Engine Filter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436454 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Engine Filter Market Size

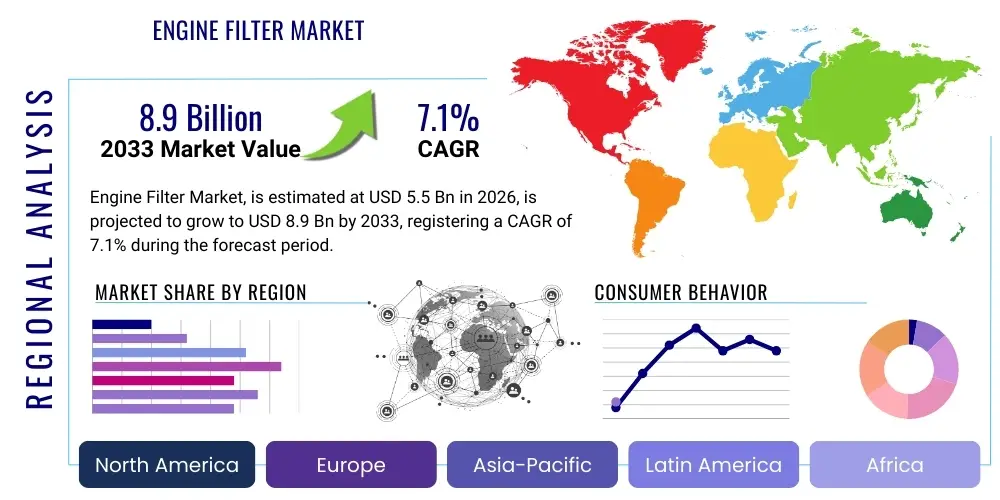

The Engine Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at $5.5 Billion in 2026 and is projected to reach $8.9 Billion by the end of the forecast period in 2033.

Engine Filter Market introduction

The Engine Filter Market encompasses the manufacturing and distribution of essential filtration components designed for internal combustion engines and related systems, crucial for maintaining optimal performance, fuel efficiency, and longevity of vehicles and industrial machinery. These filters, which primarily include air filters, oil filters, fuel filters, and cabin air filters, prevent abrasive particulate matter, contaminants, and moisture from entering critical engine components. The function of these products is inherently linked to environmental compliance, as efficient filtration directly reduces harmful emissions and ensures that the engine operates within stringent regulatory parameters established globally.

Product descriptions vary significantly across the types of filters; air filters protect the intake system from dust and debris, oil filters clean the engine lubricant from metal shards and carbon buildup, and fuel filters remove rust, dirt, and water from the fuel supply. Major applications span the entire transportation sector, including passenger vehicles (sedans, SUVs), heavy commercial vehicles (trucks, buses), off-highway machinery (construction, agriculture), and industrial power generation units. The increasing complexity of modern engines, particularly the move toward smaller, turbocharged direct-injection (GDI/TDI) engines, necessitates higher-efficiency filtration media capable of handling elevated pressures and temperatures, thereby driving continuous innovation in filter media material science.

The primary benefits derived from high-quality engine filtration include extended engine life, reduced maintenance costs, improved fuel economy due to cleaner combustion, and enhanced overall vehicle reliability. Driving factors for market expansion include the stringent global emission standards (such as Euro 6 and Bharat Stage VI), which require superior protection for complex engine systems, the accelerating growth of the global vehicle fleet, particularly in emerging economies like China and India, and the robust demand from the aftermarket segment fueled by regular maintenance cycles. Furthermore, technological advancements in synthetic and blended media offer higher dirt-holding capacity and better flow characteristics, contributing significantly to market growth.

Engine Filter Market Executive Summary

The Engine Filter Market is characterized by steady growth driven predominantly by regulatory pressures concerning environmental emissions and the subsequent need for high-performance filtration solutions across the automotive and industrial sectors. Key business trends indicate a robust shift towards the utilization of synthetic media and multi-layered filter designs, moving away from traditional cellulose-only papers, to meet the demands of modern engine architectures requiring greater efficiency in capturing ultra-fine particulates without compromising flow dynamics. The competitive landscape is intensely focused on material innovation, intellectual property surrounding nanotech filtration layers, and optimizing supply chain logistics to serve both Original Equipment Manufacturers (OEMs) and the burgeoning, price-sensitive global Aftermarket.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, underpinned by explosive fleet growth, rising vehicle production, and increasingly strict local emission mandates, making it the most lucrative geographical market segment. North America and Europe, while mature, exhibit strong demand for premium and specialized filters, particularly in the commercial vehicle and high-performance aftermarket sectors, where total cost of ownership and extended service intervals are critical purchasing criteria. Latin America and the Middle East & Africa (MEA) present significant opportunities driven by infrastructure development projects and the subsequent utilization of heavy-duty equipment, increasing the demand for robust off-road filtration systems capable of handling harsh environmental conditions.

Segment trends highlight the dominance of Air Filters and Oil Filters based on volume, reflecting their mandatory replacement frequency and necessity in engine operation. However, Fuel Filters are experiencing rapid value growth due to the complexities associated with modern fuel injection systems (especially common rail direct injection systems) which are highly sensitive to microscopic contaminants and water ingress. The Aftermarket segment maintains a larger overall share in revenue generation compared to the OEM segment, owing to cyclical replacement rates and the vast installed base of vehicles globally. Key companies are focusing on mergers and acquisitions to consolidate market share and leverage specialized filtration technologies to gain a competitive edge in both segments.

AI Impact Analysis on Engine Filter Market

User queries regarding AI's influence on the Engine Filter Market frequently center on predictive maintenance capabilities, supply chain optimization, and the potential for AI-driven design of filtration media. Users are concerned about how AI will transform traditional replacement schedules, transitioning from time-based maintenance to condition-based monitoring, which could affect aftermarket revenue predictability. Key themes include the integration of smart sensors into filters (IoT integration), AI algorithms analyzing filtration performance in real-time based on engine diagnostics (oil quality, pressure drop), and the efficiency gains possible through optimizing filter geometry and material composition using generative design AI tools. The main expectation is that AI will enhance product lifecycle management, reduce unscheduled downtime for commercial fleets, and ultimately lead to the development of "smarter" filters with longer service lives.

AI is set to revolutionize the manufacturing process itself. Machine learning algorithms are increasingly utilized to optimize production lines, predict equipment failures within filter manufacturing plants, and ensure material quality consistency, particularly for complex synthetic fiber blending processes. Furthermore, in the realm of predictive analytics, AI models ingest massive datasets related to vehicle usage patterns, environmental conditions, and filter performance metrics to forecast the exact point of filter saturation. This level of precision minimizes premature filter replacement while simultaneously preventing engine damage from excessively prolonged filter usage, offering quantifiable economic benefits to large fleet operators and end-users.

From a market intelligence perspective, AI and advanced analytics are becoming indispensable tools for manufacturers to monitor competitive pricing, analyze consumer purchasing behavior across various digital channels, and manage inventory levels more effectively within the complex global distribution network. This ensures that the right type of filter is available at the right regional distribution center at the precise moment it is needed, minimizing stockouts and reducing obsolescence. While AI may not directly change the core function of physically separating contaminants, its indirect impact on design efficiency, quality control, maintenance strategy, and logistical optimization is profound and expected to define the market's operational structure over the next decade.

- AI-driven Predictive Maintenance: Transitioning fixed schedules to condition-based monitoring using sensor data and machine learning algorithms.

- Generative Design Optimization: Utilizing AI to model optimal filter geometry and media structure for enhanced efficiency and lower pressure drop.

- Supply Chain & Inventory Management: Predictive analytics minimizing stockouts and optimizing global distribution based on real-time demand forecasts.

- Manufacturing Quality Control: AI vision systems and algorithms ensuring consistent filtration media quality during production.

- IoT Integration: Incorporation of smart sensors (pressure, flow, particle count) into filters for real-time performance tracking and engine health monitoring.

- Enhanced Filtration Material Development: Accelerating research into new nano-fiber and synthetic media combinations through data analysis.

DRO & Impact Forces Of Engine Filter Market

The Engine Filter Market dynamics are primarily shaped by three critical forces: stringent environmental regulations acting as a perpetual driver; technological inertia and product commoditization serving as key restraints; and the transition to electric vehicles (EVs) presenting both a short-term opportunity for cabin and specialized filters and a long-term restraint on traditional engine filtration. The overall impact force is moderately positive, contingent upon the speed of transition in major automotive markets and the subsequent growth of the global vehicle parc in developing regions. Drivers overwhelmingly focus on purity requirements for increasingly sensitive engine components, requiring higher ISO efficiency ratings for lubricants and fuels, demanding constant product improvement and faster replacement cycles under harsh operating conditions.

Key drivers include the global push for lower emissions, compelling manufacturers to design engines that demand ultra-clean fluids and air, thereby increasing the performance specifications required of filters. The expanding global vehicle population, particularly in high-growth economies where road conditions and fuel quality can be suboptimal, further necessitates frequent filter replacement and drives high volume demand in the aftermarket. Opportunities lie significantly in developing advanced synthetic media that offer extended service intervals, appealing directly to large fleet operators seeking reduced operational expenditure, and in penetrating the emerging market for high-efficiency cabin air filters (including HEPA-grade or anti-viral) driven by heightened consumer awareness of air quality inside the vehicle.

Conversely, the market faces significant restraints. The long-term threat posed by the acceleration of electric vehicle adoption will eventually cannibalize the demand for traditional oil and fuel filters, forcing market participants to diversify into non-combustion filtration products (e.g., thermal management filters, battery cooling filters). Furthermore, the continuous fight against low-quality, counterfeit filters, which erode consumer trust and intellectual property rights, remains a persistent challenge, especially in the aftermarket segment across developing regions. The major impact forces include the cyclical nature of the automotive industry and the intense price competition, particularly for standard cellulose filters, which necessitates continuous cost-efficiency improvements in manufacturing processes.

Segmentation Analysis

The Engine Filter Market segmentation is crucial for understanding market dynamics, allowing stakeholders to analyze trends based on filter functionality, media material, vehicle application, and route to market. The market is fundamentally segmented by the type of contaminant they target: Air, Oil, Fuel, and Cabin. The complexity of modern engine filtration systems means that OEMs increasingly require filters that perform multiple functions or use specialized materials to handle the higher pressures and operating temperatures associated with downsized turbocharged engines, directly impacting the material-based segmentation.

Further segmentation by media type, encompassing cellulose, synthetic, and blended options, reveals the technological trajectory of the industry, with synthetic media experiencing the fastest value growth due to superior efficiency and dirt-holding capacity. Vehicle type segmentation—covering passenger cars, commercial vehicles, and two-wheelers—reflects differences in required filter robustness and replacement volume. Passenger cars dominate unit sales, while commercial vehicles contribute significantly to market value due to the larger size and higher cost of heavy-duty filters, which often require specialized construction to withstand severe vibration and high flow rates.

The distribution channel analysis distinguishes between OEM sales, where filters are supplied directly to vehicle assembly lines, and Aftermarket sales, which involve replacement filters sold through independent distributors, authorized service centers, and retail chains. The Aftermarket segment is the backbone of the industry, generating the majority of the market revenue due to the non-negotiable need for regular maintenance and filter replacement throughout a vehicle's lifespan, typically every 5,000 to 15,000 miles depending on the filter type and application.

- Filter Type:

- Air Filter

- Oil Filter

- Fuel Filter

- Cabin Air Filter (Pollen Filter)

- Media Type:

- Cellulose

- Synthetic

- Blended (Cellulose/Synthetic Mix)

- Microglass Fiber

- End-Use Vehicle Type:

- Passenger Car (PC)

- Commercial Vehicle (CV)

- Off-Highway Vehicles (OHV)

- Two-Wheelers

- Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket and OES/Dealer Channels)

Value Chain Analysis For Engine Filter Market

The value chain for the Engine Filter Market begins with upstream activities focused on raw material procurement, which primarily involves sourcing specialized paper, nonwoven fabrics (synthetic media), plastics, metals (casings, seals), and adhesives. Key upstream analysis involves securing reliable supplies of high-quality filtration media, particularly advanced micro-fiber glass and synthetic polymers, which are often subject to commodity price volatility. Manufacturers heavily invest in R&D at this stage to optimize media pore size, thickness, and pleat geometry to achieve required filtration efficiency (beta ratios) while minimizing pressure drop. Strategic relationships with specialized material suppliers are crucial for maintaining quality and cost control.

The core manufacturing stage involves converting these materials into finished filters through complex processes such as pleating, cutting, assembling, and sealing. This midstream activity is highly automated and subject to rigorous quality control to meet OEM specifications (dimensional accuracy and burst strength). The downstream segment focuses primarily on distribution. The Original Equipment Channel (OEM) requires just-in-time delivery directly to vehicle assembly lines, demanding high logistical precision and zero-defect quality. Margins in the OEM channel are typically lower but guarantee high volume and stability.

The independent distribution channel (Aftermarket) is complex, involving multiple layers of wholesalers, distributors, retail auto parts stores, and independent garages. Direct sales (often through branded dealer networks or online platforms) provide better margin control and closer customer relationships, while indirect channels utilize third-party logistics partners to achieve broad geographical reach. The profitability of the engine filter value chain is heavily dependent on efficiency gains in manufacturing and the ability to maintain premium pricing in the aftermarket by emphasizing superior filtration technology, longevity, and brand trust over generic, low-cost alternatives.

Engine Filter Market Potential Customers

The potential customers for engine filters can be broadly categorized into Original Equipment Manufacturers (OEMs), large fleet operators, and individual consumers purchasing through the diverse aftermarket channels. OEMs, including global automotive and heavy machinery manufacturers like Toyota, Ford, Daimler, Caterpillar, and John Deere, represent the primary initial demand source. They require engine filters designed and validated to meet the specific performance, size, and longevity requirements integrated into their engine designs. These relationships are long-term and volume-intensive, placing high importance on technical collaboration and supplier reliability throughout the vehicle development cycle.

Large commercial fleet operators, such as trucking companies, logistics firms, public transportation authorities, and mining/construction conglomerates, constitute another vital customer segment. For these buyers, filters are not just maintenance items but critical components of their operational efficiency strategy. Their purchasing decisions are highly influenced by the filter's Total Cost of Ownership (TCO), focusing on factors like extended drain intervals, durability in harsh environments, and the availability of bulk ordering and specialized fleet service programs. They often seek strategic partnerships with filter manufacturers to streamline their procurement and maintenance processes across thousands of vehicles.

The largest and most fragmented customer base resides within the independent Aftermarket. This includes millions of vehicle owners globally who purchase filters either directly through retail outlets for DIY maintenance or indirectly through independent repair garages, franchised service centers, and quick lube establishments. These customers prioritize product accessibility, competitive pricing, and brand recognition. For high-end consumers, performance filters (like high-flow air filters) represent a niche but lucrative segment focused on enhancing engine power and responsiveness, differentiating them from standard OE-equivalent replacement filters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.5 Billion |

| Market Forecast in 2033 | $8.9 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson, Mann+Hummel, Parker-Hannifin, Cummins, Sogefi, Mahle, Clarcor (now part of Parker-Hannifin), Baldwin Filters, Atlas Copco, Affinia Group, K&N Engineering, Freudenberg Filtration Technologies, Lydall, Ahlstrom-Munksjö, Denso, Bosch, Hengst SE, Filter Manufacturers Inc., UFI Filters, Champion Laboratories. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Engine Filter Market Key Technology Landscape

The technological landscape of the Engine Filter Market is defined by a continuous pursuit of higher efficiency, extended service life, and reduced physical size, largely driven by the constraints of modern engine compartments and stricter regulatory demands. A key area of innovation is in filtration media science, moving towards multi-layered synthetic media, often incorporating nanotechnology elements or electrostatic charging to capture ultra-fine particles (PM2.5 and smaller) more effectively than traditional cellulose fibers. These synthetic media, typically made from polymers such as polyester or polypropylene, offer superior chemical resistance and consistent porosity, crucial for maintaining optimal flow under high pressure and variable temperature conditions prevalent in turbocharged and diesel applications.

Another pivotal technology involves the development of self-cleaning or extended-life filters, particularly in the heavy-duty and industrial sectors. For instance, air filtration systems now utilize cyclonic pre-filtration stages or pulsed air systems that automatically eject large particulates, significantly extending the life of the primary filter element. Furthermore, the integration of intelligent monitoring technologies, often referred to as 'smart filters,' is gaining traction. These systems incorporate sensors (pressure drop indicators, oil quality sensors) that communicate real-time performance data to the Engine Control Unit (ECU) or telematics systems, facilitating predictive maintenance rather than relying solely on mileage or time intervals.

In the domain of fuel filtration, advancements are focused on improving water separation capabilities, which is critical for protecting common rail direct injection (CRDI) systems from corrosion and damage. Specialized coalescing media and sophisticated fuel filter housings are designed to meet stringent OEM requirements regarding water removal efficiency (often exceeding 95%). For oil filtration, the trend is towards full-flow and by-pass filter combinations, utilizing specialized media designed to handle the increasing prevalence of additives and contaminants in synthetic lubricants. These technological shifts require significant investment in R&D and specialized manufacturing processes, driving market differentiation among key players.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily propelled by rapid industrialization, burgeoning vehicle manufacturing hubs in China, India, and Southeast Asia, and massive government investment in infrastructure projects requiring heavy machinery. The region is witnessing a rapid transition toward adopting stringent emission standards, forcing the replacement of older vehicle fleets with newer models that require high-efficiency filtration. The sheer volume of new vehicle sales and the size of the existing vehicle parc create unparalleled demand for both OEM and aftermarket filtration products, often characterized by severe operating conditions (dust, congestion), leading to shorter filter replacement cycles compared to mature markets.

- North America: This region is a mature yet premium market, driven by the demand for heavy-duty commercial vehicle filtration, particularly for long-haul trucking which emphasizes product longevity and reduced downtime. North America leads in the adoption of advanced filtration technologies, including synthetic media and specialized off-highway filters capable of handling extreme cold and dusty environments. The robust aftermarket here is characterized by strong brand loyalty and a preference for OE-quality or better performance filters, making it a critical region for technological innovators.

- Europe: Driven by the strict enforcement of Euro 6/7 emission norms and a high degree of technological sophistication, Europe exhibits strong demand for high-performance, compact filtration systems. The region shows a significant uptake of advanced cabin air filtration (including activated carbon and anti-allergen filters) reflecting high consumer awareness regarding in-car air quality. While the transition to electric vehicles is faster here than in other major markets, the massive installed base of highly engineered diesel and gasoline engines ensures sustained high-value demand for complex filtration units.

- Latin America (LATAM): LATAM is an emerging market characterized by varied fuel quality standards and challenging road conditions, necessitating robust and frequently replaced filters, particularly fuel filters with advanced water separation capabilities. Market growth is closely tied to economic stability and infrastructure investment, with Brazil and Mexico serving as key manufacturing and consumption centers. Price sensitivity is higher in the aftermarket, leading to fierce competition between domestic and global suppliers.

- Middle East and Africa (MEA): This region is heavily influenced by the high demand for filtration in the construction, mining, and oil & gas sectors. Severe desert and dusty environments mandate the use of heavy-duty, multi-stage air filtration systems to protect high-value machinery. Demand is concentrated in countries with significant commercial activity (Saudi Arabia, UAE, South Africa). Political stability and commodity price fluctuations significantly impact capital expenditure and, consequently, the demand for industrial and heavy-vehicle filtration systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Engine Filter Market.- Donaldson Company, Inc.

- Mann+Hummel Group

- Parker-Hannifin Corporation

- Cummins Inc. (Fleetguard)

- Sogefi S.p.A.

- Mahle GmbH

- Baldwin Filters (CLARCOR Industrial Air)

- Atlas Copco AB

- Affinia Group Inc.

- K&N Engineering, Inc.

- Freudenberg Filtration Technologies

- Lydall, Inc.

- Ahlstrom-Munksjö Oyj

- Denso Corporation

- Robert Bosch GmbH

- Hengst SE

- UFI Filters S.p.A.

- Filter Manufacturers Inc.

- Champion Laboratories Inc.

- Purolator Filter Products

Frequently Asked Questions

Analyze common user questions about the Engine Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for synthetic media in engine filters?

Demand is driven by increasingly strict emission standards and the requirement of modern engines (especially GDI/TDI) for ultra-clean fluids. Synthetic media offers superior efficiency, higher dirt-holding capacity, and better flow characteristics, allowing for extended filter service intervals and protection against ultra-fine particulate matter (PM2.5).

How will the global shift towards Electric Vehicles (EVs) impact the traditional engine filter market?

The EV transition poses a long-term restraint on the demand for traditional oil and fuel filters. However, it presents opportunities in new areas, such as high-efficiency cabin air filters, specialized cooling filters for battery thermal management systems, and specialized air filters for hydrogen fuel cell stacks, requiring market diversification.

Which segment, OEM or Aftermarket, dominates the Engine Filter Market revenue?

The Aftermarket segment consistently dominates revenue. This is due to the cyclical nature of maintenance, where filters must be replaced multiple times throughout a vehicle’s lifespan, creating substantial, recurring demand volume compared to the one-time sale to the Original Equipment Manufacturer (OEM).

What are the primary challenges posed by counterfeit engine filters?

Counterfeit filters are a significant restraint, primarily in the aftermarket, as they offer inferior performance, leading to premature engine wear and potential damage. They undermine brand reputation, erode intellectual property rights, and pose safety risks, particularly in regions with less stringent quality oversight.

What is the role of sensors and AI integration in the future of engine filtration?

Sensors and AI facilitate the transition to predictive maintenance by monitoring filter performance (e.g., pressure drop) in real-time. This smart integration optimizes replacement cycles, reduces unnecessary downtime for commercial fleets, and contributes to the design of more durable and efficient filter systems via generative engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager