Engine Nacelle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433466 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Engine Nacelle Market Size

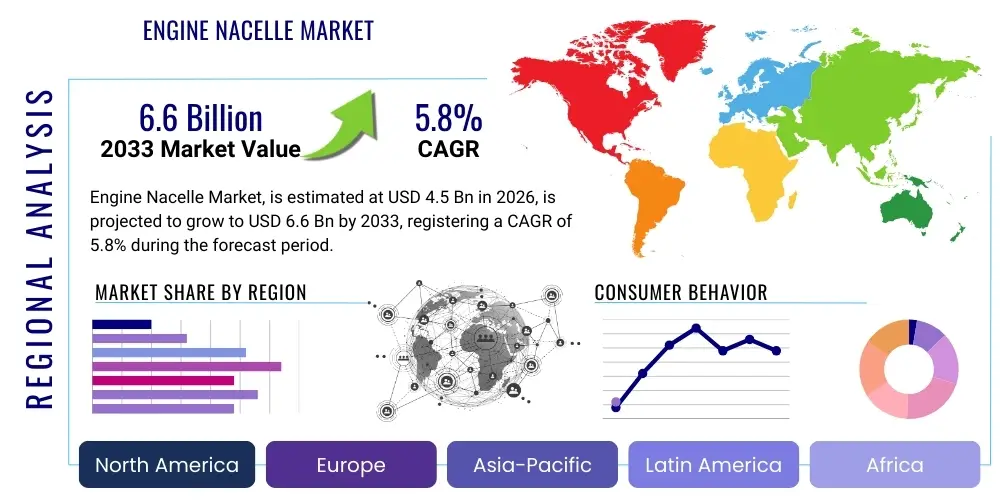

The Engine Nacelle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033.

Engine Nacelle Market introduction

Engine nacelles are aerodynamic structures designed to house, protect, and provide an air intake system for the aircraft engine. These critical components are integral to aircraft performance, contributing significantly to overall aerodynamic efficiency, noise reduction, and safety containment in the event of engine failure. The product description encompasses various structural elements, including the inlet cowl, fan cowl, thrust reverser, and exhaust nozzle, each meticulously engineered to optimize airflow and thrust generation. Major applications are predominantly found across the commercial aviation sector, including narrow-body, wide-body, and regional aircraft, as well as defense and business jet segments, driven by stringent regulatory requirements for lower emissions and reduced noise pollution.

The primary benefits derived from advanced nacelle systems include improved fuel efficiency through enhanced aerodynamics, substantial reduction in community noise due to optimized acoustic linings, and simplification of engine maintenance procedures through modular design. Furthermore, the incorporation of advanced composite materials, such as carbon fiber reinforced polymers (CFRPs), provides necessary weight savings, which directly translates into operational cost reductions for airlines. These systems also house the thrust reverser mechanism, a vital safety feature for braking during landing, particularly on wet or short runways, ensuring high standards of operational integrity.

Key driving factors accelerating market expansion include the substantial growth in global air passenger traffic, necessitating large-scale fleet modernization and expansion, particularly in the Asia-Pacific region. There is a strong global emphasis on developing new generation, fuel-efficient aircraft programs (e.g., A320neo, B737 MAX, B777X) that require highly optimized and lightweight nacelle systems tailored for advanced turbofan engines. Furthermore, the stringent enforcement of noise regulations by international bodies like the International Civil Aviation Organization (ICAO) compels manufacturers to invest in cutting-edge acoustic technology integrated into the nacelle structure, thereby sustaining robust demand for technologically advanced products.

Engine Nacelle Market Executive Summary

The Engine Nacelle Market is characterized by intense technological competition centered on material science and acoustic engineering, with market growth primarily tethered to long-term aircraft production cycles and post-pandemic recovery in air travel. Current business trends indicate a significant shift towards utilizing advanced composite materials, specifically carbon fiber reinforced plastics (CFRPs), to achieve critical weight reduction targets set by OEMs and airframers for new engine programs, thereby maximizing fuel efficiency. This material evolution is concurrently driving demand for specialized manufacturing techniques, including advanced resin transfer molding (RTM) and automated fiber placement (AFP), which are redefining production scalability and precision within the component manufacturing industry.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, propelled by rapidly increasing middle-class populations, subsequent high demand for air travel, and massive investment in fleet expansion by carriers in China and India. North America and Europe, while representing mature markets, maintain high revenue share due to the strong presence of major aircraft OEMs (Boeing, Airbus) and engine manufacturers, alongside robust maintenance, repair, and overhaul (MRO) activities. Market dynamics in these mature regions are increasingly focused on the aftermarket segment, specializing in high-value repairs and upgrades for legacy aircraft to meet evolving environmental performance standards, particularly concerning noise mitigation.

Segment trends underscore the dominance of the Narrow-Body Aircraft segment, largely due to the high volume production rates of single-aisle aircraft, which form the backbone of global commercial fleets. In terms of product segmentation, the Thrust Reverser segment commands a substantial value share, reflecting its complexity and crucial safety function. The shift towards lightweight materials, especially composites, is accelerating, positioning the Composites segment as the primary growth driver over traditional metallic nacelles. Furthermore, the Original Equipment Manufacturer (OEM) segment accounts for the largest immediate revenue, but the Aftermarket/MRO segment is anticipated to exhibit stable, long-term growth driven by aging fleet requirements and life-cycle maintenance demands.

AI Impact Analysis on Engine Nacelle Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Engine Nacelle market frequently center on three critical themes: optimizing aerodynamic design for fuel economy, enhancing predictive maintenance capabilities in MRO operations, and streamlining the complex manufacturing processes involving advanced composites. Users are concerned about how AI can move beyond simple data analysis to actively influence the physical geometry of nacelles, expecting AI algorithms to iterate designs faster than traditional computational fluid dynamics (CFD) methods to achieve optimal inlet shapes and noise damping structures. Furthermore, a significant area of user expectation revolves around AI's ability to analyze real-time operational data from engine sensors, predicting structural integrity issues, micro-cracks in composite panels, or potential thrust reverser malfunctions long before scheduled inspections, thereby reducing aircraft downtime.

The implementation of AI and Machine Learning (ML) is fundamentally changing the R&D landscape for nacelle components. AI-driven generative design tools are allowing engineers to explore vast parameter spaces concerning weight, acoustic performance, and structural load distribution simultaneously, leading to novel, non-intuitive designs that maximize aerodynamic efficiency while minimizing material usage. This approach dramatically shortens the development cycle for new nacelle programs, ensuring that components are perfectly matched to the highly efficient turbofan engines they house. By leveraging deep learning models trained on millions of flight hours and structural testing data, manufacturers can achieve unprecedented levels of design optimization and durability validation, mitigating risks associated with advanced material failures.

In the maintenance and service sector, the application of AI dramatically improves the efficiency and accuracy of inspections. AI algorithms are used to process imagery from non-destructive testing (NDT), such as ultrasound or eddy current inspections, quickly identifying subsurface defects in composite structures that might be missed by human inspectors. This capability is paramount for complex nacelles, where damage detection is challenging. AI systems also integrate fleet-wide sensor data to establish precise component fatigue models, shifting the industry from time-based maintenance to true condition-based maintenance (CBM), which optimizes resource allocation, reduces maintenance costs, and extends the operational life of the nacelle components, particularly the thrust reverser cascade structures.

- Generative Design Optimization: AI algorithms automate the design iteration process to achieve minimal weight and maximum aerodynamic efficiency for inlet and fan cowls.

- Predictive Maintenance (CBM): Utilization of Machine Learning to analyze operational data for forecasting component failure (e.g., acoustic liner degradation or mechanical wear in thrust reversers).

- Enhanced Quality Control: AI-powered computer vision systems improve automated inspection accuracy during manufacturing, identifying microscopic defects in composite layup.

- Acoustic Performance Modeling: AI simulations predict and optimize the effectiveness of new acoustic liner designs under various flight conditions, accelerating noise reduction compliance.

- Supply Chain Resilience: AI tools manage complex supply chains for specialized materials and components, predicting sourcing risks and optimizing inventory levels.

DRO & Impact Forces Of Engine Nacelle Market

The Engine Nacelle Market is significantly influenced by a confluence of accelerating drivers and persistent restraints, creating a dynamic environment characterized by high barriers to entry and intense innovation pressure. Key drivers include the robust global demand for new commercial aircraft, particularly the high-volume replacement cycles for aging fleets, which mandates the procurement of next-generation engines and corresponding nacelle systems designed for superior fuel economy and reduced environmental footprint. Furthermore, increasing regulatory focus worldwide on limiting aircraft noise, exemplified by tighter Stage 5 standards, forces continuous investment into advanced acoustic technology and noise-dampening structures integrated within the nacelle assembly, sustaining R&D expenditure and market revenue.

However, market growth is significantly restrained by the extremely high costs associated with advanced material processing, particularly the specialized techniques required for aerospace-grade composites and high-temperature titanium alloys, which contributes to substantial capital expenditure for manufacturers. The long, cyclical nature of aerospace production programs, coupled with stringent certification requirements from bodies like the FAA and EASA, introduces significant time delays and financial risk, acting as a structural restraint. Economic downturns or geopolitical instability can lead to delays or cancellation of aircraft orders, immediately affecting demand projections for nacelle suppliers due to the direct linkage with OEM output schedules.

Opportunities for market stakeholders lie predominantly in the development of lightweight, smart nacelles that incorporate sensor technology for structural health monitoring (SHM) and condition-based maintenance, thereby adding value beyond passive components. The expanding MRO segment, driven by the increasing average age of commercial aircraft and the need to retrofit older planes with lighter, more durable composite nacelles, offers lucrative aftermarket potential. Furthermore, the emergent urban air mobility (UAM) sector and development of hybrid-electric propulsion systems present long-term opportunities for specialized, smaller-scale nacelle designs that cater to novel airframe configurations and power requirements, necessitating fresh innovation in thrust vectoring and thermal management within the nacelle housing.

The impact forces within this market are defined by the powerful influence of major airframe OEMs (e.g., Airbus and Boeing) on the supply chain, which dictates design specifications, delivery schedules, and price points, thus exerting significant buyer power. Supplier power is moderate, concentrated among a few specialized Tier 1 manufacturers with proprietary composite manufacturing expertise and acoustic technologies, making substitution difficult. The threat of new entrants remains low due to high regulatory hurdles, immense capital investment required for aerospace qualification, and the long-term, entrenched relationships between existing suppliers and OEMs. Overall industry profitability is maintained through technological differentiation and leveraging high switching costs associated with engine integration and certification.

- Drivers:

- Accelerated global demand for new fuel-efficient commercial aircraft programs.

- Increasingly stringent global noise and emission regulations requiring advanced acoustic and aerodynamic solutions.

- Rising air travel demand, necessitating fleet expansion, particularly in emerging markets.

- Restraints:

- High manufacturing and certification costs associated with advanced composite materials.

- Long and sensitive aerospace industry cycles, leading to vulnerability to order cancellations.

- Intense price competition and limited supplier base dictated by major airframe manufacturers.

- Opportunities:

- Growth in the high-margin aftermarket MRO segment for repairs and upgrades.

- Development of new, complex nacelle designs for future hybrid and electric aircraft propulsion systems.

- Integration of smart technologies (sensors, SHM systems) for improved operational efficiency and maintenance scheduling.

- Impact Forces:

- Bargaining Power of Buyers (High): Dominated by major OEMs setting strict design and cost requirements.

- Bargaining Power of Suppliers (Moderate to High): Concentrated suppliers with specialized materials and technology expertise.

- Threat of New Entrants (Low): Significant regulatory and capital barriers to entry.

- Threat of Substitutes (Low): Nacelles are non-substitutable, critical safety components.

Segmentation Analysis

The Engine Nacelle Market is rigorously segmented based on product functionality, the type of aircraft served, the material used in construction, and the final end-user application, providing a granular view of demand dynamics across the aerospace value chain. Understanding these segments is crucial for stakeholders to tailor their product offerings, R&D investments, and market strategies. The segmentation highlights the intrinsic link between the technological advancements in engine design and the resulting specifications for the surrounding nacelle components, emphasizing the functional requirements of each structural part, from noise suppression in the inlet cowl to the critical performance of the thrust reverser during landing operations.

The segmentation by aircraft type, particularly the volume-driven Narrow-Body segment, dictates overall market size, while the segmentation by material, dominated by Composites, defines the direction of future technological evolution and supply chain sourcing strategies. Furthermore, the split between OEM and Aftermarket sales dictates the financial model for manufacturers, with OEM contracts providing high volume stability and the Aftermarket segment offering resilient, higher-margin revenue streams associated with critical repairs, spare parts, and system upgrades over the entire operational life of the aircraft.

- By Product Type:

- Inlet Cowl

- Fan Cowl

- Thrust Reverser

- Exhaust System/Nozzle

- Others (Pylons, fairings)

- By Aircraft Type:

- Narrow-Body Aircraft (NBA)

- Wide-Body Aircraft (WBA)

- Regional Aircraft

- Business Jets

- Military Aircraft

- By Material:

- Composites (CFRP, Fiberglass, Aramid Fiber)

- Aluminum Alloys

- Titanium Alloys

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO)

Value Chain Analysis For Engine Nacelle Market

The value chain for the Engine Nacelle market is highly specialized, beginning with the upstream segment characterized by raw material procurement and the fabrication of highly engineered specialized materials. Upstream analysis involves sourcing critical aerospace-grade materials, including carbon fiber prepregs, high-performance resins, and exotic metals like titanium and nickel alloys, often requiring specialized production capabilities and strict quality control protocols from Tier 2 and Tier 3 suppliers. Key activities at this stage focus on material traceability, optimizing the cost-to-performance ratio, and ensuring the long-term supply stability necessary for multi-year aerospace contracts. The increasing demand for lightweight composites means suppliers who can deliver high-quality, certified composite systems hold a crucial position in the early value chain stages.

The middle segment of the value chain is dominated by Tier 1 nacelle manufacturers who execute complex design, integration, and manufacturing processes, including sophisticated composite layup, machining, bonding, and assembly of the entire nacelle system. These manufacturers work in close collaboration with engine OEMs (like GE, Pratt & Whitney, Rolls-Royce) and airframe OEMs (like Boeing and Airbus) to ensure perfect aerodynamic and structural integration. Quality assurance, rigorous testing (acoustic, structural load, containment), and securing regulatory certification (FAA/EASA) represent the most capital-intensive and time-consuming activities in this stage, establishing high barriers to entry for new competitors and reinforcing the dominance of established players.

The downstream segment primarily involves distribution channels leading to the end-users: aircraft OEMs and MRO facilities. For OEM sales, the distribution is typically direct, with nacelle components shipped straight to the airframer’s final assembly line (FAL) on a just-in-time basis, requiring highly synchronized logistics. The aftermarket segment, however, utilizes a combination of direct sales (OEMs supplying proprietary spare parts) and indirect channels (independent MRO providers and third-party distributors). MRO distribution focuses on ensuring global availability of spare parts, repair services, and technical support, which are critical for maximizing aircraft operational readiness. The control over the repair and overhaul technical data package (TDP) provides a significant competitive advantage to the OEM or designated MRO partners.

Engine Nacelle Market Potential Customers

The primary potential customers and end-users of engine nacelle systems span the entire aerospace ecosystem, fundamentally categorized into Original Equipment Manufacturers (OEMs), which drive initial sales, and the Maintenance, Repair, and Overhaul (MRO) segment, which sustains long-term operational demand. Aircraft OEMs, such as Boeing, Airbus, COMAC, and Embraer, are the largest immediate buyers, purchasing nacelles in high volumes for their commercial aircraft production lines. These customers demand highly specific, integrated solutions that meet stringent performance criteria regarding weight, noise suppression, and durability, often procuring these systems directly from Tier 1 suppliers under long-term, exclusive agreements tied to specific engine programs. Their purchasing decisions are driven by total cost of ownership (TCO) for the airline customer and the overall aerodynamic performance contribution of the nacelle to the airframe.

The second major group of end-users comprises the global MRO facilities, including airline-owned MROs, independent MRO providers, and specialist component repair shops. These customers are primarily focused on the aftermarket segment, requiring replacement parts, structural repair services, and comprehensive overhaul activities necessary to maintain the airworthiness of aging fleets. Demand from MRO customers is characterized by fluctuating needs based on flight cycles, unexpected damage (e.g., foreign object debris ingestion), and scheduled heavy maintenance checks. Suppliers targeting this segment must ensure global logistics capability and rapid response times for critical spare parts like fan cowls and thrust reverser components, which are prone to damage and wear.

A third segment includes government and defense entities that operate military transport, surveillance, and tanker aircraft, which also utilize specialized engine nacelles often designed for higher robustness and specific mission profiles. Although military volume is lower than commercial aviation, the requirements are technically demanding, involving components resistant to extreme conditions and sometimes requiring stealth or specialized materials. Finally, emerging sectors, particularly manufacturers involved in the development of future hybrid-electric aircraft and Advanced Air Mobility (AAM) vehicles, represent new customer bases requiring novel, smaller, and electrically integrated nacelle solutions, signaling a future shift in customer technical needs towards power distribution and thermal management components within the nacelle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S.A., Spirit AeroSystems, FACC AG, Leonardo S.p.A., GKN Aerospace (Melrose Industries PLC), Middle River Aircraft Systems (MRAS - a subsidiary of ST Engineering), Bombardier Inc., Triumph Group, NORDAM, Barnes Group Inc., Chengdu Aircraft Industrial Group, Mitsubishi Heavy Industries (MHI), Hindustan Aeronautics Limited (HAL), Liebherr-Aerospace, Collins Aerospace (Raytheon Technologies), Turkish Aerospace Industries (TAI), AVIC SAC Commercial Aircraft, Fokker Technologies (GKN Aerospace), Rolls-Royce Holdings PLC, MTU Aero Engines. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Engine Nacelle Market Key Technology Landscape

The Engine Nacelle Market is highly reliant on continuous technological innovation focused primarily on material science, manufacturing techniques, and advanced acoustic treatment necessary to meet evolving performance metrics and regulatory demands. The shift towards lightweight materials, particularly advanced thermoset and thermoplastic composite matrix systems, represents the most significant technological trend. Manufacturers are intensively researching next-generation carbon fiber reinforced polymer (CFRP) systems that offer higher impact resistance, improved fatigue life, and the ability to operate effectively in the high-temperature environment surrounding the engine core. Techniques like automated fiber placement (AFP) and automated tape laying (ATL) are critical manufacturing technologies, enabling precise, repeatable, and cost-effective production of complex, large-scale composite nacelle structures, replacing traditional hand layup methods.

A crucial area of technological advancement is acoustic engineering, specifically the development of optimized acoustic liners designed to minimize engine noise during takeoff and landing, ensuring compliance with ICAO noise standards. Current research focuses on developing advanced perforated materials, acoustic foams, and impedance-matched liner designs that can selectively absorb broadband engine noise across varying frequency ranges and flow conditions. Furthermore, the integration of Additive Manufacturing (AM) technologies, or 3D printing, is gaining traction, primarily for producing complex, low-volume metal parts within the nacelle assembly, such as brackets, hinges, and intricate ducting for anti-icing systems, which significantly reduces part count and assembly time, though its use for primary structural composite parts remains limited by material qualification hurdles.

Beyond materials and acoustics, the technological landscape includes the integration of advanced anti-icing systems, typically utilizing engine bleed air or electrical resistance heating elements, which must be seamlessly integrated into the inlet cowl without compromising aerodynamic smoothness or structural integrity. Furthermore, structural health monitoring (SHM) technology, leveraging embedded sensors (e.g., fiber optics, strain gauges) to continuously assess the condition of composite panels and metallic structures, represents a frontier technology. This allows for proactive maintenance, detecting damage from impacts or fatigue in real-time, thereby maximizing operational safety and efficiency while significantly optimizing MRO schedules and reducing reliance on traditional labor-intensive inspection methods.

Regional Highlights

The global Engine Nacelle Market exhibits distinct regional dynamics, primarily driven by localized aerospace manufacturing capabilities, the pace of fleet modernization, and the volume of commercial air traffic growth. North America, anchored by major airframe OEMs (Boeing) and Tier 1 suppliers (Spirit AeroSystems, MRAS), holds a significant share of the global market, benefiting from mature MRO infrastructure and substantial defense spending. Demand here is characterized by high technological sophistication, focusing on next-generation nacelles for programs like the B777X and continued support for existing large fleets. The region acts as a major hub for R&D in composite materials and manufacturing automation, securing its position as a primary revenue generator.

Europe represents another mature and technologically advanced market, driven by the presence of Airbus and key European suppliers such as Safran and Leonardo. The European market emphasizes stringent environmental regulations, particularly noise reduction and emissions standards, which necessitate continuous innovation in acoustic and aerodynamic nacelle design. While OEM production volumes are high, the region also features an extremely robust and fragmented MRO sector, providing strong aftermarket stability. Eastern Europe is emerging as a critical region for lower-cost component manufacturing and specialized MRO services, leveraging highly skilled labor.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, fueled by exponential growth in passenger traffic, massive fleet expansion programs (especially in China and India), and government investment in establishing indigenous aerospace manufacturing capabilities. Countries like China (COMAC) and Japan (MHI) are investing heavily in establishing local supply chains, shifting the region's focus from purely consumption to manufacturing. The need for new narrow-body aircraft is the primary driver in APAC, leading to high-volume demand for associated nacelle systems. Latin America and the Middle East & Africa (MEA) represent smaller but expanding markets, primarily driven by fleet purchases from dominant airlines (e.g., Emirates, Qatar Airways) and the strategic importance of hub airports, which support significant MRO activity, driving moderate aftermarket growth.

- North America: Dominant market share due to the presence of Boeing and leading suppliers; high concentration of advanced material research and mature MRO infrastructure. Focus on wide-body and defense programs.

- Europe: Strong market driven by Airbus production and strict environmental mandates. Key players focus on acoustic efficiency and sophisticated composite manufacturing processes. Highly established aftermarket base.

- Asia Pacific (APAC): Highest CAGR fueled by commercial fleet expansion in China and India; increasing localization of aerospace component manufacturing and reliance on new-generation narrow-body aircraft.

- Middle East and Africa (MEA): Growth driven by hub expansion and substantial long-haul fleet modernization by major international carriers, leading to a strong demand for WBA nacelles and MRO services.

- Latin America: Moderate growth supported by internal regional connectivity expansion and fleet renewal cycles, particularly focusing on regional and narrow-body aircraft segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Engine Nacelle Market.- Safran S.A. (Safran Nacelles)

- Spirit AeroSystems

- FACC AG

- Leonardo S.p.A.

- GKN Aerospace (Melrose Industries PLC)

- Middle River Aircraft Systems (MRAS - a subsidiary of ST Engineering)

- Collins Aerospace (Raytheon Technologies)

- Triumph Group

- NORDAM

- Barnes Group Inc.

- Rolls-Royce Holdings PLC (In-house capabilities)

- MTU Aero Engines (Engine integration focus)

- Bombardier Inc. (Internal manufacturing for business jets)

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries (MHI)

- Hindustan Aeronautics Limited (HAL)

- Turkish Aerospace Industries (TAI)

- AVIC SAC Commercial Aircraft

- Liebherr-Aerospace

- Israel Aerospace Industries (IAI)

Frequently Asked Questions

Analyze common user questions about the Engine Nacelle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced composite materials in the Engine Nacelle Market?

The primary driver is the aerospace industry’s critical requirement for weight reduction to enhance fuel efficiency and minimize operational costs. Composites like CFRP offer superior strength-to-weight ratios compared to traditional aluminum, enabling manufacturers to meet strict OEM performance specifications for modern turbofan engines.

How do stringent noise regulations impact the design and technology of engine nacelles?

Stringent noise regulations (such as ICAO Stage 5) force manufacturers to heavily invest in advanced acoustic technology. This includes developing optimized acoustic linings, known as treatment panels, often involving complex perforated structures and cellular honeycomb materials integrated within the inlet cowl and fan duct to absorb engine noise efficiently.

What is the difference between the OEM and Aftermarket segments in the Engine Nacelle Market?

The OEM segment involves direct sales of new nacelle systems to airframe manufacturers (like Airbus or Boeing) for installation on newly built aircraft. The Aftermarket segment, encompassing Maintenance, Repair, and Overhaul (MRO), focuses on providing replacement parts, repair services, and upgrades for nacelles already in service, offering stable, long-term revenue.

Which product segment accounts for the highest value share in the Engine Nacelle Market and why?

The Thrust Reverser segment typically commands the highest value share due to its complexity. It is a critical safety component involving intricate mechanical systems (e.g., cascade vanes, hydraulic actuators) that facilitate braking upon landing, requiring highly specialized engineering, precision manufacturing, and frequent inspection/maintenance.

How is Artificial Intelligence (AI) expected to be utilized in future Engine Nacelle development?

AI will primarily be utilized for generative design optimization, allowing faster iteration of aerodynamic shapes for fuel efficiency, and in predictive maintenance (CBM) applications. AI algorithms analyze real-time sensor data and NDT scans to forecast structural degradation, shifting maintenance from scheduled intervals to condition-based requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager