Enclosed Belt Conveyor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437898 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Enclosed Belt Conveyor Market Size

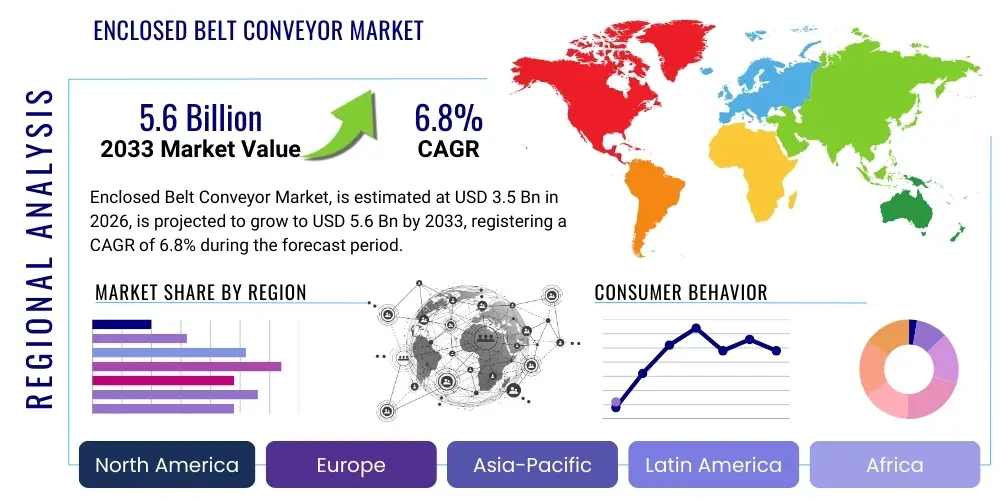

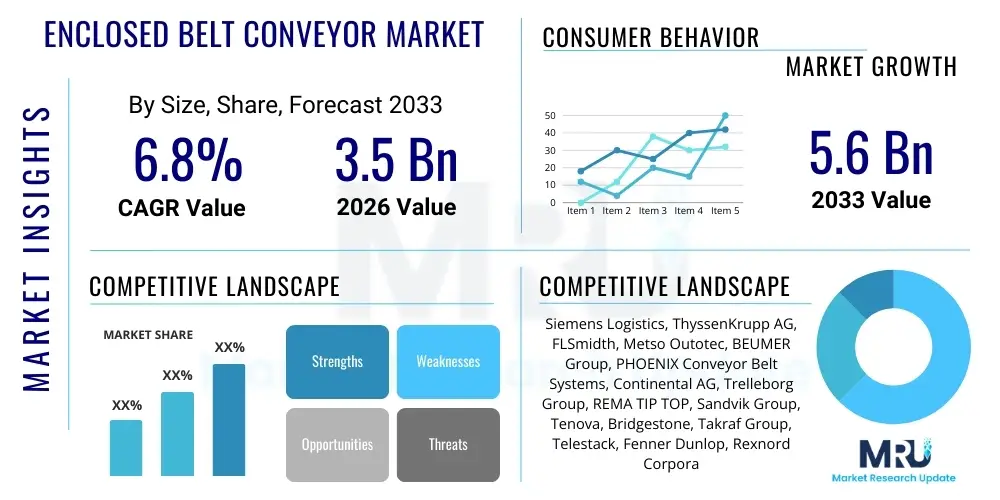

The Enclosed Belt Conveyor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Enclosed Belt Conveyor Market introduction

The Enclosed Belt Conveyor Market encompasses specialized material handling systems designed to transport bulk materials within a fully sealed casing or structure, offering superior environmental protection and safety compared to conventional open trough conveyors. These systems are crucial for handling materials that are dusty, volatile, abrasive, or sensitive to external contamination, ensuring that the conveyed product remains contained and the surrounding environment is protected from fugitive emissions. The inherent design, often utilizing pipe conveyors or fully covered trough systems, addresses stringent environmental regulations concerning particulate matter and dust control, making them indispensable in industries such as mining, cement manufacturing, power generation, and chemical processing. This critical function drives stable demand globally, particularly as industrial operations seek enhanced operational efficiency coupled with strict compliance standards.

The primary benefits of utilizing enclosed belt conveyor systems include vastly improved worker safety by eliminating access to moving parts, significant reduction in material spillage and dust generation, and the ability to handle steep incline angles, thus minimizing the required spatial footprint of the conveying infrastructure. Furthermore, these systems often enable the transportation of materials over complex terrains, including curved sections, which is particularly beneficial in quarrying and large-scale infrastructure projects where linear paths are impractical. The robustness and longevity of components, often constructed from heavy-duty steel and specialized rubber compounds, contribute to lower long-term maintenance costs and higher operational uptime, appealing directly to industries where continuous operation is paramount.

Driving factors for sustained market expansion include the global surge in mineral extraction activities, fueled by increasing demand for battery components and infrastructure materials, which requires high-capacity, environmentally responsible transport solutions. Furthermore, the stringent enforcement of occupational safety and environmental protection mandates across developed and rapidly industrializing economies compels end-users to upgrade existing open systems to modern enclosed variants. The ongoing modernization of aging infrastructure in North America and Europe, coupled with massive new project developments in the Asia Pacific region, specifically in urban construction and large industrial zones, establishes a resilient foundation for robust market growth throughout the forecast period.

Enclosed Belt Conveyor Market Executive Summary

The Enclosed Belt Conveyor Market is characterized by a strong push toward automation, digitalization, and enhanced environmental sustainability, marking a shift from basic material transport solutions to integrated, smart logistical components. Business trends indicate a rising preference for modular, customizable enclosed systems that can be rapidly deployed and adapted to varying operational requirements, minimizing installation time and optimizing capital expenditure. Key manufacturers are focusing heavily on developing predictive maintenance solutions leveraging IoT sensors and data analytics, moving the market focus from reactive repair to proactive system management, thereby improving overall equipment effectiveness (OEE). The competitive landscape remains moderately consolidated, with major players investing in proprietary belt technology and advanced sealing mechanisms to gain a technological edge, particularly in high-abrasion or extreme temperature applications.

Regionally, the Asia Pacific (APAC) stands as the principal growth engine, driven by unprecedented industrial expansion, rapid urbanization, and significant government investment in infrastructure development, particularly in China, India, and Southeast Asian nations. This region’s high volume of new projects in mining, bulk chemical handling, and large-scale power plants necessitates the implementation of efficient, enclosed conveying solutions to meet both production targets and nascent environmental regulatory pressures. Conversely, North America and Europe are experiencing stable, replacement-driven demand, focusing on modernizing legacy equipment to meet stricter emissions standards and incorporating smart monitoring technologies, thereby prioritizing quality and technological sophistication over sheer volume growth. Latin America and the Middle East and Africa (MEA) represent emerging opportunity zones, spurred by renewed commodity extraction activities and essential infrastructure projects.

Segment trends reveal that the heavy-duty application segment, particularly pipe conveyors due to their ability to handle complex routing and sticky materials while offering complete enclosure, maintains market dominance. Furthermore, the mining and metallurgy sector remains the largest end-user, though the power generation industry, specifically those handling biomass and fly ash, is exhibiting one of the fastest growth trajectories, driven by the need for clean and safe ash removal and fuel supply systems. Technological adoption is favoring integrated control systems that allow for seamless connectivity with plant-wide SCADA systems, ensuring efficient throughput management and real-time fault detection, which is crucial for maintaining operational continuity in high-stakes environments.

AI Impact Analysis on Enclosed Belt Conveyor Market

Users frequently inquire about the practical implementation and return on investment of integrating Artificial Intelligence (AI) and Machine Learning (ML) into existing conveyor infrastructure, often focusing on how these technologies can transition maintenance schedules from time-based or reactive methods to genuinely predictive protocols. Common concerns revolve around the cybersecurity risks associated with networked industrial control systems (ICS), the complexity and cost of retrofitting older analog systems with necessary sensors and edge computing capabilities, and the required workforce skills transformation necessary to manage and interpret the vast datasets generated by AI-driven monitoring systems. Key expectations center on achieving near-zero unscheduled downtime, optimizing energy consumption based on real-time load fluctuation, and enabling truly autonomous operational adjustments in response to immediate environmental or material condition changes.

AI’s primary influence is manifesting through advanced diagnostic capabilities and operational efficiency enhancements, allowing enclosed belt conveyor operators to move beyond basic vibration and temperature monitoring. By processing complex multivariate data streams—including acoustics, thermal imaging, power draw, and strain gauge readings—AI algorithms can detect subtle anomalies indicative of impending component failure, such as belt splice issues, idler bearing wear, or misalignment problems, far earlier than traditional methods. This predictive capability significantly extends component lifespan, reduces the cost of emergency repairs, and maximizes the availability of the critical conveying systems, which are often bottlenecks in high-volume production plants. Furthermore, AI contributes to optimizing belt speed and material flow rates dynamically, ensuring maximum throughput under variable loading conditions while minimizing energy expenditure, addressing both cost efficiency and environmental goals.

The integration of deep learning models also offers substantial improvements in anomaly detection related to material composition and load profile within the enclosed structure. For example, in mining operations, AI can analyze visual data collected via internal cameras to detect foreign objects or changes in material quality that could damage downstream processing equipment or compromise the integrity of the belt itself. This level of automated inspection and quality control within the enclosed environment is impossible with manual supervision. Although initial deployment costs remain a concern for smaller operators, the long-term operational savings and the enhanced safety profile generated by AI-driven systems are quickly making them a standard requirement for large-scale, mission-critical enclosed conveyor installations.

- AI enables predictive maintenance, dramatically reducing unplanned system downtime.

- Machine learning optimizes energy consumption by dynamically adjusting belt speed based on load.

- Advanced algorithms analyze sensor data (vibration, acoustics, thermal) for early fault detection.

- AI facilitates autonomous system adjustments to maintain optimal material flow rates.

- Deep learning models improve internal quality control by detecting foreign materials or anomalies.

- Enhanced cybersecurity measures are driven by AI to protect networked conveyor control systems.

DRO & Impact Forces Of Enclosed Belt Conveyor Market

The market dynamics for enclosed belt conveyors are shaped by a complex interplay of stringent safety regulations and operational efficiency demands (Drivers), high capital investment requirements and inherent logistical challenges (Restraints), advancements in smart technology and expansion into new geographical markets (Opportunities), and the influence of fluctuating commodity prices and environmental legislation (Impact Forces). The imperative to comply with increasingly strict global standards regarding dust emissions, particularly from organizations like the EPA and equivalent regional bodies, acts as a powerful driver compelling industries handling bulk solids to adopt fully enclosed systems. Simultaneously, the persistent drive within manufacturing and mining sectors to minimize operational expenditure through automation and reduced labor dependence further stimulates the demand for technologically advanced enclosed conveyor solutions offering superior reliability and reduced spillage management costs.

However, the market faces significant restraints primarily centered on the relatively high initial procurement and installation costs associated with enclosed systems compared to traditional open conveyors, especially for specialized designs like pipe conveyors which require precise alignment and robust support structures. Furthermore, the sheer physical scale and bulkiness of these systems present logistical challenges during transportation and on-site assembly, particularly in remote mining locations or congested urban environments. Economic volatility in the commodity markets directly influences capital expenditure decisions in the mining and construction sectors, sometimes leading to the deferral of large-scale conveyor system purchases, thereby introducing cyclical market instability.

Despite these barriers, substantial opportunities exist, driven by the emergence of smart material handling technologies, including sophisticated sensor integration, condition monitoring platforms, and the adoption of modular designs that facilitate easier maintenance and expansion. The untapped potential in developing economies, particularly in regions undergoing massive infrastructure and industrial build-out, offers lucrative avenues for market penetration. The major impact forces acting on this market include the global shift towards renewable energy, which necessitates specialized conveying solutions for biomass and ash handling in power plants, and the ongoing global supply chain constraints affecting the availability and pricing of critical raw materials such such as high-grade steel and conveyor belt composites, influencing manufacturer margins and final product pricing strategies.

Segmentation Analysis

The Enclosed Belt Conveyor Market is systematically segmented based on Type, Application, and End-User Industry to provide a granular understanding of demand drivers and market composition. The Type segmentation primarily differentiates between the mechanical design and functionality of the enclosure, focusing on traditional fully covered trough conveyors, pipe conveyors (tube conveyors), and steep-angle conveyors, each addressing specific constraints regarding space utilization, material characteristics, and terrain complexity. Application segmentation distinguishes between the purpose of the transport, typically categorized by capacity ranges (e.g., low capacity, medium capacity, and high capacity/heavy-duty systems), reflecting the varying demands of small processing plants versus large-scale mines or ports. This differentiation is critical for manufacturers in tailoring product specifications and performance characteristics to meet specific industry benchmarks.

The End-User Industry segmentation is perhaps the most defining characteristic of the market, identifying the primary sectors utilizing these specialized systems, including Mining & Metallurgy, Cement, Power Generation, Chemical Processing, Ports & Logistics, and Food & Beverage. Each sector imposes unique demands: mining requires extreme durability and high throughput; power generation demands strict dust control for hazardous materials like coal and ash; and the food & beverage sector requires hygienic, easy-to-clean enclosures to prevent contamination. The growth trajectory and adoption rates vary significantly across these segments, with the infrastructure-heavy industries typically driving the largest volume demand.

Analyzing these segments allows stakeholders to identify high-growth niches and tailor marketing and R&D efforts effectively. For instance, the growing focus on sustainable mining practices has accelerated the adoption of pipe conveyors due to their minimal environmental footprint and superior dust containment capabilities, while the global commitment to cleaner energy sources ensures sustained investment in conveyor systems dedicated to biomass handling and complex ash removal processes. The continuous refinement of standardized modular components further aids in reducing segment-specific customization costs, broadening the appeal of enclosed conveyors across diverse industrial applications.

- Type

- Fully Covered Trough Conveyors

- Pipe Conveyors (Tube Conveyors)

- Steep-Angle Enclosed Conveyors

- Overland Enclosed Systems

- Application

- Bulk Material Handling

- High-Capacity Transport

- Curved Path Conveying

- Long-Distance Transport

- End-User Industry

- Mining & Metallurgy

- Cement & Aggregate

- Power Generation (Coal, Ash, Biomass)

- Ports, Terminals, and Logistics

- Chemical Processing

- Pulp & Paper

Value Chain Analysis For Enclosed Belt Conveyor Market

The value chain for the Enclosed Belt Conveyor Market begins with the upstream sourcing of critical raw materials, primarily high-strength steel (for structural components, idlers, and pulleys), specialized rubber and polymer compounds (for belting), and various precision mechanical and electronic components (motors, gearboxes, sensors). The quality and consistency of these raw materials significantly dictate the final performance and longevity of the conveyor system, making strategic supplier relationships crucial. Fluctuations in global steel and synthetic rubber prices often exert direct pressure on the manufacturing margin, necessitating robust hedging and inventory management strategies by major conveyor manufacturers. The manufacturing phase involves complex engineering design, fabrication, welding, and assembly, requiring specialized machinery and highly skilled labor, differentiating key players based on their internal vertical integration capabilities and quality control processes.

The midstream of the value chain involves the crucial stages of system integration and distribution. Distribution channels are typically a mix of direct sales to large, multinational end-users (especially in mining and power) who require bespoke engineering and installation services, and indirect sales through specialized regional distributors or system integrators for smaller, standardized projects. Direct channels allow for higher margins and better control over complex project execution, while indirect channels provide essential market access and local support in diverse geographical areas. System integration is vital, as the conveyor is often a customized solution that must interface seamlessly with existing plant infrastructure and control systems, demanding significant engineering consultancy and project management expertise.

The downstream portion of the value chain focuses heavily on installation, commissioning, and, most critically, after-sales service and maintenance. Given the high capital expenditure and mission-critical nature of enclosed conveyors, ongoing support—including spare parts provisioning (e.g., idlers, replacement belts, specialized rollers), preventative maintenance contracts, and operational training—is a major source of recurring revenue and a key determinant of customer satisfaction. Digital services, such as remote monitoring and AI-driven predictive maintenance platforms, are increasingly becoming integral components of the downstream value offering. This emphasis on long-term service relationships drives the overall lifecycle value of the product and strengthens brand loyalty within the highly technical end-user segments.

Enclosed Belt Conveyor Market Potential Customers

Potential customers for enclosed belt conveyor systems represent a diverse array of heavy industries characterized by the need for high-volume, reliable bulk material transport, coupled with stringent environmental and safety compliance requirements. The primary customer base resides within sectors that handle abrasive, hazardous, or high-value materials susceptible to contamination or environmental leakage. These end-users, or buyers, prioritize operational efficiency, system longevity, and adherence to modern industrial safety standards, making the enclosed design a strategic necessity rather than a mere preference. Investment decisions are typically made by high-level engineering departments or capital project managers who focus on total cost of ownership (TCO) over a lifespan that often exceeds two decades, rather than just the initial purchase price.

The Mining and Metallurgy sector stands out as the largest purchaser, utilizing enclosed conveyors for transporting raw ore, tailings, and processed minerals both underground and overland, where dust suppression is critical for worker health and regulatory compliance. Cement and Aggregate manufacturers are also major buyers, employing these systems to move dusty materials like limestone, clinker, and finished cement without releasing significant particulate matter into the air, a key factor in densely populated or environmentally sensitive areas. Furthermore, the Power Generation industry, especially facilities relying on coal, petroleum coke, or biomass, represents a core customer segment, requiring enclosed systems for the clean and safe handling of fuel inputs and the subsequent removal of environmentally challenging ash and gypsum byproducts.

Other significant customer groups include major Ports and Terminal operators, who use high-capacity enclosed systems to load and unload bulk carriers efficiently while controlling dust near waterways and urban areas, and the large-scale Chemical Processing industries handling fine powders and reactive substances where product purity and sealed transport are essential to prevent cross-contamination or atmospheric exposure. As industrial automation continues to expand, the demand base is broadening to include specialized manufacturing operations requiring hermetically sealed conveyance for specific components or feedstock, thus ensuring consistent, controlled material flow throughout complex processing chains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Logistics, ThyssenKrupp AG, FLSmidth, Metso Outotec, BEUMER Group, PHOENIX Conveyor Belt Systems, Continental AG, Trelleborg Group, REMA TIP TOP, Sandvik Group, Tenova, Bridgestone, Takraf Group, Telestack, Fenner Dunlop, Rexnord Corporation, General Kinematics, Efacec, PCL Conveyors, and NERAK Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enclosed Belt Conveyor Market Key Technology Landscape

The technological landscape of the Enclosed Belt Conveyor Market is rapidly evolving, driven by the need for increased durability, reduced energy consumption, and superior connectivity. Core technological advancements focus primarily on belt material science, structural engineering, and system monitoring capabilities. High-performance conveyor belting materials, often reinforced with aramid fibers or specialized steel cords, are designed to withstand extreme abrasive environments, high tension loads, and prolonged exposure to varying temperatures and chemical substances, significantly extending maintenance intervals. Furthermore, modular structural designs are gaining prominence, utilizing standardized components that simplify on-site assembly, enable rapid reconfiguration, and reduce the complexity of integrating curved or steeply inclined sections, minimizing overall project implementation timelines and costs while maintaining structural integrity required for full enclosure systems.

A critical technology trend involves the sophisticated integration of Internet of Things (IoT) sensors and data analytics platforms into the conveyor system. This includes advanced idler monitoring systems that detect bearing wear and alignment issues via vibration and thermal sensors, coupled with specialized belt monitoring technologies that use embedded sensors or non-contact scanners to check for longitudinal rips, splice degradation, or premature wear. The data collected by these integrated systems is processed at the edge or transmitted to cloud platforms, forming the backbone of the aforementioned predictive maintenance models. This connectivity ensures real-time operational transparency, allowing operators to optimize performance and prevent catastrophic failures, which are particularly costly in long-distance, enclosed overland conveying systems.

Specific innovations in enclosed designs, such as improvements in sealing technology for pipe conveyors, are crucial for maintaining dust-free operations and handling challenging materials, including fine, sticky, or highly volatile powders. Continuous improvements in drive technology, including the adoption of high-efficiency permanent magnet motors and smart variable frequency drives (VFDs), allow for precise speed control and optimize power consumption according to real-time loading conditions, directly addressing the industry pressure to reduce energy footprints. The convergence of these material science, mechanical engineering, and digitalization efforts is defining the next generation of enclosed belt conveyors, positioning them as complex, intelligent assets within the broader industrial ecosystem, rather than mere mechanical transport systems.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and technological adoption rates within the enclosed belt conveyor market, reflecting local industrial maturity, regulatory stringency, and available capital investment for infrastructure. The market is broadly divided into five primary geographical segments, each presenting distinct growth drivers and competitive environments that necessitate tailored market entry strategies and product offerings from global manufacturers.

Asia Pacific (APAC) stands out as the undisputed leader in market size and growth potential, driven primarily by massive investments in infrastructure development, rapid industrialization, and sustained demand from key industries like cement, power generation, and metal processing in nations such as China, India, and Australia. The sheer volume of new construction and mining projects in this region necessitates high-throughput bulk handling solutions, often over challenging distances and terrains. While cost sensitivity remains a factor, increasing urbanization and emerging local environmental regulations are simultaneously driving a push towards high-quality, enclosed systems that minimize pollution and comply with nascent regional safety standards, favoring long-term, reliable solutions over initial low cost.

Europe and North America represent mature markets characterized by replacement demand, strict environmental protection acts, and advanced integration of smart technologies. European demand is intensely focused on high standards for dust containment and worker safety, propelling the adoption of complex pipe conveyor systems and demanding compliance with EU machinery directives. North America’s market is dominated by modernization efforts within the mining and aggregate sectors, with significant emphasis placed on automation and the deployment of advanced diagnostic technologies (AI/IoT) to reduce labor costs and maximize system uptime in the face of aging infrastructure. These regions, while slower in volume growth than APAC, lead the way in technological sophistication and premium component demand.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing cyclical growth tied strongly to global commodity prices, particularly minerals and hydrocarbons. Latin America's strong mining presence drives significant, yet volatile, demand for robust overland and enclosed systems to move materials from remote sites to port facilities, where environmental protection is becoming an increasingly regulated issue. The MEA region is witnessing growing investment in large-scale infrastructure and industrial zones (such as petrochemical and construction material hubs), creating a stable requirement for large capacity, durable enclosed systems capable of operating reliably in harsh climate conditions, often sourced through international engineering, procurement, and construction (EPC) contractors.

- Asia Pacific (APAC): Largest and fastest-growing market due to infrastructure spending, urbanization, and robust mining sector expansion in China, India, and Indonesia.

- North America: Focus on modernizing aging infrastructure, high penetration of smart monitoring (AI/IoT), and stringent occupational safety standards in the mining and aggregate sectors.

- Europe: Driven by strict environmental and safety regulations (EU Directives), leading to high adoption of specialized, highly sealed systems like pipe conveyors and a strong focus on energy efficiency.

- Latin America: Demand linked to cyclical global commodity prices, particularly high-volume overland conveying needs for copper, iron ore, and other major mineral exports.

- Middle East & Africa (MEA): Emerging growth driven by new industrial zones, construction materials production, and harsh environment operational requirements in resource extraction activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enclosed Belt Conveyor Market.- Siemens Logistics

- ThyssenKrupp AG

- FLSmidth

- Metso Outotec

- BEUMER Group

- PHOENIX Conveyor Belt Systems

- Continental AG

- Trelleborg Group

- REMA TIP TOP

- Sandvik Group

- Tenova

- Bridgestone

- Takraf Group

- Telestack

- Fenner Dunlop

- Rexnord Corporation

- General Kinematics

- Efacec

- PCL Conveyors

- NERAK Systems

Frequently Asked Questions

Analyze common user questions about the Enclosed Belt Conveyor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and main benefit of an enclosed belt conveyor system?

The primary function is the contamination-free, high-volume transportation of bulk materials. The main benefit is superior environmental control, which includes eliminating dust emissions, reducing material spillage, and significantly enhancing worker safety by isolating the moving components, thereby ensuring compliance with stringent regulatory standards, particularly in sensitive industrial and urban environments.

How does the total cost of ownership (TCO) for enclosed conveyors compare to open systems?

While enclosed belt conveyors typically involve a higher initial capital expenditure (CAPEX) due to complex structural requirements and specialized components, their Total Cost of Ownership (TCO) is often lower over the long term. This reduction is achieved through minimal material loss, decreased operational costs associated with dust cleanup and spillage remediation, and substantially longer intervals between maintenance cycles due to protection from environmental wear and tear.

Which end-user industries are the dominant drivers of demand for enclosed conveyor technology?

The dominant drivers of demand are the Mining and Metallurgy sector, requiring robust, high-capacity transport for bulk ores and tailings, and the Power Generation industry, utilizing these systems for the clean and controlled handling of coal, biomass, and especially hazardous ash materials. The Cement and Aggregate industries also represent major segments due to the necessity of strict particulate matter emission control.

What role does digitalization play in the future growth of the enclosed belt conveyor market?

Digitalization, powered by IoT integration and AI analytics, is pivotal for future growth. It enables advanced predictive maintenance by monitoring belt health and component wear in real-time, optimizing energy consumption via dynamic speed adjustment, and providing remote diagnostic capabilities. This shift from reactive maintenance to intelligent, proactive system management drives operational efficiency and maximizes system availability.

What is the difference between a fully covered trough conveyor and a pipe conveyor?

A fully covered trough conveyor uses a standard trough belt profile with a fixed cover or housing placed over the top to contain dust. A pipe conveyor (or tube conveyor) utilizes a standard belt that is formed into a closed, circular tube shape around the material during transport, offering complete encapsulation, the ability to handle complex horizontal and vertical curves, and allowing for two-way material transport on a single belt structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager