Engineering Consultation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437348 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Engineering Consultation Market Size

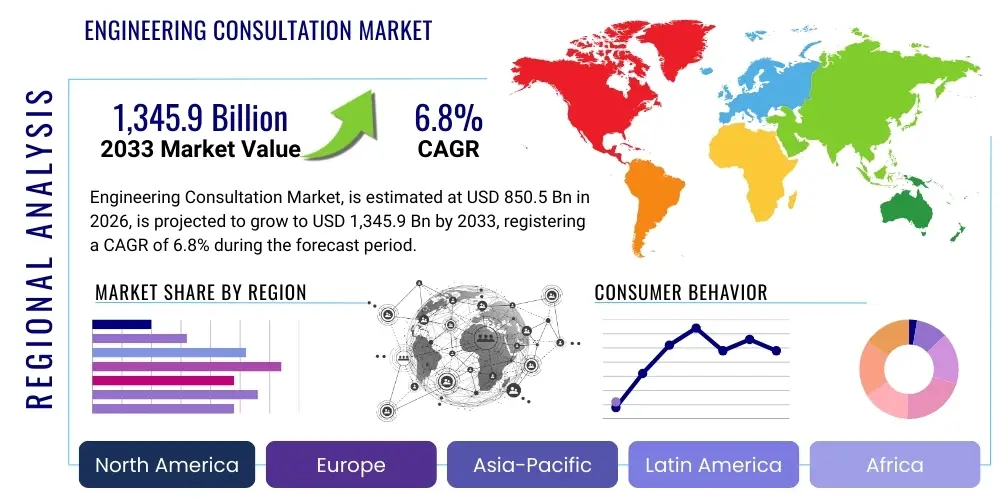

The Engineering Consultation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is underpinned by significant global investments in infrastructure development, energy transition projects, and complex manufacturing modernization initiatives requiring specialized technical expertise. The increasing regulatory complexity across environmental, social, and governance (ESG) standards further necessitates expert engineering guidance, driving demand for high-value consultation services across all major industrial sectors. This comprehensive professional landscape encompasses planning, design, execution, and operational optimization across civil, structural, mechanical, and electrical domains.

The market is estimated at $850.5 Billion in 2026 and is projected to reach $1,345.9 Billion by the end of the forecast period in 2033. This substantial valuation reflects the criticality of engineering consulting firms in delivering large-scale capital projects efficiently and sustainably. Factors contributing to this accelerated market expansion include the rapid urbanization trends in emerging economies, coupled with the need for digital transformation and asset life cycle management integration in mature economies. Firms are increasingly leveraging advanced data analytics, Building Information Modeling (BIM), and Internet of Things (IoT) technologies, which themselves require specialized consultation during deployment, thus creating a virtuous cycle of market expansion and technological adoption.

Engineering Consultation Market introduction

The Engineering Consultation Market encompasses the provision of expert, professional, and technical services related to the design, planning, procurement, construction, and operation of engineered assets and systems across various industries. These services range from preliminary feasibility studies and risk assessment to detailed design specification, project management oversight, and post-construction technical support, catering to sectors such as infrastructure, energy, utilities, industrial manufacturing, and environmental management. The market is defined by the transfer of specialized, knowledge-intensive solutions designed to optimize client performance, ensure regulatory compliance, reduce operational costs, and mitigate technical risks inherent in complex capital projects. Major applications span critical national infrastructure, including transportation networks, power generation facilities, water treatment plants, sophisticated telecommunications backbone deployment, and the development of sustainable, resilient smart cities.

The primary benefits delivered by engineering consultants include enhanced project efficiency through standardized processes, reduced time-to-market for new developments, and access to highly specialized skills that clients may not possess internally, particularly concerning novel technologies like green hydrogen infrastructure or advanced geothermal systems. The core product offered is intellectual capital and domain expertise, tailored to resolve specific technical challenges and provide strategic advice on capital deployment. The market’s driving factors are profoundly linked to global macroeconomic trends, including aggressive governmental spending on infrastructure stimulus programs, the mandated global shift toward renewable energy sources and decarbonization goals, and the increasing complexity of industrial processes requiring high-precision design and automated control systems. Furthermore, stringent safety and environmental regulations act as persistent drivers, mandating specialized consultancy to achieve certification and adherence to global standards, transforming risk into a growth opportunity for specialized consulting niches.

Engineering Consultation Market Executive Summary

The Engineering Consultation Market is experiencing a paradigm shift characterized by accelerated digital transformation and a strong emphasis on sustainability, forming the core business trends defining current competitive strategies. Consulting firms are pivoting from traditional advisory roles to integrated delivery models, incorporating technologies such as Digital Twins, predictive analytics, and sophisticated project management software to enhance transparency and efficiency throughout the project lifecycle. Geographically, while established markets in North America and Europe continue to dominate revenue share due to high-value infrastructure maintenance and modernization mandates, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapid urbanization, massive infrastructure deficits requiring immediate redress, and burgeoning industrialization across major economies like China and India. This regional dynamic is compelling global firms to strengthen their local presence and develop culturally adapted service offerings to capitalize on diverse developmental needs and complex regulatory environments.

Segment trends indicate robust demand concentration within the civil and structural engineering consultation segments, primarily driven by large public-private partnership (PPP) infrastructure projects, encompassing high-speed rail, smart grid deployment, and resilient coastal defense structures. Furthermore, the environmental and sustainability consulting segment is observing exponential growth, directly correlating with corporate net-zero commitments and mandatory climate-related financial disclosures, positioning ESG expertise as a premium service offering. Technology-wise, consulting services centered around cybersecurity integration for operational technology (OT) systems and the application of generative design in product development are emerging as critical growth pockets. The competitive landscape is consolidating, with major global players aggressively pursuing mergers and acquisitions to acquire niche technological capabilities, expand their geographic footprint, and integrate adjacent services such as management consulting and specialized software deployment, thereby offering comprehensive, end-to-end solutions to their expansive client base.

AI Impact Analysis on Engineering Consultation Market

Common user questions regarding AI's impact on the Engineering Consultation Market center around fears of job displacement, the adoption rate of generative design tools, and the ethical implications of using AI in critical infrastructure decision-making. Users are specifically concerned about how AI will reshape traditional design workflows, whether smaller consulting firms can afford implementation, and the extent to which AI can improve predictive maintenance accuracy and reduce project timelines. Key themes emerging from these inquiries include the expectation that AI will primarily automate routine tasks such as data processing, simulation, and basic reporting, freeing up human engineers to focus on complex, high-value problem-solving, strategic client engagement, and creative innovation. There is significant interest in AI's role in optimizing resource allocation, enhancing project risk management through advanced predictive modeling, and achieving superior energy efficiency in building and systems design, fundamentally transforming the methodology by which engineering solutions are conceived and delivered to clients globally.

- Automation of routine design tasks and technical documentation, accelerating project initiation phases.

- Enhancement of feasibility studies through rapid analysis of extensive geographical and environmental datasets.

- Application of Generative Design techniques, allowing engineers to explore thousands of optimal design permutations simultaneously, optimizing material use and structural integrity.

- Improvement in predictive maintenance schedules and asset life cycle management using real-time operational data analytics powered by machine learning algorithms.

- Advanced risk modeling and simulation for complex projects, including climate resilience assessment and supply chain fragility analysis.

- Optimization of construction sequencing and logistics, minimizing delays and reducing overall project costs through automated scheduling.

- Creation of intelligent Digital Twins that evolve dynamically with the physical asset, improving operational consultation and ongoing performance monitoring.

- Development of specialized AI tools for quality assurance and compliance checking against stringent national and international engineering standards.

- Shift in required consultant skills toward data science, prompt engineering, and the integration of AI outputs into actionable engineering strategies.

- Facilitation of complex systems integration across diverse disciplines (e.g., merging civil structures with IoT networks and renewable energy systems) through AI-driven coordination platforms.

DRO & Impact Forces Of Engineering Consultation Market

The market dynamics of the Engineering Consultation Market are principally driven by robust global infrastructure spending and the imperative for sustainable development practices, acting as critical propelling forces that sustain demand even during economic fluctuations. Key drivers include accelerating urbanization in developing regions, mandating large-scale investments in transportation and utility networks, alongside significant capital deployment in advanced manufacturing capabilities, particularly within the semiconductor and electric vehicle supply chains. Conversely, the market faces significant restraints, most notably the persistent shortage of highly skilled engineering talent specializing in emerging fields like digital engineering and complex systems integration, leading to increased labor costs and potential project execution delays. Additionally, economic uncertainties, including volatile commodity prices and rising global interest rates, can decelerate or defer large capital projects, impacting the revenue streams of consultation firms, particularly those reliant on purely discretionary spending from private sector clients. These restraining factors necessitate strategic workforce planning and diversified service offerings to ensure resilience against macro-economic headwinds, focusing on essential, non-deferrable consulting needs such as regulatory compliance and critical asset maintenance.

Despite these restraints, substantial opportunities are emerging, predominantly centered around the global energy transition, which necessitates vast consultation services for planning, designing, and implementing renewable energy infrastructure (solar farms, offshore wind, green hydrogen production). Furthermore, the burgeoning demand for resilient infrastructure capable of withstanding extreme weather events, driven by climate change awareness, presents opportunities for specialized structural and environmental consulting. The dominant impact force influencing the market is the increasing convergence of Information Technology (IT) and Operational Technology (OT), compelling engineering firms to offer integrated cyber-physical solutions. This force mandates deep expertise in both physical infrastructure design and secure digital management systems, elevating the complexity and value proposition of consulting services. Consequently, firms must strategically position themselves as facilitators of digital transformation, bridging the gap between traditional engineering principles and advanced digital methodologies, thereby securing long-term contracts for ongoing operational consultation and digital asset management, which promises recurring revenue streams.

Segmentation Analysis

The Engineering Consultation Market is highly diversified and is segmented primarily based on service type, specialization, and end-use application, reflecting the heterogeneous nature of engineering requirements across various industrial and public sectors. Analyzing these segments provides strategic insights into areas of highest demand and emerging technical expertise concentration. The service type segmentation differentiates between foundational activities such as feasibility studies and technical due diligence, high-value core services like detailed design and engineering procurement construction (EPC) management, and essential post-implementation services such as operational optimization and asset performance consultation. The complexity and longevity of modern infrastructure projects mean clients are increasingly seeking bundled, integrated service packages, driving consulting firms toward multi-disciplinary teams capable of handling projects from inception through to operational retirement, maximizing project coherence and accountability.

The segmentation by specialization often focuses on the core engineering discipline required, such as civil, mechanical, electrical, structural, and chemical engineering, with specific sub-segments like geothermal, nuclear, or telecommunications being critical niche areas. End-use application segmentation reveals where capital is most actively deployed, encompassing major categories like residential and commercial building, energy and power generation, transportation (rail, road, port), and water and wastewater management. The highest revenue generation typically resides within the public and utilities sectors, driven by government mandates and non-discretionary spending on critical national assets. However, significant growth momentum is observed in the manufacturing segment, particularly in sectors undergoing rapid technological upgrades, such as high-tech electronics and bio-pharmaceuticals, where precision engineering consultation is crucial for maintaining competitive advantages and adhering to stringent quality control standards.

- By Service Type:

- Feasibility Studies and Technical Due Diligence

- Conceptual and Preliminary Design

- Detailed Design and Engineering

- Procurement and Contract Management

- Construction Supervision and Project Management (PM/CM)

- Testing, Commissioning, and Handover

- Operational Optimization and Asset Management

- Environmental and Regulatory Consulting

- By Specialization:

- Civil and Structural Engineering Consulting

- Mechanical, Electrical, and Plumbing (MEP) Consulting

- Chemical and Process Engineering Consulting

- Environmental and Geotechnical Consulting

- Control Systems and Automation Consulting

- Digital Engineering and BIM Consulting

- By Application (End-User):

- Infrastructure (Roads, Bridges, Airports, Rail)

- Energy and Utilities (Power Generation, Transmission, Distribution, Renewables)

- Building and Real Estate (Commercial, Residential, Industrial Facilities)

- Industrial Manufacturing (Automotive, Aerospace, Electronics, Pharma)

- Water and Waste Management (Treatment Plants, Distribution Networks)

- By Ownership:

- Public Sector Projects

- Private Sector Projects

- Public-Private Partnerships (PPP)

Value Chain Analysis For Engineering Consultation Market

The value chain for the Engineering Consultation Market begins with the upstream analysis, which involves the foundational intellectual capital, encompassing academic research, specialized software development (e.g., advanced simulation tools, proprietary design algorithms), and the acquisition of highly specialized human talent—the most critical input resource. This upstream stage focuses heavily on knowledge management, proprietary methodologies, and continuous professional development, ensuring consultants remain at the forefront of technological and regulatory changes. The key upstream suppliers are educational institutions, specialized IT providers for CAD/CAE software licenses, and external data vendors providing geological or meteorological data necessary for accurate project planning. Effective integration at this stage is crucial for developing high-value, differentiated consulting offerings that meet the increasingly complex demands of modern infrastructure and industrial clients, positioning the firm for specialized, high-margin projects.

Midstream activities constitute the core delivery process, involving client needs assessment, proposal generation, detailed engineering design, project execution monitoring, and quality assurance. This phase is characterized by intensive collaboration, project management expertise, and the integration of various engineering disciplines. Distribution channels for consultation services are predominantly direct, meaning firms interact directly with the client—whether a government agency, a utility provider, or a manufacturing corporation—to tailor a specific solution. Indirect channels, although less prevalent, include strategic partnerships with large construction contractors or software vendors who embed consultation services within their broader offering, effectively leveraging the consultants' expertise to enhance their own project bids and delivery capabilities. Maintaining high levels of communication, transparency, and certified compliance throughout this delivery phase is paramount to securing client trust and fostering repeat business, which is a hallmark of successful consulting practices.

Downstream analysis focuses on the final output—the successful implementation, operational handover, and subsequent long-term advisory services related to asset performance management, facility maintenance planning, and digital twin management. The downstream consumer segment determines the long-term value derived from the initial consultation. The quality of consultation directly impacts the client's operational efficiency, sustainability metrics, and regulatory standing for the life cycle of the asset. Therefore, consulting firms are increasingly offering ongoing retainer agreements for technical support and performance monitoring, effectively extending the value chain past the initial design phase. This shift towards a service-oriented approach maximizes the recurring revenue potential and strengthens the consultant's role as a strategic partner rather than merely a transient project vendor, locking in client relationships and guaranteeing future consultation opportunities linked to operational expansion or refurbishment needs.

Engineering Consultation Market Potential Customers

The potential customers for the Engineering Consultation Market are extremely diverse, spanning both public and private sectors globally, representing any entity undertaking significant capital expenditure projects requiring specialized technical guidance or regulatory compliance assurance. The largest segment of end-users are government agencies and municipal authorities responsible for developing and maintaining public infrastructure, including transportation departments, water regulatory bodies, and public housing authorities, which frequently contract out feasibility studies, design services, and construction management to private engineering consultants due to resource constraints and the need for specialized expertise in large, complex governmental projects. Utility companies, including electric power generators, natural gas distributors, and telecommunications providers, represent another high-value customer base, especially concerning the complex transition to smart grids, renewable energy integration, and fiber optic network deployment, areas where proprietary consultation is essential for technological success and system reliability.

In the private sector, major potential customers include large industrial conglomerates, particularly in the chemicals, oil and gas, mining, and aerospace sectors, which require continuous technical consultation for process optimization, plant expansion, safety audits, and adherence to evolving environmental protection standards. The real estate development sector, encompassing commercial, residential, and institutional property developers, relies heavily on structural, mechanical, and environmental consultants to ensure building safety, energy efficiency certification (e.g., LEED standards), and site readiness, navigating complex zoning laws and building codes. Furthermore, technology companies, specifically those building large data centers or manufacturing advanced semiconductors, constitute a rapidly growing customer segment, seeking specialized engineering consultation to design highly controlled environments, manage cleanroom construction, and optimize sophisticated heating, ventilation, and air conditioning (HVAC) systems crucial for maximizing operational uptime and minimizing technological obsolescence risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Billion |

| Market Forecast in 2033 | $1,345.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jacobs Engineering Group Inc., AECOM, WSP Global Inc., Fluor Corporation, Tetra Tech, Inc., Arcadis NV, Wood Group (John Wood Group PLC), SNC-Lavalin Group Inc., HDR, Inc., Mott MacDonald Group, GHD Group Pty Ltd, Arup Group, Stantec Inc., Ramboll Group A/S, KBR, Inc., Bechtel Corporation, Black & Veatch, China Railway Group Limited (CREC), Pöyry PLC (now AFRY), Typsa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Engineering Consultation Market Key Technology Landscape

The Engineering Consultation Market is undergoing profound transformation driven by the integration of sophisticated digital technologies aimed at improving efficiency, accuracy, and collaboration across the project lifecycle. The cornerstone of this technological evolution is Building Information Modeling (BIM) and its advanced iteration, 5D and 6D BIM, which provides a centralized, intelligent 3D model that facilitates collaboration between architects, engineers, and constructors, moving beyond traditional 2D documentation to a comprehensive digital asset definition. Consultants are using BIM extensively for clash detection, quantity take-offs, and scheduling optimization, significantly reducing errors and rework on complex projects, thereby delivering higher-value consultation and project predictability to their clients. This adoption is mandatory for large-scale public sector projects in many developed economies, ensuring that expertise in BIM management and integration remains a high-demand consulting skill, focusing on data interoperability and model fidelity.

Further enhancing the landscape is the widespread deployment of cloud-based project management platforms and Common Data Environments (CDEs), enabling global engineering teams to access, share, and modify project data in real-time, regardless of geographical location, a necessity for multinational infrastructure projects. Coupled with this infrastructure are specialized simulation and analysis tools, incorporating Computational Fluid Dynamics (CFD), Finite Element Analysis (FEA), and advanced geotechnical modeling, which allow consultants to predict the performance of materials and systems under extreme conditions with unprecedented precision, mitigating engineering risks preemptively. The application of Virtual Reality (VR) and Augmented Reality (AR) technologies is also becoming standard practice, used for conducting immersive design reviews, training operational staff, and simulating construction sequences, enabling clients to visualize complex projects before ground is broken, thereby enhancing stakeholder engagement and facilitating early design approval, streamlining the consultation process.

Finally, the growing influence of Artificial Intelligence (AI) and Machine Learning (ML) is redefining the consultation process, particularly in predictive engineering and operational advisory services. AI algorithms are utilized for processing vast amounts of sensor data from existing infrastructure to predict potential failures, optimize maintenance schedules, and improve energy consumption profiles in smart buildings and grids. This data-driven approach moves consultation from reactive problem-solving to proactive value creation, offering clients insights into long-term asset performance and capital expenditure planning. Additionally, drone technology and high-resolution LiDAR scanning are integral for rapidly conducting site surveys, monitoring construction progress, and creating accurate digital terrain models (DTMs), dramatically reducing the time and cost associated with initial data collection, providing consultants with accurate and up-to-date inputs necessary for rigorous analytical assessment and timely project commencement.

Regional Highlights

- North America: This region remains a dominant force in the global Engineering Consultation Market, driven by high-value public investments in modernizing aging infrastructure, particularly transportation networks and water utilities, alongside massive private sector capital expenditure in high-tech manufacturing, such as semiconductor fabrication plants and hyperscale data centers. The market is characterized by a strong demand for specialized consulting in cybersecurity for operational technology (OT) systems and advanced digital engineering (Digital Twins, BIM level 3). Regulatory pressures, especially concerning environmental remediation and energy resilience, ensure sustained demand for expert technical advisory services, positioning the U.S. and Canada as leaders in sophisticated, high-margin consulting work. The widespread adoption of Public-Private Partnership (PPP) models further fuels demand for financial and technical feasibility consultation, linking strategic advisory services with execution oversight.

- Europe: The European market is defined by stringent environmental, social, and governance (ESG) regulations, making sustainability consultation a crucial market driver. The continent is heavily investing in the energy transition, specifically large-scale offshore wind projects, interconnection grids, and green hydrogen infrastructure development, requiring specialized expertise in renewable energy planning and integration. Countries such as Germany, the UK, and France are focused on decarbonizing their building stock and industrial processes, generating significant demand for high-performance building design, energy efficiency audits, and circular economy consulting. Regional market maturity means competition is intense, forcing consulting firms to differentiate themselves through technological integration (e.g., advanced simulation) and cross-border project delivery capabilities, aligning with pan-European regulatory directives.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate, fueled by unprecedented rates of urbanization and massive governmental investments in creating new, integrated infrastructure across rapidly developing nations like India, Indonesia, and Vietnam. China continues to drive immense consultation demand in areas like high-speed rail expansion, smart city development, and modern industrial park construction. The region's unique climate risks (monsoons, seismic activity) mandate specialized consulting in resilient engineering and disaster mitigation planning. While cost-sensitivity can be a factor, the sheer volume of greenfield and brownfield projects ensures high utilization rates for consulting firms, with a growing emphasis on expertise transfer and local capacity building within joint ventures and partnerships.

- Latin America (LATAM): Growth in LATAM is closely linked to commodity cycles, with significant consultation required in the mining, oil and gas, and agribusiness sectors, focusing on sustainable resource extraction, operational safety, and process efficiency improvements. Infrastructure deficits in transportation and power remain substantial, prompting governments to seek consultation for developing viable PPP schemes and optimizing project financing structures. Political instability and varying regulatory environments present unique challenges, necessitating local market expertise and strong risk management consultation, particularly for international firms entering the region, focusing services on regulatory adherence and complex stakeholder management.

- Middle East and Africa (MEA): The Middle East is characterized by mega-projects and future-focused urban developments (e.g., NEOM, ambitious tourism initiatives), requiring specialized consultation in ultra-modern architecture, sustainable building systems, and large-scale water and power generation (desalination, solar PV). The region's pivot toward economic diversification away from hydrocarbon reliance drives significant investment in non-oil sectors, creating high demand for industrial and technology park planning. The African market, while fragmented, shows emerging opportunities in power generation (especially off-grid and micro-grid solutions), telecommunications backbone development, and water sanitation infrastructure, often supported by multilateral development bank financing which mandates high standards of consultation rigor and oversight.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Engineering Consultation Market.- Jacobs Engineering Group Inc.

- AECOM

- WSP Global Inc.

- Fluor Corporation

- Tetra Tech, Inc.

- Arcadis NV

- Wood Group (John Wood Group PLC)

- SNC-Lavalin Group Inc. (AtkinsRéalis)

- HDR, Inc.

- Mott MacDonald Group

- GHD Group Pty Ltd

- Arup Group

- Stantec Inc.

- Ramboll Group A/S

- KBR, Inc.

- Bechtel Corporation

- Black & Veatch

- China Railway Group Limited (CREC)

- Pöyry PLC (now AFRY)

- Typsa

Frequently Asked Questions

Analyze common user questions about the Engineering Consultation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological trends are currently redefining engineering consultation services?

The market is being fundamentally redefined by the widespread adoption of Building Information Modeling (BIM) for project visualization and data management, the integration of Artificial Intelligence (AI) for predictive analytics and generative design, and the use of Digital Twins for real-time asset performance monitoring and operational advisory services.

Which segments are showing the highest growth potential in the Engineering Consultation Market?

The highest growth potential is concentrated within the Environmental and Sustainability Consulting segment, driven by global net-zero commitments, and within the Digital Engineering segment, focusing on integrating complex IT/OT systems, smart grid development, and critical infrastructure cybersecurity consultation services.

How is the global shift towards renewable energy influencing demand for engineering consultation?

The transition to renewable energy mandates significant capital planning, design expertise, and technical advisory services for complex projects such as offshore wind farms, large-scale solar arrays, and green hydrogen production facilities. Consultants are essential for site selection, regulatory compliance, and grid integration studies worldwide.

What are the primary restraints affecting the growth of the Engineering Consultation Market?

The primary restraints include the critical shortage of specialized engineering talent, particularly those skilled in data science and digital technologies, and susceptibility to macroeconomic volatility, where rising interest rates and inflation can lead clients to defer or scale back large, non-essential capital expenditure projects.

Why is the Asia Pacific region considered the fastest-growing market for engineering consultation?

APAC’s accelerated growth is due to aggressive governmental infrastructure spending addressing vast urbanization needs, rapid industrialization, and high demand for resilient transportation networks and utility systems, positioning the region as the epicenter for new, large-scale greenfield development projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager