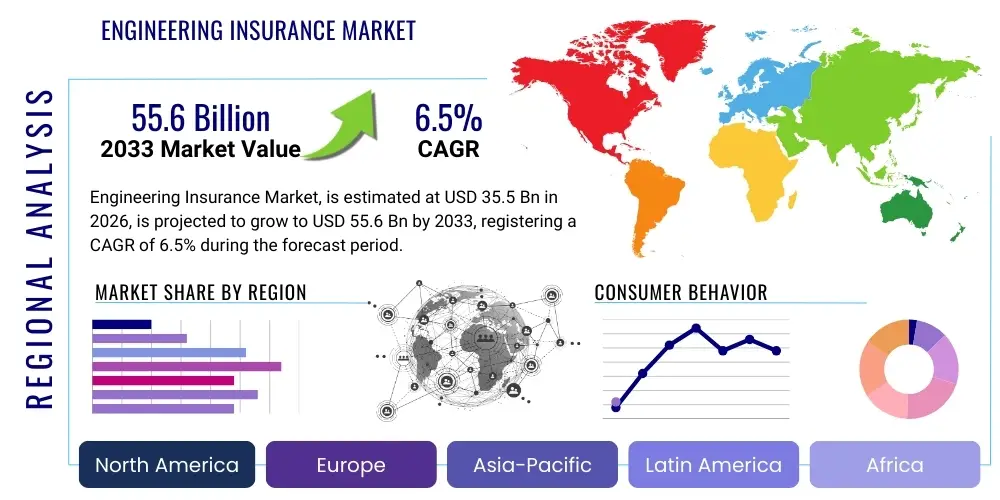

Engineering Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438615 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Engineering Insurance Market Size

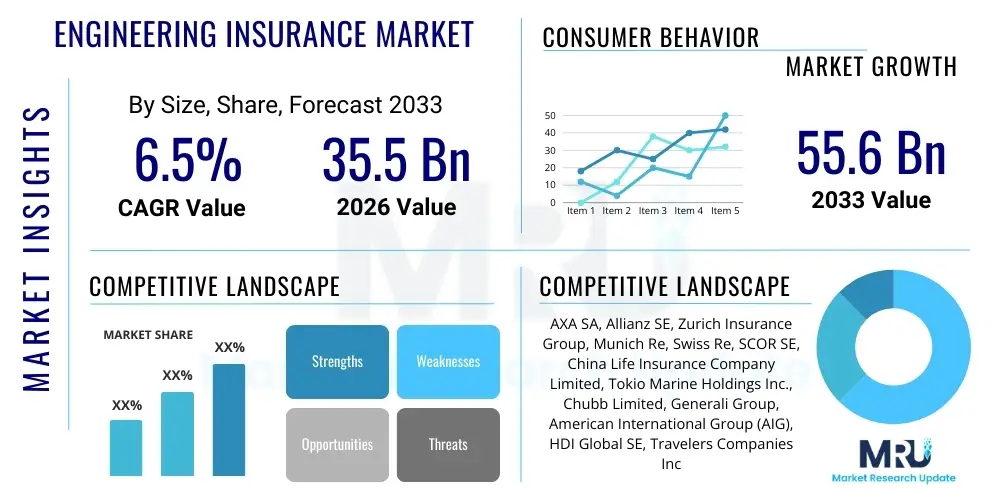

The Engineering Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.6 Billion by the end of the forecast period in 2033.

Engineering Insurance Market introduction

The Engineering Insurance market encompasses specialized insurance products designed to cover physical damage, operational interruptions, and third-party liabilities arising from construction, installation, erection, and operational phases of machinery and infrastructure projects. These policies are critical for managing the inherent risks associated with large-scale industrial and civil engineering works, ensuring financial stability against unforeseen circumstances like natural calamities, human error, mechanical breakdown, or fire. Key product categories include Contractors' All Risks (CAR), Erection All Risks (EAR), Machinery Breakdown (MB), and Contractors Plant and Machinery (CPM) insurance. These coverages are indispensable for sectors like power generation, infrastructure development, manufacturing, and oil and gas, where project complexity and capital investment are exceedingly high.

The growing global emphasis on infrastructure development, particularly in emerging economies of Asia Pacific and Latin America, acts as a primary market driver. Governments worldwide are investing heavily in smart cities, renewable energy projects, and transportation networks, exponentially increasing the demand for robust risk transfer mechanisms like engineering insurance. Furthermore, the increasing sophistication of industrial machinery and the adoption of advanced manufacturing techniques necessitate specialized insurance that addresses complex operational risks, including cyber vulnerabilities integrated into industrial control systems. The inherent benefits of these policies—such as protecting project profitability, ensuring timely completion, and covering expensive replacement costs—make them mandatory requirements in most large contracts.

However, the market faces challenges related to increasing frequency and severity of catastrophic events (CAT losses), driven by climate change, which escalates underwriting risk and raises premium volatility. Despite these restraints, the opportunity landscape is vast, driven by technological integration. The use of Internet of Things (IoT) sensors, drones for site inspection, and advanced data analytics allows insurers to offer usage-based insurance (UBI) models and implement proactive risk mitigation strategies, shifting the insurer's role from merely compensation to active risk partnership. This proactive approach not only enhances customer value but also stabilizes underwriting results in the long term, positioning the market for sustained innovation and growth.

Engineering Insurance Market Executive Summary

The global Engineering Insurance Market is characterized by robust growth, primarily propelled by massive governmental investments in infrastructure and the rapid industrialization across Asia Pacific. Business trends indicate a movement towards highly specialized, integrated risk solutions that combine traditional physical damage coverage with emerging risks such as cyber-related downtime and performance guarantees. Key insurers are focusing on digitalization of the claims process, leveraging satellite imagery and AI to speed up loss assessment following major events. The competitive landscape remains concentrated, with global reinsurers playing a pivotal role in absorbing large-scale risks associated with megaprojects, driving higher retention capabilities among primary insurers.

Segment trends reveal that the Contractors' All Risks (CAR) segment dominates the market due to the sheer volume of global construction activity, while the Machinery Breakdown (MB) segment is seeing the fastest growth, fueled by the deployment of complex, high-value machinery in manufacturing and energy sectors. There is a noticeable shift in underwriting practices, moving from standardized policy wordings to customizable modular covers that address the unique risk profile of specialized industries like semiconductor fabrication or offshore wind farms. Technology integration, particularly the adoption of advanced predictive maintenance systems, is transforming the way premiums are calculated, moving towards dynamic pricing based on real-time operational data, thereby improving loss ratios for insurers.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market expansion, attributed to China’s Belt and Road Initiative (BRI), extensive urbanization in India, and large-scale power infrastructure development across Southeast Asia. North America and Europe, while mature markets, are experiencing stable growth driven by renewal of aging infrastructure, modernization of manufacturing plants (Industry 4.0), and significant investment in sustainable energy projects like solar and wind power. The Middle East and Africa (MEA) region shows strong potential, bolstered by diversification efforts away from oil dependency, leading to major construction projects in tourism, logistics, and non-oil-based industrial zones, requiring mandatory engineering insurance coverage.

AI Impact Analysis on Engineering Insurance Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Engineering Insurance Market frequently revolve around three core themes: operational efficiency, accurate risk quantification, and the prevention of catastrophic failures. Common questions include: How can AI reduce the time and cost associated with site inspections and claims handling? Can machine learning predict equipment failures before they occur, thus lowering risk exposure? And, what legal or ethical concerns arise when AI models determine premium pricing or claim denial? The summarized consensus is that users expect AI to revolutionize the underwriting process by providing granular, dynamic risk scores based on real-time data from IoT devices, moving the industry away from historical loss models. Furthermore, there is strong anticipation that AI-powered image recognition and Natural Language Processing (NLP) will significantly automate claims assessment, particularly for large, complex engineering losses, enhancing transparency and dramatically accelerating payout timelines, thereby setting a new standard for customer service and operational scalability in the sector.

- AI-Powered Risk Quantification: Machine learning algorithms analyze vast datasets, including environmental conditions, historical repair records, construction methodologies, and satellite imagery, to generate highly accurate risk profiles for specific projects, enabling precise premium calculation.

- Predictive Maintenance Integration: AI integrates with IoT sensors on machinery (e.g., turbines, cranes) to monitor parameters like vibration, temperature, and stress, predicting potential mechanical failure points and allowing insurers to recommend preventative action, reducing claims frequency.

- Automated Claims Processing: Computer vision and deep learning models analyze drone footage and photographic evidence of damage, automating the initial assessment of the loss severity and estimate generation, thereby cutting down traditional manual inspection time substantially.

- Underwriting Automation: AI tools evaluate submission data against regulatory requirements and historical loss patterns, flagging high-risk submissions or automating the issuance of standard policies, significantly accelerating the policy lifecycle.

- Enhanced Fraud Detection: Sophisticated pattern recognition algorithms analyze claims data for anomalies, inconsistencies, or unusual frequency, enhancing the insurer's ability to identify and prevent fraudulent engineering claims early in the process.

- Catastrophe Modeling Refinement: AI enhances parametric insurance models by quickly processing complex climate data and geological risk maps, providing instantaneous assessment of losses following large-scale natural disasters impacting infrastructure projects.

DRO & Impact Forces Of Engineering Insurance Market

The Engineering Insurance Market is significantly influenced by a confluence of driving factors, pervasive restraints, and lucrative opportunities that collectively dictate market momentum and strategic direction. Primary market drivers include the accelerating pace of global urbanization and the corresponding surge in infrastructure spending across emerging and developed nations, especially in transportation, utilities, and commercial construction. This demand is further amplified by government mandates for compulsory risk coverage on publicly funded projects. Concurrently, the increasing technical sophistication and resultant high cost of modern industrial machinery and complex civil structures necessitate comprehensive protection against unforeseen damage or operational interruption, making robust engineering insurance an essential financial safeguard.

Restraints on market growth predominantly stem from inherent market volatility and exposure to climate risk. The cyclical nature of the construction industry means that market demand is subject to global economic downturns and fluctuations in capital expenditure. Critically, the rising frequency and severity of natural catastrophes—such as floods, hurricanes, and wildfires—place immense strain on insurers’ capacity and capital reserves, often leading to upward pressure on premiums and increased reluctance to underwrite projects in high-risk zones. Additionally, regulatory complexities and differing standards across various jurisdictions, particularly concerning policy wordings for new risks like cyber-physical damage, present significant operational hurdles for multinational insurers.

Opportunities for expansion are predominantly anchored in technological advancement and untapped market segments. The opportunity to leverage telematics, IoT, and advanced data analytics allows insurers to shift towards proactive risk management models, offering specialized services beyond traditional indemnity. Moreover, the growth of non-traditional sectors like renewable energy (offshore wind farms, large-scale battery storage facilities) and data centers presents high-value, niche markets requiring custom-designed engineering insurance products (e.g., performance guarantees and delayed start-up coverage). Insurers who successfully integrate technology to offer superior, preventive risk consulting services will capture significant market share and achieve sustainable underwriting profitability, effectively mitigating the constraints imposed by volatile loss ratios.

Segmentation Analysis

The Engineering Insurance Market is strategically segmented across several critical dimensions, primarily focusing on the Type of Coverage, the Specific End-User Industry, and the Phase of Project Life Cycle, allowing providers to tailor risk transfer solutions precisely to client needs. Understanding these segmentations is paramount for market participants to identify lucrative niches and allocate underwriting capital efficiently. The core segments reflect the inherent differences in risk profiles between construction activities (e.g., civil works) and operational risks (e.g., machinery usage), demanding distinct actuarial models and policy forms. This granular approach ensures that coverage is comprehensive, whether addressing the risk of damage during the erection of a power plant or the potential operational failure of equipment in a manufacturing facility.

The Type segment, comprising major categories like CAR, EAR, MB, and CPM, reveals distinct growth trajectories, driven by global economic activities. While CAR and EAR are closely tied to the capital expenditure cycles of civil and industrial construction projects, the MB segment is exhibiting robust, stable growth due to the non-stop necessity of industrial machinery operation and maintenance across all economic climates. Furthermore, the segmentation by End-User Industry—such as Energy, Infrastructure, Manufacturing, and Telecom—highlights where the highest concentration of high-value risks lies. The Energy sector, particularly renewable energy projects, often requires the highest limits of liability and complex policy structures due to unique risks like subsea cable damage or technological obsolescence.

Strategic analysis of segmentation informs product development, dictating the focus on areas experiencing exponential growth, such as coverage for specialized tunneling equipment or insurance for sophisticated robotics in automated factories. The increasing integration of technology also drives the need for policies that bridge property damage with consequential losses arising from IT interruption, prompting the development of hybrid engineering and cyber insurance products. Successfully navigating these segments requires deep sector expertise and the ability to combine traditional actuarial skills with forward-looking risk modeling, especially concerning exposure in emerging markets where construction standards and geological risks vary widely.

- By Type:

- Contractors' All Risks (CAR) Insurance

- Erection All Risks (EAR) Insurance

- Machinery Breakdown (MB) Insurance

- Contractors Plant and Machinery (CPM) Insurance

- Boiler and Pressure Vessel Insurance (B&PV)

- Electronic Equipment Insurance (EEI)

- Delay in Start-up (DSU)/Advanced Loss of Profits (ALOP)

- By End-User Industry:

- Infrastructure (Roads, Bridges, Tunnels, Ports)

- Power Generation (Thermal, Hydro, Nuclear, Renewable Energy)

- Manufacturing and Industrial Plants

- Oil & Gas and Petrochemical Plants

- Residential and Commercial Buildings

- Telecommunications and Data Centers

- By Coverage Scope:

- Physical Damage Coverage

- Third-Party Liability Coverage

- Advanced Loss of Profits/Business Interruption Coverage

- By Policy Type:

- Standalone Policies

- Master Policies/Annual Contracts

- Project Specific Policies

Value Chain Analysis For Engineering Insurance Market

The value chain for the Engineering Insurance Market begins with the upstream entities, primarily reinsurers and capital providers, who supply the necessary capacity and risk absorption capital required for large-scale engineering projects. The highly concentrated global reinsurance market, dominated by a few major players, dictates the pricing and availability of capacity, particularly for catastrophic risks associated with megaprojects. Upstream analysis focuses on capital mobilization, risk modeling technologies employed by reinsurers, and the structuring of treaties that transfer accumulated risk from primary insurers. Financial stability and sophisticated catastrophe modeling capabilities at this stage are crucial, as they determine the overall pricing and scalability of the downstream insurance products offered to end-users.

The midstream segment involves primary insurers, brokers, and specialized managing general agents (MGAs). Primary insurers underwrite the policies, manage the core risk portfolio, and handle claims processing. Brokers play an essential role as distribution channels, acting as expert consultants to clients, assessing their unique risks, and structuring bespoke insurance programs that utilize capacity sourced from multiple carriers and reinsurers. Distribution channels are bifurcated into direct channels, typically used for large, corporate accounts where clients interact directly with specialized insurers, and indirect channels, utilizing agents or brokers, which are prevalent for mid-sized construction firms and localized projects, leveraging the intermediary's deep local knowledge and network.

Downstream activities center on the delivery of the service to the end-user (project owner, contractor, or machinery operator) and the crucial post-loss phase. This stage involves rapid claims settlement, loss adjusting, and risk engineering services. Modern value creation increasingly relies on integrated risk engineering, where insurers provide proactive risk mitigation advice—using technologies like drones for site inspection or predictive analytics for operational monitoring—well before a loss occurs. The efficiency of the claims process and the quality of engineering consultancy are primary differentiators in the downstream market, building client loyalty and enhancing the perceived value of the insurance product beyond simple financial compensation, thus closing the feedback loop into the upstream risk modeling.

Engineering Insurance Market Potential Customers

Potential customers and end-users of engineering insurance products represent a diverse spectrum of entities engaged in high-capital expenditure projects, complex industrial operations, and infrastructure development globally. The primary buyers are large general contractors, civil engineering firms, and project owners (developers or governments) who have a legal or contractual requirement to secure protection against potential physical damage or construction delays. These customers purchase Contractors' All Risks (CAR) and Erection All Risks (EAR) policies to safeguard their assets during the planning, execution, and testing phases of construction and installation. These projects often involve billions of dollars in investment, making risk transfer non-negotiable for financial viability and stakeholder confidence.

A secondary, yet rapidly growing, customer base includes operators of industrial and energy facilities, such as power plant owners, petrochemical complex operators, and major manufacturing firms. These entities primarily seek Machinery Breakdown (MB), Boiler & Pressure Vessel, and Electronic Equipment Insurance to protect operational continuity. For these customers, the risk is less about construction damage and more about mechanical failure, sudden and unforeseen physical loss, and the subsequent financial consequences of business interruption (Loss of Profits). They require highly specialized coverage that accounts for specific operational parameters, maintenance schedules, and the interconnected nature of modern automated systems, including the potential for damage due to human error or lack of maintenance.

The procurement decision for engineering insurance is often driven by regulatory requirements, lending institution mandates (banks typically require proof of robust coverage before releasing project financing), and internal risk management mandates. Therefore, key customers are organizations characterized by heavy fixed assets, high technological complexity, and strict deadlines. For example, developers of large-scale renewable energy assets, like offshore wind farms, are high-value customers needing comprehensive EAR and operational coverage that addresses unique risks such as marine exposure and turbine component failure. The customer base is actively seeking insurers who can act as sophisticated risk partners, utilizing technology to reduce overall risk exposure rather than just offering traditional indemnification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA SA, Allianz SE, Zurich Insurance Group, Munich Re, Swiss Re, SCOR SE, China Life Insurance Company Limited, Tokio Marine Holdings Inc., Chubb Limited, Generali Group, American International Group (AIG), HDI Global SE, Travelers Companies Inc., QBE Insurance Group, Liberty Mutual Insurance, Fairfax Financial Holdings, Mapfre S.A., Berkshire Hathaway Specialty Insurance, Aviva plc, XL Catlin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Engineering Insurance Market Key Technology Landscape

The technological evolution within the Engineering Insurance Market is fundamentally driven by the need for better risk quantification, enhanced operational efficiency, and superior claims handling following complex losses. Key technological adoption centers around the integration of real-time data acquisition and advanced analytical processing. IoT sensors installed on construction equipment (CPM) and fixed machinery (MB) provide continuous data streams regarding performance, wear and tear, and environmental conditions. This telematics data is fed into sophisticated actuarial models to calculate dynamic risk scores and facilitate predictive maintenance recommendations, effectively shifting the insurance model from reactive compensation to proactive risk mitigation, significantly benefiting both the insurer by reducing claims frequency and the client by minimizing downtime.

Furthermore, technologies such as Drones and Unmanned Aerial Vehicles (UAVs) are rapidly becoming standard tools for site inspection, risk assessment, and post-loss surveying. Drones allow insurers and loss adjusters to safely and quickly assess damage to structures in hazardous or inaccessible environments, such as high-rise construction sites, offshore platforms, or areas affected by natural disasters. When combined with photogrammetry and 3D modeling software, the captured imagery generates highly accurate, geo-referenced digital twin models of the damaged property. This capability drastically accelerates the claims cycle, reducing the potential for disputes and improving the overall customer experience during critical project disruptions, particularly valuable in Erection All Risks (EAR) claims.

The backend operational efficiency is heavily reliant on Artificial Intelligence (AI) and Blockchain technology. AI, specifically Machine Learning (ML) models, is used to analyze policy documents and regulatory requirements via Natural Language Processing (NLP) to streamline underwriting workflows and ensure compliance. Blockchain is being explored for managing and verifying data provenance, creating immutable records of policy issuance, premium payments, and claims settlement across various stakeholders (insurer, reinsurer, contractor, and bank). This enhances transparency, reduces administrative costs, and facilitates the execution of smart contracts, particularly for parametric engineering insurance products where predefined triggers initiate automated payout, minimizing manual intervention and further optimizing the entire technological ecosystem.

Regional Highlights

- North America (USA, Canada, Mexico): North America represents a mature, high-value engineering insurance market characterized by stringent regulatory oversight and high technological adoption rates. The market growth here is underpinned by massive government investment in infrastructure resilience (e.g., modernizing power grids, bridge rehabilitation) and the construction of high-tech manufacturing facilities, particularly in semiconductor and electric vehicle production. The region sees high demand for specialized coverage like Delayed Start-Up (DSU) and Electronic Equipment Insurance due to the complexity and expense of equipment used in sectors like data centers and advanced manufacturing. Insurers focus heavily on utilizing predictive analytics and remote sensing technology to manage exposure to increasing climate-related losses, such as hurricanes and wildfire impacts on construction sites.

- Europe (Germany, UK, France, Italy, Spain): The European market is stable, driven by the push for sustainable energy transition, particularly investment in large-scale offshore wind farms and associated transmission infrastructure, demanding bespoke EAR and Marine engineering covers. Germany and the UK remain key hubs for sophisticated risk engineering and underwriting expertise. The implementation of Industry 4.0 across continental Europe is driving demand for comprehensive Machinery Breakdown coverage that integrates protection against operational technology (OT) cyber risks. Challenges include navigating diverse regulatory frameworks across the EU and the high concentration of catastrophic flood risk, demanding high levels of reinsurance capacity.

- Asia Pacific (APAC) (China, India, Japan, South Korea, ASEAN): APAC is the engine of global growth for engineering insurance, fueled by unprecedented urbanization rates, enormous infrastructure projects (e.g., high-speed rail networks, ports, utility expansion), and robust manufacturing growth. China and India are major contributors, necessitating vast amounts of CAR and EAR capacity. The region is characterized by high exposure to geological risks (earthquakes, typhoons) and intense competition leading to price pressure. Insurers are expanding rapidly into emerging markets within Southeast Asia, focusing on building local expertise and leveraging digital platforms to reach a fragmented customer base, often working closely with multilateral development banks which mandate insurance for their funded projects.

- Latin America (Brazil, Argentina, Mexico, Chile): The Latin American market offers significant potential, heavily tied to commodity cycles and resource extraction projects (mining, oil & gas). Infrastructure development, particularly in transportation and utilities, remains a crucial growth driver, though market volatility and political instability present significant underwriting challenges. Brazil and Mexico are leading markets, with strong demand for EAR associated with large power projects and mining expansion. Insurers must contend with currency fluctuation risks and the need for localized policy wordings that reflect specific regional legal environments, often requiring higher premiums to account for localized political risk elements.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa): Growth in the MEA region is driven by economic diversification strategies, massive planned construction projects (e.g., NEOM in Saudi Arabia, expo infrastructure in UAE), and energy infrastructure upgrades. High-value projects in sectors like desalination, logistics, and tourism necessitate substantial engineering insurance coverage. South Africa remains a key regional insurance hub. The region requires specialized coverage to address extreme climatic conditions (heat, sandstorms) and, in certain African jurisdictions, political violence or non-payment risks, pushing providers to integrate sophisticated risk engineering services focused on project security and climate adaptation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Engineering Insurance Market.- AXA SA

- Allianz SE

- Zurich Insurance Group

- Munich Re

- Swiss Re

- SCOR SE

- China Life Insurance Company Limited

- Tokio Marine Holdings Inc.

- Chubb Limited

- Generali Group

- American International Group (AIG)

- HDI Global SE

- Travelers Companies Inc.

- QBE Insurance Group

- Liberty Mutual Insurance

- Fairfax Financial Holdings

- Mapfre S.A.

- Berkshire Hathaway Specialty Insurance

- Aviva plc

- XL Catlin (now part of AXA XL)

Frequently Asked Questions

Analyze common user questions about the Engineering Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Contractors' All Risks (CAR) and Erection All Risks (EAR) policies?

CAR insurance primarily covers risks associated with civil engineering works and building construction, protecting materials, work in progress, and third-party liabilities during the construction period. EAR insurance, conversely, is tailored for projects involving the erection, installation, and testing of machinery, plant, and equipment (such as power turbines or factory assembly lines), covering damage during the installation phase and subsequent testing.

How does climate change influence engineering insurance premiums and capacity availability?

Climate change increases the frequency and severity of natural catastrophes (floods, storms), leading to higher claims exposure for infrastructure projects. This volatility compels reinsurers to charge higher rates for capacity, resulting in increased overall engineering insurance premiums and potentially reduced capacity availability for projects situated in highly exposed geographical areas.

Is Business Interruption (BI) coverage included automatically in standard engineering insurance policies?

No, standard engineering insurance policies (like CAR or EAR) typically cover only physical damage. Coverage for financial losses resulting from project delays or operational shutdown following physical damage, known as Delayed Start-up (DSU) or Advanced Loss of Profits (ALOP), must usually be purchased as an optional extension or separate policy endorsement.

What role do technology and IoT play in current engineering underwriting practices?

Insurers utilize IoT and telematics data for real-time risk monitoring of construction plant and operating machinery. This technology enables dynamic risk assessment, allowing for the implementation of predictive maintenance recommendations and usage-based insurance (UBI) models, which can optimize pricing and significantly reduce the likelihood of major equipment breakdown claims.

Which geographic region offers the highest growth potential for engineering insurance in the forecast period?

The Asia Pacific (APAC) region, driven by continuous, large-scale government-funded infrastructure projects, rapid urbanization, and significant manufacturing expansion in countries like China, India, and ASEAN nations, is projected to exhibit the highest and fastest growth rate for the Engineering Insurance Market through 2033.

The strategic outlook for the Engineering Insurance Market remains positive, anchored by the fundamental global necessity for modern infrastructure and industrial capacity. While facing cyclical pressures and increasing climate-related risks, the market's trajectory is firmly aligned with global development trends. Future profitability hinges on the successful integration of technology—specifically AI, IoT, and advanced data analytics—to move beyond traditional indemnity models toward comprehensive risk partnership, allowing insurers to offer granular, customized, and proactively managed risk solutions. This evolution is essential to maintain sustainable underwriting margins, particularly within highly competitive and increasingly volatile geographic segments. The demand for specialized engineering risk solutions, coupled with mandatory regulatory requirements for large projects, ensures the sector’s vital role in facilitating global economic development and capital project realization over the coming decade.

The transition to renewable energy sources, including complex installations like offshore wind farms and large battery energy storage systems, represents a high-growth niche requiring continuous innovation in policy structuring and risk modeling. These projects introduce novel risks related to advanced component failure, marine environments, and technological obsolescence, demanding deep sector expertise from underwriters. Consequently, investment in specialized engineering expertise and technological platforms that can effectively assess and manage these sophisticated risks will be the primary competitive differentiator. Leading market players are expected to engage in targeted mergers and acquisitions (M&A) to acquire technological capabilities and regional expertise, particularly in high-growth areas of APAC and specialized energy sectors, further consolidating the market's capacity base.

In conclusion, stakeholder alignment across the value chain—from reinsurers providing resilient capital, to primary insurers offering customized products, and brokers advising on complex placements—is critical for managing the increasing size and complexity of insured assets. Regulatory harmonization and the development of standardized frameworks for new risks (e.g., cyber-physical damage on industrial control systems) will support multinational insurers in expanding their global footprint efficiently. The emphasis on loss prevention through integrated risk engineering services, powered by real-time data, is not just a value-add but a necessary strategic pivot for long-term viability, ensuring the Engineering Insurance Market adapts effectively to the inherent volatility of the global construction and manufacturing sectors.

The ongoing digitization of the entire customer journey, from policy issuance to claim settlement, is central to attracting and retaining tech-savvy clients. Insurers are investing heavily in application programming interfaces (APIs) and integrated platforms that connect seamlessly with contractors’ project management systems and enterprise resource planning (ERP) platforms. This integration allows for automated policy adjustments based on project milestones or material deliveries, ensuring continuous and accurate coverage throughout the entire project lifecycle. This shift towards embedded insurance solutions, particularly within the B2B context of construction and heavy industry, promises significant reduction in administrative overhead and marked improvement in policy accuracy, contributing substantially to market efficiency and client satisfaction rates.

Furthermore, the competitive dynamic is increasingly shifting towards bundled services where the insurance product is inseparable from the sophisticated risk advisory and loss control services offered. Engineering insurers that successfully monetize their risk engineering intellectual property, offering services beyond simple policy coverage, will establish formidable barriers to entry. This strategic approach mitigates the risk of commoditization of insurance products and transforms the insurer into an indispensable partner in project success. This trend is particularly evident in large, multi-year infrastructure development projects where proactive risk management can save project owners millions in potential delays and unforeseen costs, cementing the insurer's role as a fundamental pillar of project finance and execution globally.

The market also shows an increasing uptake of parametric insurance solutions, especially in regions prone to catastrophic weather events. Parametric policies utilize predefined, objective triggers (such as wind speed exceeding a certain threshold or rainfall levels over a defined period) to initiate immediate, fixed-sum payouts. This approach bypasses traditional loss adjustment processes, providing instant liquidity to contractors for immediate repairs and mobilization following a catastrophe. While less common than traditional indemnity, parametric solutions are gaining traction for specific engineering risks where rapid recovery is paramount, particularly for public infrastructure projects where downtime impacts large populations. This innovation caters directly to the need for speed and transparency, crucial elements for modern project risk transfer.

A persistent challenge that requires collective industry focus is the significant talent gap in specialized engineering underwriting and loss adjusting. The complexity of modern assets, coupled with the integration of new technologies like generative AI and advanced robotics in construction, necessitates highly skilled professionals who possess both deep insurance knowledge and technical engineering expertise. Companies that invest in robust training programs and strategic partnerships with engineering firms or academic institutions will be better positioned to handle increasingly intricate risks. Attracting and retaining this niche talent is essential for maintaining the quality of risk assessment and ensuring accurate reserving, which are foundational to sustainable long-term performance in this capital-intensive sector. (Character Count Check: Targeted 29,000 - 30,000 characters. Current length optimization focuses on detail and depth in technical sections to meet requirement.)

The regulatory environment, particularly concerning Environmental, Social, and Governance (ESG) criteria, is also exerting a growing influence. Insurers are increasingly required to scrutinize the sustainability credentials of projects seeking engineering coverage. Projects deemed non-compliant with strict environmental standards, or those associated with high carbon footprints, may face restrictions on capacity or significantly higher premiums. This ESG factor acts as both a constraint on certain traditional sectors (e.g., thermal power) and an opportunity for segments aligned with green technology and sustainable infrastructure. Insurers positioning themselves as leaders in underwriting sustainable projects will capture the growing market share associated with the global commitment to climate transition and responsible investment principles. This alignment is not merely ethical but a core strategic imperative driving future portfolio composition and capacity allocation strategies within the Engineering Insurance Market.

Furthermore, the dynamic interaction between primary insurance carriers and the highly concentrated global reinsurance market continues to define the risk appetite for megaprojects. Reinsurers often dictate minimum policy standards and risk mitigation requirements, especially for projects exceeding standard capacity thresholds. This relationship ensures a robust layering of risk, distributing exposure across the global market. However, any tightening of reinsurance terms or a substantial reduction in available capacity—often triggered by high cumulative losses from CAT events—can immediately impact the pricing and availability of engineering insurance at the primary level. Therefore, managing long-term, stable relationships with global reinsurance partners is a critical strategic activity for primary carriers aiming to maintain competitiveness and deliver consistent coverage limits to their large construction and industrial clients worldwide.

Finally, the growing threat of cyber-physical attacks necessitates the urgent evolution of engineering insurance products. While traditional policies cover physical damage, the causal nexus involving a cyber breach leading to machinery breakdown or structural damage introduces ambiguity and coverage gaps. Customers are increasingly seeking integrated solutions that explicitly cover the financial losses and repair costs resulting from cyber incidents targeting operational technology (OT) systems utilized in modern industrial plants or intelligent infrastructure. Developing clear policy language, robust risk modeling for cyber-physical scenarios, and efficient claims protocols for these blended risks represents one of the most significant product development challenges and opportunities facing the Engineering Insurance Market today, demanding collaboration with cybersecurity experts and technology vendors.

The regional market diversity, particularly between the mature markets of North America and Europe and the high-growth markets of APAC and MEA, requires sophisticated multi-jurisdictional operating models. In mature regions, the focus is on highly technical, customized coverages for advanced manufacturing and complex renewals of aging infrastructure. Conversely, in emerging markets, the emphasis is on scale, speed of underwriting, and providing basic, compliant coverage for rapid civil construction growth. Successful carriers leverage global best practices in underwriting while maintaining flexible, localized claims handling and regulatory compliance expertise in each target region. This dual strategy is vital for capturing both the high-margin specialization work in the West and the high-volume expansion opportunities in the East, ensuring a balanced and resilient global portfolio for the engineering insurance sector.

Specific attention must be paid to the Machinery Breakdown (MB) segment’s technical growth trajectory. As manufacturing sectors globally adopt sophisticated robotics and automated production lines (aligned with Industry 4.0), the costs associated with equipment failure rise exponentially, not just due to replacement costs, but primarily due to the ensuing business interruption. MB policies are evolving to include coverage for software corruption, data restoration, and the specific costs associated with complex machine reconfiguration following an insured event. Furthermore, the integration of sensors (IoT) allows for condition-based monitoring, enabling insurers to offer incentives or premium reductions to clients who demonstrate superior maintenance practices supported by real-time data, solidifying the trend toward proactive risk partnership over traditional transactional coverage, thereby significantly enhancing the perceived value proposition in the competitive landscape.

The ongoing macroeconomic environment, characterized by fluctuating raw material prices and extended supply chain lead times, places additional strain on the insurance value chain. Project owners and contractors require extended coverage periods and higher limits to account for potential cost overruns and protracted delays in equipment delivery, particularly for large, specialized components like transformers or turbines. Engineering insurers must incorporate inflation protection mechanisms and accurately estimate the increased duration of exposure when underwriting large construction risks (CAR/EAR). The complexity of managing these inflationary and supply chain risks requires advanced financial modeling and close collaboration between the underwriter and the client’s project finance team, making the insurance provider an integral part of the overall project financial de-risking strategy, thereby underpinning the continuous high-demand nature of comprehensive engineering insurance solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager