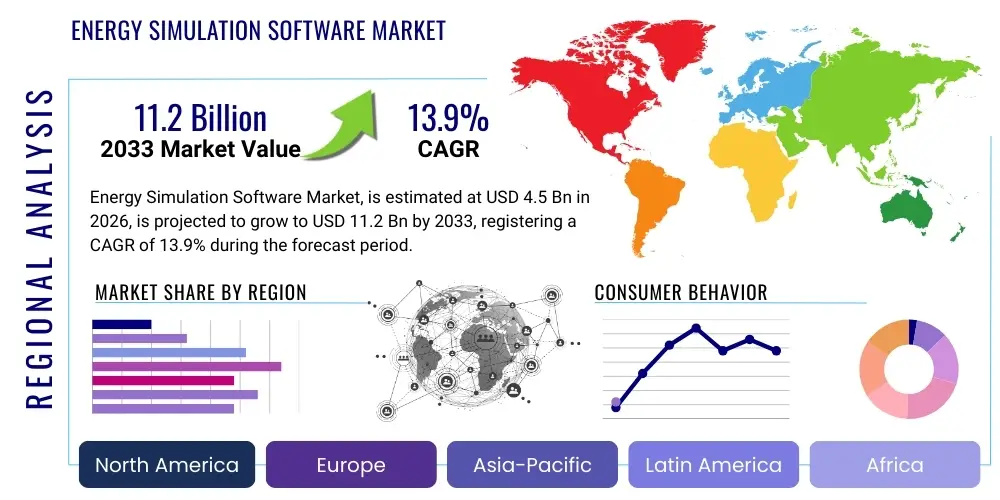

Energy Simulation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435797 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Energy Simulation Software Market Size

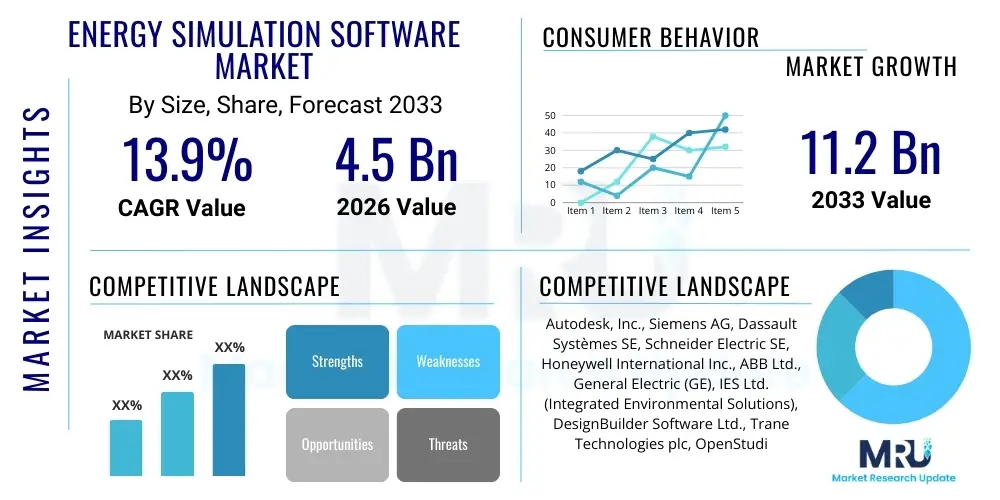

The Energy Simulation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.9% between 2026 and 2033. The market is estimated at 4.5 Billion USD in 2026 and is projected to reach 11.2 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global emphasis on energy efficiency, decarbonization mandates, and the widespread adoption of smart building technologies. Regulatory frameworks worldwide, especially in developed economies, are increasingly demanding high levels of energy performance modeling for new construction and significant renovation projects, thereby cementing the necessity of advanced simulation tools.

Energy Simulation Software Market introduction

The Energy Simulation Software Market encompasses advanced analytical tools designed to model, predict, and optimize energy consumption and performance in buildings, industrial processes, and utility networks. These sophisticated platforms utilize complex algorithms and physics-based modeling to analyze factors such as thermal dynamics, daylighting, HVAC performance, and renewable energy integration potential. The core product provides stakeholders—including architects, engineers, facility managers, and utility planners—with data-driven insights necessary for making critical design and operational decisions aimed at reducing environmental impact and minimizing operational costs. Key applications span from optimizing individual building envelopes to simulating the performance of entire district energy systems.

Major applications include comprehensive building energy management systems (BEMS), real-time HVAC optimization, urban planning for sustainable development, and forecasting the integration challenges associated with intermittent renewable energy sources onto existing grids. The primary benefits realized by users are significant reductions in energy waste, enhanced occupant comfort, and proven compliance with stringent green building certifications like LEED and BREEAM. Furthermore, the iterative modeling capabilities inherent in these platforms allow for rapid prototyping and scenario testing of complex energy retrofits before committing significant capital, thereby drastically mitigating financial risk associated with large-scale infrastructure investments.

The market growth is primarily driven by global governmental mandates requiring net-zero energy buildings, the increasing volatility of global energy prices, and rapid technological advancements in cloud computing and visualization capabilities. Stakeholders are recognizing that upfront investment in accurate energy modeling leads to decades of operational savings and improved asset valuation. The integration of Building Information Modeling (BIM) workflows has further solidified the role of energy simulation software as an indispensable tool in the modern sustainable design process, ensuring seamless data flow from conceptual design through construction and facility operation.

Energy Simulation Software Market Executive Summary

The Energy Simulation Software Market exhibits robust growth propelled by critical business trends centered around sustainability and digitalization. The transition from simplistic spreadsheet analysis to highly complex, integrated 3D modeling tools is a defining feature of the current landscape. Key business trends include the strong demand for subscription-based Software-as-a-Service (SaaS) models, which lower the entry barrier for smaller engineering firms, and the pervasive integration of simulation outputs directly into digital twins for ongoing asset performance monitoring. Furthermore, strategic partnerships between software vendors and major building automation system providers are creating closed-loop optimization systems that leverage simulation data for real-time adjustments, significantly enhancing operational efficiency across large commercial portfolios.

Regionally, North America and Europe dominate the market due to early and stringent energy efficiency regulations, mature infrastructure for green building certifications, and high consumer awareness regarding sustainable practices. However, the Asia Pacific (APAC) region is forecasted to display the highest growth rate, driven by rapid urbanization, massive investment in new smart city infrastructure, and emerging government initiatives in China and India focused on climate change mitigation. Specific regional trends involve Europe focusing heavily on utility-scale renewable energy integration simulation, while North America emphasizes complex commercial building performance modeling tailored to varied climate zones and localized utility rate structures.

Segment trends reveal that the Cloud-Based deployment model is rapidly outpacing the traditional On-Premise segment, offering superior scalability, collaborative features, and reduced hardware overhead for users. Among applications, Building Energy Management remains the largest segment, but the Utility Planning and Grid Modernization segment is experiencing exponential growth, reflecting the global need to simulate the resilience and capacity of electric grids under increasing load and decentralized generation. The services component, particularly advanced consulting and system integration, is becoming crucial, enabling end-users to fully customize and effectively deploy highly complex simulation environments tailored to their unique operational profiles and regulatory environments.

AI Impact Analysis on Energy Simulation Software Market

Users commonly inquire about how Artificial Intelligence (AI) will fundamentally transform the time-consuming and expertise-dependent nature of traditional energy modeling. Key themes revolve around the potential for AI to dramatically accelerate the simulation process, enhance predictive accuracy beyond current physics-based models, and automate the optimization loops necessary for achieving net-zero goals. Concerns often center on the 'black box' nature of AI recommendations and the validation of AI-generated inputs versus established engineering principles. Users expect AI to seamlessly integrate vast, multi-source datasets—such as historical utility consumption, occupancy patterns, and real-time weather data—to create highly granular and dynamic predictive models, moving the industry from static design analysis to continuous operational optimization. The primary expectation is that AI will democratize high-level energy modeling, making sophisticated tools accessible to a broader range of professionals.

- AI-driven optimization algorithms reduce model runtimes by intelligently pruning inefficient design iterations, leading to faster design cycles.

- Machine learning models enhance predictive accuracy by analyzing vast operational data to calibrate and fine-tune initial physics-based simulation inputs.

- Automated fault detection and diagnostics (AFDD) utilize AI to compare real-time building performance against simulated baselines, identifying and resolving operational drift instantly.

- Generative design leveraging AI allows users to explore thousands of high-performing design options that traditional manual modeling processes cannot practically evaluate.

- Predictive maintenance schedules are optimized using AI insights derived from simulated component degradation under various operational stress scenarios.

DRO & Impact Forces Of Energy Simulation Software Market

The Energy Simulation Software Market is primarily driven by stringent global energy efficiency regulations and the accelerating integration of sustainable building standards into mandatory compliance frameworks. Restraints include the high initial capital investment required for comprehensive software suites and the acute shortage of highly specialized professionals capable of effectively interpreting and managing complex simulation outputs. Opportunities arise from the massive global push toward digital twins for infrastructure management and the burgeoning demand for highly accurate modeling of decentralized renewable energy systems. These market forces collectively exert significant impact, necessitating continuous innovation in user interfaces and model complexity while balancing accessibility and accuracy for a diverse user base globally.

Drivers: Global mandates, such as the European Union’s Energy Performance of Buildings Directive (EPBD) and national net-zero commitments, necessitate the verifiable performance metrics provided by simulation software. Furthermore, the economic incentive driven by soaring energy prices motivates both private and public sectors to seek tools that can reliably pinpoint opportunities for operational cost reduction. The maturation of Building Information Modeling (BIM) frameworks provides a data-rich environment that simulation tools can leverage seamlessly, dramatically improving the efficiency of model creation and reducing human error associated with data transfer.

Restraints: A significant restraint is the high computational complexity and resource intensity required for detailed urban-scale or whole-facility simulations, often demanding substantial hardware investment. Moreover, the inherent complexity of advanced simulation tools necessitates specialized training, creating a barrier to widespread adoption, particularly among small and medium-sized engineering firms. Data reliability—specifically, ensuring that real-world operational inputs match design-stage assumptions—often leads to performance gaps, sometimes causing skepticism regarding the accuracy and return on investment (ROI) of the simulation results if not properly managed.

Opportunity: The largest opportunities lie in expanding the use case beyond design validation to continuous operational performance optimization through digital twin technology. Integrating simulation software with real-time IoT data streams allows for prescriptive recommendations, moving the tool from a planning asset to an active operational component. The developing markets, particularly in Asia Pacific and the Middle East, present untapped potential as they embark on large-scale infrastructure projects that prioritize sustainability from the foundational design stages, demanding robust, localized energy modeling solutions.

Impact Forces: The impact forces are currently skewed toward the positive influence of regulatory mandates and technological integration (like AI and IoT). These forces compel market players to develop more sophisticated yet user-friendly platforms. However, the restraining force of specialized skill requirements acts as a bottleneck, meaning rapid market growth is highly contingent on the industry's ability to provide comprehensive training and automate core modeling tasks to bridge the existing talent gap effectively. The resultant market trajectory is one of accelerated adoption, focused intensely on cloud-based deployment to minimize restraining hardware costs and maximize global accessibility.

Segmentation Analysis

The Energy Simulation Software market is segmented based on deployment type, component, application, and end-user, reflecting the diverse needs across various sectors involved in energy management and sustainable design. The segmentation highlights the shift toward accessible, cloud-based models that facilitate collaboration and real-time data integration, contrasting with the traditional on-premise solutions favored by large enterprises requiring stringent control over proprietary data. Analysis across these segments is crucial for vendors to tailor their offerings, focusing either on niche applications, such as specialized HVAC optimization, or broad platforms catering to utility planning and smart city initiatives, which represent high-growth verticals requiring robust simulation capabilities for complex infrastructure challenges.

The component segmentation shows that while the core software license or subscription generates the primary revenue, the associated services—including implementation, consulting, and ongoing maintenance—are essential for ensuring customer success and maximizing the ROI from these sophisticated tools. The dominant application segment, Building Energy Management, continues to evolve, integrating deeper with building automation systems (BAS) to provide closed-loop performance feedback. Geographically, the segmentation underscores the regulatory disparities and varying adoption rates globally, with APAC poised to significantly increase its market share due to unparalleled growth in new infrastructure development focused on energy conservation and efficiency mandates.

- Deployment Type: On-Premise, Cloud-Based (SaaS)

- Component: Software, Services (Consulting, Implementation, Maintenance & Support)

- Application: Building Energy Management (BEM), HVAC Systems Optimization, Renewable Energy Integration Simulation, Utility Planning and Grid Modernization, Urban and District Energy Modeling

- End-User: Construction and Real Estate, Utilities and Energy Sector, Manufacturing and Industrial Facilities, Government and Public Sector, Education and Research Institutions

Value Chain Analysis For Energy Simulation Software Market

The value chain for Energy Simulation Software begins with upstream activities focused on data acquisition and core software development. Upstream involves specialized data providers offering granular, location-specific weather data, material properties libraries, and validated thermal performance inputs necessary for accurate modeling. Core software developers, including large engineering conglomerates and specialized software firms, focus heavily on R&D to incorporate advanced algorithms, physics engines, and integration capabilities (e.g., BIM compatibility). This stage is capital-intensive, requiring high levels of intellectual property protection and continuous technological updates to stay competitive in model accuracy and feature depth.

The midstream focuses on distribution channels and implementation. Direct channels involve software vendors selling licenses or subscriptions directly to major engineering firms and utility companies, often accompanied by in-house training and support services. Indirect channels, which are rapidly expanding, leverage value-added resellers (VARs), specialized energy consulting firms, and system integrators who customize the software solution, integrate it with existing enterprise resource planning (ERP) systems or building automation systems, and provide localized support. The efficiency of this midstream layer is critical for market penetration, especially in regions with diverse technical standards and language requirements, making robust partnerships essential for scalability.

The downstream stage revolves around the end-users and the feedback loop necessary for continuous product improvement. Downstream users include architects utilizing the software during conceptual design, mechanical engineers for system sizing, facility managers for operational optimization, and grid planners for resilience testing. The data generated at the downstream level—actual building performance metrics—is fed back to the upstream developers, enabling iterative product enhancements and model calibration (particularly crucial for AI integration). The efficiency of this closed-loop system determines the overall perceived value of the software, driving future adoption and renewal rates based on demonstrable energy savings and compliance assurance.

Energy Simulation Software Market Potential Customers

The primary potential customers for Energy Simulation Software are entities across the built environment and energy infrastructure sectors that require detailed performance validation and cost-benefit analysis before deployment. These customers are universally focused on regulatory compliance, operational efficiency, and achieving ambitious sustainability goals. The key buyers are often multi-disciplinary firms involved in large capital projects where the cost of energy consumption over the lifecycle far outweighs the initial investment in design tools. The procurement decision is typically driven by Chief Sustainability Officers, VP of Engineering, and IT Directors responsible for large-scale enterprise software deployments and digital transformation initiatives.

End-users can be broadly categorized into three groups: designers (architects and engineers) who use the software to optimize preliminary and detailed design choices; owners/operators (real estate investment trusts, facility managers) who use the software for operational benchmarking, predictive maintenance, and strategic portfolio management; and government/utilities who utilize the tools for regional planning, grid stability analysis, and implementing demand-side management programs. For instance, a major utility company is a potential customer utilizing simulation to forecast peak demand scenarios under climate change models, ensuring grid resilience and justifying infrastructure upgrades based on modeled necessity, while a large commercial property developer utilizes it to guarantee LEED Platinum certification and maximize asset valuation through documented energy performance.

The rapid growth of the smart cities movement is creating a new class of potential customers—municipal and metropolitan authorities seeking integrated energy simulation platforms that can model the interconnected thermal, electrical, and transportation energy flows across entire urban districts. These authorities require tools capable of handling vast datasets and complex interactions between diverse infrastructure elements. This customer segment is highly motivated by public pressure to meet climate goals and the need for fiscal responsibility in public spending, making demonstrable energy efficiency a key criterion for software adoption and implementation contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 4.5 Billion USD |

| Market Forecast in 2033 | 11.2 Billion USD |

| Growth Rate | 13.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autodesk, Inc., Siemens AG, Dassault Systèmes SE, Schneider Electric SE, Honeywell International Inc., ABB Ltd., General Electric (GE), IES Ltd. (Integrated Environmental Solutions), DesignBuilder Software Ltd., Trane Technologies plc, OpenStudio Coalition, EnergyPlus Development Team (NREL), EDSL, Inc., Arup, Green Building Studio (Autodesk), Sefaira (Trimble), ETAP/Operation Technology, Inc., DNV GL, Chelsio Communications, ThermoAnalytics Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Energy Simulation Software Market Key Technology Landscape

The technological landscape of the Energy Simulation Software Market is rapidly evolving, moving beyond traditional physics-based engines (like EnergyPlus and DOE-2) to incorporate advanced computational methods and data integration capabilities. A fundamental technological requirement is seamless interoperability with Building Information Modeling (BIM) software, utilizing open standards such as Industry Foundation Classes (IFC) to facilitate automated geometry creation and data transfer, which dramatically reduces the modeling preparation time. Cloud computing is central, enabling high-performance parallel processing necessary for complex, multi-zone, and long-duration simulations, thereby lowering the need for high-end local workstations for many users.

The integration of digital twin technology is perhaps the most impactful technological shift. Digital twins utilize simulation models as the core predictive engine, continuously fed by real-time data from IoT sensors and Building Management Systems (BMS). This allows the software to execute 'what-if' scenarios based on current operational data and provide prescriptive maintenance and optimization strategies rather than just passive performance reports. Furthermore, the adoption of Artificial Intelligence and Machine Learning (AI/ML) is enhancing the core simulation engines by calibrating model parameters based on historical usage data, increasing the accuracy of predictions, especially concerning occupant behavior and stochastic loads, which are notoriously difficult to model accurately using only deterministic physics-based approaches.

Geospatial Information Systems (GIS) technology is critical for urban-scale and utility simulation, allowing users to model the impact of large-scale renewable energy farms, district heating networks, and microgrids within a real-world topographical and environmental context. Advanced visualization techniques, including augmented reality (AR) and virtual reality (VR), are also emerging, enhancing how engineers and non-technical stakeholders interact with complex simulation results, making the data more accessible and actionable. This continuous convergence of high-fidelity physics, big data analytics, and user-centric visualization defines the competitive technological edge in the current market environment.

Regional Highlights

Regional dynamics heavily influence the adoption and application of Energy Simulation Software, driven primarily by differing governmental policy frameworks, energy market structures, and prevailing construction standards. North America (NA) remains a powerhouse, largely due to the early establishment of energy codes (e.g., ASHRAE 90.1) and widespread adoption of green building certification programs. The demand here is concentrated among large commercial real estate developers, data centers, and specialized engineering consultants who require highly granular simulation for complex, large-scale projects, with a strong focus on compliance and maximizing utility incentives.

Europe, driven by the ambitious decarbonization goals of the EU Green Deal and directives like EPBD, demonstrates mature adoption. The European market emphasizes simulation tools capable of modeling district heating and cooling systems, renewable energy storage, and integrated building-to-grid solutions. Regulatory pressure ensures high penetration, particularly in Germany, the UK, and Nordic countries, where energy modeling is often a mandatory component of the building permit process. The trend toward nearly zero-energy buildings (nZEB) further mandates continuous innovation in modeling envelope performance and passive design strategies.

Asia Pacific (APAC) is projected as the fastest-growing region, characterized by massive infrastructure development and rapid urbanization, especially in China, India, and Southeast Asia. While regulatory compliance is less uniform than in the West, the immense scale of new construction and the critical need to manage energy shortages are driving market demand. Key adoption factors include the necessity for simulating the impact of high-density housing and commercial towers on regional energy infrastructure, alongside increasing governmental focus on establishing localized green building standards, creating significant untapped opportunities for cloud-based and scalable simulation platforms.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets. In the Middle East, high cooling loads necessitate advanced thermal modeling, and massive smart city projects (like NEOM) are utilizing simulation software extensively for integrated urban planning and renewable energy optimization. In LATAM, market growth is slower but steady, supported by private sector investment in sustainable industrial facilities and commercial buildings, often driven by multinational companies adhering to global corporate sustainability mandates, even where local regulations may be less stringent.

- North America: Dominant market share due to mature regulatory framework (ASHRAE, IECC) and high demand from the specialized building consulting sector, heavily focused on compliance and utility incentive maximization.

- Europe: High penetration driven by stringent EU directives (EPBD, Green Deal); strong focus on nZEB, district energy modeling, and deep integration with urban planning initiatives.

- Asia Pacific (APAC): Highest CAGR driven by large-scale infrastructure projects, rapid urbanization, and emerging government mandates in China and India focusing on energy efficiency and resilient grid development.

- Middle East & Africa (MEA): Growth fueled by large-scale smart city developments and the critical need for advanced simulation to optimize extreme climate cooling loads and massive solar energy integration projects.

- Latin America (LATAM): Steady adoption in corporate sustainability projects and industrial efficiency upgrades, with market penetration reliant on improving local regulatory enforcement and availability of skilled engineering talent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Energy Simulation Software Market.- Autodesk, Inc.

- Siemens AG

- Dassault Systèmes SE

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- General Electric (GE)

- IES Ltd. (Integrated Environmental Solutions)

- DesignBuilder Software Ltd.

- Trane Technologies plc

- OpenStudio Coalition

- EnergyPlus Development Team (NREL)

- EDSL, Inc.

- Arup

- Green Building Studio (Autodesk)

- Sefaira (Trimble)

- ETAP/Operation Technology, Inc.

- DNV GL

- Chelsio Communications

- ThermoAnalytics Inc.

Frequently Asked Questions

Analyze common user questions about the Energy Simulation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver accelerating the adoption of Energy Simulation Software?

The primary driver is the global enforcement of stringent energy efficiency regulations, particularly governmental and regional mandates requiring verifiable proof of sustainable performance in new and renovated buildings to meet net-zero carbon emission targets.

How is cloud computing influencing the accessibility of energy simulation tools?

Cloud computing, through the SaaS model, significantly increases accessibility by providing on-demand high-performance computing (HPC) power necessary for complex simulations, drastically reducing the required upfront investment in specialized local hardware for engineering firms.

What is the role of Artificial Intelligence (AI) in modern energy simulation?

AI and Machine Learning are used to improve the accuracy of predictions by calibrating models with real-world data, automate optimization processes, and rapidly generate design alternatives, moving simulation from static design validation to continuous performance intelligence.

Which end-user segment is showing the highest growth potential for this software?

The Utility Planning and Grid Modernization end-user segment is experiencing exceptional growth, driven by the critical need to model the integration challenges and resilience requirements associated with large-scale distributed renewable energy sources.

What are the main constraints hindering the widespread deployment of energy simulation software?

Key constraints include the scarcity of highly trained professionals capable of accurately using and interpreting advanced simulation results, alongside the initial complexity and high cost associated with implementing comprehensive enterprise-level software solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager