Enhanced Fire Detection and Suppression Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435187 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Enhanced Fire Detection and Suppression Systems Market Size

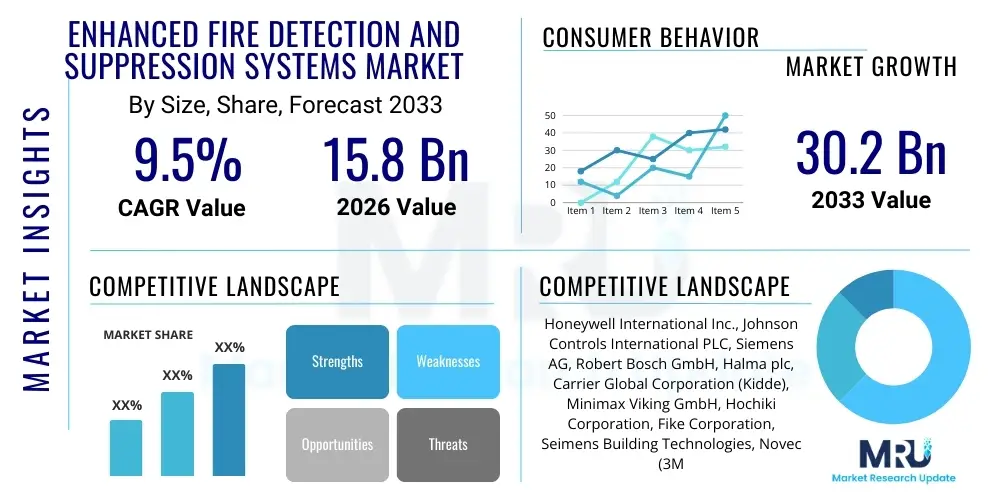

The Enhanced Fire Detection and Suppression Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 30.2 Billion by the end of the forecast period in 2033.

Enhanced Fire Detection and Suppression Systems Market introduction

The Enhanced Fire Detection and Suppression Systems Market encompasses advanced technological solutions designed to identify fire incidents rapidly, often utilizing predictive algorithms and sophisticated sensor networks, and to mitigate damage through highly efficient, localized suppression methods. These systems move beyond conventional smoke alarms and sprinkler systems by integrating complex technologies such as aspirating smoke detection (ASD), video image smoke detection (VISD), multi-sensor detectors, and environment-friendly clean agent suppression systems. The core product offering includes smart control panels, networked sensors, specialized detection apparatus for challenging environments (e.g., data centers, industrial complexes), and automated suppression mechanisms like inert gas systems, chemical agents, and advanced water mist technologies.

Major applications of these enhanced systems span critical infrastructure, including large commercial buildings, high-rise residential complexes, manufacturing facilities, transportation hubs (airports, metros), and particularly sensitive environments such as data centers, museums, and healthcare facilities. The heightened necessity for business continuity and the protection of high-value assets are primary factors driving their adoption in the industrial and commercial sectors. Furthermore, the stringent regulatory environment worldwide, mandating active fire protection measures in new constructions and retrofitting existing structures, provides a consistent demand base for advanced solutions that offer greater reliability and faster response times than traditional systems.

The principal benefits derived from deploying these systems include superior accuracy in hazard identification, minimized false alarms, reduced time lag between detection and suppression, and lower collateral damage, especially when using clean agents. Driving factors for market growth include the escalating frequency of catastrophic fire incidents globally, leading insurance companies and regulatory bodies to enforce stricter safety standards. Additionally, the integration of Internet of Things (IoT) connectivity, artificial intelligence (AI) for predictive maintenance, and the demand for wireless, easily scalable systems contribute significantly to the market's expansion, enabling proactive risk management and centralized monitoring across diverse physical locations.

Enhanced Fire Detection and Suppression Systems Market Executive Summary

The Enhanced Fire Detection and Suppression Systems Market is poised for substantial growth, driven fundamentally by the convergence of stringent global safety regulations and rapid technological integration, notably IoT and AI. Business trends indicate a significant shift from reactive detection methods toward proactive, preventative systems capable of analyzing environmental factors and predicting potential fire risks before ignition. Key industry participants are focusing heavily on developing robust, integrated platforms that combine detection, notification, control, and suppression into seamless security ecosystems, moving away from disparate components. Furthermore, sustainability is becoming a critical competitive factor, with manufacturers investing in clean agent suppression systems that minimize environmental impact and comply with evolving global environmental protocols.

Regionally, North America and Europe maintain leading market shares, primarily due to established regulatory frameworks, high awareness levels regarding life safety, and significant capital expenditure allocated towards infrastructure modernization, particularly in the retrofit market. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This acceleration in APAC is fueled by massive urbanization, rapid industrialization, and subsequent large-scale investments in smart city projects and commercial building development, especially in emerging economies like China, India, and Southeast Asian nations. Regulatory harmonization efforts across these fast-developing regions are also spurring the adoption of international safety standards, boosting market penetration.

Segment trends highlight the burgeoning dominance of intelligent detection technologies, particularly multi-sensor and video-based detection systems, which drastically reduce nuisance alarms while increasing detection fidelity in complex environments. In the suppression segment, non-toxic and non-residual clean agent systems, such as inert gases and chemical suppressants (e.g., FM-200 replacement technologies), are gaining preference over traditional water-based sprinklers in sensitive applications like server rooms and telecommunication infrastructure. The end-user segments, particularly the industrial and data center sectors, are exhibiting accelerated adoption rates due to the imperative need to protect mission-critical operations and high-value physical assets from fire-related disruption.

AI Impact Analysis on Enhanced Fire Detection and Suppression Systems Market

User inquiries regarding AI's influence in the fire safety domain primarily revolve around the enhancement of predictive capabilities, the reduction of false alarms, and the potential for autonomous response mechanisms. Users are keenly interested in how Artificial Intelligence can process complex data streams—derived from thousands of sensors, CCTV footage, and environmental monitoring systems—to distinguish genuine fire signatures from benign sources like steam, dust, or welding activity. Common questions also address the scalability of AI solutions, the cybersecurity risks associated with networked, smart systems, and the regulatory challenges of deploying autonomous suppression decisions guided by machine learning models. The overarching theme is the expectation that AI will transform fire safety from a reactive measure into a highly proactive and integrated component of building management, dramatically improving system reliability and reducing operational costs related to fire incidents and system downtime.

Artificial Intelligence is fundamentally restructuring the fire safety paradigm by enabling sophisticated pattern recognition and decision-making capabilities within detection systems. AI algorithms can be trained on vast datasets encompassing different types of combustion patterns, ambient conditions, and architectural layouts. This allows intelligent systems to optimize detection thresholds dynamically, significantly minimizing the costly and disruptive phenomenon of false alarms, which is a major constraint in conventional systems. Furthermore, AI facilitates predictive maintenance by continuously analyzing the performance metrics of installed sensors and hardware, alerting operators to potential failures or degradations before they compromise system integrity. This preventative approach ensures maximum uptime and compliance effectiveness.

The integration of AI extends prominently into video image fire detection (VIFD) and early warning systems. By employing deep learning and computer vision technologies, VIFD systems can instantly identify flames and smoke visually, even in large or poorly lit environments, providing a faster response than traditional spot detectors that rely on smoke particulate accumulation. Moreover, AI models are central to sophisticated evacuation planning and management. In the event of a confirmed incident, AI can analyze real-time data on fire spread, building occupancy, and blocked exits to dynamically route occupants via optimized, safe pathways, communicating these changes through integrated notification systems, thereby significantly enhancing life safety outcomes.

Future development is concentrated on creating fully integrated, cognitive fire safety networks where AI manages the entire lifecycle of risk. This includes risk assessment, real-time threat monitoring, autonomous decision-making regarding suppression activation, and detailed post-incident reporting and analysis for continuous improvement. As these systems become more prevalent, addressing concerns related to data privacy, algorithmic transparency, and ensuring the reliability of autonomous responses under extreme conditions will be paramount for widespread market acceptance and regulatory approval. The high computational demands of these systems also drive innovation in edge computing and decentralized processing to ensure rapid response times crucial for fire safety applications.

- AI-powered analytics drastically reduce false alarms by filtering out non-threat signatures (e.g., steam, high dust).

- Predictive modeling diagnoses potential hardware faults, enabling proactive maintenance of detection components.

- Integration with VIFD utilizes deep learning for rapid visual confirmation of flames and smoke across wide areas.

- Dynamic evacuation routing optimizes occupant safety based on real-time fire progression and building flow data.

- Autonomous suppression systems utilize AI to confirm threat validity and activate localized suppression quickly and accurately.

- Enhanced data correlation merges input from environmental sensors, HVAC, and security systems for holistic threat assessment.

DRO & Impact Forces Of Enhanced Fire Detection and Suppression Systems Market

The Enhanced Fire Detection and Suppression Systems Market is shaped by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global tightening of fire safety codes, accelerated industrialization in emerging markets leading to complex infrastructure projects, and the increasing value of digital assets housed in data centers, necessitating superior protection. Restraints largely center on the high initial capital expenditure required for advanced systems, particularly aspirating smoke detection and clean agent solutions, and the operational challenge of ensuring seamless integration between diverse legacy systems and modern, IP-enabled devices. Opportunities arise from the proliferation of IoT and 5G technology, facilitating wireless networking and remote diagnostics, and the growing focus on retrofitting aging infrastructure with smart, sustainable fire safety solutions. These elements collectively generate powerful impact forces on market trajectory, dictating technology adoption rates and regional investment flows.

One of the primary driving forces is the increasing awareness and regulatory mandate for life safety standards, particularly in the commercial and institutional sectors. International standards bodies, such as NFPA and ISO, continuously update requirements, forcing developers and building owners to implement multi-layered, technologically advanced fire protection systems that surpass minimum standards. Furthermore, the economic impact of fire—including loss of life, property damage, and significant business interruption costs—compels risk-averse organizations, particularly those in manufacturing, petrochemicals, and technology, to invest heavily in advanced suppression technologies that guarantee faster mitigation and minimal residual damage. The rising complexity of modern buildings, incorporating large atriums, mixed-use spaces, and specialized materials, demands detection systems capable of operating effectively in varied, non-standard environments, bolstering demand for high-sensitivity products like ASD.

However, the market faces significant restraints related to the standardization and interoperability of different manufacturers' products. Building owners often operate disparate fire safety systems across their portfolios, making centralized management and data integration difficult. Moreover, while clean agent suppression systems offer excellent asset protection, their adoption can be limited by regional regulatory restrictions concerning certain chemical agents, necessitating continuous R&D investment in finding compliant, non-ozone-depleting alternatives. The complexity of installing and maintaining these advanced systems also requires highly specialized technical expertise, which presents a training and labor constraint, particularly in developing economies where skilled labor availability is limited, impacting broader market penetration.

Opportunities for exponential growth are concentrated in the transition toward comprehensive, cloud-based Fire and Safety as a Service (FSaaS) models, allowing end-users to manage advanced systems through subscription models, thereby mitigating high upfront costs. The integration of 5G networks and edge computing capabilities enables real-time data processing for localized decision-making, significantly enhancing system reliability and speed in large industrial campuses. Furthermore, the burgeoning smart city initiatives globally provide a substantial platform for deploying interconnected, intelligent fire safety networks across entire urban infrastructures. The development of advanced thermal imaging and hyperspectral detection technologies capable of identifying incipient combustion indicators before visible smoke or flame appears represents a critical, high-potential growth avenue.

Segmentation Analysis

The Enhanced Fire Detection and Suppression Systems market segmentation provides a granular view of technology adoption and end-user behavior, critical for strategic market planning. The market is broadly categorized based on Product Type (detection versus suppression equipment), Technology utilized (e.g., ASD, water mist, clean agents), and the End-Use application (e.g., industrial, commercial, residential, transportation). This structure reveals that while detection equipment drives volume, the suppression segment, particularly clean agents, generates higher average revenue per unit due to the specialized nature and cost associated with the agents and high-pressure storage systems. Analyzing these segments is crucial for understanding shifts in demand influenced by technological maturity, regulatory changes, and varying risk profiles across industries.

- By Product Type:

- Detection Systems (Smoke Detectors, Heat Detectors, Flame Detectors, Multi-Sensor Detectors, Control Panels)

- Suppression Systems (Sprinklers, Gaseous Suppression Systems, Water Mist Systems, Chemical Agent Systems)

- Services (Installation, Maintenance, Inspection, Monitoring)

- By Technology:

- Aspirating Smoke Detection (ASD)

- Video Image Smoke Detection (VISD/VIFD)

- IoT-Enabled Wireless Systems

- Gas and Chemical Suppression (Inert Gases, Halocarbon Agents)

- High-Pressure Water Mist

- By End-Use Vertical:

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial (Manufacturing, Oil & Gas, Power Generation)

- Residential (Multi-Family Dwellings, High-Rise Apartments)

- Infrastructure (Data Centers, Telecommunications, Healthcare, Transportation)

Value Chain Analysis For Enhanced Fire Detection and Suppression Systems Market

The value chain for Enhanced Fire Detection and Suppression Systems begins with the upstream segment, dominated by specialized component manufacturers and raw material suppliers. This includes providers of sophisticated sensor technology (e.g., laser-based particle counters for ASD), specialized chemicals (clean agents), high-performance metals for suppression system piping, and advanced microprocessors for control panels. Intense R&D is concentrated at this stage, focusing on miniaturization, enhanced sensitivity, and compliance with environmental regulations. Key manufacturers often maintain tight relationships with these upstream suppliers to ensure component quality and secure supply chains for proprietary materials, such as the specific compounds used in halocarbon agents, which directly influence system effectiveness and cost.

The midstream involves the core manufacturing, assembly, and integration of the final systems. Major market players design, assemble, and test the complete system packages, including networked control panels, specialized detectors, and integrated suppression modules. This stage is crucial for ensuring the interoperability and certification (UL, FM) of the entire solution. Distribution channels are complex, involving both direct sales models, particularly for large industrial and data center projects requiring custom engineering, and indirect models utilizing certified distributors, value-added resellers (VARs), and authorized installers. The indirect channel is essential for penetrating the highly fragmented commercial and residential retrofit markets, relying heavily on the local expertise and accreditation of system integrators.

The downstream segment is primarily defined by the installation, commissioning, maintenance, and monitoring services. The end-user demand dictates the distribution channel strategy; large industrial clients often engage directly with major system providers for turnkey solutions and long-term maintenance contracts. Smaller commercial and residential buyers rely almost exclusively on certified third-party contractors and local distributors for installation and mandatory periodic inspection. The shift towards remote monitoring and cloud-based diagnostics is transforming the downstream, allowing manufacturers to offer high-margin, recurring revenue services (FSaaS), increasing customer stickiness and system lifespan, making efficient service delivery a critical competitive differentiator.

Enhanced Fire Detection and Suppression Systems Market Potential Customers

The potential customers for Enhanced Fire Detection and Suppression Systems are diverse but primarily concentrated in sectors where the cost of operational downtime or asset loss is exceptionally high, or where population density necessitates rapid, highly reliable safety measures. Data centers and telecommunication facilities are premier customers, driven by the absolute necessity to protect mission-critical servers and data, favoring sophisticated technologies like ASD and clean agent suppression systems due to their sensitivity and minimal cleanup requirements. Similarly, high-value manufacturing sectors, including semiconductor fabrication plants, automotive production lines, and pharmaceutical facilities, constitute a major customer base, requiring tailored solutions that prevent production halt and protect specialized equipment.

The commercial and institutional sectors represent the largest volume market. High-rise office buildings, expansive retail complexes, and hospitality venues require integrated systems that comply with stringent egress and life safety standards. Educational institutions and hospitals, which house vulnerable populations and operate 24/7, demand robust, failure-proof detection and notification systems. These sectors often prioritize multi-sensor detection and addressable systems that pinpoint the exact location of an incident quickly, facilitating targeted response efforts and minimizing disruption across large properties.

Finally, the transportation and infrastructure segments, encompassing airports, underground railway systems, shipping vessels, and power generation plants, are rapidly adopting enhanced systems. These environments are often characterized by challenging conditions—high air flow, vibration, and limited accessibility—which necessitate the use of specialized technologies like linear heat detection and ruggedized suppression systems. Government and municipal bodies purchasing for public safety infrastructure represent a continuous and often non-cyclical demand source, driven less by immediate economic returns and more by regulatory compliance and public safety mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 30.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Johnson Controls International PLC, Siemens AG, Robert Bosch GmbH, Halma plc, Carrier Global Corporation (Kidde), Minimax Viking GmbH, Hochiki Corporation, Fike Corporation, Seimens Building Technologies, Novec (3M Company), Gentex Corporation, Napco Security Technologies, Amerex Corporation, Buckeye Fire Equipment Company, Chemetron Fire Systems, Tyco Fire Protection Products, Telefire Fire & Gas Detectors, Advanced Fire & Safety, Inc., The Viking Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enhanced Fire Detection and Suppression Systems Market Key Technology Landscape

The technology landscape of Enhanced Fire Detection and Suppression Systems is characterized by high sensitivity, network connectivity, and environmental compliance. Aspirating Smoke Detection (ASD) systems remain crucial for mission-critical applications. ASD technology actively draws air samples from a protected area through a network of specialized pipes and analyzes them using highly sensitive laser detection chambers. This active sampling allows for the detection of incipient fire conditions—smoke particulates—at the very earliest stage, often hours before traditional systems would react, providing essential time for investigation and intervention. Ongoing innovation in ASD focuses on minimizing the chamber size, increasing laser sensitivity, and incorporating AI to filter out environmental noise (dust, humidity) that previously caused false alerts, making them more reliable in challenging industrial settings.

In suppression technology, the major shift is towards environmentally sustainable clean agents that replace older, harmful halons and potent greenhouse gases. Technologies like inert gas systems (blends of nitrogen, argon, and carbon dioxide) and new-generation halocarbon agents (such as FK-5-1-12, or 'clean agents' like Novec 1230 replacement fluid) dominate the high-value segment. These agents suppress fire by reducing oxygen concentration or removing heat at the molecular level without leaving behind residue, ensuring sensitive equipment, such as electronics, remains undamaged and operational quickly after discharge. The engineering focus is on optimizing agent storage pressure and nozzle design to ensure rapid, uniform dispersal while maintaining human safety within occupied spaces.

The integration of IoT and wireless mesh networks represents the defining technological trend driving market growth and efficiency. Modern systems leverage low-power wide-area network (LPWAN) protocols to connect sensors, control panels, and notification devices across vast and complex buildings without extensive hard-wiring. This dramatically reduces installation time and cost, making sophisticated systems accessible for retrofit projects. Furthermore, these networked systems feed real-time operational data into cloud platforms, enabling remote diagnostics, proactive system updates, and centralized monitoring. This digitalization facilitates the development of Fire Safety as a Service (FSaaS) models, offering predictive insights and reducing total cost of ownership for end-users by optimizing maintenance schedules based on usage and environmental factors.

Regional Highlights

- North America: North America holds a dominant position in the market, primarily driven by stringent adherence to NFPA codes and state-level building safety regulations, coupled with high spending on critical infrastructure renewal and data center construction. The U.S. constitutes the largest segment, characterized by high adoption rates of advanced detection technologies (ASD and VISD) and a mature market for integrated fire and life safety platforms. Investment is heavily focused on replacing aging infrastructure and ensuring resilience against high-impact events. The market is highly competitive, emphasizing product certification, reliability, and integration capabilities with comprehensive building automation systems (BAS).

- Europe: The European market is mature and innovation-focused, propelled by European Union directives emphasizing worker safety, environmental protection, and energy efficiency in buildings. Regulations such as EN 54 provide a standardized framework across the continent, favoring manufacturers compliant with high-quality standards. There is a particularly strong demand for sustainable, clean agent suppression solutions, driven by aggressive environmental targets. Germany, the UK, and the Nordic countries are leaders in implementing smart fire safety solutions in industrial and commercial sectors, often integrating systems seamlessly with intelligent energy management platforms.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented rates of urbanization, massive industrial expansion, and significant governmental investment in smart city projects, particularly in China and India. While the adoption rate varies, regulatory reforms are rapidly converging toward international standards, demanding more sophisticated systems. The high density of new commercial and residential high-rise construction creates a substantial greenfield market opportunity. Demand is centered on scalable, cost-effective detection systems initially, quickly followed by requirements for specialized suppression in high-tech manufacturing and rapidly expanding IT infrastructure.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions present significant growth opportunities, although market maturity varies. In the Middle East, particularly the Gulf Cooperation Council (GCC) countries, mega-projects in hospitality, residential, and commercial sectors (driven by economic diversification) mandate the installation of world-class, enhanced fire safety systems, often relying on imported technology and expertise. In LATAM and parts of Africa, growth is driven by increasing foreign direct investment in manufacturing and energy sectors, requiring specialized industrial fire protection. Challenges include complex logistics, local regulatory variations, and reliance on imported technology, but the pace of regulatory harmonization is accelerating.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enhanced Fire Detection and Suppression Systems Market.- Honeywell International Inc.

- Johnson Controls International PLC

- Siemens AG

- Robert Bosch GmbH

- Halma plc

- Carrier Global Corporation (Kidde)

- Minimax Viking GmbH

- Hochiki Corporation

- Fike Corporation

- Seimens Building Technologies

- Novec (3M Company)

- Gentex Corporation

- Napco Security Technologies

- Amerex Corporation

- Buckeye Fire Equipment Company

- Chemetron Fire Systems

- Tyco Fire Protection Products

- Telefire Fire & Gas Detectors

- Advanced Fire & Safety, Inc.

- The Viking Corporation

Frequently Asked Questions

Analyze common user questions about the Enhanced Fire Detection and Suppression Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between aspirating smoke detection (ASD) and traditional fire alarms?

ASD systems actively pull air samples into a laser detection chamber, offering significantly higher sensitivity and earlier detection of microscopic smoke particles compared to traditional spot detectors, which rely on smoke reaching the sensor passively. ASD is critical for high-value or challenging environments like data centers and cold storage.

How does AI reduce false alarms in fire detection systems?

AI algorithms are trained to analyze complex data patterns from multi-sensors and video feeds, differentiating genuine fire signatures (e.g., combustion chemicals, specific thermal signatures) from environmental factors such as dust, steam, or ambient temperature fluctuations, thereby increasing detection accuracy and reducing costly false alerts.

Which suppression technology is preferred for protecting highly sensitive electronic equipment?

Clean agent suppression systems, which utilize non-conductive, non-residual agents like inert gases (e.g., Inergen) or halocarbon alternatives (e.g., Novec 1230 fluid replacements), are preferred. These agents suppress fire quickly without damaging sensitive electronics or requiring extensive post-discharge cleanup, ensuring business continuity.

What major regulatory standards drive the Enhanced Fire Detection and Suppression Systems Market?

The market is primarily driven by global standards established by organizations like the National Fire Protection Association (NFPA) in North America, harmonized European standards (EN 54), and ISO guidelines. These regulations mandate minimum performance criteria, testing procedures, and installation requirements for life safety and property protection.

What is the primary role of IoT in modern fire safety systems?

IoT enables seamless connectivity and data exchange between all system components (sensors, control panels, notification devices). This connectivity facilitates remote monitoring, cloud-based analytics, predictive maintenance scheduling, and real-time alerts, supporting the transition towards subscription-based Fire Safety as a Service (FSaaS) models.

The comprehensive analysis provided above details the market dynamics, technological trajectory, competitive landscape, and regulatory environment shaping the Enhanced Fire Detection and Suppression Systems Market. The structural integration of AI and IoT technologies is projected to redefine risk management protocols across industrial and commercial verticals, driving sustained market expansion throughout the forecast period due to an increasing global focus on proactive safety measures and asset protection mandates. Furthermore, the imperative for environmentally benign suppression agents underscores the sustainability focus now central to product development.

Market stakeholders must prioritize strategic partnerships for system integration and invest heavily in certified training to address the skilled labor shortage, particularly concerning the complexity of advanced detection and suppression system commissioning. The rapid growth in APAC necessitates localized manufacturing and certification efforts to capitalize on the region’s massive infrastructure spending. The shift from capital expenditure to operational expenditure models (FSaaS) offers a crucial pathway for penetrating small and medium-sized enterprise markets which might otherwise be deterred by high initial investment costs for advanced technology.

The long-term viability of market players will hinge on their ability to offer fully integrated, cloud-enabled platforms that provide end-to-end fire safety and building management solutions. The continuous evolution of fire risks, particularly in energy storage facilities and highly automated manufacturing environments, demands ongoing innovation in detection sensitivity and targeted, localized suppression capabilities. Ensuring rigorous cybersecurity measures for networked fire safety systems is also becoming a non-negotiable requirement for critical infrastructure clients, influencing procurement decisions and technological architectures moving forward.

Technological advancement is not solely limited to hardware; software intelligence, including predictive fault detection, automated compliance reporting, and dynamic system optimization, is becoming a key differentiator. Vendors who successfully integrate AI to minimize operational friction, such as reducing nuisance alarms and simplifying maintenance workflows, will capture significant market share. The convergence of physical security systems with fire safety platforms into unified command centers is streamlining response protocols and enhancing situational awareness for facility managers globally.

This market is moving toward greater resilience and self-diagnosis. Enhanced fire detection systems are increasingly expected to perform continual internal checks and communicate their health status proactively, guaranteeing peak performance when required. This shift towards proactive system management reduces the reliance on costly manual inspections and ensures that critical safety infrastructure meets stringent performance standards 24/7. Investment in robust sensor calibration and remote diagnostics forms the cornerstone of competitive advantage in the modern fire safety landscape.

The demand for water-mist suppression systems is seeing a resurgence in certain applications where clean agents may be unsuitable or cost-prohibitive. High-pressure water mist offers a highly efficient fire suppression mechanism using significantly less water than traditional sprinklers, minimizing water damage while maximizing fire knockdown capability. Its acceptance is rising in historical buildings, commercial kitchens, and specific industrial applications where fast, low-impact suppression is necessary. Continued R&D in nozzle design and system control logic is expanding the operational envelope of water mist technology, challenging the dominance of gaseous systems in several segments.

The regulatory emphasis on environmental, social, and governance (ESG) factors further accelerates the adoption of enhanced systems. Organizations are increasingly judged by their operational safety records and environmental footprint. Utilizing clean agent suppression aligns with corporate sustainability goals, and installing highly accurate detection systems demonstrates a commitment to life safety that satisfies investors and regulatory bodies alike. This ESG pressure acts as a powerful, non-cyclical driver for market growth across all major geographical segments, pushing adoption beyond mere legal compliance towards best-practice standards.

Moreover, the construction of mega-projects, such as new metropolitan airports, massive logistics centers, and integrated resort complexes, particularly in the Middle East and Asia, requires bespoke fire safety engineering. These projects necessitate specialized smoke management solutions, complex communication networks, and highly reliable centralized control systems. These large-scale deployments serve as proving grounds for the most advanced technologies, often setting new benchmarks for system integration, redundancy, and performance under extreme operational loads.

Supply chain management remains a critical operational consideration, especially for specialized components like proprietary inert gases and high-performance sensors. Market leaders are vertically integrating or establishing long-term sourcing agreements to mitigate supply risks and maintain competitive pricing. Geopolitical shifts and trade restrictions can impact the supply of critical electronic components, necessitating diversified manufacturing footprints and robust inventory strategies to ensure continuous system deployment timelines, particularly in high-growth regions like APAC.

Finally, the growing threat of lithium-ion battery fires, particularly in electric vehicle charging stations, battery storage facilities, and consumer electronics production, presents a unique technological challenge and a significant market opportunity. These fires require specialized detection (e.g., thermal runaway sensors, off-gas detection) and suppression (e.g., specialized aerosol or localized cooling systems) solutions. Innovation in this niche segment is expected to be rapid, driving substantial short-term R&D investment and creating highly specialized, high-margin product lines for early movers in the enhanced fire safety market.

The market trajectory is firmly directed towards smart, self-optimizing, and interconnected systems. The long-term success of vendors is dependent on developing robust cybersecurity frameworks to protect these networked systems from digital threats, ensuring the integrity and reliability of safety-critical data. Standardization efforts in data communication protocols will facilitate easier integration, accelerating the market's move toward truly holistic life safety and asset protection platforms across the globe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager