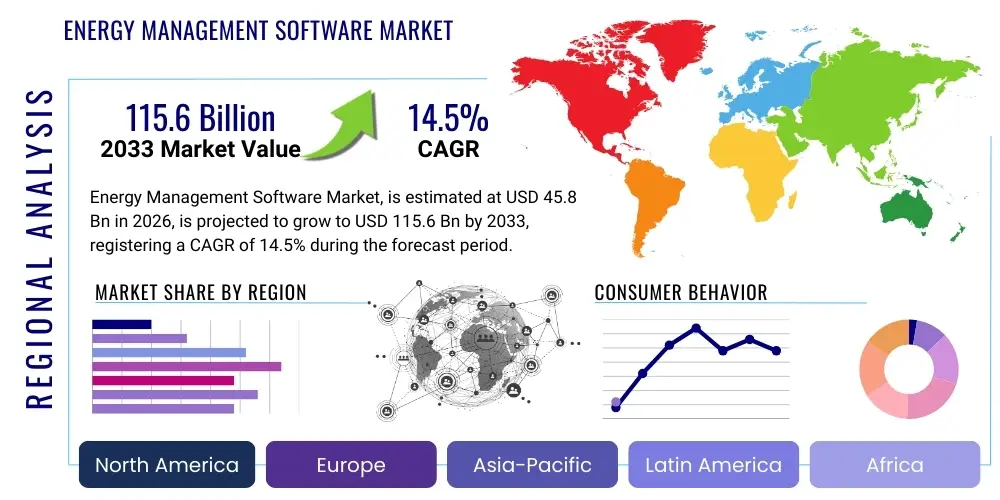

Energy Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436233 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Energy Management Software Market Size

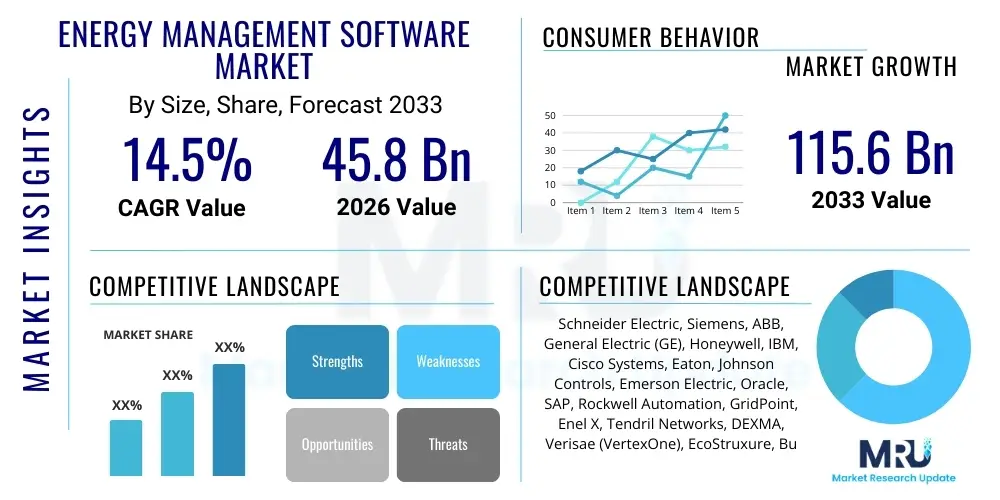

The Energy Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 115.6 Billion by the end of the forecast period in 2033.

Energy Management Software Market introduction

The Energy Management Software (EMS) Market encompasses advanced digital solutions designed to monitor, analyze, control, and optimize energy consumption across various enterprises and infrastructure components. These comprehensive platforms integrate data from sensors, smart meters, building management systems (BMS), and production machinery to provide granular insights into energy usage patterns, enabling organizations to implement strategic efficiency measures. The core objective of EMS is to reduce operational costs, enhance energy reliability, and ensure compliance with increasingly stringent environmental regulations, thereby supporting global decarbonization efforts.

Key applications of EMS span industrial facilities, commercial buildings, residential sectors, and utility operations. In the industrial sector, EMS facilitates real-time monitoring of complex manufacturing processes, identifying wastage and optimizing asset performance. For commercial enterprises, the software is crucial in managing HVAC systems, lighting controls, and plug loads, often leading to substantial reductions in energy expenditure. The driving factors behind this market growth include the escalating global prices of energy resources, the imperative for corporate sustainability reporting (ESG mandates), and rapid advancements in IoT and cloud computing technologies, making EMS solutions more accessible and scalable.

The product description typically involves modular components such as data acquisition modules, analytical dashboards, reporting tools, and predictive modeling capabilities. Benefits realized by adopting EMS include improved energy procurement strategies, early detection of equipment faults (preventive maintenance), minimized carbon footprint, and adherence to international standards like ISO 50001. The move towards Software-as-a-Service (SaaS) models is further accelerating adoption, offering businesses flexible deployment and lower upfront capital investment, which is particularly appealing to Small and Medium-sized Enterprises (SMEs) seeking digital transformation in their energy operations.

Energy Management Software Market Executive Summary

The Energy Management Software market is undergoing a significant transformation driven by mandatory global sustainability targets and the convergence of operational technology (OT) and information technology (IT) systems. Key business trends include the widespread adoption of cloud-based EMS solutions, which offer superior scalability, real-time data processing, and integration capabilities with existing enterprise resource planning (ERP) systems. There is a noticeable shift towards prescriptive energy management, leveraging AI and machine learning to not only report historical data but also provide autonomous recommendations and execute corrective actions, minimizing human intervention and maximizing efficiency gains.

Regional trends highlight North America and Europe as established leaders, characterized by mature regulatory frameworks, high levels of digital readiness, and substantial investment in smart grid infrastructure. The Asia Pacific (APAC) region, however, is projected to exhibit the fastest growth, primarily fueled by rapid industrialization, massive infrastructure development, and increasing government incentives in countries like China and India focused on curbing carbon emissions from the burgeoning manufacturing sector. The focus in APAC is often on adapting EMS for large, resource-intensive operations, contrasting with the emphasis on granular building optimization prevalent in developed Western markets.

Segment trends underscore the dominance of the commercial and industrial end-user segments, which possess the largest energy footprint and therefore offer the highest potential for cost savings. Within components, the services segment (implementation, integration, maintenance, and consulting) is experiencing accelerated growth, driven by the complexity of integrating EMS platforms with disparate legacy systems. Furthermore, application segmentation shows strong demand for energy monitoring and reporting tools, which serve as the foundational layer for all subsequent optimization efforts, followed closely by demand response management capabilities aimed at balancing grid loads during peak demand periods.

AI Impact Analysis on Energy Management Software Market

Common user questions regarding the integration of Artificial Intelligence (AI) into Energy Management Software center primarily on Return on Investment (ROI), data requirements, and the transition from descriptive to prescriptive analytics. Users are keen to understand how AI can move beyond simple alerts to deliver predictive maintenance schedules, optimize real-time energy sourcing, and automatically adjust building parameters based on occupancy forecasts and weather predictions. Key themes also revolve around data privacy, the trustworthiness of AI-driven recommendations, and the necessary skill set required for facility managers to effectively deploy and manage these sophisticated cognitive platforms. The underlying concern is balancing the complexity of AI implementation with guaranteed, measurable efficiency improvements and seamless integration across diverse asset portfolios.

AI is fundamentally reshaping the competitive landscape of the EMS market by enabling cognitive capabilities that were previously unattainable. AI algorithms facilitate the creation of highly accurate energy consumption baselines and digital twins of buildings or industrial processes. These models allow for continuous optimization, adapting dynamically to changing operational conditions, utility tariffs, and external environmental factors. This transformative power means EMS is shifting from a static reporting tool to a dynamic, self-optimizing energy governance system, drastically reducing the latency between anomaly detection and corrective action, thereby maximizing savings for end-users.

Furthermore, AI accelerates decision-making processes, integrating complex variables—such as renewable energy generation variability, energy storage system status, and geopolitical energy market fluctuations—into optimization strategies. This capability is vital for large organizations managing distributed energy resources (DERs) and participating in demand response programs. The impact is a market where competitive advantage is increasingly tied to the proprietary quality and sophistication of the embedded AI engine, pushing vendors toward specialization in deep learning for specific industry applications, such as heavy manufacturing optimization or hyperscale data center power management.

- AI-driven predictive maintenance reduces unplanned downtime and utility cost spikes.

- Machine learning algorithms enable highly accurate load forecasting and optimized energy procurement.

- Cognitive EMS facilitates automated demand response participation and grid integration.

- Digital twin technology models real-time asset performance for simulation and optimization.

- Natural Language Processing (NLP) enhances user interaction and simplifies data reporting for non-technical stakeholders.

- AI optimizes complex microgrid management and integration of distributed energy resources (DERs).

- Enhanced anomaly detection identifies hidden energy waste patterns in large datasets.

DRO & Impact Forces Of Energy Management Software Market

The Energy Management Software market is propelled by critical drivers such as escalating global energy prices and stringent governmental mandates focused on carbon reduction, compelling enterprises across all sectors to track and minimize consumption. Restraints, conversely, include the high initial capital expenditure required for system installation, integration challenges with legacy operational technology (OT) infrastructure, and persistent concerns regarding data security and privacy, especially for cloud-based deployments. Opportunities emerge from the accelerating adoption of IoT devices, the proliferation of smart cities initiatives, and the increasing convergence of EMS with smart grid technology and blockchain for secure energy trading. These forces collectively shape a market environment characterized by high growth potential offset by significant technological implementation hurdles.

The primary driving force is the global regulatory environment, particularly the establishment of carbon taxes, cap-and-trade schemes, and mandatory ESG reporting standards, which transform energy efficiency from a cost-saving measure into a critical compliance requirement and reputational necessity. This regulatory push ensures sustained investment, even when economic conditions fluctuate. Additionally, the rapid advancements in sensor technology and edge computing capabilities have significantly lowered the cost and increased the precision of data collection, making sophisticated EMS platforms technically and economically viable for a broader range of enterprises, including SMEs.

However, complexity remains a major impact force. Many organizations utilize disparate, proprietary systems for lighting, HVAC, security, and industrial control. Integrating a centralized EMS platform across these silos requires significant system integration expertise, which often mandates expensive professional services, acting as a restraint. Furthermore, while the opportunity presented by integrating distributed energy resources (like solar PV and battery storage) is immense, the underlying infrastructure standardization remains fragmented, creating interoperability challenges that must be addressed by vendors and system integrators to unlock the market’s full potential.

Segmentation Analysis

The Energy Management Software market is broadly segmented based on Component, Deployment Type, Application, and End-User. This segmentation allows for precise market targeting and product development tailored to specific industry needs, whether it involves foundational data monitoring or complex, AI-driven prescriptive control. The market structure reflects the transition from simple utility bill management towards comprehensive energy performance contracting and optimization services, highlighting the increasing value placed on consulting and implementation support over standalone software licenses. Deployment flexibility, particularly the dominance of cloud models, is critical across all segments, ensuring rapid scalability for global corporations and accessibility for decentralized operations.

- By Component: Software (Data Management, Reporting & Analysis, Visualization), Services (Consulting, Implementation & Integration, Support & Maintenance).

- By Deployment Type: On-Premise, Cloud-Based (SaaS).

- By Application: Energy Monitoring & Reporting, Carbon Management, Demand Response Management, Utility Bill Management, Load Forecasting.

- By End-User: Commercial (Retail, Healthcare, IT & Telecom, Offices), Industrial (Manufacturing, Power & Energy, Oil & Gas), Residential.

Value Chain Analysis For Energy Management Software Market

The value chain for the Energy Management Software market begins with upstream activities focused on core technological components, including software development (AI/ML algorithms, cloud infrastructure), sensor manufacturing (IoT devices, smart meters), and data standardization protocols development. Key players in this phase focus on intellectual property creation and robust cybersecurity frameworks. The midstream segment involves the core EMS vendors responsible for platform integration, customization, and packaging the software modules to meet diverse industry requirements. This stage is highly competitive, emphasizing user interface (UI) and integration efficacy with existing Building Management Systems (BMS) and Enterprise Resource Planning (ERP) tools.

The distribution channel represents the transition point to the downstream segment. Direct channels involve large EMS vendors selling and implementing solutions directly to major industrial and utility clients, often facilitated through specialized energy service company (ESCO) subsidiaries or internal sales teams dedicated to complex, long-term contracts. Indirect channels rely heavily on system integrators, value-added resellers (VARs), and channel partners who handle localization, installation, and ongoing maintenance for commercial and SME end-users. This indirect approach is crucial for achieving wide market penetration, particularly in geographically diverse regions or sectors requiring bespoke integration expertise.

Downstream activities center on deployment, training, and ongoing technical support and maintenance services. The value shifts here from software license fees to high-margin recurring service contracts, focusing on performance guarantees (e.g., guaranteed energy savings). System integrators play a vital role, bridging the gap between sophisticated software capabilities and the specific operational requirements of facility managers. The effectiveness of the overall value chain is determined by seamless data flow from sensors (upstream) through the analytical platform (midstream) to the end-user reporting and control interfaces (downstream), ensuring that optimized energy decisions are executed efficiently.

Energy Management Software Market Potential Customers

The potential customers for Energy Management Software solutions are organizations across the commercial, industrial, and utility sectors that face high operational energy costs, possess complex asset portfolios, or are subject to significant environmental regulatory pressure. The primary decision-makers or buyers typically include Chief Technology Officers (CTOs) and Chief Operating Officers (COOs) focused on long-term operational efficiency, alongside Sustainability Directors mandated to achieve corporate Environmental, Social, and Governance (ESG) goals. Facility Managers and Energy Directors are critical end-users, requiring practical, actionable insights to optimize day-to-day energy performance and manage capital expenditure related to energy infrastructure upgrades.

In the commercial sector, major buyers include multi-site retailers, large hospital systems, educational campuses, and data centers. These entities prioritize solutions offering centralized monitoring capabilities to manage diverse locations and standardize energy practices. Data centers, in particular, represent high-value customers due to their enormous power usage effectiveness (PUE) challenges and mission-critical power reliability requirements. For industrial customers, spanning heavy manufacturing (automotive, chemical), oil and gas, and mining, the focus shifts to process-level energy optimization, waste heat recovery management, and adherence to production schedules while minimizing utility costs. These customers often seek highly specialized industrial EMS (IEMS) integrated directly with SCADA and MES systems.

Utilities and grid operators constitute another major customer segment, procuring EMS for demand-side management (DSM), grid optimization, and managing distributed energy resources (DERs). These solutions enable utilities to balance supply and demand dynamically, defer infrastructure investments, and comply with renewable energy integration mandates. Finally, large residential aggregators and smart home ecosystem providers are emerging buyers, utilizing EMS capabilities for load shifting and enabling participation in residential demand response programs, thereby extending the market reach beyond purely commercial or industrial applications into the consumer energy ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 115.6 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Siemens, ABB, General Electric (GE), Honeywell, IBM, Cisco Systems, Eaton, Johnson Controls, Emerson Electric, Oracle, SAP, Rockwell Automation, GridPoint, Enel X, Tendril Networks, DEXMA, Verisae (VertexOne), EcoStruxure, BuildingIQ |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Energy Management Software Market Key Technology Landscape

The technology landscape of the Energy Management Software market is defined by the symbiotic relationship between advanced connectivity tools and sophisticated analytical capabilities. The foundational technology remains the Internet of Things (IoT), involving pervasive deployment of smart sensors, gateways, and edge computing devices that collect massive volumes of granular energy data in real-time. This ubiquitous data collection is essential for moving beyond simple historical reporting. Furthermore, seamless integration through standardized protocols (like BACnet, Modbus, and open APIs) ensures interoperability between diverse operational assets—such as HVAC systems, lighting controls, variable frequency drives, and renewable energy generators—enabling a single pane of glass view for energy management.

A second critical technology cluster is Advanced Analytics, primarily encompassing Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are utilized for predictive energy modeling, fault detection and diagnostics (FDD), and optimizing energy flows under volatile conditions, such as integrating intermittent solar and wind generation. The adoption of cloud-native architectures (SaaS) ensures that these computationally intensive analytical models can scale efficiently, offering subscription-based flexibility and continuous feature updates to end-users. The increasing reliance on cloud infrastructure also necessitates robust cybersecurity technologies, including encryption, multi-factor authentication, and regular vulnerability assessments, due to the critical nature of energy data and control systems.

Emerging technologies, specifically Digital Twins and Blockchain, are poised to further disrupt the market. Digital Twins provide virtual replicas of energy-consuming assets or entire buildings, allowing facility managers to simulate optimization scenarios and evaluate the impact of infrastructure changes before physical deployment. Blockchain technology is gaining traction, particularly in the utility and commercial segments, for enabling secure, transparent, and decentralized peer-to-peer energy trading and managing complex contractual agreements for distributed energy resources. These technologies collectively contribute to highly resilient, predictive, and autonomous energy systems, cementing the software's role as the central nervous system of modern infrastructure.

Regional Highlights

The regional dynamics of the Energy Management Software market demonstrate distinct growth maturity and regulatory adherence levels across major geographical areas. North America, driven primarily by the United States and Canada, holds a commanding position, attributed to early technological adoption, significant investments in smart grid infrastructure, and strong compliance requirements imposed by federal and state governments regarding emissions and efficiency. The highly competitive environment in North America fosters continuous innovation, particularly in AI-driven solutions tailored for hyperscale data centers and large industrial complexes.

Europe represents a highly mature market segment, propelled by the European Union’s ambitious energy efficiency directives, such as the EU Green Deal and stringent building performance standards. Countries like Germany, the UK, and France are leaders in adopting EMS for decarbonization efforts, focusing heavily on integrating renewable energy sources and enhancing energy efficiency in the existing building stock. The strong emphasis on sustainability reporting and the widespread use of smart metering infrastructure provide a fertile ground for sophisticated carbon management and utility optimization software platforms.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by unprecedented urbanization, massive infrastructural investments (especially in China, India, and Southeast Asia), and the urgent need to mitigate pollution resulting from fast-paced industrialization. While initial adoption was focused on large industrial users, the commercial sector is quickly catching up, driven by smart city projects and growing awareness of long-term operational cost savings. Government subsidies and mandates to improve energy efficiency in public and commercial buildings are key catalysts in this region. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, with growth primarily concentrated in oil and gas operations, and luxury real estate/commercial complexes, where high energy costs justify immediate investment in efficiency software.

- North America: Dominant market share due to stringent regulations, mature infrastructure, and high adoption of cloud and AI-driven predictive analytics, particularly in the industrial and IT sectors.

- Europe: High growth driven by aggressive decarbonization policies (EU Green Deal), strong focus on energy performance in buildings, and widespread integration of distributed energy resources.

- Asia Pacific (APAC): Fastest growing region, fueled by rapid industrialization, urbanization, massive infrastructure spending, and government incentives to tackle energy intensity in manufacturing.

- Latin America (LATAM): Emerging market characterized by selective adoption in utility modernization projects and large mining/industrial facilities seeking operational resilience against grid volatility.

- Middle East and Africa (MEA): Growth focused on reducing reliance on subsidized energy, driven by smart city developments (e.g., UAE, KSA) and managing energy-intensive infrastructure in oil and gas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Energy Management Software Market.- Schneider Electric

- Siemens

- ABB

- General Electric (GE)

- Honeywell

- IBM

- Cisco Systems

- Eaton

- Johnson Controls

- Emerson Electric

- Oracle

- SAP

- Rockwell Automation

- GridPoint

- Enel X

- Tendril Networks

- DEXMA

- Verisae (VertexOne)

- EcoStruxure

- BuildingIQ

Frequently Asked Questions

Analyze common user questions about the Energy Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying cloud-based Energy Management Software (EMS)?

The primary benefit of cloud-based EMS is enhanced scalability, flexibility, and reduced upfront capital expenditure, allowing organizations to access real-time data analytics and continuous feature updates without managing dedicated on-premise hardware infrastructure.

How does Energy Management Software contribute to ESG compliance?

EMS provides auditable, accurate data collection and reporting on energy consumption, greenhouse gas emissions, and operational efficiency, directly supporting mandated Environmental, Social, and Governance (ESG) disclosures and enabling quantifiable carbon reduction strategies.

What are the biggest challenges organizations face when implementing EMS?

Major challenges include integrating the new EMS platform with existing, disparate legacy Operational Technology (OT) and Building Management Systems (BMS), ensuring data accuracy across various sensors, and overcoming initial implementation costs and securing sensitive operational data.

Which end-user segment drives the highest demand for advanced EMS solutions?

The Industrial and Commercial end-user segments, particularly sectors with high energy intensity such as manufacturing, data centers, and large-scale commercial real estate, drive the highest demand due to their substantial potential for cost reduction and regulatory compliance requirements.

How does AI improve the functionality of traditional Energy Management Software?

AI integrates machine learning to transition EMS from reactive reporting to proactive, prescriptive optimization, enabling precise load forecasting, automated fault detection and diagnostics (FDD), and continuous, autonomous adjustment of energy consuming assets based on predictive models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager