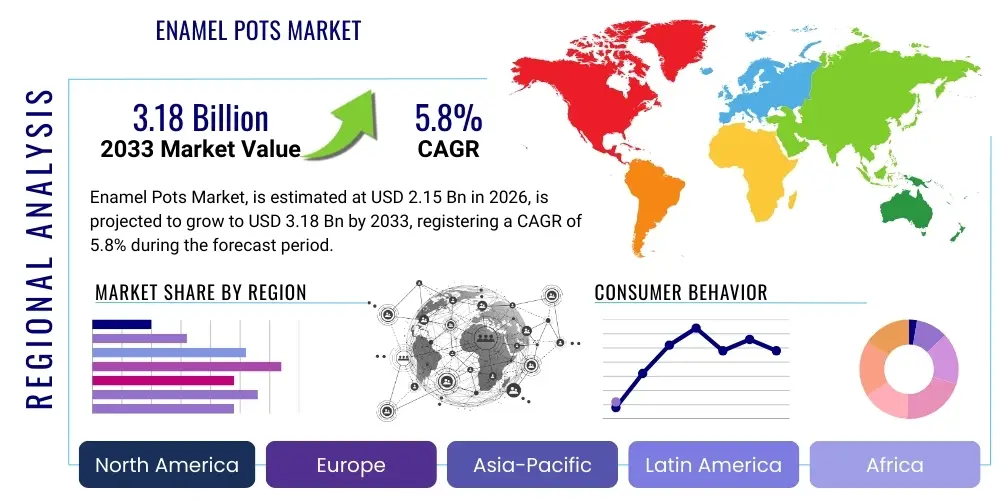

Enamel Pots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435146 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Enamel Pots Market Size

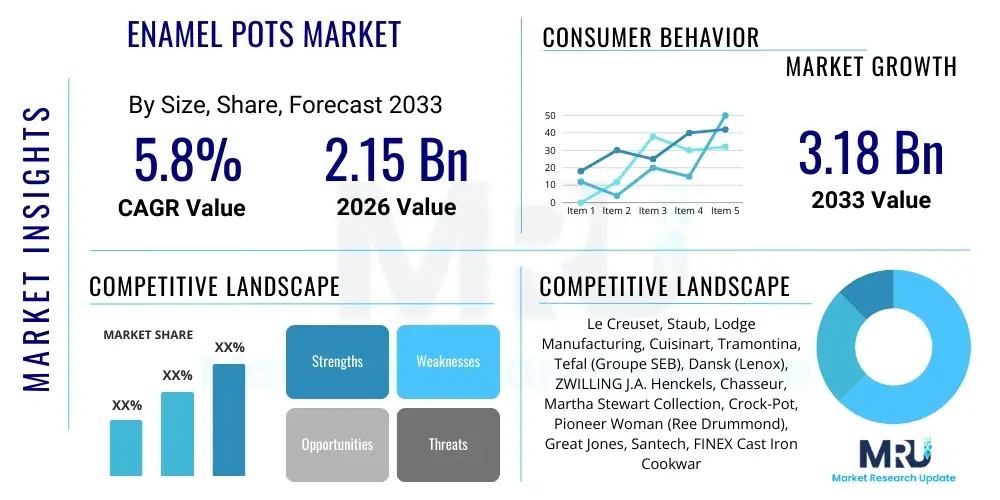

The Enamel Pots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.18 Billion by the end of the forecast period in 2033.

Enamel Pots Market introduction

The Enamel Pots Market encompasses cooking vessels manufactured from a base material, typically cast iron or steel, coated with porcelain enamel. This process involves fusing powdered glass to the substrate through high heat, resulting in a smooth, non-reactive, and durable surface highly valued for its aesthetic appeal and functional properties in culinary applications. These pots are widely utilized across residential kitchens, professional culinary settings, and specialized catering services due to their excellent heat retention and distribution capabilities, making them ideal for slow cooking, stewing, and baking. The aesthetic diversity offered by enamel finishes, ranging from vibrant colors to sophisticated matte looks, strongly influences consumer purchasing decisions, positioning enamel pots not merely as utilitarian objects but as pieces of kitchen decor.

The primary applications of enamel pots include boiling, simmering, roasting, and bread making, benefiting significantly from the non-stick properties inherent in the highly polished glaze and the chemical stability of the enamel layer, which prevents leaching of metallic tastes into food. Key benefits driving market adoption include exceptional longevity, resistance to rust and acidic foods, and ease of cleaning compared to traditional uncoated metal cookware. Furthermore, the robust nature of the cast iron core, especially in high-end Dutch ovens, ensures that heat is stored efficiently and released evenly, crucial for complex cooking techniques. This combination of hygiene, durability, and superior thermal performance underpins their growing acceptance globally, especially among consumers prioritizing investment in long-term kitchen tools.

Driving factors for the growth of the Enamel Pots Market are multifaceted, stemming from increasing consumer focus on durable and non-toxic cookware alternatives, coupled with robust growth in the global home cooking trend fueled by lifestyle changes and health consciousness. The rise of social media platforms dedicated to culinary arts and home aesthetics has significantly boosted the visibility and desirability of high-quality, visually appealing enamel cookware. Additionally, ongoing innovation in manufacturing techniques, particularly concerning lighter base materials (like carbon steel enamel) and enhanced enamel formulations that resist chipping, is broadening the market's accessibility and appeal. Urbanization and the consequent demand for aesthetically pleasing and multi-functional kitchen equipment further cement the positive growth trajectory for this market segment.

Enamel Pots Market Executive Summary

The Enamel Pots Market Executive Summary reveals robust expansion driven primarily by escalating consumer demand for premium, long-lasting kitchen solutions and a significant shift toward home cooking globally. Current business trends indicate a strong move toward product diversification, with manufacturers focusing heavily on lighter weight materials, enhanced scratch resistance, and environmentally sustainable production practices to capture market share. Supply chain optimization, particularly the integration of automation in the enameling process, is becoming crucial for maintaining competitive pricing and quality consistency. Mergers and acquisitions focusing on design innovation and direct-to-consumer (D2C) channels are characterizing the competitive landscape, emphasizing brand loyalty and aesthetic differentiation as core strategic pillars for market leaders.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by rapidly increasing disposable incomes, modernization of kitchens, and the strong cultural tradition of slow-cooked cuisine that benefits immensely from enamel pots. North America and Europe maintain leading market shares, primarily driven by established consumer preferences for high-quality brands and the enduring popularity of cast iron Dutch ovens in Western culinary traditions. Furthermore, emerging markets in Latin America and the Middle East are exhibiting promising growth potential, motivated by the expansion of organized retail and increasing awareness regarding cookware safety standards. Regulatory frameworks concerning material safety and traceability are becoming stricter globally, influencing sourcing and manufacturing standards across all key geographic markets.

Segmentation trends indicate that the Cast Iron Enamel Pots segment dominates the market in terms of value, owing to its superior durability and thermal performance, commanding premium price points. However, the Steel Enamel Pots segment is demonstrating faster volume growth due to its lighter weight and lower cost, making it highly attractive for everyday use and mass-market penetration. Within applications, the Residential segment remains the primary revenue contributor, though the Commercial segment, encompassing restaurants and hotels, is showing consistent expansion due to the need for robust, high-volume cooking equipment. The emphasis on aesthetic customization and specialized shapes (e.g., tagines, casseroles) is driving innovation across both material segments, ensuring continuous relevance and market vitality.

AI Impact Analysis on Enamel Pots Market

Common user questions regarding AI's impact on the Enamel Pots Market often revolve around how technology can enhance the manufacturing process, improve material quality control, personalize consumer recommendations, and optimize supply chain efficiency. Users are keenly interested in whether AI-driven quality checks can eliminate defects like chipping or uneven coating, a common pain point for enamel cookware. Additionally, questions frequently address AI's role in predicting design trends based on social media analysis and customizing product offerings, particularly concerning color palettes and shapes. The key themes summarized from this analysis indicate a strong expectation that AI will primarily serve to refine manufacturing precision, reduce waste, improve product longevity, and significantly tailor marketing efforts to individual household preferences, ultimately raising the overall quality and efficiency of the enamel pots ecosystem.

- AI-powered predictive maintenance reduces downtime in high-heat enameling furnaces, optimizing production flow.

- Machine Vision Systems (MVS) utilize AI to conduct real-time quality control checks, instantly identifying micro-defects or inconsistencies in the enamel coating layer, significantly lowering reject rates.

- Generative Design algorithms assist in optimizing the geometric shape of the pots for maximum thermal efficiency and reduced material usage while ensuring aesthetic appeal.

- AI-driven demand forecasting improves inventory management for raw materials (cast iron, glass frit) and finished products, mitigating supply chain bottlenecks.

- Personalized marketing engines, driven by AI analysis of consumer purchase history and culinary preferences, enhance the effectiveness of D2C sales channels.

- AI sensors integrated into manufacturing lines monitor temperature gradients during the firing process, ensuring consistent enamel fusion and hardness, thus extending product lifespan.

DRO & Impact Forces Of Enamel Pots Market

The dynamics of the Enamel Pots Market are significantly shaped by a combination of key Drivers, inherent Restraints, and emerging Opportunities, collectively constituting the Impact Forces. A primary driver is the rising global preference for safe, durable, and visually appealing cookware, especially in high-income regions where consumers are willing to pay a premium for certified non-toxic materials. The increasing popularity of traditional, slow-cooked meals and the trend toward specialized cooking equipment (such as Dutch ovens and cocottes) further accelerate demand. Simultaneously, urbanization and the associated growth of organized retail chains facilitate wider distribution and greater consumer visibility for branded enamel products. The focus on product longevity, often positioned as an antithesis to disposable consumer goods, strongly resonates with environmentally conscious buyers.

However, the market faces notable restraints, chiefly concerning the high initial cost of premium enamel pots, particularly those made from high-quality cast iron, which can deter budget-sensitive consumers. The susceptibility of enamel coating to chipping or cracking when subjected to severe mechanical shock or extreme temperature variations remains a significant structural restraint, leading to consumer reluctance and concerns over product durability under misuse. Furthermore, the manufacturing process is highly energy-intensive, requiring substantial capital investment and incurring high operational costs, which restricts market entry for smaller players. Competition from advanced non-stick materials, such as ceramic and high-grade PTFE-free coatings, also exerts downward pressure on pricing and market share.

Opportunities for growth are abundant, primarily centered on technological innovation aimed at improving chip resistance and reducing manufacturing costs through automation. Developing lighter weight enamel products using advanced steel or aluminum substrates coated with specialized, high-performance enamel (optimized for induction cooking) presents a lucrative avenue for expansion. Geographic expansion into untapped markets in Southeast Asia and Africa, coupled with strategic partnerships with major kitchen appliance retailers, can unlock new revenue streams. Moreover, leveraging the D2C model and focusing on highly customizable, designer collections catered to the millennial consumer demographic represents a powerful opportunity for branding and margin enhancement. The overarching impact forces thus favor established brands capable of combining premium material science with robust aesthetic design and efficient global distribution networks.

Segmentation Analysis

The Enamel Pots Market is comprehensively segmented based on material type, product type, application, and distribution channel, providing a granular view of market dynamics and consumer preferences. Understanding these segments is critical for manufacturers to tailor production, pricing strategies, and marketing campaigns effectively. Material segmentation highlights the traditional dominance of cast iron due to its thermal superiority, contrasting with the growing volume dominance of steel/carbon steel due to cost-effectiveness and weight. Product segmentation details the various forms of cookware, with Dutch ovens commanding significant value share, reflecting their multi-functional appeal, while saucepans and casseroles serve essential, high-frequency cooking needs. Application segmentation clearly delineates the high-volume needs of the residential sector versus the stringent durability demands of the commercial sector. Finally, distribution segmentation tracks the shift from traditional brick-and-mortar stores to highly efficient e-commerce platforms, which offer broader reach and competitive pricing.

- By Material Type: Cast Iron Enamel, Steel Enamel (Carbon Steel and Stainless Steel), Aluminum Enamel.

- By Product Type: Dutch Ovens/Cocottes, Saucepans, Casseroles/Roasters, Stockpots, Skillets/Fry Pans.

- By Application: Residential Use, Commercial Use (Hotels, Restaurants, Catering Services).

- By Distribution Channel: Online Retail (E-commerce Platforms, Brand Websites), Offline Retail (Specialty Stores, Department Stores, Supermarkets/Hypermarkets).

Value Chain Analysis For Enamel Pots Market

The Value Chain for the Enamel Pots Market begins with upstream activities involving the sourcing of primary raw materials: high-grade iron ore for cast iron, specialized steel sheets, and silica/frit for the porcelain enamel coating. The quality and purity of these materials are paramount, directly influencing the final product's durability and chemical safety. Key upstream suppliers include metallurgical industries and specialized chemical manufacturers that provide the glass frits, pigments, and fluxing agents necessary for the enameling process. Ensuring a stable and ethically sourced supply of these high-quality components is a core concern, especially given the global volatility in steel and iron prices. Manufacturers often invest heavily in long-term contracts with established material providers to maintain cost predictability and consistency in material specifications, which is vital for achieving the required adhesion and non-reactive properties of the enamel coating. The capital-intensive nature of casting and stamping base metal components also defines the initial value addition phase.

Midstream activities involve the complex manufacturing processes, including casting or deep drawing the metal base, surface preparation (such as sandblasting or chemical cleaning), application of the enamel slurry (often through dipping or spraying), and the critical high-temperature firing process where the enamel fuses to the metal substrate. Technological advancements, particularly in automated spray systems and temperature control within kilns, dictate manufacturing efficiency and product quality. The midstream phase is where most proprietary technology and intellectual property reside, focusing on developing more chip-resistant enamel formulas and optimizing the thermal profile of the metal base. Quality control checkpoints are extremely rigorous during and after the firing stage, ensuring uniform coating thickness and absence of porosity or blistering. Packaging design, emphasizing protection against chipping during transit, also constitutes a vital part of this manufacturing stage.

The downstream segment focuses on distribution and sales, encompassing both direct and indirect channels. Indirect distribution, leveraging major retailers, department stores, and specialized kitchenware shops, provides broad market exposure but requires negotiating favorable margins and managing large logistics chains. Direct distribution, primarily through dedicated brand websites and flagship stores, allows manufacturers greater control over branding, pricing, and customer experience, often leading to higher profit margins and direct customer feedback. E-commerce platforms, while technically an indirect channel, are increasingly treated as a specialized focus area due to the unique challenges of shipping heavy, fragile items and the need for high-quality visual content. Marketing efforts at this stage emphasize product aesthetics, thermal performance claims, and the lifetime warranty offered by premium brands, solidifying the product's positioning as an heirloom investment rather than a disposable commodity. Effective downstream logistics, minimizing damage during the final mile of delivery, is a crucial determinant of customer satisfaction.

Enamel Pots Market Potential Customers

The primary consumers and end-users of the Enamel Pots Market span a wide demographic range, yet they share a common prioritization of durability, health safety, and aesthetic quality in their kitchen investments. The most significant segment of potential customers resides within the affluent to middle-upper-class residential demographic, particularly individuals aged 30 to 65 who engage regularly in home cooking, baking, and entertaining. These customers are often motivated by the desire to acquire high-quality, long-lasting kitchen tools, frequently seeking premium brands like Le Creuset or Staub, often as generational investments or wedding registry items. They value the non-reactive nature of the enamel coating, which is crucial when cooking acidic ingredients, and appreciate the superior heat retention vital for slow cooking techniques, such as making stews, braising meats, and baking sourdough bread.

A secondary, rapidly growing segment includes culinary enthusiasts, professional home cooks, and food bloggers who are heavily influenced by aesthetic trends and seek cookware that performs exceptionally while also serving as visually appealing content for social media. This group often targets specialized enamel products, such as colorful Dutch ovens or uniquely shaped casserole dishes, driving demand for product novelty and limited-edition color releases. For this segment, the pot is a tool and a statement piece reflecting culinary dedication and personal style. Their purchasing decisions are highly informed by online reviews, professional chef recommendations, and visual appeal, often leading them toward D2C brands that prioritize design and visual storytelling.

The commercial sector represents another critical segment, including high-end restaurants, boutique hotels, and institutional catering services. These commercial buyers prioritize industrial-grade durability, uniform heat distribution for consistent quality control, and large-volume capacity. While aesthetics are less critical than functionality in this setting, the non-reactive, easy-to-clean surface of enamel pots is highly valued for maintaining hygiene standards and resisting staining from intense, daily use. Purchasing decisions in the commercial space are driven by rigorous testing, cost-of-ownership analysis, and suitability for high-heat environments (e.g., induction compatibility and oven safety). Therefore, manufacturers targeting the commercial market focus on robust construction, standardized sizing, and comprehensive commercial warranties to meet the demanding requirements of professional kitchens.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.18 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Le Creuset, Staub, Lodge Manufacturing, Cuisinart, Tramontina, Tefal (Groupe SEB), Dansk (Lenox), ZWILLING J.A. Henckels, Chasseur, Martha Stewart Collection, Crock-Pot, Pioneer Woman (Ree Drummond), Great Jones, Santech, FINEX Cast Iron Cookware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enamel Pots Market Key Technology Landscape

The technological landscape of the Enamel Pots Market is primarily focused on enhancing material science, refining manufacturing precision, and improving product longevity while optimizing energy consumption. The core technology remains the porcelain enameling process, which involves preparing the metal substrate, applying the glass frit suspension (slurry), and firing the item at temperatures often exceeding 800°C (1472°F). Recent technological advancements concentrate on developing new enamel formulations, specifically engineered to increase the coefficient of thermal expansion match between the metal base and the glass coating. A perfect match minimizes internal stresses, drastically improving resistance to thermal shock and reducing the likelihood of chipping, which is a major quality differentiator for premium brands. Innovations also include utilizing high-solids enamel slurries and electrostatic powder coating techniques, which ensure a more uniform and consistent coating thickness compared to traditional dipping methods, leading to higher efficiency and fewer defects.

Automation and process control represent another critical technological area. Modern manufacturing facilities employ sophisticated, computer-controlled conveyor systems and robotic spraying arms to ensure precise, repeatable application of the enamel, minimizing human error and maximizing material utilization. Furthermore, the use of induction heating technology in commercial and high-end residential kitchens has driven demand for enamel pots optimized for compatibility. This necessitates precise machining of the base metal (especially in cast iron) to ensure a perfectly flat surface for optimal magnetic contact and energy transfer, demanding high-precision CNC machining post-casting or stamping. Advanced non-destructive testing (NDT) techniques, often leveraging ultrasonic or eddy current inspection methods, are increasingly integrated into the production line to assess the integrity and adhesion of the enamel layer without damaging the finished product.

Beyond the core manufacturing, technological emphasis is also placed on developing sustainable manufacturing practices. This includes optimizing furnace design for better heat recovery and reduced gas consumption, alongside water recycling systems for the chemical cleaning and slurry preparation phases. The development of low-temperature firing enamels, while still niche, represents a significant technological goal to lower the energy footprint and production costs associated with traditional high-temperature firing. Furthermore, integrating advanced supply chain technologies, such as IoT sensors for tracking raw materials and finished goods, ensures full traceability and optimizes logistics, particularly crucial for international shipping of fragile, heavy cookware. The technological thrust is thus balanced between improving the product's functional properties (durability, heat performance) and enhancing the efficiency and sustainability of its production.

Regional Highlights

- North America (NA): Characterized by high consumer disposable income and strong brand loyalty, North America is a mature market dominated by premium and luxury brands. The demand is primarily driven by the enduring popularity of cast iron Dutch ovens, driven by home baking and slow-cooking trends. E-commerce penetration is extremely high, and the market is highly competitive, with established European and domestic manufacturers vying for market share. Key market growth is observed in the expansion of high-end, aesthetic-focused cookware targeting millennials and Generation Z consumers who view kitchen goods as lifestyle products.

- Europe: Europe represents the historical and spiritual home of premium enameled cast iron cookware, with countries like France (Le Creuset, Staub) and Germany maintaining a strong manufacturing and consumer base. The market is defined by high-quality expectations, demanding performance, and strong adherence to traditional designs, although modern, Scandinavian-influenced aesthetics are gaining traction. Regulatory standards concerning food contact materials (e.g., REACH regulations) are strict, ensuring high product safety, which further cements consumer trust in European-made goods.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid urbanization, rising middle-class income, and the shift from traditional Asian cooking methods to Western styles (like baking and braising). Countries like China, India, and South Korea are witnessing explosive growth. While value-focused (steel enamel) products dominate the volume, the desire for status symbols is fueling significant growth in the premium cast iron segment, particularly in metropolitan areas. Localized manufacturing and distribution strategies are essential to cater to diverse regional culinary requirements.

- Latin America (LATAM): This region is an emerging market characterized by price sensitivity but growing awareness of quality cookware benefits. Brazil and Mexico are the primary markets, where local manufacturers, alongside international brands, compete heavily on price and perceived value. The market is slowly transitioning from basic aluminum cookware to more durable, hygienic alternatives like enamel pots, supported by expanding modern retail infrastructure.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high purchasing power and exposure to international cooking trends. The market shows strong demand for large-capacity pots suitable for communal and celebratory cooking. Challenges include logistics complexity and dependence on imported goods, making distribution efficiency a key competitive factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enamel Pots Market.- Le Creuset

- Staub

- Lodge Manufacturing

- Cuisinart

- Tramontina

- Tefal (Groupe SEB)

- Dansk (Lenox)

- ZWILLING J.A. Henckels

- Chasseur

- Martha Stewart Collection

- Crock-Pot

- Pioneer Woman (Ree Drummond)

- Great Jones

- Santech

- FINEX Cast Iron Cookware

- Denby Pottery Company

- Miyabi

- KitchenAid

- Villeroy & Boch

- Calphalon

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Enamel Pots Market?

The Enamel Pots Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing consumer investment in high-durability and aesthetically pleasing kitchen cookware globally.

Why are enamel pots preferred over traditional uncoated cast iron cookware?

Enamel pots are preferred primarily because the porcelain glaze provides a non-reactive, non-toxic, and easy-to-clean surface that does not require seasoning, making them ideal for cooking acidic foods without imparting metallic flavors or rust.

Which material segment dominates the market in terms of value?

The Cast Iron Enamel Pots segment holds the dominant share in market value due to its superior heat retention properties, exceptional durability, and its positioning as a premium, long-lasting investment product, commanding high average selling prices.

What is the biggest restraint affecting the growth of the Enamel Pots Market?

The primary restraint is the high initial purchase cost of premium enameled products, particularly those made from cast iron, coupled with the product's susceptibility to chipping if dropped or exposed to rapid temperature changes, raising consumer concerns about longevity.

How is AI impacting the quality control in enamel pot manufacturing?

AI is significantly impacting quality control through the integration of Machine Vision Systems (MVS), which use sophisticated algorithms to perform real-time, high-precision inspections of the enamel coating, identifying minute defects like porosity or surface unevenness faster and more accurately than human inspectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager