Endovenous Ablation Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432215 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Endovenous Ablation Devices Market Size

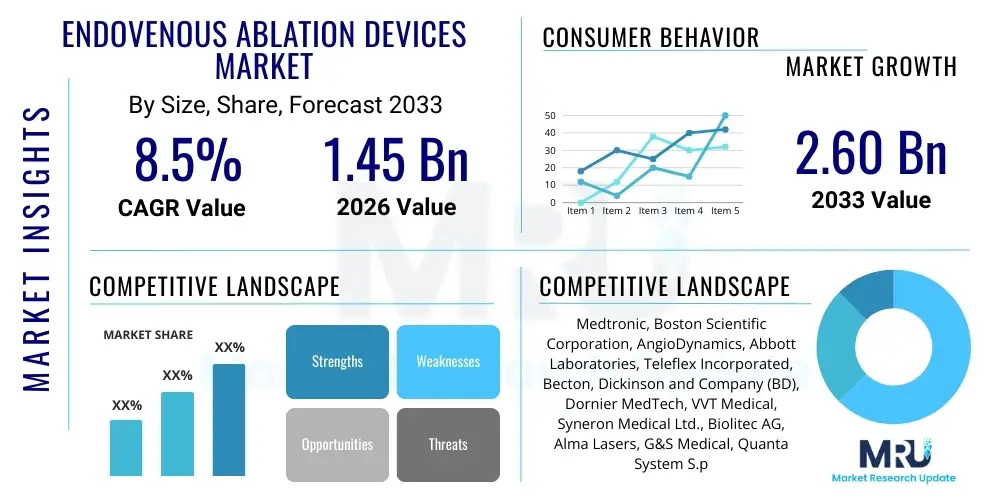

The Endovenous Ablation Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.45 Billion in 2026 and is projected to reach $2.60 Billion by the end of the forecast period in 2033.

Endovenous Ablation Devices Market introduction

The Endovenous Ablation Devices Market encompasses specialized medical instruments utilized primarily for the treatment of chronic venous insufficiency (CVI) and varicose veins. These devices employ minimally invasive techniques, such as radiofrequency (RF) energy, laser light (EVLT), or non-thermal methods (mechanochemical or adhesive), to close or destroy damaged veins from the inside, redirecting blood flow to healthier vessels. The efficacy and lower recovery times associated with endovenous ablation compared to traditional surgical stripping procedures have fueled rapid adoption globally. Key products include RF generators and catheters, diode lasers, and specialized delivery systems designed to ensure precise energy application and minimize collateral tissue damage. These technologies represent a significant advancement in vascular medicine, offering high success rates and improving patient quality of life by alleviating symptoms such as pain, swelling, and skin changes related to venous disease.

Major applications of endovenous ablation devices center on treating superficial venous reflux, which is the underlying cause of most symptomatic varicose veins and CVI. Hospitals, specialized vein clinics, and ambulatory surgical centers (ASCs) are the primary end-users, increasingly favoring these devices due to their procedural simplicity and suitability for outpatient settings. The inherent benefits of these procedures—including reduced risk of infection, minimal scarring, and rapid mobilization of patients—drive their market expansion. Furthermore, the evolving regulatory landscape, which increasingly supports the use of minimally invasive techniques, and ongoing clinical evidence demonstrating superior long-term outcomes compared to conservative management strategies bolster market growth and penetration across developed economies.

Key driving factors accelerating the market include the rising global incidence of obesity, sedentary lifestyles, and the aging population, all contributing significantly to the prevalence of CVI. Continuous technological innovation, particularly in developing non-thermal, non-tumescent ablation techniques (NTNT), such as VenaSeal and Clarivein, enhances patient comfort and expands the applicability of these treatments to broader patient demographics. Growing awareness among both physicians and the public regarding the effectiveness of early intervention for venous diseases further stimulates demand. Moreover, supportive reimbursement policies in major markets like North America and Europe incentivize healthcare providers to invest in advanced endovenous ablation infrastructure and training, solidifying the market’s positive growth trajectory through the forecast period.

Endovenous Ablation Devices Market Executive Summary

The Endovenous Ablation Devices Market is characterized by robust business trends focused on transitioning care delivery from inpatient hospital settings to high-volume ambulatory surgical centers (ASCs) and specialized vein clinics, driven by cost efficiency and patient preference for convenience. Business strategies heavily emphasize the development of integrated procedural kits and disposable components, ensuring sterile and standardized use across diverse clinical environments. Key market participants are aggressively pursuing mergers and acquisitions and strategic partnerships to expand their geographical footprint, particularly targeting high-growth regions in the Asia Pacific. Furthermore, the convergence of device manufacturing with digital health solutions, incorporating patient monitoring and outcome tracking, is a dominant business trend aimed at enhancing procedure success rates and supporting value-based care models.

Regionally, North America maintains market dominance due to high healthcare expenditure, established reimbursement frameworks for venous procedures, and the widespread adoption of advanced medical technologies, including third-generation RF and laser systems. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by increasing awareness of venous disorders, significant improvements in healthcare infrastructure, and the growing medical tourism sector in countries like India and China. Europe presents a mature market characterized by stringent regulatory standards but supported by universal healthcare coverage and high geriatric populations, ensuring steady demand for proven ablation technologies, while focusing on minimizing invasiveness and enhancing post-procedural patient mobility.

Segment trends highlight the technological shift towards non-thermal ablation methods, which are gaining significant traction due to their ability to eliminate the need for tumescent anesthesia, thereby reducing procedural time and potential complications. While radiofrequency ablation (RFA) remains the leading technology segment based on established clinical history and cost-effectiveness, the non-thermal category, including cyanoacrylate closure (CAC) and mechanochemical ablation (MOCA), is exhibiting the fastest growth rate. The hospital end-user segment still accounts for the largest share in terms of volume, but the ambulatory surgical center (ASC) segment is expected to experience faster revenue growth, driven by favorable outpatient reimbursement structures and increasing specialization of vein treatments outside the traditional hospital environment.

AI Impact Analysis on Endovenous Ablation Devices Market

User queries regarding the impact of Artificial Intelligence (AI) on the Endovenous Ablation Devices Market frequently center on themes such as enhanced diagnostic precision, automation of procedural planning, and the potential for robotic assistance in catheter navigation. Concerns often revolve around the validation of AI models in vascular imaging (e.g., automated vein mapping via ultrasound), data security, and the integration costs associated with these sophisticated technologies into existing ablation systems. Users expect AI to reduce human error during complex procedures, optimize energy delivery settings (for RF or laser), and provide real-time feedback on treatment efficacy and potential complications, ultimately leading to improved patient safety profiles and more predictable outcomes in the treatment of chronic venous disease.

- Enhanced Pre-Procedural Planning: AI algorithms analyze complex venous anatomy from ultrasound and CT scans to generate optimized treatment plans, identifying optimal puncture sites and ablation path trajectories.

- Real-Time Guidance and Catheter Navigation: Integration of machine learning models for visual and haptic feedback to guide catheter placement accurately, especially in tortuous or difficult-to-access veins, increasing procedure consistency.

- Automated Energy Parameter Optimization: AI systems dynamically adjust radiofrequency or laser power settings based on real-time feedback (e.g., tissue impedance, temperature monitoring) to ensure effective vein closure while minimizing thermal damage to surrounding structures.

- Predictive Outcome Modeling: Use of large clinical datasets by AI to predict the probability of treatment success or recurrence for individual patients, aiding clinicians in selecting the most appropriate ablation technology.

- Streamlined Post-Procedural Monitoring: AI-driven analysis of follow-up ultrasound images to detect early signs of recanalization or Deep Vein Thrombosis (DVT), ensuring timely intervention and improved long-term surveillance protocols.

DRO & Impact Forces Of Endovenous Ablation Devices Market

The dynamics of the Endovenous Ablation Devices Market are heavily influenced by a confluence of technological drivers, market restraints, and significant emerging opportunities. The primary driver is the exponentially growing global prevalence of Chronic Venous Insufficiency (CVI), intrinsically linked to aging demographics, prolonged periods of standing or sitting occupationally, and lifestyle factors such as high BMI. This expanding patient pool necessitates effective and minimally disruptive treatments. Furthermore, the continuous, demonstrable preference shift among both patients and physicians away from high-morbidity surgical stripping toward minimally invasive endovenous techniques acts as a powerful market accelerator. Technological advancements, particularly the successful introduction and refinement of non-thermal, non-tumescent (NTNT) methods, which eliminate the risks and discomfort associated with thermal ablation's reliance on tumescent anesthesia, provide a compelling growth momentum.

However, the market faces significant restraints. The initial capital investment required for high-precision endovenous ablation systems, particularly the sophisticated RF generators and laser consoles, poses a substantial barrier to entry for smaller clinics and healthcare providers in developing economies. Regulatory hurdles and the long, rigorous process required for achieving market approval (especially for novel NTNT technologies in major markets like the U.S. and Europe) often delay product commercialization and widespread adoption. Additionally, while overall reimbursement is generally favorable, inconsistencies in coverage policies across different geographic regions for specific device types (e.g., cyanoacrylate glue vs. RFA) can restrict market growth and influence physician selection of treatment modalities. Concerns regarding the longevity and long-term efficacy of some newer non-thermal treatments, while improving, still require long-term clinical data to fully overcome physician skepticism.

Opportunities for market expansion are substantial and primarily center on penetrating untapped emerging markets, particularly within the APAC and Latin American regions, where venous disease awareness and healthcare infrastructure are rapidly improving. Secondly, there is a distinct opportunity in technological diversification, focusing on miniaturization, portability, and increasing the user-friendliness of ablation systems, making them viable for office-based procedures. The potential for integrating advanced imaging technologies (e.g., intravascular ultrasound (IVUS)) directly with ablation catheters to enhance procedural visualization, guidance, and precision presents a significant avenue for innovation. Finally, addressing unmet needs in treating larger or more complicated veins and developing cost-effective, disposable ablation solutions tailored for high-volume settings offer attractive long-term market prospects.

Segmentation Analysis

The Endovenous Ablation Devices Market is comprehensively segmented based on technology, procedure type, end-user, and geographic region to provide a granular understanding of market dynamics and adoption patterns. The technology segment is the most competitive, dominated by established thermal methods like Radiofrequency Ablation (RFA) and Endovenous Laser Treatment (EVLT), which have extensive clinical history supporting their efficacy. However, the rapidly expanding Non-Thermal Ablation segment is disrupting the traditional landscape by offering patient-centric solutions that minimize procedural complexity and post-operative discomfort. Analysis across these segments reveals distinct adoption rates, pricing strategies, and regional preferences, essential for strategic planning within the vascular device industry.

- By Technology

- Radiofrequency Ablation (RFA) Devices

- Laser Ablation Devices (EVLT)

- Non-Thermal Ablation Devices (e.g., Mechanochemical Ablation (MOCA), Cyanoacrylate Closure (CAC), Steam Vein Ablation)

- By Procedure

- Thermal Ablation Procedures

- Non-Thermal Ablation Procedures

- By Indication

- Varicose Veins

- Chronic Venous Insufficiency (CVI)

- Spider Veins (Micro-ablation treatments)

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs) and Specialty Clinics

- By Region

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Endovenous Ablation Devices Market

The value chain for the Endovenous Ablation Devices Market begins with upstream activities focused on the specialized manufacturing of raw materials, including medical-grade polymers, highly precise metallic components for catheters, and sophisticated electronic components necessary for RF generators and laser consoles. Research and Development (R&D) activities are intensely upstream, focusing on improving catheter flexibility, enhancing thermal efficiency, and minimizing power consumption of generators. Key upstream relationships involve long-term contracts with specialized component suppliers who meet strict ISO and FDA standards for medical device material quality and reliability. Innovations in materials science, particularly those supporting minimally invasive deployment and biocompatibility, directly impact the final device cost and performance profile, dictating the competitive advantage of manufacturers.

Midstream activities involve the core manufacturing, assembly, and rigorous quality control of the final ablation devices and accessories. This stage requires significant investment in cleanroom facilities and highly regulated production lines. After manufacturing, the distribution channel plays a critical role. Direct sales models are often employed by major players for high-value capital equipment (generators/consoles) to provide comprehensive installation, training, and maintenance support directly to large hospital systems and specialized vein centers. Conversely, indirect distribution through established regional medical device distributors is frequently used for high-volume, disposable components like ablation catheters and introducer kits, particularly when penetrating geographically diverse or fragmented healthcare markets globally.

Downstream analysis focuses on the end-users—hospitals and Ambulatory Surgical Centers (ASCs)—where the actual clinical procedure is performed. The value is realized through successful patient outcomes and procedural volume. Post-sales activities, including extensive physician training on new techniques (especially for non-thermal technologies) and ongoing technical support, are crucial for market adoption and brand loyalty. The payment mechanism (reimbursement) critically impacts the downstream demand, influencing facility investment decisions. The efficiency of the distribution channel directly affects the timely delivery of sterile, single-use devices, crucial for maintaining high procedural throughput in busy clinical environments, ensuring that the entire value chain is synchronized to maximize patient access and procedural effectiveness.

Endovenous Ablation Devices Market Potential Customers

The primary potential customers and end-users of Endovenous Ablation Devices are highly specialized healthcare institutions and professionals focusing on vascular disease management. Hospitals, particularly those with dedicated cardiology, radiology, or vascular surgery departments, represent the largest segment due to their high procedural capacity, ability to handle complex venous cases, and substantial budgets for capital equipment acquisition. These facilities require robust, multi-application ablation systems capable of supporting both thermal (RF and Laser) and newer non-thermal modalities, catering to a diverse patient population and maintaining continuity of care for potential complications.

Ambulatory Surgical Centers (ASCs) and specialized independent vein clinics constitute the fastest-growing segment of potential customers. These centers focus predominantly on outpatient procedures, often specializing exclusively in the treatment of chronic venous disease and varicose veins. ASCs prioritize systems that offer quick turnaround times, portability, and low procedural costs, making disposable ablation catheters and streamlined non-thermal systems particularly attractive. The shift towards ASCs is driven by favorable outpatient reimbursement and the desire for a focused, patient-friendly environment, positioning them as critical buyers for the latest, less-invasive technologies.

Furthermore, interventionally trained specialists, including vascular surgeons, interventional radiologists, and phlebologists, act as key opinion leaders and direct purchasers of these devices. Their decision-making is based heavily on clinical evidence, ease of use, device safety profile, and comprehensive technical support provided by manufacturers. Finally, regional healthcare systems and government procurement bodies in emerging economies are becoming increasingly important potential customers as they modernize their cardiovascular infrastructure and seek cost-effective solutions for widespread venous disease management, often preferring systems that balance initial cost with proven clinical efficacy and durability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.45 Billion |

| Market Forecast in 2033 | $2.60 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Boston Scientific Corporation, AngioDynamics, Abbott Laboratories, Teleflex Incorporated, Becton, Dickinson and Company (BD), Dornier MedTech, VVT Medical, Syneron Medical Ltd., Biolitec AG, Alma Lasers, G&S Medical, Quanta System S.p.A., Alna Medical, Vascular Solutions (a Teleflex company), Joline GmbH & Co. KG, Spectranetics (a Philips company), Lumenis, Endologix, Inc., Sciton, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Endovenous Ablation Devices Market Key Technology Landscape

The technology landscape of the Endovenous Ablation Devices Market is highly dynamic, characterized by a persistent evolution from thermal energy delivery toward more sophisticated, non-tumescent methods aimed at enhancing patient experience and procedural efficiency. Radiofrequency Ablation (RFA) technology remains foundational, utilizing heat generated by high-frequency alternating current to cause collagen shrinkage and subsequent vein closure. The advancement within RFA is focused on improved catheter design, such as segmental ablation catheters (e.g., ClosureFast), which automate pullback and ensure uniform energy delivery, thereby reducing user variability and guaranteeing predictable outcomes across the treated segment of the vein. Concurrently, Endovenous Laser Treatment (EVLT) utilizes concentrated laser light delivered via optical fibers, with recent innovations centered on optimizing fiber tips (e.g., jacketed or radial firing fibers) to ensure circumferential energy delivery, minimizing vein wall perforation, and reducing post-procedural bruising and pain compared to older bare-tip fibers.

The most significant technological shift involves the rapid commercialization and adoption of Non-Thermal, Non-Tumescent (NTNT) technologies. These innovations, crucially, eliminate the need for large volumes of tumescent anesthesia, simplifying the procedure, reducing procedural time, and expanding accessibility for patients who might be sensitive to local anesthetics or have complex anatomy where tumescent infiltration is challenging. Key players in this space include Cyanoacrylate Closure (CAC), such as the VenaSeal system, which uses medical glue to seal the vein instantly, and Mechanochemical Ablation (MOCA), such as Clarivein, which combines mechanical disruption of the vein lining with chemical sclerosant delivery. These technologies capitalize on the desire for truly minimally invasive procedures, offering comparable long-term efficacy to thermal methods but with immediate patient mobility and virtually no requirement for post-operative pain management, thereby streamlining the post-procedural recovery pathway significantly.

Future technological developments are geared towards integrating smart systems and enhanced visualization tools. The incorporation of Intravascular Ultrasound (IVUS) technology directly into ablation catheters allows for precise, real-time imaging during the procedure, mitigating risks associated with misplacement near crucial structures or inadequate contact with the vein wall. Furthermore, there is an increasing focus on developing high-frequency focused ultrasound (HIFU) or micro-pulse ablation systems for completely non-invasive, external vein closure, although these are still predominantly in the research stages. Overall, the market's technological trajectory prioritizes precision, speed, reduced invasiveness, and enhanced connectivity, ensuring that new devices offer compelling clinical and economic benefits over established thermal treatments, supporting high procedural volume in outpatient settings globally.

Regional Highlights

- North America (U.S. and Canada)

North America maintains its dominant position in the Endovenous Ablation Devices Market, primarily driven by exceptionally high awareness of venous disorders, robust insurance coverage, and sophisticated healthcare infrastructure that facilitates the rapid adoption of premium, innovative devices. The United States, in particular, benefits from favorable reimbursement policies for both thermal and newer non-thermal ablation procedures performed in both hospitals and ASCs, creating a strong economic incentive for providers to invest in the latest equipment. High healthcare expenditure per capita and a large aging population contribute significantly to the high volume of procedures performed annually. Leading medical device manufacturers often target North America as the initial launch market for cutting-edge technology, such as the latest iterations of cyanoacrylate closure systems or advanced RFA segmental catheters, establishing strong market benchmarks for the rest of the world.

The market environment is highly competitive, pushing companies towards continuous product refinement and robust clinical trial data generation to secure market share. The increasing shift of complex venous treatments from hospitals to specialized vein clinics and high-volume Ambulatory Surgical Centers (ASCs) is a defining regional trend. This shift is motivated by cost containment strategies adopted by payers and the patient preference for convenient, dedicated outpatient settings. Furthermore, substantial clinical training and professional society guidelines (e.g., SVS guidelines) in the region strongly endorse endovenous ablation as the first-line treatment for superficial venous reflux, solidifying its market penetration and growth trajectory. Regulatory processes, while stringent through the FDA, ensure high standards of device quality and safety, lending credibility to the technologies adopted across the regional market.

- Europe (Germany, UK, France, Italy, Spain)

Europe represents a mature and technologically advanced market for Endovenous Ablation Devices, characterized by strong clinical acceptance and high standards of care across key countries such as Germany, the UK, and France. Market growth is supported by high prevalence rates of CVI among the large geriatric population and the comprehensive coverage provided by national health services (NHS in the UK, statutory health insurance in Germany). While the pace of adoption of extremely novel technologies may sometimes trail the US due to varying country-specific health technology assessment (HTA) procedures, thermal ablation techniques (RFA and EVLT) are well-established and widely utilized across public and private healthcare systems.

A key regional characteristic is the strong regulatory influence of the MDR (Medical Device Regulation), which has intensified scrutiny on clinical evidence, particularly for non-thermal devices. This environment drives manufacturers to provide long-term follow-up data demonstrating the safety and sustained efficacy of their products. Western European markets show a slight preference for non-thermal options when patient comfort and rapid return to work are paramount considerations, especially in private clinics. Conversely, countries in Eastern Europe are rapidly increasing their adoption rates, often favoring slightly more cost-effective RFA systems as they modernize their venous treatment infrastructure and expand treatment accessibility to a broader demographic. Germany stands out with one of the highest procedural volumes due to its advanced network of specialized phlebology clinics.

- Asia Pacific (Japan, China, India, South Korea)

The Asia Pacific (APAC) region is poised to exhibit the highest CAGR during the forecast period, transitioning from a historically underserved market to a major growth engine for endovenous ablation devices. This explosive growth is underpinned by significant improvements in healthcare access, rising disposable incomes, and increasing awareness campaigns regarding the treatability of chronic venous disease, which was traditionally under-diagnosed and managed conservatively. Countries like China and India are seeing substantial investment in medical infrastructure, facilitating the establishment of dedicated vascular centers capable of performing complex endovenous procedures.

While the market is price-sensitive compared to North America and Europe, the demand for minimally invasive treatments is accelerating rapidly, mirroring global trends. Local manufacturing capabilities are also developing, providing lower-cost alternatives, though premium imported devices from major global players still dominate the high-end hospital segment. Japan and South Korea lead the region in terms of technology adoption and clinical sophistication, utilizing advanced thermal and non-thermal techniques, often focusing on precise laser technologies. The large, rapidly urbanizing populations and subsequent rise in lifestyle-related venous disorders across the entire region ensure that APAC will be the critical focal point for global market expansion and increased procedural volume over the next decade.

- Latin America and Middle East & Africa (LATAM and MEA)

The LATAM and MEA regions currently hold smaller market shares but offer substantial growth potential, largely contingent upon economic stability and the pace of healthcare infrastructure development. In Latin America, Brazil and Mexico are leading the adoption curve, driven by a combination of a substantial private healthcare sector and a high prevalence of CVI. The market here typically balances the adoption of proven thermal technologies (RFA and EVLT) with growing interest in the cost-saving and efficiency benefits of newer non-thermal techniques, although pricing pressures remain significant challenges for broad market penetration of premium devices.

The Middle East and Africa present a highly fragmented market. The GCC countries (e.g., UAE, Saudi Arabia) possess significant capital and advanced medical centers, leading to high adoption rates of the latest, high-cost ablation technologies through direct importation from US and European manufacturers. South Africa acts as a regional hub in Sub-Saharan Africa, showing steady growth in procedural volumes. However, political instability and limited healthcare budgets across much of the African continent pose ongoing restraints. Market expansion in these regions is heavily reliant on distributor networks providing essential training and maintenance support to ensure the sustainable utilization of these complex medical devices in diverse clinical environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Endovenous Ablation Devices Market.- Medtronic

- Boston Scientific Corporation

- AngioDynamics

- Abbott Laboratories

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- Dornier MedTech

- VVT Medical

- Syneron Medical Ltd.

- Biolitec AG

- Alma Lasers

- G&S Medical

- Quanta System S.p.A.

- Alna Medical

- Vascular Solutions (a Teleflex company)

- Joline GmbH & Co. KG

- Spectranetics (a Philips company)

- Lumenis

- Endologix, Inc.

- Sciton, Inc.

Frequently Asked Questions

Analyze common user questions about the Endovenous Ablation Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Endovenous Ablation Devices Market?

The market growth is primarily driven by the escalating global prevalence of Chronic Venous Insufficiency (CVI), coupled with the increasing patient and physician preference for minimally invasive treatments over traditional surgical vein stripping due to shorter recovery times and high efficacy rates.

How do non-thermal ablation devices differ from traditional RF and laser systems?

Non-thermal ablation devices (like Cyanoacrylate Closure or Mechanochemical Ablation) seal the diseased vein using medical adhesive or mechanical disruption combined with a sclerosant, eliminating the need for thermal energy and the associated risks and discomfort of tumescent anesthesia required by RF and laser systems.

Which region holds the largest market share for Endovenous Ablation Devices?

North America currently holds the largest market share, attributed to high healthcare expenditure, established reimbursement frameworks, and the widespread, early adoption of advanced ablation technologies in specialized vein clinics and ambulatory surgical centers (ASCs).

What are the main restraints hindering full market expansion?

Key restraints include the high initial capital investment costs for advanced RF generators and laser consoles, and ongoing regulatory hurdles, particularly concerning the validation and long-term efficacy data required for novel non-thermal ablation techniques in large markets.

How is AI expected to influence endovenous ablation procedures?

AI is anticipated to enhance procedural precision by optimizing pre-operative planning, providing real-time guidance during catheter insertion and energy delivery, and improving post-procedural surveillance for early detection of complications like vein recanalization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager