Enasidenib Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435547 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Enasidenib Drugs Market Size

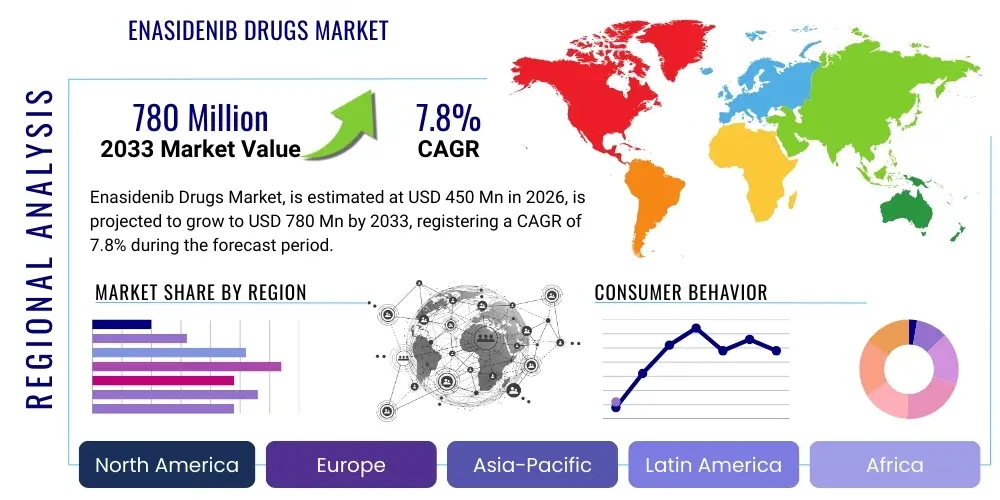

The Enasidenib Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 780 Million by the end of the forecast period in 2033.

Enasidenib Drugs Market introduction

The Enasidenib Drugs Market centers around the therapeutic agent Enasidenib (Idhifa), a targeted inhibitor approved primarily for treating acute myeloid leukemia (AML) characterized by a specific mutation in the isocitrate dehydrogenase-2 (IDH2) gene. This targeted therapy represents a significant advancement in personalized oncology, moving away from conventional chemotherapy regimens toward agents that specifically disrupt cancer cell metabolism. Enasidenib works by inhibiting mutant IDH2, thereby reducing the production of 2-hydroxyglutarate (2-HG), an oncometabolite that drives oncogenesis and blocks cellular differentiation. The drug is administered orally, offering convenience and improved quality of life compared to intravenous treatments, making it a critical component of the relapse and refractory AML treatment landscape.

Major applications of Enasidenib are predominantly focused on adult patients suffering from relapsed or refractory AML who harbor the IDH2 mutation. Beyond this primary indication, there is ongoing research exploring its utility in newly diagnosed AML patients, particularly those ineligible for intensive chemotherapy, and potentially in other hematologic malignancies exhibiting similar metabolic alterations. The benefits of Enasidenib include durable remissions, manageable toxicity profile compared to traditional cytotoxic agents, and the ability to induce differentiation in leukemic blast cells, leading to cytoreduction. The drug’s efficacy is contingent upon accurate molecular diagnosis through companion diagnostics, which ensures that only patients likely to benefit receive the treatment, thereby enhancing overall therapeutic efficiency.

Driving factors propelling the expansion of this specialized market include the rising global incidence of AML, increased understanding and adoption of personalized medicine approaches in oncology, and advancements in molecular diagnostics that facilitate precise identification of eligible patients. Furthermore, supportive regulatory pathways, particularly for orphan drugs targeting niche populations with high unmet medical needs, encourage further investment and uptake. As pharmaceutical companies seek to maximize the lifecycle of targeted therapies, efforts to expand the label into earlier treatment lines or combination therapies continue to sustain market growth, addressing the critical challenge of therapeutic resistance observed in late-stage AML.

Enasidenib Drugs Market Executive Summary

The Enasidenib Drugs Market is characterized by robust growth driven by the successful integration of precision medicine into hematological oncology, marked by its role as the first targeted IDH2 inhibitor approved for relapsed/refractory AML. Key business trends include strategic collaborations between pharmaceutical manufacturers and diagnostic companies to streamline patient identification and treatment initiation. Furthermore, there is a sustained industry focus on developing combination regimens, pairing Enasidenib with hypomethylating agents (HMAs) or standard chemotherapy to improve deep response rates and overall survival, particularly in older or frailer patient populations. Pricing strategies remain premium, reflective of its orphan drug status and the significant clinical value proposition it offers in a difficult-to-treat cancer setting, although pressure from biosimilar development for related oncology targets may influence long-term pricing stability.

Regionally, North America maintains the largest market share, attributable to high AML prevalence, superior infrastructure for advanced molecular testing, and favorable reimbursement policies for targeted oncology drugs. Europe follows, with market penetration increasing as clinical guidelines are updated to prioritize mutation-specific therapies, though adoption speed varies depending on individual national health technology assessment (HTA) bodies. The Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid improvements in healthcare spending, expanding access to sophisticated diagnostic tools, and increasing awareness among oncologists regarding targeted therapeutic options for AML. Significant investment is being made in countries like China and India to establish localized clinical trial infrastructure, which will further accelerate the regional uptake of Enasidenib.

Segment trends highlight the dominance of the oral dosage form, aligning with patient preference and clinical practicality. In terms of application, the relapsed/refractory AML segment currently holds the largest market share, but the segment encompassing newly diagnosed AML patients, especially those unfit for intensive chemotherapy, is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR). This shift is driven by clinical trial data demonstrating safety and efficacy in the frontline setting. Distribution channel analysis shows that specialty pharmacies and hospital-based oncology centers remain the primary points of dispensing, emphasizing the need for specialized patient support and adherence programs critical for successful long-term oral chemotherapy management.

AI Impact Analysis on Enasidenib Drugs Market

Common user questions regarding AI's influence on the Enasidenib market revolve primarily around enhancing patient stratification, predicting therapeutic response, and accelerating drug development for next-generation IDH inhibitors. Users frequently inquire about how AI algorithms can improve the speed and accuracy of identifying rare IDH2 mutations in large genomic datasets, thereby overcoming diagnostic bottlenecks. A major concern is whether AI can reliably predict primary or secondary resistance to Enasidenib before treatment initiation, allowing clinicians to select optimal combination therapies immediately. Key expectations center on AI-driven clinical trial design optimization, particularly in refining patient inclusion criteria and identifying predictive biomarkers that ensure maximum efficacy in targeted populations, ultimately increasing the cost-effectiveness and successful deployment of Enasidenib.

AI is fundamentally transforming the R&D and deployment landscape for targeted small-molecule inhibitors like Enasidenib. In the preclinical phase, AI and machine learning (ML) models are employed for analyzing large chemical libraries to identify novel IDH inhibitors with improved selectivity, potency, and pharmacological profiles, minimizing off-target effects. Furthermore, AI excels at integrating multimodal patient data—including clinical history, genomic sequencing, and radiomic images—to create predictive models of response. These models help in early identification of patients who are most likely to achieve a complete response versus those who may require alternative or combination strategies, optimizing precious healthcare resources and improving patient outcomes.

In the clinical setting, the application of AI extends to monitoring real-world data and enhancing pharmacovigilance. ML algorithms analyze electronic health records (EHRs) and patient-reported outcomes to detect subtle trends in adverse event profiles associated with long-term Enasidenib use that might be missed in controlled trials. This sophisticated data analysis allows for proactive risk management and timely intervention. Additionally, AI systems are instrumental in forecasting demand and optimizing supply chains for these highly specialized, low-volume pharmaceuticals, ensuring that drugs reach the specific centers treating AML patients efficiently, thereby supporting the continuous accessibility of Enasidenib therapy globally.

- AI-enhanced diagnostic algorithms accelerate the detection of rare IDH2 mutations.

- Machine Learning predicts patient response heterogeneity and potential for resistance to Enasidenib.

- AI optimizes clinical trial design, identifying ideal patient cohorts for combination studies.

- Natural Language Processing (NLP) extracts and synthesizes real-world data for post-market surveillance and adverse event monitoring.

- Deep learning models accelerate the discovery of next-generation IDH inhibitors with improved pharmacokinetic properties.

DRO & Impact Forces Of Enasidenib Drugs Market

The dynamics of the Enasidenib Drugs Market are shaped by a complex interplay of internal and external forces. The primary drivers are the demonstrated clinical superiority and targeted mechanism of action in a subset of AML patients, coupled with increasing molecular testing rates that expand the eligible patient pool. Regulatory support through fast-track and breakthrough therapy designations accelerates market entry and adoption. However, market growth is restrained by the high cost of treatment, which creates access barriers in less affluent healthcare systems, and the competitive threat posed by the development of rival IDH inhibitors (e.g., Ivosidenib, an IDH1 inhibitor) or novel classes of AML therapies. Opportunities lie in expanding Enasidenib’s use into earlier treatment lines, establishing efficacious combination therapies, and exploring its potential in non-AML IDH2-mutated malignancies. These forces collectively dictate the adoption curve, market penetration, and long-term sustainability of Enasidenib as a cornerstone targeted therapy.

Drivers: The increasing prevalence of AML globally, especially among aging populations, provides a continually expanding patient base. Crucially, the proven efficacy of Enasidenib in achieving durable hematologic responses in R/R AML patients with the IDH2 mutation addresses a historically difficult-to-treat population with poor prognosis. Furthermore, the integration of companion diagnostics into standard AML workup ensures that treatment is highly targeted, maximizing the clinical benefit and enhancing healthcare system efficiency. The oral formulation of the drug significantly contributes to patient adherence and quality of life, further driving clinical preference over intensive intravenous regimens. Heightened research focus on IDH pathway dependencies also leads to continuous refinement of treatment protocols, improving outcomes.

Restraints: Significant restraints include the development of acquired resistance mechanisms, necessitating subsequent therapies and limiting the long-term effectiveness of the drug. The market is also hampered by the relatively small target population—only about 8-12% of AML patients harbor the IDH2 mutation—which inherently caps the maximum market size. Furthermore, intense price scrutiny and payer pushback across various international markets due to the high annual cost of targeted oncology drugs restrict broad market access and slow reimbursement timelines, particularly in developing economies. Competition from other IDH inhibitors, and emerging cellular or immunotherapy approaches for AML, also serve as a crucial limiting factor.

Opportunities: Major opportunities exist in developing Enasidenib for use in combination therapy, particularly synergistically with Venetoclax or HMAs, to target residual disease and improve complete remission rates in both newly diagnosed and relapsed settings. Expanding regulatory approval to other IDH2-mutated hematological malignancies, such as myelodysplastic syndromes (MDS) or certain solid tumors, could significantly broaden the addressable market. Furthermore, utilizing comprehensive genomic and proteomic analysis to identify biomarkers that predict exceptional responders offers a pathway to future treatment optimization and market differentiation. Strategic geographical expansion into emerging markets, coupled with local manufacturing or distribution partnerships, represents a high-potential avenue for growth.

Segmentation Analysis

The Enasidenib Drugs Market is meticulously segmented based on key attributes including application, dosage form, and distribution channel, reflecting the specific nature of targeted oncology therapeutics. Application segmentation differentiates between the approved use in relapsed/refractory settings and emerging use in the newly diagnosed population, reflecting ongoing clinical shifts. Dosage form segmentation highlights the primary oral tablet format, which is the established method of delivery. Analysis across distribution channels reveals the dependence on highly specialized networks, ensuring that this Schedule H drug is handled and dispensed in controlled clinical environments, maximizing patient safety and adherence protocols required for high-risk leukemia patients. Understanding these segment dynamics is crucial for manufacturers to tailor their marketing, supply chain, and patient support strategies effectively.

The segmentation by application clearly indicates the therapeutic evolution of Enasidenib. While initially confined to the challenging relapsed or refractory setting, subsequent clinical trials investigating its use in induction therapy for older patients deemed ineligible for intensive chemotherapy have positioned the newly diagnosed segment as a high-growth area. This transition is important because treating AML earlier often yields better long-term outcomes and expands the duration of therapy, thereby increasing market volume. The dominant segment remains relapsed/refractory due to the initial approval, but strategic R&D efforts are heavily focused on penetrating the upfront treatment market. Meanwhile, the inherent segmentation based on the required genetic mutation (IDH2 positive only) defines the ultimate ceiling for all application segments, underscoring the market’s reliance on accurate and widespread molecular testing.

The physical characteristics of the drug define the segmentation by dosage form, which is currently dominated by the 50 mg film-coated oral tablet. The convenience of an oral formulation is a significant differentiator in oncology treatment, providing logistical benefits for both patients and healthcare providers compared to injectable therapies. Regarding distribution, the primary channels reflect the necessity of highly regulated dispensing environments. Specialty pharmacies are critical partners, as they manage complex insurance verification, patient financial assistance programs, and specialized counseling regarding the drug’s potential differentiation syndrome and adherence requirements. Hospital pharmacies play a crucial role, particularly for initiation and inpatient monitoring phases of therapy, reinforcing the need for tight integration within established oncology treatment centers.

- Application:

- Relapsed or Refractory Acute Myeloid Leukemia (R/R AML)

- Newly Diagnosed AML (Unfit for Intensive Chemotherapy)

- Dosage Form:

- Oral Tablets (50mg)

- Distribution Channel:

- Hospital Pharmacies

- Specialty Pharmacies

- Retail Pharmacies (Limited Use)

- End User:

- Hospitals and Oncology Centers

- Specialty Clinics

Value Chain Analysis For Enasidenib Drugs Market

The value chain for the Enasidenib Drugs Market begins with intensive upstream activities focused on complex small-molecule synthesis and Active Pharmaceutical Ingredient (API) manufacturing. Given the targeted nature of Enasidenib, this stage requires highly specialized chemical expertise and adherence to stringent Good Manufacturing Practices (GMP). Key upstream elements include sourcing high-purity chemical intermediates and ensuring robust intellectual property protection for the unique compound structure and formulation. Efficiency in process chemistry is vital for managing the high production costs associated with targeted therapies. This phase transitions into formulation and packaging, where the specific dose stability and bioavailability of the oral tablet are ensured before entering the distribution network.

Downstream activities are dominated by distribution and commercialization, requiring a tightly controlled cold chain and specialized logistics management given the high value and controlled substance nature of the drug in certain jurisdictions. The distribution channel is bifurcated into direct channels, where manufacturers engage directly with major hospital systems or closed-network specialty providers, and indirect channels, which involve wholesale distributors who manage inventory flow to smaller oncology clinics and community pharmacies. A critical downstream component is the integration with companion diagnostic providers. Since Enasidenib efficacy is contingent on the IDH2 mutation status, seamless coordination between molecular testing labs and treatment centers is mandatory for appropriate and timely patient access.

Direct distribution, though costly, allows the manufacturer greater control over pricing, inventory management, and gathering real-world clinical data. Indirect distribution leverages established pharmaceutical wholesale infrastructure to achieve wider geographic reach, particularly important in dispersed regional markets. Both channels rely heavily on comprehensive payer access programs, patient assistance foundations, and specialized education for healthcare professionals regarding the unique side effect profile (e.g., differentiation syndrome) associated with Enasidenib. The ultimate value delivery is achieved when the drug reaches the specialized hematological oncologist who administers and monitors the therapy, completing the chain that starts with advanced biopharmaceutical research.

Enasidenib Drugs Market Potential Customers

The primary customers for Enasidenib are specialized healthcare institutions and professionals focused on hematological oncology, specifically treating acute myeloid leukemia. This includes large academic medical centers, university hospitals, and dedicated cancer treatment hospitals that have the infrastructure and expertise to perform complex molecular testing (IDH2 mutation detection) and manage the specialized side effects of targeted differentiation therapies. The decision-makers within these institutions are typically hematologists, medical oncologists, and pharmacy directors who evaluate the drug based on clinical efficacy data, safety profiles, comparative effectiveness against existing standards of care, and cost-effectiveness analysis.

Secondary but critical customers include governmental and private payers (insurance companies and national health services), who ultimately determine patient access and reimbursement levels. Their analysis centers on the drug’s value proposition in terms of quality-adjusted life years (QALYs) and total treatment cost, especially considering the high initial investment required for targeted therapies. Patient advocacy groups, while not direct buyers, significantly influence the market by advocating for broader access, faster regulatory approval, and comprehensive insurance coverage for IDH2-mutated AML patients.

The ideal end-user patient profile is an adult diagnosed with relapsed or refractory AML (or newly diagnosed AML deemed unfit for intensive chemotherapy) who has confirmed positive results for the IDH2 mutation. This specific molecular signature defines the entire commercial opportunity. The continuity of this customer base is guaranteed by the high mortality and relapse rates associated with AML, ensuring a persistent need for advanced second- and third-line targeted treatments like Enasidenib.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 780 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol Myers Squibb, Celgene Corporation, Agios Pharmaceuticals, Novartis AG, Pfizer Inc., Johnson & Johnson, Daiichi Sankyo Company, Ltd., Astellas Pharma Inc., Gilead Sciences, Inc., AbbVie Inc., Roche Holdings AG, Amgen Inc., Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Merck & Co., Inc., Sanofi S.A., Astrazeneca PLC, Genentech (a Member of Roche Group), Stemline Therapeutics, Inc., Jazz Pharmaceuticals plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enasidenib Drugs Market Key Technology Landscape

The technological landscape surrounding the Enasidenib market is heavily dependent on advancements in targeted therapy development and associated diagnostics. The core technology utilized is small molecule inhibition, specifically designed to target the aberrant enzymatic activity of the mutant IDH2 protein. This technology relies on sophisticated synthetic chemistry to create compounds with high specificity for the target mutation, minimizing off-target effects that characterize traditional chemotherapy. Key pharmaceutical technologies include high-throughput screening (HTS) used in the discovery phase to identify lead compounds, advanced structure-activity relationship (SAR) studies to optimize potency and selectivity, and sophisticated drug delivery systems that ensure optimal oral bioavailability and metabolic stability within the patient’s system, maximizing the therapeutic window and minimizing unnecessary degradation.

Equally vital are the technologies underpinning companion diagnostics (CDx). The clinical utility of Enasidenib is inseparable from the ability to accurately and rapidly detect the IDH2 R140/R172 mutations in patient samples. This relies on modern molecular diagnostic platforms, primarily Next-Generation Sequencing (NGS) and quantitative Polymerase Chain Reaction (qPCR). NGS technology allows for multiplex testing, simultaneously screening for IDH2 and other relevant AML mutations, providing comprehensive genomic profiles crucial for treatment selection. The technological infrastructure supporting these diagnostics must be robust, compliant with regulatory standards (e.g., FDA-approved CDx), and capable of producing results quickly to avoid delaying critical treatment initiation for acutely ill AML patients. These diagnostic technologies are constantly evolving, becoming faster, cheaper, and more sensitive, which directly supports the wider adoption of Enasidenib.

Furthermore, digital technologies are playing an increasing role in optimizing the utilization of Enasidenib. Electronic Health Records (EHRs) integrated with clinical decision support systems (CDSS) ensure that clinicians are alerted to the necessity of IDH2 testing and appropriate prescribing guidelines. Telemedicine platforms support patient monitoring for adverse events, particularly the monitoring for differentiation syndrome, a potentially life-threatening complication that requires rapid intervention. Pharmacovigilance relies on advanced database management and cloud computing to analyze the safety data collected globally, enhancing the long-term clinical profile and safety management of the drug. The synergy between drug technology, diagnostic technology, and digital health technology is paramount to the continued growth and responsible deployment of Enasidenib.

Regional Highlights

- North America (United States and Canada): This region is the undisputed leader in the Enasidenib Drugs Market, largely due to high healthcare expenditure, established reimbursement mechanisms (Medicare/Medicaid and private insurers), and rapid adoption of advanced targeted therapies. The presence of major pharmaceutical companies and leading academic cancer research centers ensures continuous investment in clinical trials and high rates of molecular testing for AML patients. The U.S. FDA approval process and designation of Enasidenib as an orphan drug facilitated its market entry, solidifying its position as a key standard of care for IDH2-mutated AML.

- Europe (Germany, UK, France, Italy, Spain): Europe represents the second-largest market. While adoption is robust in major economies like Germany and France, uptake speed is often dictated by stringent Health Technology Assessment (HTA) procedures specific to each country. The market is fragmented by differing national pricing and reimbursement rules. However, the high standard of oncology care and strong research collaborations (e.g., European LeukemiaNet) ensure that clinical guidelines rapidly incorporate mutation-specific therapies, driving steady market expansion.

- Asia Pacific (APAC, including China, Japan, India, South Korea): APAC is projected to be the fastest-growing region. Market growth is fueled by increasing disposable income, improving healthcare access, and the rapidly growing infrastructure for sophisticated genomic testing in countries like Japan and South Korea, which have advanced oncology ecosystems. China and India represent massive untapped potential, with efforts focused on regulatory streamlining and establishing local manufacturing or distribution partnerships to overcome pricing hurdles and accelerate patient access to targeted therapies.

- Latin America (LATAM, including Brazil and Mexico): The market in LATAM is emerging, characterized by significant disparity in access. While private healthcare systems in major cities offer cutting-edge treatments, public access is limited by high drug costs and complex regulatory barriers. Growth relies on government initiatives to expand oncology services and negotiated pricing agreements to integrate Enasidenib into essential medicine lists, particularly in countries with high AML incidence like Brazil.

- Middle East and Africa (MEA): This region holds the smallest share but demonstrates high-value growth potential in the GCC countries (Saudi Arabia, UAE), driven by high per-capita healthcare spending and governmental focus on specialized medical tourism and advanced cancer care facilities. In contrast, access across sub-Saharan Africa remains challenging due to infrastructural limitations and the significant economic burden of targeted therapies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enasidenib Drugs Market.- Bristol Myers Squibb

- Celgene Corporation

- Agios Pharmaceuticals

- Novartis AG

- Pfizer Inc.

- Johnson & Johnson

- Daiichi Sankyo Company, Ltd.

- Astellas Pharma Inc.

- Gilead Sciences, Inc.

- AbbVie Inc.

- Roche Holdings AG

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Merck & Co., Inc.

- Sanofi S.A.

- Astrazeneca PLC

- Genentech (a Member of Roche Group)

- Stemline Therapeutics, Inc.

- Jazz Pharmaceuticals plc

Frequently Asked Questions

Analyze common user questions about the Enasidenib Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action of Enasidenib and what target population does it treat?

Enasidenib (Idhifa) is a targeted oral therapeutic that functions as a small-molecule inhibitor of the mutant isocitrate dehydrogenase-2 (IDH2) enzyme. It is specifically approved for adult patients with relapsed or refractory Acute Myeloid Leukemia (AML) who harbor an IDH2 R140 or R172 mutation, reversing the production of the oncometabolite 2-HG and promoting normal myeloid cell differentiation.

How is the competitive landscape for Enasidenib evolving with the introduction of other targeted AML therapies?

The competitive landscape is intensifying due to the presence of other IDH inhibitors, such as Ivosidenib (IDH1 inhibitor), which targets a similar molecular niche. Furthermore, broader AML therapies like Venetoclax (a BCL-2 inhibitor) in combination with hypomethylating agents are setting high benchmarks for response rates in the frontline setting, pressuring Enasidenib to demonstrate efficacy in combination regimens to maintain market share.

What are the key drivers for market growth in the Asia Pacific region for Enasidenib?

The growth in APAC is predominantly driven by increasing investment in healthcare infrastructure, rising awareness and adoption of molecular diagnostics (like NGS) crucial for identifying eligible IDH2+ patients, and expanding governmental support for advanced cancer therapies. Improved market access and favorable regulatory pathways in countries like Japan and South Korea are accelerating uptake.

What is the biggest clinical restraint limiting the widespread use of Enasidenib?

The primary clinical restraint is the high specificity required; only 8-12% of all AML patients possess the target IDH2 mutation, inherently limiting the addressable patient population. Additionally, the potential for acquired resistance mechanisms during long-term therapy and the need for specialized management of differentiation syndrome pose challenges for widespread clinical application.

How does the integration of Artificial Intelligence specifically benefit the deployment of Enasidenib therapy?

AI significantly benefits Enasidenib deployment by enhancing patient stratification through accelerated, accurate genomic analysis of IDH2 mutations. AI models are also utilized to predict patient response and potential for resistance, allowing clinicians to select personalized combination treatments, optimize clinical trial design, and improve overall resource allocation in personalized medicine.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager