Endoscope Objective Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432377 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Endoscope Objective Lens Market Size

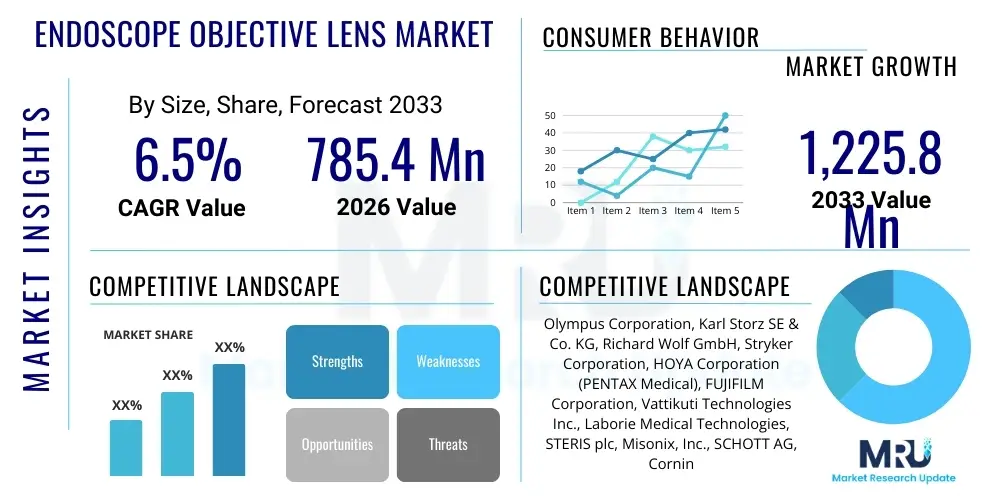

The Endoscope Objective Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,225.8 Million by the end of the forecast period in 2033.

Endoscope Objective Lens Market introduction

The Endoscope Objective Lens Market encompasses the specialized optical components crucial for capturing high-quality images and video during minimally invasive surgical procedures and diagnostic examinations. These lenses are the primary interface between the internal anatomy and the endoscopic imaging system, requiring extremely high precision in terms of resolution, field of view (FOV), depth of field (DOF), and aberration correction. The performance of the objective lens directly dictates the clarity and accuracy of the visual data provided to the clinician, which is paramount for ensuring diagnostic certainty and successful surgical intervention. The increasing complexity of endoscopic procedures, coupled with the rising global demand for minimally invasive surgery (MIS) techniques that reduce patient recovery time and hospital stays, serves as a fundamental driver for continuous innovation in objective lens technology, pushing towards smaller diameters, wider FOVs, and higher resolution capabilities.

Product descriptions within this market vary significantly based on endoscope type—including flexible, rigid, and capsule endoscopes—each demanding unique optical designs tailored to specific clinical applications, such as gastroenterology, pulmonology, urology, and orthopedics. For instance, rigid endoscopes used in laparoscopy require robust, high-magnification objectives with excellent light transmission, while flexible endoscopes necessitate micro-optics capable of maintaining image quality despite fiber optic bundles and articulation mechanisms. The objective lenses often incorporate advanced coatings to minimize light reflection and internal scatter, ensuring optimal contrast and color fidelity, particularly in challenging internal body environments with limited illumination. These sophisticated optical systems are fundamental to the successful adoption of advanced visualization technologies, including 4K and forthcoming 8K endoscopic imaging platforms.

Major applications revolve around clinical diagnostics, therapeutic interventions, and surgical guidance across various medical specialties. Benefits include superior visualization, enhanced diagnostic accuracy through magnification, improved targeting of lesions or surgical sites, and the facilitation of complex therapeutic maneuvers under direct vision. Driving factors include the global aging population, which necessitates more frequent endoscopic screenings; technological advancements in sensor technology and illumination systems; and increasing patient preference for less invasive procedures. Furthermore, stricter regulatory standards concerning reusable medical devices are also influencing the design towards more robust, sterilizable, and durable objective lens assemblies, often using materials resistant to high-temperature and high-pressure sterilization cycles like autoclaving.

Endoscope Objective Lens Market Executive Summary

The Endoscope Objective Lens Market is poised for robust growth, driven primarily by favorable business trends centered around the rapid adoption of high-definition (HD), 4K, and 3D imaging systems that require superior optical performance from objective lenses. Strategic investments in research and development by key market players are focusing on miniaturization, enhancing optical throughput, and developing specialized optics compatible with robotic surgery platforms. A significant business trend involves the shift toward single-use, disposable endoscopes, particularly in areas sensitive to cross-contamination risk such as bronchoscopy and urology. This shift requires cost-effective, high-volume manufacturing of objective lens components while maintaining stringent quality control, presenting both a challenge and a substantial opportunity for specialized component suppliers.

Regional trends indicate that North America and Europe currently hold the largest market shares due to high healthcare expenditure, established infrastructure for advanced diagnostics, and early adoption of robotic and advanced endoscopic technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by improving healthcare access, rapidly increasing medical tourism, government initiatives promoting advanced diagnostic tools, and the massive, expanding patient pool requiring gastrointestinal and pulmonary screenings. Manufacturers are increasingly looking to establish production and distribution hubs in APAC to capitalize on localized demand and favorable regulatory pathways, focusing on lenses designed for mass-market, budget-sensitive flexible endoscopy systems.

Segment trends highlight the dominance of lenses used in flexible endoscopes, reflecting the high volume of gastrointestinal procedures performed globally. Within lens specifications, objective lenses offering a wider Field of View (FOV) are gaining traction, as they improve situational awareness during complex procedures, minimizing the need for constant scope manipulation. Furthermore, the market is seeing increased segmentation based on resolution compatibility, with objectives optimized specifically for 4K imaging becoming standard in high-end hospital settings. Hospitals remain the dominant end-user segment, although Ambulatory Surgical Centers (ASCs) are growing rapidly due to the trend of shifting procedures to lower-cost outpatient settings, driving demand for durable yet specialized objective lens solutions.

AI Impact Analysis on Endoscope Objective Lens Market

Common user questions regarding AI’s impact on the Endoscope Objective Lens Market often center on whether AI-enhanced visualization will necessitate new lens designs, how AI systems process image quality from existing lenses, and the role of objective lenses in facilitating automated image recognition and diagnosis. Users are keen to understand if AI-driven features like real-time lesion detection or automated measurements require specific optical characteristics, such as higher contrast ratios or optimized color rendering, to function optimally. Key themes reveal concerns about latency in AI processing due to data volume (especially 4K video) and the expectation that objective lenses must deliver near-perfect, distortion-free images for AI algorithms to achieve high accuracy. Expectations are high that AI will increase the diagnostic value derived from standard endoscopic images, placing pressure on lens manufacturers to maintain impeccable optical quality and consistency across production batches.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into endoscopic platforms significantly influences the future design requirements for objective lenses. AI algorithms rely on highly precise, consistently illuminated, and aberration-free images to accurately identify subtle pathologies like early-stage cancer or microscopic tissue changes. If an objective lens introduces distortions, chromatic aberrations, or insufficient resolution, the AI diagnostic tools will produce false positives or negatives, compromising patient safety and clinical utility. Therefore, the rise of AI compels lens manufacturers to invest heavily in advanced computational optics and quality control, ensuring that the image quality delivered to the sensor is pristine, effectively serving as the foundational 'ground truth' data for AI interpretation.

The primary concern is ensuring that the objective lens, which captures the initial data, is optimized for the downstream computational steps. This means moving beyond standard human perception metrics and focusing on factors that improve algorithmic performance, such as uniformity of illumination across the entire field of view and minimal geometric distortion, especially at the periphery. AI tools that perform automatic measurements or depth perception also necessitate high fidelity optics. In the future, specialized lenses might incorporate features optimized for AI, such as multispectral imaging capabilities, which require objectives designed to transmit specific, broader ranges of wavelengths beyond the visible spectrum, thus expanding the data available for machine analysis and enhancing diagnostic precision.

- AI mandates higher resolution and lower aberration in objective lens design for accurate lesion detection.

- Increased demand for objective lenses optimized for uniform illumination to ensure consistent data input for ML models.

- AI-driven real-time analysis requires lenses that minimize latency-inducing image processing corrections.

- Adoption of multispectral objective lenses driven by AI requiring broader wavelength data capture.

- Optical distortions must be critically low, as AI algorithms amplify minor errors in image geometry.

- AI integration supports the trend toward standardized, reproducible imaging quality across different lens platforms.

DRO & Impact Forces Of Endoscope Objective Lens Market

The Endoscope Objective Lens Market is profoundly shaped by a combination of powerful drivers (D), significant restraints (R), and transformative opportunities (O), which collectively define the impact forces acting upon industry growth. Key drivers include the global epidemic of chronic diseases requiring endoscopic intervention, such as colorectal and gastric cancer, coupled with the increasing preference for minimally invasive surgical techniques due to improved patient outcomes and reduced healthcare costs. The relentless technological push toward higher resolution (4K and 8K) imaging platforms necessitates continuous upgrades of objective lens systems, which must be capable of delivering the required optical performance to capitalize on advanced sensor technology. This technological imperative ensures consistent demand for innovative optical solutions.

However, the market faces significant restraints, primarily revolving around the high initial cost associated with manufacturing precision optics and the stringent regulatory hurdles required for medical device clearance, particularly in major markets like the U.S. and E.U. Furthermore, the inherent susceptibility of objective lenses to damage during reprocessing and sterilization (especially repeated autoclaving) shortens their lifespan, leading to higher maintenance costs for healthcare providers. The growing prevalence of single-use, disposable endoscopes, while solving contamination issues, presents a cost challenge for objective lens manufacturers who must produce high-quality optics at significantly lower price points to meet the economic demands of disposable device manufacturing, potentially eroding margins for high-end optical components.

Opportunities abound in developing specialized optics for emerging endoscopic fields, such as robotic surgery, where objective lenses must integrate seamlessly with complex mechanical articulation systems while maintaining extreme optical stability. The untapped potential in emerging economies, particularly in Asia and Latin America, represents a massive opportunity for growth, provided manufacturers can develop robust, cost-effective lens solutions tailored to regional healthcare budgets. Furthermore, the push towards developing smart endoscopes, utilizing technologies like near-infrared (NIR) and narrow-band imaging (NBI) for enhanced visualization of blood vessels and specific tissues, opens up niches for objective lenses designed to maximize the efficacy of these specialized lighting and filtering techniques, offering a significant competitive edge to pioneering firms.

Segmentation Analysis

The Endoscope Objective Lens Market is extensively segmented based on several critical parameters, including the type of endoscope, the specific medical application, the required field of view, the target image resolution, and the ultimate end-user facility. This segmentation allows manufacturers to tailor optical systems precisely to the operational needs and technical demands of distinct clinical environments. The segmentation based on endoscope type—rigid, flexible, and capsule—is foundational, as the optical design principles (e.g., relay lenses vs. micro-lenses on a chip) vary drastically. For instance, rigid objective lenses emphasize magnification and high clarity, while flexible objective lenses prioritize compactness and broad field coverage despite articulation limitations. Understanding these divisions is vital for accurate market forecasting and strategic product positioning.

Further granular segmentation by application reveals variations in design specifications. Gastroenterology demands highly durable objectives resistant to corrosive internal environments, whereas neuroendoscopy requires extremely small diameters and long focal lengths for deep access. The segmentation by resolution is becoming increasingly important, driving the demand for lenses capable of supporting 4K and 8K sensors, requiring tighter tolerances on spherical and chromatic aberration correction than standard HD optics. Geographically, market segments reflect differences in regulatory requirements and healthcare spending, necessitating varied product offerings—from ultra-premium lenses in developed markets to rugged, cost-optimized lenses for high-volume use in developing regions.

The evolution of surgical techniques continues to drive the demand for highly specialized sub-segments, such as objectives designed for three-dimensional (3D) endoscopy, which require dual objective systems or advanced computational optics for depth perception. This necessitates innovation in materials science to create lighter, more durable lenses that can withstand repeated exposure to aggressive sterilization methods without compromising optical integrity. The continuous refinement across all these segments ensures that the market remains dynamic, with specialized suppliers often dominating niche segments requiring unique expertise, such as micro-optics for capsule endoscopy.

- By Endoscope Type:

- Rigid Endoscope Objective Lenses

- Flexible Endoscope Objective Lenses

- Capsule Endoscope Objective Lenses

- By Application:

- Gastroenterology

- Pulmonology/Bronchoscopy

- Urology/Cystoscopy

- ENT (Otolaryngology)

- Orthopedics/Arthroscopy

- Gynecology/Laparoscopy

- By Field of View (FOV):

- Narrow FOV (less than 90°)

- Standard FOV (90° to 120°)

- Wide FOV (above 120°)

- By Resolution Capability:

- HD/Full HD Compatible Lenses

- 4K Compatible Lenses

- 8K Compatible Lenses

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers & Clinics

Value Chain Analysis For Endoscope Objective Lens Market

The value chain for the Endoscope Objective Lens Market begins with upstream activities centered on the procurement and processing of highly specialized raw materials, primarily optical grade glass, specialized polymers for lens bodies, and advanced coating materials. Key upstream suppliers include specialized glass manufacturers (like SCHOTT and Corning) and precision molding firms. This stage requires rigorous quality control, as the purity and homogeneity of the glass dictate the ultimate optical performance and consistency of the objective lens. Strategic relationships with raw material suppliers are crucial for securing high-quality, defect-free material essential for miniaturized, high-resolution optics used in modern endoscopes, particularly those requiring achromatic or apochromatic correction.

The midstream phase involves the complex design, manufacturing, and assembly of the objective lens system. This is often the most value-intensive stage, encompassing advanced processes like grinding, polishing, thin-film coating (for anti-reflection and scratch resistance), and precise assembly of multiple lens elements (micro-lens stacks) into compact housings. Design expertise, involving computational optical engineering, is a major differentiator here, particularly for firms developing wide-angle, distortion-corrected objective systems. Original Equipment Manufacturers (OEMs) like Olympus and Karl Storz either handle this in-house or rely on highly specialized contract manufacturers (CMOs) focusing solely on precision optics, integrating these components into the final endoscope device.

Downstream activities focus on the distribution channel, which is highly specialized. Endoscope objective lenses are rarely sold separately; rather, they are integrated into the final endoscope, which is then distributed directly or indirectly to hospitals and healthcare providers. Direct distribution is favored by major OEMs for high-value surgical endoscopes, allowing for comprehensive support, service, and maintenance contracts. Indirect distribution utilizes established medical device distributors, particularly for consumable items or replacement parts, ensuring broad geographic reach. The final stage involves the maintenance, repair, and eventual replacement of the objective lens assemblies, which form a significant component of the after-market revenue stream for the endoscope manufacturers.

Endoscope Objective Lens Market Potential Customers

Potential customers for the Endoscope Objective Lens Market are essentially the ultimate end-users and buyers of the complete endoscopic systems, as the objective lens is an integrated, non-separable core component of the device. The primary buyers are large hospital networks and multispecialty hospitals, which possess dedicated endoscopy suites and significant capital budgets for purchasing high-definition, high-throughput endoscopic towers. These institutions require objective lenses capable of supporting a high volume of procedures across various disciplines, demanding superior longevity, robustness against sterilization, and high-fidelity imaging essential for training and complex surgical interventions. The purchasing decisions in hospitals are often driven by centralized procurement groups focused on long-term cost of ownership and compatibility with existing infrastructure.

Ambulatory Surgical Centers (ASCs) represent a rapidly growing customer segment. As many routine diagnostic and therapeutic procedures shift from costly inpatient hospital settings to outpatient ASCs, the demand for cost-effective, durable, and sometimes disposable endoscopic solutions increases. ASCs typically prioritize systems that offer quick turnaround times and minimal maintenance, influencing demand toward highly robust objective lenses or, conversely, highly cost-efficient objectives embedded in single-use scopes. This segment’s growth is particularly significant in gastroenterology and arthroscopy, where quick procedures are common, making them vital buyers of specific, application-focused objective lens systems.

Diagnostic Centers and specialized clinics, particularly those focusing on cancer screening (e.g., colonoscopy and bronchoscopy), constitute another key customer base. These centers rely heavily on the high precision and clarity provided by advanced objective lenses to detect subtle pre-cancerous and early-stage lesions, where optical quality is directly linked to diagnostic certainty. Research institutions and medical universities also act as important potential customers, often driving demand for cutting-edge objective lens technologies, such as those used in advanced preclinical imaging or novel endoscopic modalities like fluorescence or confocal endomicroscopy, pushing the boundaries of current optical specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,225.8 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, Stryker Corporation, HOYA Corporation (PENTAX Medical), FUJIFILM Corporation, Vattikuti Technologies Inc., Laborie Medical Technologies, STERIS plc, Misonix, Inc., SCHOTT AG, Corning Incorporated, Edmund Optics Inc., Precision Optics Corporation, Opto-Engineering S.r.l., Advanced Medical Optics (AMO), Sunoptics Technologies, LGI Medical, JMD Healthcare, Innova Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Endoscope Objective Lens Market Key Technology Landscape

The technology landscape of the Endoscope Objective Lens Market is defined by the necessity for extreme miniaturization combined with high optical performance, driven primarily by the shift towards high-resolution digital imaging and specialized diagnostic modalities. A major technological focus is computational optics, where sophisticated software algorithms are used in conjunction with the physical lens design to correct for residual aberrations, distortion, and field curvature in real-time. This approach allows designers to utilize simpler, smaller lens assemblies while achieving superior image quality than would be possible with purely conventional optical designs, which is crucial for maximizing the field of view in small-diameter endoscopes.

Another dominant technological trend is the use of advanced materials, specifically high-refractive-index, low-dispersion glass and precision molded polymer optics. Polymer optics are gaining traction, especially in the disposable endoscope segment, as they offer the advantage of low-cost, high-volume manufacturing through injection molding, provided they can meet the necessary precision and dimensional stability. Furthermore, manufacturers are focusing on developing durable, bio-compatible coatings that enhance light transmission (minimizing reflectance losses) while also resisting degradation from harsh sterilization chemicals and repeated high-temperature cycles, thereby extending the practical lifespan of reusable objective lens assemblies.

Emerging technologies like Chip-on-Tip (CoT) endoscopy have revolutionized flexible scope optics by placing the image sensor and micro-objective lens directly at the distal tip. This technology eliminates the need for complex, large fiber optic bundles, allowing for sharper images and smaller scope diameters. For these CoT systems, the objective lens assembly becomes an extremely compact micro-lens system integrated directly onto the CMOS sensor cover glass, requiring high numerical aperture designs within millimeter-scale dimensions. Additionally, the adoption of specialized imaging modalities, such as fluorescence endoscopy using specific fluorophores, necessitates objective lenses optimized for multiple distinct wavelengths (e.g., UV, visible, and NIR), demanding complex multi-band transmission coatings and specialized optical filters integrated into the lens assembly itself.

Regional Highlights

The global distribution and growth profile of the Endoscope Objective Lens Market are characterized by significant regional variation, reflecting differences in healthcare infrastructure maturity, reimbursement policies, and the rate of adoption of advanced surgical technologies. North America, particularly the United States, commands the largest market share due to its established healthcare system, high expenditure on medical devices, early adoption of high-definition 4K and 3D endoscopy systems, and the pervasive presence of leading medical device manufacturers and large university hospitals that drive technological innovation and demand for premium optics. The continuous push toward reducing surgical invasiveness and expanding the use of screening procedures ensures consistent, high-value demand in this region.

Europe represents the second-largest market, exhibiting steady growth propelled by stringent quality standards (MDR regulations) and strong investment in public health infrastructure across key nations like Germany, the UK, and France. The European market shows a robust demand for both reusable, autoclavable objective lens systems and increasingly for single-use, specialized optics in high-risk contamination areas. Demand is often centered on sophisticated procedures in gastroenterology and urology, driven by national health programs focused on early detection and diagnosis. The market dynamics are influenced by strong local optical engineering expertise, especially in Central Europe, which supports internal innovation among major regional players.

Asia Pacific (APAC) is anticipated to be the fastest-growing region during the forecast period. This accelerated expansion is attributed to the rapidly improving access to healthcare, massive population base demanding basic and advanced diagnostic screenings, and increasing healthcare infrastructure development in populous countries like China and India. While price sensitivity remains a factor, the shift toward minimally invasive surgery and the rising prevalence of gastrointestinal cancers are creating massive new markets. Manufacturers are strategically focusing on developing cost-effective, high-volume production capabilities for objective lenses tailored for high-quality, entry-to-mid-level flexible endoscopy systems in this region. Latin America and the Middle East and Africa (MEA) follow, demonstrating growth driven by expanding private healthcare sectors and governmental efforts to modernize medical facilities, increasing the penetration of basic and intermediate endoscopy technology.

- North America: Market leader, high adoption of 4K/8K systems, robust reimbursement policies, and strong presence of major OEMs driving demand for advanced, precision objective lenses.

- Europe: Mature market with steady growth, focused on stringent quality standards and balanced demand for reusable and single-use objective lenses across public and private sectors.

- Asia Pacific (APAC): Highest projected CAGR, driven by vast patient population, increasing healthcare access, government investment, and growing demand for cost-effective, high-volume endoscopy optics.

- Latin America (LATAM): Emerging growth market, characterized by increasing investment in private hospitals and rising medical device imports, primarily driving demand for standard and HD objective lenses.

- Middle East & Africa (MEA): Growth concentrated in oil-rich Gulf Cooperation Council (GCC) states, fueled by medical tourism and modernization of hospital infrastructure requiring advanced, durable endoscopic objective lenses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Endoscope Objective Lens Market.- Olympus Corporation

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- Stryker Corporation

- HOYA Corporation (PENTAX Medical)

- FUJIFILM Corporation

- Vattikuti Technologies Inc.

- Laborie Medical Technologies

- STERIS plc

- Misonix, Inc.

- SCHOTT AG

- Corning Incorporated

- Edmund Optics Inc.

- Precision Optics Corporation

- Opto-Engineering S.r.l.

- Advanced Medical Optics (AMO)

- Sunoptics Technologies

- LGI Medical

- JMD Healthcare

- Innova Medical

Frequently Asked Questions

Analyze common user questions about the Endoscope Objective Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-resolution objective lenses in endoscopy?

The transition toward 4K and 8K visualization systems and the integration of Artificial Intelligence (AI) for enhanced, automated diagnosis are the primary drivers. AI requires ultra-high-fidelity optical data, compelling manufacturers to develop objective lenses with minimal distortion and superior chromatic aberration correction to ensure diagnostic accuracy.

How does the shift to single-use endoscopes impact the objective lens manufacturing process?

The shift necessitates the high-volume, cost-effective production of miniature objective lenses, often utilizing precision molded polymer optics instead of traditional high-cost glass assemblies, while strictly maintaining medical-grade image quality for disposable devices.

What technological innovations are currently being implemented to improve objective lens durability?

Manufacturers are focusing on developing advanced, robust anti-reflective and protective coatings that can withstand repeated exposure to aggressive sterilization techniques, such as high-temperature autoclaving and chemical reprocessing, thereby extending the effective service life of reusable objective lenses.

Which geographical region is projected to experience the fastest growth in the Endoscope Objective Lens Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by significant investments in healthcare infrastructure, expanding medical tourism, and a rapidly increasing patient base requiring endoscopic screening and therapeutic procedures.

What is the main challenge associated with incorporating objective lenses into robotic surgical systems?

The key challenge involves designing highly compact objective lens assemblies that can maintain optical stability and precision despite being subjected to the dynamic movements, articulation, and mechanical stresses inherent in complex robotic end-effectors, demanding specialized mechanical and optical housing integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager