified, NFC-enabled EMV terminals. Furthermore, the paradigm shift toward integrated commerce platforms—where the terminal functions as a smart hub managing inventory, employee hours, and sophisticated loyalty programs alongside payments—is fueled by the development of open operating systems, predominantly Android-based. This transformation converts the terminal from a simple payment acceptance device into a powerful, value-added business tool that offers enhanced data analytics capabilities and seamless ecosystem connectivity, cementing the EMV POS terminal as an indispensable, integrated component of modern, omnichannel retail management strategies globally.

EMV POS Terminals Market Executive Summary

The global EMV POS Terminals market is currently defined by a profound strategic pivot toward platform-based solutions, wherein hardware functions as a highly secure, certified entry point for a comprehensive suite of integrated software services, often delivered via the cloud. Key business trends indicate aggressive consolidation within the industry, where large payment technology providers (e.g., Worldline, Fiserv) are strategically acquiring smaller terminal manufacturers and specialized software developers to construct seamless, end-to-end unified commerce platforms, thereby addressing the historic fragmentation of the payment ecosystem. This consolidation trend compels terminal manufacturers to prioritize open architecture designs and robust API compatibility to ensure effortless integration with various existing merchant enterprise resource planning (ERP), inventory management, and customer relationship management (CRM) systems. The market is also experiencing a clear bifurcation of offerings: sophisticated, high-performance smart terminals tailored for complex, integrated retail environments versus highly cost-effective, ruggedized mPOS devices designed for rapid, low-complexity deployment in high-growth, micro-merchant segments. This dual focus necessitates versatile manufacturing capabilities and strategic, flexible pricing models adapted to the vastly different operational requirements and financial constraints of these respective customer demographics.

Regionally, the market dynamics are substantially differentiated based on the maturity of EMV deployment and existing card penetration levels. North America and Western Europe, categorized as highly mature markets, are experiencing stable revenue growth driven primarily by necessary technology refresh cycles—upgrading legacy compliant terminals to support sophisticated new features such as advanced biometric authentication, enhanced cryptographic protocols (specifically Point-to-Point Encryption, or P2PE), and significantly faster contactless processing capabilities essential for minimizing queue times in high-volume environments. In stark contrast, the Asia Pacific (APAC) and Latin American markets represent the core engines of volume growth, propelled by massive first-time deployments. In APAC, governmental digital payment mandates, combined with exceptionally high mobile phone penetration, strongly favor the immediate and widespread adoption of low-cost, interconnected mPOS solutions designed for scalability. Latin America, particularly high-growth economies like Brazil and Mexico, demonstrates robust expansion fueled by historically high fraud rates demanding the superior security offered by EMV solutions, supplemented by the rapid expansion of challenger banks and fintech providers aggressively pushing payment acceptance infrastructure to previously unbanked or underserved populations, thereby expanding the total addressable market significantly.

Segmentation trends decisively underscore the dominance of the mobile POS (mPOS) segment in terms of annual unit shipment growth, reflecting the pervasive global demand for operational flexibility and mobility across sectors ranging from dynamic food delivery services to essential field services and temporary retail setups. While traditional countertop terminals maintain steady, high-margin revenue through essential refresh cycles by major enterprise retailers, the accelerated proliferation of mPOS is fundamentally reshaping the competitive landscape. This favors manufacturers capable of producing highly cost-efficient, exceptionally durable, and connectivity-agnostic devices that can operate reliably in varied conditions. Furthermore, a deep Component analysis reveals that the Software and Services segment, which includes sophisticated cloud-based terminal management systems (TMS), remote secure key injection services, and licensing fees for proprietary operating systems, is achieving superior revenue growth rates compared to the growth of the core hardware sales component. This crucial trend signifies that long-term value creation in the EMV terminal market is increasingly anchored in the ability of vendors to provide continuous, cloud-enabled software innovation and robust device life-cycle management services, effectively transforming the traditional transactional revenue model derived from hardware sales into a more stable, recurring subscription-based service model for large fleet management contracts.

AI Impact Analysis on EMV POS Terminals Market

Common user questions regarding the influence of Artificial Intelligence (AI) and Machine Learning (ML) on the EMV POS Terminals market frequently revolve around how these technologies can fundamentally enhance transactional security, optimize complex inventory management workflows through terminal data aggregation, and personalize the crucial customer checkout experience. Users are particularly keen to understand if advanced AI models can predict and mitigate evolving transaction fraud vectors more effectively and proactively than current static rule-based or legacy algorithmic systems. A major theme of inquiry concerns how integrated AI could transform the terminal from a basic, specialized payment device into a sophisticated, intelligent commerce hub capable of autonomous decision-making. Concerns often raised include complex issues related to data privacy compliance (especially concerning deep learning on transactional data), the demanding processing power required for running advanced ML models locally (edge computing) on terminal hardware, and the resulting elevated cost structure associated with embedding such powerful, sophisticated technology into standard retail hardware. The overarching expectation is that AI will elevate payment processing beyond simple acceptance to deliver real-time, actionable business insights and superior risk management capabilities.

The strategic integration of AI and ML is fundamentally transforming the core value proposition of EMV POS terminals by significantly enhancing security intelligence and dramatically optimizing operational efficiency for merchants. AI algorithms are being primarily deployed for highly accurate, real-time transactional risk assessment and fraud scoring. These systems analyze thousands of diverse data parameters—including geolocation data, historical purchase records, transaction velocity, and behavioral anomalies—instantaneously to detect and prevent fraudulent activities with a substantially higher degree of precision and speed than previous rule-based methods. This proactive, intelligent fraud detection capability not only minimizes costly chargebacks for merchants but also ensures continuous compliance with increasingly rigorous security standards, thereby bolstering the overall resilience and trustworthiness of the EMV ecosystem. Furthermore, advanced AI-powered systems are utilized to facilitate intelligent dynamic currency conversion (DCC) and optimize network routing decisions based on real-time network latency metrics, ensuring the quickest and most cost-effective transaction completion pathway, which is critical for global retailers operating across multiple jurisdictions.

Beyond security enhancements, AI integration robustly supports sophisticated operational capabilities, particularly in automated inventory management, localized merchandising optimization, and direct customer relationship management (CRM) delivered directly through the POS terminal interface. For example, integrated AI models can analyze dynamic purchasing patterns and comprehensive sales data captured through every transaction on the terminal to generate automated, predictive restocking alerts, optimize product placement suggestions, or deliver highly personalized promotional offers displayed directly to the customer during the checkout process. This capability fundamentally transforms the terminal into a critical data collection and intelligent action point within the retailer’s overarching omnichannel strategy. However, the operational requirement for significantly higher processing power and the need for secure, high-performance edge computing capabilities to execute these complex ML models locally present a considerable technical challenge for mass deployment. This complexity drives terminal manufacturers to adopt highly powerful System-on-Chips (SoCs) and specialized operating systems capable of handling complex computational tasks while critically maintaining exceptional transaction speed and unwavering adherence to stringent PCI compliance requirements, balancing sophistication with operational necessities.

- Enhanced Fraud Detection: Utilization of sophisticated Machine Learning models for real-time analysis of thousands of transaction parameters to predict and prevent complex fraudulent activities (AEO focus: Predictive transaction security).

- Intelligent Inventory Management: Generating AI-driven insights directly at the point of sale to dynamically optimize stock levels, ordering frequency, and product allocation based on real-time consumer demand signals.

- Personalized Customer Engagement: Delivering contextually relevant, tailored promotions and loyalty program prompts based on comprehensive, aggregated historical purchase data captured and analyzed by the terminal.

- Optimized Operational Workflow: Employing AI to monitor terminal operational health, predict potential hardware or software failures before they occur, and intelligently optimize network connectivity and transaction routing pathways for maximum efficiency.

- Integrated Biometric Authentication: Integration of AI for secure biometric verification methods (e.g., facial recognition, advanced fingerprint scanning) at the terminal, particularly for high-value transactions or secure employee access control.

DRO & Impact Forces Of EMV POS Terminals Market

The market dynamics for EMV POS Terminals are profoundly influenced by a complex interplay of mandatory regulatory push factors, rapid, continuous technological innovation, and persistent structural infrastructural hurdles across various geographic markets. Drivers center primarily on strict global security mandates, most notably the continuous reinforcement and expansion of liability shift enforcement by major card schemes worldwide, which financially compels merchants to upgrade to certified chip-and-PIN/chip-and-signature technology to protect themselves from escalating financial liabilities associated with card-present fraud. This essential regulatory necessity is synergistically coupled with surging, widespread consumer demand for highly convenient contactless payments (NFC) and the acceptance of diverse digital wallets, requiring continuous hardware refreshment cycles to deploy modern, NFC-enabled terminals. Substantial opportunities are emerging in the rapidly developing markets of Asia Pacific (APAC) and Latin America, driven by large-scale national financial inclusion initiatives, high cellular connectivity rates perfectly suited for mPOS deployment, and the significant, untapped potential for Value-Added Services (VAS) integration into newly deployed smart terminal ecosystems.

Conversely, several significant, enduring restraints temper the overall robust growth trajectory of the market. The considerable initial capital investment required for certified terminal hardware procurement, complex software integration, and employee training, particularly burdensome for price-sensitive small businesses and emerging market micro-merchants, acts as a primary and effective barrier to entry. Furthermore, the inherent complexity and high cost of maintaining continuous compliance with the constantly evolving PCI Data Security Standard (PCI DSS) requirements, coupled with diverse regional regulatory frameworks (such as Brazil's specific local payment requirements), demands rigorous and costly continuous software updates, frequent certified testing, and regular hardware recertification, significantly increasing the total cost of ownership (TCO) for merchants and fleet managers. In crucial developing regions, persistent and widespread issues related to unreliable telecommunications infrastructure, inconsistent internet connectivity, and unreliable power supply present significant operational challenges for always-connected smart terminals, inevitably limiting their effectiveness and widespread, reliable adoption compared to basic, offline-capable mobile solutions.

The powerful impact forces currently shaping the competitive structure of the market include the accelerating, pervasive transition to fully integrated payment processing platforms and the intensifying competitive threat posed by alternative digital payment solutions, such as popular QR code payments (which are particularly dominant in many Asian markets) and direct mobile bank transfers (P2P), both of which seek to bypass traditional, specialized terminal hardware infrastructure entirely. The bargaining power of major buyers, specifically large enterprise retailers and dominant Payment Service Providers (PSPs), is exceptionally high. These powerful entities demand aggressively low Total Cost of Ownership (TCO) and highly customized, white-label payment solutions, exerting constant, downward pressure on terminal manufacturer margins and forcing continuous hardware price optimization. Conversely, the threat of new market entrants, while partially mitigated by the extremely high regulatory and certification barriers required for complex, secure hardware production (specifically multi-level PCI PTS certification), remains constantly high in the value-added software and services layer. Here, innovative fintech companies continually disrupt the status quo by developing novel terminal operating systems and third-party applications, aggressively pushing incumbent terminal manufacturers toward adopting open platform strategies to maintain crucial market relevance and sustain competitive advantage.

Segmentation Analysis

The EMV POS Terminals market is meticulously segmented across several critical dimensions, including the functional type of device deployed, the complex components comprising the complete solution package, and the diverse range of end-user applications utilizing the payment technology. This highly granular segmentation is absolutely vital for accurately interpreting market trends, as deployment strategies and product requirements vary significantly between large, established retailers demanding integrated, sophisticated countertop systems and the expansive segment of micro-merchants requiring portable, ultra-cost-effective mobile POS (mPOS) solutions. The comprehensive segmentation structure reflects the market's deep evolution from a historically hardware-centric model to a modern, service-and-software-driven ecosystem, where proprietary value-added services bundled alongside the physical terminal hardware are increasingly critical components for achieving market differentiation, customer loyalty, and sustainable revenue generation. Analyzing these distinct segments enables stakeholders to precisely tailor product offerings and marketing strategies to specific vertical industry needs, optimizing crucial security features, processing speeds, and connectivity options based on the required transaction volume and operational environment.

The Type segment, comprising traditional Countertop terminals and highly flexible Mobile POS (mPOS) terminals, robustly captures the ongoing structural shift occurring across global retail, where operational mobility, speed, and deployment flexibility are now paramount priorities. Countertop terminals maintain their essential role in high-volume, fixed retail environments that necessitate extremely robust connectivity and deep integration with physical peripherals (e.g., cash drawers, complex receipt printers, and scanners), guaranteeing stability and high throughput. In contrast, the mPOS segment is undeniably the key driver of new market penetration and volume growth, particularly among the vast global population of small and informal businesses seeking economical and accessible payment solutions. Within the crucial Component segment, the physical Hardware remains the foundational basis of the ecosystem, but the significantly accelerating growth of proprietary operating systems and essential cloud-based infrastructure services (collectively, Software and Services) explicitly highlights the powerful market trend toward platformization, which facilitates essential capabilities such as secure, remote device management, advanced transaction analytics, and seamless over-the-air software updates necessary for immediate regulatory compliance and enhanced functionality, establishing the terminal as a connected IoT device.

The Application segmentation rigorously reveals concentrated demand in those industry sectors facing both the highest transaction volumes and the most stringent regulatory compliance requirements. Retail and Hospitality remain the single largest consuming sectors, rapidly adopting highly integrated smart POS systems that comprehensively combine secure payment processing with core business functions like table management and inventory control. Increasingly significant emerging sectors like Healthcare and Public Transportation are dramatically increasing their deployment of certified EMV terminals for secure, audited payment collection (e.g., patient co-pays, mass transit fares), driven powerfully by regulatory pushes for enhanced financial transparency and superior digital payment security. The sheer diversity across these varied applications mandates that manufacturers offer highly resilient, profoundly customizable, and fully certified solutions capable of meeting specific, sometimes unique, industry operational demands, such as specialized ruggedized designs for field service use or highly tailored software interfaces for efficient table management and tip processing in full-service restaurants, thereby ensuring sustained market penetration across complex vertical landscapes.

- By Type:

- Countertop Terminals (Traditional fixed installations)

- Mobile POS (mPOS) Terminals (Portable and highly integrated systems)

- By Component:

- Hardware (Physical Terminals, PIN Pads, Integrated Components)

- Software (Operating Systems, Payment Applications, Security Libraries)

- Services (Managed Services, Remote Maintenance, Integration Support, Key Management)

- By Application:

- Retail (Supermarkets, Department Stores, Small Retail, E-commerce Integration)

- Hospitality (Restaurants, Hotels, Quick Service Restaurants (QSRs), Bars)

- Healthcare (Clinics, Hospitals, Pharmacies)

- Entertainment and Media (Cinemas, Theatres, Event Venues)

- Transportation and Logistics (Taxis, Public Transit, Delivery Services)

- Others (Government Services, Education Institutions, Specialized Financial Services)

- By Technology:

- Contact EMV (Chip and PIN/Signature)

- Contactless EMV (NFC/Tap to Pay, Mobile Wallet Acceptance)

Value Chain Analysis For EMV POS Terminals Market

The highly complex value chain of the EMV POS Terminals market initiates with upstream activities encompassing critical component suppliers, primarily specialized silicon manufacturers providing secure microcontrollers (microchips) and sophisticated secure element providers (SEs) that are absolutely crucial for managing cryptographic keys and executing secure cryptographic operations, alongside general hardware component suppliers for essential elements like high-resolution displays, durable lithium-ion batteries, and various connectivity modules. These highly specialized suppliers hold a critical position because the ultimate security and certification level of the final payment product is entirely dependent on the integrity, reliability, and certification status of these foundational, high-security components. Significant bargaining power is often concentrated with specialized secure semiconductor manufacturers due to the extensive and costly stringent certification processes (such as Common Criteria assurance levels and demanding PCI PTS requirements) necessary for obtaining approval for payment hardware components. Consequently, the entire upstream stage focuses with intense rigor on meeting globally harmonized security standards and ensuring a stable, traceable, and certified supply chain for these core components, which is critical for achieving sustainable, large-scale production volumes.

The midstream phase involves the core, high-value-add activities of terminal manufacturing, proprietary software development, and deep system integration. Major manufacturers (Original Equipment Manufacturers or OEMs) meticulously assemble the sophisticated hardware and develop or license proprietary or open-source operating systems that are highly optimized for secure, high-speed payment processing. This stage is heavily dominated by a few large, established global players, such as Worldline (Ingenico) and Verifone, who manage vast and complex global supply chains, requiring expertise in navigating highly diverse regional regulatory compliance frameworks, sourcing components efficiently, and maintaining strict quality control. Following the manufacturing and initial key injection process, the distribution channel assumes a pivotal role. This channel typically utilizes a mixed strategy comprising direct sales engagements targeting large, Tier 1 retailers and major international Payment Service Providers (PSPs), alongside extensive indirect sales conducted through a widespread network of national distributors, specialized Independent Sales Organizations (ISOs), and regional Value-Added Resellers (VARs). PSPs are frequently the primary large-scale buyers, often purchasing terminals in massive volumes and subsequently subsidizing, leasing, or bundling them with comprehensive payment service contracts to merchants, thereby significantly influencing regional pricing structures, market access strategies, and competitive dynamics.

Downstream activities are focused entirely on deployment, ongoing secure maintenance, and the crucial delivery of continuous software and cloud-based services. This critical stage involves secure remote key injection procedures, terminal personalization, deploying mandatory over-the-air software updates, and sophisticated remote device management, functions that are overwhelmingly handled by the PSPs, specialized merchant acquirers, or dedicated third-party logistics and service providers. Direct channel distribution is favored by major large enterprise retailers who require superior control over their deployment procedures and seek customized, deep integration capabilities with their complex existing ERP systems. Conversely, the extensive indirect channels facilitated through ISOs and VARs are indispensable for efficiently penetrating the fragmented SME and micro-merchant segments, offering essential localized technical support, tailored financial packages, and dramatically faster deployment timelines. Crucially, the profitability downstream is increasingly and heavily driven by recurring revenue from subscription-based software services, cloud-based terminal management platforms, and advanced analytics tools that collectively enhance the core functionality of the physical terminal, securing predictable, long-term revenue streams well beyond the initial singular hardware sale and fostering crucial, high-switching-cost customer lock-in.

EMV POS Terminals Market Potential Customers

The core potential customers and end-users of EMV POS terminals are fundamentally all commercial enterprises and non-commercial organizations that accept or are mandated to accept card-based payments, spanning across virtually every single commercial and institutional sector globally. End-users can be broadly categorized into three distinct financial profiles: large, multinational enterprises (Tier 1 & 2 retailers, major hospitality chains, and large financial institutions) demanding highly customized, deeply integrated, and scalable solutions; small to medium-sized enterprises (SMEs) requiring affordable, reliable devices with moderate feature sets; and the rapidly expanding cohort of micro-merchants and informal businesses who overwhelmingly prioritize maximum simplicity, lowest initial cost, and operational mobility, heavily relying on streamlined mPOS solutions. Large enterprise buyers, such as national supermarket chains and major hotel groups, necessitate extremely sophisticated features including deep integration with proprietary loyalty management systems, state-of-the-art end-to-end encryption (P2PE) capabilities, and centralized, remote device fleet management for potentially thousands of geographically dispersed terminals, typically engaging directly with major manufacturers or high-level payment processors (PSPs) for customized solutions and advantageous volume pricing agreements.

The vast segment of SMEs and micro-merchants, conversely, is predominantly targeted and served through indirect, volume-based distribution channels, relying significantly on specialized Independent Sales Organizations (ISOs) and regional distributors who efficiently bundle the certified terminals with highly competitive, recurring payment processing services. This crucial segment is universally characterized by a high demand for cost-effective, readily available, and plug-and-play solutions that minimize setup complexity, require minimal operational maintenance, and can be easily subsidized or leased. Additionally, specialized niche markets represent substantial untapped potential customer bases; these include essential healthcare providers utilizing terminals for secure co-payment processing under stringent regulatory oversight (e.g., HIPAA compliance in the US), public transportation authorities for efficient ticketing, fare collection, and data management, and various public sector bodies seeking highly secure, auditable, and transparent digital payment collection mechanisms, often mandating specialized certification, robust connectivity, and ruggedized hardware designs to meet their unique, demanding operational needs and longevity requirements.

Crucially, the financial institutions (Acquirers and Issuers) and large Payment Service Providers (PSPs) serve as vital, institutional indirect customers within the market structure. While these entities do not typically use the terminals internally for retail transactions, they are the primary entities responsible for purchasing, inventorying, certifying, and strategically distributing the terminal hardware to their massive merchant base, ensuring the entire processing network infrastructure is fully compliant, secure, and technologically up-to-date. Their procurement and purchasing decisions are heavily influenced by paramount factors such as terminal security certification (PCI PTS compliance), proven hardware reliability, processing speed, total service uptime, and the critical ability of the hardware to seamlessly support and process modern, advanced transaction technologies like dynamic tokenization, sophisticated end-to-end encryption, and next-generation contactless payment acceptance. This institutional demand actively drives the continuous upgrade cycle essential for sustaining market growth

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $81.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingenico (Worldline), Verifone, PAX Global, Newland Payment Technology, Squirrel Systems, Castles Technology, BBPOS, Square (Block Inc.), Clover (Fiserv), SZZT Electronics, Spire Payments, NCR Corporation, Diebold Nixdorf, CitiXsys, Aures, Elo Touch Solutions, HP Inc., Fujian Landi Commercial Equipment Co. Ltd., Posiflex Technology, Shenzhen Xinguodu Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EMV POS Terminals Market Key Technology Landscape

The technological landscape of EMV POS terminals is undergoing rapid, fundamental evolution, driven primarily by the strategic shift towards unified omnichannel commerce and the continuous requirement for exceptionally enhanced transactional security protocols. A foundational technology driving current market innovation is Near Field Communication (NFC), which enables seamless contactless payments (commonly known as tap-to-pay). NFC adoption has seen exponential, widespread growth globally, necessitating that all newly deployed terminals be equipped with robust, certified NFC readers capable of reliably handling transactions originating from major digital wallets such as Apple Pay and Google Wallet, as well as high-speed contactless EMV cards. Concurrently, the reliance on advanced, state-of-the-art encryption standards, particularly end-to-end encryption (E2EE) and Point-to-Point Encryption (P2PE), is absolutely paramount. These encryption technologies are meticulously designed to ensure that sensitive cardholder data is cryptographically protected from the precise moment it is captured—whether swiped, tapped, or dipped—until it securely reaches the payment processor's environment, thereby dramatically reducing the merchant's PCI compliance scope and rigorously mitigating the critical risk of catastrophic data breaches, which serves as a key competitive differentiator among certified hardware providers.

Furthermore, the strategic shift away from restrictive, traditional proprietary operating systems toward flexible, open-source, or licensed Android-based smart terminals represents a profound technological transformation in the terminal market architecture. This pivotal shift toward open platforms empowers third-party developers to easily integrate a wide range of essential business applications directly onto the terminal hardware itself, significantly extending the terminal's utility far beyond its original function of simple payment processing to include advanced inventory management, detailed time clock functionality for employees, and sophisticated loyalty program administration. This deep integration dramatically enhances the terminal's overall value proposition, securely positioning it as an integrated, multi-functional business intelligence tool rather than merely a standalone payment capture device. Crucial connectivity technologies are also continuously advancing, with integrated 4G/5G cellular capabilities becoming the mandatory standard for mobile and remote terminals, guaranteeing maximum speed for transaction processing, low latency, and superior operational uptime, which is absolutely essential for maximizing efficiency and customer satisfaction in high-traffic, time-sensitive environments like pop-up stores, food trucks, or remote field services.

Finally, the rapidly growing, ubiquitous adoption of tokenization technology significantly impacts and enhances the security architecture of the entire payment ecosystem. Tokenization replaces sensitive primary account numbers (PANs) with a unique, non-sensitive surrogate identifier (a token), substantially fortifying the security profile of every transaction, particularly in complex omnichannel environments where transactions may originate online but require physical reference in a store setting. Hardware Security Modules (HSMs) are integral and essential components within the terminal infrastructure, mandated for securely managing, protecting, and storing the sensitive cryptographic keys used for both dynamic encryption and token generation. This ensures the terminal rigorously meets the highest levels of hardware protection and physical tamper resistance required by global payment schemes and regulatory bodies like PCI PTS. These continuous, complex technological mandates require new terminals to maintain crucial backward compatibility with older card types and network infrastructures while simultaneously supporting and preparing for future payment innovations such as biometric payment methods and the potential for regulated crypto-payment acceptance, creating a technologically demanding, dual mandate for global terminal manufacturers and payment system integrators.

Regional Highlights

- North America: This highly mature region is defined by exceptionally high rates of credit and debit card penetration and a fully implemented EMV infrastructure following the crucial 2015 liability shift in the U.S. and continued upgrades in Canada. Future market expansion is primarily driven by necessary terminal replacement cycles, specifically focusing on upgrading existing compliant EMV terminals to advanced, cloud-connected smart terminals capable of supporting extensive value-added services, complex integrated business management software, and faster contactless processing. The region's robust and aggressive regulatory environment ensures sustained high security compliance levels, guaranteeing predictable, continuous demand for certified, P2PE-enabled hardware solutions.

- Europe: As a historical pioneer in the initial EMV adoption (Chip and PIN), Europe possesses one of the world's most developed and pervasive payment infrastructures. The market's current trajectory is dominated by the massive, widespread adoption of NFC/contactless technology, powerfully driven by changing consumer preference and the systematic removal or relaxation of maximum contactless transaction value limits across key nations. Countries like the UK, Germany, and France are leading the rapid transition to modern, adaptable Android-based smart POS systems, strategically leveraging the EU’s Payment Services Directive 2 (PSD2) to vigorously foster innovation in integrated payment solutions and promote open banking interfaces within the POS environment.

- Asia Pacific (APAC): APAC is emphatically positioned as the fastest-growing global region for EMV terminal deployment, fueled by massive, largely untapped merchant potential in emerging economies such as India, Indonesia, and Vietnam, where central governments are actively promoting digital and cashless economies through incentives and mandates. Volume growth is overwhelmingly dominated by the high-volume deployment of affordable, reliable mPOS terminals perfectly suited for the vast population of small merchants rapidly transitioning away from traditional cash-only operations. China remains a distinct, enormous market where powerful domestic payment schemes (e.g., China UnionPay) heavily influence terminal specifications, driving intense localized production and focused innovation primarily centered on mobile wallet acceptance (e.g., Alipay, WeChat Pay).

- Latin America: This region continues its strong, mandatory migration towards full, comprehensive EMV compliance, powerfully spurred by historically high card fraud rates, making enhanced physical and cryptographic security features the paramount purchasing factor for merchants and acquirers. Brazil, Mexico, and Argentina are the core, high-growth markets, exhibiting rapid, exponential growth in mPOS adoption due to exceptionally high mobile penetration rates and the urgent need to efficiently service remote, underserved, or previously excluded small, informal businesses. Regional regulatory standardization and rigorous anti-fraud enforcement efforts are driving strategic consolidation among major payment processors, which significantly influences bulk terminal procurement strategies that prioritize durable, multi-functional devices designed for challenging operational environments.

- Middle East and Africa (MEA): Market growth in the MEA region is strongly concentrated in the prosperous GCC states (UAE, Saudi Arabia) due to ambitious national economic diversification plans, robust technological infrastructure investment, and significant government initiatives aggressively pushing digital payments adoption. Africa represents a colossal frontier market where essential financial inclusion and deep mobile money integration are the primary demand drivers. Terminals deployed here often require highly specialized software features to seamlessly integrate with local mobile money wallets (e.g., M-Pesa) and demand highly robust, self-sufficient connectivity solutions (often satellite or 4G/5G enabled) to handle reliable transactions in areas with extremely limited fixed-line infrastructure, making them essential technological components for modernizing retail ecosystems across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EMV POS Terminals Market.- Ingenico (now Worldline)

- Verifone

- PAX Global

- Newland Payment Technology

- Squirrel Systems

- Castles Technology

- BBPOS

- Square (Block Inc.)

- Clover (Fiserv)

- SZZT Electronics

- Spire Payments

- NCR Corporation

- Diebold Nixdorf

- CitiXsys

- Aures

- Fujian Landi Commercial Equipment Co. Ltd.

- Posiflex Technology

- Shenzhen Xinguodu Technology Co. Ltd.

- Elo Touch Solutions

- HP Inc.

Frequently Asked Questions

Analyze common user questions about the EMV POS Terminals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the non-discretionary adoption of EMV POS terminals globally?

The foremost driver is the mandatory enforcement of liability shift regulations by major global card networks (Visa, Mastercard, etc.), which legally transfers financial responsibility for card-present fraud back to merchants who fail to adopt and utilize certified EMV chip technology, compelling continuous system upgrades and compliance investment.

How are mobile POS (mPOS) terminals fundamentally influencing the competitive landscape of the market?

mPOS terminals are radically democratizing payment acceptance by substantially lowering the financial barrier to entry for micro-merchants and SMEs globally, enabling widespread acceptance of secure chip-and-PIN/contactless payments using portable mobile devices, thus significantly increasing market competition and accelerating adoption in historically underserved emerging markets.

What is the strategic role of Artificial Intelligence integration in modern smart EMV terminals?

AI is strategically integrated into EMV terminals primarily to significantly enhance real-time fraud detection through sophisticated predictive pattern analysis, optimize transaction network routing pathways, and provide advanced value-added services such as highly personalized marketing and intelligent predictive inventory management directly at the point of sale interface.

What are the key mandatory security standards and certifications modern EMV POS terminals must achieve?

EMV POS terminals must meet the Payment Card Industry Data Security Standard (PCI DSS) and, more specifically, the rigorous PCI PIN Transaction Security (PCI PTS) requirements for hardware devices. This ensures mandatory secure cryptographic key management, high physical tamper resistance, and robust data encryption (P2PE) throughout the entire transaction lifecycle.

Which geographical region is currently exhibiting the highest anticipated growth rate for new EMV POS Terminals?

The Asia Pacific (APAC) region is strongly projected to show the highest unit shipment and revenue growth rate, driven by massive governmental financial inclusion programs, the rapid and widespread consumer migration from cash to digital payments, and the enormous, high-volume scale of adoption of highly affordable mobile POS solutions across developing economies in Southeast Asia and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager